OPFI Deep Dive: The Fintech Lender That’s Beating the Odds

How OppFi’s AI, bank partnerships, and high-margin model are transforming subprime lending and why its 3.2x FCF multiple won’t last long

Updates:

Nov2’25: Q3 2025 Earnings Results

Aug10’25: Q2 2025 Earnings Results

On my third engineering gig, I worked alongside a 20-year veteran who lived and breathed the company from late nights to weekend call-outs. One morning, management announced a “strategic shift,” and just like that, the seasoned pro was marched out with a cardboard box while I, a rookie with maybe three years under my belt, kept my badge.

A week later, I dropped by his house to see how he was holding up. He was wrecked. Big family to feed, a kitchen reno he’d just finished, and his middle kid about to start university. With severance uncertain, he’d taken out a bank loan just to bridge expenses until he landed something new.

What stunned me most?

This guy, who’d earned way more than I did, had virtually no savings. (Money management is a story for another day.) That visit drove home the brutal lesson: depending on one paycheck is like balancing a bridge on a single beam; one sudden move and the whole span collapses.

That gut-punch lesson stuck: a single paycheck is a flimsy bridge with zero margin of safety. Engineers design redundancy into every span; why wouldn’t engineers build the same buffer into their income stream?

So I got to work. Step one was the stock market. But I didn’t dive straight into picking individual stocks. Like most people, I started with mutual funds, then gradually shifted to ETFs, and eventually built the confidence (and curiosity) to research and buy individual stocks. (If you’re curious, I tell the full story in the first chapter of my book.)

As my nest egg grew over the years, I branched out into rental properties for steady cash flow, and later into peer-to-peer lending, where yields looked juicy if I could underwrite risk better than the crowd. Each new stream thickened the safety net the way extra girders strengthen a bridge.

But lending raised an awkward question. Why can I borrow at 5 % while the guy down the street pays 22% or, if he’s unlucky, triple-digit APR? The answer turned my moral dilemma into an investing thesis: sub-prime rates are high because default rates are higher still. Offering someone 15% when their only other choice is a 400% payday loan isn’t predatory, it’s a lifeline priced for risk.

That framing is exactly why OppFi (OPFI 0.00%↑) landed on my radar. Yes, its loans can sport headline APRs up to 160%, but those rates reflect real default math and provide a responsible alternative for people locked out of traditional credit. Pair that with OppFi’s bank partnerships, AI-driven underwriting (“Model 6”), and fast-improving margins, and you’ve got a niche fintech solving a massive problem—and doing it profitably.

On November 11, 2024, I sent out a trade alert adding OPFI to the portfolio. It’s been a fun little roller coaster since.

I entered just below $7 per share, and in April 2025, I boosted the position, bringing our average cost basis up to $7.78.

Well, after a +50% run-up in the share price… is it still a good investment?

In short: yes.

Below is the quick elevator pitch, and if you’re up for it, I’ve laid out a full deep dive.

Sit back and enjoy the read.

Elevator pitch

OppFi is a tech-enabled payday/instalment lender for credit-challenged Americans, using machine learning to cut losses and scale profitably. Its 2025 guidance calls for double-digit revenue growth, a sharp drop in defaults, and expanding margins. Trading at roughly <10x forward earnings (below the broader financial sector’s ~12x) and generating about $320M a year in operating cash, OppFi looks like a risk-adjusted bargain if credit stability holds.

I’m long OppFi because I believe its technology and bank partnerships can sustain high returns despite macro volatility, and because the stock seems undervalued given its growth.

Table of Contents:

OppFi 101: How the Business Works

OppFi’s core product is OppLoans, a fully online, fixed-rate personal loan of $2.5K–$10K. The borrower is typically someone with subprime credit: they’re employed, have a bank account, but maybe no credit score or a history of late payments.

OppFi’s marketing is geared toward “credit-insecure” Americans. The New York Fed estimates this is a ~60 million people market, of which 77% are underbanked and the rest are unbanked. That is a lot of people, 60 million people is about 18% of the U.S. population. These customers often need emergency cash for things like car repairs, medical bills, or rent, and they have few good options.

Crucially, OppFi doesn’t lend its own money anymore. Instead, it partners with nationally chartered banks (FinWise Bank, First Electronic Bank, Capital Community Bank) that originate the loans. OppFi provides the digital platform, underwriting, marketing, and servicing, while the bank funds the loan. Under this “bank partnership” model, OppFi is paid a service fee per loan by its bank partners. (It also keeps the loan on its books for a couple of days and buys a small “participation” slice, but this is just a few days’ worth of interest and is economically minor.)

This arrangement has advantages: because the loan is technically made by a real bank, it bypasses many state usury caps that banks can preemptively avoid. It also lets OppFi operate nationwide without opening stores or branches, keeping overhead low. According to the latest 10-Q, OppFi held about $455M of loans on its books as of Q1 2025 and “acquires certain participation rights” for 2–3 days in each loan, but it’s effectively a tech & servicing business, not a warehouse of loans.

Revenue Model

Since OppFi is a service provider, most of its revenue comes from two sources: interest income from short-term participations and fees from bank partners. In practice, the interest income is tiny because loans move out so fast, so nearly all revenue is accounted for as interest and loan-related income on the “service provider fee” for each originated loan (it looks like interest in the financials, but it’s really OppFi’s cut of the interest stream).

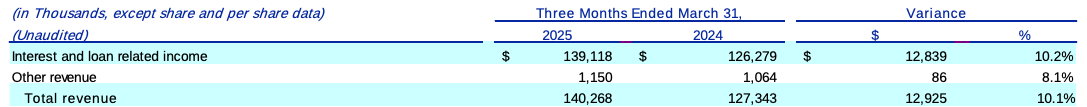

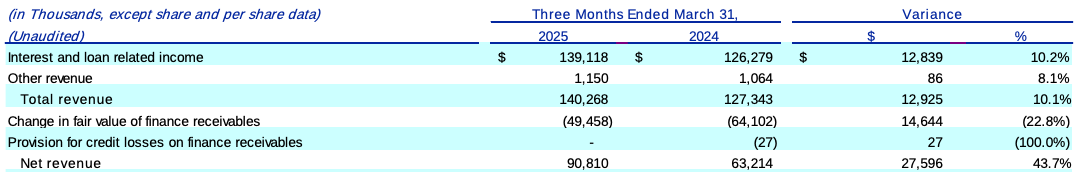

For example, OppFi reported $140.3M of total revenue in Q1 2025 (up 10% y/y), almost all of which is interest from loans.

It earned a tiny $1.15M from the “Turn-Up” referral program (which shops customers around for better offers), so the business is effectively “originations x cut = revenue.”

Because of this, OppFi’s profit drivers are loan volume and loan yield minus losses. More loans, higher rates = more gross revenue, but too many defaults can wipe that out, so their machine-learning underwriting is key.

Under the Hood: AI, Model 6 and 79% Automation

OppFi’s big claim to fame is “Model 6,” their sixth-generation credit engine. It’s a sophisticated, proprietary machine-learning model. Rather than using a FICO score (which subprime borrowers often lack or have frozen), Model 6 digs through hundreds of data points: bank-account cash-flow trends, paycheck consistency, merchant details, fraud signals, device data, and Instant Bank Verification (IBV) that confirms account balances.

According to the company, over 500 attributes are fed into this algorithm on every application. The model learns from real borrower outcomes: if similar past applicants defaulted, Model 6 will demand a higher rate or reject. If data shows a borrower saved steadily or got a positive bump in income (e.g. from Experian Boost connections), Model 6 may approve them more cheaply. It’s a continuous feedback loop: underwriting, pricing, and even collections data all feed back to refine future decisions.

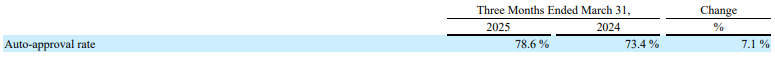

In practice, this tech works very fast: in Q1 2025, 79% of all loan applications were approved “instantly” without any human review.

That’s up from 73% a year prior. More auto-approvals mean one person can process 4–5x the volume, so OppFi’s staff costs don’t grow linearly with loans. CEO Todd Schwartz noted in Q1 2025 that higher automation and Model 6’s accuracy “propelled our net revenue up 44%” y/y.

Wait, what’s the difference between total revenue and net revenue?

It’s a good question, and it explains why Schwartz could mention a 44% jump while the top line only grew 10%. Total revenue is just all the money coming in from loans. But net revenue subtracts key costs like provisioning for credit losses (basically, money set aside for loans that won’t get paid back) and fees paid to partner banks.

And that’s where the magic happened.

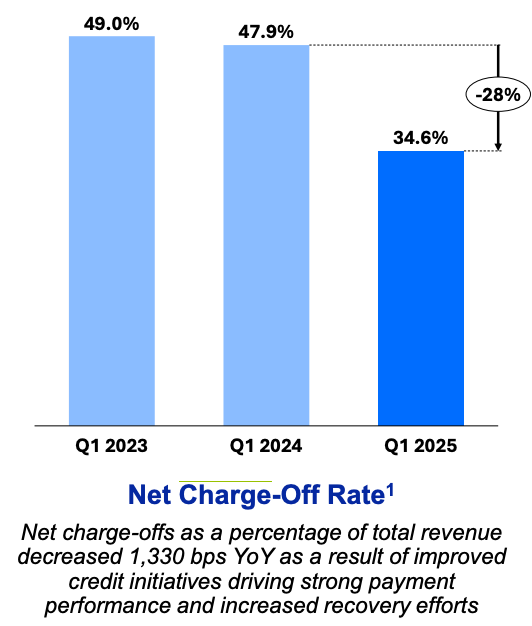

In Q1, net revenue jumped 44% to $91 million, because charge-offs dropped from 48% of revenue to just 35%. In other words, OppFi isn’t just growing, but also it’s getting way more efficient. More of every loan dollar is sticking, and that’s what’s propelling the business forward.

Why is this better than payday loans or banks? Traditional payday and installment lenders often use very rigid rules: two paychecks and a FICO check. Many subprime people don’t qualify for anything at a big bank as they have variable income or thin credit files.

OppFi’s engine goes beyond that.

A classic bank might cap you at 36% APR; a basic payday store might charge 200% APR. OppFi sits in the middle: their average yield was 136% APR in Q1 2025. That’s high, but lower than most tribal “rent-a-bank” payday loans, which can exceed 300% APR. Plus, unlike cash-advance payday loans, OppFi’s loans are installment-based: you pay them back over 6–36 months, rather than a big balloon after 2 weeks. This can make payments more manageable.

Their underwriting also gives a competitive moat: the platform is fully digital, analytics-driven, and constantly learning. OppFi notes that this digital native approach yields “exceptional scalability, cost efficiency…and a best-in-class customer experience”.

It’s hard for a brick-and-mortar payday lender or a slow-moving bank to match that tech. By serving customers online in 40 states (their bank partners’ charters), OppFi bypasses the expense of physical branches and passes on some cost savings to borrowers. In effect, OppFi believes it has a “significant and durable advantage” over banks that still use legacy systems, and over high-cost alternatives like tribal or payday lenders.

Who Are OPFI’s Customers and Products?

OppFi targets Americans who are employed, banked, but under-resourced. LendingTree research suggests 21% of the adult US population has a credit score under 670 or no score; that is ~55 million adults (259 million adults x 21.2%). That lines up with OppFi’s stated addressable market of 60 million.

The average OppLoans customer works at a private-sector job, pays bills on time about half the time, and might have $0–$200 in their checking account on a bad day. Many need cash for unexpected expenses but have no credit card limit to tap.

When a customer applies, OppFi’s platform gathers traditional info (income, debts) and nontraditional signals. If approved, the borrower gets a fixed loan with clear terms: no hidden fees, no prepayment penalty, and full amortization. Importantly, OppFi advertises no prepayment penalty. You can pay off the loan early and save on interest. Customers can make payments via bank ACH or send money orders, etc., and OppFi offers some hardship programs like interest rate reductions after on-time payments or deferments for disasters.

OppFi even partners with financial education apps (Zogo, OppU) to help borrowers learn budgeting or credit-building after they take a loan.

In 2024, OppFi originated over $525 million in loans (per full-year results), and more in 2025. By way of scale, that’s still a tiny slice of the 60 million underbanked. If each customer borrowed an average $5,000, that’d be ~105,000 loans in 2024, or about 0.2% of the subprime population taking an OppLoan.

In other words, there’s a huge runway. And because OppFi’s tech can evaluate thousands of applications a day, it can grow volume without hiring 1000s of extra people. As CEO, Todd said: As originations grow, OppFi gains ‘greater operating leverage”.

In mid-2024, OppFi also expanded into small-business credit by acquiring a 35% stake in Bitty, a startup offering revenue-based finance to entrepreneurs (short-term loans repaid from future revenues).

This was intended to diversify beyond consumers and use OppFi’s risk engine on businesses. During Q1 2025, management noted Bitty’s loans are “short duration,” which can help in uncertain times. It’s still early, and Bitty contributes a small slice of OppFi’s revenue, but it shows OppFi thinking beyond just one product.

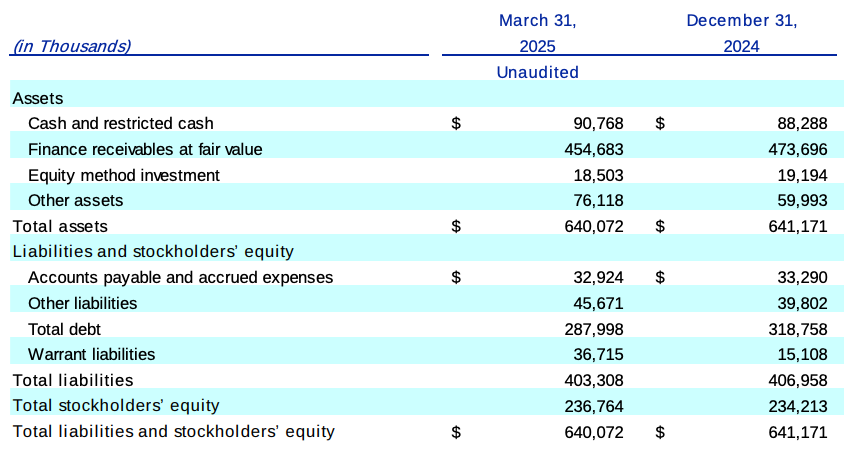

The Numbers: Revenue, Profit and Efficiency (Q1 2025)

Q1 2025 was a monster quarter:

Revenue Growth

Total revenue was $140.3M, up 10% y/y, a clear acceleration from 2024’s sluggish 3–4% annual growth. That rebound was driven by a 16% jump in net originations ($189.2M), but more importantly, it brings OppFi back in line with its longer-term growth trajectory.

Since 2020, OppFi has delivered a 15.6% CAGR in total revenue, rising from $291M in 2020 to $539M as of Q1 2025 (TTM). That kind of sustained momentum suggests this quarter’s growth isn’t a fluke.

Net Revenue

After accounting for write-offs and recoveries, net revenue was $90.8M, a 43.7% y/y jump.

Why the jump?

Because Q1 saw huge improvement in credit losses: gross charge-offs were $59.2M (down 15%) and recoveries $10.6M (up 25%).

In short, far more of the loan principal came back. As a result, net charge-offs as a percentage of revenue fell to 34.6% (annualized), from 47.9% in Q1 2024.

Even on an ABS sense, net charge-offs per outstanding loan are down to ~47% from 62% a year ago. This credit turn is huge. It was clear from Q1 that Model 6’s refinements made OppLoans safer to lend.

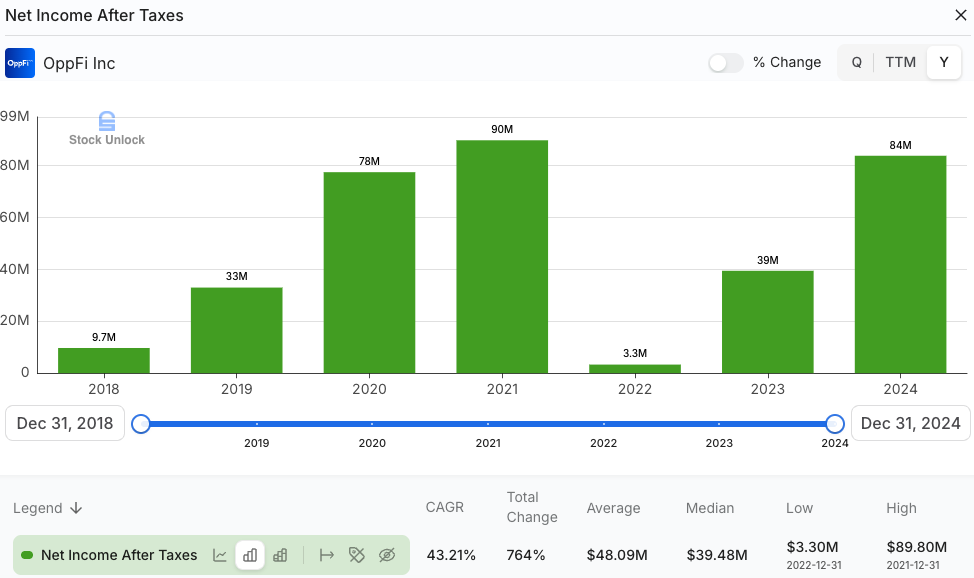

Profitability

Because revenue rose and losses fell, OppFi flew into profitability. Operating income in Q1 was $42.5M vs only $5.3M a year ago. (Yes, that’s nearly 700% growth.)

Adjusted operating expenses before interest were only $38.1M, down 18% y/y despite higher originations.

Efficiency shot up: Expense ratio fell from 45.5% of revenue to 34.4% as they laid off redundant staff, slashed some tech spend, and refined marketing.

Key Metrics

79% of loans auto-approved (vs 73% prior). Interest expense fell to 7% of revenue (from 9%) thanks to paying down high-cost debt. Yield on loans (coupon rate weighted by balance) hit a record 136%, up from ~130% last year. Net interest margin surged.

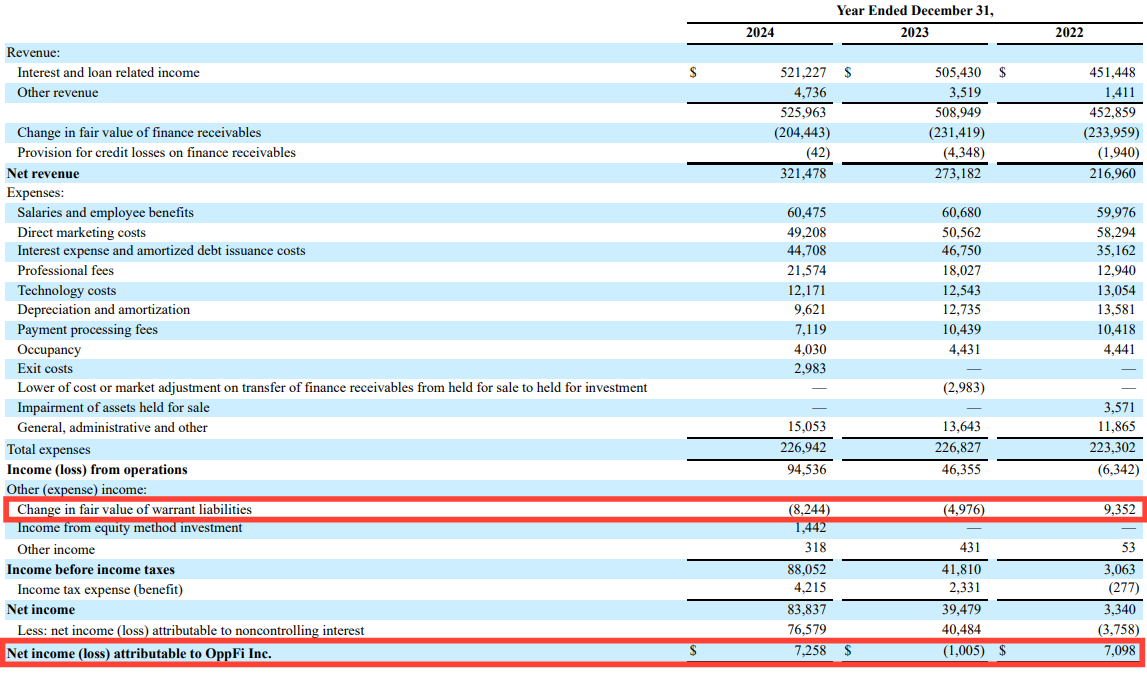

Bottom Line

GAAP net income was quirky due to OppFi’s Up-C structure (non-controlling interests, warrant revaluations, etc.), but economic net income (OppFi-LLC) rose sharply.

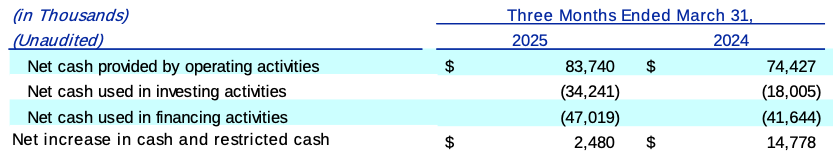

On an adjusted basis, OppFi reported $34M adjusted net income in Q1, up 285% from $9M. Cash flow from operations was a whopping $83.7M for the quarter (vs $74.4M prior), implying ~$320M annual run-rate.

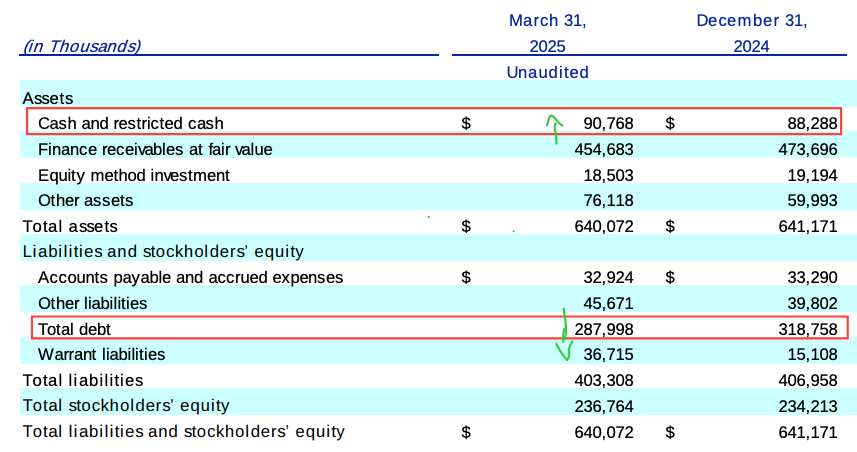

After paying $30M+ to clear a term loan, OppFi still finished Q1 with $91M cash and $288M debt. In short, OppFi is now a cash-generating machine: more cash is coming in from loans than it needs to fund them.

All of this indicates a virtuous cycle: better underwriting → lower losses → higher actual revenue → more profit to invest back into technology. OppFi says “disciplined growth” and “dynamic pricing” drove this performance.

The takeaway is that Q1’s charts show 20–30 point improvements in key ratios (charge-off rate, expense rate), all while growing revenues and originations. That’s a powerful combination.

This is best viewed in context: OppFi is still young and historically has had looser underwriting during growth phases. Q1’s results suggest they’re tightening standards selectively, which is why yield jumped (they’re making slightly smaller loans at higher interest to safer borrowers) and losses plunged. Management is explicitly trading higher credit quality for slightly slower growth and higher margins. If they can continue to narrow that gap, the earnings engine revs up.

Valuation: Discount to Peers with Upside

By almost any traditional metric, OppFi trades at a steep discount. Its trailing P/E is 9.5x, while the financial sector median is 12x.

Even looking at forward earnings, OppFi trades around 9.5x vs a financial-services median of ~11.0x. The market is giving OppFi no premium for growth as it’s cheaper than the sector that includes giant banks.

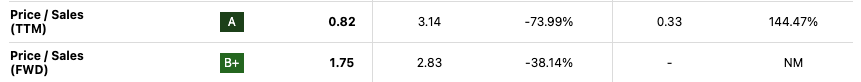

Profit/sales tells a similar story. OppFi’s price/sales is 0.8x, whereas typical banks trade 3x.

Even if we account for the subprime nature of its customer base, OppFi has posted consistent profitability, including positive net income every year since going public, something not every fintech can say.

But here’s the thing: earnings aren’t the full story. When you’re evaluating a company like OppFi where depreciation is low, growth doesn’t require heavy capex, and working capital investment is mostly optional, free cash flow (FCF) is the metric that matters.

So let’s talk FCF.

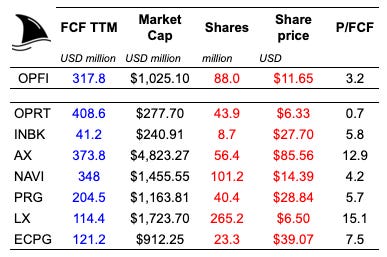

OppFi generated $317.8 million in free cash flow over the trailing twelve months, and is currently trading at a market cap of around $1.025 billion. That’s a P/FCF of just 3.2x.

Let me say that again: 3.2x.

To put that in context, I pulled the P/FCF multiples of a range of fintech and specialty lenders. Here’s how they stack up:

The median P/FCF excluding OppFi is 5.8x, and the average is 7.4x.

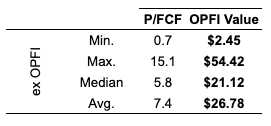

So what should OppFi be worth?

Even if you slap just the median 5.8x multiple on current FCF, you get a fair value of ~$21 per share.

Now, some might argue,

“Well, OppFi deserves a discount; it’s lending to subprime borrowers.”

And sure, point taken. But three things:

Most of its peers lend to similar or slightly better credit profiles, and yet still trade at much higher multiples.

Free cash flow already accounts for loan losses, that is what makes FCF such a robust metric here. You’re seeing what’s left after the defaults.

A discount vs. high-quality banks or prime lenders? Fair. But a discount vs. the median of its direct competitors? That’s hard to justify.

The market is mispricing OppFi not because it’s underperforming, but because it’s misunderstood. It’s a hybrid; a profitable fintech operating in a legacy space that’s ripe for disruption. With fully diluted shares around 88–90 million and consistent cash generation, OppFi can fund growth, reduce debt, buy back stock, and maybe even initiate a recurring dividend down the road.

And if you believe margins will keep improving thanks to automation (Model 6), and that FCF could grow further in 2025, then paying just 3.2x FCF feels… well, kind of ridiculous.

I think fair value is at least $21. It may never trade at 12x or 15x like some flashier names, but 5.8x isn’t unreasonable, and frankly, it’s conservative when the business is throwing off $300M+ in annual cash.

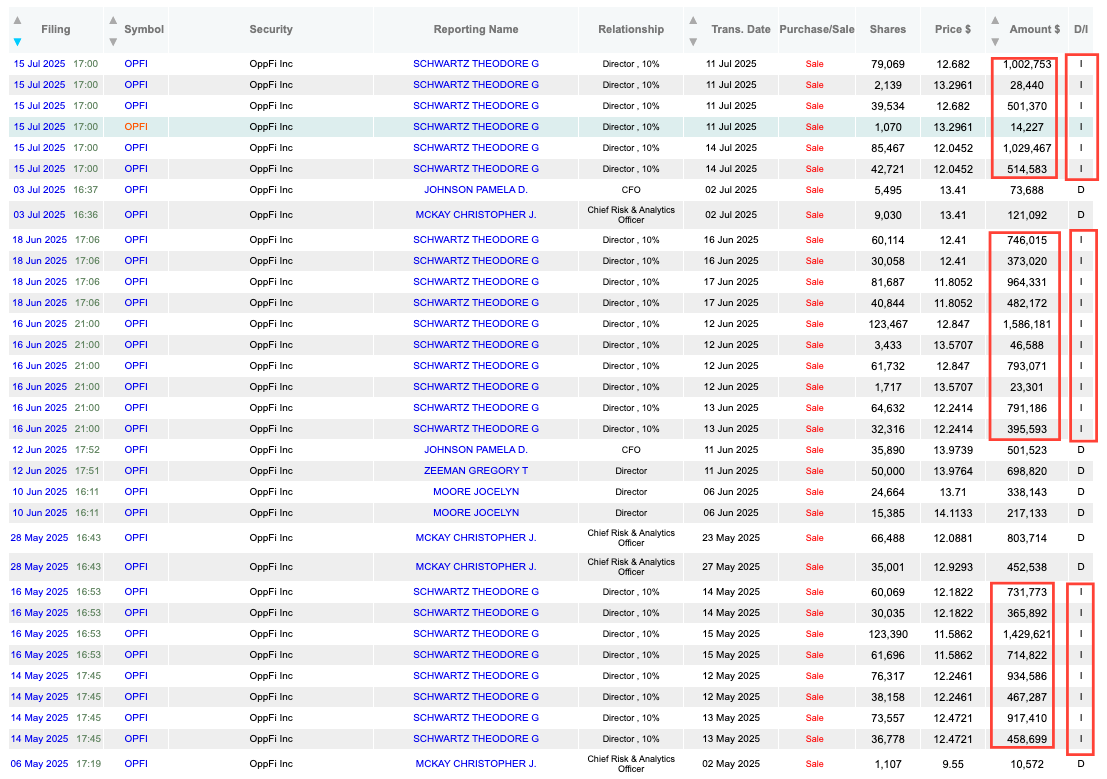

Insider Sales: Mostly “Indirect”

One concern investors sometimes flag is insider selling. Since 2023, several OppFi insiders have been selling chunks of stock. At first glance, the Dataroma chart (above) looks scary, lots of millions in sales by the CFO, COO, and some board members. However, a deeper look shows most of these were “indirect” sales. That means the shares were held in trusts or family LLCs controlled by the insiders. Selling an LLC stake is a tax/estate planning move, not the same as the insider personally dumping shares for cash.

For example, CFO Pam Johnson’s $5.5M sale (March 2024) and CEO Todd Schwartz’s sales were tagged “I” (indirect). This often happens when executives hold shares in pre-IPO LLCs (OppFi’s Up-C structure) and later exchange them for publicly traded stock to satisfy stock grant obligations. It doesn’t necessarily mean they lost faith. In fact, through late 2024 and 2025, top execs have not sold large “direct” blocks in the open market. And importantly, they still own lots of stock and they just paid themselves a huge dividend out of their cash!

In short, the insider selling pattern appears more about tax planning than bearishness.

SPAC Origins and “Up-C” Structure

A quick tangent: OppFi went public via a SPAC (special purpose acquisition company) merger on July 20, 2021. The combined entity was organized as an “Up-C,” which means the public stock (Class A shares) represents interests in an LLC (OppFi-LLC) that runs the actual business. This structure often results in large tax payments to insiders (the “Tax Receivable Agreement” or TRA) as the LLC equity converts.

Why does this matter to us as common shareholders?

First, OppFi’s GAAP earnings are skewed by this structure: you saw Q1 GAAP net income vs adjusted net income was very different, because part of the profit goes to minority members of OppFi-LLC or is eaten by warrant revaluations.

The economics, however, favour the business. OppFi-LLC generates the real cash, and the Class A shares get essentially that profit (minus taxes and TER). Over time, the tax sharing payments (TRA) will reduce cash flow to shareholders, but OppFi has guidance on this, and we can account for it by looking at Adjusted Net Income and Adjusted EPS, which it reports.

Bottom line: because of the SPAC/Up-C, the “net income to OppFi Inc.” line can be confusing, and insider ownership is partly in the form of LLC units with special treatment. But for forecasting, just focus on the LLC’s profits (or the guidance they give for adjusted EPS). Essentially, OppFi’s public float (~90M shares fully diluted) represents nearly 100% of the business, so we can value it like a normal company with some add-back for tax agreements.

Massive Market Opportunity (TAM)

The Total Addressable Market here is enormous. I already noted ~60 million Americans with subprime or no credit. Many rely on payday lending or buy-now-pay-later, or simply go without credit.

The cumulative origination potential is staggering. For context, OppFi’s 2024 originations were only $525M, that’s $525M of loans that go to ~105k people (average loan size $5,000). In other words, OppFi currently captures 0.2% of this potential market (105k / 60M).

Even within this niche, OppFi is not the only player, but it is one of the largest fintech lenders in this space. Its main competitor, Best Egg (OneMain), declined to SPAC and stayed private; then there are smaller brick lenders, Buy-Now-Pay-Later entrants, and other fintechs like Upstart (which went too prime) or Affirm (mostly prime). But no pure-play competitor has OppFi’s combination of bank partners, tech stack, and transparent loans in this market.

Moreover, OppFi’s automation means every incremental loan costs much less to approve. Their customer acquisition mix (mostly affiliates with fixed fees ) suggests stable unit economics.

If OppFi wanted to grow 50% in a year, it could largely do so by turning on more affiliate channels or modestly increasing digital ad spend. It wouldn’t need to hire 5,000 new underwriters. This high scalability means growth can happen faster than with a traditional lender.

Given the TAM, OppFi’s growth strategy is basically “scrape the barrel of credit-challenged Americans until you’re the big fintech in there.” A few bullets on opportunity:

Subprime Consumers (~60M people): OppFi has only skimmed this market. Even doubling 2024 originations to ~$1B would still be a fraction of credit demand.

Short-term Small Biz Loans: The Bitty stake addresses small businesses needing quick capital. There are millions of small firms, many underserved by banks. Bitty’s revenue-based products can scale alongside OppFi’s platform.

Expansion Potential: If OppFi refines Model 6 further, they could potentially approve slightly lower-credit-score applicants or larger loan sizes while still keeping charge-offs manageable. The Q1 call noted Model 6 identified “where there could be an increase in loan sizes for current and past customers”. In other words, a higher AOV (average loan) is possible.

Overall, OppFi’s growth is limited by capital and regulation more than demand. Banks funding OppFi are willing up to certain credit limits, but OppFi has already shown it can attract warehouse financing (Blue Owl facility) and pay down expensive debt. 2025’s guidance (revenue +7–13%) might even be conservative given tailwinds in digital lending and equity capital accessibility. If they can keep default rates low, I don’t see a quick natural cap on growth until maybe the percentage-of-wallet is much higher, and that could be years away.

Regulation and Legal Risks: AB 539 in California

No deep dive is complete without regulatory context, especially since OppFi plays in a hot regulatory arena. The big issue has been California’s AB 539 (the “Fair Access to Credit Act”). Passed in 2019, AB 539 caps interest on loans from $2.5K–$10K at 36% APR if deemed under California law.

OppFi’s partner FinWise Bank is chartered in Utah, which doesn’t have such caps, so OppFi argued Calif’s law doesn’t apply to their loans. The California Dept. of Financial Protection and Innovation (DFPI) disagreed, calling this a “rent-a-bank” scheme, essentially alleging OppFi is the true lender and should be subject to state caps.

Here’s where it stands: OppFi sued DFPI in March 2022 to block enforcement, and DFPI counterclaimed to label OppFi the true lender. On Oct. 30, 2023, the California court denied DFPI’s request for an injunction. The judge said DFPI hadn’t shown OppFi’s loans were usurious or that OppFi was clearly the true lender. The ruling was a major win for OppFi, at least short-term. It means OppFi can keep operating in California under FinWise’s bank charter, charging its normal rates, while the case continues.

This legal battle is still unresolved, but the immediate risk is mitigated. If OppFi ultimately prevails (final win), California’s out of the picture. If OppFi loses (unlikely given the injunction denial), OppFi would likely stop offering loans in California under this model (or slash rates to 36%). Given California’s size, that could knock ~$25–30M off revenue (speculative), but it wouldn’t break the company. Other states have looser restrictions (Nevada, for example, allows higher caps).

For now, OppFi sees this as a known risk. Indeed, their 10-K cautions that losing the case “could negatively impact” California originations. But the injunction denial suggests OppFi’s partners are likely safe for at least a year or two.

Broadly, the regulatory landscape for online lending is getting tougher: CFPB scrutiny of loans, state consumer advocates pushing more caps, etc. The company mentions other risks like any new usury or debt collection laws. On the other hand, OppFi’s use of regulated banks gives it some protection; if anything, regulators may focus more on enforcement against truly predatory actors (like some tribal lenders), and OppFi can argue it’s already regulated by banking regulators via its partners (FinWise is FDIC-supervised).

So, OppFi got to keep lending in CA for now. The case will eventually go to trial to decide who the true lender is, but OppFi’s share price (and guidance) are based on the assumption that California stays open. We should watch news: if the case ever heads back to injunction at higher court, risk might resurface.

Risk of Recession and Charge-Off Trends

A recession is the natural enemy of a subprime lender. If unemployment spikes or credit conditions tighten, OppFi’s customers could struggle to repay. How vulnerable are they? The Q1 results give clues: OppFi’s customers are already among the lowest credit scores, so even “normal” times see ~$0.35 of every loan defaulted. But if 2008 repeats, could that go to $0.50 or $0.60? Possibly.

Historically, OppFi’s charge-offs have been high but improving. As we saw, 2024 net charge-offs were ~39.1% of revenue (versus 43.5% in 2023). That improvement reflects a combination of tightening underwriting and favourable economic conditions (2024 was still expansionary overall).

The first quarter of 2025 is even better at 34.6% of revenue. If the economy slows, we might see this creep back up. However, OppFi does build in provisions and a “fair value” mark on the loan book, which cushions earnings. Note Q1 had no CECL provision (that was very small), meaning they believe their current default projections are baked into the fair value adjustment.

In terms of safety nets, OppFi’s loans are relatively short (most around 6–24 months), so the “peak charge-off” happens quickly. If a loan survives 6 months, chances of default drop sharply. This helps in recessions: borrowers who can make it a year are likely stable. Furthermore, OppFi’s strategy seems to prioritize lower-risk pockets first; the 2024 vs 2023 drop in losses suggests a cohort effect. If a downturn comes, OppFi could always dial back new loan issuance (they have no required minimum origination with banks), preserving capital until delinquency stabilizes.

So the risk is real but somewhat mitigated. OppFi’s Tier 1 capital cushion (equity plus retained earnings) and cash flow give it runway even if defaults temporarily worsen. The stock already trades as if credit could worsen; it’s at 9–11x earnings, not 20x. So near-term, I see more reward than new risk priced in. The big question is whether OppFi’s model really holds up if unemployment ticks up to even 6–7%. In 2023, one slump in mortgage refinancings caused consumer paycheck strains, but OppFi’s customers might feel that more.

That’s why it’s important that OppFi has strong loan-loss reserves and can absorb a hiccup. The Q1 “change in fair value of receivables” was -$49.5M (net of recoveries): that’s how much they wrote down their loan portfolio in 3 months.

If defaults temporarily spiked, we’d see that rise. The 2024 10-K shows they anticipate roughly 50–60% of outstanding receivables could turn to net losses in a bad year. But it also shows they plan no large additional CECL reserves beyond the automatic mark.

In other words: watch reserves closely in future filings to see how prepared OppFi is for a cycle.

Bitty and Small Business Lending

OppFi’s entry into small business credit via Bitty (35% stake) is an intriguing diversification. Bitty provides revenue-based financing (a short-term, flexible loan repaid as a fixed percentage of sales). It targets small operators like restaurateurs, independent retailers, etc. OppFi’s logic: use the same data-driven underwriting on SMBs, hedge by being a minority investor, and capture a new growth market.

In the earnings call, Todd Schwartz noted Bitty is “short-duration” and “well-positioned to weather choppiness”. That aligns with the product since loans self-adjust with cash flow; a downturn reduces repayments proportionally. OppFi’s share of Bitty’s profits appears to already be a few million a quarter (the income from equity method, $1.076M in Q1). It also earned some one-time cash distributions.

Strategically, small biz is a tiny part of OppFi now. But there’s synergy: Bitty can cross-sell to OppLoans customers who start small businesses, or let OppFi use Bitty’s data feeds. The caveat is that SMB credit is also risky, and Bitty is early-stage. OppFi is only on the hook for its investment, not guarantying all Bitty loans. If Bitty tanks, OppFi loses equity. But if Bitty thrives, OppFi gets 35% of a growing fintech. I’d say it’s a modest positive: it shows OppFi can expand beyond personal loans.

If things go well, OppFi might fund more acquisitions. In Q1, management said they’re eyeing “consumer POS” (point-of-sale financing) and other SMB/niche credit spaces. They want any expansion to be high-ROI and non-dilutive to shareholders. Given their strong cash position, I wouldn’t rule out a future bolt-on purchase in a related area. For now, Bitty gives diversification but not materially changes OPFI’s risk profile.

Conclusion: A Fintech That’s Not Just Surviving, but Thriving

OppFi isn’t some speculative moonshot; it’s a cash-generating, tech-enabled lender with a growing moat in a misunderstood market. While subprime lending will never be risk-free, OppFi’s Model 6 underwriting, bank partnerships, and automation give it real staying power.

With 3.2x free cash flow, a massive addressable market, and improving credit metrics, the market seems to be pricing in the past…not the progress.

The bridge I started building years ago now has a pretty sturdy beam running through it. And OppFi? It’s helping lay down a few more.