When the Story Changes: Why Manulife’s Asian Growth Didn’t Live Up to the Hype

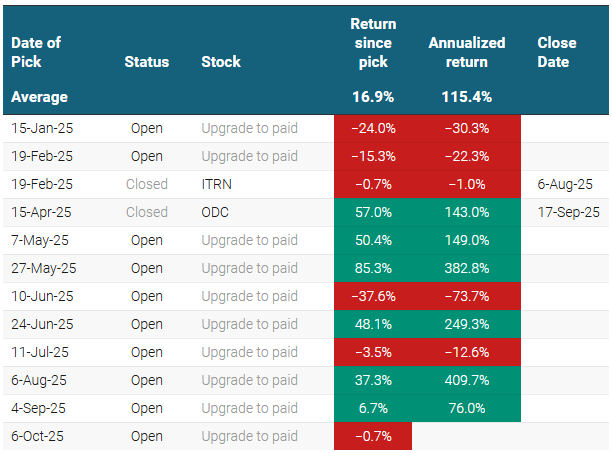

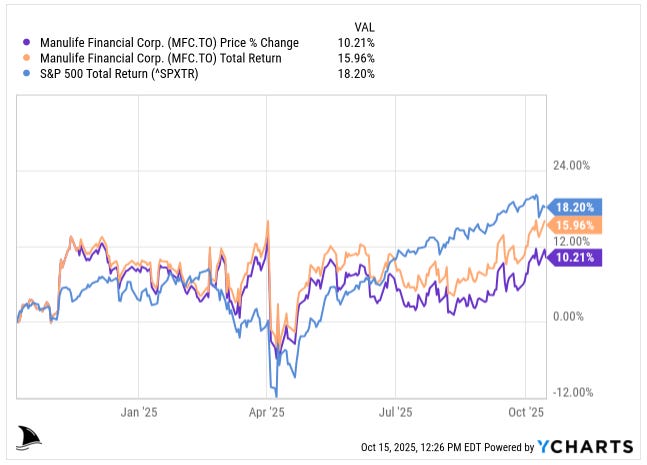

Cashing out of Manulife (MFC) after a year and a 16% total return; here’s a deep dive on why Asia’s potential didn’t pan out.

I got my start in insurance working with my brother on deals years ago, and those lessons stuck. I’ve since had some wins investing in the insurance space.

For example, I picked up KINS 0.00%↑ around $10, and it’s up +50% since then.

Also, the August stock pick is also in the insurance space and it is up +40% since it was picked.

This Financial Stock Doubled Quietly, But It’s Still Cheap

Some of the best-performing stocks aren’t flashy tech names or trendy AI plays. They’re boring. Overlooked. Financially sound. And mispriced.

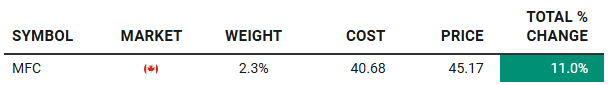

I added MFC 0.00%↑ to my Beating the Tide portfolio in October 2024 as I believed the company was poised for strong growth in Asia driving overall top-line growth.

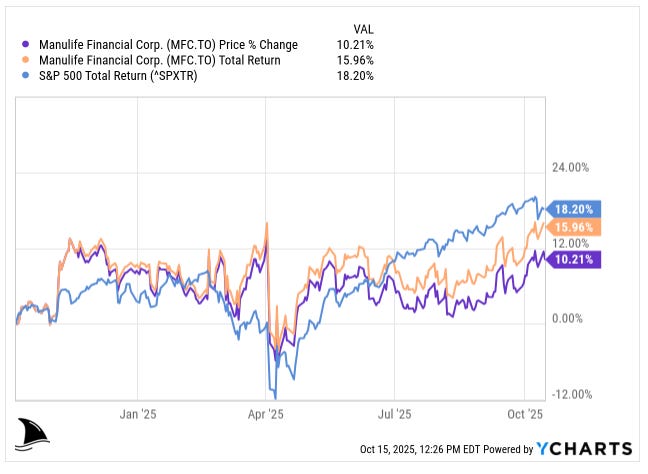

The company itself was targeting to boost Asia to 50% of its earnings by 2027 (from 41% in 2024), signaling big ambitions in the region. One year later, I haven’t seen the progress I’d hoped for. While the stock price gained ~10%,

the total return, including dividends, was 16%; not bad, not great also.

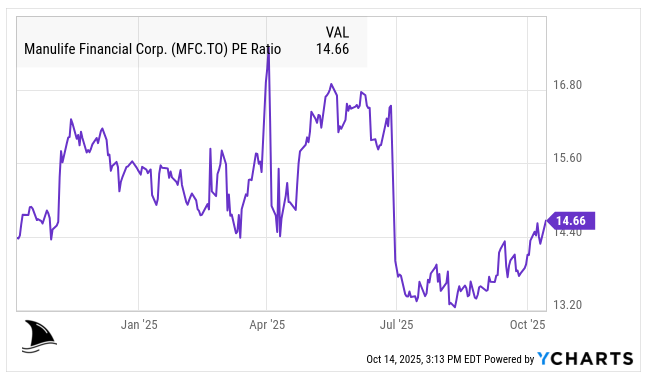

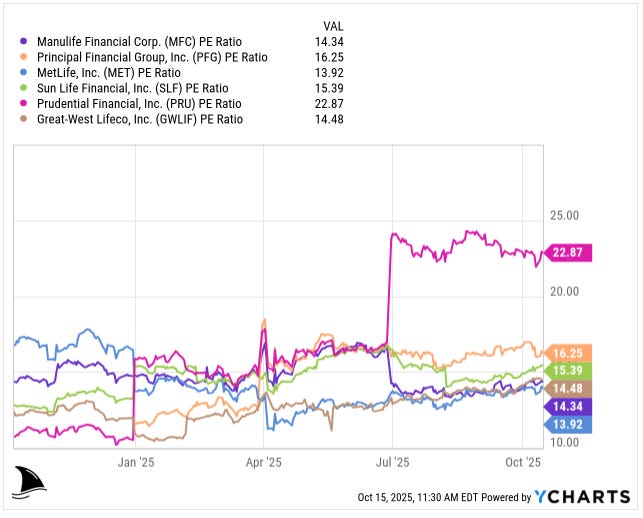

In other words, the P/E ratio is still stuck around 14x (about the same as when I bought in).

That tells me the market’s view of Manulife’s value hasn’t really changed. The bold Asia growth story hasn’t (yet) translated into a durable edge or any re-rating of the stock. Given that, I’m now closing the position, taking my profits, and looking to redeploy the capital into more compelling ideas.

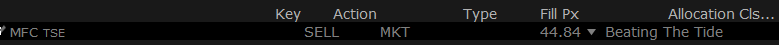

Trade alert:

Close MFC 0.00%↑ (TSX: MFC) position

Why I’m Exiting Manulife, The Short Answer

MFC is a solid, steady insurer with a strong dividend. However, it lacks a sustainable competitive edge, especially in Asia. I bought it for its Asia growth potential, yet recent results show good-but-not-great execution.

Asia sales are growing, but competition is intense and profit margins on new policies remain below lofty targets. Meanwhile, the core business in North America is slogging along in a commoditized market.

The thesis that Asia would be a game-changer hasn’t panned out. I still view Manulife as a stable company, but without evidence of a unique advantage or accelerating growth, I’d rather cash out and allocate to an idea with better upside.

That was the short answer, if you want the long answer, sit back and enjoy the show (I meant the read) 😊

Table of Contents:

Company History and Evolution

Manulife has a long and storied history. It was founded in 1887 as The Manufacturers Life Insurance Company, and its first president was actually Sir John A. Macdonald (Canada’s first Prime Minister).

Starting as a Canadian life insurer, Manulife expanded beyond Canada surprisingly early: by the 1890s it was already selling policies in the Caribbean and Asia, including China and Hong Kong. In the 1930s, Manulife opened a branch in Hong Kong and became a leading life insurer in that region. This early foothold in Asia would later become a cornerstone of its growth strategy.

Fast forward to the late 20th century: Manulife was a mutual company (owned by its policyholders) for most of its existence, but in 1999 it demutualized (meaning it converted to a shareholder-owned company) and listed on public stock exchanges in Toronto, New York, the Philippines, and Hong Kong.

A few years later, in 2004, Manulife made a transformative move by acquiring Boston-based John Hancock Financial in a +$10 billion merger. This deal made Manulife one of the largest life insurers in North America overnight and gave it a major presence in the U.S. (John Hancock is a well-known U.S. life insurance brand).

Throughout the 2000s and 2010s, Manulife continued to expand and adapt. It entered new markets (like launching operations in Cambodia in 2012) and struck partnerships to widen its distribution. For example, in 2015, Manulife inked a 15-year bancassurance partnership with DBS Bank that gave it exclusive access to sell insurance through DBS’s branches in Singapore, Hong Kong, China, and Indonesia.

Deals like that are crucial. In many Asian markets, having bank distribution or agent networks can make or break an insurer’s growth. Manulife also ventured into asset management (it now has its own investment management arm and even a bank in Canada).

Today, Manulife is a multinational insurance and financial services giant. It operates as “Manulife” in Canada and Asia, and as “John Hancock” in the U.S. By the numbers, it’s the largest insurance company in Canada and as of a few years ago serviced over 26 million customers worldwide.

It manages a massive asset base of CAD $1.6 trillion in assets under management and administration making it one of the largest fund managers globally.

This evolution from a Canadian insurer to a global player sets the context for Manulife’s current strategy: it’s now leveraging its scale and century-plus experience to chase growth in emerging markets (especially Asia) while managing mature businesses in North America.

How Manulife Makes Money

Manulife’s business is life insurance at its core, but it has several components. The company sells life insurance policies, annuities (retirement income products), and group benefit plans, and it also offers investment and wealth management products.

Insurance Premiums & Underwriting

Manulife collects premiums from customers for life insurance (and health or long-term care, etc.) and promises to pay out benefits in the future (to your family if you pass away, for example).

In a simple sense, an insurer wants to take in more in premiums than it pays out in claims and expenses… that difference is the underwriting profit. In practice, life insurance is a long-term game: policies can last decades, and the company must invest the premiums wisely to ensure it can meet future claims.

The ultimate source of a life insurer’s profit is how well it can price risk and manage those investments. Life insurers have two major profit sources:

underwriting profit (premiums minus claims and costs) and

investment income from investing the premiums until claims come due.

Ideally, you want both to contribute. However, if an insurer underprices its policies (to gain customers in a competitive market), it might rely too much on investment income to make money which can be risky and not a true competitive advantage (investment gains can be luck or market-driven, not something unique to the company).

Investment Management (Global WAM)

MFC also has a sizable Global Wealth and Asset Management (WAM) business. This segment manages money for clients (think mutual funds, retirement funds, etc.) and earns fee income.

Roughly a fifth of the company’s earnings come from managing these assets. Asset management can be a higher-margin, scalable business if done right (and can warrant a “moat” if the firm has unique investment products or distribution, though in Manulife’s case it’s still only 25% of earnings, so it doesn’t dominate the picture).

Geographical Segments

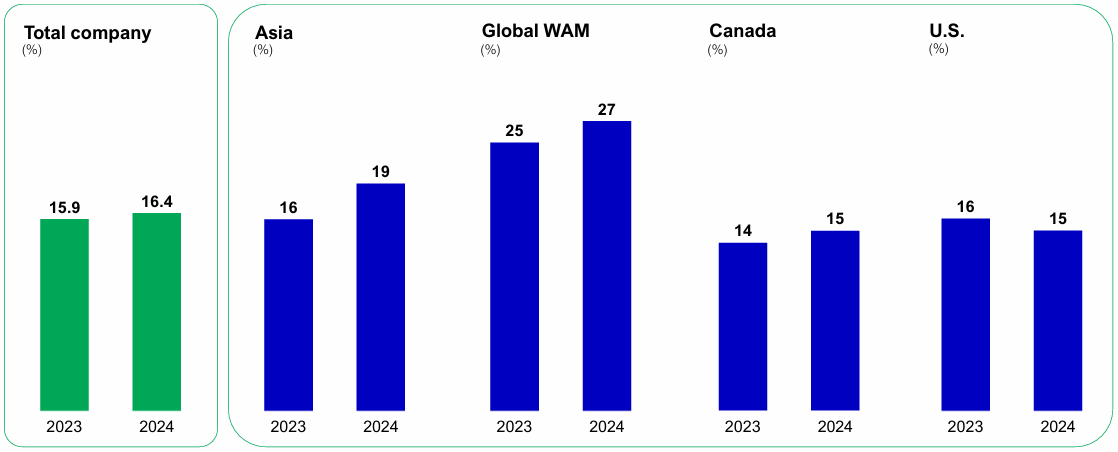

MFC reports its earnings by region: Canada, United States, and Asia, plus the Global WAM unit. Each contributes roughly a quarter of earnings, with Asia slightly more.

In 2024, Asia was ~36% of adjusted earnings, Canada ~22%, the U.S. ~23%, and Global WAM ~20%. This diversification means Manulife makes money in different markets: the Canadian business is stable and includes things like individual insurance and group benefits; the U.S. business (John Hancock) sells life insurance, long-term care, and runs a large retirement plan administration arm; the Asia business spans 12 countries, selling life insurance and wealth products to a rapidly growing middle class. Asia is seen as the growth engine (more on that soon).

To put it simply, Manulife makes money by taking on risk (insuring lives and health), investing the premiums carefully, and charging fees on managed assets. If it manages risk better than competitors (fewer claims than expected, efficient operations) or earns a better return on investments without too much risk, it can outperform. The challenge is that life insurance is a highly competitive, often commoditized industry as many products end up being similar across companies, and consumers often shop based on price or agent recommendation. Brand loyalty in life insurance is not as strong as, say, in consumer goods.

Also, being big doesn’t dramatically lower costs in life insurance because a lot of costs are variable (e.g. sales commissions to agents). That means Manulife, despite its size, can’t simply crush smaller players on cost so it has to compete on service, product features, and distribution.

A quick example to illustrate the model: Imagine Manulife as a casino taking bets except the bets are insurance premiums. Manulife gathers a large pool of “bets” (premiums), invests that money (in bonds, stocks, real estate, etc.), and later pays out to the “winners” (policyholders who claim, like beneficiaries of life insurance). What’s left after payouts and expenses is the casino’s profit. The trick is setting the odds (premiums vs. payouts) right. If Manulife miscalculates and charges too little, it might dip into those invested funds to pay claims and could even lose money. If it charges too much, customers go to a competitor. It’s a balancing act, and most insurers end up with similar odds, so to speak, which keeps profits in check across the industry.

Industry Landscape and Outlook

The insurance industry (especially life insurance) is mature in Western markets and rapidly growing in many Asian markets. Manulife straddles both worlds, so let’s look at the landscape it operates in:

Competition and Commoditization

Life insurance is often a tough business to differentiate. Many products (a 20-year term life policy, for example) are very similar no matter who sells them, and thus competition often comes down to price, coverage terms, and distribution reach.

This means no one’s making Apple-iPhone-like margins in plain life insurance. If one insurer starts doing well in a niche, others can replicate the product or undercut the price. There’s little to stop a rival from eroding any advantage. Technological improvements (like better data analysis, AI for underwriting) might give a temporary edge, but those tend to be competed away or passed on to consumers through lower pricing in the long run.

Interest Rates and Investment Climate

Life insurers are heavily influenced by interest rates. They invest a lot in bonds to back the policies they’ve sold. For much of the past decade (the 2010s), ultra-low interest rates were a headwind as it was hard to get good returns on the investment portfolio, which squeezed profits and made certain guarantees (like annuities or long-term care) more burdensome.

Now, rates have risen, which is generally a positive for new investments (future returns should be higher). However, rising rates can also cause short-term accounting hits or lower market values of existing bonds (though under new accounting rules like IFRS 17, insurers handle this differently).

Overall, a higher rate environment should help Manulife’s investment income over time but it also means they must be careful with credit risk (rising rates can lead to defaults in bond portfolios, etc.).

In Q2 2025, for instance, Manulife had to strengthen credit loss provisions due to some shakier investments. The CFO noted they had higher provisions on non-investment-grade debt that quarter. So, the investment landscape is a double-edged sword: higher yield potential but also potential for asset quality issues if the economy turns.

Secular Trends: Aging and Protection Gap

In North America and Europe, aging populations mean there’s demand for retirement and health products, but pure life insurance sales growth is relatively low (most people who want life insurance already have it).

In Asia, however, there’s a huge “protection gap”. A lot of the population is underinsured relative to their needs, and the middle class is growing fast. Many Asian countries have younger populations, rising incomes, and a cultural emphasis on savings and insurance. This is why Asia is the big growth story for companies like Manulife. The Asian life insurance market benefits from secular tailwinds like a growing middle class and low insurance penetration rates (lots of people who don’t have insurance yet).

Manulife’s leadership often points out that in markets from China to Indonesia, millions of new customers are entering the insurance market each year. Indeed, 71% of Manulife’s new business value (NBV) in 2024 came from Asia (that stat shows how crucial Asia is for driving new sales). The company is leaning into this: it has expanded distribution (e.g. more agents, bank partners) and rolled out digital tools across Asia to grab market share.

Regulatory and Capital Environment

Insurers are heavily regulated for solvency (rightly so as you need them to be around to pay claims decades in the future). Manulife, being global, has to meet Canadian capital rules (LICAT ratio) and local regs in Asia and the US.

It’s currently sitting on a strong capital position; at end of 2024 its capital ratio was 137% (LICAT) which is well above the regulatory requirement and its own 120% target. This gives it flexibility to weather shocks or return capital to shareholders. Regulatory changes (like new accounting standards IFRS 17 in 2023, or Global Minimum Tax rules) can affect reported earnings, but those are technical and industry-wide. The key is Manulife is well-capitalized right now, which is a comfort in this industry.

Digital Disruption and Insurtech

There’s a lot of buzz about fintech/insurtech startups aiming to disrupt insurance (think online platforms, AI-driven underwriting, etc.). So far, incumbents like Manulife have largely adapted by investing in their own tech and partnering with or acquiring new tech.

Manulife, for instance, launched an advanced digital platform for agents called Manulife Pro and even a generative AI tool to help with sales in Asia. These moves are intended to make its army of agents more productive and to attract independent agents to sell Manulife’s products by offering better support.

In 2024, Manulife reported over CAD $600 million in efficiency gains from its digital initiatives. That’s significant, and it shows they’re trying to stay on the cutting edge. The outlook is that digital capabilities will be essential for lowering costs and attracting customers, but again, any successful tech is likely to be copied by competitors.

Still, the near-term outlook is that Manulife can squeeze out some expense improvements and sales growth through these digital investments (they plan to invest about CAD $1 billion in digital transformation from 2023-25). Hitting their efficiency goals early (they’re already at their 45% expense efficiency ratio target) suggests upside if they can drive it even lower.

Competitors and Manulife’s Edge (or Lack Thereof)

Manulife is often dubbed one of the “Big Three” Canadian life insurers, alongside Sun Life Financial (SLF 0.00%↑) and Great-West Lifeco (through Power Corp). It competes with these rivals at home, but its competitor list expands globally.

Canadian Market

In Canada, Manulife, Sun Life, and Great-West dominate, collectively about 80% of the life insurance market. Manulife has a leading position in many segments in Canada and earns decent returns here.

But the Canadian market is mature. The products (insurance, group benefits, pensions) are fairly commoditized. All three big players are financially strong and price competitively, so none can really run away with the market.

Manulife does have an advantage of brand recognition (John Hancock in the U.S., Manulife in Canada, both are well-known names) and large distribution (lots of agents and partnerships). But Sun Life and Great-West have similar strengths.

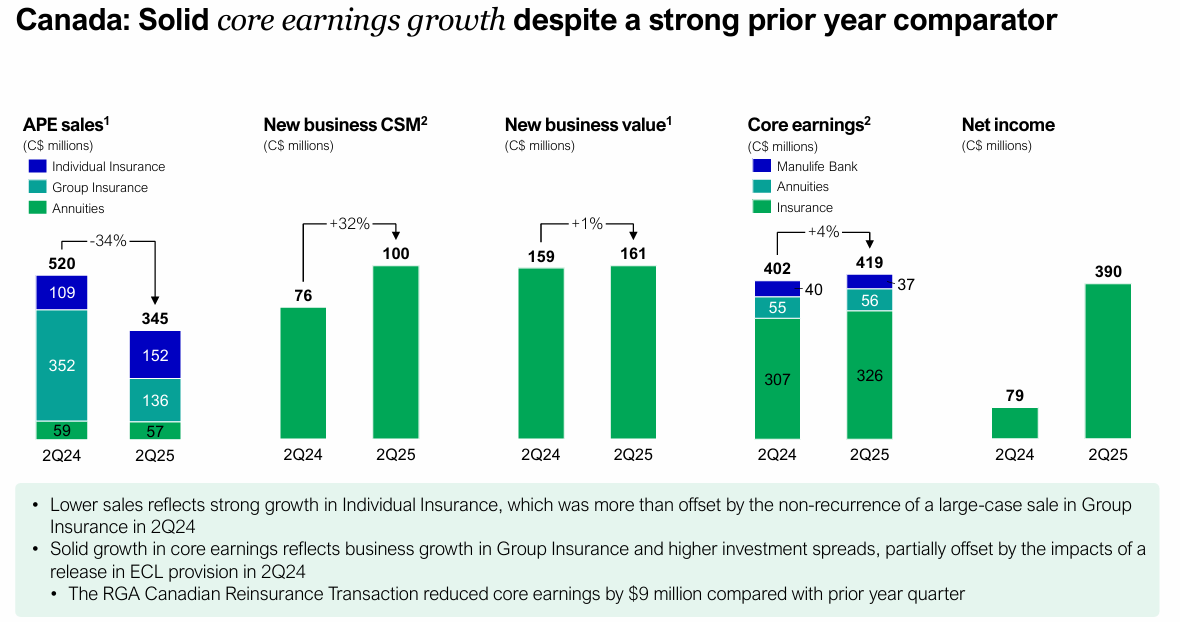

For instance, Great-West through its Empower arm is huge in U.S. retirement services, and Sun Life also has a global footprint (it’s active in Asia and asset management too). In terms of recent performance, Manulife’s Canadian segment has been steady; in Q2 2025 it saw strong growth in group insurance sales, but overall Canada is a low-growth, cash-cow segment.

United States

In the U.S., Manulife (John Hancock) is up against giants like MetLife, Prudential Financial (PRU 0.00%↑), New York Life, Lincoln Financial, and others depending on the product line.

John Hancock is one of the top 20 life insurers in the US, but it’s not #1. A lot of U.S. life insurance is sold by mutuals (like Northwestern Mutual, New York Life) that don’t have shareholders pressuring for high returns, which can make pricing competitive.

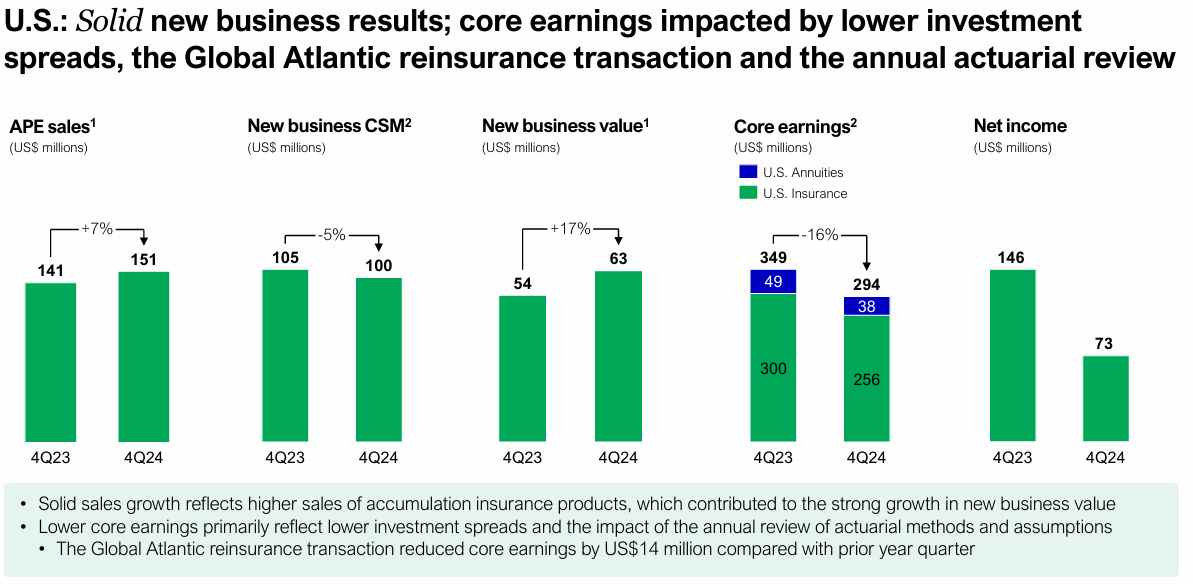

John Hancock’s challenges have been evident: for example, in recent quarters the U.S. segment’s earnings were hurt by higher life insurance claims and lower investment spreads.

In 2Q 2025, Manulife’s U.S. adjusted earnings actually dropped 53% y/y due to those higher claims and some credit provisions. That shows how quickly the U.S. business can swing with experience variances (e.g., maybe more people passed away than expected in a period; something many insurers saw during COVID or just random fluctuation).

Competitively, John Hancock has been innovative in some areas (they have a Vitality program that rewards policyholders for healthy behavior), but again, it’s not something rivals can’t copy. Manulife’s U.S. retirement business (401k record-keeping) is another area. Here they compete with Fidelity, Empower (Great-West), and others. Hancock’s retirement AUM is much smaller than the top players, so it could face fee pressure in that business. No clear edge there either.

Asia

This is the big one. Manulife is the third-largest pan-Asian life insurance operator, behind likely AIA Group and Prudential plc (the UK-based Prudential, which focuses on Asia).

In individual countries, Manulife competes with multinational and local insurers: AIA (a powerhouse in Hong Kong, China, Southeast Asia), Prudential (strong in Southeast Asia and Hong Kong), Allianz and AXA (European players with Asia presence), and large local firms like Ping An and China Life in China, Lic of India, etc., depending on the market.

Does Manulife have an edge in Asia?

Well, it has a long history there (over 100 years in Hong Kong), and a broad footprint (operations in 12 countries). It also has major bank partnerships (like DBS in multiple countries). These give it a platform to compete.

In 2024, Asia accounted for 71% of Manulife’s new business value, so it’s executing in terms of sales. However, the quality of those sales is a concern. Manulife’s Asian new business value (NBV) margins have been on the weak side in recent quarters.

Why?

The sales mix has skewed toward lower-ROE, savings-type products (perhaps things like single-premium savings policies which are popular in Asia but have thinner margins). Management knows this and is trying to pivot to more profitable segments. For example, selling more health and protection products and tapping into the high-net-worth client market for big life insurance policies. Those areas usually have higher margins.

But here’s where competition bites: every insurer wants the high-margin customers. AIA, for instance, is extremely strong at selling protection products through its massive agent force. So Manulife faces an uphill battle to significantly improve its margins in Asia.

I don’t see Manulife achieving its 50% NBV margin target in Asia mid-term because competition is intense in the very areas (health, high-net-worth) that Manulife is targeting. I also doubt Manulife will hit its ambitious 21% ROE target for Asia for the same reason as any excess profitability tends to get eroded by competitors coming in with better rates or commissions to agents.

Asset Management (Global WAM)

Competitors here are global asset managers and other insurers’ asset arms,think BlackRock, Fidelity, Prudential’s PGIM, Sun Life’s MFS, etc. Manulife Investment Management’s strength is partly its connection to the insurance operation (managing some of those assets) and distribution (it can sell funds to Manulife’s insurance clients).

It has built out a presence in areas like private assets. For instance, Manulife has been growing in private credit: in 2024 it acquired a firm called CQS (a credit manager), and in 2025 it’s buying a majority stake in Comvest Credit Partners to boost private debt offerings. These moves aim to give WAM more fee income from alternative assets, competing with private equity or specialized asset managers.

While Manulife’s wealth business could have a small competitive advantage in itself (successful investment products can create client stickiness), it’s still a quarter of earnings. So any advantage there only goes so far in the big picture.

Its advantages are mostly scale (being large and well-capitalized), diversification (spread across different markets and products), and a track record of prudent management. For example, Manulife has actively derisked parts of its business (we’ll discuss how management shed risky legacy blocks). That gives it a bit of an edge in stability.

Also, being in Asia at scale is an advantage in itself as not many Western insurers have the footprint Manulife does there. So one could argue Manulife’s edge is that it’s a global insurer with a strong Asia focus. It’s not just Canada and US like many peers; it has a leg in the faster-growing markets. Bulls would say this geographic mix and experience give it better growth prospects than a peer like MetLife (which has limited Asia presence).

However, bears would counter that life insurance growth tends to get competed away. New entrants or aggressive competitors can always show up to chase the same opportunity, keeping returns in check. Also, Manulife’s diversity means it has exposure to underperforming areas too (e.g., the U.S. long-term care business hurt them in the past, the U.S. segment had a rough quarter recently).

In my view, Manulife’s “edge” is not a classic durable competitive advantage, but rather competent execution across many markets. It’s a bit like being a jack of all trades, master of none. That’s served it well to deliver steady profits and a nice dividend, but it hasn’t proven that it can materially out-innovate or out-price the competition in a way that sustains above-average growth or margins. And that realization is part of why I’m deciding to take my chips off the table.

Management Quality and Capital Allocation

I have to give credit where it’s due: MFC’s management has done a pretty good job in the past several years steering the ship and delivering on what they can control. The company’s current strategic focus has been to reduce risk, cut costs, grow Asia and wealth management, and modernize via digital. They’ve made tangible progress on these fronts:

De-risking Legacy Businesses

Manulife had some troublesome legacy blocks such as long-term care (LTC) insurance and variable annuities sold in the past, which carried a lot of market risk and were tying up capital.

Over 2017–2024, management systematically reduced its exposure to these low-return, high-risk businesses, largely by reinsurance deals (essentially paying other companies to take on the risk). These transactions cut the earnings exposure of those legacy blocks from 24% of the company’s earnings down to just 10%.

In doing so, MFC freed up a whopping CAD $18 billion in capital that was previously locked as reserves for those policies. And importantly, instead of hoarding that capital, management returned the majority of it to shareholders (primarily through share buybacks).

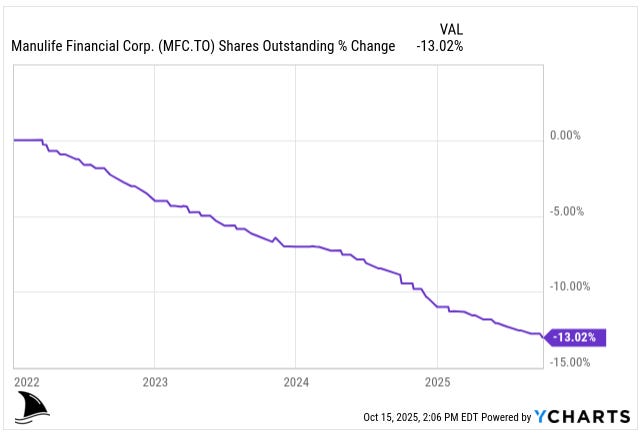

Since late 2021, MFC has reduced the share count by 13%.

This is a shareholder-friendly move: they basically took money that was stuck backing stodgy old policies and gave it back to investors as those risks were offloaded.

It also means those volatile legacy exposures are less likely to blow a hole in Manulife’s balance sheet during a market downturn (though about 10% of earnings still come from them, so there’s some remaining risk).

Expense Efficiency and Digital Transformation

Manulife set a target to get its expense efficiency ratio (essentially operating expenses as a percentage of earnings or revenue) down to 50% then 45%. By 2024 they hit 44.8% efficiency, which is actually slightly better (lower) than their medium-term goal.

This came from a combination of cost cutting and growth (growing the denominator). How did they cut costs? Partly through investing in technology: digitizing processes, automating underwriting and customer service, and moving more sales to digital platforms.

Management claims over CAD $600 million in cumulative savings/benefits from digital initiatives in 2024 alone. For instance, they launched a new sales platform and AI tools in Asia to help agents sell more efficiently. They also streamlined their operations (they have consolidated offices, simplified product offerings, etc.).

The fact that they’re already at a 45% efficiency ratio suggests there may be additional upside if they continue this trajectory. Management hinted that beating the target is likely in coming years. From a capital allocation perspective, spending on digital transformation (CAD $1 billion budgeted through 2023-25) is a long-term investment.

So far, it appears to be paying off in both better sales (e.g., APE sales up 30% in 2024 partly thanks to digital tools for agents) and in cost containment. It’s refreshing to see an insurer not just talk about digital but show results.

Capital Returns: Dividends and Buybacks

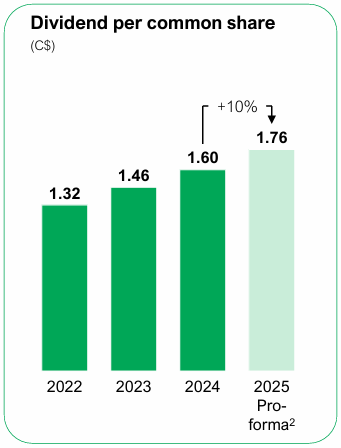

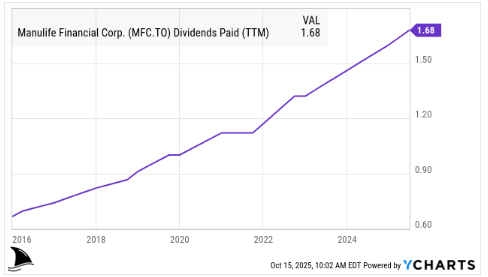

MFC has been generous to shareholders recently. In February 2025, on the back of strong 2024 results, the company raised its quarterly dividend by 10% to CAD $0.44 per share.

Since 2014, they’ve grown the dividend steadily from 13 cents per quarter to 44 cents as of today (this 10% hike was actually above their 5-year average growth rate, signaling confidence).

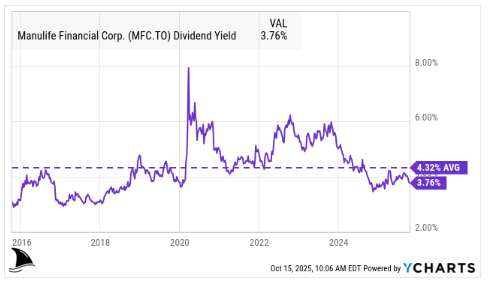

The dividend yield is around 3.8%.

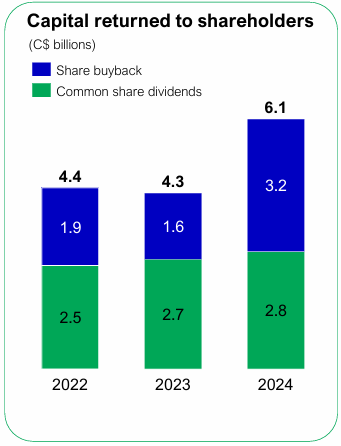

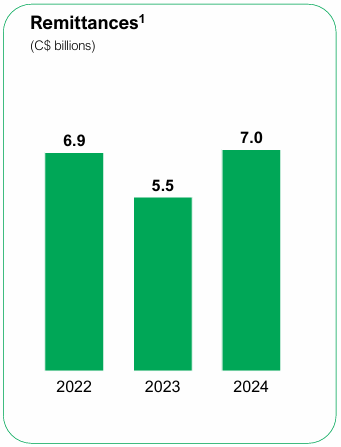

They also announced a new share buyback program. In 2024, Manulife returned over CAD $6 billion to shareholders through dividends and buybacks.

To put that in context, that was about 85% of the year’s free cash generation returned directly to investors.

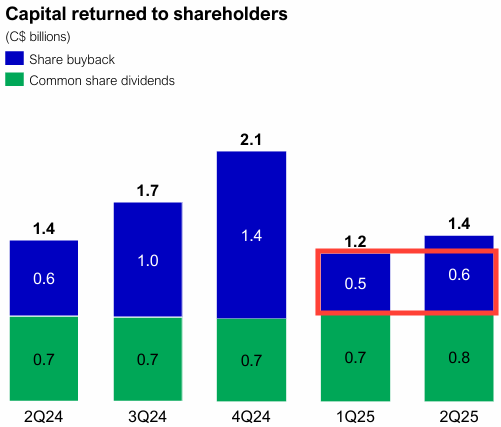

They even bought back $1.1 billion worth of stock in the first half of 2025.

All this points to a management team that is disciplined in capital allocation. They’ve kept their leverage reasonable (debt-to-capital 24%, comfortably below industry norms), so they’re not overextending to fund these payouts either.

Strategic Investments and M&A

Management has made some selective acquisitions to boost growth areas, like the aforementioned Comvest deal which expands their private credit asset management business. They paid about $1.28 billion for 75% of Comvest. The price seems a bit high (mid-teens EBITDA multiple) but not egregious

In any case, this shows the new CEO (as of 2025, Roy Gori has handed the reins to Phil Witherington) is continuing on the path of growing fee-based, less capital-intensive lines (like asset management) to complement the core insurance business.

These strategic moves are relatively small in the scheme of Manulife, so they’re more “bolt-on” than transformational. I view that as prudent as they’re not betting the farm on an acquisition, just enhancing capabilities.

Leadership Transitions

Roy Gori, who was CEO from 2017 and drove much of this strategy, stepped down in 2025. The new CEO is Phil Witherington (previously CFO). Since Phil was part of formulating the current game plan, I don’t expect a radical shift.

In the Q2 2025 conference call (his first as CEO), he emphasized continuity and “building on our success” while further improving customer service and leveraging digital/AI. He also promoted some internal leaders (e.g., a new Asia CEO, Steve Finch, who was Chief Actuary).

The tone is that Manulife will stay the course on its strategic priorities. Internal promotions suggest stability as they’re not bringing in some outsider to shake things up (which usually only happens if things were going poorly, which they’re not).

The only critique is perhaps they set very ambitious targets. For example, management’s medium-term goals include 10–12% core EPS growth and ~18% core ROE by 2027. These are lofty from a normal mid-cycle view. If they fall short of those targets, the market could be disappointed. But I’d rather have a team aiming high than one that’s complacent. At least those targets show they aspire to break out of the low-growth mold. Whether that’s realistic is another story (I have my doubts, as discussed).

Financials: Steady, Not Spectacular (2024 & Q2 2025)

2024 Full-Year Highlights

MFC had a strong year in 2024 overall. Core earnings (Manulife’s preferred measure, which smooths out market fluctuations and one-offs) were CAD $7.2 billion, up 8% on a constant currency basis.

This was the first time core earnings topped $7 billion, a nice milestone. The growth was driven by improved sales and business growth across most segments (with the U.S. being the one laggard). Here are some key points:

Insurance Sales and New Business

APE sales (a measure that combines new policy sales) were up 30% y/y. That’s a hefty jump, showing robust demand. Asia was the star: Asia contributed more than half of total APE, with its APE sales growing 36% in 2024. This surge was partly credited to Manulife’s expansion of its Manulife Pro platform to more markets (Indonesia, Japan, Hong Kong).

Manulife Pro, as mentioned, gives agents better tools and support. Since agents can sell competitors’ policies too, offering them a slick platform and dedicated underwriting support is a way to win their favor (and thus win more sales).

It seems to be working. APE sales jumped 23% in agency channels where Pro was deployed. Additionally, Manulife launched a new AI sales tool in Asia in 2024 as part of rolling out advanced digital capabilities. Management claimed over CAD $600 million in benefits from digital initiatives across segments, much higher than the prior year. So, 2024’s sales growth wasn’t just luck as it was aided by conscious improvements in distribution and tech.

Earnings and ROE

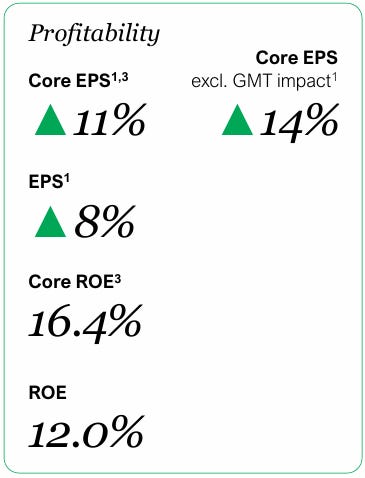

Core EPS rose 11% for 2024, and 14% if you strip out the Global Minimum Tax impact. Core ROE was 16.4% for the year, while reported ROE was 12.0%.

Management finished the year with a 137% LICAT ratio and 23.7% financial leverage. Book value per share climbed 15% to C$25.63, adjusted BVPS reached C$37.02, and CSM per share hit C$11.39.

Segment Performance

By segment, Asia and Global WAM were the growth engines. Asia core earnings grew strongly (they don’t break out full-year percentage in the summary, but given NBV and APE growth, it was clearly up), and Global Wealth & Asset Management earnings grew double-digits too.

Meanwhile, the U.S. was the weak spot, with core earnings roughly flat or down (pressured by things like higher claims and the run-off of those reinsured blocks). Canada was stable/modest growth. This pattern of Asia & WAM up and U.S. sluggish persisted into 2025.

Capital and Cash Flow

In 2024, Manulife’s businesses generated a lot of cash for the holding company. Over CAD $7 billion in cash remittances from the operating units.

That’s how they funded the $6 billion returned to shareholders. The financial leverage was trimmed to ~23.7%, so they de-levered a bit while still rewarding shareholders. All very healthy signs.

Q2 2025 Update

The second quarter of 2025 was a bit of a mixed bag. Continued growth in Asia and wealth, offset by some one-time headwinds in the U.S.:

Earnings

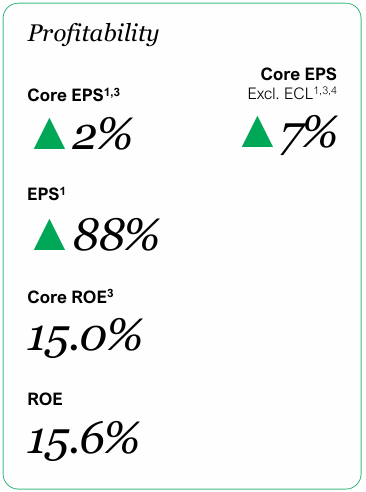

Manulife reported core earnings of CAD $1.7 billion for Q2 2025, which was actually down 2% from the same quarter in 2024 on a constant FX basis. If you exclude a change in expected credit loss provisions (i.e., ignore that they set aside extra for potential loan losses), core earnings would have been up 2%.

Core EPS was CAD $0.95 for the quarter, up 2% y/y. So basically flat growth in earnings. Actual net income (including market effects) was $1.8 billion, which jumped 88% y/y, but that’s largely because Q2 2024 had some investment losses that depressed net income. The core number is the better gauge of trend, and that was roughly flat.

Sales and New Business

The new business metrics were strong. APE sales were up 15% and NBV up 20% from Q2 2024. That’s very healthy growth in the volume and value of new policies.

Also notable: all three insurance segments achieved over 30% growth in new business contractual service margin (CSM). CSM is an IFRS 17 metric that represents the expected profit from new contracts, so that indicates strong future profit potential being added.

The CEO highlighted that Asia had strong APE sales and even increased its NBV margin sequentially. Specifically, Asia’s NBV margin in Q2 ticked up to about 40.0% from 38.1% in Q1 (though it was roughly in line with ~41% a year ago). This suggests they’re making some headway selling slightly more profitable product mix in Asia recently. Still, 40% NBV margin is far from management’s >50% ambition.

By Segment

In Q2, Asia core earnings rose 17% y/y and Global WAM core earnings rose 20%. Great numbers from those segments. Asia’s growth reflects higher sales and some expense discipline. WAM’s growth came from higher asset under management (markets were up y/y, plus net inflows of $0.9 billion in Q2) and improved fee margins.

Canada’s core earnings were up. U.S. core earnings, however, plunged 53%. Why? The U.S. had unfavorable life insurance claims experience (maybe higher mortality in a specific block or just an adverse variance) and lower investment spreads (possibly the impact of higher credit provisions and lower yields on some assets).

They also added to credit loss reserves (post-tax $82 million in Q2) mostly on below-investment-grade assets in the U.S. portfolio. The CFO assured that their normal run-rate credit provision is only $30–50 million a quarter, implying this quarter’s $82M was an outlier. Essentially, the U.S. had some hiccups that dragged the overall earnings growth to zero. Without those, Manulife would’ve posted high-single-digit earnings growth.

ROE and Capital

Core ROE in Q2 2025 was 15.0%, an improvement from that 12% for full-year 2024 (quarterly annualized ROEs can bounce around, but it’s a good level).

The LICAT capital ratio remained strong at 136%. They kept buying back shares, $600 million bought in Q2 alone, contributing to $1.1B in first half as mentioned.

Management Tone

Management’s commentary in Q2 was optimistic. CEO Phil Witherington said the results “underscore the strength and resilience of our global franchise,” citing “high-quality growth across a diversified portfolio”.

He pointed out that all insurance segments had over 30% growth in new business CSM (future profits metric), and “Asia continued to generate strong APE sales and increased NBV margin sequentially”, and that Global WAM delivered double-digit earnings growth.

The CFO noted that core EPS growth was dampened by the U.S. claims and credit provisions, but underlying fundamentals in Asia, Canada, and WAM are strong, and they even reduced core expenses by 3% y/y. Also, book value per share was up 5% y/y.

In summary, recent financials show a company performing solidly, if not spectacularly. 2024 was a banner year in many ways, and 2025 so far shows continued strength in the growth engines (Asia & wealth) but some normal volatility in the US.

The numbers show a well-run company with stable growth, but not one delivering huge upside surprises. Core EPS up a few percent, dividend up, steady ROE. That’s fine, but it’s not the stuff that doubles a stock. The solid results are just maintaining the valuation rather than boosting it.

This realization is a big factor in my decision: if the company executes well and the reward is the stock maintains a 14x earnings multiple, then my returns are basically going to be in line with earnings growth + dividend yield.

With ~4% yield and, say, high single-digit EPS growth, that’s a high single digits percentage annual return potential in a rosy scenario. That’s okay, but I think I can aim higher with other investments, especially considering the risks and uncertainties in hitting those growth targets.

Valuation and Recent Stock Performance

Valuation is where the rubber meets the road. A great company is only a great investment if bought at a good price. In my case, I bought Manulife because I thought it was undervalued relative to its prospects. After a year, the valuation is merely 10% up.

Current Valuation Metrics

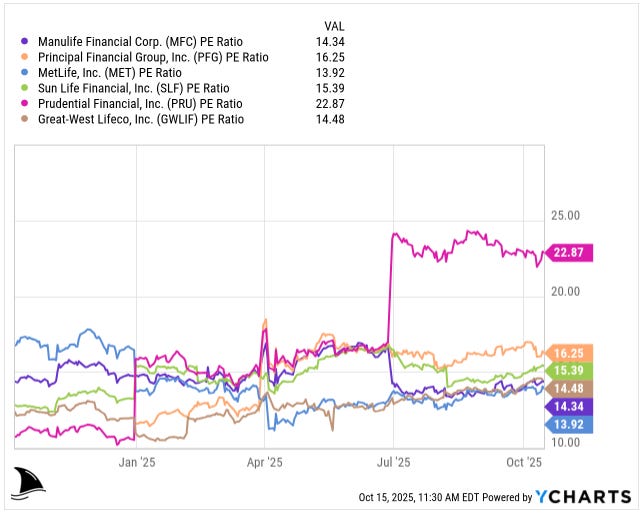

Manulife stock trades around US$32 on the NYSE and C$45 on the TSX, translating to about 14.3x trailing earnings, which keeps it on the lower end of the peer range. MET 0.00%↑ trades near 13.9x, while SLF 0.00%↑ and PFG 0.00%↑ are at 15–16x, and PRU 0.00%↑ sits far higher around 22.9x. So, MFC’s multiple reflects its middle-of-the-road growth profile but also its steadier earnings base.

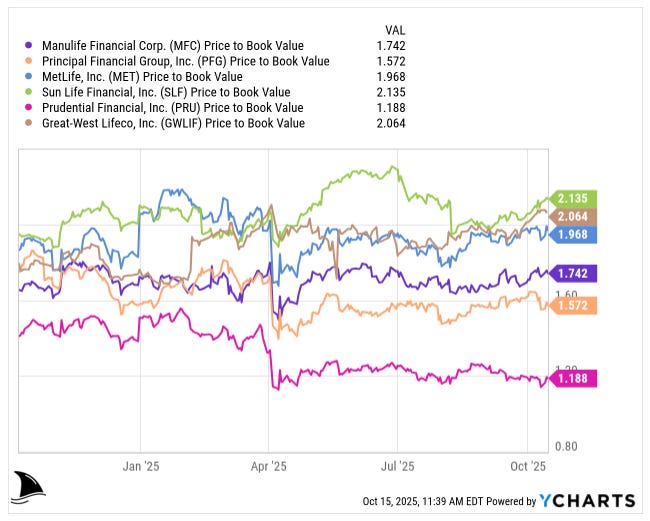

On price-to-book, MFC’s 1.74x multiple again lands mid-pack, above Prudential (1.19x) and Principal (1.57x), but below Sun Life (2.14x) and Great-West Lifeco (2.06x). That’s consistent with a firm that’s not the cheapest, yet not rewarded like the top-tier compounders either.

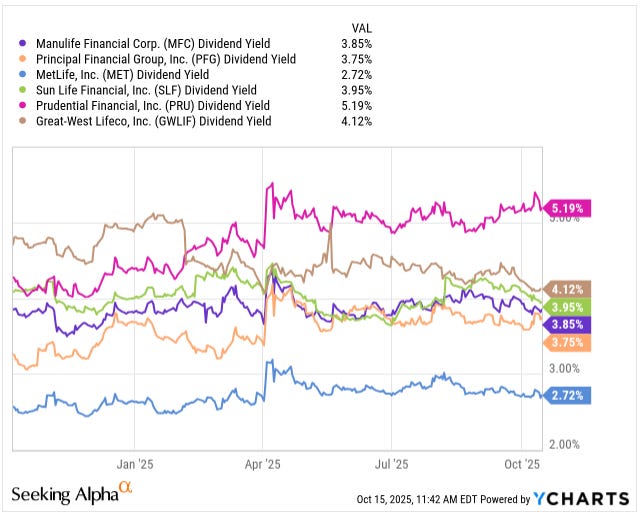

The dividend yield tells a similar story. Manulife pays in line with peers: Principal, Sun Life, and Great-West roughly 4%. Only Prudential’s 5.2% stands out as materially higher, but it carries more exposure to U.S. annuities. And MET is lower at 2.7%.

Put together, these metrics show that Manulife sits comfortably in the middle of the pack; not overpriced, not dirt-cheap, but priced for stable execution rather than outsized growth.

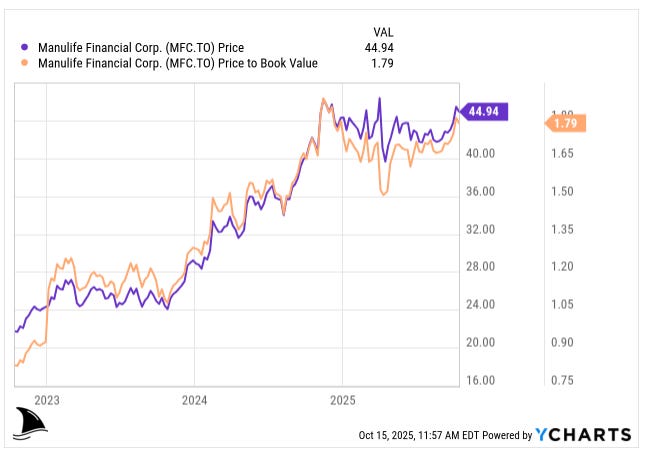

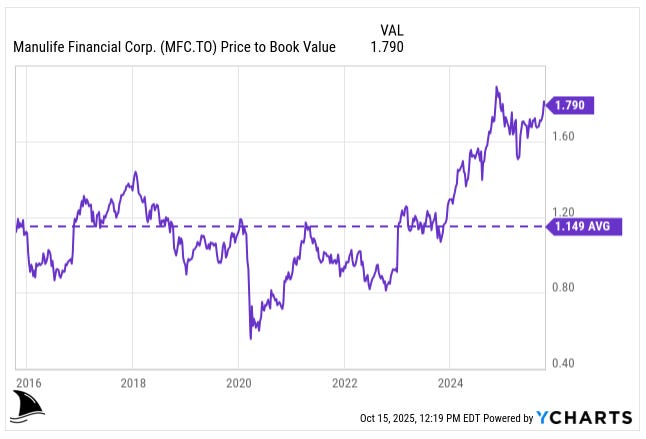

Over the past three years, Manulife’s valuation multiple has expanded sharply as the market rewarded its improved performance. The stock climbed from about C$22 to C$45, and its P/B more than doubled from 0.8x to 1.8x over that period.

By February 2025, it was trading well above its 10-year average ~1.1x.

This essentially means the market was pricing in the expectation of higher future ROEs and growth (i.e., the Asia growth story, risk reduction, etc.).

Stock Performance

From when I bought in Oct 2024 to now, the stock’s total return of ~16% (with dividends) is respectable but not market-beating. In fact, over a comparable period the S&P 500 did a bit better.

Fair Value vs Upside

I reran my intrinsic value model using updated inputs for each of Manulife’s regions. Instead of the aggressive growth I initially assumed for Asia, I now expect mid-single-digit APE and earnings growth there, with margins stabilizing rather than expanding.

For Canada and the U.S., I trimmed long-term growth to about 3%, reflecting mature markets and persistent claims pressure. Global WAM remains a steady earner, but I kept a modest 5% growth assumption given fee compression and tougher inflows.

On the cost side, I assumed the efficiency ratio holds near 45% rather than improving further, and I used a cost of equity of roughly 10% (consistent with its beta and peer range). I also applied a terminal multiple of 13x on normalized EPS, which lines up with its historical average when ROE sits around 12–13%.

Running those through my DCF and relative valuation cross-check gives me a fair value near US$30 per share (C$42). That’s a bit below where it trades today, suggesting limited upside unless Asia accelerates faster than I expect.

Could I be wrong?

Sure!

If Manulife wins more high-margin share in Asia or sees a step-change in WAM inflows, it could rerate higher. But based on current trends, my math says the risk-reward skews to the downside. I’d rather lock in the gain and redeploy the capital into names with clearer catalysts.

Scenarios

What would justify, say, a $40 stock (USD) for Manulife? That would be around 18x earnings, or it would require earnings to jump about 25% with the multiple staying ~14x.

The former (18x multiple) seems unlikely given the industry and comparables.

The latter (25% earnings jump) could happen over a few years if they hit 10% EPS growth annually. So, yes, in 2-3 years the stock could be somewhat higher, collecting dividends along the way. But when I compare that to other opportunities with clearer catalysts or deeper undervaluation, it doesn’t compel me to hang on.

MFC is priced for the company to continue doing well. If everything goes right (Asia growth, higher ROE, etc.), the current valuation is justified and maybe has a little upside. If things disappoint, there’s downside risk to the multiple.

My estimate is that at ~14x earnings and ~1.8x book, with a 15% ROE run-rate, the stock is more or less fairly valued. I wouldn’t call it a sell due to extreme overvaluation (it’s not) but it’s fully valued relative to its prospects.

And for my portfolio, I prefer to deploy capital in stocks that are either undervalued or where I have very high conviction of an upcoming positive re-rating. After a year with Manulife, I don’t have that conviction anymore.

Key Risks

Before hitting the sell button, I always double-check the risk factors.

Risk #1. Asia margins stay flat

Manulife’s growth story still depends on Asia. The risk isn’t growth itself, but profitability. NBV margins there have hovered near 40% and slipped in some markets as mix shifts toward lower-margin savings products.

If Manulife can’t push higher-margin protection and health products, or if rivals like AIA and Prudential outcompete on agent networks, earnings growth could stall even as sales rise. Asia might remain large but less profitable than the bull case assumes.

Risk #2. U.S. claims pressure and credit risk

The U.S. unit remains a weak link. Recent quarters showed unfavourable life claims and credit-loss provisions that cut into segment profits. If these trends persist, they could offset gains from Asia and Global WAM. The U.S. long-term care block is smaller now after reinsurance deals, but still sensitive to claims volatility and reserve changes.

Risk #3. Asset-mix exposure

Manulife runs with a bigger allocation to equities and private assets than peers. That boosts earnings in good markets but cuts both ways in downturns. A correction in equities or commercial real estate would hit both investment income and fee revenue from Global WAM.

Risk #4. Execution risk on digital and M&A

Management is spending heavily on digital initiatives and acquisitions like Comvest Credit Partners. If integration or ROI falls short, expense leverage could fade and EPS growth slow.

Risk #5. Asia regulatory shifts

MFC’s expansion depends on regulatory goodwill. Policy changes in China, Japan, or Southeast Asia could limit product approvals or raise capital requirements. Any sign of protectionism could blunt new-business momentum.

Verdict: Taking Profits and Moving On

Manulife Financial is a solid company. It’s financially strong, well-managed, and pays a juicy dividend. A year ago, I bought in because I believed those strengths, combined with a growing Asian franchise, could lead to market-beating returns.

Today, after reviewing the evidence, I’ve concluded that while Manulife remains a steady ship, it hasn’t proven it can pull ahead of the pack in a lasting way. The optimistic scenario of Asia turbo-charging growth hasn’t fully played out, at least not in a way that gives Manulife a distinct edge.

My roughly 16% gain (including dividends) is nice, but it appears to be mostly “beta” (market and sector movement) and dividend yield, rather than “alpha” (outperformance due to unique execution). In other words, holding Manulife for the past year was like holding a fairly typical insurance stock; it did fine, but it didn’t crush any benchmarks or reveal hidden value.

The crux of my decision is this: Manulife lacks a durable competitive advantage that would allow it to consistently outperform. It competes in a tough arena where any boost in returns is quickly challenged by rivals. This isn’t a knock on management or the business quality, it’s just the reality of the insurance industry.

Could I continue to hold and collect the ~4% dividend yield, trusting that slow-and-steady growth will give me high-single-digit total returns over time? Sure.

But my investment style (and the ethos of Beating the Tide) is to look for better risk/reward opportunities. Stocks with more compelling upside or mispricing. After a year with Manulife, I feel that my capital can be put to work more effectively elsewhere. There are other fish in the sea that offer either deeper value or more exciting growth with a moat to fend off competitors.