Weekly #30: The Cheat Codes to Life Monopoly — And How to Escape the Game Smarter, Not Harder

How to win at the real game of money (with 7 timeless finance tips), market momentum hits ‘greed,’ and portfolio performance rebounds. Our portfolios are once again beating the S&P 500 and TSX.

Hello fellow Sharks,

This week, all our portfolios officially flipped back into the green, outperforming both the S&P 500 and the TSX. (If you want to skip straight to the portfolio update, click here.)

The market’s been climbing with a vengeance. CNN’s Fear & Greed Index jumped from 62 to 71 — brushing up against "Extreme Greed" territory. It’s now higher than it was a year ago and back to the levels we saw last October.

There are some recession warnings floating around. Personally, I don’t think we’ll see one — though we might hit a short-term bump over the next couple of weeks. Thanks to the 145% tariffs, a lot of cargo was rerouted from China to Vietnam. Redirecting those ships back to China will take time, which likely means empty shelves and higher prices in the interim. But it’s a temporary hiccup. Once shipments land in the U.S., shelves will restock, and we’ll probably see a wave of overspending to make up for the lag.

As for this week’s Thought of the Week, I’m zooming out. It’s less about picking the next winning stock and more about the bigger game we’re all playing. You’ll see why fundamentals like paying yourself first and investing in assets matter even more than chasing the highest return. Don’t get me wrong — I’m a big believer in stock picking, as I would rather have $26 million in the bank than a mere $300,000 as I explained here. But before you can invest, you need capital, and that starts with getting the financial basics right.

Table of Contents:

In Case You Missed It

This week, I wrote deep dives on two positions that I recently exited:

T-Mobile Stock Analysis & 47% Gain: Why I’m Taking Profits Now. TMUS 0.00%↑

I break down why I originally bought T-Mobile at $163, what played out as expected (subscriber growth, margins, FCF), and what’s changed. Insider selling is accelerating, competition is heating up, and valuation looks stretched. The risk-reward has flipped, so I took profits.

Why I Just Locked a 90% Gain on Royal Caribbean — And Why I’m Stepping Off the Ship. RCL 0.00%↑

Valuation is stretched, insiders are cashing out, and the risk/reward has flipped. In this deep dive, I break down why I sold, and why sometimes the best move is stepping off before the tide turns.

Thought of the Week: Cheat Codes for Life Monopoly

I have a confession: I’m a board game nerd. Give me a free evening and I’ll happily pull out Ticket to Ride. There’s just something about the strategy, the friendly competition, and the shared laughs over plastic trains that I enjoy. But as much as I enjoy board games, my wife doesn’t. And that is fine, I respect her decision, people should be free to choose if they want to play a game.

However, there is one game we are all forced to play since the day we are born, and the worst part is that most of us don’t even know we are playing the game. I want to talk about the game “Life Monopoly”. This is the one game we’re all forced to play in real life, whether we like it or not.

Life Monopoly: You’re Already Playing It

Think about it: from the moment you start earning your own money, you’ve been plopped onto a real-life Monopoly board. You “pass Go” on payday, get taxed, pay rent or a mortgage, and occasionally draw an unlucky Chance card (surprise car repair, anyone?). We’re all players in this system — a “Life Monopoly” game — with rules set by society. Want to sit out this game? Too bad; opting out just means falling behind. Even Monopoly’s inventor, Lizzie Magie, originally designed an earlier version (called Landlord’s Game) in 19041 as a cautionary tale about the evils of unfettered capitalism. (Oh, the irony that today we gleefully play to become the very tycoon she warned against!) In the real world, though, the stakes aren’t play money — they’re your time, your income, and your future.

The Real Rules: Time, Money, and Illusions. Part of what makes Life Monopoly tricky is that we often don’t question the “rules” we play by. Take time, for example: Society chops it into a fixed 9-to-5 workday and a 40-hour workweek (thanks, Henry Ford, for popularizing that). We treat time as a rigid, scarce resource — “money equals hours” — even though physicists like Carlo Rovelli (read his book, The Order of Time, eye opener) tell us this is largely an illusion (our common sense of time flowing steadily is just a convenient story).

Then there’s money itself: centuries ago, it was shells and gold; today it’s mostly digital bits flowing between banks. Yet, we collectively behave as if these constructs are as real as gravity (I go deep into the stories we tell ourselves here). We trade hours of our life for pieces of paper (or more likely, numbers on a screen) because that’s the rule of the game: you need money to survive. Over decades, we’ve built a culture where a “normal life” means school, then a 9-to-5 job until ~65, all to hopefully retire with enough savings to enjoy whatever time we have left.

Historically, this made sense — the industrial age needed standard hours, and people traded labour for wages. But fast forward: in recent decades, wages for most folks barely budged (today’s average paycheck has about the same buying power it did 40 years ago), while those who owned assets like stocks or real estate saw their wealth compound. In other words, the game rules have been quietly favouring the asset-owners over the labour-for-money players.

No, this isn’t a conspiracy rant — it’s to highlight why classic investing advice (the boring stuff your grandparents might've told you) matters more than ever. You’ve probably heard maxims like “pay yourself 10% first,” “invest in assets, not liabilities,” or “don’t spend more than you earn.” They sound so basic — almost too simple in a world obsessed with finding the next hot stock or crypto coin. But the truth is, winning your Life Monopoly often comes down to these unsexy fundamentals. Picking the perfect stock is great, but it’s kind of like landing on Boardwalk and drawing a lucky Chance card — rare and not within your full control. Meanwhile, consistently following the basic rules is like steadily buying up railroads and utilities: not as flashy, but quietly powerful over time.

Why Basics Beat Stock Picking (Most of the Time)

Imagine two scenarios: In one, you’re an investing wizard and somehow double a $1 investment — a 100% return! In another scenario, you’re not as “gifted” at stock picking, but you diligently invest $100 every month and manage a 30% annual return. After year one, the wizard has turned $1 into $2. Our steady investor has something like $1,565 (after contributing $1,200 plus growth). Not impressed?

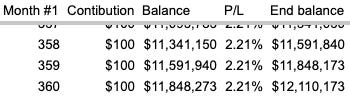

Fast forward 30 years. Our steady 30%-a-year investor who kept adding $100 monthly would end up with $12,110,173 after 30 years. Yes, you read that right — roughly $12 million from just a hundred bucks a month invested at a high compound rate.

A 100% gain on a single dollar versus an engine of compounding contributions — see the difference? The lesson: focus on playing the long game and increasing your “assets” (the money you invest), rather than swinging for a one-time homerun. Consistency and time > one lucky stock tip.

Now, let’s connect this back to Life Monopoly. In Monopoly, the board game, you win by accumulating assets (properties) that pay you rent each turn. You don’t win by saving up cash under the mattress, nor by blowing all your money on Mayfair (Boardwalk) and then going broke. Real life is strikingly similar. The people who “win” are usually those who steadily acquire assets — stocks, index funds, real estate, skills that boost their earning power — and avoid the traps of overspending on liabilities.

As Robert Kiyosaki bluntly put it,

An asset puts money in your pocket, while a liability takes money out.

Simple, yet so many of us spend decades playing by the wrong rules — pouring our hard-earned cash into liabilities (fancy cars, gadgets, etc. that just eat money) instead of assets that work for us.

So, how do we tilt the odds in our favour? How do we win (or at least cheat-proof) our personal Monopoly game without losing our minds? Let’s talk practical strategy — the kind of timeless investing tips and life hacks that help you build wealth with minimal stress, one turn at a time.

7 Tips for Winning at Life Monopoly (Without Losing Your Mind)

Tip #1. Pay Yourself First — You Come Before the Bills

The minute that paycheck hits your account, skim off a chunk for yourself before you pay anyone else. A classic target is 10%, but I recommend 20%-30% (I will explain why in a future Weekly). This is the golden rule of personal finance. Even Warren Buffett swears by it, famously saying:

Don’t save what is left after spending; spend what is left after saving.

Treat your savings like the first bill you must pay each month. For example, if you earn $4,000 a month, immediately whisk away $400 into a separate savings or investment account. You’ll be surprised how the rest of your expenses adjust to what’s left. It’s like giving Future-You a salary. And Future-You, trust me, will be very grateful. (Bonus: automating this — so the money moves on its own — is the best way to enforce the rule when your willpower wanes on a tempting Amazon splurge.)

Tip #2. Invest in Yourself – The Best Stock is You

Looking for the next 10x investment? Start with the face in the mirror. Investing in your own skills, knowledge, and health offers returns no stock can match.

Buffett says:

The best investment you can make is in yourself.

This can mean taking an online course to level up your career, reading books on finance or leadership, or even just getting enough sleep and exercise. Research shows healthy habits (exercise, sleep, good nutrition) pay off in longevity and even financial well-being. And new skills or certifications can lead to promotions, better jobs, or profitable side hustles.

Example: if you spend $500 on a coding bootcamp or marketing course, that could translate to a new job paying $10,000 more per year — that’s a 2000% return on your “self-investment.” Not too shabby! Plus, unlike a volatile stock, the knowledge and abilities you gain can’t be taken away by a market crash. You are your own greatest asset; nurture it.

Tip#3. Create Multiple Income Streams — Don’t Rely on One Dice Roll

In Monopoly, having only one property means that if a bad roll comes, you’re in trouble. In life, relying solely on one paycheck is similarly risky. The average millionaire has seven streams of income, and that’s not a coincidence — multiple income streams provide stability and faster growth. Start with small steps: maybe it’s a side gig freelancing a skill you have, renting out a spare room, or investing in dividend stocks that pay you regularly.

Passive income is the holy grail — money that comes in while you sleep. Or as Buffett bluntly put it:

If you don’t find a way to make money while you sleep, you will work until you die.

That might sound extreme, but the idea is spot on. Even an extra $200 a month from a side hustle or investment can be life-changing over time (you could invest that $200 and watch it compound!). Over the years, you can grow those drips of extra income into a veritable river. And if, knock on wood, you lose one source of income (job layoffs, etc.), you won’t be left high and dry. Think of each income stream as a backup heart for your financial life — if one stops, the others keep you alive.

Tip #4. Avoid Mindless Consumption — Don’t Buy Stuff to Impress People

In the consumer society we live in, it’s disturbingly easy to blow money on things that add zero long-term value to our lives. New gadgets, designer clothes, that $7 daily caramel latte — they can eat away at your cash without you realizing it.

Look at the video below, one guy buys a McDonald’s burger every day, the other puts that $10 into McDonald’s stock instead.

Fast forward 20 years — the burger guy’s down $73,000, the investor’s sitting on $1.2 million.

Small habits, big difference

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

The goal isn’t to never have fun or indulge; it’s to be mindful and intentional with spending. Ask: Does this purchase bring me joy or move me forward, or am I just keeping up appearances?

As the old joke (popularized by financial guru Dave Ramsey and the movie Fight Club) goes:

We buy things we don't need with money we don't have to impress people we don't like.

Ouch. But true! Curbing mindless spending doesn’t mean you become a miser — it just means channeling money toward what matters to you.

Try this: before any non-essential purchase, wait 48 hours. Often, the impulse fades, and you realize you didn’t truly need another pair of shoes or the latest gadget. And when you do spend, spend on experiences or items that align with your goals (e.g., a good laptop if you’re learning to code, or travel that enriches you) rather than just scrolling Instagram and clicking “Buy Now” because an influencer made it look cool.

Remember, every dollar not squandered on junk is a soldier you can deploy to work for you (invested, saved, or used for something truly meaningful).

Tip #5. Buy Assets, Not Liabilities — Make Your Money Work for You

This is Classic Investing 101, but it’s amazing how many people ignore it. An asset is something that puts money into your pocket over time; a liability takes money out of your pocket. Sounds obvious, yet think about how we usually spend. A new car (liability — it costs money in payments, gas, insurance).

Now think in terms of assets: stocks, bonds, rental property, starting a small side business, or even something like a YouTube channel that eventually earns ad revenue. These are things that can generate income or grow in value. Every time you’re about to make a major purchase, pause and categorize: Is this an asset or a liability?

Now, we all need some liabilities (you need a place to live, maybe a car to get to work, etc.), but the key is to minimize the liabilities that don’t improve your life and funnel more of your money into assets. For example, buying a used, reliable car for $10k instead of a new $30k one could save you $20k — money which, if invested, might grow to +$60k in a decade.

That’s the true cost of a liability: it’s not just the sticker price, it’s also the lost opportunity for that money to grow. Adopting an “asset mindset” might mean some unsexy choices now (stocks over luxury cars), but your future self will be driving whatever car they want and have a fat investment portfolio on the side.

Tip #6. Don’t Let Culture Dictate Your Spending – Avoid the ‘Joneses’ Trap

Society and social media love to set benchmarks for us: the dream house, the luxury car, the exotic vacations, the designer clothes. It’s easy to fall into the trap of “everyone is doing it, so I should too.” But here’s a secret: a lot of those folks financing flashy lifestyles are losing the money game.

The truly wealthy often live quite modestly. Most real millionaires live in average neighbourhoods, own used cars, and avoid conspicuous consumption. Meanwhile, a huge chunk of luxury car drivers and McMansion homeowners are up to their eyeballs in debt, not net worth. In fact, in The Millionaire Next Door, Thomas Stanley found that 86% of people driving luxury brand cars are NOT millionaires (they’re just looking rich).

Oops. Keeping up with the Joneses is a surefire way to blow your chance at financial independence. To escape this, get clear on your own values and goals. Maybe you don’t actually care about a McMansion and would be just as happy in a cozy cottage, with more money left to invest or travel. Maybe driving a paid-off Honda is fine by you if it means you can max out your 401(k).

Take pride in not following the herd. There’s a quiet, subversive joy in being the one who drives the 10-year-old car because you have nothing to prove. Remember, financial independence is the real flex. When you can walk away from a job you don’t like (as I have done…a couple of times) or take a spontaneous trip because you’re financially secure, that’s far cooler than impressing strangers with depreciating toys.

Tip #7. Be Frugal, Not Cheap — There’s a Big Difference

Frugality is about value, mindfulness, and efficiency; being cheap is just about spending the absolute least, consequences be damned. Frugal people seek quality at a good price and think long-term. Cheap people cut corners and hurt themselves (and others) in the process.

For example, a frugal person will happily tip a good waiter and seek out a sturdy pair of shoes (because they last longer), but maybe skip buying $300 designer sneakers. A cheap person might stiff the waiter to save a buck, or buy the absolute cheapest shoes that fall apart in a month. See the difference? One approach wins long-term loyalty, better experiences, and durability; the other burns bridges or results in shoddy stuff that costs more later.

Frugality also means you understand “price is what you pay; value is what you get.” A $100 item that you use daily for a decade is far better than a $20 item that breaks in a week. So, don’t be afraid to spend on important things — invest in a good laptop if it’s crucial for your work, pay for a course that could boost your salary, or treat your loved ones once in a while.

Just cut ruthlessly on the things that don’t matter to you, and spend generously on the things that do (within reason). This way, you’re optimizing your life for happiness and financial health. Being frugal is a badge of smart play in Life Monopoly; being cheap is like trying to win by avoiding opportunity, not a winning strategy.

Final Thoughts – Loading Your Dice (Legally)

You might have noticed a theme: none of these tips are about picking the next Nvidia or timing the market just right. That’s because winning the money game is less about fancy moves and more about consistent habits and mindset. The cultural narrative of the genius stock-picker or the lucky Bitcoin millionaire is sexy, but it’s the exception, not the rule. For most of us seeking financial independence, boring is beautiful. Slow and steady truly can win the race.

But boring doesn’t mean your life has to be boring. Getting your finances in order is liberating — it frees you to take risks in your career, to start that business you’ve dreamed of, or to simply sleep better at night without money stress. When you follow the principles above, you’re essentially stacking the deck in your favour. It’s like you’ve been handed the “Get Out of Jail Free” card and a handful of bonus Chance cards that say “Advance to Go, Collect $$.” You’re giving yourself options in a world where too many feel financially trapped.

And hey, speaking of cheat codes and stacking the deck — that’s exactly what I aim to give you with this newsletter. Every week, I connect the dots on stock investing, the economy, and ways to outsmart the Life Monopoly game so you don’t have to figure it all out alone. It’s like getting the game’s strategy guide handed to you. 😉 If you’ve made it this far, you’re clearly serious about improving your financial future (high five for that!). So why not keep the momentum going?

Remember, the best players seek every advantage. Beating The Tide is here to be your advantage — your secret weapon, your personal “best stock newsletter” meets financial life coach, all in one. I’ll keep sharing the investing tips, big-picture context, and candid humour to keep you learning and laughing on the road to financial freedom. You just keep playing your game, one wise move at a time. Together, we’ll beat this Life Monopoly — and have some fun along the way!

Here’s to your next turn being a great one. 🎲🚀

Portfolio Update

Portfolios are back in the green! 😉

Portfolio USA’s performance improved less than the S&P 500’s, but we are still outperforming the S&P 500 by 86 bps YTD (from 100 bps last week). Portfolio Canada’s performance improved significantly more than the TSX’s, narrowing the performance gap from -263 bps to -84 bps YTD.

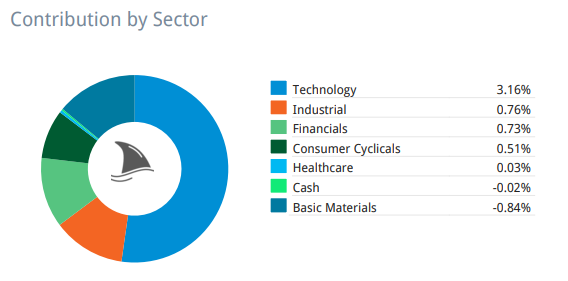

Tech, industrials, financials and consumer cyclicals led the recovery of both portfolios. Gold was a negative contributor in 🇨🇦 and education in 🇺🇸.

Contribution by Sector - Portfolio USA

Contribution by Sector - Portfolio Canada

Notable contributors to Portfolio 🇺🇸:

0.55% TSM 0.00%↑

0.37% AGX 0.00%↑

0.14% POWL 0.00%↑

0.13% DXPE 0.00%↑

Notable contributors to Portfolio 🇨🇦:

3.19% CLS 0.00%↑

For the full breakdown, here’s the weekly stock performance for each portfolio: Weekly Stock Performance Tracker

That’s it for this week. Happy investing, and see you on the board next week!

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Connecting the Dots in Stock Investing: Sharpening Your Mosaic Thinking

What Does It Mean for a Market to Be Efficient? (And Why It Matters for Stock Investing)

Why you should aim to make a living rather than making a killing

Three decades after The Landlord's Game was invented in 1904, Parker Brothers published a modified version, known as Monopoly.