Weekly #66: CLS Dropped 12% for No Valid Reason. Mr. Market Gave a Gift.

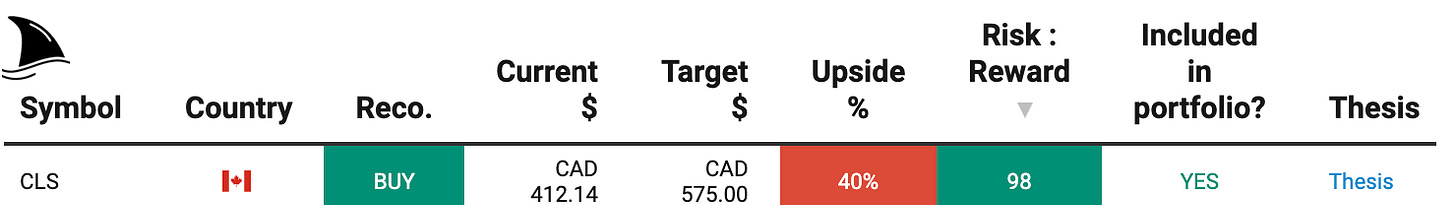

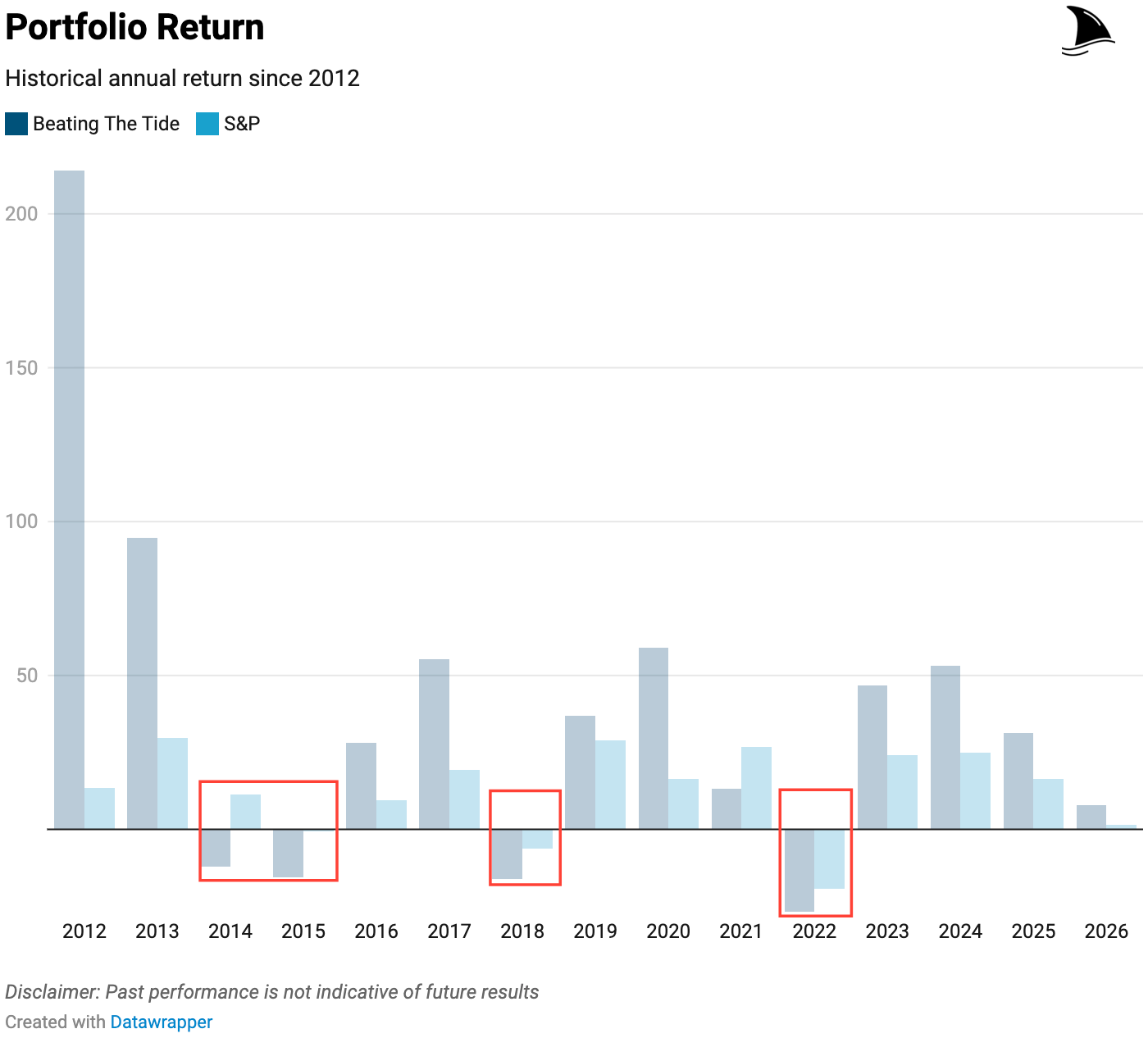

Portfolio +8.4% YTD, 2.6x the market since inception. Plus break down the CLS dip, share the survey takeaways, and walk through the changes I’m rolling out.

Hello fellow Sharks,

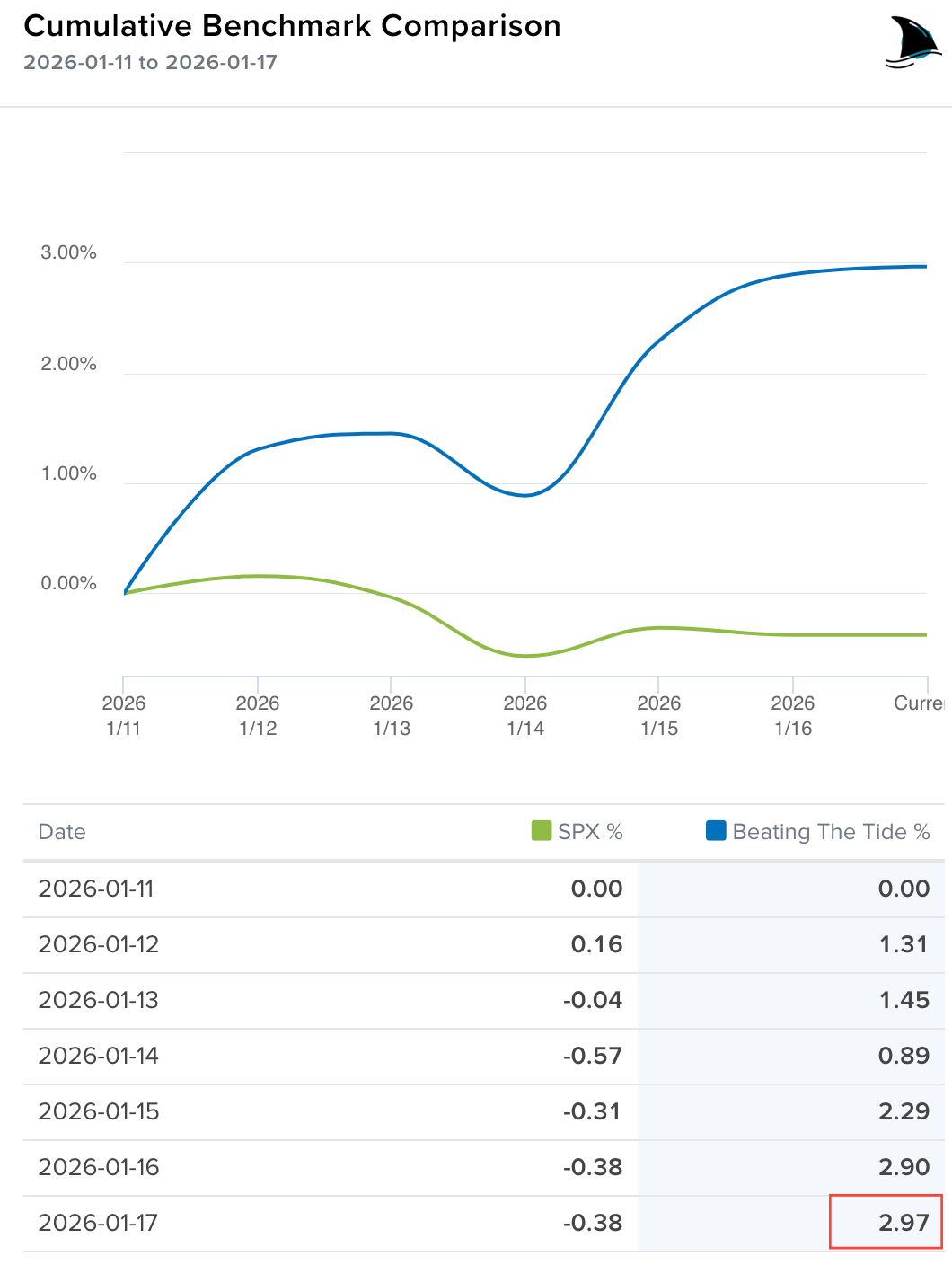

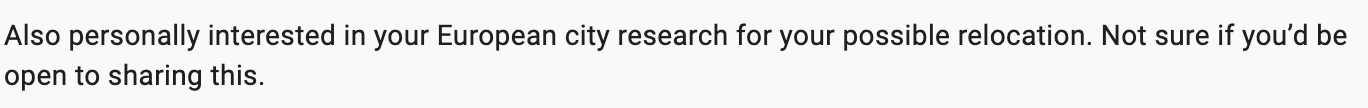

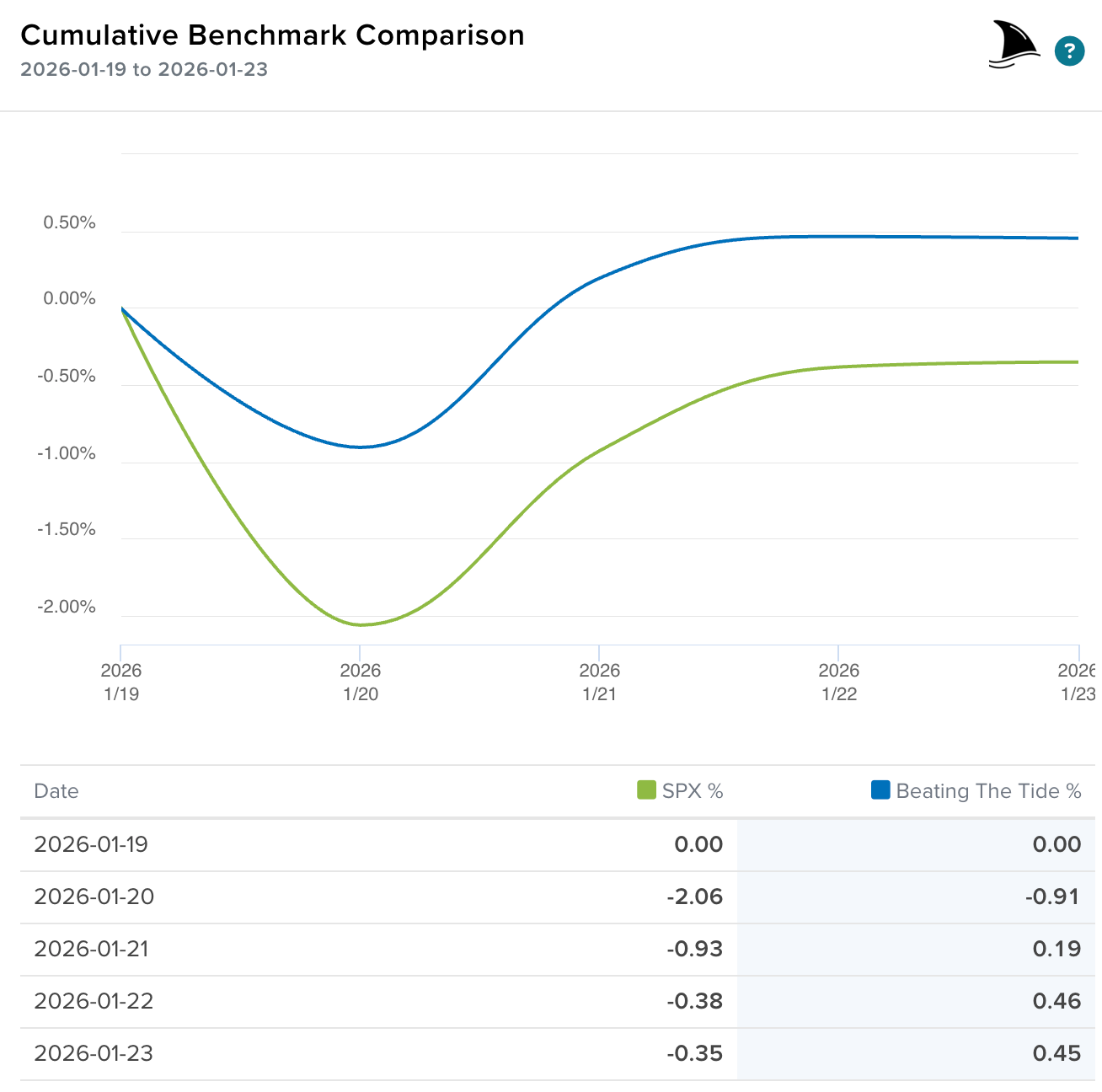

This is the second week in a row where, while the S&P 500 pulled back, the portfolio gained ground. YTD, the portfolio is up more than 8x the S&P 500. If you want to skip straight to the numbers, jump to the Portfolio Update.

In this Weekly, I’ll cover what happened to CLS’s stock price and why it was a great opportunity to pick up shares at a discount. I’ll also go over the survey findings, the changes already in place, a few ideas I’m considering, and I’ll answer all of your questions.

Enjoy the read, and have a great Sunday.

~George

Table of Contents:

In Case You Missed It

On Jan 21, I published my January monthly stock pick deep dive.

I laid out the full thesis, the catalyst, the valuation, and what could break the story. It’s already up 8.9%, which is a nice start.

Thought Of The Week: Mr. Market Keeps Giving Us Entry Opportunities

In the past, I used to have a love-hate relationship with Mr. Market, as I thought it was unfair that it would drop irrationally and drag my dear stocks down with it.

But I have grown up.

In the last couple of years I have grown to understand Mr. Market and that it is actually giving me a hand rather than punishing me.

And since last year, Mr. Market has been trying to seduce me with its moves.

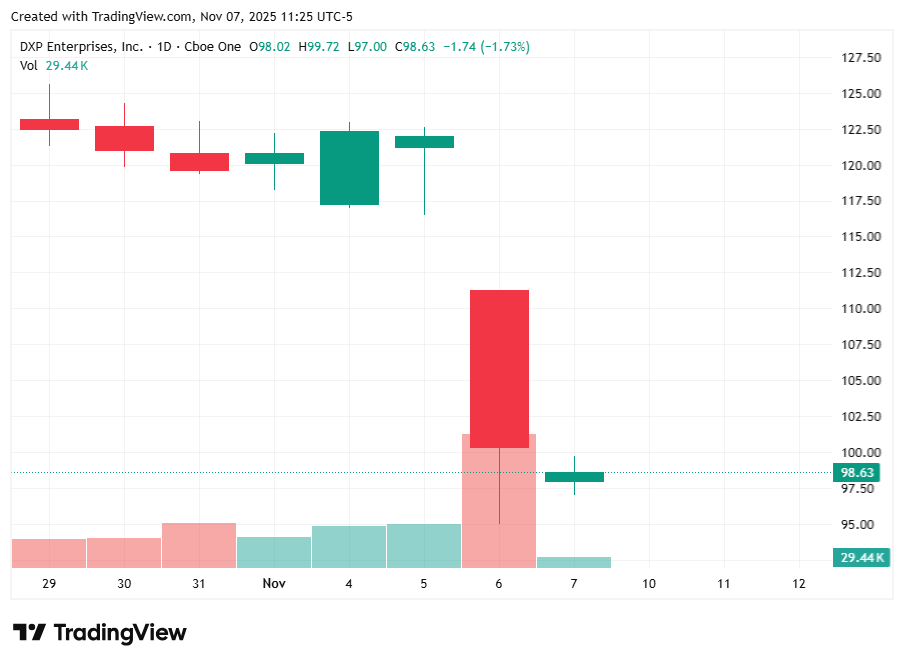

For example, in November 2025, DXPE stock dropped 20% to $98 on solid earnings results.

I wrote why I thought the drop was overblown.

After I published my article, the stock dropped further to $84. But fundamentals win in the end, and now the shares trade at $132. If you had bought more shares after my article, you would be up 34% in just two months.

So on Jan 22, Mr. Market handed us an entry point in CLS. The stock dropped as much as 12% intraday. If you missed it, he even offered a second chance the next day. CLS has already bounced back and now sits only about 3% below the pre-DigiTimes headline level.

Moments like this remind me why process matters. Knowing when to act fast and when to slow down makes a difference.

The market panicked after a Seeking Alpha news report claimed Google might move its TPU assembly to other firms. This report used a poor translation of a Digitimes article. Many sold the stock because they feared Google was replacing Celestica.

This fear is a mistake as Google is not leaving. It is adding help.

The original Digitimes text says Google is adding Inventec to its supply chain. Inventec previously provided Level 6 motherboards but will now handle L10 and L11 assembly. These orders will ship from a new plant in Texas. The report did not say Google is dropping Celestica. It said Google is expanding its base. Demand for ASIC servers is exploding. Google needs more capacity than Celestica can provide alone.

Google expects a massive year for its hardware. The same Digitimes article predicts Google will deliver 3.325 million TPUs in 2026. This is 1 million more units than the prior year. CLS cannot meet this demand as it is already running at almost full capacity.

CLS’ CEO gave a clear quote during the Q1 2024 call. He stated, “capacity or utilization is extremely high in our sites where the majority of our AI demand is fulfilled”. In the same call, he mentioned they are expanding capacity carefully. But capacity expansion hasn’t kept pace with demand. And that is okay, I would rather CLS expand cautiously than over-expanding.

I saw a gift in this price drop. And I didn’t buy any more as CLS is already the largest position in the portfolio.

The timing was perfect as earnings come out on January 28, 2026.

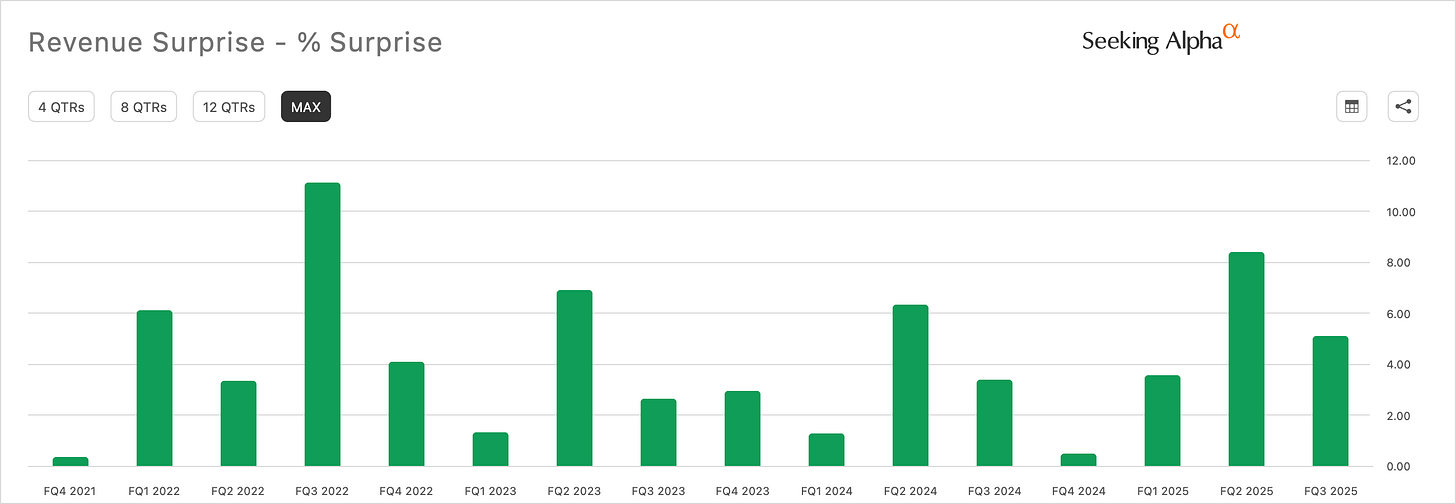

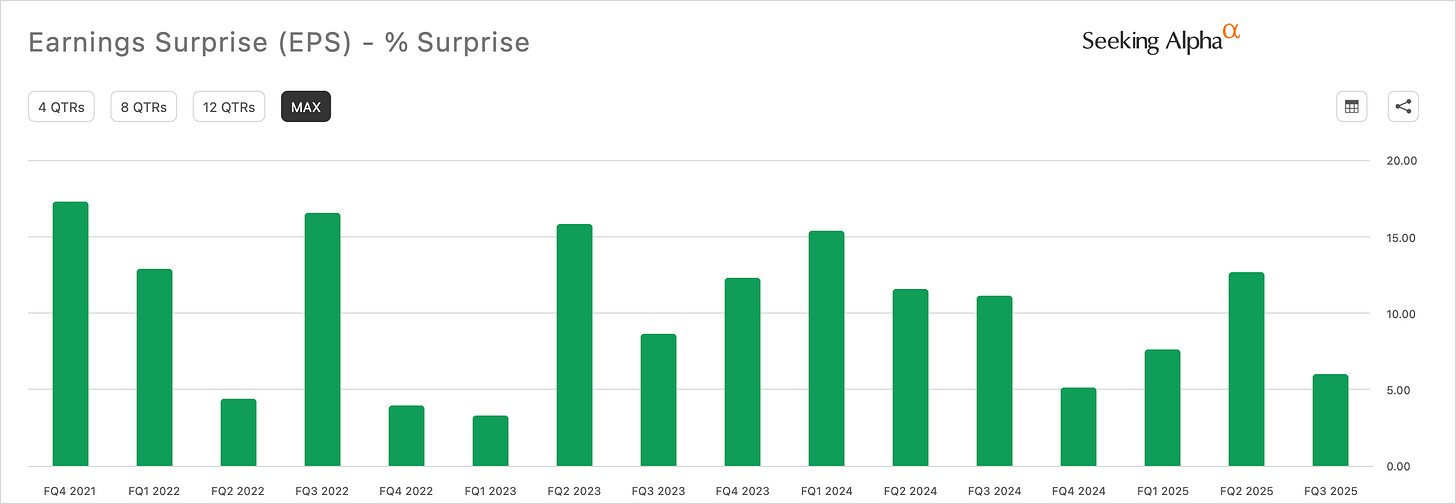

History shows a pattern of success. CLS has consistently beaten consensus estimates for revenues…

…and EPS.

I’m looking for a double beat next week.

CLS runs a conservative playbook. Growth is measured, debt is kept in check, and expansion only happens when demand calls for it. That discipline creates operating leverage: margins stay healthy while revenue climbs.

The CCS segment is where the AI story lives. Hyperscalers make up most of the demand. Celestica wins here because it can scale complex technology: liquid-cooled racks, 800G switches, and even 1.6T switch programs already lined up for 2026.

Then there’s the global footprint, which acts as a moat. CLS operates across 16 countries with 7.3 million square feet of space. In Texas, it’s doubling down and adding a design hub in Austin and planning a new plant for a major customer. Thailand is expanding too, with new capacity to support thousands of AI racks. This network isn’t just about growth; it’s insurance against trade policy shocks.

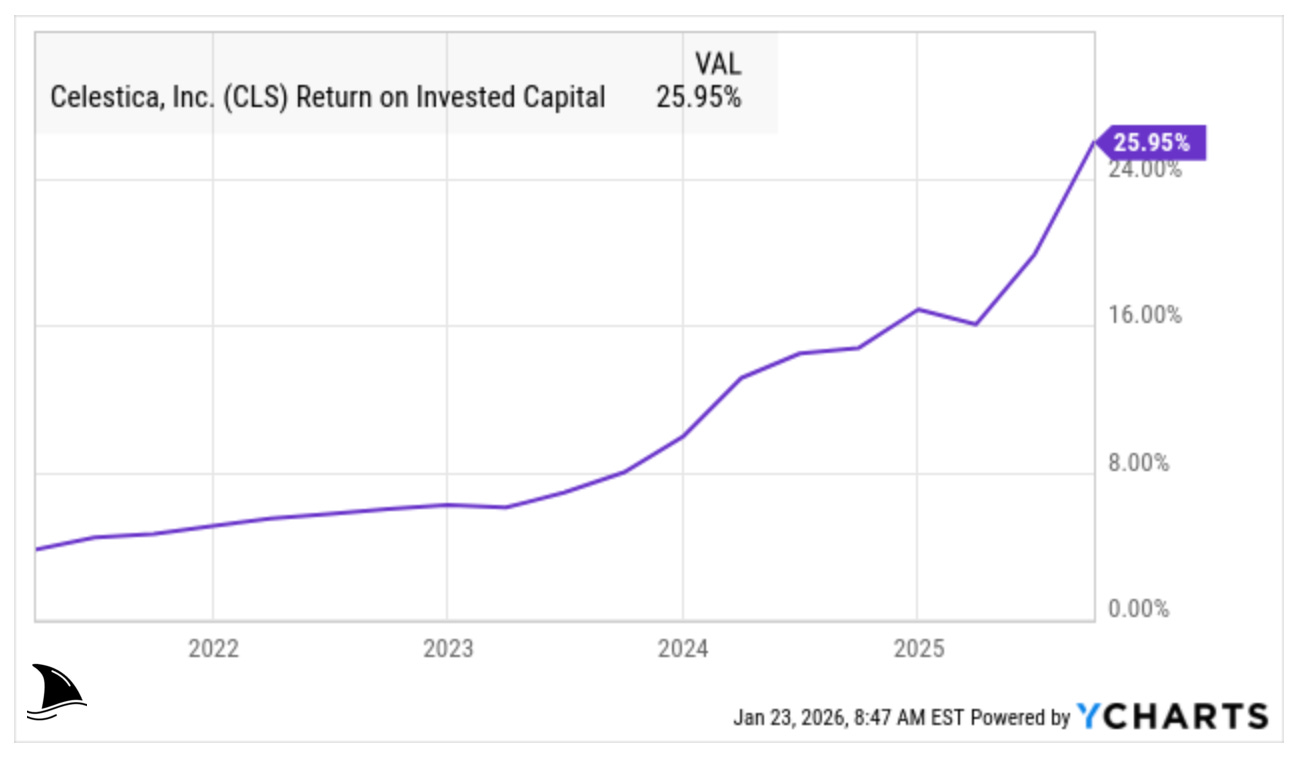

I find the financial health of the business impressive. TTM ROIC is close to 26%, which is almost 6x the ROIC of just 5 years ago.

The company has produced positive free cash flow every quarter for six years.

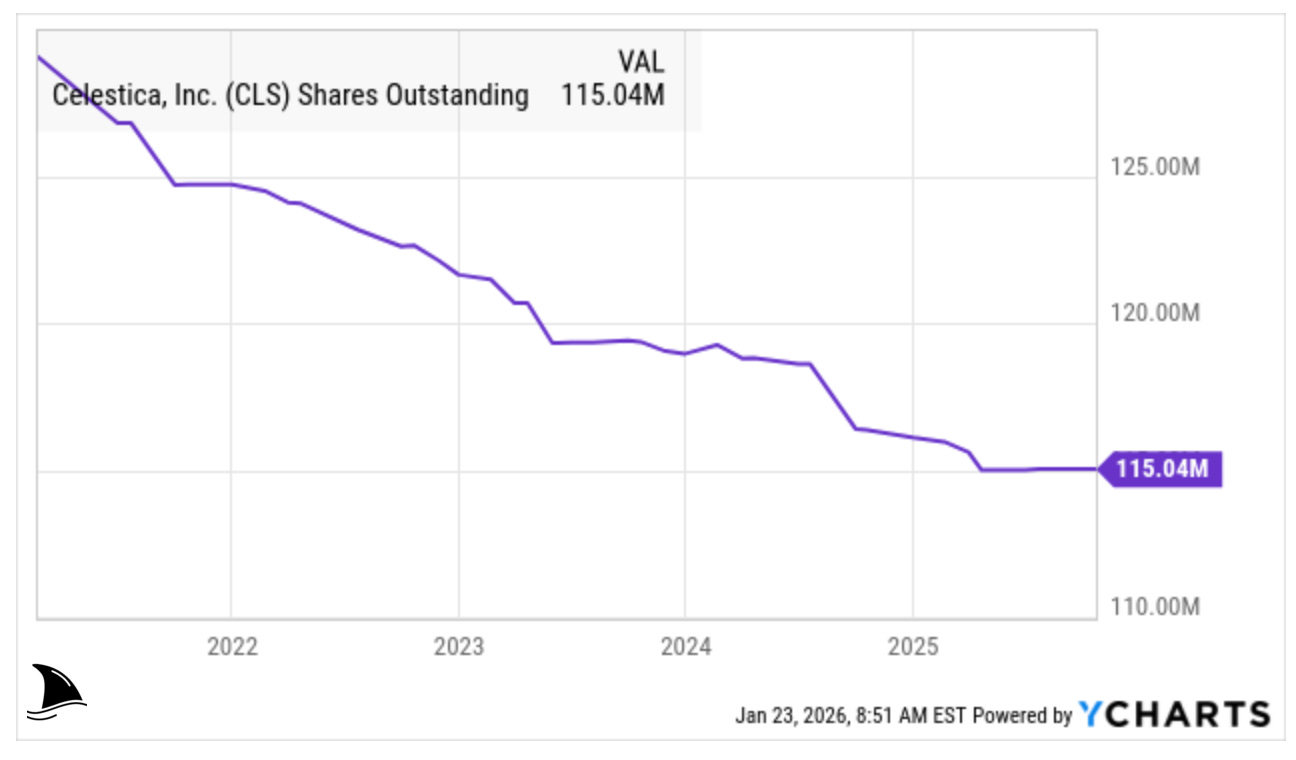

It expects $425 million in free cash flow for 2025. It uses this cash to buy back shares. Celestica has reduced its share count by 11% in the last five years.

The ASIC era is just beginning. Google is betting on its 7th-generation Ironwood TPU. Custom chips offer better power efficiency than GPUs. They lower costs for large language models.

CLS is the leader in this niche. It has a 55% market share in the white box switch market. It owns 41% of the total market for high-bandwidth Ethernet ports. Competition struggles to keep up with these speeds.

I believe the Jan 22 sell-off was irrational. Short sellers took advantage of a language barrier to create panic. Google needing more help is a bullish signal. It confirms that AI infrastructure demand is outstripping supply. Celestica will sell every unit it can build. Inventec is taking the overflow that Celestica cannot handle. This is not a loss of business. It is a sign of a massive market.

I expect the earnings call next week to clear the air. Management will likely confirm that utilization remains at peak levels. I anticipate they will raise guidance for 2026.

I hope you bought this dip.

Survey Results & Action Plan

The results are in!

First of all, thank you to all 19 subcribers that took the time to fill out the survey. The following subscribers won a 1-month access to the paid membership.

Enjoy!

I will divide this section into:

Key Findings

I love that the newsletter resonates with you. This started as a place to write my thoughts freely (since Seeking Alpha became very restrictive on what you can say in articles), and it has grown into a really satisfying project.

Some of your feedback:

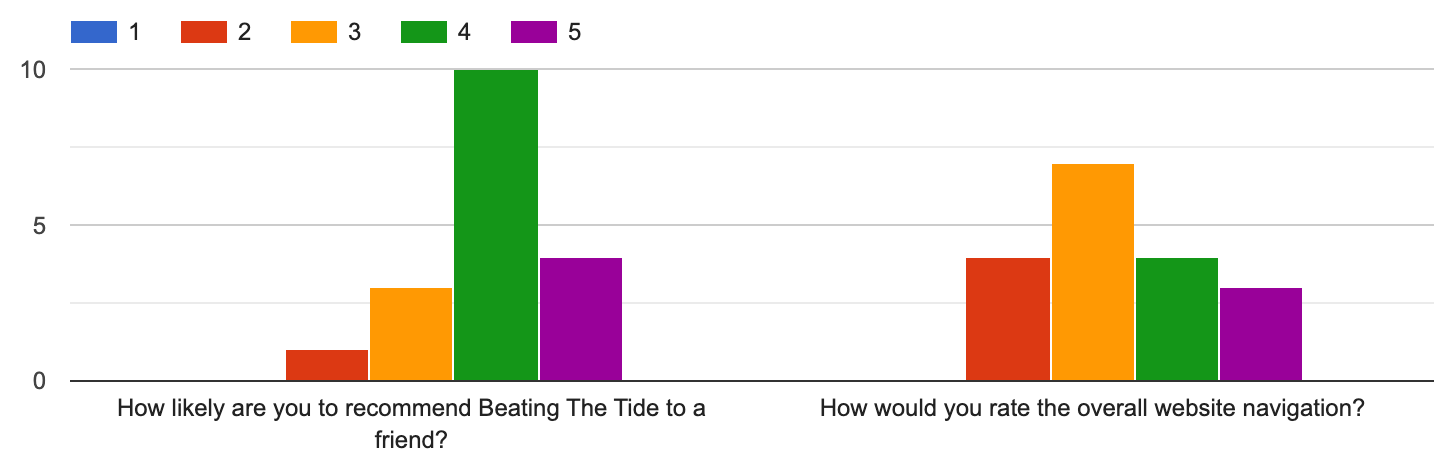

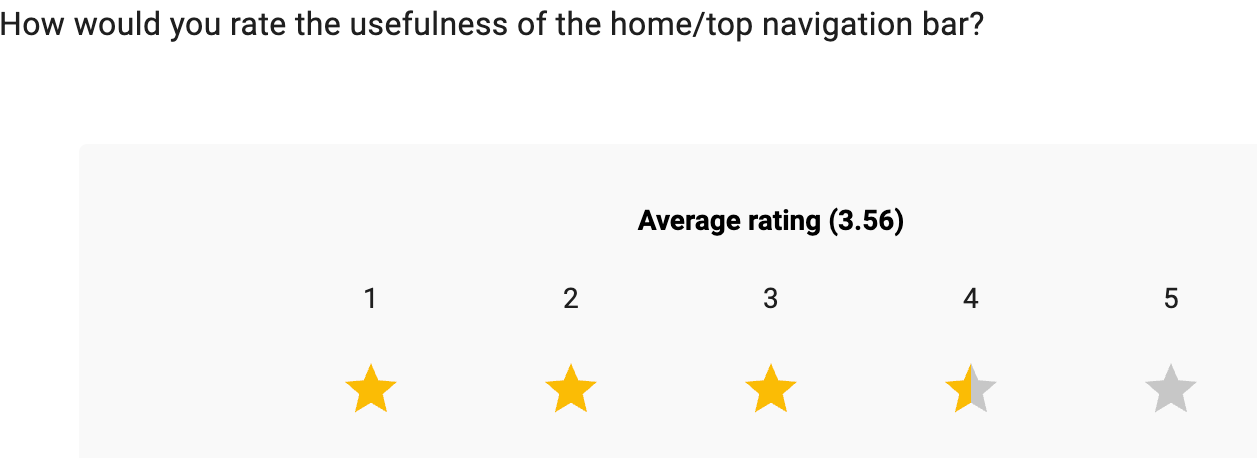

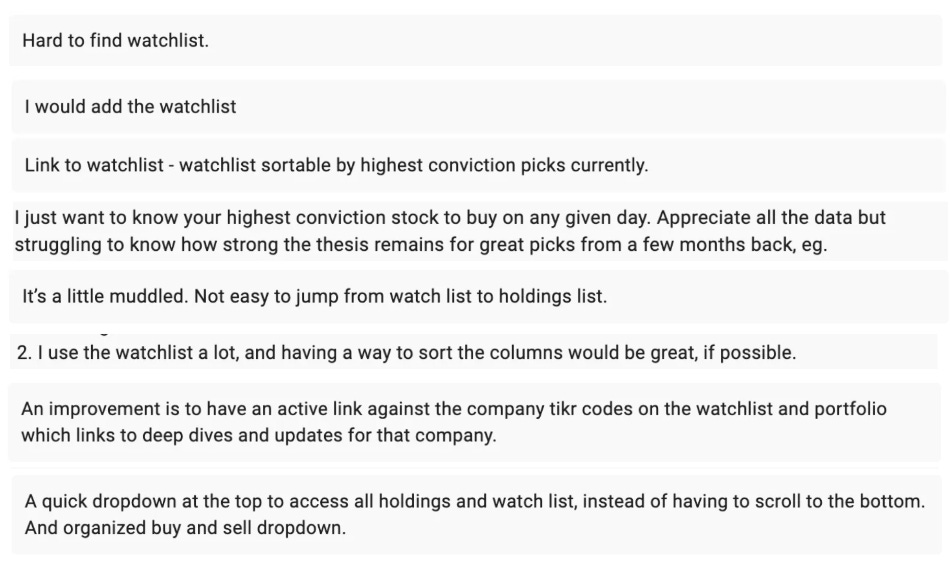

I was gladly surprised that most of you would recommend BTT. But most of you think the website navigation has room for improvement.

So let’s improve it!

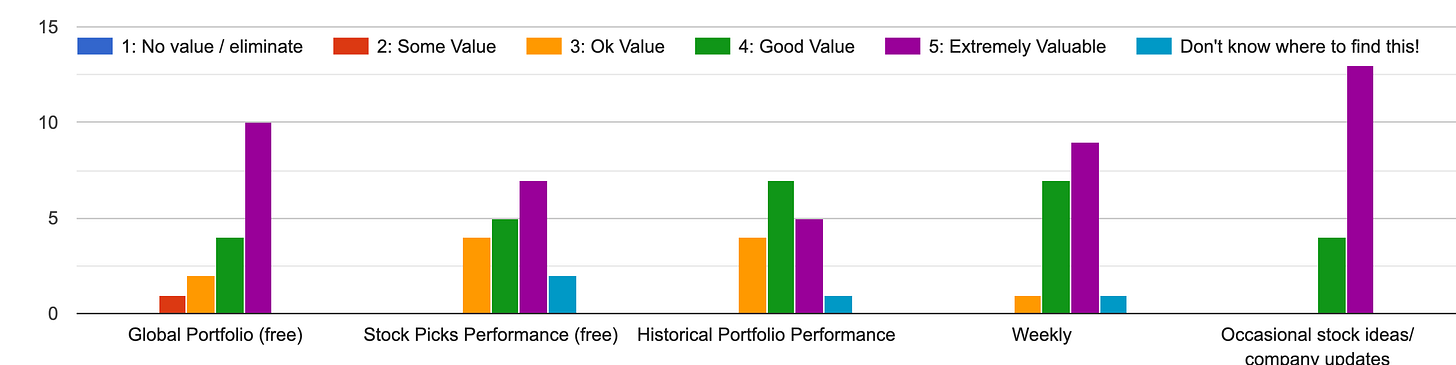

Most of you find all the content for free subscribers useful (especially the stock ideas and company updates). Some of you couldn’t find the weeklies and performance.

Both are now in the top bar.

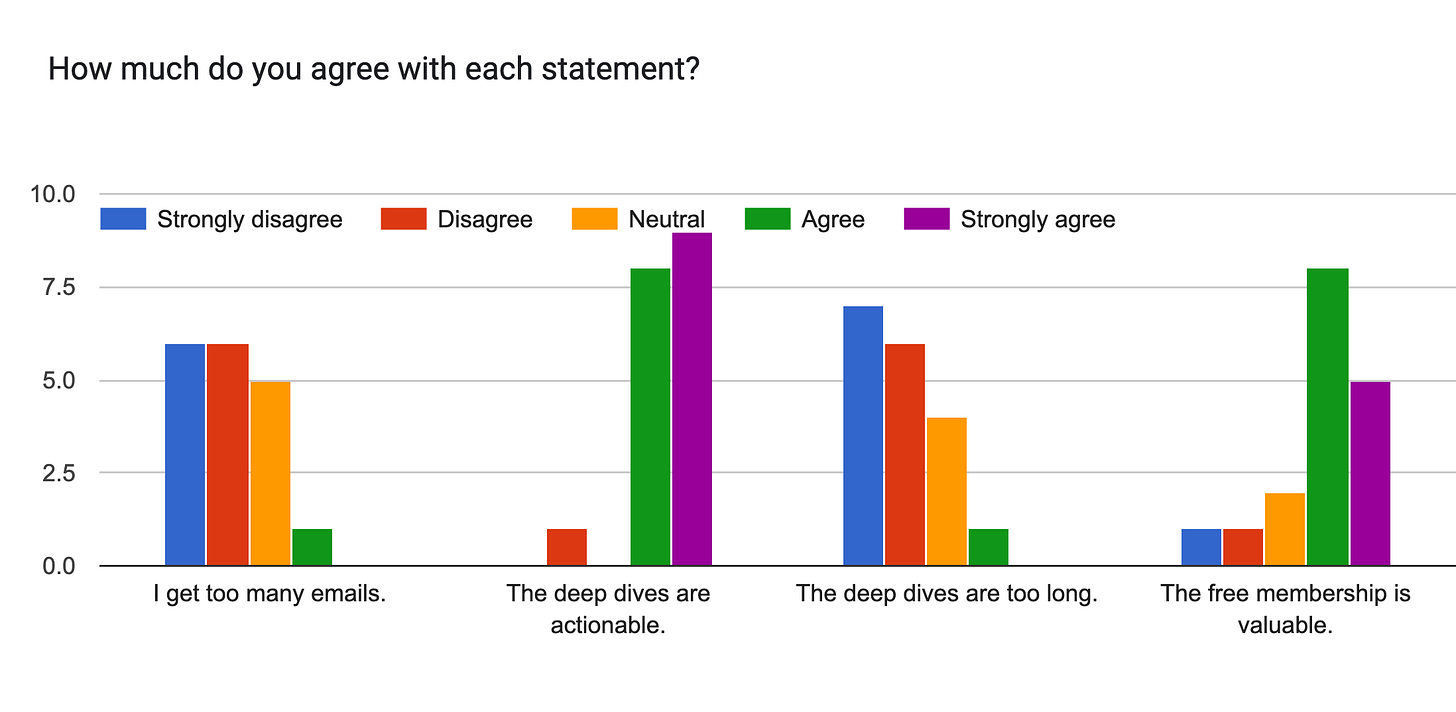

Most of you don’t think I send too many emails. You think the free membership is valuable, and that the deep dives are actionable. I was surprised that most of you think the deep dives are not long enough?!

What I take from that is I can go even longer on the deep dives if needed. This helps because sometimes I go down a rabbit hole (the tech behind the tech… haha), and then I spend time summarizing as the article ended up too long. Going forward, I’ll make the TLDRs a bit longer too, so you can act based on the TLDR without needing to read the full writeup.

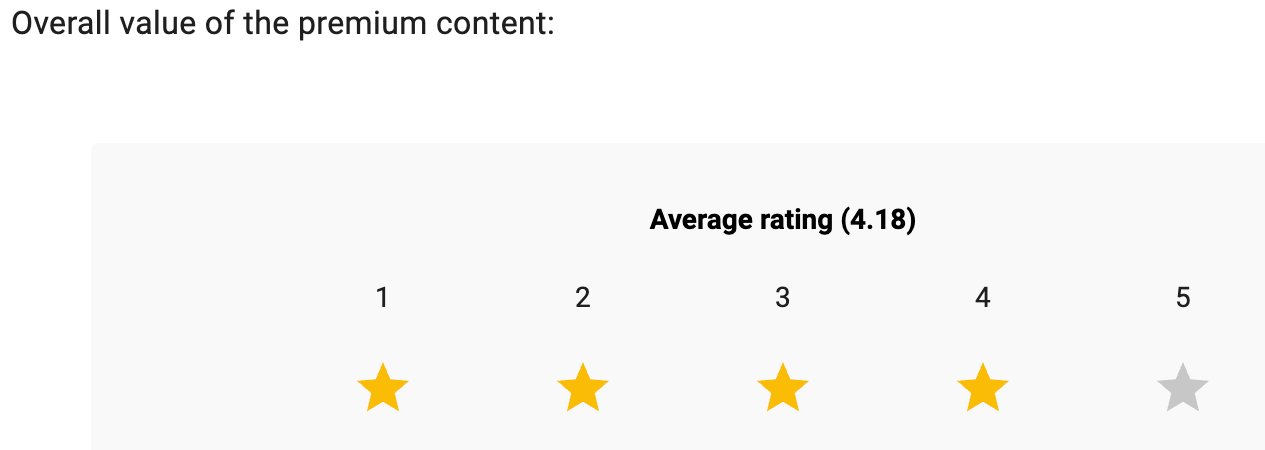

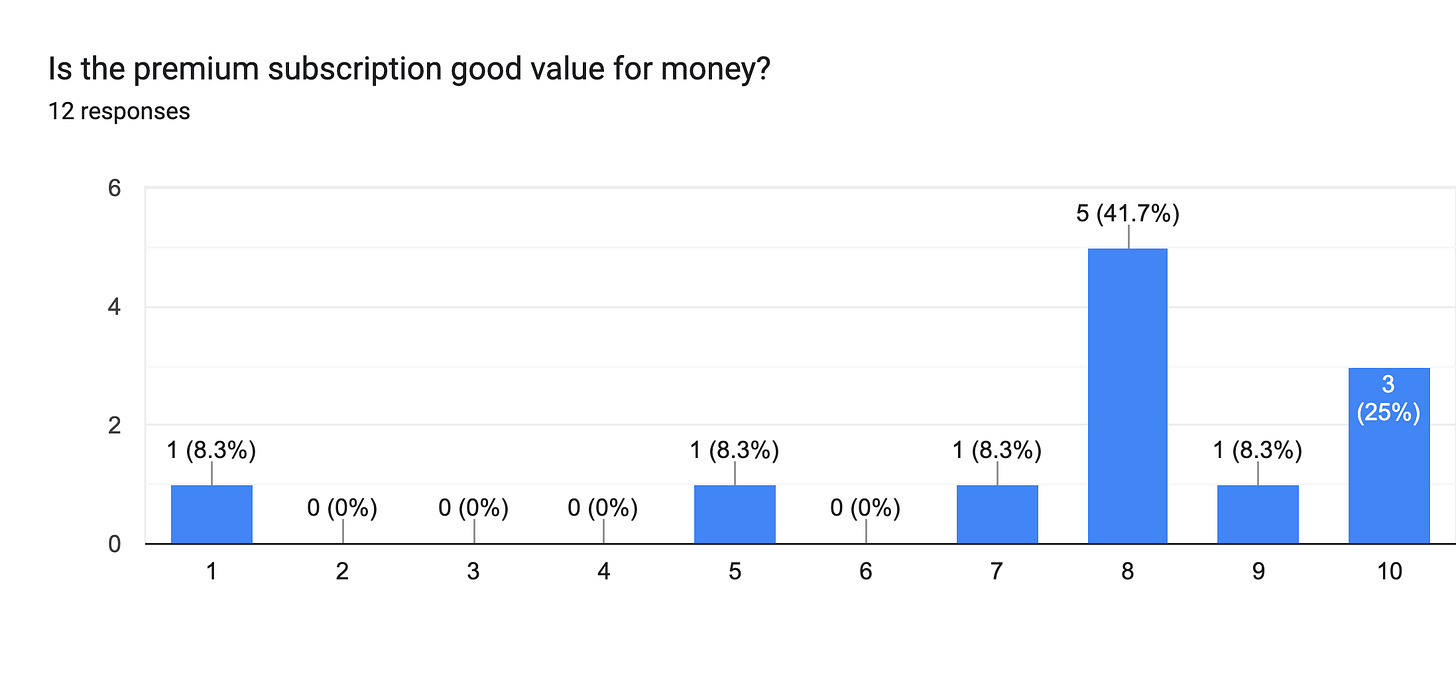

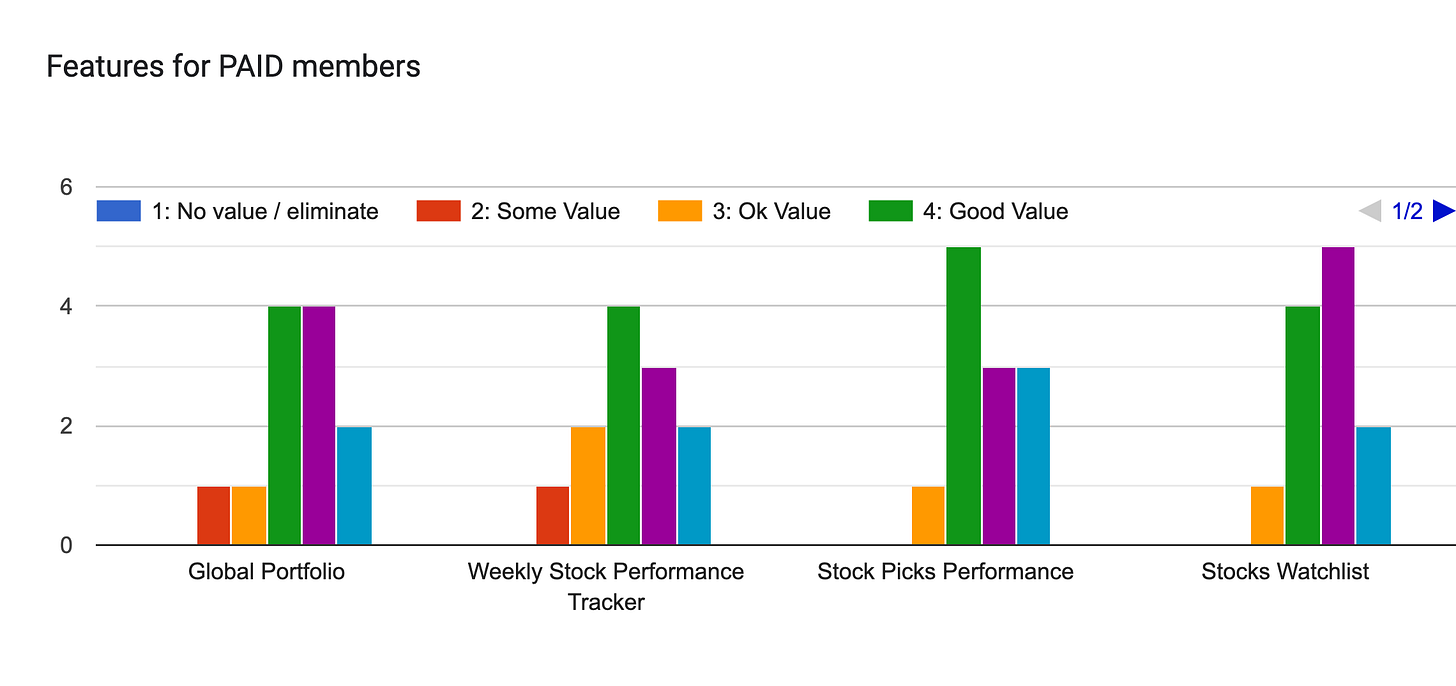

The overwhelming majority of paid subscribers think it is a good value for the money, which is great news!

Most of you value the tools I offer, but I was surprised that some of you couldn’t find them! I created a paid-member hub where you can find all the tools. Also, I added it to the right banner of the main page.

Improvements

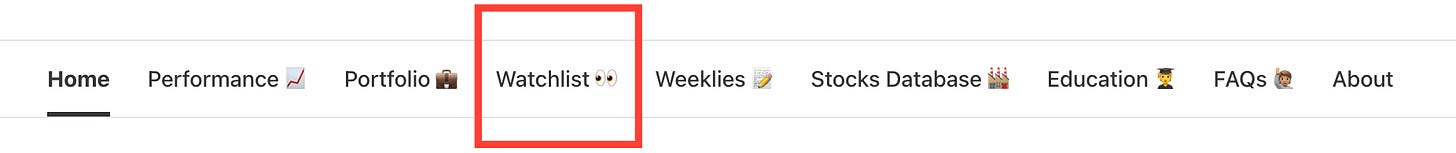

Improvement #1: Watchlist

I moved the watchlist to the top navigation bar.

Within the watchlist, I made a few changes:

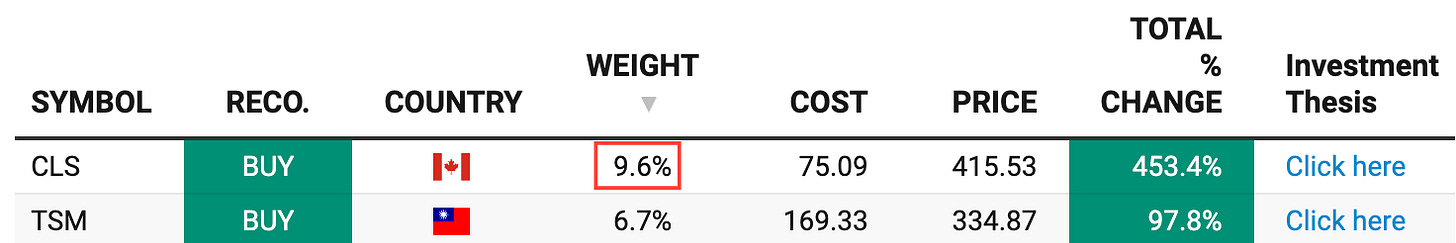

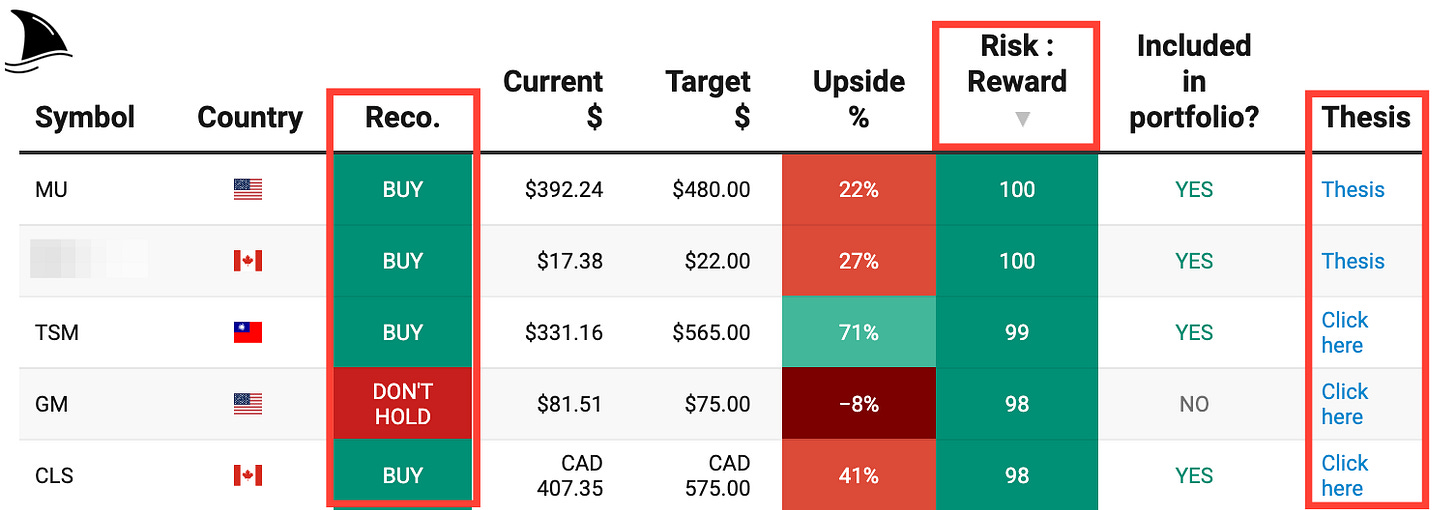

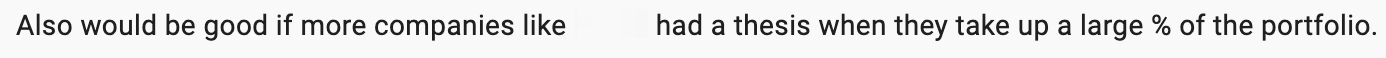

I added a column with the current recommendation (BUY, HOLD, DON’T HOLD). So if you don’t want to buy all +30 positions in the portfolio, you can focus on the BUY ideas. Note that I don’t use a SELL recommendation. I use DON’T HOLD, because if I used SELL, some readers might misinterpret that as me recommending shorting the shares. Remember, I run a long-only portfolio.

When you first enter the watchlist, the stocks are sorted by the best risk:reward score. You can click any header to sort by upside, symbol, and more.

I also added a column with a link to the thesis for each position.

Improvement #2: Portfolio

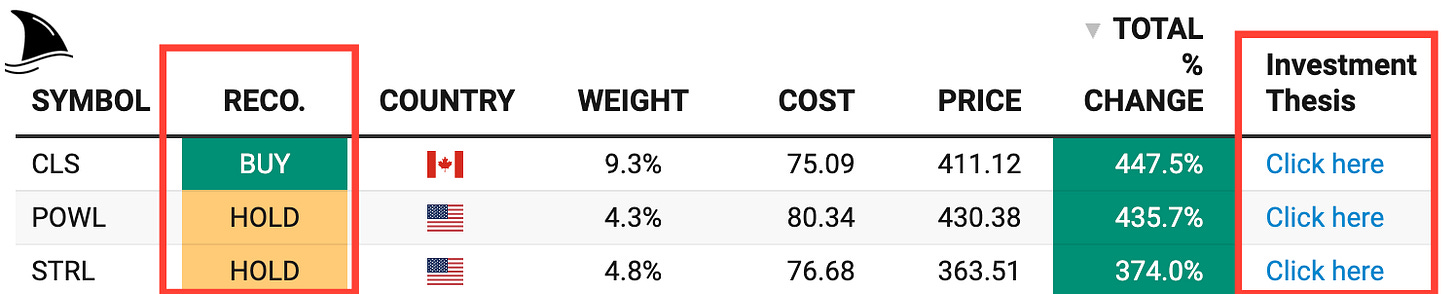

I added two columns to the portfolio. The first is a recommendation column (RECO.) with my current view on the stock (either a BUY or a HOLD) so if you don’t want to replicate the +30-portfolio, you can focus on the BUY positions (that column is sortable).

The second addition is a clickable column that will take you to the thesis and everything I have written about the stock.

Improvement #3: Quick Thoughts on Portfolio Positions

Within the Weekly Stock Performance Tracker, I will add commentary on portfolio positions that reported earnings or had large moves. You can find the tracker in the Paid-Member Hub and in every Weekly.

Testing (beta)

Beta #1: Chat / Forum

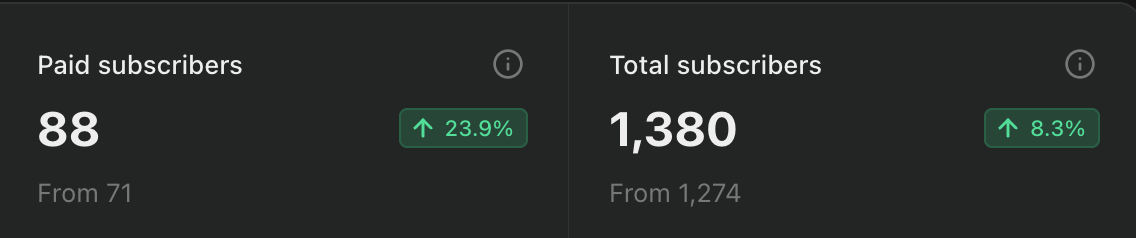

Currently, the newsletter has 88 paid members and a total of 1,380 subscribers.

A forum is a good idea, but I think the most useful thing would be for subscribers to use the comment section under each article. Some of you already ask questions or comment there, but right now it’s mostly me replying. I’d love to see more members engage in the comments (similar to what happens in the comment section in Seeking Alpha…which some consider more valuable than the articles themselves).

I also enabled the Chat option, which you can find in the Paid-Member Hub, or you can join by clicking below.

Beta #2: Podcast (huge maybe)

I’m hesitant about a podcast, even if it is AI-generated. It is time-consuming (time I could use analyzing stocks), but I see the point that every big newsletter has some type of podcast. I may explore generating a short podcast using NoteBookLM and see how it goes. But this is definitely beta testing.

Beta #3: DCF

The good thing is that most of my DCFs (all post-2018, when I migrated from Excel to Google Sheets) live in the cloud. So I’ve been considering sharing them alongside the deep dives.

The drawback is that some people might misinterpret the value of a DCF. The output (a target price) is not the main benefit. The benefit is the process. Building the model forces you to understand how the business makes money, what drives costs, and what the key assumptions really are. It also lets you run scenario analysis so you can see what would actually move the needle. And maybe the biggest benefit is that it helps you understand the company’s numbers better than almost anyone else.

That said, I have no problem sharing my DCFs. I just need to clean them up a bit first. In my head, the newsletter’s organization was crystal clear. But from the survey, I realized it’s organized around how I think and process information.

So before I share the models, I’ll tidy them up. I’ll most likely share the first one with my February stock pick. And as I update older positions, I’ll share those DCFs too.

Beta #4: New “expensive” stock commentary

I run into expensive companies from time to time during my process, and I like the idea of talking about them (just not in as much detail as a deep dive). So I’ll be adding a new section to future Weeklies where I cover one crazy stock. I’m calling it “The Greater Fool Report.” If you have a better name, let me know, and I may use it.

Answers to your questions

Answer #1: Performance on the home page

Right now, I am hosting the newsletter on Substack, so I don’t have full control over the look & feel of the website. But for now, I added the portfolio performance to the top navigation bar.

In the future, I may migrate to Wordpress but not yet. Maintaining a website is time-consuming, and Substack, while frustrating, does most of the back office for me so I can focus on my competitive advantage (analyzing stocks) rather than on website design. Actually, people agree with that decision.

Answer #2: Write-ups for companies that I passed

I have written about companies that I didn’t end up investing in and mentioned the rationale as to why. I may write a post-mortem after a year, but it will depend on my workload at the moment. Below are some companies that I analyzed but didn’t invest in:

Answer #3: Search bar

Actually, on the top right of the page, there is a search functionality, and it is quite good.

Answer #4: Educational Content

I eliminated the “Start Here” page and reallocated the Investment Philosophy and Monthly Investing Fundamentals to a new top tab called Education.

Within the Education page, you can find my book, educational articles, my Investment Philosophy, and an Udemy course I created back in 2019.

Answer #5: Heat Index

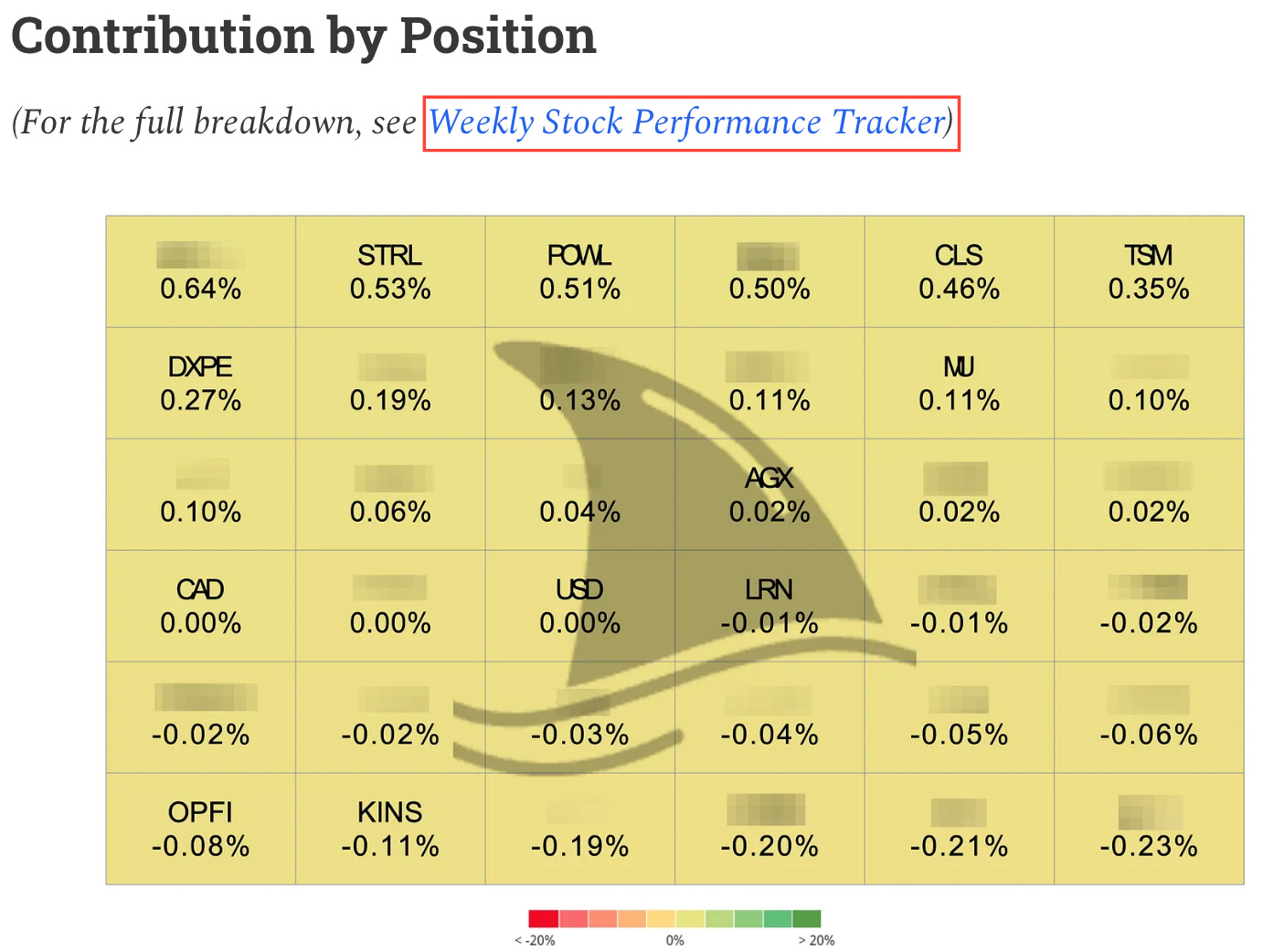

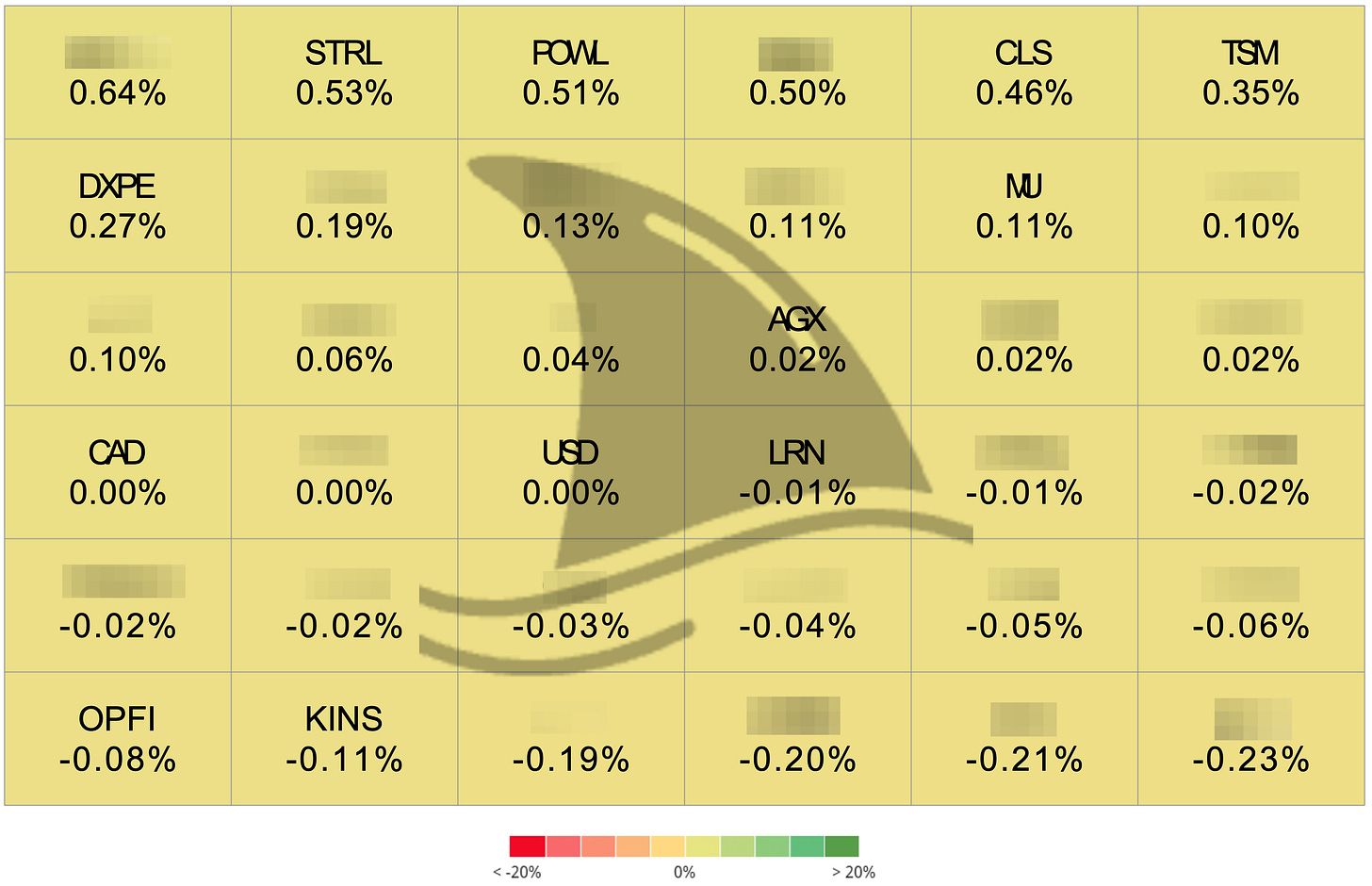

At the bottom of the Weekly, I add the portfolio heat map (heat map for paid subscribers is in here). It simply shows how much each position contributed to the portfolio performance that week.

So, for example, two weeks ago the portfolio gained 2.97%.

STRL contributed 0.53 points to the 2.97 points, POWL contributed 0.51 points and so on. If you sum them all up, it totals 2.97.

Answer #6: Reflections

My reflections are in the Weeklies. And I don’t have any special skills, a secret sauce, or the holy grail of investing that makes me stand out. I think my consistent returns come from keeping it simple, doing the work, and not following the herd.

I’m pretty sure most BTT subscribers would beat my track record if they stopped investing in stocks and started investing in companies. Don’t speculate. Stay disciplined. Do that for a decade and let time do the compounding.

But human nature pushes us to seek action and suffer from FOMO. That’s why I think I’ll keep beating the market for decades to come 🙂

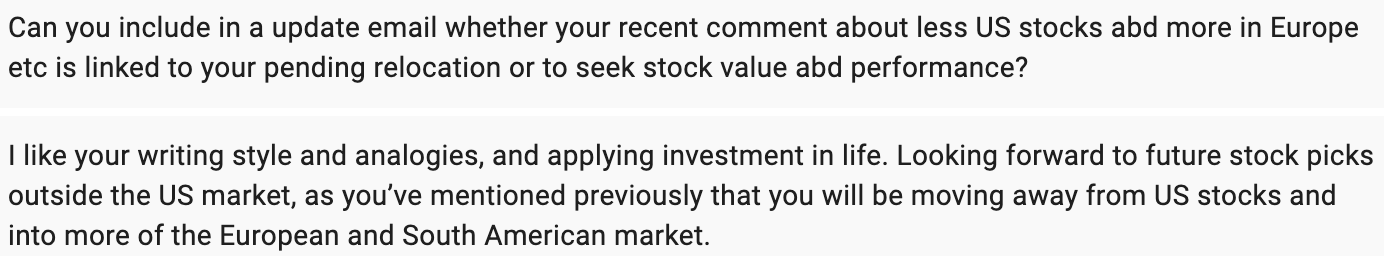

Answer #7: Increasing non-US exposure

My pending relocation has nothing to do with lowering my US exposure. I still like the long-term prospects of the US, and like Buffett says, I’m not betting against America.

The reason I’ve been looking more outside the US is simple: opportunity density. Right now, the US market feels heavily driven by one theme, AI, and the index has become very top-heavy. The top names carry a huge weight, so when money flows into “AI winners,” it pulls the whole market with it. That can be great for returns, but it also makes it harder to find mispriced stocks.

Outside the US, I see pockets where the setups feel cleaner. Europe still trades at a meaningful valuation discount vs the US, even after the rally. This article (Some See a Renaissance for European Equities) makes a nice argument for European stocks.

And geopolitics is forcing real spending on things like defence and infrastructure, which creates opportunities that don’t rely on AI hype.

Answer #8: When is a premium worth it?

That’s a very good question. My quick answer is that premium is worth it is you don’t want to spend 50 hours a week analyzing stocks AND you have an investment amount of at least $10,000.

But if you want the “technical” answer, here it goes:

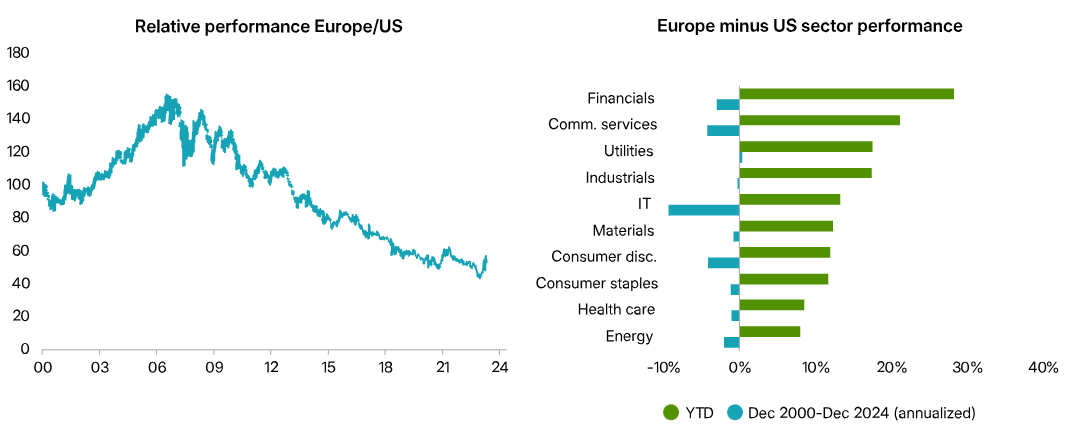

There are two types of benefits: tangible (monetary returns) and intangible (learning how to invest). If we focus only on the tangible side, over 14.5 years, my portfolio has gained 4,254%, which works out to 29.6% annualized.

Keep in mind that past performance is not indicative of future results. But to justify the $299/year price tag, you’d need a portfolio of roughly $1,009 to break even. Also, keep in mind that I’ve had years where my portfolio lost money.

Answer #9: More deep dives and macro analysis

I actually got a couple of similar pieces of feedback asking for more deep dives and more stock ideas.

I aim to publish at least one deep dive per month for paid subscribers. That’s 12 ideas per year. I’m a one-man show, and even one deep dive per month is a stretch if I want to maintain the high quality I’ve delivered so far. I’ve been able to keep up that pace because I’ve streamlined my process over the years (read here).

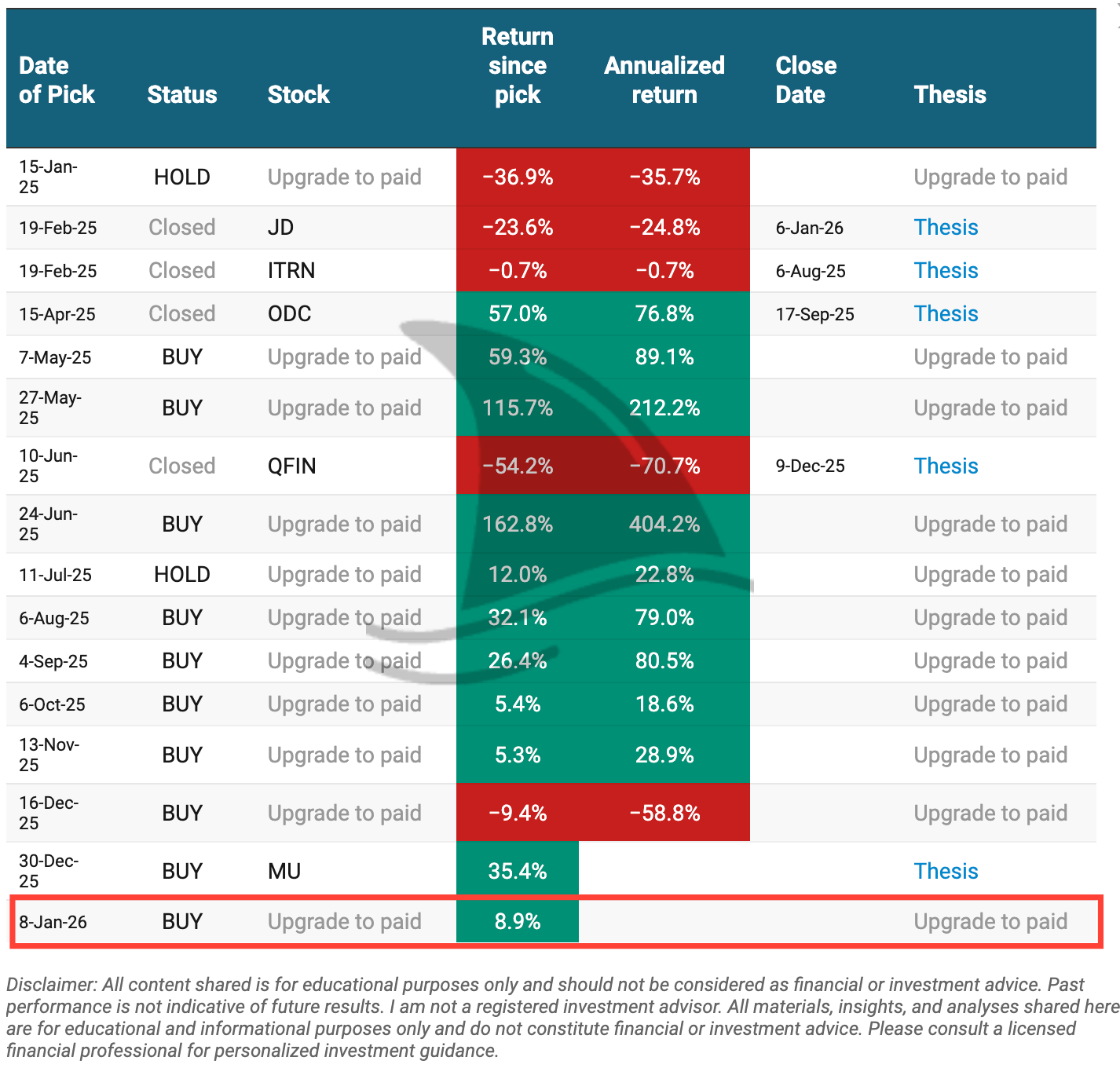

But even if I could publish more deep dives per month, your portfolio wouldn’t necessarily benefit. In investing, quality beats quantity. For example, my top pick for 2015 returned 134% (or 166% over the full holding period).

Below, you can see that (with some exceptions) I’ve published about one deep dive per month, and the winners have significantly outweighed the underperformance from the losers. I don’t think I could maintain that track record if I published more deep dives.

That said, I’ve published 38 deep dives since launching BTT, and over time, the library will keep growing (I’m aiming for 22 - 26 deep dives per year). These are foundational deep dives. They don’t just help you understand the company, but the entire space. Think about how TSM expanded our investment universe into other chip providers, and even further down the supply chain into data center and power plant constructors.

I also got this feedback…

Fair point. I’m writing those deep dives little by little. If you’ve noticed, only two large positions are still missing a deep dive. They’re coming soon!

Lastly, I limit my macro opinions to how they impact current positions. I’m not planning to add general macro commentary (e.g., whether I think the Fed will cut rates). First, I’m no economist. Second, focusing on macro is a distraction, and I’d rather spend that time reading 10-Ks 😊

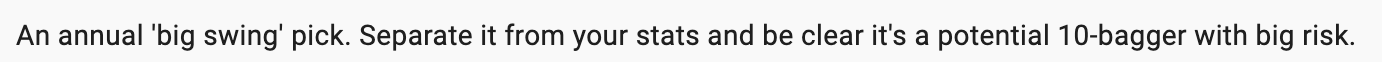

Answer #10: High Risk, High Reward Pick

That’s not really how my mind works. While I’ve had several multi-baggers like DQ, LMB, and CLS, I never assign a “10x” target when I first enter a position. Instead, I start with a more conservative target price, usually 50% to 150% upside. Then, as the thesis gets confirmed, I collect more data points, and the story gets validated, I adjust my target price using more realistic (and less conservative) assumptions.

For example, my initial target price for CLS was $153 in the original deep dive. Since then, I’ve raised that target multiple times as the fundamentals kept improving.

And yes, I moved it again…

Answer #11: Leave a Review and get 1-month of paid

Maybe I have not promoted the book the proper way. But if you leave a review on Amazon, I will give you a 1-month access to the premium.

First: Download the book here (for free)

Second: Leave a rating/review on Amazon

Third: Email me (george@beatingthetide.com) with a screenshot

Fourth: Enjoy your month of premium access.

Answer #12: My possible relocation

Whoa, this section ended up longer than I thought. So I left the “lighter” question for the end.

First, my relocation has nothing to do with my investment exposure. It’s mainly because I’m not tied to a location for work, and we want to raise our family somewhere with a better climate and overall lifestyle.

At first, we considered many countries in Europe, but discarding some was easy. Germany is a great country, but the weather and the language were deal breakers for us. After going through the list, the final choice was Spain. It has great weather (maybe too hot in the summer), it’s my wife’s mother tongue, and there are tax advantages for my business.

While we’ve been to many cities in Spain before, we were always in vacation mode. This time, we’re planning to visit 5–6 cities at the end of the year to assess how “liveable” each one is through the family lens. These are our finalist cities so far (let me know if you have suggestions):

Madrid

Valencia

Mallorca

Malaga

Alicante

Granada

Santander

We already ruled out Barcelona due to the crime rate (a deal breaker for my wife). You’re about 2.9x more likely to be robbed in Barcelona than in other Spanish cities. We also ruled out Sevilla because it gets too hot in the summer.

Portfolio Update

For a second week in a row, the S&P 500 retracted while our portfolio gained ground.

Portfolio Return

Month-to-date: +8.4% vs. the S&P 500’s +1.0%.

Since inception: +53.0% vs. the S&P 500’s +20.3%. That’s 2.6x the market.

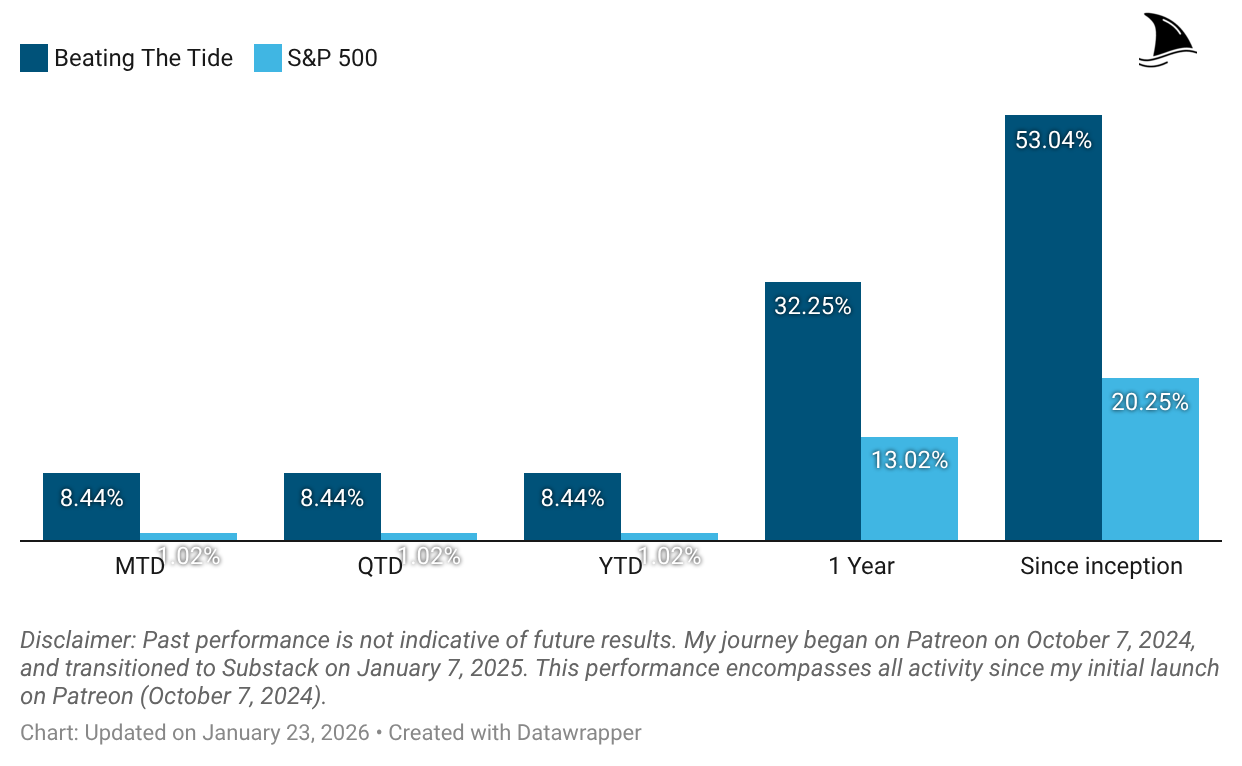

Contribution by Sector

Gold (hitting an all-time-high), utilities and industrials led the positive performance, partially offset by tech.

Contribution by Position

(For the full breakdown plus commentary on earnings results and the big movers, see Weekly Stock Performance Tracker)

+23 bps MU 0.00%↑ (Thesis): The shares gained 10.17% this week, and they’re keeping the momentum going in 2026. I’m now up almost 40% YTD on my top stock pick for 2026, and we are still in January. More people are waking up to the same simple reality: the memory market looks tight, and rising memory prices flow straight into earnings power. The stock also popped on Jan 21 after J.P. Morgan flagged Micron, Nvidia, and Broadcom as favourite semiconductor names heading into earnings season, and kept an Overweight rating on MU.

+13 bps DXPE 0.00%↑ (Thesis)

+4 bps LRN 0.00%↑ (Thesis)

+1 bps STRL 0.00%↑ (Thesis)

flat OPFI 0.00%↑ (Thesis)

-2 bps POWL 0.00%↑ (Thesis)

-2bps KINS 0.00%↑ (Thesis)

-14 bps TSM 0.00%↑ (Thesis)

-41 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Good process info on the CLS wobble. Has been moving in a range for a while after the huge run. Staying anchored to fundamentals while others react to headlines.

Best of luck with whatever you decide for the podcast.

Great Weekly, George. Love the PM style framing (process + portfolio behavior vs SPX, not just picks). CLS pullback breakdown was especially useful. Curious how you manage exposure , adds during index pullbacks , structured playbook or bottom-up tape-driven?