KINS Q3 2025 Earnings: Record Profit, Higher Guidance, Stock Goes Nowhere

The insurer delivered another strong quarter, yet its stock barely budged amid an extreme fear market.

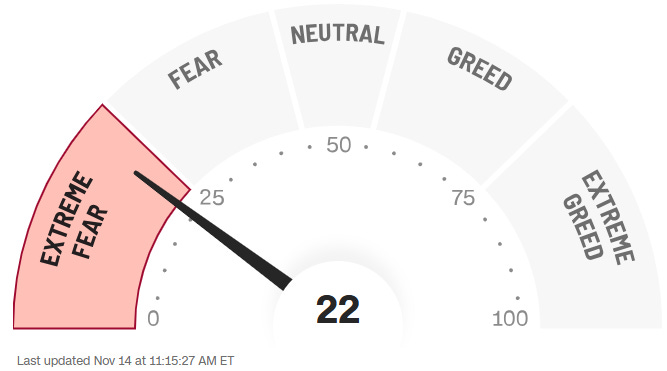

The current market is stuck in binary thinking, extreme fear has taken hold, and investors are punishing any misstep while giving little credit for success.

We just saw a stark example: DXPE missed earnings by a hair and its stock got walloped with a 23% drop.

On the flip side, KINS beat consensus estimates and even raised its outlook, yet the stock barely moved. This all-or-nothing mentality, likely fueled by the CNN Fear & Greed Index sitting in “extreme fear”, means solid results often go unrewarded while minor stumbles are punished disproportionately.

In this environment, Kingstone’s third quarter 2025 earnings didn’t spark the rally one might expect from such a strong report. But as long-term investors, we need to look past Mr. Market’s knee-jerk reactions. Let’s dig into Kingstone’s Q3 performance, which by all measures was excellent, and see how it aligns with the turnaround thesis.

Kingstone’s Q3: Strong Results Continue

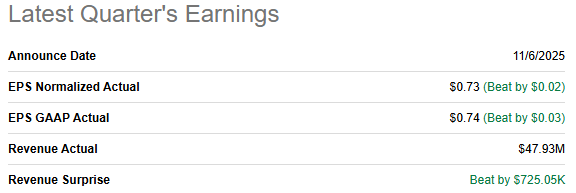

Kingstone delivered one of the strongest quarters in its history. Net income jumped 56% y/y, and diluted EPS came in at $0.74 (up from $0.55 in the prior-year quarter). Both top and bottom lines beat expectations.

Revenue (net premiums earned) grew 43% to $47.9 million, and direct premiums written (the raw premium sales before reinsurance) rose about 14% y/y. This marked Kingstone’s eighth consecutive profitable quarter, underscoring that the turnaround is not a one-quarter blip but an ongoing trend.

Crucially, profitability remained exceptional. The GAAP combined ratio was 72.7%. That means Kingstone kept nearly 27 cents of every premium dollar as underwriting profit, an extremely strong margin for an insurer. (For context, a combined ratio under 100% indicates an underwriting profit; under 80% is stellar.)

Even adjusting for unusually light catastrophe losses this quarter, management noted the combined ratio would still have been in the low 80s, reflecting the fundamentally improved profitability of Kingstone’s book. Annualized ROE was about 42.9% in Q3, a slight dip from the freakishly high 55.6% ROE a year ago (which benefited from an especially mild quarter), but on a YTD basis ROE is nearly 40%, up from 37% last year. These are excellent returns, especially for a regional insurer that just a couple of years ago was struggling.

Key Q3 highlights:

Record profits: Net income of $10.9M (+$3.9M y/y) and diluted EPS $0.74. This was Kingstone’s second-most profitable quarter ever, only behind the record Q2 result. Underwriting was solidly profitable, with a 72.7% combined ratio.

Strong premium growth: Direct premiums written grew 14% y/y. Net premiums earned (after ceding to reinsurers) were up 44% y/y, the third consecutive quarter above 40% growth as prior new business and a reduced quota share arrangement feed into earned premiums. Policies in force ticked up 4% from a year ago to +78,000. Modest policy growth, but higher average premiums and great retention drove the premium increase.

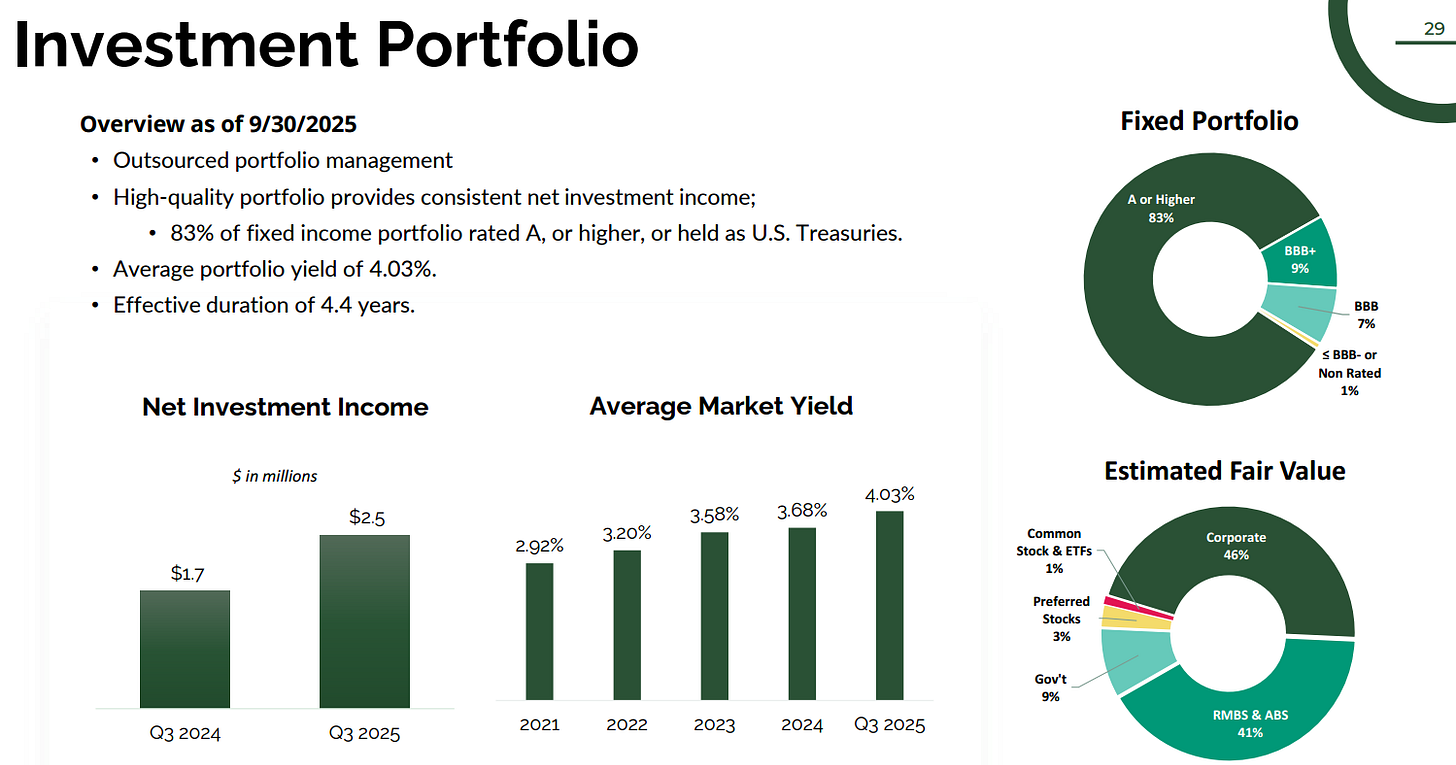

Investment income boost: Net investment income jumped 52% to $2.5M for the quarter. With interest rates higher, Kingstone’s conservative portfolio is yielding 4.0% now, versus 3.4% a year ago. The company put more cash to work in bonds at +5% yields, so investment earnings are providing a nice tailwind on top of underwriting profits.

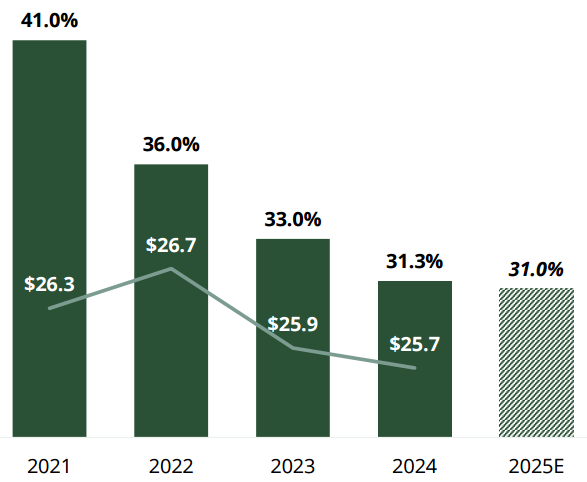

Expense discipline: The expense ratio improved dramatically to 28.4%, from 33.0% in Q3 last year. This was partly due to higher ceding commissions from reinsurance. Essentially, because Kingstone’s loss ratios have been so good, it earned additional profit commission under its quota share treaty, which reduced net expenses. YTD, the expense ratio is about 30.8%, down 1.1 points versus 2024, and management expects full-year 2025 expenses to come in below last year’s level. Controlling costs has been a key part of the turnaround, and we’re seeing that play out.

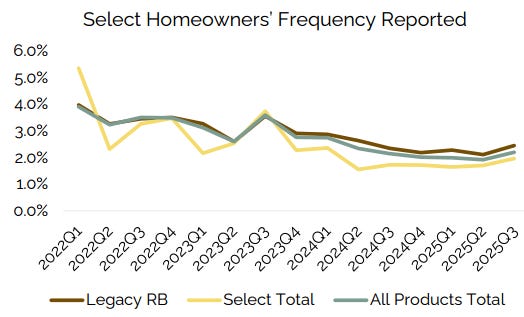

Underwriting quality: The net loss ratio (portion of premiums paid out in claims) was 44.3% this quarter. That’s up from an unusually low 39.0% a year ago (last year’s Q3 had extraordinarily benign weather and claim activity), but still very healthy. Notably, catastrophe losses were minimal at 0.2% of premiums. Even if we assume a more normal cat impact, Kingstone’s core loss ratio would be around mid-40s%, consistent with disciplined underwriting. Management highlighted lower claim frequency in its book, thanks to a shift toward lower-risk policies, as a factor supporting the excellent combined ratio. More on that next.

All told, Q3 demonstrated that Kingstone’s profitable growth story is intact. The company is writing more premium, keeping expenses low, and avoiding big losses : a recipe for high earnings. Now let’s examine some drivers behind these results: the underwriting turnaround, the “Select” product mix, and the favorable market conditions Kingstone is exploiting.

Underwriting Turnaround: Discipline Paying Off

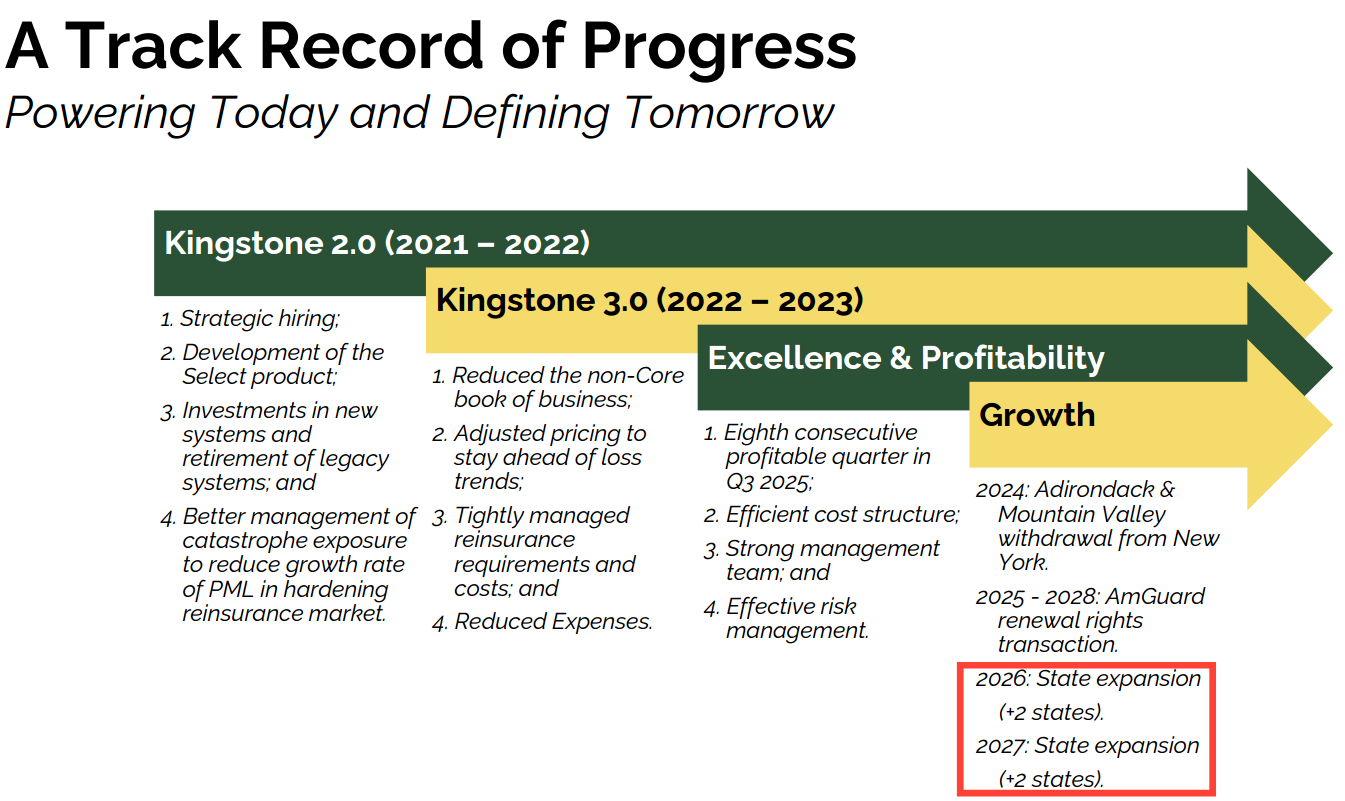

If we rewind to a couple of years ago, Kingstone was in crisis: mounting losses, a bloated expense structure, and capital concerns. The new leadership team led by CEO Meryl Golden executed a dramatic turnaround plan (“Kingstone 3.0”), and the fruits of that effort are evident in the numbers.

Q3’s combined ratio of 73% is night-and-day compared to the +100% ratios Kingstone had during its troubled years. In fact, even 80% combined ratios have become the norm over the last year, which is well below management’s initial sub-85% goal for sustainable profitability. This quarter’s result benefited from very low catastrophe claims, but even normalizing for weather, Kingstone is consistently underwriting at a healthy profit.

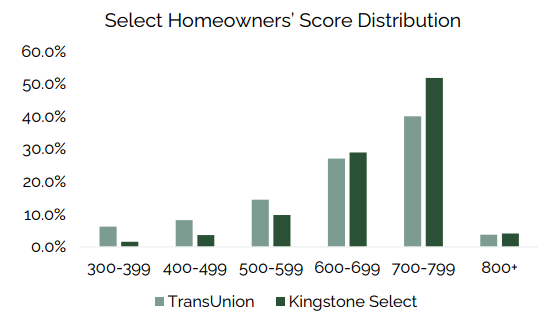

A big driver of this improvement is risk selection. Kingstone’s modernized Select product (launched in 2022) focuses on lower-risk homes and uses granular, data-driven pricing. By design, Select targets homeowners with better insurance scores, well-maintained properties (e.g. many with newer roofs), and higher deductibles, among other factors.

The outcome is a book of business that experiences far fewer claims. In fact, the company disclosed that claim frequency on Select policies is ~31% lower than on the legacy book.

This year, as more of the portfolio has shifted into the Select program, losses have stayed low. By September 30, over 54% of Kingstone’s policies were on the Select platform, up significantly from 34% at the end of 2024.

That mix shift toward safer, more profitable policies is a core part of the thesis and is clearly happening. Lower frequency of everyday claims (especially non-weather water damage claims, which are a common issue in home insurance) has been a boon to the loss ratio. Management noted earlier in the year that non-catastrophe claim frequency was down nearly 30% y/y, “the Select mix is the driver”.

Beyond better underwriting, Kingstone also strengthened its reinsurance program to protect the downside. In Q2, the company expanded its catastrophe reinsurance coverage (including issuing its first cat bond) such that it has a higher limit (+57% capacity) for a fairly modest increase in cost. Kingstone also maintained a $5M first-event retention, meaning losses above that are covered by reinsurers.

All this gives confidence that even if a severe event hits, Kingstone’s capital won’t be wiped out. The ceding commission arrangement mentioned earlier (a sliding scale where Kingstone gets more commission back when losses are low) further aligns the reinsurance partners with Kingstone’s success.

In Q3, because losses were so low, Kingstone recognized an extra $1.4M of reinsurance commissions, directly reducing expenses. This kind of structure means that in benign periods, profitability gets a boost, while in disaster periods, reinsurance kicks in to absorb the big hits.

Crucially, Kingstone’s expense base remains lean. After heavy cost-cutting in 2022-2023, the company is keeping a tight lid on expenses even as premiums grow. The Q3 underwriting expense ratio of 28.4% is very competitive, and management expects the full-year ratio to be in line with 2024’s 31% or perhaps a bit lower given the recent commission adjustments.

In other words, Kingstone is scaling up its premium (the denominator) faster than expenses are rising, which drives operating leverage. The efficiency of the operations gives Kingstone a durable margin advantage. As long as they maintain underwriting discipline, this low expense, low loss frequency model should continue yielding combined ratios in the 70s–80s range, which is excellent.

Growth Engines: Premium Uptick and Investment Income

While controlling losses and expenses is one side of the coin, Kingstone is also benefiting from growth tailwinds on the top line. In Q3, direct written premiums were $75.8M, up 13.8% y/y.

How is Kingstone growing premiums despite writing more selectively?

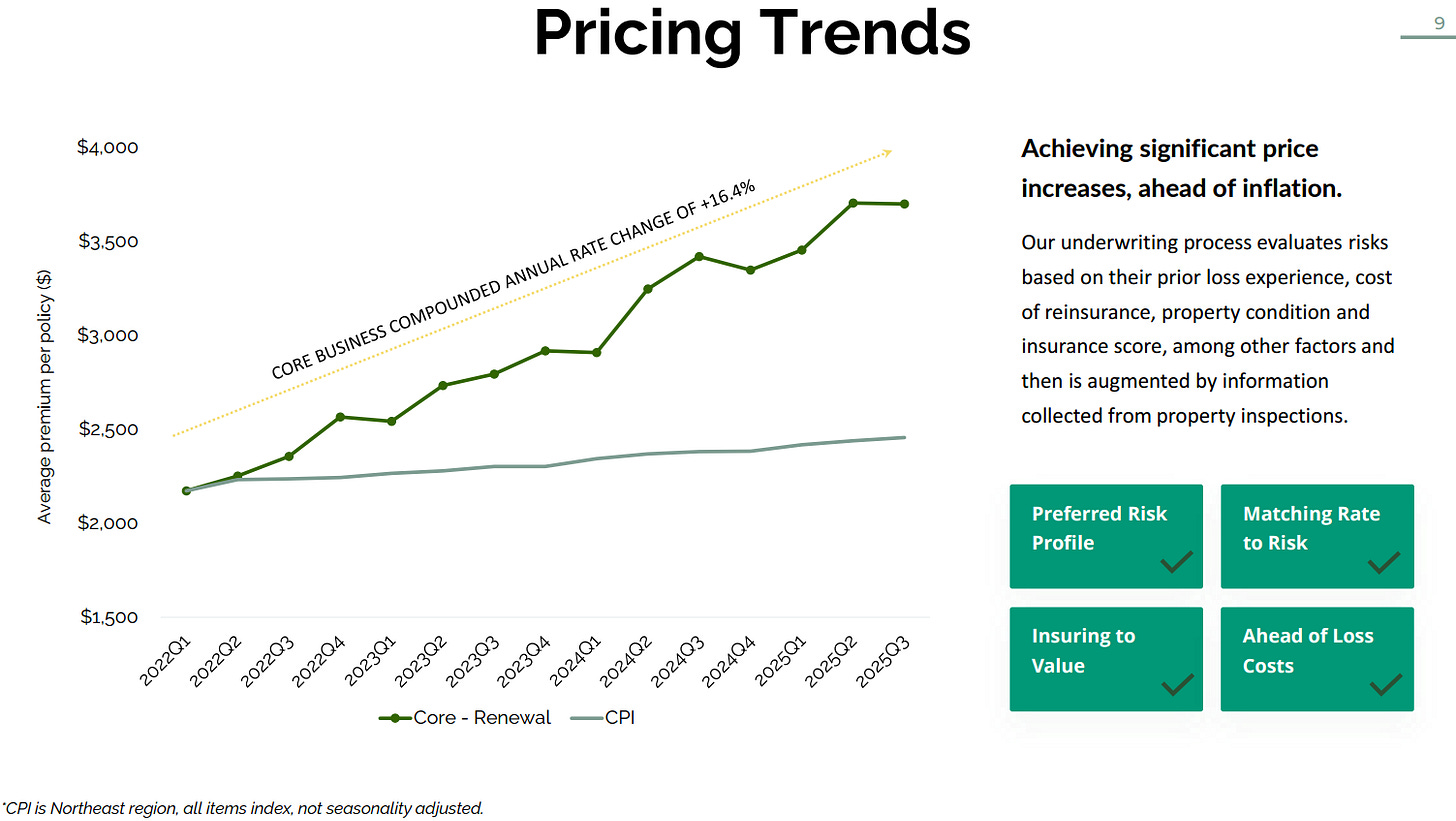

Mainly through higher pricing and strong customer retention. The average premium per policy increased ~13%y/y in Q3, as the company continues to push through rate increases in the hard insurance market.

At the same time, retention of existing customers remains very high (over 80%) and actually trending upward. This makes sense: when the whole market is raising rates (and many competitors in NY have pulled back or exited), customers have fewer alternatives, and Kingstone’s agent relationships help keep business on the books.

The CEO noted that new business flow had moderated from last year’s surge (when two rival insurers, Adirondack and Mountain Valley, left the NY market and Kingstone scooped up a lot of their business), but encouragingly, new policy counts have been picking up month-over-month since June. In fact, Kingstone has started writing policies from a renewal rights acquisition (from AmTrust/Guard), which will contribute to policy growth going forward.

All combined, policies in force rose to 78,000 (up 4% y/y) by quarter-end, and the premium per policy is higher, yielding that 14% DWP growth. It’s a healthy, organic growth story primarily within Kingstone’s niche Downstate NY market.

Because Kingstone has lowered its reinsurance quota share (ceding less premium away), the growth in net earned premiums is even more eye-popping. Net earned premium was $47.9M in Q3, up 43.5% y/y. This “earned premium” growth (which reflects premiums actually recognized as revenue in the period) is supercharged by two factors: (1) the lower quota share means Kingstone keeps a larger percentage of the premiums it writes, and (2) the surge of business written in late 2024 and early 2025 is now fully earning through the income statement.

Essentially, a policy written last year contributes earned premium over the following 12 months, so the big jump in written premiums we saw in H2 2024 is still flowing into the 2025 results. Golden described this as a “powerful tailwind” that will continue at least through year-end.

Indeed, 2025 is shaping up to be a year of extraordinary growth in earned premiums. Management’s full-year forecast of $187M NPE implies 49% growth over 2024. It’s not often you see an insurer growing revenues nearly 50% while also delivering underwriting profits. That combination underscores how unique Kingstone’s situation is (benefiting from an isolated market dislocation and a turnaround from a low base).

On top of the underwriting-driven gains, Kingstone’s investment income is providing a nice boost thanks to higher interest rates. Q3 net investment income was $2.5 million, up 52% from $1.65M. YTD, investment income is up 39%. The company has been able to reinvest its growing cash flows into bonds at yields in the 5% range, significantly higher than the yields on its older portfolio.

As of September, Kingstone’s portfolio yield was about 4.03%, up from 3.39% a year prior. They’ve also modestly extended the duration of the portfolio to 4.4 years (from 3.7), locking in some of these higher rates.

Importantly, Kingstone remains conservative in its investments (mostly investment-grade bonds, no risky equity bets) so this income is stable and reflects the strength of the “float” (the premiums invested before claims are paid). Higher investment income contributed about $0.13 per share this quarter (roughly $2.5M pre-tax), which meaningfully supplements the underwriting profit.

All in all, growth is robust but controlled. Kingstone isn’t chasing reckless expansion; it’s growing where it sees profitable opportunities. Management actually reaffirmed that the NY market remains “hard” (conducive to raising rates) and noted that while a couple of competitors have started broadening appetite again, Kingstone’s volume trends are still positive. They plan a measured expansion outside NY starting next year entering two new states in 2026 and two more in 2027 but will do so cautiously (excess & surplus lines to start, to avoid regulatory hurdles).

Strengthened Balance Sheet and Updated Guidance

Kingstone’s balance sheet is in much better shape now than during its troubled period a few years ago. After eight quarters of profitability, the capital base has rebuilt significantly. Shareholders’ equity stood at $107 million as of Q3, an 80% increase y/y. Book value per share was about $7.28 (diluted), up 69% from a year earlier. Even excluding accumulated other comprehensive income (which accounts for unrealized investment gains/losses), book value is around $7.74, up 56% y/y. This reflects the strong earnings retention. Kingstone has been retaining profits to bolster its capital, which was much needed after the near-death experience in 2020-2021.

Importantly, capital quality has improved: the holding company has no debt, and the statutory surplus of the insurance subsidiary has been growing. In Q3, management felt confident enough to reinstate the quarterly dividend, paying $0.04 per share for the first time since suspending it during the crisis.

They also brought in a new CFO (Randy Patten) in August and refreshed the board, signaling a focus on governance and financial oversight. All these are positive signals that the company is on stable footing.

With a 40% ROE YTD, Kingstone is internally generating capital at a high rate, which can support its growth (and possibly more capital return to shareholders in the future). Management noted that they have “ample capital to fund disciplined growth” and currently no need for raising funds.

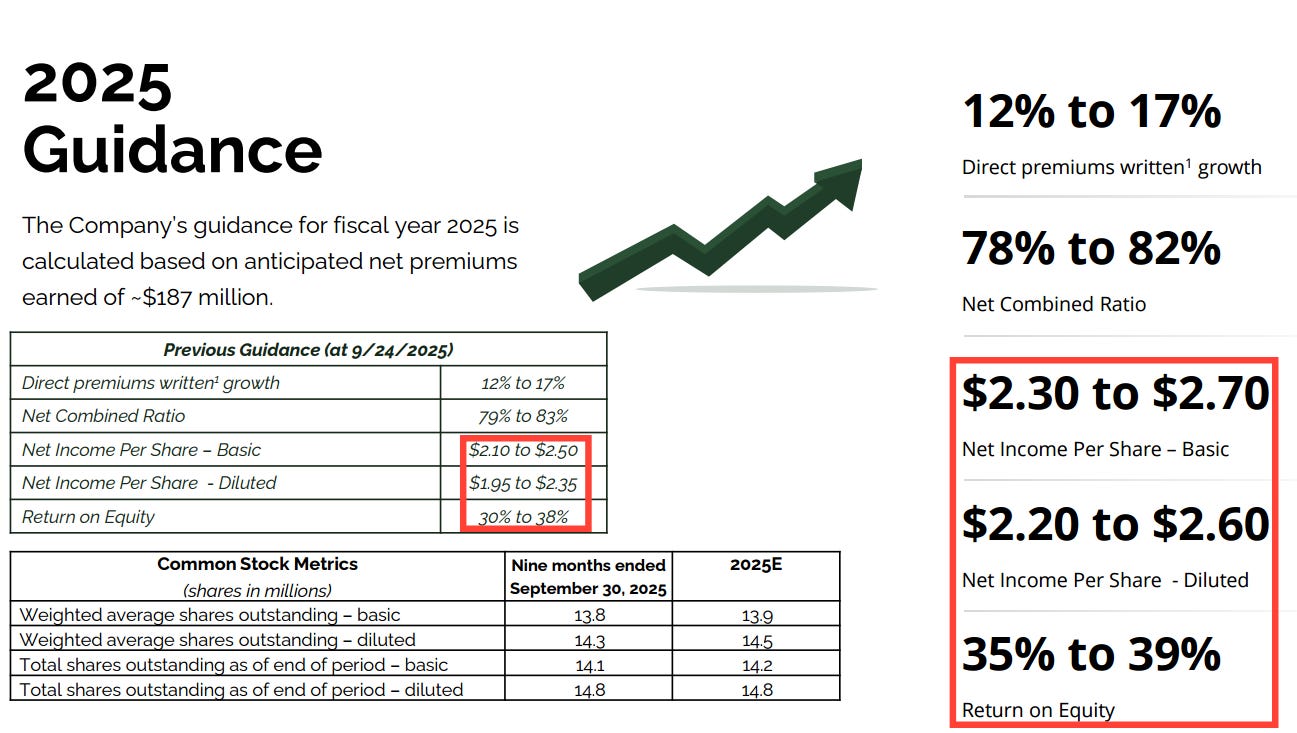

Given the strong results, Kingstone raised its full-year 2025 guidance for the second time this year.

Back in Q2 they had already boosted their outlook; now they’ve done it again.

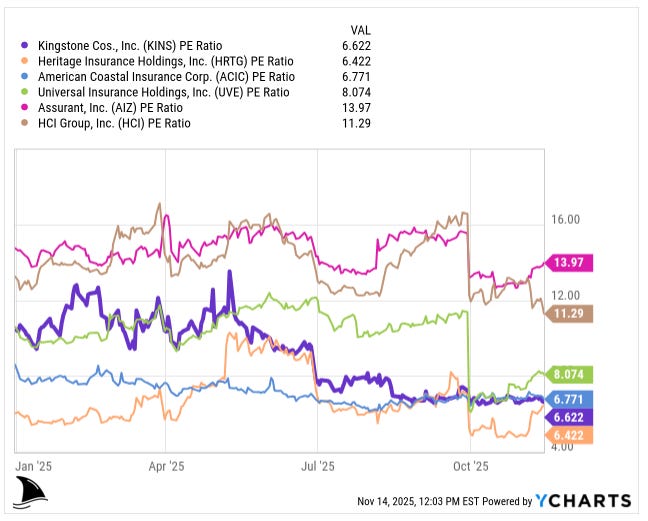

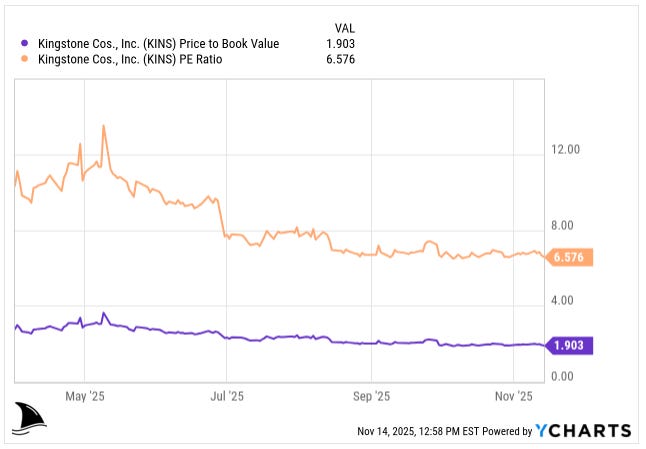

In short, Kingstone is on track for roughly $2.50 in EPS this year (give or take) and an ~80% combined ratio. To put that in perspective, at the current share price ($14.60), the stock trades around 6.6x TTM earnings and 5.8x 2025E earnings despite the company generating 40% ROE.

The guidance implies Q4 will be a bit lighter than Q2/Q3 (partly because they are assuming more normal winter weather and some seasonality), but even so, 2025 will be a banner year.

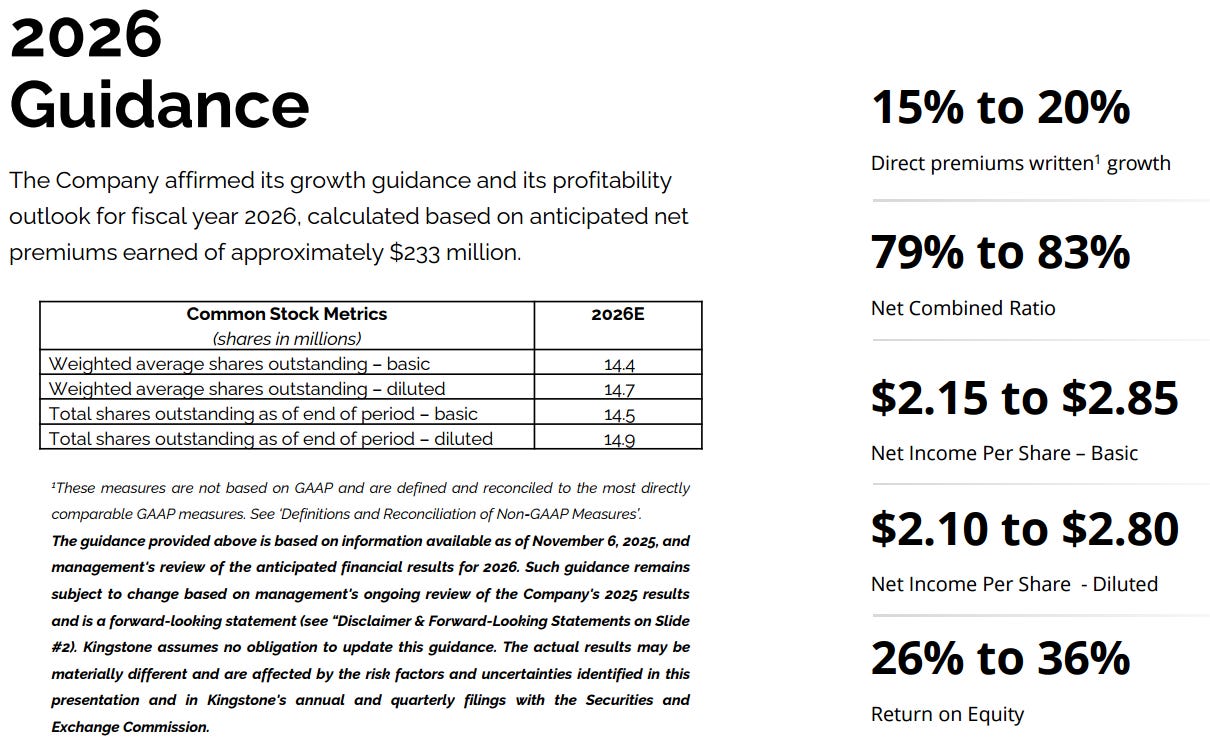

Management also reiterated its preliminary 2026 guidance, which calls for 15%–20% DWP growth and a 79%–83% combined ratio next year.

They baked in a more normal catastrophe load for 2026 (since 2024 and 2025 were blessed with mild weather), which is prudent. The 2026 EPS guidance of $2.10–$2.80 diluted actually assumes higher catastrophe losses; if weather stays benign, there could be upside. We’ll get a refined 2026 outlook in March, but the big picture is that Kingstone expects to remain solidly profitable even as it pursues growth beyond New York.

They also teased a multi-year strategic roadmap to be presented in the first half of 2026, including the expansion to new states and a five-year goal (announced last quarter) to double premiums to $500M by 2029. That ambitious growth plan will require continued flawless execution, but so far this management team is earning the benefit of the doubt.

Thesis Check-In: Playing Out Versus Expectations

In my original deep dive on KINS (April 2025) and the Q2 update, I laid out a thesis for Kingstone as a turnaround story with further upside, albeit with some caution after the stock’s initial 80% surge. Now that we have Q3 results and updated guidance, it’s a good time to assess what’s playing out as expected and what hasn’t.

What’s going right (as predicted):

Turnaround delivering profitable growth: The core premise was that Kingstone’s new focus on disciplined underwriting and cost cuts would yield durable sub-85% combined ratios and double-digit ROEs. This has materialized in spades. YTD combined ratio is 79% and ROE 40%. Kingstone has strung together eight profitable quarters, validating the CEO’s strategy. The company’s “record” earnings in Q2 and near-record in Q3 show the turnaround has real momentum, not just a one-off. Underwriting profits are now the norm.

“Select” product mix shift: A key part of the thesis was that the introduction of the Select program would improve portfolio quality by attracting safer risks. Indeed, Select policies are now over half of the book (54% of PIF), up from one-third at end of 2024. This shift has led to significantly lower claim frequency (roughly 30% fewer claims on Select vs legacy), which in turn has helped push loss ratios down. Management’s commentary continues to highlight lower water damage claims and overall frequency improvements thanks to the Select focus. This is exactly what I hoped to see, the new underwriting approach making the business fundamentally more profitable.

Improved capital & risk profile: The thesis argued that Kingstone would shore up its capital and reduce risk exposure, which would remove the overhang from its troubled past. This, too, has happened. The capital base is far healthier now: equity up ~80% y/y, no holding-company debt, and regulators have allowed dividends again. The comprehensive reinsurance program (including a cat bond and higher limits) put in place in mid-2025 provides a safety net against disasters, exactly as envisioned. Kingstone is no longer walking a tightrope; it has a cushion to withstand bad luck. That peace of mind for shareholders was part of the thesis for holding through the turnaround and now we have it.

Management executing & sticking to the plan: I expected a disciplined, execution-focused management to drive this story, and so far Meryl Golden’s team has delivered. They pruned non-core lines, doubled down on the profitable NY homeowners market, and are expanding methodically (one small renewal rights deal, planning E&S entries in new states cautiously). They also followed through on shareholder-friendly moves once appropriate (reinstating the dividend, refreshing leadership). The clear communication, e.g. providing multi-year targets, raising guidance when warranted, builds credibility. In short, the qualitative factors (strategy, capital allocation, transparency) have aligned with what I hoped for from this management.

What hasn’t played out (yet):

Valuation re-rating: Despite vastly improved fundamentals, the stock price has not materially rewarded investors since the initial run-up. When I first bought KINS around $10 and wrote about it near $18, I noted that a lot of the easy gains were realized, but saw 20–30% further upside if execution held up. Here we are: execution not only held up but exceeded expectations (guidance has been raised twice), and yet the stock sits around $14–15. In the week after this earnings beat and guide-up, KINS shares barely moved. In fact, they’re roughly flat over the past few months and down from the summer highs. There has been no P/E expansion. The market is effectively valuing Kingstone at ~6x this year’s earnings and ~1.9x book, which is actually a compression from earlier in the year when it was ~$18 (around 10x forward earnings and ~3.5x book then).

This lack of rerating is disappointing but perhaps not surprising given the fearful market mood and small-cap illiquidity. Investors remain skeptical, maybe waiting to see if results are “too good to be true.”

Conclusion: Staying the Course & Increasing the Target Price

Kingstone’s Q3 2025 report reinforces my confidence in this holding. The company is firing on all cylinders operationally: underwriting profit, growth, and capital strength are all trending in the right direction. We’ve seen a textbook turnaround from crisis to record profitability within two years. Yet, due to the market’s risk-averse mindset, the stock is trading as if none of this progress happened. That disconnect won’t last forever.

I am updating my price target from $23 to $25, which is 10x a $2.50 EPS. Essentially the middle of management’s guidance.