Weekly #28: Buffett’s Greatest Lesson: The One Skill That Builds Wealth

Markets change. Strategies evolve. But this Buffett principle still wins.

Table of Contents:

Happy Sunday, fellow Sharks,

It was another good week for the markets. This is your go-to investing newsletter for deep, actionable stock insights backed by fundamentals.

Also, the market was less fearful than last week, increasing the index from 35 to 43.

In Case You Missed It

This past week I released:

Kingstone Companies: Hold or Fold After the +80% Surge? KINS 0.00%↑ - This is a deep dive on a position we have been holding since it was a $10 stock. Now that it has surged to $18, I am taking a second look to see whether we close our position or keep riding the wave.

Closing three positions in Portfolio USA - Also, I sent a trade alert to paid subscribers, closing 3 of our positions that don’t have a favourable risk-reward profile anymore and also to make room for new additions to the portfolio (coming soon).

We had a lot of news in the markets this week: Trump scaled back some auto tariffs, job openings fell to their lowest since September, U.S. GDP shrank 0.3% in Q1, and Mark Carney won the Canadian elections.

While headlines like these may jolt your portfolio in the short term, they’re just minor blips on a much longer wealth-building journey.

That’s why, in this Weekly, I want to shift your focus away from the noise and toward something that actually moves the needle: a timeless principle that’s far more important to your long-term financial success.

Thank you, Warren Buffet, for decades of invaluable insights and for demonstrating the true power of patient, disciplined investing. This piece was your inspiration.

Thought of the Week: Why Most Investors Fail: The One Skill You Need to Succeed

(Adapted from my LinkedIn newsletter: Weekly Investing Fundamentals)

Stock investing ideas take time to play out—anywhere from weeks to years. On average, mine tend to materialize in about 2.5 years, but I've seen some pan out in just a few months, and others took as long as five years. How quickly things come together usually depends on how accurately I can identify catalysts—the events or triggers that move your investment forward. (Catalysts deserve a whole post on their own, so hang tight, I promise it's coming...BE PATIENT 😉)

So here's a question for you:

Patience is a critical ingredient in successful investing, and there’s no better example of this than Warren Buffett. With Buffett recently announcing plans to step down as CEO of Berkshire Hathaway at year-end, it's a fitting moment to pause and appreciate his decades-long demonstration of disciplined patience.

Buffett has consistently emphasized maintaining a long-term perspective, famously stating, “Our favourite holding period is forever.” Yet even Buffett acknowledges the importance of timing and opportunity, keeping a substantial cash pile ($347 billion as of Q1) ready to deploy when compelling opportunities arise. He emphasized this during Berkshire’s latest shareholders meeting: “If we acquired businesses or accumulated stock solely for the sake of getting that cash pile down, that would be the dumbest thing in the world.”

If you want to invest successfully, you need to be comfortable waiting. Think of it like planting a garden—sure, you could keep digging up the seeds every day to check if they're growing, but all you'll get is a patch of dirt and frustration. Your best ideas will always be those that seem slightly too early or even unpopular at the time. By the time everyone else jumps on board because they read about it online, it's usually too late—the market already knows, and prices are sky-high. So being early is good, but being early means you'll be sitting on your investment for a while. It's just how this game works.

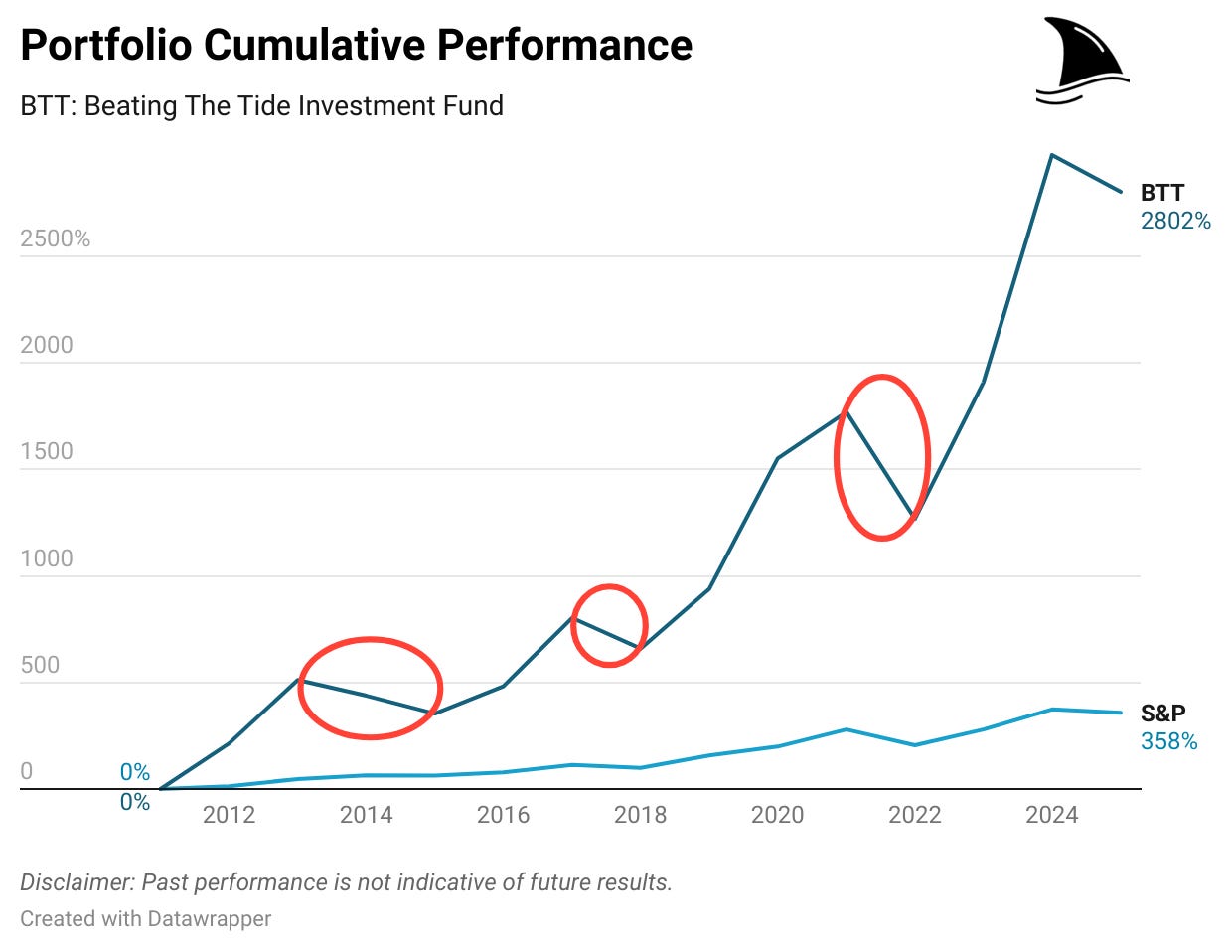

Buffett’s patient and disciplined approach has consistently created exceptional value. Buffett’s Berkshire Hathaway’s stock traded at $290 on May 18, 1985 and was $809,350 as of May 2, 2025, that is an annual return of 19.3% over almost 45 years!

This disciplined patience isn’t only about letting your investments slowly sprout; it’s also crucial when things temporarily go south. Consider my own portfolio: thanks to recent tariff drama, it swung from +8% YTD on February 9, 2025, to -17% YTD by April 6, 2025. But that’s just short-term noise. Keeping cool allowed me to pick up quality stocks at a bargain, aiding the eventual recovery. Today, the portfolio performance is approximately -5% YTD—had I panicked and moved to cash at the lowest point, I'd have missed out on significant gains.

In times like these, I like to reflect on the graph below. The red circles highlight periods where the portfolio experienced losses, but ultimately, we emerged stronger as the market eventually returned to its senses and rewarded quality companies.

You also need patience with yourself. Good investing takes consistent effort. Do you actually enjoy reading annual reports or catching up on industry trends? If your answer is "meh, not really," no shame—just invest most of your savings in passive funds (I still prefer active investing and here is why) and leave a small portion for your curiosity or pay someone to invest the time for you (cough cough Beating The Tide). But if you're serious about active investing, plan to dedicate at least a couple of hours per week to stay sharp.

Upgrade to paid. I’ll do the heavy lifting. That’s less than what most people lose panic selling once.

Personally, I like having a simple weekly routine. Monday through Thursday, I'll check in on one of the stocks in my portfolio. Friday, I'll look around for something new and exciting. Saturday, when things slow down, I’ll dig deeper—maybe run a valuation model or craft a detailed narrative about a stock investing idea. Trust me, a schedule makes life easier. Without structure, you're basically throwing darts blindfolded (fun at parties, less fun when managing your retirement).

Spending a couple of hours a week on thoughtful investing is worlds apart from day trading, where you’re glued to screens five hours a day. And trust me, you can handle a serious job and still find a couple of hours a week. I've done it. Unless your job is literally saving the world daily (in which case, thanks!), you probably can too.

I already covered why day trading is a bad idea here, but here is the simplest difference between day trading and long-term investing:

Day trading: You're buying and selling based purely on price moves or news, usually within the same day. You're ignoring the actual fundamentals of the companies you trade. Plus, those commissions and transaction costs pile up quickly, quietly eating away your lunch money.

Long-term investing: You dig into the company's fundamentals—think future cash flows, competitive advantages, all that nerdy-but-important stuff—and hold your investments patiently. Your costs are usually limited to taxes when you eventually sell (and maybe some minor fees).

So, do you have the patience—and frankly, the interest—to let your investments grow at their own pace, even during rough patches? Or are you still chasing quick wins? And how much time are you realistically ready to dedicate each week?

Something worth thinking about. If you're realizing that patience and deep-diving into fundamentals aren't really your thing, that's perfectly okay! You might find the paid membership helpful. I share my portfolio, along with real-time investment alerts, to let you know precisely when I buy or sell. It’s a great way to invest smarter without getting bogged down by the day-to-day noise. Upgrade to paid and join one of the best investing newsletters for long-term stock investors

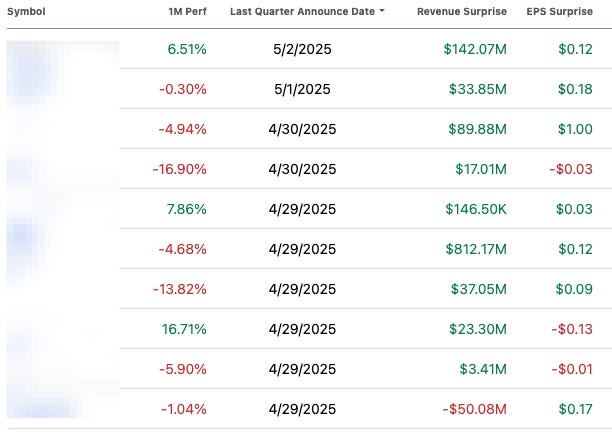

Ten More Companies Reported Earnings

Nearly half the S&P 500 reported earnings this week. Companies broadly delivered better-than-feared results, though forward guidance remained cautious amid ongoing tariff uncertainty and softer consumer spending.

Since the last earnings update, 10 more portfolio companies reported earnings. Only one missed revenue consensus estimate and three missed EPS consensus estimates. However, two of the EPS misses were insignificant ($1.31 vs. $1.34) and ($$0.10 vsa $0.11).

Portfolio Update

Portfolios continued the path to recovery. Portfolio USA’s performance improved less than the S&P 500’s, widening the gap from -162 bps to -230 bps YTD. Portfolio Canada’s performance improved more than the TSX’s, narrowing the performance gap from -259 bps to -226 bps YTD.

Tech, industrial and education led the recovery of Portfolio USA, offset by a decline in consumer. Tech, financials and consumer cyclicals led the recovery in Portfolio Canada, offset by a decline in gold.

Contribution by Sector - Portfolio USA

Contribution by Sector - Portfolio Canada

Here’s the weekly stock performance for each portfolio: Weekly Stock Performance Tracker

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

I too tend to find that Buffett quote a bit misleading when we think about individual stocks. He moves stuff around all the time and is highly opportunistic in certain scenarios. What I love about Buffett is his passion for investing and his openness about mistakes. Some losses are the macro cycle, some losses are our own wrong calls — most heal with time.