DXP Enterprises Q3 2025: Overreaction Creates Opportunity

A noisy quarter, a calm setup: why the 20% selloff says more about fear than fundamentals

I wrote recently about the market’s “all-or-nothing” mindset and how a minor miss can trigger outsized punishment.

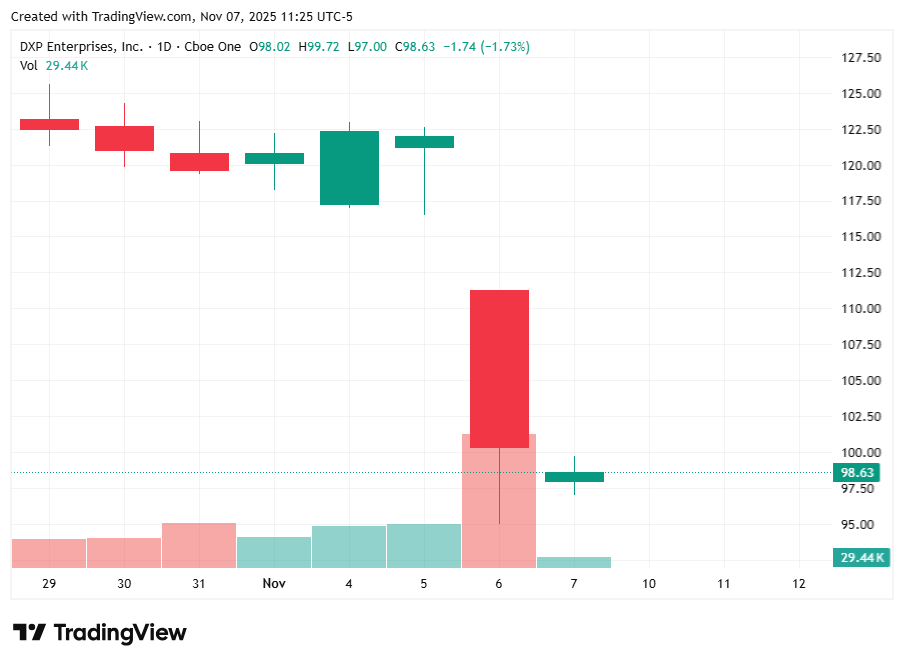

We saw exactly that with DXPE after Q3 earnings. Despite solid growth, DXPE’s stock plunged nearly 20% in a single day, a knee-jerk selloff driven by fear rather than fundamentals.

When sentiment is this fearful, investors seem to think either everything is perfect or it’s a disaster, with no middle ground.

In reality, DXPE’s quarter was far from a disaster. The post-earnings plunge looks like an overreaction, and I view it as a buying opportunity for those willing to see the nuance beyond the headline miss.

By the way, if you need a refresher on DXPE, here is the original investment thesis.

Q3 2025 Earnings vs. Expectations

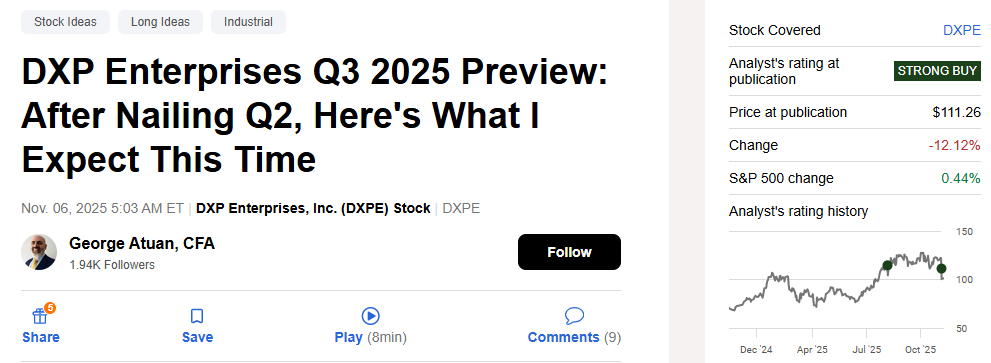

In my earnings preview published on Seeking Alpha on November 6, I reiterated DXPE as a Strong Buy and expected healthy growth.

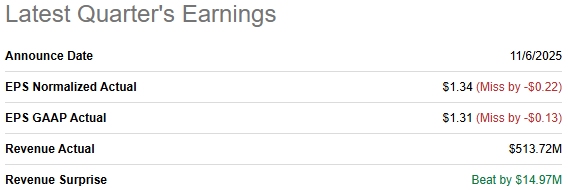

I forecasted 8%–15% EPS growth and modest revenue upside versus consensus, noting that an all-time high IPS segment backlog would drive margin expansion. I was partly right: revenue indeed beat expectations, but earnings per share came in lighter than hoped.

Top-line Beat

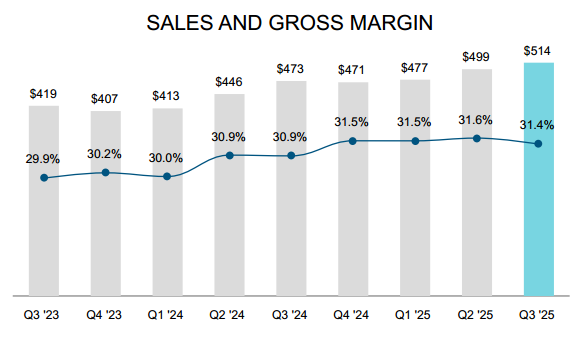

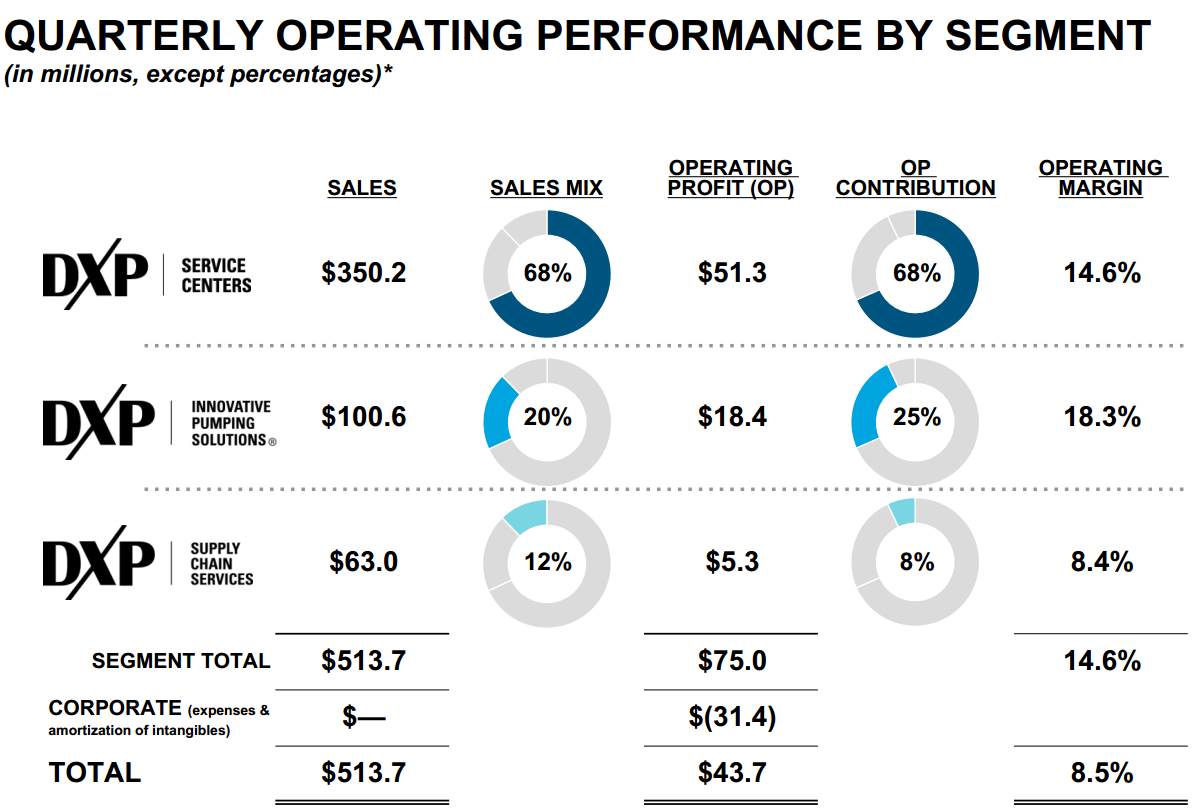

DXPE delivered $513.7 million in Q3 sales, up 8.6% y/y, surpassing the $499 million consensus and my expectation of between $502M to $512M. This was driven by steady organic demand and contributions from acquisitions (about $18 million of the quarter’s sales).

I anticipated a revenue beat, and DXPE’s strong backlog in areas like water infrastructure projects underpinned this growth. Backlog acts like DXPE’s order book, and management noted demand remains at record levels going into Q4. In short, the growth story remains intact. Q3 set another sales record for the company.

EPS Miss

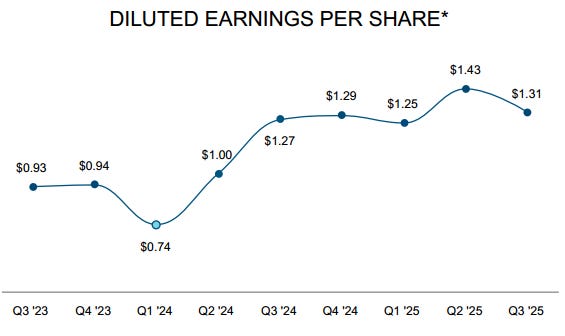

DXPE reported $1.31 in GAAP EPS ( $1.34 adjusted), which rose about 3% from a year ago, but missed analyst expectations of $1.44 and mine of $1.55-$1.65. In my preview I was looking for high-single to mid-teens EPS growth, so this result was softer than I projected.

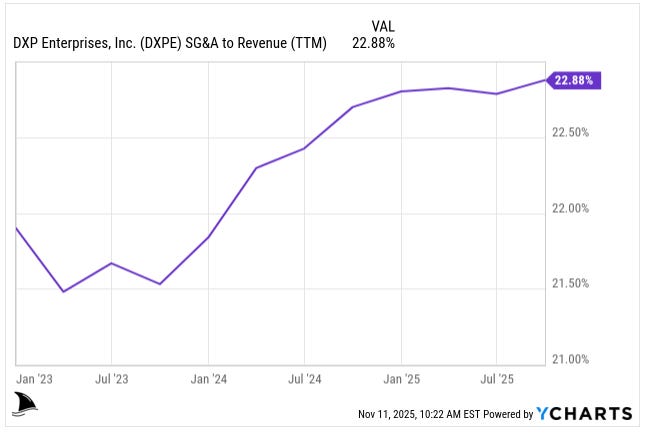

The miss boiled down to margin pressure: while gross profit margins actually improved to 31.4% (up 50 bps y/y), operating costs grew faster than sales, crimping the bottom line. Operating income margin was 8.5%, roughly flat to slightly up from last year. Not bad, but below the bullish margin expansion I had hoped for. In other words, DXPE’s earnings didn’t keep pace with its sales growth, due to higher expenses this quarter.

Stock Reaction

The market’s response was swift and severe. DXPE’s stock tumbled 20% in after-hours and next-day trading on the earnings news. As I highlighted in Weekly #55, this was a classic overreaction: “It wasn’t a huge miss, but the stock still got walloped… meet the target or else.” The market treated a single quarter’s shortfall as if the company fundamentally faltered, even though YTD sales are up 11.8% and margins remain around record levels. In my view, the selloff has far overshot what the actual results justify.

Why EPS Fell Short: One-Off Costs, Mix, and Timing

So what went wrong under the hood? A few transient factors hit Q3 earnings, none of which suggest a lasting problem in DXPE’s business:

Higher SG&A Expenses

These costs rose $11 million from Q3 last year. SG&A was 22.9% of sales in the quarter, a bit higher than historical levels.

This reflects investments in people, tech, and acquisitions, as well as inflation in wages and benefits. Essentially, DXPE spent more on growth initiatives and talent which increases costs now but should fuel future sales.

One-Off Insurance and Corporate Costs

Management pointed out some unusual Q3 expenses that hit the bottom line. The timing of insurance renewals and a few unique health claims drove corporate costs higher. The CFO noted this timing issue will similarly inflate Q4’s costs, but it’s not an ongoing drag beyond that.

Additionally, acquisition-related professional fees (deal costs) were higher. These are one-time or seasonal costs that aren’t core operating expenses. As the CEO explained on the call, “expenses were a little higher than expected, but they were really for all the right reasons and for things that are necessary for us to be a growth-oriented company.”

In other words, DXPE spent on insurance, integration, and people: necessary costs that temporarily hit EPS but don’t reflect a deteriorating business.

Sales Mix and Seasonality

DXPE’s revenue mix in Q3 had some puts and takes. The highest-margin segment, IPS, grew 11.9% and now makes up 20% of sales, helped by large water infrastructure projects. That’s positive for margins (IPS posted an 18.3% operating margin).

However, the SCS segment declined 5% y/y. SCS runs on thinner margins (8.4% in Q3), so a drop in SCS volume actually raised the overall margin mix slightly, but it also means DXPE lost some contribution from a usually steady business.

Management attributed SCS’s dip to slower pricing adjustments (many SCS contracts price electronically with a lag) and customer year-end seasonality. In plain English, some SCS clients (think large industrial customers) likely drew down inventory and paused orders ahead of holidays, and DXPE couldn’t pass through price increases as quickly in that segment. This is more of a timing issue than a structural demand problem. In fact, DXPE is adding new SCS customers and expects that segment to rebound in 2026.

Seasonality also played a role: Q3 is often strong, but Q4 will have fewer billing days due to holidays, as many SCS customer sites have year-end shutdowns. The CFO cautioned that Q4 will likely be a “mild” quarter due to these seasonal factors, with a stronger uptick expected as we head into Q1 2026. So, part of the Q3/Q4 earnings softness is simply the normal seasonal ebb and flow of DXPE’s business.

Segment Drag from SCS

As mentioned, SCS was the only segment shrinking this quarter. While Service Centers (the core MRO distribution arm) grew 10.5% and IPS grew nearly 12%, the 5% decline in SCS was a drag on total growth.

Importantly, this decline is not expected to persist. DXP’s SCS unit is signing up new accounts and should stabilize or return to growth as those pricing lags normalize. The broader industrial environment for MRO seems solid so SCS’s issues look temporary and fixable (mostly an internal pricing cadence issue).

It’s worth noting that even with SCS down, DXPE still beat on revenue, which underscores how well the other areas performed.

None of these factors scream “long-term problem” to me. They explain why EPS came in light this quarter, but they appear temporary or self-correcting. Higher SG&A from growth investments should pay off in future sales. One-time insurance/claims costs will wash out after Q4. Seasonal slowdowns will reverse when customers resume normal activity. And SCS’s hiccup can be addressed with new pricing systems and new customers (management is already on it).

Temporary Speed Bumps or Structural Issues?

Whenever a stock plunges like this, we have to ask: Has the long-term thesis changed, or is this a bump in the road? In DXPE’s case, I believe it’s the latter. The core fundamentals that attracted me to DXPE are still in place:

Robust Demand & Backlog

DXPE’s end markets (energy, water infrastructure, manufacturing, etc.) remain healthy. The CEO noted “end market demand and DXPE’s performance remain at record levels” through Q3. A key project backlog, especially in the water and industrial pump segment, is feeding revenue growth and gives good visibility into future sales.

In fact, backlog in the water-focused IPS business is at an all-time high as of Q3, which should continue to drive revenue and margin expansion as those high-margin projects are delivered. In short, customers still want what DXPE offers, and plenty of orders are in the pipeline.

Sustainable Margins

Despite the cost hiccups, DXPE still posted 11.0% adjusted EBITDA margins in Q3 and management is confident they can sustain 11% EBITDA margin going forward.

On the call, the CFO reiterated that 11% is the new normal, some quarters might be 11.2% or 10.8%, but overall the business is structurally running at 11% EBITDA profitability. That’s a record-level margin for DXPE, and far above where it was a few years ago.

It tells me the company’s diversification and efficiency moves are working. Gross margins are rising (31.4% this quarter) thanks to a richer sales mix (more high-margin equipment and solutions sales). Acquisitions are accretive to margins too. The CFO highlighted that recent acquisitions “continue to be accretive to both our gross and operating margins.” So, the underlying margin structure is solid.

The main reason EPS missed was those transient SG&A and corporate costs. Not a deterioration in the business model. Once those normalize, DXPE should resume translating its revenue growth into proportional earnings growth. There’s no sign that pricing or competitive pressures are eroding margins; on the contrary, DXPE’s pricing power seems intact (they improved gross profit despite SCS’s temporary pricing lag).

Growth Drivers Intact

DXPE’s multi-pronged growth strategy of organic sales momentum, plus bolt-on acquisitions is still firing. YTD, sales are up almost 12% and EBITDA up 18%, excellent for an industrial distributor.

The company closed three acquisitions in Q3 and two more in early Q4, expanding their reach in pumps and services. These deals not only add revenue but often bring new product lines and customer relationships, which DXPE can leverage across its platform.

Crucially, management is staying disciplined with these deals (keeping net leverage around 2.3x EBITDA, which is a comfortable level). Internally, DXPE is also investing in e-commerce and digital channels to drive efficiency. None of these long-term moves are derailed by one quarter’s earnings variance. If anything, the Q3 results reinforce the strategy: for example, IPS growth and margins were standout, validating the focus on water and diversified industrial markets.

DXPE’s diversification beyond oil & gas (now less than 25% of sales) insulates it from any single sector downturn, and Q3’s strength in water, manufacturing, and general industry shows that. The one soft spot, SCS, is already being addressed and is expected to improve next year.

On the earnings call, management remained confident and upbeat. The CEO emphasized that DXPE is hitting “new high watermarks” in sales and EBITDA and “continues to execute our growth strategy”. He noted they’re “very pleased with our performance” and progress as a growth company.

Importantly, he acknowledged the higher expenses but framed them as investments for the right reasons (growth and necessary improvements). The CFO also struck an optimistic tone, saying Q3 was a “high watermark” and that they expect to finish 2025 strong with momentum into 2026.

They clearly do not view Q3’s margin dip as the start of a trend, and neither do I. When asked about the cost uptick, management essentially said “we spent a bit more now to support growth, and we’re fine with that.” This doesn’t sound like a team that missed earnings because of any demand issue or mis-execution. It sounds like a conscious trade-off to invest in the business.

In sum, the factors that caused the EPS miss look temporary and manageable, whereas DXPE’s growth engines (strong demand, high backlog, M&A pipeline, margin discipline) remain full steam ahead. These are exactly the situations I look for: the market is fearful and short-sighted, dumping the stock because of a short-term earnings wobble, while the company’s long-term trajectory is largely unchanged.

Reaffirming My Bullish Stance

Given the analysis above, I’m maintaining my bullish view on DXPE. In fact, my conviction is strengthened by this overreaction. Nothing fundamental has broken; if anything, the Q3 report showed that DXP’s business is resilient (growing sales, maintaining double-digit EBITDA margins) even with some one-off headwinds.

I had previously calculated a fair value $156 per share, based on sum-of-parts and growth outlook. That remains my price target, which offers significant upside from the current sub-$100 share price. I see no reason to change that target after Q3.

The only caveat is if the cost issues we saw persist well into 2026. If, for example, SG&A keeps rising faster than sales for more than a couple of quarters, then we’d need to revisit our assumptions. But given management’s commentary, I expect these headwinds to abate within a quarter or two.

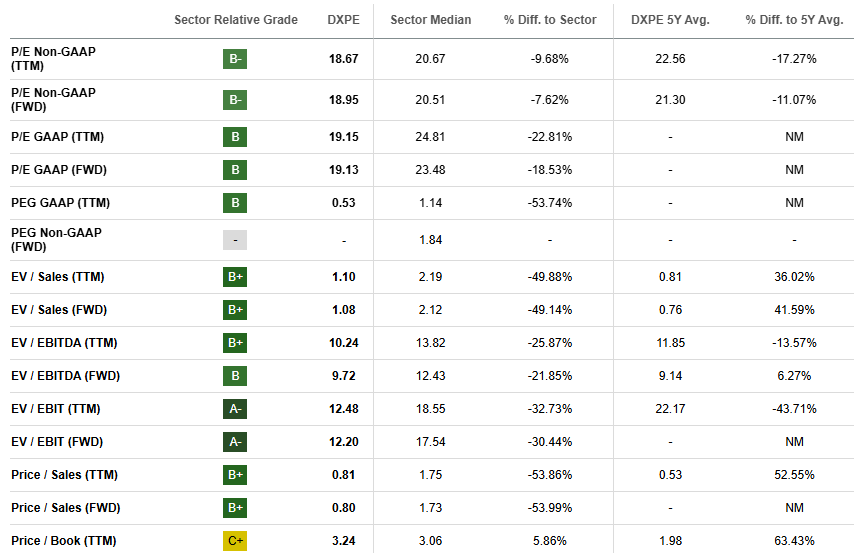

Assuming that’s the case, DXPE is now even more undervalued post-selloff. At $98-$100, the stock is trading at 19x forward earnings (vs. 23.5x for the sector), 9.7x forward EBITDA (vs. 12.4x for the sector) and a PEG of just 0.5x (vs. 1.1x for the sector). All cheap metrics for a company growing double-digits with improving quality of earnings (high margins, strong cash flow).

Conclusion: Market Overreaction = Investor Opportunity

Stepping back, the 20% post-earnings plunge in DXPE looks like a textbook emotional overreaction from a market stuck in binary thinking. Yes, earnings missed estimates, but the company is still growing and profitable, and the miss came from fixable issues. The market, in its “all-or-nothing” mood, treated the quarter as “nothing” when in fact it was pretty decent.

When fear is high, Wall Street often shoots first and asks questions later. That seems to be what happened here: a shoot-first selloff. But after asking the questions and digging into the details, I like what I see.