Weekly #67: Trump Thinks He Found His Denzel Moment

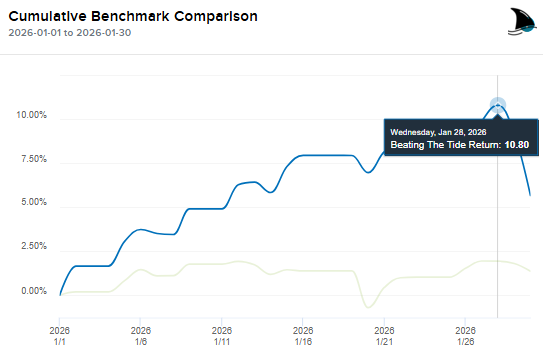

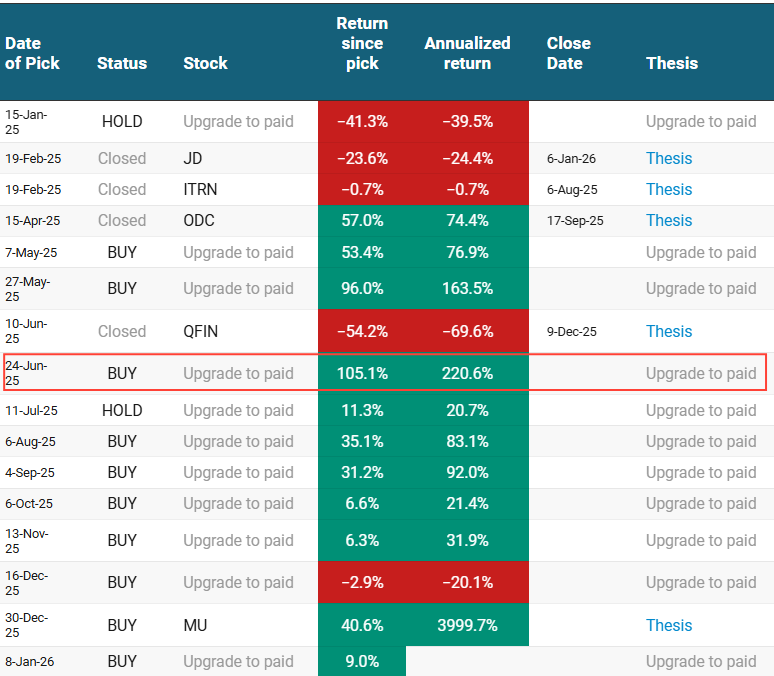

Portfolio +5.7% YTD, 2.4x the market since inception. Plus from a Fed shock to Micron adds and LRN vindication, this was a week where patience paid.

Hello fellow Sharks,

By Wednesday, we were closing the month up close to 11%. One of my best monthly runs. Then Mr. Market said, “Not so fast, George.”

If you want to skip straight to the numbers, jump to the Portfolio Update.

The trigger for the drop was Trump’s pick for Fed Chair: Kevin Warsh. Trump seems to think he picks champions like Denzel Washington as Macrinus in Gladiator 2 (by the way, I still prefer the original movie).

Macrinus picked Hanno, the son of Maximus. That pick helped him climb the ladder in Rome and end up almost as emperor.

But the market doesn’t think Trump picked his Hanno. For weeks, investors had piled into gold and silver as a hedge against Fed “independence” drama. Warsh came across as a more conventional, more hawkish pick than people had braced for. More of a Commodus than a Hanno. So the hedge trade got unwound fast.

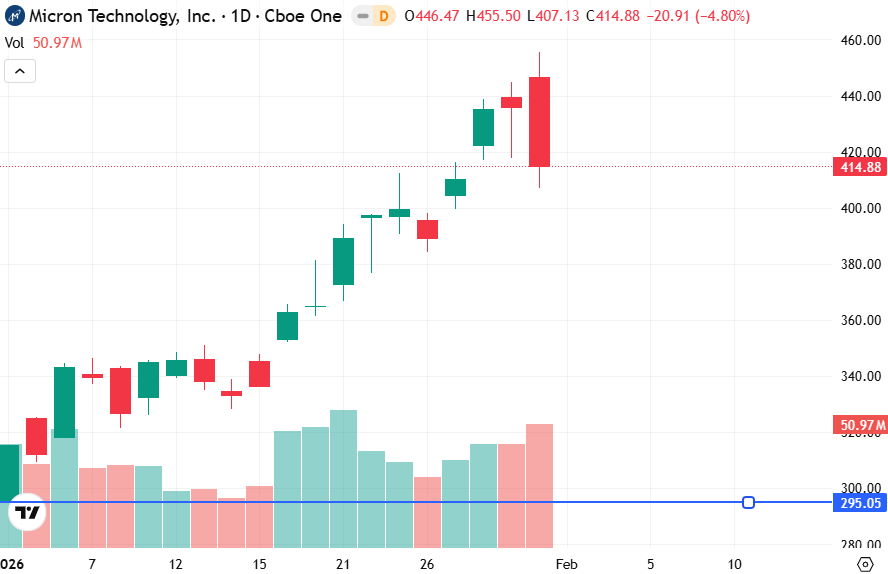

Even though this hit the portfolio, I’m not worried. I did the opposite of panic. I took advantage of the move and sent rebalancing trades to paid subscribers (more on that in the In Case You Missed It section below). One of those trades increased our Micron (MU) position. Below, I explain why I added even though MU is up about 40% since I picked it and sits close to my target price.

I also go over Stride’s (LRN) earnings and my updated target price.

Enjoy the read, and have a great Sunday.

~George

Table of Contents:

In Case You Missed It

On Jan 30, I sent a trade alert to paid subscribers to add to three existing positions after Friday’s selloff.

I used some of the cash I’ve been building from recent net selling in the portfolio to lean into weakness. The adds were in: Micron (MU), my Top Pick for 2026; my January Monthly Pick; and our gold miner, the June Monthly Pick, which dropped around 20% in the selloff. Even after that hit, the gold miner is still up about 105% from our entry.

Also on Jan 30, I published a fresh update CLS after earnings and raised my target price to $575 even as the stock dropped 15%.

And on Jan 28, I shared why I closed my position in NatWest [NWG 0.00%↑].

Micron: Why It’s Still My Top Pick After a 40% YTD Run

When I sent my rebalancing trades on Friday one pushback I got was: “MU already gained 56% YTD (before the sell off) and it’s close to your $480 target price; is it still a good buy?”

My answer is twofold. First, after Friday’s selloff, MU is “only” up about 40% YTD. But more importantly, the fundamentals have improved since I first wrote the thesis.

Memory is tight; pricing power is real; and the buyers with the deepest pockets are calling the shots. Even Apple has flagged memory supply as a constraint, which is not something you hear often from a company that usually dictates terms to its suppliers. When supply is limited, and only a handful of players can deliver high-end chips at scale, negotiation power shifts. The hyperscalers come first because they pay top dollar for the best memory, especially for AI-heavy server builds; everyone else fights for what’s left.

That matters because Micron sits in the middle of the most important bottleneck in AI hardware right now: memory bandwidth and capacity. If demand keeps rising and supply stays disciplined, pricing and margins can surprise to the upside. So yes, $480 might look “close” on an old model; the setup keeps improving. When I refresh my valuation, I would not be surprised if the intrinsic value lands meaningfully above $480.

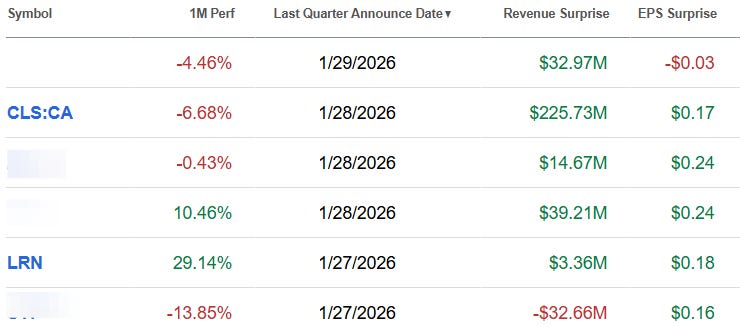

Earnings Results: 5/6 Beats

Only one out of the six companies reporting this week missed consensus revenues. For the full list and analysis, click here.

On Friday, I discussed CLS’s earnings and revised my target price upwards.

Thought Of The Week: Stride Q2 2026: Vindication After the Hiccup

Back on November 2, 2025, I wrote that Mr. Market had handed us a gift when Stride [LRN 0.00%↑] shares plunged 50% after a messy platform rollout.

I doubled my position amid the panic. Why? Because I saw that drop as a short-term hiccup in an otherwise solid story. The new student platform had a botched rollout, but I believed that the issue was fixable and the fundamental demand for online education was intact.

I noted the long-term tailwinds, especially growing demand for Stride’s Career Learning programs, and argued the sell-off was driven by fear rather than any permanent damage to the business.

In my November piece, I wrote that the plunge looked like an overreaction and that all the “macro currents” (i.e. industry trends and customer demand) were still flowing in Stride’s favour. I contrasted the market’s panic with Stride’s operational reality.

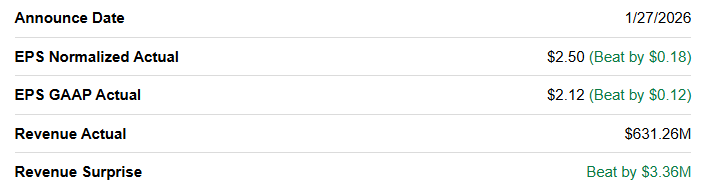

Q2 2026 Earnings: A Sharp Rebound

This week, Stride reported its fiscal Q2 2026 earnings, and the stock surged 34% at the open (touching about $92) before settling back in the mid-$80s (around $84 now).

Mr. Market’s mood swing came from a wave of good news: Stride delivered strong results and put those platform issues largely in the rear-view mirror. The core business is back on track, and the numbers tell the story:

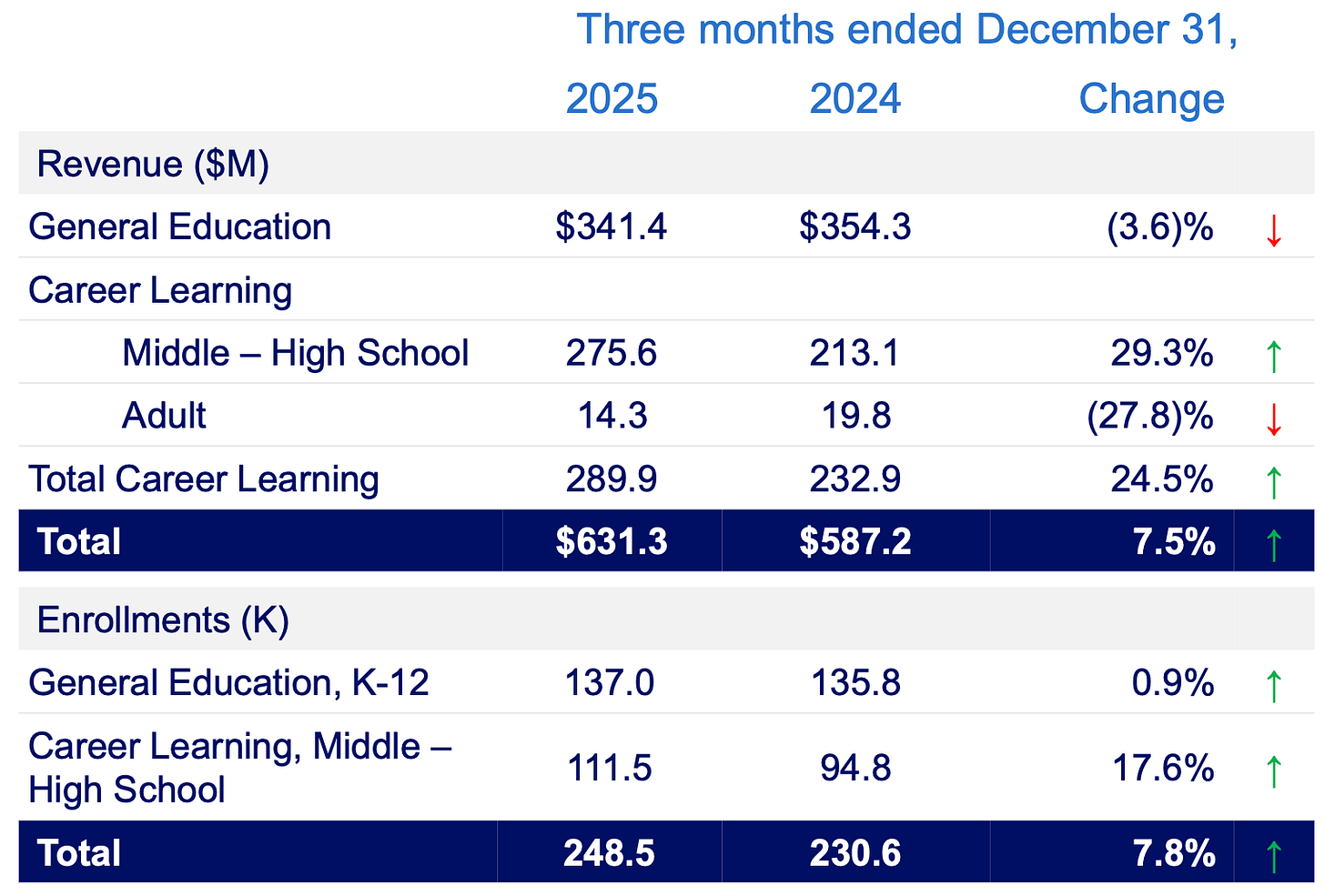

#1 Solid Growth

Revenue was $631.3 million, up 7.5% y/y. This topped expectations and showed that Stride’s top-line is growing again at a healthy clip. Adjusted earnings per share came in at $2.50, beating consensus by $0.18.

In other words, profit was stronger than anticipated. Operating income rose 17% as well. Margins held up nicely even as the company fixed its tech problems. Gross margin for the quarter was about 41.1%, an improvement from last year as some cost headwinds eased.

#2 Enrollment Rebound

Enrollments climbed 7.8% to 248,500 students.

Remember, last fall’s platform fiasco had caused some students to withdraw. Now those losses have been backfilled. Enrollment is actually higher than a year ago. Importantly, Stride’s key Career Learning programs saw 17.6% growth in enrollments. Families continue to flock to these offerings. Revenue in the Career Learning segment soared 29% y/y, a huge jump that highlights where the demand is.

By contrast, the General Education segment saw revenue dip 3.6%. So the mix is shifting toward Career Learning.

#3 Platform Fixed & Stability Restored

Management confirmed that the core platform issues have been resolved. In fact, after they fixed a major login glitch a couple of months ago, support call volumes dropped over 90% week-over-week. In other words, once the tech was patched, the flood of customer help calls dried up.

The CEO said on the call that the “core issues are behind us” and that he’s confident such a fiasco won’t recur. Withdrawal rates have returned to historical norms as the second semester began, meaning students aren’t quitting at abnormal rates anymore. This was a big question mark going into Q2 and the answer came back positive. Stride effectively stopped the bleeding, and things are operating as expected again.

#4 Financial Highlights

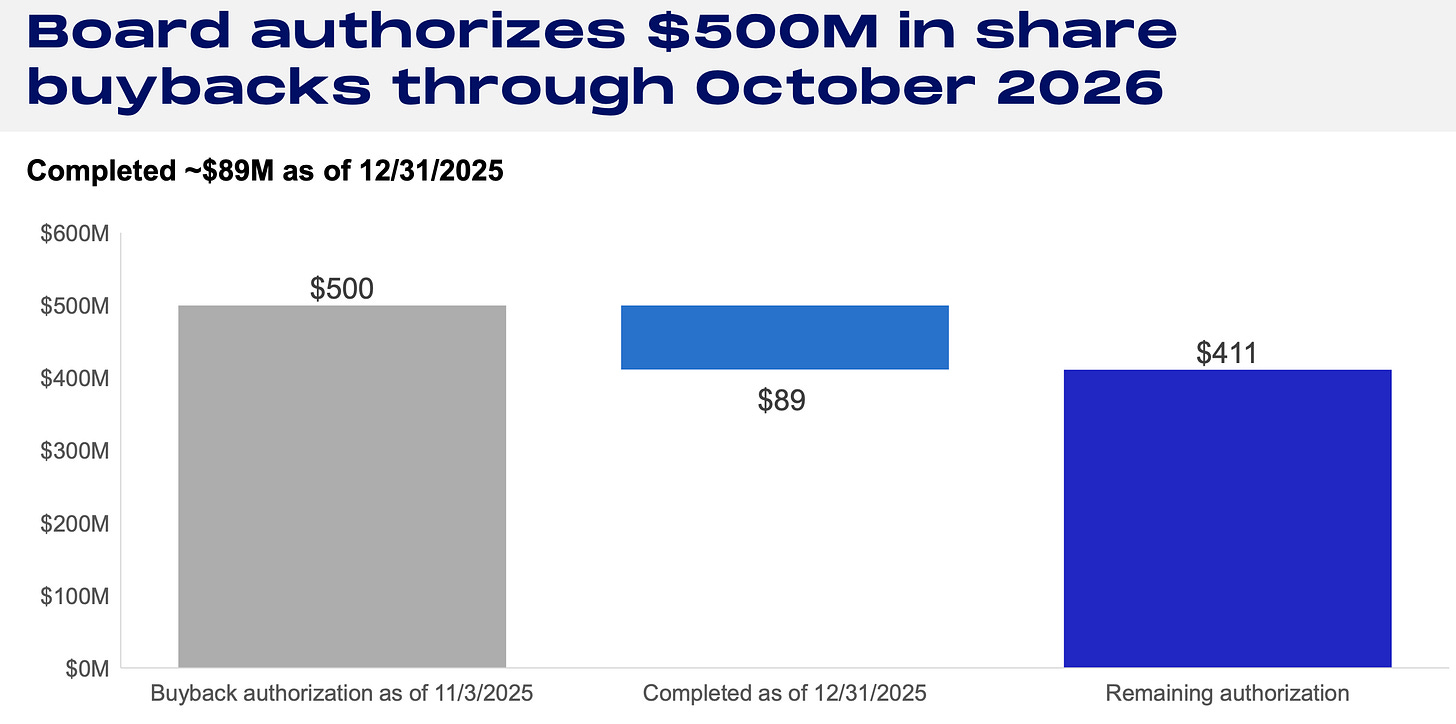

Stride’s operating income for Q2 was $146.9M (adjusted $159.0M), roughly 17% higher than last year. Net income was $99.5M (about $2.12 per share) on a GAAP basis. The company generated $75.9M in free cash flow during the quarter, and ended Q2 with a hefty $676M in cash and equivalents on the balance sheet.

Stride has been using some of that cash to buy back stock: they repurchased $88.6M of shares in Q2. (The board had authorized a big $500M repurchase program in November, and management wasted no time taking advantage of the low share price. I just wish they bought more shares when the shares were in the $60s 😉)

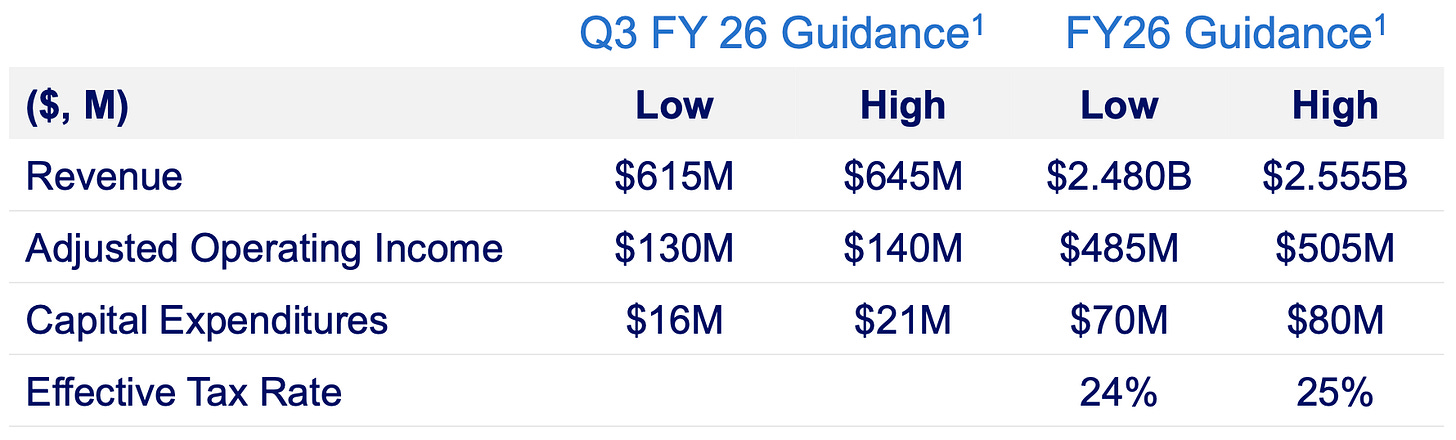

#5 Guidance and Outlook

The company struck an optimistic but prudent tone.

Full-year FY 2026 revenue guidance was reaffirmed at $2.48–$2.555 billion, which implies around mid to high single-digit growth for the year, basically confirming that the earlier stumble hasn’t derailed their year.

More notably, Stride raised its full-year adjusted operating income guidance to $485–$505 million (from a prior $475–$500M), reflecting confidence in improved profitability.

For next quarter (Q3), they guided revenue of $615–$645M, which is roughly flat to modest growth versus the prior year, and AOI of $130–$140M. This essentially telegraphs that Q3 will be stable.

Management is prioritizing stability after the turbulence. They’re also holding the line on capital spending ($70–$80M for the year, largely for continuing platform enhancements). All told, the outlook is solid and unsurprising: steady as she goes.

So why did the stock rocket up +30% on these results? In my view, Stride delivered exactly what the market needed to see. The short-term fears are fading, and my long-term thesis is being validated. The “pothole” really did turn out to be a one-off issue. Now that Stride has patched up its platform, the underlying demand trends are shining through again.

The Overreaction Unwinds: I Got This One Right

Seeing Stride at $84 today (vs. ~$66 at the depths of the panic) underscores how Mr. Market’s fear last fall was overdone. In November, I said the stock plunge was an emotional overreaction and that Stride’s growth story wasn’t broken. I emphasized that management’s ultra-cautious 5% growth guidance for FY26 was likely sandbagging, a conservative stance after the platform mess.

Sure enough, Q2’s 8% revenue growth and the 7.8% jump in enrollments show that Stride is easily beating that low-bar guidance. Demand didn’t evaporate; if anything, it’s still robust. The CEO noted on the call that applications for enrollment remain near last year’s record levels. In other words, plenty of families are still looking to online schooling and career-oriented education, even without aggressive marketing. This organic demand is exactly the “signal” I talked about, cutting through the noise.

I also highlighted the Career Learning segment as a long-term growth engine, and Q2’s results confirmed that in spades: 29% revenue growth in that segment is huge. Meanwhile, the smaller decline in General Education (-3.6%) isn’t alarming to me; it reflects some students returning to brick-and-mortar schools post-pandemic and the impact of the platform hiccup, but it’s more than offset by Career Learning gains.

The fundamentals remain intact, just as I believed. Stride is still a cash-generative, asset-light business meeting a real and growing need. This isn’t a cyclical or fad company and it provides education services that parents and school districts commit to in advance, and that stability is showing up again.

Perhaps most gratifying, management’s actions and comments mirror the points I made last fall. They deliberately prioritized stability over short-term growth this year. Essentially, slowing down marketing and new enrollments to ensure the ship was righted. That’s a wise approach, and it worked: the CEO noted that they “backfilled much of our attrition” from Q1 and ended Q2 with roughly the same enrollment as the prior quarter. In plain English, they replaced the students who left during the turmoil. Now with withdrawal rates back to normal, the company can confidently move forward.

Critically, Stride’s leadership learned from the fiasco. They’re bolstering their technology and not over-relying on third-party platforms going forward. Rhyu talked about adding redundancy and pursuing more “proprietary control” over the user experience. The goal is to have more direct influence over their platform’s performance. Essentially, to control their own destiny and avoid being at the mercy of an outside vendor’s mistakes.

This kind of tech “self-reliance” is a long-term positive. It might cost a bit more upfront, but it should reduce the risk of another system-wide meltdown. Stride is turning its tech misstep into an improvement opportunity, which is what you want to see from a management team. They’ve also indicated they won’t chase every potential student if it compromises quality. Instead, they’re focusing on sustainable growth after solidifying the foundation. All of these points point to a company that’s back on offence, but with the lessons of the past well in hand.

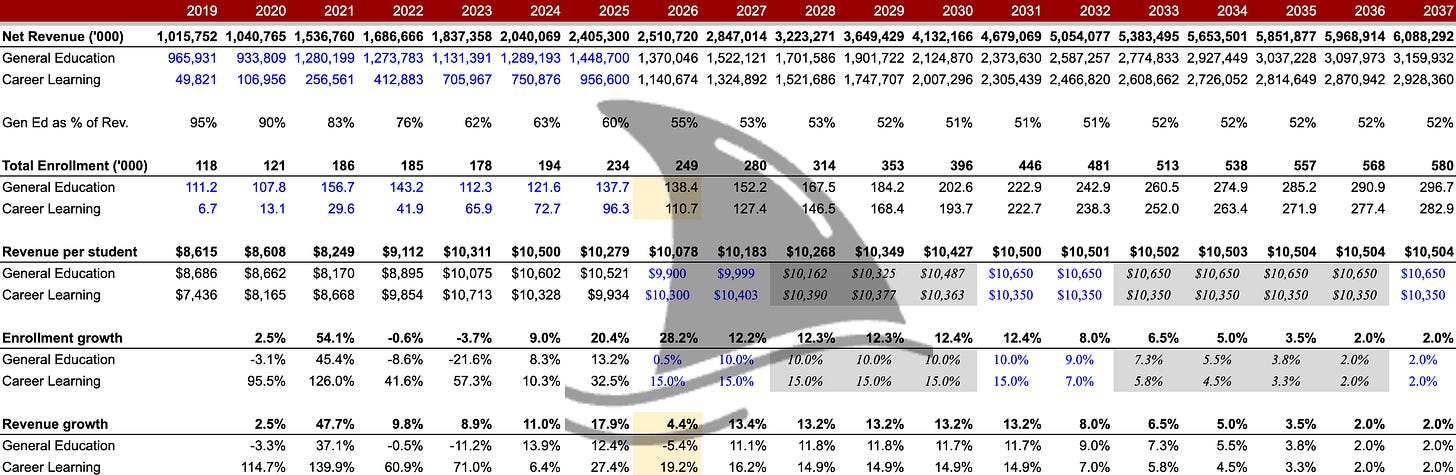

Updated Valuation: Small Tweaks, Big Upside Remains

After this earnings report, I went back to my valuation model. I only had to make modest adjustments… mainly incorporating slightly slower near-term growth and a bit lower revenue per student than I previously modelled.

The result? My estimated fair value for Stride comes out to $195 per share, down just a bit from the $209 I calculated in November. To put that in context, $195 is more than double the current stock price.

The stock’s rally off the bottom hasn’t closed the gap by any means. Importantly, this $14 drop in my fair value isn’t due to any serious concern about Stride’s business; it’s mostly because I reined in my growth assumptions (the company itself reaffirmed mid-single-digit % revenue growth for this year, and I don’t want to overshoot on pricing power given that revenue-per-enrollment only rose 1.8% in Q2).

In other words, the intrinsic value is still far above where the stock trades, and my confidence in Stride’s long-term trajectory is undiminished. I just have a slightly more conservative outlook on how fast they’ll get there, now that we have the latest data.

To address a couple of concerns: Yes, the General Education segment is a bit soft, and Stride’s overall revenue per student isn’t growing very quickly. General Ed enrollment has faced headwinds as some students return to traditional classrooms post-COVID, and Q2’s 3.6% revenue dip in that segment reflects that.

And true, Stride isn’t yet cranking up prices dramatically. Revenue per enrollment was roughly $2,437 this quarter, only about 2% higher than last year. But I’m not overly worried. The strategy (and the future) lies in Career Learning, which delivers higher value and can command better pricing over time. The strong 29% revenue growth in Career Learning shows that when Stride offers compelling career-focused programs, schools and students are willing to enroll in droves. That mix shift will naturally boost margins and revenue per student in the long run, even if headline “revenue per enrollment” inches up slowly in the short run.

Also, keep in mind this year Stride intentionally wasn’t pushing on growth as they held back marketing to focus on quality and retention. Once they resume a normal growth posture (likely after this stabilization year), we could see both enrollment and per-student metrics tick up more briskly.

The big picture here is that stabilization is the real story of Q2 2026. Stride proved that the platform fiasco was temporary. The company didn’t lose its ability to attract and retain students. Now that the road is clear, we’re already seeing growth resume and margins improve.

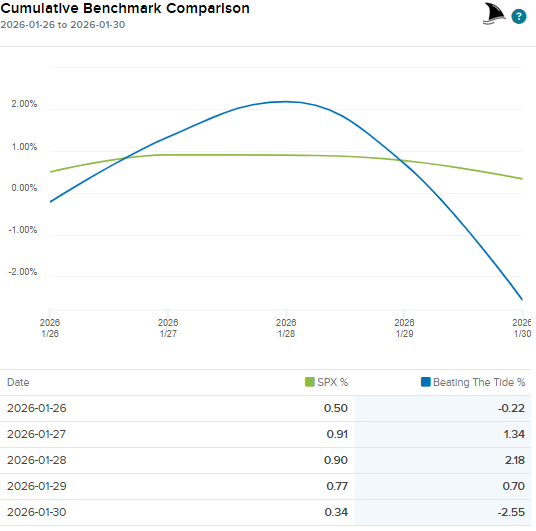

Portfolio Update

By Wednesday, we were beating the S&P 500 nicely, but Friday’s sell-off changed the tide.

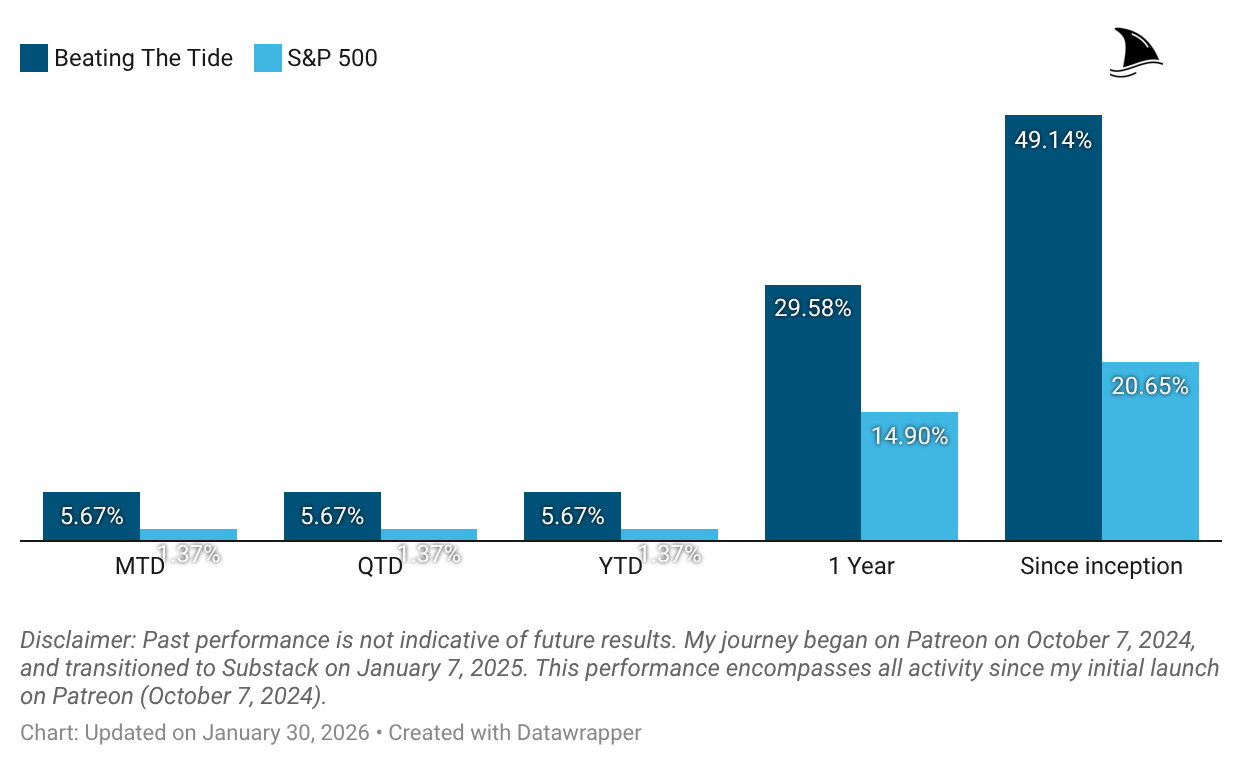

Portfolio Return

Month-to-date: +5.7% vs. the S&P 500’s +1.4%.

Since inception: +49.1% vs. the S&P 500’s +20.7%. That’s 2.4x the market.

Contribution by Sector

Gold’s reversal on Friday and the tech sell-off led to the losses. Keep in mind, though, gold is still up 12% for the month.

Contribution by Position

(For the full breakdown plus commentary on earnings results and the big movers, see Weekly Stock Performance Tracker)

+23 bps POWL 0.00%↑ (Thesis)

+14 bps LRN 0.00%↑ (Thesis)

+8 bps STRL 0.00%↑ (Thesis)

+4 bps DXPE 0.00%↑ (Thesis)

+1 bps KINS 0.00%↑ (Thesis)

-6 bps OPFI 0.00%↑ (Thesis)

-8 bps TSM 0.00%↑ (Thesis)

-86 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Brillaint breakdown on the LRN turnaround. That Career Learning segment growing 29% really underscores how operational issues get overblown when the demand side is solid. I noticed the same thing with a SaaS company last year where a bad UI launch tanked the stock but churn actualy stayed flat. The market treats tech glitches like business model failures way too often.

Thank you for the weekly George. Very interesting take on LRN. Your thesis is slowly starting to pay off. Quite disheartening though to see the market down so much. I was up 5% since starting my portfolio in December and up until 2 weeks ago when the Greenland tariffs threats happened. Am down since then all the way to 0.5%. Such is the stock market it seems and one has to get used to it!