Why I’m Rotating Out of IAMGOLD (IAG)(TSX: IMG) Into a Leaner, Faster-Growing Gold Miner

IAG just delivered big gains, but with rising gold prices, I’m betting on the miner with lower costs, more upside, and 100% ownership.

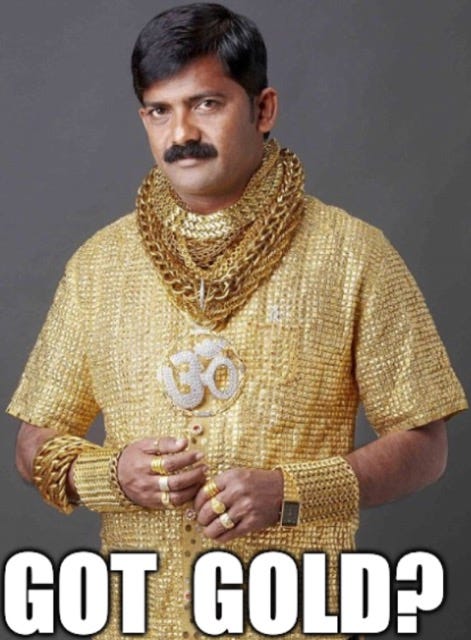

I’m not sure exactly when it started, but I’ve always had an interest in gold. Maybe it’s my Middle Eastern roots, where gold isn’t just a shiny metal, it’s practically a cultural currency.

Your neighbour has a baby? … You gift gold earrings.

Your cousin gets married? … A gold bracelet it is.

Gold symbolizes something special, something enduring. In fact, about nine years ago, when my portfolio hit an important milestone, I celebrated by buying a Rolex Submariner 16618…pure gold, of course.

Back in 2009, after finishing my MBA, my passion even took a professional turn. I tried several times (unsuccessfully, unfortunately…or fortunately (?)) to land a role as an equity research associate covering mining companies. To build some credibility, I started a LinkedIn group called “The Gold Mining Group,” where I’d share my research on gold stocks. That little hobby project ballooned into something bigger than I expected. Today, it boasts over 43,000 members. Sadly, I don’t have enough hours in the day to nurture that community anymore.

But let’s refocus on why we’re here. Although I concentrate my portfolio mostly in sectors where companies have control over their top lines (think: pricing power), I still carve out a small space for gold miners. The reason I keep that allocation modest is straightforward: gold miners don’t have full control over their revenues. Ultimately, the market (supply, demand, central banks…) calls the shots. That leaves miners with just two primary levers to pull: keeping costs low and increasing production efficiently. Companies that do this well can still be highly profitable, even in volatile markets.

Now, don’t get me wrong: commodities have been good to me. My best-ever investment, after all, was in Daqo Energy DQ 0.00%↑ (check it here), a polysilicon producer.

I also believe gold is set up for another strong year, not just because of central banks or inflation, but because of volatility regimes. In the April Weekly #24: “When the VIX Hits 45: What Actually Happens Next,” I showed that gold has outperformed every other asset class over the following 12 months after the VIX spikes to 45. We saw that VIX hit 45 in April and gold promptly climbed, even shrugging off equity weakness. History tells us this pattern often repeats. So yes: volatility regimes favor gold in the year ahead.

So for this trade alert, I’m closing IAMGOLD IAG 0.00%↑ (TSX:IMG), which performed well (+32%).

I’m now redeploying that capital into another gold miner stock that offers even stronger growth potential and significantly lower all-in sustaining costs.

Let’s dive into exactly why I’m making this shift.