Weekly #56: Why Passive Taking Over Is Great News for the Rest of Us

Portfolio +28.4% YTD, 2.2x the market since inception. Why passive investing and index funds now dominate, what it means for active investing

Hello fellow Sharks,

The portfolio gave back a bit of ground this week while the S&P 500 stayed roughly flat. YTD the portfolio is up 28.4% compared to the S&P 500’s 14.5%, more than 2.2x the market. If you want, to skip straight to the numbers, jump to the Portfolio Update.

This week’s Thought of the Week looks at the rise of passive investing. Index funds and ETFs have finally overtaken active funds in total assets. I walk through why investors are flocking to passive funds, how these flows move money without looking at fundamentals, and why I think that creates more, not fewer, opportunities for stock pickers who stay patient and do the work.

I also have an important update on pricing.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

Upcoming Price Increase for New Members

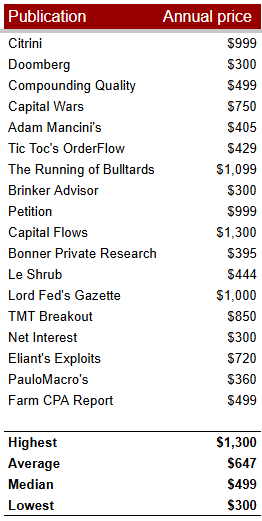

I’m raising the annual price of the paid tier on January 1, 2026. The new price will be $299 per year. It only applies to new paid members who join after that date. If you already are a paid member, I will honor your current price for as long as you stay subscribed. If you’re a free reader and you’ve been on the fence, this is your window to lock in the $130 rate before it goes away.

The new price is still below what the top finance publications charge. Most well-known research letters on Substack run between $300 and $1,300 per year.

With the holidays coming up, you might also be thinking about gifts. If you have someone in your life who loves investing or wants help compounding wealth, this is a gift that actually adds value over time. It’s simple, practical, and useful.

In Case You Missed It

I covered two earnings prints this week. KINS reported record profit again and the stock barely moved. I broke down why the quarter was stronger than the market thinks and why the gap between fundamentals and sentiment stays wide. The setup looks better now than it did a month ago.

DXPE also delivered numbers that did not justify the sharp selloff. I walked through the moving pieces, including the mix shift and the drop in working capital that spooked some traders. I think the reaction says more about the market’s mood than the company’s health.

I also shared November’s monthly pick for paid readers. It is a high-ROE financial with durable underwriting, clean credit, and a valuation that leaves room for real upside. I explained why the market overlooked it, what the forward multiple could look like in a normal environment, and why I added it to the portfolio.

Thought of the Week: What Passive Dominance Means for Active Returns

Following the market news and online chatter, it’s easy to believe active trading is booming. Social media and subreddits like WallStreetBets showcase flashy stock picks and “smart money” moves every day.

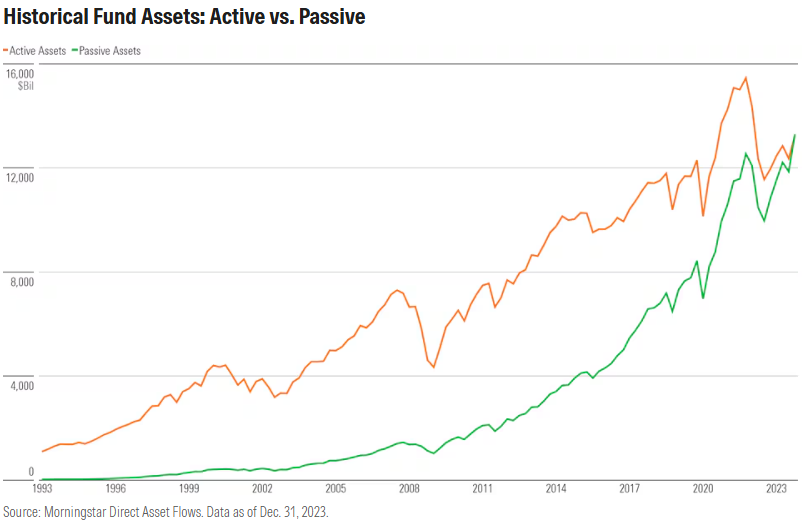

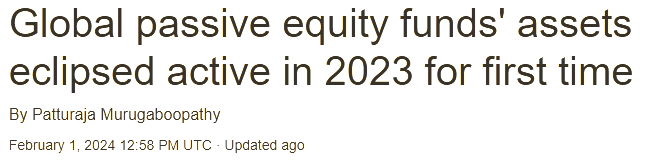

However, it turns out passive funds have officially overtaken active funds in total assets as per Reuters and Morningstar, marking a major shift in how people invest.

That graph is up to 2023, but in 2024 and so far in 2025, the trend continues…

This milestone got me thinking about what’s driving investors into index funds and ETFs, and what it means for those of us who still pick stocks. In this Thought of the Week, I want to explore why passive investing is winning, how it works, and why that could actually be great news for an active investor like me.

Passive Investing Rises to the Top

Globally, passive equity funds’ assets hit a record $15.1 trillion at the end of 2023, surpassing the $14.3 trillion in active equity funds for the first time.

In the U.S. market, we saw a similar tipping point. By 2024, assets in U.S. passive mutual funds and ETFs narrowly exceeded those in actively managed funds. This wasn’t a one-off fluke as it’s the result of a steady trend years in the making.

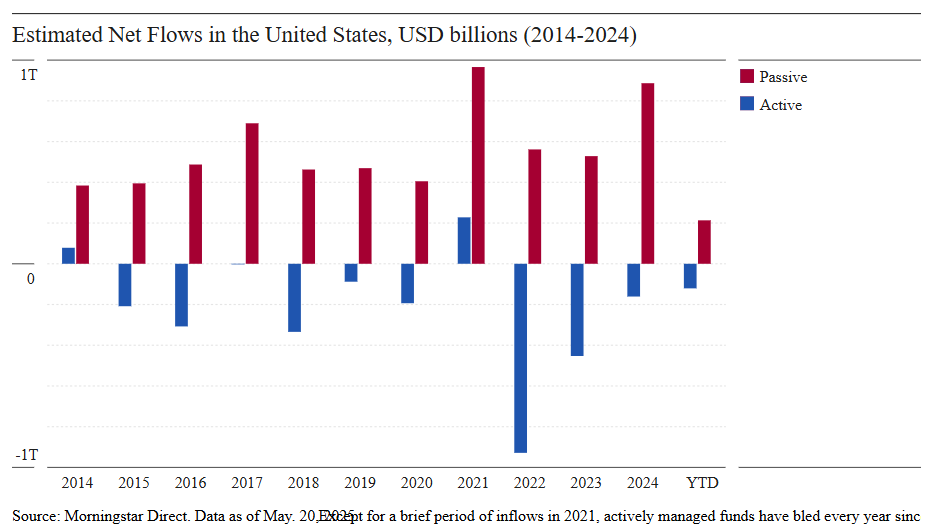

In fact, passive funds have been gathering more money than active funds for over a decade. Investors have pulled roughly $1.9 trillion out of U.S. stock mutual funds since 2014, while pouring about $2.9 trillion into stock ETFs in the same period. The fund flow data underscores this sea change. Active equity funds have bled assets almost every year since 2014, whereas passive funds have enjoyed consistent inflows.

Even in 2023, a year of shaky recovery in markets, active funds globally saw outflows of about $576 billion, while passive funds attracted roughly $466 billion in new money. In other words, investors are voting with their feet, and they’re largely choosing passive vehicles over traditional stock-picking funds.

It’s a remarkable shift when you consider how investing used to be. A generation ago, most people entrusted their money to star fund managers or tried to beat the market themselves. Now, index funds and ETFs have become the default choice for many. Passive strategies started as a niche idea in the 1970s, but today they’ve grown into a multi-trillion-dollar force.

By some measures, over half of all U.S. equity fund assets are now in passive trackers. This rise of passive investing has fundamentally reshaped the financial landscape. It’s even been called the “index investing revolution,” as trillions of dollars shift from the hands of stock pickers to automated, low-cost index funds. The milestone of passive overtaking active is both symbolic and tangible proof of this revolution.

Why Investors Are Flocking to Passive Funds

Cost is a big factor.

Passive funds typically charge much lower fees than active funds, and investors have become very fee-conscious. On average, an actively managed stock fund charges around 0.6% per year, whereas a passive index fund might charge about 0.1% or even less.

That difference means more money stays in your pocket. Over time, high fees eat into returns, and many have realized that cheaper index funds often deliver similar (or better) outcomes than pricey active managers. When you can get the broad market’s return for virtually free, it’s hard for a high-cost fund to justify its price.

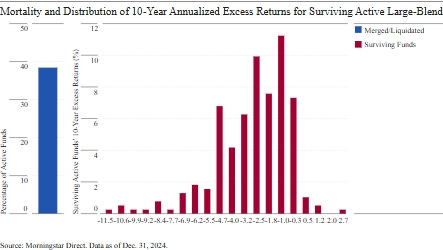

Another key reason is performance, or rather, the lack of consistent outperformance by active funds. A lot of investors have been disappointed by active managers who fail to beat the market. And the data is not kind to stock pickers. In the U.S., less than 1 in 4 active funds managed to both survive and outperform their passive peers over the past decade.

For large-cap U.S. stock funds, the success rate is even more dismal as only about 7% of active large-cap funds beat their indexed rivals over ten years. With odds like that, many folks conclude that trying to pick a winning fund (or stocks) isn’t worth it. It feels safer to accept the market’s return through an index fund.

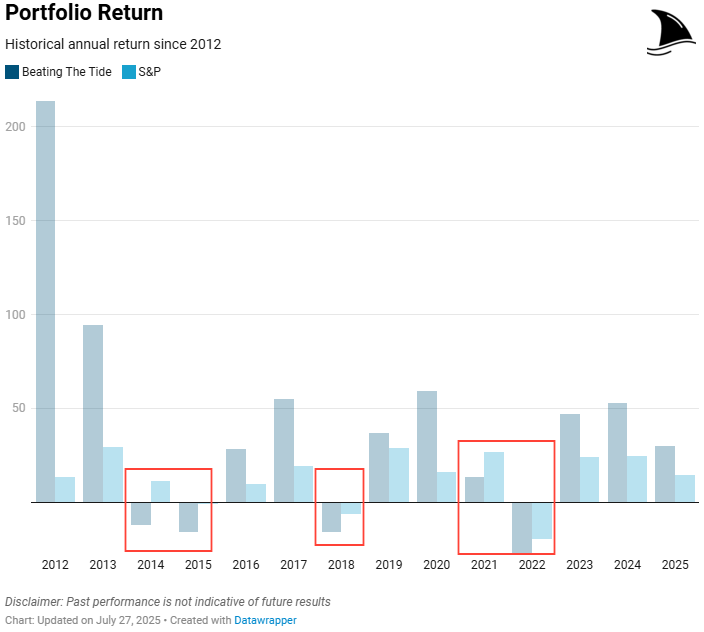

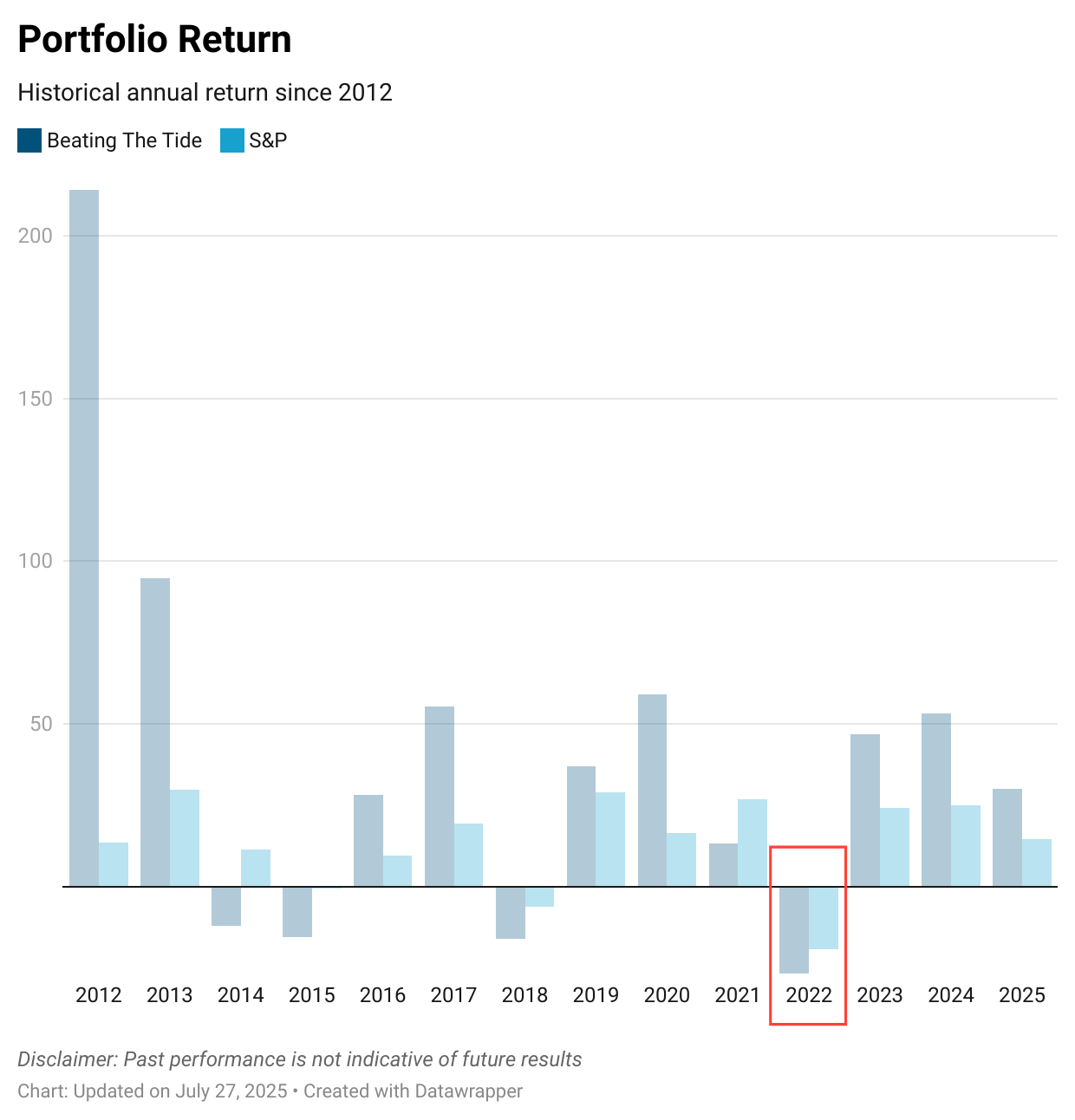

You might look at numbers like that and think active investing is a lost cause. I get the sentiment. But then I look at my own track record and it tells a different story. I have been doing this for almost fifteen years and I have only underperformed the S&P 500 in five years.

Even underperforming the market 1/3 of the time, the chart below shows the cumulative performance of my portfolio. It has compounded far ahead of the index even through messy markets, bear cycles, and a few mistakes along the way.

That kind of run does not come from luck. It comes from process, discipline, and a refusal to follow the crowd when the crowd stops thinking. If passive flows keep growing, I expect more mispricing, not less. And if mispricing grows, I expect my edge to grow with it.

As a result, investors have gravitated toward passive funds as a reliable, no-fuss way to get market exposure. You don’t have to worry about whether your fund manager will underperform. By design, a passive fund will just match the market (minus a tiny fee).

Simplicity and broad exposure add to the appeal. With one index ETF, I can invest in the 500 companies of the S&P 500 or thousands of stocks worldwide. That instant diversification is attractive, especially to newcomers or those without the time to research individual stocks. Passive funds offer a kind of “set it and forget it” approach. There’s no manager trying to trade in and out of positions, and no complex strategy to understand.

This was particularly comforting after the 2008 financial crisis, when many people lost faith in “experts” and just wanted a safe, steady way to grow their money. Indeed, passive funds gained popularity in the aftermath of the crisis as investors looked for safety and predictability in uncertain times. The idea of owning the whole market (or a big chunk of it) and riding the general uptrend has a lot of appeal, especially when every news cycle brings new uncertainties.

Lastly, technology and access have played a role. The rise of online brokers and retirement platforms has made index funds and ETFs more accessible to everyone. It’s never been easier to buy a low-cost ETF with a few clicks. Meanwhile, transparency around fees and performance has improved and investors can clearly see that many expensive funds aren’t worth their cost.

All these factors create a powerful incentive to go passive.

How Passive Investing Works (Index Funds 101)

What exactly do I mean by “passive investing”? It typically refers to investing in index funds or ETFs that mirror a market index rather than trying to beat it. The concept is straightforward. Say you buy a fund that tracks the S&P 500. That fund will simply buy all (or a representative sample of) the stocks in the S&P 500, in the same proportions as the index. If Apple is about 7% of the index, then roughly 7% of any money you invest in the fund will go into Apple stock. If a smaller company is 0.2% of the index, a tiny slice of your money buys that stock, and so on.

The fund manager isn’t making judgment calls about which stocks are attractive. They’re replicating the index’s holdings. Once the fund is set up, they “buy and hold” those stocks, only making changes when the index itself changes. This minimal trading and hands-off approach is why passive funds can charge such low fees. There’s no expensive research team or star stock-picker; the strategy is essentially on autopilot.

Let me illustrate with a concrete example. Imagine I put $1,000 into a Nasdaq-100 index ETF. Tech giant NVIDIA is a member of that index, and it makes up 14% of the index.

My $1,000 contribution means the ETF automatically buys about $140 of NVIDIA stock on my behalf. It doesn’t matter whether NVIDIA’s share price is soaring or if I personally feel it’s overvalued. The fund will buy according to the index weights, no questions asked.

The same happens for every other company in the index, from Apple to Zoom. Every dollar that flows into the fund gets split across all the stocks in the basket by formula. The goal isn’t to beat the index, but simply to be the index. This means a passive fund is fully invested at all times in whatever the index holds, good or bad.

This mechanical approach has significant implications for the market. Because passive funds don’t care about price, they buy high and low, as long as money flows in and the index says to buy. When a stock’s price skyrockets and it becomes a larger part of the index, index funds end up buying more of it (since its weight in the index grows). Conversely, if a stock drops out of an index, passive funds tracking that index will all eventually sell it, regardless of whether it’s a screaming bargain at that point.

In essence, passive investing funnels money into stocks based on their size in the index, not on an analysis of their fundamentals. Companies that are already large and popular get more and more investment just because they’re large and popular. This can create a feedback loop. For example, when a handful of big tech stocks were responsible for most of the S&P 500’s gains, index funds kept buying those stocks and further boosting their prices, simply because those stocks’ market caps grew and dominated the index.

There’s no human at the helm saying “wait, this stock is overvalued, let’s not buy more.” The index methodology rules the day which is both the strength and the blind spot of passive investing.

Opportunities and Imperfections in a Passive-Dominated Market

As an active investor, I watch this passive tidal wave with a bit of excitement and caution. On one hand, the more money that flows into passive funds, the more inefficient the market can become. If everyone is just buying everything in the index without regard to business fundamentals, some stocks will inevitably become mispriced.

Think of a stock that’s hyped and balloons in market value. Passive funds will keep buying it as long as it’s in the index, potentially driving it even further above any reasonable valuation. On the flip side, a solid company that’s out of favor might be undervalued because passive funds aren’t specifically directing money its way (and active funds might be too small to correct the mispricing if most investors are passive).

In a market increasingly dominated by passive capital, prices can diverge more from intrinsic value, at least temporarily. For those of us who do in-depth research and pick stocks, this is actually welcome news. Greater mispricing means greater opportunity. Less efficiency in pricing can allow active investors to find bargains or short overpriced hype stocks (I, personally, don’t short anymore), profiting when reality eventually sets in. In simple terms, the rise of passive investing could be a boon for stock pickers like me, because it’s easier to beat the market if the market is not perfectly rational.

I do believe that as passive investing grows, active investors who remain will have richer hunting grounds. For example, if an index fund is forced to buy a high-flying tech stock at any price, I as an active investor can choose to avoid that stock if I think it’s overhyped. I might instead invest in a less popular mid/small cap stock that’s fundamentally strong but not in a major index (suck as my November stock pick).

If I’m right, when the hype stock eventually comes back to earth and the overlooked stock gets recognized, my active portfolio would outperform. In theory, this dynamic should help active strategies stage a comeback in certain areas.

I believe that market conditions will eventually swing the pendulum back a bit toward active management. For instance, if the economy shifts or interest rates change, we might see smaller or under-followed stocks (often ignored by passive indexes) start to shine, giving skilled stock pickers a chance to beat the index.

The other side of the coin is that markets can stay irrational far longer than I’d like. A stock that’s wildly overpriced thanks to endless passive inflows can remain overpriced for a long time, especially if more and more money keeps gushing into index funds. It can be frustrating as an active investor to watch a clearly overvalued stock keep climbing simply because it’s in the index and everyone’s buying the index.

Betting against such momentum can be painful before it’s profitable. We’ve seen episodes where bubbles form and persist. In the late 1990s dot-com era, for example, index funds piled into tech stocks that kept rising beyond any sensible valuation, and value investors who bet against that trend looked foolish until the bubble burst.

More recently, think of the frenzy in certain “hot” stocks: if a company like NVIDIA is priced for perfection due to AI optimism, a passive fund will keep adding to it regardless of whether the price makes sense relative to its earnings. That can inflate a bubble. It might take a major wake-up call such as say a big earnings miss, a loss of subscribers for a platform company, a cut in AI spending by customers, etc. to jolt the market back to reality on those names. And until that happens, passive flows can keep a stock elevated, and active skeptics have to wait it out (or risk shorting and getting burned in the interim).

In essence, while I cheer the mispricing opportunities, I also respect the power of the passive tide. It can lift all boats (deserving or not) for quite a while. Active investors need patience and risk management in this environment. Our advantage is the ability to see the train coming and step off the tracks, in a way passives don’t, meaning we can avoid or exit a dangerous stock or sector before it crashes.

But that only helps if we get the timing right.

Sometimes even active managers fail to dodge the train, as happened in 2022 when many (including myself) didn’t anticipate how inflation would hammer certain stocks.

So I remind myself to stay humble. The growing dominance of passive funds offers opportunities for sure, but capitalizing on them is not easy. It requires conviction and sometimes a contrarian mindset to go against what “the index” is doing, and then the patience to wait for vindication. I find that calm, rational analysis is more important than ever when so much money is sloshing passively.

A Global Perspective: The Passive Trend Worldwide

It’s worth zooming out beyond the U.S. to see how this active-versus-passive battle is playing out internationally. The shift to passive investing is a global phenomenon, though it’s farther along in some markets than others.

The United States has been leading the charge, roughly half or more of U.S. equity fund assets are now in passive funds, and the gap keeps widening.

But in other regions, active management still holds the majority for now. Take Europe, for instance. European investors have been slower to adopt index funds. By the end of 2024, active mutual funds and ETFs in Europe held roughly €9.2 trillion in assets, compared to about €3.8 trillion in passive funds.

That means passive is still less than one-third of the fund market in Europe. Morningstar data shows that outside the U.S., passive strategies make up only around 29% of assets under management, so active funds remain the dominant choice globally (for now).

However, the direction of change is similar everywhere. Passive funds are gaining ground in Canada, Europe, Asia, and beyond. In the UK, for example, passive equity funds grew from a tiny 7% of the market in 2004 to about 26% by 2023. That’s a huge shift in two decades, although the U.S. still outpaces it (the U.S. was around 55% passive by early 2024). Emerging markets and certain smaller countries have also seen increased adoption of ETFs and index-linked investing as these products become more available and investors become more fee-aware.

The trend appears to be one-way: passive market share keeps rising. Globally, the share of passive fund assets climbed from roughly 20% in 2014 to 40% in 2023.

Why is Europe (and others) behind the U.S. in passive uptake? There are a few reasons often cited. Culturally and historically, European investors have favored active funds more, sometimes due to the strong presence of national fund managers and banks that distribute funds.

Fee structures and regulations also differ by country. In some places, advisors had incentives to sell higher-fee active funds, though that’s changing. Additionally, some markets outside the U.S. are less efficient or have fewer widely followed index products, so active management can add more value there (for instance, in certain small-cap or emerging markets, where a good active manager might exploit inefficiencies). Indeed, data shows European active managers have higher success rates in less-followed segments like mid-cap or small-cap stocks. But even with those factors, the cost advantage of passive and the general global awareness of index investing are gradually winning people over. We’re seeing international index funds and ETFs expand, and companies like Vanguard and BlackRock (iShares) promoting passive strategies across the globe.

The big picture is that passive investing’s rise is not just a U.S. story, it’s happening worldwide, albeit at different speeds. For equity investors everywhere, this raises similar questions about market dynamics. If and when Europe or other regions hit that crossover point (passive overtaking active), we might see similar effects on stock pricing and opportunities for active stock pickers in those markets.

For now, if I invest internationally, I note that European and Asian markets might still be more active-driven, which could mean slightly more pricing inefficiencies are already being arbitraged away by local active managers. Conversely, in the U.S., where passive is king, I suspect there are more instances of stocks being mispriced because no one’s paying close attention (except perhaps a shrinking pool of active analysts).

Final Thoughts

The fact that passive funds have overtaken active funds in size is a landmark in investing history. It reflects a clear preference shift among millions of investors toward low-cost, no-frills market tracking. As someone who enjoys picking stocks and searching for an edge, I don’t view this as a defeat… far from it. I actually find it encouraging. The more people who choose passive investing, the more the market becomes driven by mechanical forces rather than fundamental analysis.

That can set the stage for bigger anomalies in stock prices, which I can try to exploit with careful research and patience. In a sense, it’s easier to “beat the tide” when the tide is a massive, passive wave that isn’t trying to outsmart anyone.

That said, passive investing has proven to be a very effective strategy for the majority, and it’s here to stay. It offers a great solution for those who just want market returns at minimal cost, and truthfully, that’s a sensible goal for most people.

The dominance of passive funds might make the overall market a bit more prone to excesses: both bubbles and slumps. But it also means an observant investor can find pockets of value.

The lesson of passive overtaking active is not that active investing is doomed, but that it must adapt. It reinforces why I need to be selective, disciplined, and sometimes contrarian. It’s a fascinating time to be an investor. We are truly “beating the tide” by understanding these trends, riding along with the passive wave when it makes sense, and stepping aside (or surfing ahead) when the crowd is missing something.

Portfolio Update

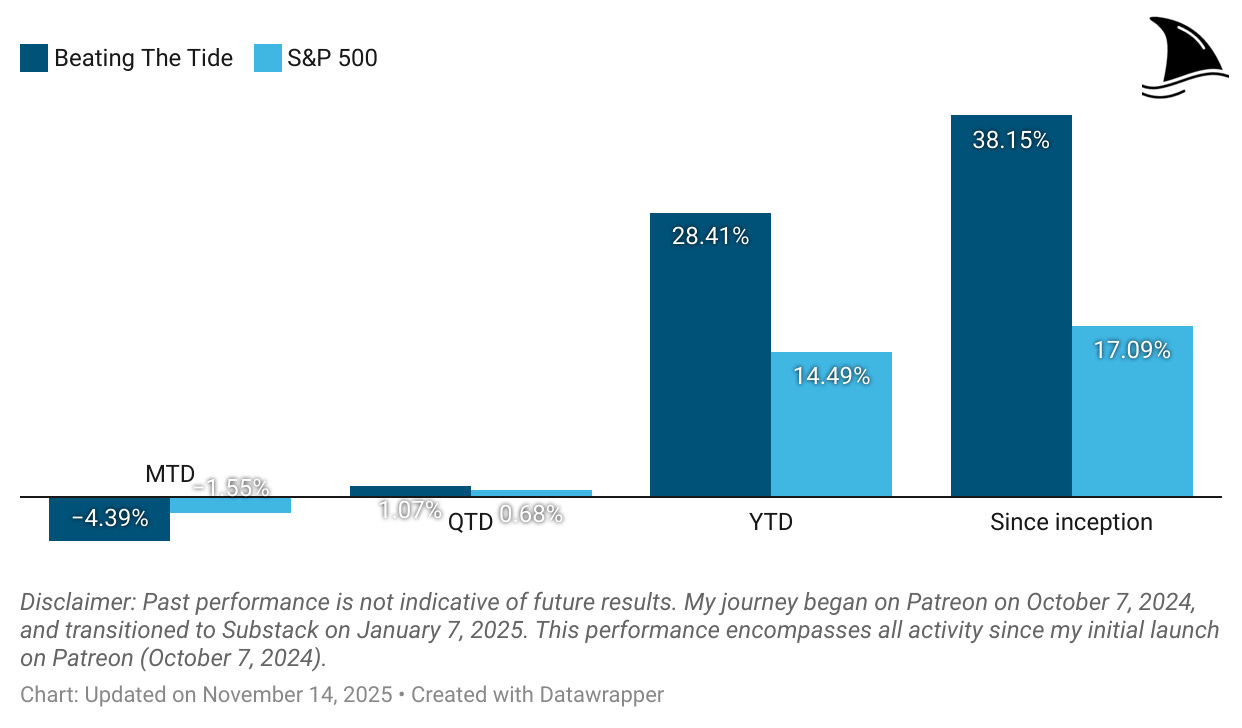

The portfolio is down this week while the S&P stayed almost flat.

Month-to-date: -4.4% vs. the S&P 500’s -1.6%.

Quarter-to-date: +1.1% vs. S&P 500’s +0.7%.

Year-to-date: +28.4% vs. the S&P’s +14.5%, a gap of 1,392 basis points.

Since inception: +38.2% vs. the S&P 500’s +17.1%. That’s 2.2x the market.

Portfolio Return

Contribution by Sector

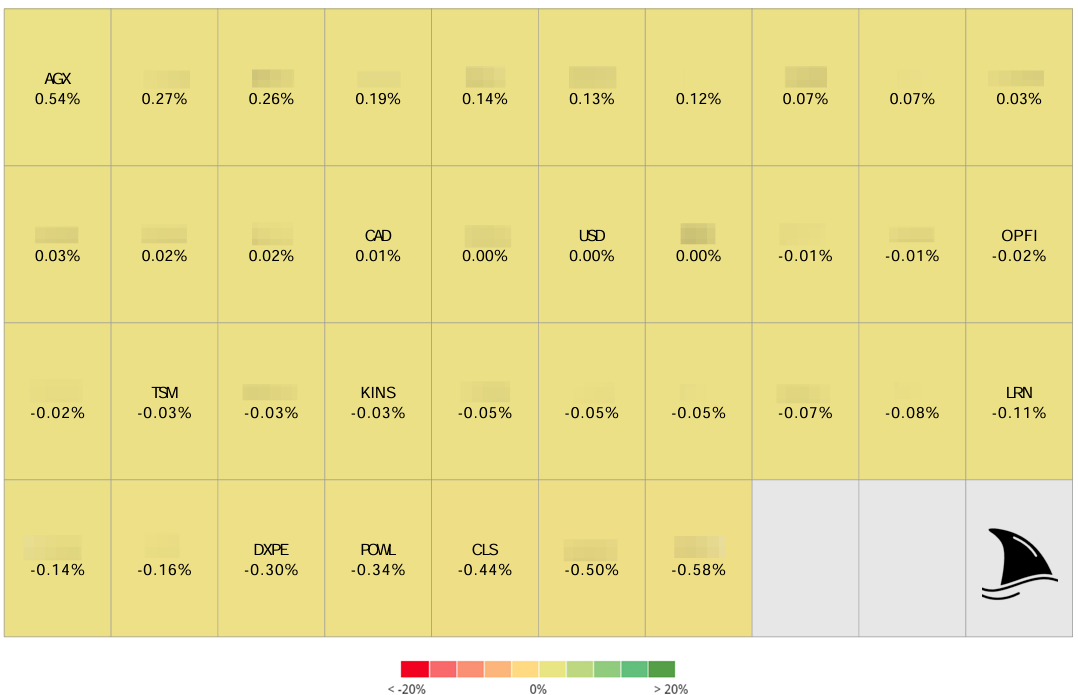

The losses were driven by tech and industrials partially offset by financials.

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+54 bps AGX 0.00%↑ (Thesis)

-2 bps OPFI 0.00%↑ (Thesis)

-3 bps TSM 0.00%↑ (Thesis)

-3 bps KINS 0.00%↑ (Thesis)

-11 bps LRN 0.00%↑ (Thesis)

-30 bps DXPE 0.00%↑ (Thesis)

-34 bps POWL 0.00%↑ (Thesis)

-44 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

The irony you highlight is perfet: as more capital flows into passive funds that ignore fundamentals, the opportunities for active investors who do their homework actualy increase. Your track record speaks for itself. The mechanical buying of index funds regardles of valuation creates exactly the kind of mispricings that patient stock pickers can exploit. Really apreciate the global perspective on how this trend is playing out diferently across regions.