Weekly #52: From Silicon Strength to Southern Storms. TSM Revised, Argentina Reassessed

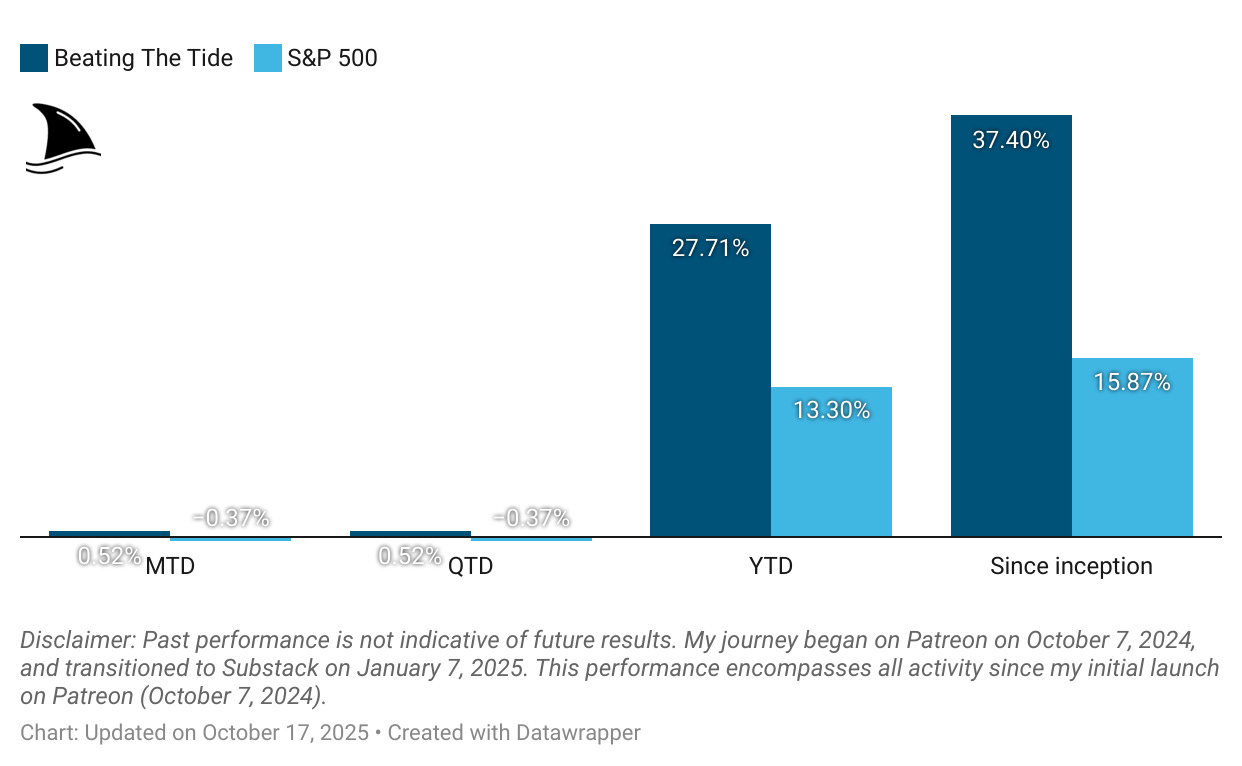

Portfolio +27.7% YTD, 2.4x the market since inception. TSM’s 2025 story just got stronger and valuation higher. Argentina’s latest downturn shows why waiting for conviction often pays best.

Hello fellow Sharks,

On October 7, I mark one year since I started this newsletter on Patreon. I moved to Substack in January 2025. In year one, the portfolio returned 36.0% versus 16.7% for the S&P 500, which is 2.2x the market. And as of last Friday, the return since inception is +37.4% or 2.4x the market. If you want, to skip straight to the numbers, jump to the Portfolio Update.

This week, I go into detail on TSM’s latest results, revise the target price (hint, the revision is upward) and I talk about Argentina. If you recall I exited the Argentine market in January. In hindsight the timing was spot on. Now that prices have reset (as it does every couple of years), I’m preparing for a future re-entry rather than rushing in.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

Closed MFC

I closed the Manulife position MFC 0.00%↑. The risk-reward compressed and the near-term catalysts look softer than I want. Asia mix shift and margin lift are taking longer, buyback tailwinds feel less punchy, and I see clearer 6–12 month upside elsewhere. Simple opportunity cost. I’ll keep tracking it, but my capital works harder in higher-conviction names right now.

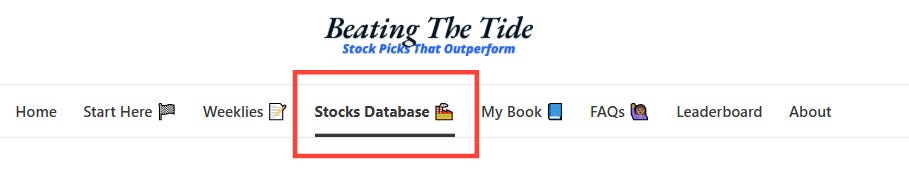

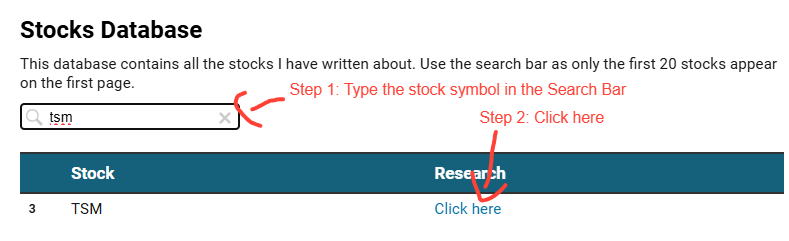

New Stocks Database

I built a one-stop page where you can pull up everything I’ve written on any stock. Click on “Stock Database” on the homepage.

Head to the page, type the ticker in the database search bar, then click the link to see all related posts in one place.

I hope it’s useful. Send me feedback; I’ll keep tuning it.

TSMC Q3 2025: Dominance On Display

Q3 2025 Earnings: Big Beat Fueled by AI and iPhones

TSMC just delivered a stellar Q3 2025, blowing past its own guidance and Wall Street estimates. Revenue hit $33.1 billion for the quarter, up 40.8% y/y and even above the high end of guidance. This was a record quarter for TSMC, driven by surging orders for advanced AI/HPC chips and new smartphone SoCs (think Apple’s latest iPhone silicon). Net income jumped 39.1% y/y to $14.8B, boosting EPS to $2.92 per ADR for the quarter.

Profit margins expanded nicely: gross margin came in at 59.5%, up nearly a point sequentially and exceeding guidance by 200 basis points. In fact, Q3 gross margin was 1.7 points higher than a year ago, a testament to TSMC’s pricing power and cost discipline. Operating margin hit 50.6%, and net profit margin was 45.7%, both improving ~3 points from last year.

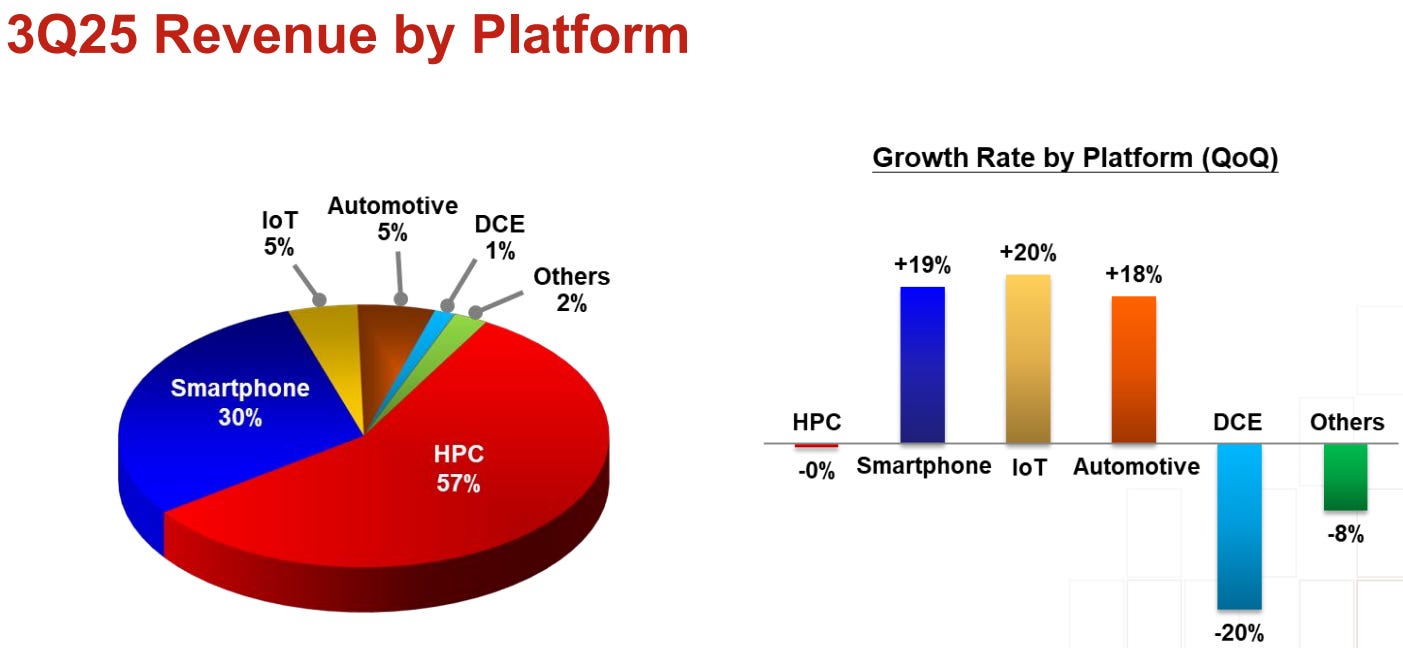

This strong showing was broad-based across TSMC’s businesses. HPC remained the largest segment at 57% of revenue in Q3. HPC sales were roughly flat from Q2 (which had already spiked).

The smartphone platform jumped 19% q/q thanks to the Apple iPhone launch, making up 30% of quarterly revenue. Even IoT and automotive chips saw 20% sequential growth.

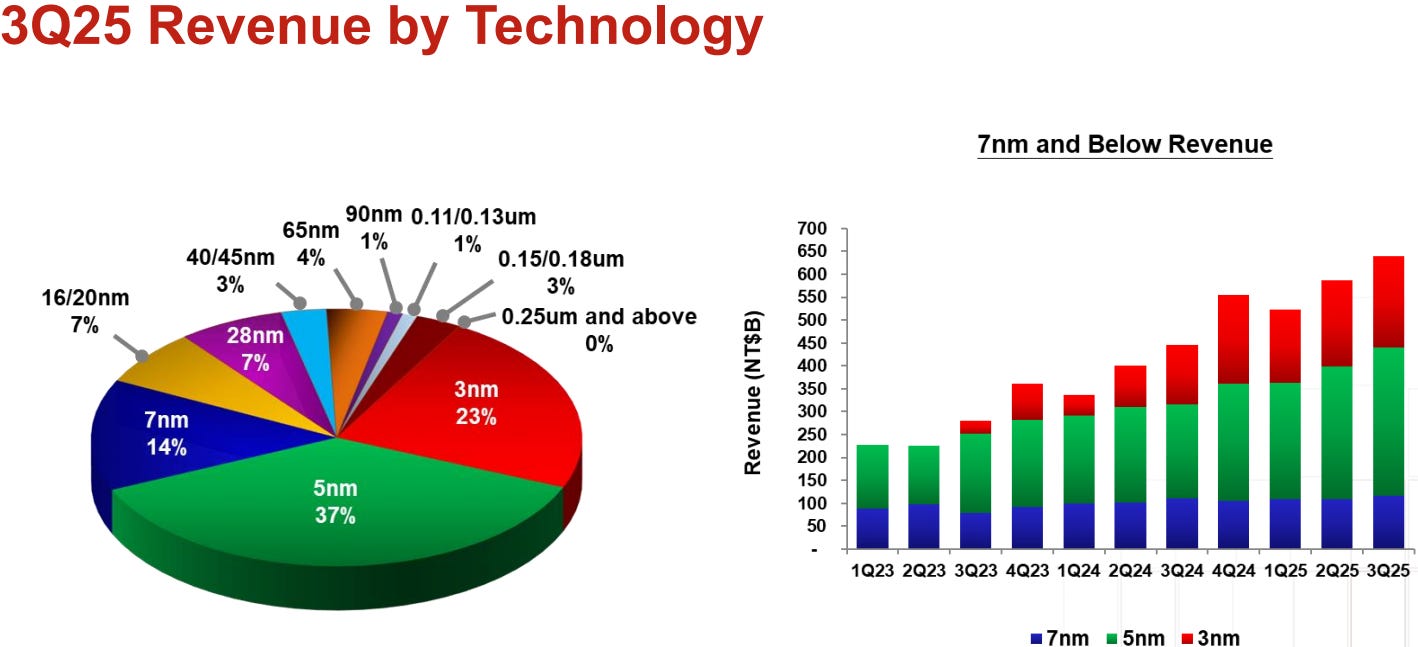

In terms of technology, 3nm ramped rapidly and it accounted for 23% of wafer revenue in Q3, a huge jump from virtually zero a year ago.

5nm contributed 37%, and 7nm another 14%, so in total “advanced nodes” made up 74% of TSMC’s wafer sales. This mix shift to leading-edge tech underscores how indispensable TSMC has become in the AI and premium smartphone boom.

TSMC also offered robust guidance for Q4 and beyond. For Q4 2025, it expects revenue of $32.2–33.4B, roughly flat sequentially (down ~1% q/q at the midpoint after the big Q3 spike) but up ~22% y/y. Management raised its full-year 2025 revenue growth outlook to the “mid-30%” range (in USD), up from ~30% before.

In other words, TSMC now anticipates ~35% y/y growth for 2025, far above the mid-20s % it guided earlier in the year. This is a huge revision for a company of this size, reflecting red-hot AI server chip demand and sustained strength in 3nm smartphone chips.

TSMC’s “AI megatrend” conviction is strengthening. Today’s AI-driven surge is not a transient blip, but rather a long-term secular upcycle. This could be observed in management’s margin guidance for Q4 pegged at 59–61%, with operating margin 50%.

In short, Q3 confirmed that TSMC is firing on all cylinders heading into year-end, powered by an insatiable appetite for advanced chips.

Stronger Pricing & AI Demand: Forecasts Revised Upward

Back in March 2025, I published a deep dive on TSMC and laid out projections for the year.

My original model was optimistic … but it turns out not optimistic enough. I had forecast 2025 revenue of $107B. Based on the latest results and management’s updated guidance, I’m now raising my 2025 revenue estimate to $119B. That’s an upward revision of ~11%, driven by two main factors: much stronger pricing power and even faster growth in AI/HPC demand than I anticipated.

Pricing Power

I underestimated TSMC’s ability to raise prices without scaring off customers. In my original thesis I assumed only modest price increases at advanced nodes, thinking competition (and customer pushback) would limit TSMC’s pricing.

The reality: TSMC has been charging more per wafer than I modeled, and customers are largely swallowing it. During the Q3 call, the CFO noted gross margin got a nice boost from “cost improvement and a higher capacity utilization rate”. Basically, efficiency gains but that was partially offset by an “unfavorable foreign exchange rate and dilution from our overseas fabs”.

What’s telling is that despite headwinds like a stronger NT dollar and higher costs in Arizona, TSMC still beat margin guidance by 2% points. This implies underlying pricing and mix were even better than expected. TSMC intends to raise prices 5–10% on 5nm/4nm and older advanced nodes, and a hefty 15–20%+ on its upcoming 2nm generation.

TSMC can do this because its technology lead means there are essentially no alternatives for cutting-edge chips…if you need the best, you pay TSMC’s price. In hindsight, my model was too conservative on margin: I had assumed gross margins in the mid-50s%, but with recent pricing actions and efficiencies, TSMC is now trending closer to 60% gross margin.

Simply put, I underestimated TSMC’s pricing power. The company’s actual price increases are stronger than I modeled, and customers (especially in AI, where performance is paramount) are tolerating these hikes. This realization forced me to boost my revenue and margin assumptions for 2025 and beyond.

AI/HPC Demand

The other big surprise has been the sheer magnitude of the AI-driven demand surge. Three quarters into 2025, it’s clear that the AI “megatrend” we discussed in March is even bigger than anticipated.

TSMC’s HPC segment is up roughly +50% y/y and now over half of total revenue. In July, TSMC already raised its full-year growth forecast by a whopping 30% (in USD) citing “insatiable” AI demand.

That trend has only strengthened into Q3.

C.C. Wei noted that data center customers are eagerly moving to TSMC’s newest nodes to support AI workloads. What’s striking is that TSMC’s overall 2025 revenue is now on track to grow ~35% largely thanks to AI and high-performance computing.

My original forecast assumed 22% growth for 2025, but TSMC blew past that. In particular, I had modeled a plateau in smartphone chip sales and only moderate growth in data-center/HPC orders due to a digestion of inventory. Instead, smartphone-related demand rebounded strongly with the 3nm Apple chip ramp, and HPC/AI orders accelerated. TSMC has struggled to keep up with feverish demand for AI GPU silicon (used by the likes of NVIDIA)

Its CoWoS advanced packaging capacity has been fully booked, prompting TSMC to double capacity this year. All of this means 2025’s growth trajectory is much higher than I thought.

I’ve increased my 2025 revenue estimate by $12B and now expect gross margins close to 59% for the year (versus 55% originally). These adjustments flow through to the bottom line.

I’ll discuss the valuation impact shortly (spoiler: my price target goes up). But first, let’s touch on some important strategic and technological updates that informed these forecast changes.

3nm vs 2nm: Next-Gen Node Brings Even Better Margins

One fascinating development is how TSMC’s newest technology is shaping up from a profitability standpoint. Typically, when a foundry launches a bleeding-edge node, margins suffer initially due to low yields and high costs.

We saw this with 3nm earlier: 3nm started production in late 2022 and had lower early yields, which usually drags on gross margin until the node matures.

However, with TSMC’s upcoming 2nm node, it appears margins might actually improve relative to 3nm almost from the get-go. 2nm will carry better profitability than 3nm, thanks to a more favorable price-to-value ratio for customers. In plain English: 2nm will offer such compelling performance/power benefits that TSMC can charge a premium (higher ASP per wafer) that more than offsets the higher cost to manufacture it.

TSMC is putting a bigger markup on 2nm relative to its cost, versus the markup it got on 3nm. This suggests better unit economics for 2nm. TSMC’s customers seem willing to pay because 2nm will deliver major improvements (it’s the first node to use GAA nanosheet transistors, promising 10-15% speed gains and +30% power reduction).

The value of those improvements, especially for AI chips which crave efficiency, means TSMC can command top dollar. C.C. Wei hinted as much on the earnings call, highlighting that all of TSMC’s major customers “have already shown excitement to move to 2nm” as soon as available.

High demand + limited supply = pricing leverage.

Thus, while I originally assumed 3nm’s ramp would pressure margins for another year or two, I’m now factoring in 2nm as a margin tailwind in late 2025/2026. By 2026, 2nm should start volume production, and if it’s priced 15-20% above 3nm (as industry chatter suggests), it will help keep TSMC’s gross margin in the high-50s% or even 60% range sustainably.

TSMC is also broadening the appeal of “older” 3nm and 5nm nodes by cutting their costs as equipment depreciates, which attracts more cost-sensitive customers without hurting margin.

Arizona Fabs: 4 of 6 to be 2nm-Capable… A Geopolitical Twist

One item that truly caught me by surprise is TSMC’s expanded plans in Arizona. We all knew TSMC was investing big in U.S. fabs (thanks to both customer pressure and geopolitical incentives). The initial plan was for two fabs in Phoenix (Fab 21 Phase 1 and 2), the first making 5nm-ish chips and the second slated for 3nm.

But TSMC has since dramatically upped its commitment: it now intends to build a total of six fabs in Arizona over the next decade, and here’s the kicker: four of those six will be capable of 2nm or beyond.

In an update, CEO C.C. Wei announced an additional $100B investment to create a full “gigafab” cluster in Arizona, including three more wafer fabs on top of the original three. The third and fourth fabs will utilize 2nm process technology, and the fifth and sixth fabs will use even more advanced tech (likely 2nm evolutions or 1nm).

By the time this cluster is built out, roughly 30% of TSMC’s 2nm and beyond capacity will reside on U.S. soil.

Frankly, I’m astonished that two-thirds of the planned Arizona fabs will be cutting-edge. I assumed TSMC might keep only one flagship fab at the leading edge in the U.S. and use the others for older nodes. Instead, TSMC is effectively transplanting a big chunk of its tech crown jewels overseas. This has several implications:

TSMC’s U.S. customers (like AAPL 0.00%↑, NVDA 0.00%↑, AMD 0.00%↑) likely drove this decision. They want more geographic diversification in their supply chain, and having critical chip production in the U.S. reduces risk. TSMC, for its part, is leveraging that demand (and U.S. government subsidies) to finance these fabs.

Costs will be higher in Arizona, no doubt. TSMC has said U.S. fab operating costs could be ~50% higher than Taiwan. That does create some margin and ROIC drag (management estimates a 2–4% gross margin hit once U.S. fabs ramp). However, they also indicated that thanks to TSMC’s overall scale, the dilution from overseas fabs is turning out a bit less than feared (~1–2% hit for full-year 2025, vs 2–3% guided before). And crucially, customers appear willing to help absorb those higher costs (via higher wafer prices) to get production on U.S. soil.

Geopolitical calculus: This is a bit of a double-edged sword. On one hand, having 2nm-capable fabs in America strengthens the U.S. semiconductor posture. It creates a safety net. If TSMC’s Taiwan operations were ever disrupted, some leading-edge capacity would already exist stateside. On the other hand, one has to ask: Does this lessen the U.S. incentive to robustly defend Taiwan? TSMC’s presence in Taiwan has often been called a “silicon shield”: a deterrent because the world (and especially the U.S.) can’t afford for it to go offline. If 30% of advanced capacity moves to Arizona, the worst-case loss from a Taiwan conflict theoretically isn’t as devastating as before. I doubt U.S. policy toward Taiwan will shift dramatically just because of TSMC’s Arizona fabs (there are many other strategic reasons to defend Taiwan). But it’s a notable development: by partially neutralizing its own strategic importance in Taiwan, TSMC could be changing the geopolitical risk profile. It’s a surprising twist that I’m still processing. The is an interesting NPR podcast talking about Taiwan’s silicon shield.

Overall, I view TSMC’s U.S. expansion as a long-term positive for business, given customers are basically footing the bill through higher prices or prepayments. The Arizona fabs underline just how indispensable TSMC’s technology is. For our thesis, the key takeaway is that TSMC is willing to replicate its leading-edge overseas, and customers remain on board despite the cost. I will be watching how this huge capex translates into output and whether the U.S. fabs can match Taiwan’s efficiency (so far the first Arizona fab reportedly achieved comparable yields to Taiwan).

The strategic dimension is fascinating, but in any case TSMC’s commitment to 2nm in Arizona signals unabated demand for its top nodes, and that gives me even more confidence in its growth runway (with a slight caveat of higher cost which, again, I’ve baked into slightly lower long-run margin than in Taiwan).

Intel: Both a “Very Good Customer” and a Challenged Rival

Perhaps the most ironic storyline in semiconductors today is Intel’s evolving relationship with TSMC. In my original piece, I touched on how Intel (historically TSMC’s competitor in leading-edge manufacturing) was also becoming its customer. That trend has deepened in recent months.

In the Q3 earnings call Q&A, C.C. Wei made a pointed remark: “that competitor happens to be our customer… a very good customer.” He confirmed TSMC is working with Intel on their advanced products. This was a subtle but clear nod to the fact that Intel relies on TSMC for some of its most cutting-edge chip components.

For instance, Intel’s current Meteor Lake and upcoming Arrow Lake client CPUs use TSMC-made tiles (the GPU and SoC chiplets are fabbed by TSMC at 5nm and 3nm, respectively).

Intel’s Ponte Vecchio data center GPU was built largely on TSMC’s 7nm. And it doesn’t stop there. Intel’s future roadmap (code-named Nova Lake, etc.) continues to include TSMC as a key foundry for certain IP blocks.

Intel is now a significant TSMC customer and is unlikely to drop TSMC anytime soon for its needs. This cozy relationship would have been unthinkable a decade ago, but it’s the reality today: Intel needs TSMC’s capacity and expertise to stay competitive in many areas.

At the same time, Intel is trying to reinvent itself as a competitor to TSMC via Intel Foundry Services. Its plan to open up its fabrication plants to make chips for others.

How is that going?

The honest answer: Intel’s foundry venture is facing an uphill battle. While Intel has poured billions into new fabs and R&D (they just started risk production of chips on their 18A process, which is roughly equivalent to TSMC 2nm), they have yet to secure the critical mass of customers needed to fill those fabs.

By Intel’s own admission, external demand for its 18A node is “not significant right now.” In fact, through the first half of 2025, Intel reported only about $50 million in revenue from external foundry customers, essentially rounding error, and certainly nowhere near what’s needed to justify the tens of billions in capital investment.

Industry reports suggest Intel has maybe 5 customers lined up for 18A (names floated include MSFT 0.00%↑ for some AI chips, the U.S. Department of Defense, and a couple of others). But that small handful of early adopters is not enough to reach critical scale. For comparison, TSMC serves hundreds of customers including virtually every major chip designer on the planet and its cutting-edge nodes typically have +20 big projects taped out in the first year alone.

Intel simply doesn’t have that breadth of customers (yet), and many potential clients are in “wait and see” mode regarding Intel’s tech.

Moreover, Intel’s 18A itself, while promising on paper, is not a proven node in high-volume. There are rumors of yield struggles. A Reuters report in August said yields on Intel’s Panther Lake (18A) chips were still very low, potentially jeopardizing profitable ramp by late 2025. Intel’s CFO has expressed optimism that yields will improve, but it’s clearly a work in progress.

And Intel made a striking comment: if it cannot land a “hero” foundry customer to fully utilize its next-gen 14A node (the successor to 18A), it might exit leading-edge manufacturing altogether. That underscores the extreme challenge Intel faces in its foundry foray.

What does this all mean for us? In my view, Intel’s struggles validate TSMC’s competitive edge. Despite all of Intel’s grand plans, TSMC still has the unquestioned lead and Intel is literally paying TSMC to produce its chips in the meantime.

I’m actually pleased to see TSMC embrace Intel as a customer rather than viewing them with animosity. TSMC is effectively saying: “Sure, Intel, you can compete with us down the road but until you catch up (if ever), we’re happy to take your money and make your chips.” This arrangement boosts TSMC’s revenue (Intel is probably a top-10 customer for TSMC now) and also arguably locks Intel in. The more Intel leans on TSMC’s manufacturing, the harder it becomes for Intel to truly go its own way.

Valuation: Updating the Model. New Target $370 (Was $338)

With all the above in mind, I’ve revised my model for TSMC. The net result is a higher earnings trajectory and a higher price target. Here’s a rundown of the key changes to my assumptions and what they mean for valuation:

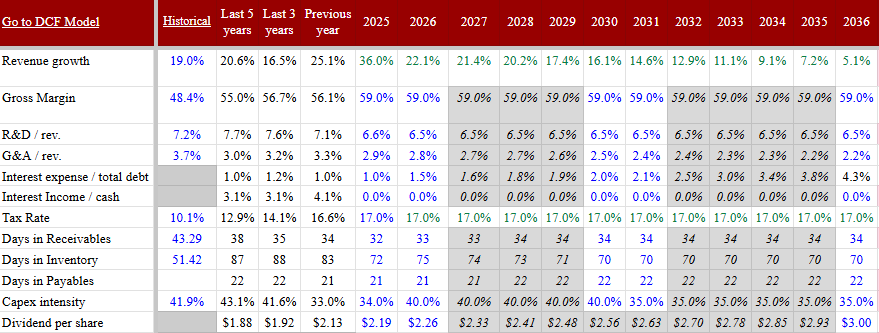

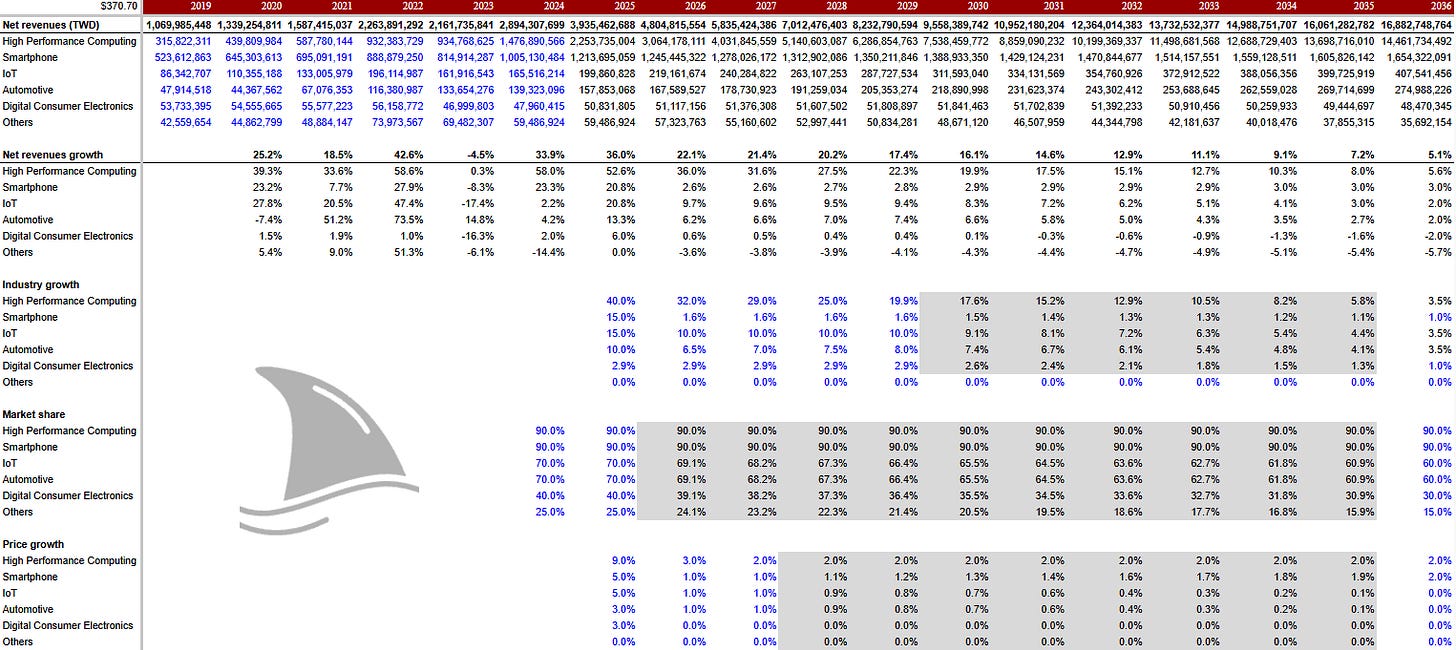

Near-Term Growth

As discussed, I now model 2025 revenue at ~$119B (up from $107B prior). That implies ~36% y/y revenue growth in 2025 and another robust year in 2026 (I’m penciling in low-20s% growth for 2026 off the higher base).

This is supported by the secular AI boom and stronger pricing.

Profitability

I nudged up my gross margin assumption. TSMC’s margin resilience has been superb even with overseas fab costs, Q3 gross margin was 59.5%. I expect gross margin of 59%.

With 2nm’s richer pricing and continued high utilization, I see TSMC comfortably staying in the high-50s% range, despite some dilution from U.S. fab costs. Operating expense discipline also remains solid, so operating margins ~50% look sustainable (TSMC hit 50.6% op margin in Q3).

These are incredible profitability levels, and they underscore TSMC’s monopoly-like position at the leading edge. I had been slightly more conservative before, but reality has shown TSMC can defend (or even expand) margin in an inflationary environment largely by passing costs to customers.

Capital Intensity & Capex

I keep TSMC’s annual capex around $41B for 2025, in line with company indications (capex guide ~$40–42B). This massive investment is needed to fund 2nm ramp (in Taiwan and Arizona) and advanced packaging capacity.

My model assumes capex then tapers off or grows more slowly, as some fabs complete. The key point is TSMC will continue to generate hefty free cash flows even at this capex level, thanks to its high margins.

All told, these changes lead to a higher intrinsic value estimate. TSMC’s fair value is around $370 per ADR now, up from about $338 previously.

Thought Of The Week: Timing the Un-Timable (Argentina Edition)

I’ve said it many times: I’m a lousy market timer.

I don’t pretend to catch tops or bottoms. I focus on conviction. When conviction is high, I get in. When conviction fades, I get out as I explained here.

In my “party lessons” piece I put it this way: I don’t try to be first through the door. I show up when the room has energy, and I leave when the vibe turns. That approach saved me time and headaches in Argentina.

In October 2024 I bought SUPV 0.00%↑, an Argentine bank, under $10 and sold under $17 about three months later.

Could I have bought at $1 or $6? Sure. Could I have squeezed a couple of bucks more and sold at $18–$20? Maybe.

The point isn’t precision. It’s process.

I entered when the setup strengthened and I exited when my conviction slipped. With what’s unfolding in Argentina, SUPV later slid to the $6 area, validating the exit.

So what changed on the ground?

President Milei pushed through harsh fiscal cuts and deregulation. Inflation cooled from panic levels, and the government posted early fiscal surpluses. Markets loved the story at first. Then the grind showed up: factories cut shifts or closed, unemployment rose, and confidence wobbled. The reform medicine worked on some macro symptoms but hurt the real economy in the short run. Political capital thinned heading into October’s midterms.

Layer on the “bailout or not” debate. Argentina secured a fresh 48-month IMF program in April (US$20B, with US$12B front-loaded).

In parallel, Washington has been brokering additional dollar support: a $20B swap line and talk of another $20B sourced from private banks and sovereign funds.

Helpful? Potentially.

But aid tied to politics isn’t a stable backbone for an equity thesis, and IMF money comes with targets that can deepen near-term pain. That mix props up the currency and buys time, but it doesn’t fix bank balance sheets or credit demand today.

Even YPF, my other preferred Argentina lever, sits inside a storm of its own: a U.S. court ruling clouded the government’s stake, and while a U.S. support package could pull down funding costs and help Vaca Muerta scale, the legal overhang and macro drift keep risk high. Energy can be a bright spot, yet sovereign noise sets the ceiling on how fast that value shows up.

How does this tie back to timing? I lean on Aswath Damodaran’s view: markets can look richly priced or cheap, but acting on timing is the impossible dream. Valuation signals are messy, and timing tools like “earnings yield vs Treasuries” (the old Fed Model) have serious flaws. He lays out sane playbooks for expensive markets: hold and rebalance, tilt exposure, hedge selectively, or, if your stomach allows, make bolder bets while admitting you’ll often be early or wrong. Translation for us: conviction first, timing second, humility always.

Back to Buenos Aires. My favorite ways to play Argentina (the banks and YPF) have fallen to interesting levels.

I’m not buying yet. Yes, if you buy now and wait long enough, odds are you’ll make money. But if you want to improve IRR, you don’t rush the entry. You wait for signals that conviction is rising again:

Sentiment: risk premia easing, fewer “emergency” headlines, and local assets trading better on bad news days.

Industry tells: loan growth baseline in the banks, deposit mix stabilizing, improving asset quality, capex and funding visibility at YPF.

Policy clarity: credible next steps on the fiscal plan and less politicized support from abroad.

Will we miss the first leg? Likely. I’m okay with that. I prefer to buy the second inning of a real turn instead of guessing the first pitch. Higher conviction on entry usually compounds into a better IRR than catching a falling knife and praying. That’s the party rule again: arrive when the music is actually playing.

So keep an eye on my Trade Alerts. Argentina’s waters are choppy, but choppy waters move the big fish closer to shore. When sentiment and the industry signals line up, I’ll wade back in not to time the market, but to time my conviction.

What’s your view on Argentina?

Portfolio Update

The portfolio gained some ground this week.

Month-to-date: +0.5% vs. the S&P 500’s -0.4%.

Year-to-date: +27.7% vs. the S&P’s +13.3%, a gap of 1,441 basis points.

Since inception: +37.4% vs. the S&P 500’s +15.9%. That’s 2.4x the market.

Portfolio Return

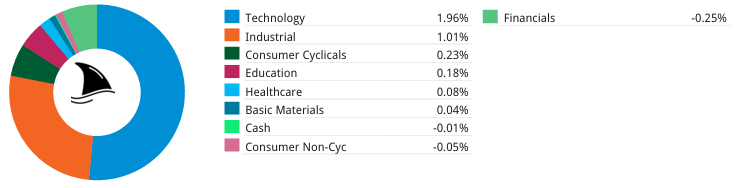

Contribution by Sector

The gains was driven by tech and industrials offset by financials.

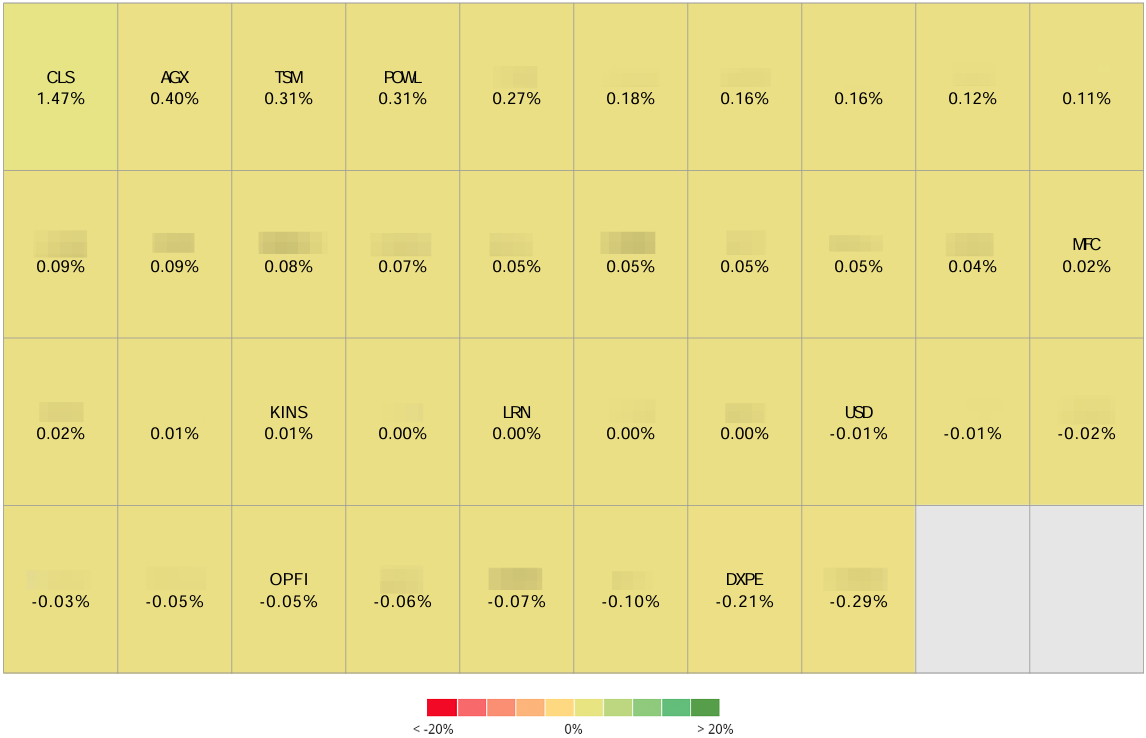

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+147 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

+40 bps AGX 0.00%↑ (Thesis)

+31 bps TSM 0.00%↑ (Thesis)

+31 bps POWL 0.00%↑ (Thesis)

+2 bps MFC 0.00%↑ (TSX: MFC) (Thesis)

+1 bps KINS 0.00%↑ (Thesis)

flat LRN 0.00%↑ (Thesis)

-5 bps OPFI 0.00%↑ (Thesis)

-21 bps DXPE 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Regarding the Argentina update, your timing on exiting and preparing for re-entry is truly insightful. It makes me wonder how you model thise cyclical market resets; is it more pattern recognition or a very deep analysis of current fundamentals that drives such precise calls?