Weekly #48: Never Stop Asking Why, The 5 Whys for Better Investing plus good and bad news on Celestica (CLS)

Portfolio +28.9% YTD, 2.4x the market, plus how a simple “5 Whys” routine improves stock selection, sell discipline, and conviction from the shop floor to the portfolio.

Hello fellow Sharks,

The portfolio’s outperformance versus the S&P 500 kept widening this week. If you want to skip straight to the numbers, jump to the Portfolio Update.

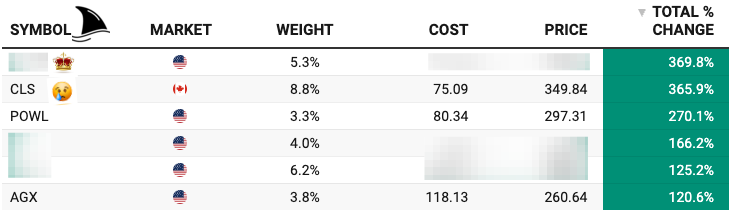

Now, I have some good and bad news. The good news is that CLS keeps printing all-time highs. On Wednesday, I’ll share a refreshed valuation with the latest updates.

The bad news is that CLS just lost the top-performer crown to another position that now sits at +370%.

Also in this Weekly, I drill into a tool I learned in engineering school that I have used extensively in my investment process.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

Last week, I shared why I exited my position in Oil-Dri (ODC 0.00%↑) even though I still like the business. And despite the company posting one of its strongest quarters in its 84-year history.

Below is my original thesis if you are curious.

In this piece, I explain the thinking behind the sale, what changed in the risk/reward profile, and how I apply my sell discipline even to companies I admire.

We booked a 57% gain in just five months on this position, that is about 195% annualized.

Thought of the Week: Never Stop Asking Why, Using the “5 Whys” to Solve Problems and Pick Stocks

As far back as I can remember, I’ve had a problem-solving mind. I was that curious kid who disassembled my bike just to see how it worked. Reassembling it took longer than expected (my first attempts were failures), but once I got it right, I really understood how bikes worked!

That hands-on curiosity never left me. It’s one big reason I pursued mechanical engineering. I’ve forgotten most of the formulas I learned in school, but the mindset of breaking down problems stuck with me. One simple tool in particular has helped me throughout my journey from engineering to corporate finance to investing: the “5 Whys.”

The 5 Whys is a simple yet amazing tool. Kids learn it intuitively. They just keep asking “Why?” about everything. I’m already bracing myself for when my little daughter gets to that stage of endless “why” questions. In fact, I can imagine a conversation with her:

Daughter: Why do I have to go to bed?

Me: Because you need sleep to grow healthy.

Daughter: Why do I need sleep to grow?

Me: Because your body uses a lot of energy to grow, and sleep recharges your batteries.

Daughter: Why do I have batteries?

Me: It’s a figure of speech. It means you need rest so you don’t run out of energy, like a toy that needs new batteries.

Daughter: Why would I run out of energy?

Me: Because your body’s like a phone. If you don’t plug in at night, your battery runs down, and your brain and muscles can’t do their jobs.

Daughter: But why…

We laugh, but that persistent curiosity is the heart of the 5 Whys approach. Unfortunately, as we grow up, we tend to lose some of that inquisitive spirit. Research shows preschool kids ask their parents around 100 questions a day, but by middle school, they’ve basically stopped asking questions. We trade our endless “whys” for quick answers and assume we know enough. The 5 Whys method urges us to reclaim that childlike curiosity. It reminds us not to settle for the first answer and to keep digging deeper.

What Is the 5 Whys Method (and Why Use It)?

The “5 Whys” technique is a problem-solving method that involves asking “Why?” repeatedly to drill down to the root cause of an issue. It was originally developed in the 1930s by Sakichi Toyoda, the founder of Toyota, as a way to find underlying causes of manufacturing problems.

Toyoda’s approach was simple: whenever something went wrong, ask “Why?” about five times in a row. By repeating ‘why’ five times, the nature of the problem as well as its solution becomes clear. In other words, the first answer you get is rarely the true root cause; you have to peel the onion layer by layer.

This method caught on because it encourages us to avoid assumptions and not jump to superficial fixes. Each “why” answer forces you to think more critically. As the Wikipedia entry on 5 Whys notes, the technique drives a troubleshooter to trace a direct chain of cause-and-effect (no guessing, no blame-shifting) until you reach a fundamental cause that connects back to the original problem. It’s a bit like being a detective: you keep asking questions until the case is solved. The 5 Whys is now a staple in Lean manufacturing and Six Sigma process improvement, thanks to its power in uncovering hidden issues.

Let me give a quick example. A classic case from Toyota goes like this: A machine in the factory stopped working.

Why?

Because a fuse blew.

Why did the fuse blow?

Because the bearing was not lubricated properly, causing it to seize.

Why wasn’t it lubricated?

Because the maintenance schedule was not followed.

Why was the schedule not followed?

Because the team was short-staffed and overwhelmed.

Why were they short-staffed?

Because management froze the hiring budget last quarter.

By the fifth why, you’ve uncovered a root cause (understaffing due to a budget decision) that is very different from the surface symptom (a blown fuse). Now you can address the real issue. In this case, by fixing the policy or process rather than just replacing fuses repeatedly.

I remember using the 5 Whys early in my career as an engineer. We had a batch of plastic cups coming out of a molding machine with defects: tiny bubbles and weak spots in the cups.

I started asking “Why?” to everyone’s annoyance.

Why were the cups defective?

Because the plastic wasn’t solidifying correctly.

Why wasn’t it solidifying correctly?

Because the molding machine’s temperature profile was inconsistent.

Why was the temperature profile inconsistent?

Because the heater was running cooler than the setpoint.

Why was the heater running cooler than the setpoint?

Because the calibration on the controller drifted.

Why did the calibration drift?

Because the sensors were being fouled by residue from the resin.

Why was residue fouling the sensors?

Because the resin we’d started using contained impurities.

Why did the resin contain impurities?

Because we had switched to a cheaper supplier without proper quality checks.

Bingo!

The root cause was the material quality, not just the machine settings. My five “whys” turned into seven in that case, but it led us to a solution: we changed the resin supply, and the defects disappeared. This illustrates something important: five is just a rule of thumb. Sometimes you might ask three whys, other times seven. The point is to keep asking until you’ve hit on a cause you can act on.

From Engineering to Investing: Asking “Why?” in Finance

Why am I talking about this in an investment newsletter? Because the 5 Whys approach is just as powerful in investing as it is in engineering. Successful investing isn’t just about memorizing ratios or following the crowd; it’s about understanding a business deeply and knowing why you own it.

In fundamental investing (or any style of investing, really), you should constantly ask: “Why am I investing in this company?” followed by “Why do I believe that?” and so on. This helps you uncover the core thesis behind an investment and test whether it truly holds water.

In my finance career, I’ve found that if I can’t answer the chain of “why” questions, I probably don’t understand the investment well enough. It’s a way of pressure-testing your logic.

For example, say you’re looking at a popular stock like AAPL 0.00%↑.

You might start with…

“Why do I want to buy Apple?”

Perhaps your answer is, “Because the iPhone is selling like crazy.”

Then ask, “Why are strong iPhone sales a good reason?”

Maybe: “Because it means Apple will have higher revenue and profit.”

Next: “Why will higher profit continue?”

“Because Apple’s brand keeps customers coming back and paying premium prices.”

Next: “Why will they keep paying a premium?”

“Because Apple’s ecosystem and quality create loyal fans who don’t want to switch.”

By the time you’ve asked why five times, you might conclude: “I invest in Apple because it has a durable brand and ecosystem that should generate long-term earnings.” If at any point your answer is “I’m not sure” or “because everyone else is buying it,” that’s a red flag telling you to dig deeper or reconsider.

This kind of questioning can save you from shallow reasoning and hype. It forces you to articulate the investment thesis clearly. In fact, even professional investors use similar techniques. A fellow investor once told me that he could sniff out flimsy management excuses by applying a “5 Whys” line of questioning in meetings. By repeatedly asking why a management decision is “the right approach,” he could tell if they truly understood their strategy or were just parroting buzzwords. The same goes for us; if we keep asking why, we either solidify our conviction or expose weaknesses in our logic.

The 5 Whys in Action: An Investing Example with OppFi

To show how the 5 Whys works in investing, here’s how I’d apply it to OppFi (OPFI 0.00%↑).

1) Why am I interested in OppFi?

Because it’s a tech-enabled lender serving underbanked borrowers through AI underwriting and bank partnerships.

2) Why do AI underwriting and bank partnerships help OppFi serve underbanked borrowers?

Because they allow OppFi to approve credit faster and more accurately while avoiding the heavy licensing and compliance costs of a traditional subprime lender.

3) Why does faster, more accurate approval with lower regulatory cost matter?

Because it raises OppFi’s loss-adjusted yield and lowers its operating expense, which improves margins compared to peers.

4) Why do improved margins give OppFi an advantage over other subprime lenders?

Because higher profitability lets it reinvest in better models, marketing, and servicing, which strengthens its data edge and makes the platform more effective.

5) Why does that stronger data edge and more effective platform make it more attractive to bank lenders?

Because banks prefer partners who can demonstrate lower default risk and operational efficiency; OppFi’s compounding data advantage can translate into more partnerships, better terms, and higher volumes than competitors enjoy.

You can continue with the Whys (“why is the market pricing OPFI conservatively?…etc.) until you get to a satisfactory answer, but you get the point by now.

Stay Curious and Keep Asking Why

The 5 Whys approach is all about keeping that curious, analytical mindset alive. It’s a reminder to never stop asking questions. Whether I’m troubleshooting a machine, figuring out why my toddler is cranky, or researching a stock, the principle is the same: don’t accept the first answer that pops up.

Dig deeper.

By doing so, we uncover root causes and core truths that others might miss. This leads to better solutions in engineering and better decisions in life, including investment decisions.

In a world obsessed with quick fixes and headline explanations, the 5 Whys technique is a breath of fresh air. It forces us to slow down and think methodically. We identify problems at their source instead of slapping on Band-Aids. We clarify our investment theses instead of buying or selling on impulse. It’s a simple habit, but it can lead to profound insights.

For me, embracing the 5 Whys has been transformative. It means approaching problems like that curious kid with the bike, not stopping at “it broke,” but figuring out why it broke and how to fix it.

It means approaching investing with the same mindset. Not stopping at “this stock is up” or “everyone likes it,” but understanding why it might succeed or fail.

This technique has stayed with me from childhood tinkering to boardroom strategy sessions. It’s a constant reminder that curiosity and clear thinking are invaluable.

So, whenever you face a problem or a big decision, channel your inner five-year-old and ask “Why?”

… then keep asking.

You might be surprised by what you discover. After all, the best insights often lie just beneath the obvious, waiting for a persistent mind to uncover them.

What about you? Where in your own work or investing have you found the “5 Whys” uncovering something you’d have otherwise missed?

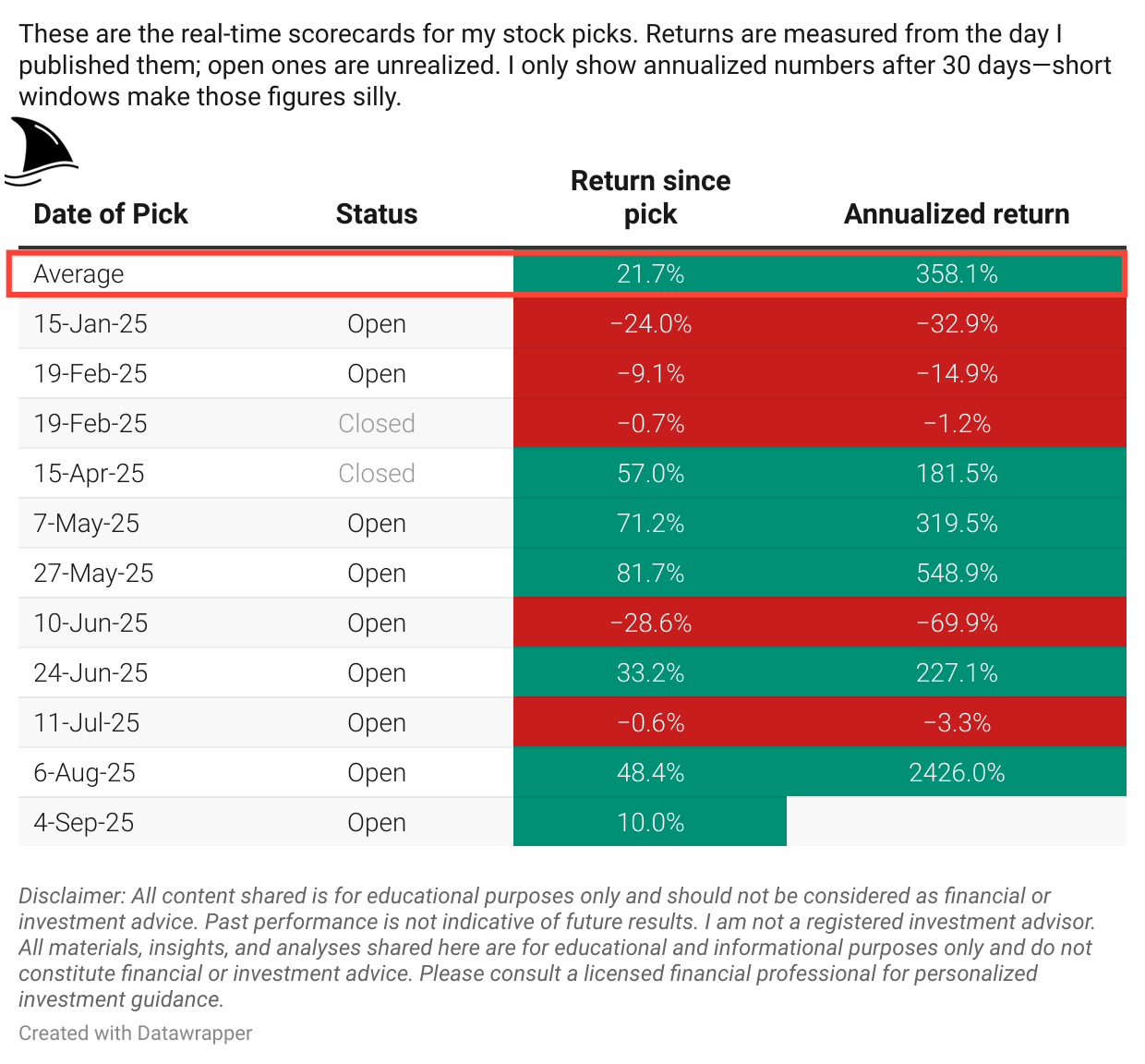

Portfolio Update

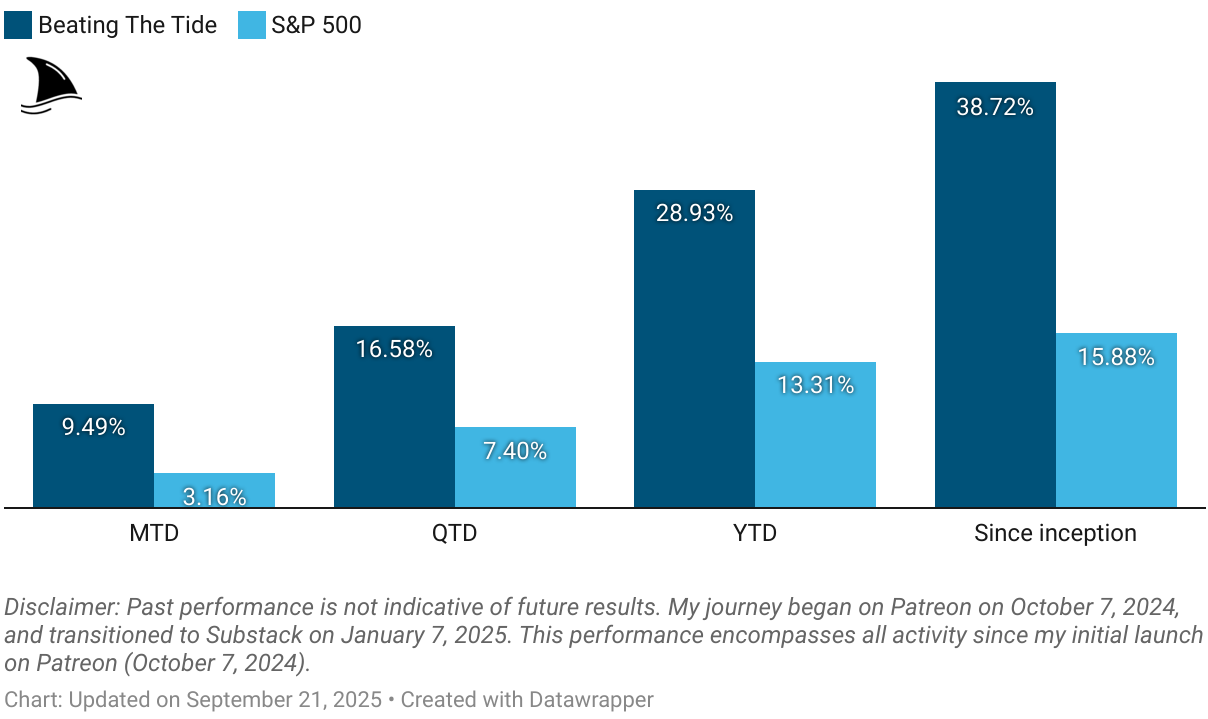

This week, we continued climbing higher into the stratosphere and widening our gap to the S&P 500 😊

Month-to-date: +9.5% vs. the S&P 500’s +3.2%.

Quarter-to-date: +16.6% vs. the S&P 500’s +7.4%.

Year-to-date: +28.9% vs. the S&P’s +13.3%, a gap of 1,562 basis points.

Since inception: +38.7% vs. the S&P 500’s +15.9%. That’s 2.4x the market.

Portfolio Return

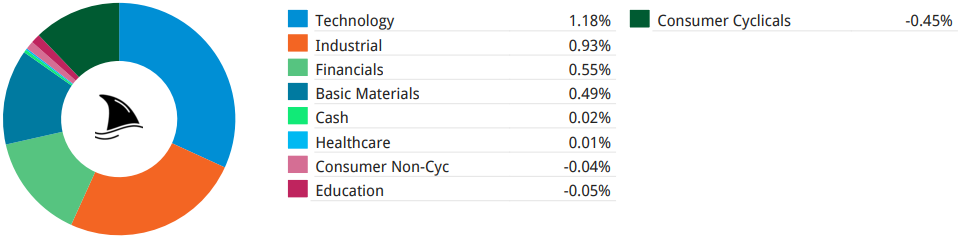

Contribution by Sector

Tech, industrials, financials and gold continued leading the gains this week, slightly offset by consumer cyclicals.

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

++54 bps CLS 0.00%↑ (TSX: CLS)

+42 bps AGX 0.00%↑

+13 bps OPFI 0.00%↑

+13 bps TSM 0.00%↑

+10 bps POWL 0.00%↑

+8 bps ODC 0.00%↑

-1 bps KINS 0.00%↑

-3 bps MFC 0.00%↑ (TSX: MFC)

-6 bps DXPE 0.00%↑

-11 bps LRN 0.00%↑

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Your analysis on CLS is fantastic. It was insightful to learn about your views on the company as it gradually compounded to become one of the fastest growing Canadian companies benefitting from the current AI capex.