SUPV Deep Dive: Argentina, Choppy Waters, Big Catches

From Sovereign Defaults to Strategic Investments in argentine banks and YPF – A Shark’s Approach to Risk and Reward.

I vividly remember Argentina losing the 1990 World Cup final to West Germany, 1-0. Back then, Argentina was seen as a developed country, envied by the rest of South America. I didn’t think about Argentina again until 2011.

In 2011, I joined an asset manager in Chile and travelled across Latin America, including Argentina. Most trips were for work, meeting companies with public shares or junk bonds, my focus at the time.

I also travelled for leisure. This photo is from almost 13 years ago in Buenos Aires, Argentina.

How time flies…

Time flies indeed, the Argentine government tends to have a very short memory, forgetting the mistakes of the past and repeating them. Since its start, Argentina experienced nine sovereign debt defaults, making it one of the countries with the most recurring debt crises. These "bankruptcies" or defaults occurred in 1827, 1890, 1951, 1956, 1982, 1989, 2001, 2014 and 2020.

Investing in Argentina is tough, actually, the first time I had to deal with a bankruptcy was in 2014 with an Argentine power firm. That ruined my zero-bankrupcies streak. After I moved on to brighter pastures, I read the company went bankrupt again in 2021 and the state had to intervene — and the drama continues up to today.

This hasn’t stopped me from investing in Argentina, but it made me aware of the Argentine default cycle and to invest around it, ready to get out before the winds change.

Over the years, my Argentine investments have focused on YPF, the Argentine oil & gas company and Argentine banks. I tend to buy when sentiment is low and exit when sentiment is at its peak.

This is the path of the Shark. This is the Way.

Case in point, when YPF shares dropped from $30 to $16 in 2016, I picked up shares based on the rationale in this article I published in Seeking Alpha. Then sold them at $25 in early 2017. I bought YPF shares again in mid-2023 at $14, only to sell them in mid-2024 at $21, missing the run-up to above $40.

My Adventures with YPF

Why invest in Argentine Banks?

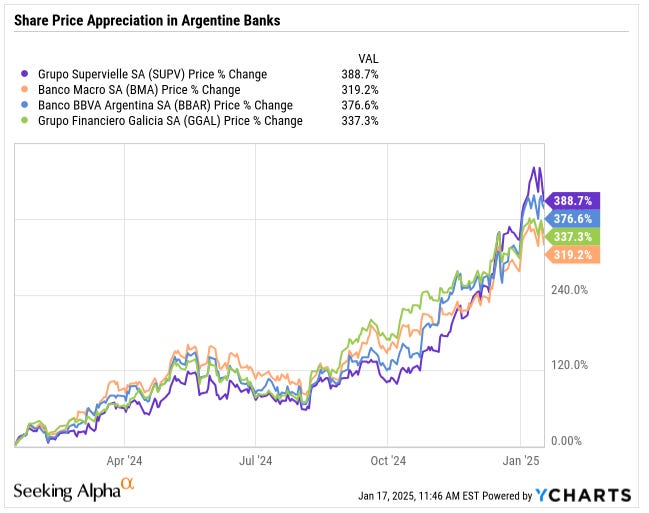

If you had invested in any of the Argentine banks below, your shares would have increased in price by anywhere from 320% to 390%.

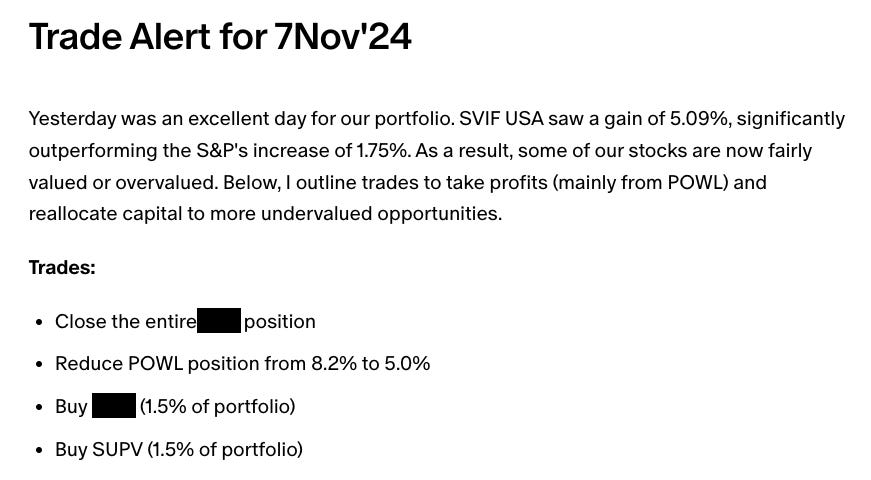

Among the banks, I picked SUPV as deserving of a spot in the portfolio. On November 7, 2024, I sent a trading alert to paid subscribers recommending buying SUPV.

The shares are up almost 78%. (As of today, the shares are $17.30.)

So which Argentine bank did I invest in?

Trade Alert: Close SUPV position in the SVIF USA portfolio.

Note that this trade alert is to close the current position in SUPV and not to short the shares.

Below I will explain why I invested in Argentine banks and why I chose SUPV specifically.

Milei’s Economic Revolution

Since taking office in December 2023, President Javier Milei has implemented transformative economic reforms that have significantly bolstered Argentine banks' performance and market value.

His administration prioritized fiscal austerity, reducing public spending by 35%, and deregulating various economic sectors to create a more business-friendly environment. These measures helped stabilize the economy and restore investor confidence.

I like President Milei. He does what he says. He is a true Shark.

He was spotted taking commercial flights rather than business or private jets1.

One of Milei's most notable achievements has been controlling inflation, which dropped from over 200% to 117.8% by the end of 2024.

This has improved the banks' operating environments, enhancing their profitability and market appeal. Additionally, his focus on boosting grain and energy exports resulted in Argentina recording its largest-ever trade surplus, estimated at $18–19 billion in 2024.

Milei also introduced a tax amnesty program that repatriated approximately $18 billion in foreign currency deposits to local banks, significantly improving liquidity and deposits. Combined with Fitch Ratings’ upgrade of the country's banking regulatory environment, these reforms have positioned Argentine banks to thrive, driving their market value upward throughout 2024.

Overview of Grupo Supervielle (SUPV)

Grupo Supervielle S.A. (SUPV) is a top diversified bank in Argentina. It offers personal and business banking, corporate banking, insurance, asset management, and more. Its products include savings accounts, various loans, leasing, payroll services, and life and home insurance. The company also operates a network of branches, ATMs, and self-service terminals.

Founded in 1887, the company has a strong foothold in Argentina's financial system and serves a broad customer base. Headquartered in Buenos Aires, it is controlled by Julio Patricio Supervielle and was rebranded from Inversiones y Participaciones S.A. to its current name in 2008.

Grupo Supervielle has undergone a major strategic transformation in recent years, focusing on digital modernization to stay competitive in a market disrupted by fintech innovation. This strategy, initiated in June 2020, involved migrating its technological infrastructure to the cloud and improving its digital channels, such as its mobile banking application. By 2024, 70% of the bank's applications had been migrated to the cloud, enabling improved operational continuity, faster product development, and reduced process times. For example, transaction processing, which previously took hours overnight, has significantly shortened.

The bank also leveraged digitalization to reduce physical branch reliance. In 2019, over 50% of its customer activity occurred in branches; by mid-2024, only 15% did, with 60% of clients using digital channels and 56% of loans originating digitally. This digital pivot required cultural and operational changes, including reskilling staff and partnering with fintechs like 123 Seguro for insurance.

Value Proposition of Grupo Supervielle

A key aspect of its value proposition lies in its strategic pivot toward private loans and a diversified asset portfolio. By focusing on high-margin credit products, such as personal and auto loans, the company positions itself to enhance its net interest margin and drive profitable growth.

Additionally, SUPV is committed to embracing digital transformation to better serve its customers. Through initiatives like mobile banking and online brokerage services, the company ensures a seamless and modern digital experience, meeting the evolving expectations of its clients while strengthening its competitive edge in the financial services sector.

Competitive Environment of Grupo Supervielle

Grupo Supervielle operates in a highly competitive banking sector, facing significant competition from well-established players.

Banco Macro S.A. (BMA)

Known for its extensive branch network across Argentina, Banco Macro focuses on retail banking services and serves a wide range of customers, including individuals and small to medium-sized businesses. It has built a strong reputation for accessibility and regional penetration.

Banco Macro demonstrates notable strengths as one of Argentina's leading banks. It boasts robust capitalization significantly exceeding regulatory requirements.

BBVA Argentina (BBAR)

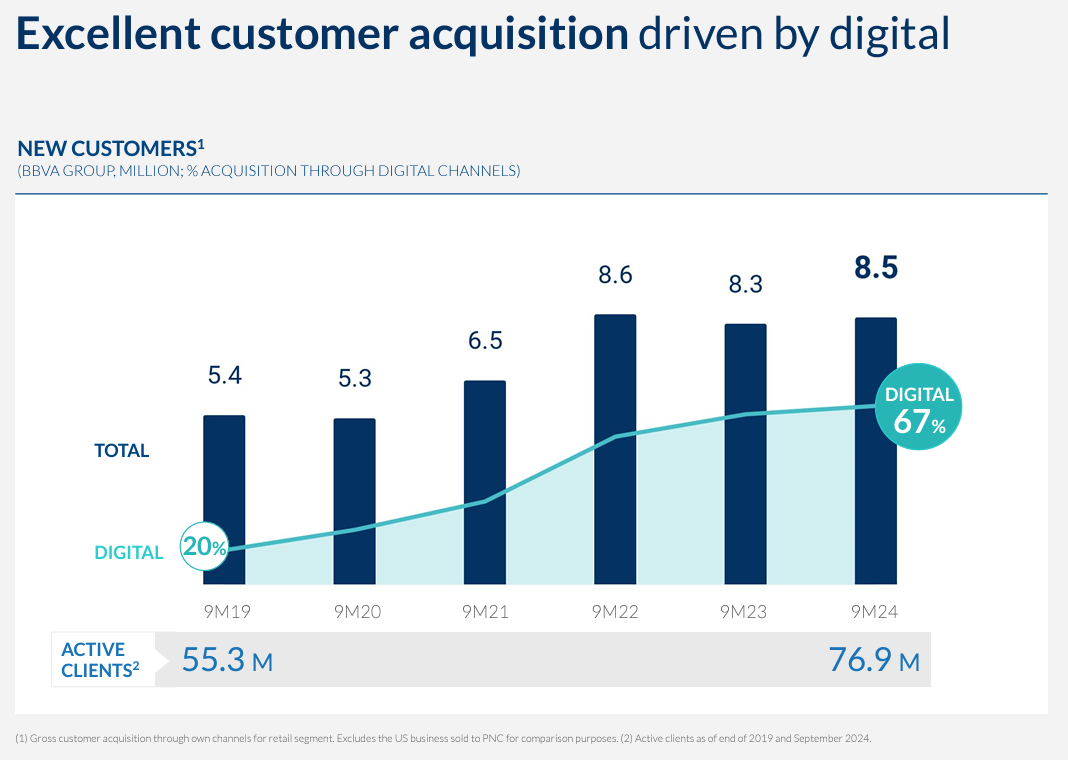

A subsidiary of the global BBVA Group, BBAR leverages its international expertise to offer a comprehensive portfolio of financial products and services. Its focus on digital transformation and innovation aligns closely with SUPV's strategy, making it a formidable competitor in the digital banking space.

BBAR benefits from its integration with the global BBVA Group, providing access to extensive resources and international expertise. The bank has a strong brand presence and a diversified product portfolio.

BBAR is undergoing significant restructuring, including leadership changes and a reorganization of its business divisions. Jorge Bledel has been appointed as the new general director, replacing Martín Zarich, with the business now divided into retail and corporate segments. This restructuring aligns with the bank's global strategy to reduce dependence on emerging markets and focus more on the Spanish market. Additionally, the bank has faced financial losses due to Argentina's high inflation, raising questions about the viability of maintaining its presence in the Argentine market.

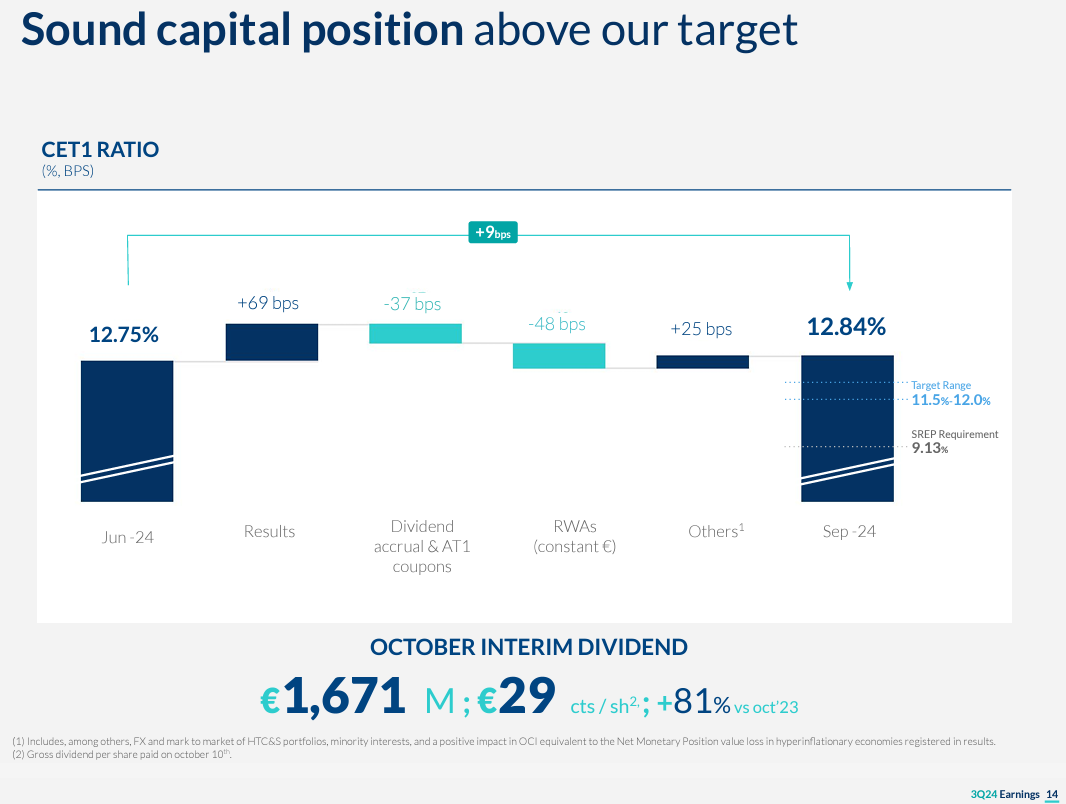

I think BBVA will be divesting its Argentine operations. BBVA is focused on consolidating its presence in core markets, particularly Spain and Mexico. The Argentine market contributes approximately 1.5% to the group's global profits, significantly trailing its primary markets. Moreover, BBVA has faced financial challenges due to its exposure to emerging economies like Argentina, where hyperinflation and currency devaluation have negatively impacted its capital ratios. Between June and September 2024, such exposures cost the bank 25 basis points in capital (most of the ‘Others’ impact in the graph below), resulting in a CET1 fully loaded ratio of 12.84%.

Additionally, BBVA's pursuit of a hostile takeover of Banco Sabadell aims to strengthen its position in Spain, potentially reducing its reliance on volatile emerging markets. Selling its Argentine operations would align with this strategy, mitigating the adverse effects of currency devaluation on the bank's financial statements.

Grupo Financiero Galicia (GGAL)

GGAL is a leading financial institution in Argentina, holding approximately 9% of the nation's total deposits as of 2022. GGAL has made significant investments in digital banking as well as BBAR and SUPV, serving over 2 million online users. The institution is also recognized for its strong brand reputation, ranking as the 4th most valuable brand in Argentina in 2022.

Despite its strengths, GGAL has a high non-performing loan (NPL) ratio of 2.7% as of September 2024. Additionally, GGAL's focus on traditional banking services limits its revenue diversification, making it more susceptible to market fluctuations.

Three reasons Why I like Grupo Supervielle

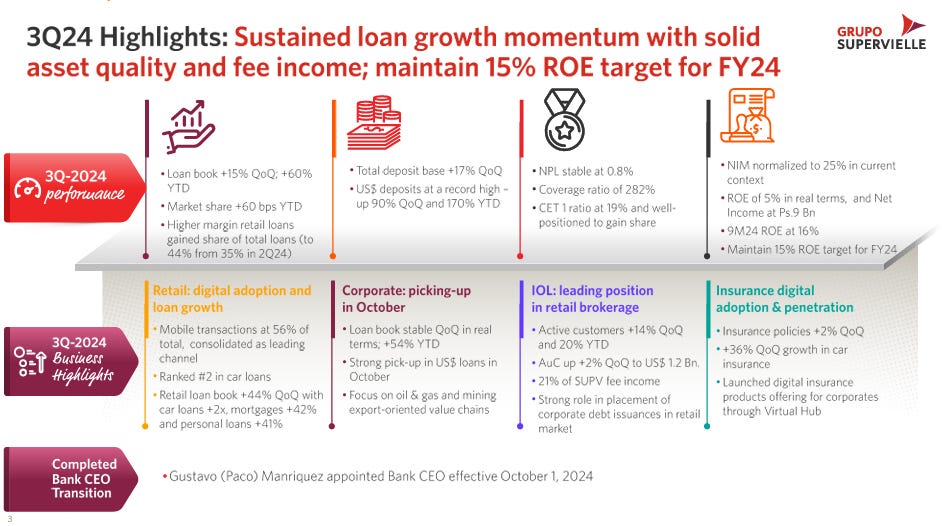

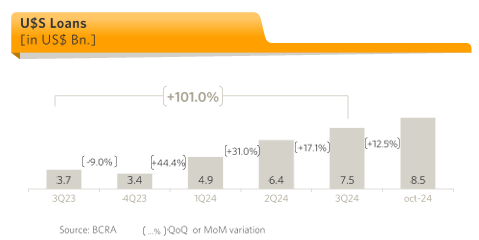

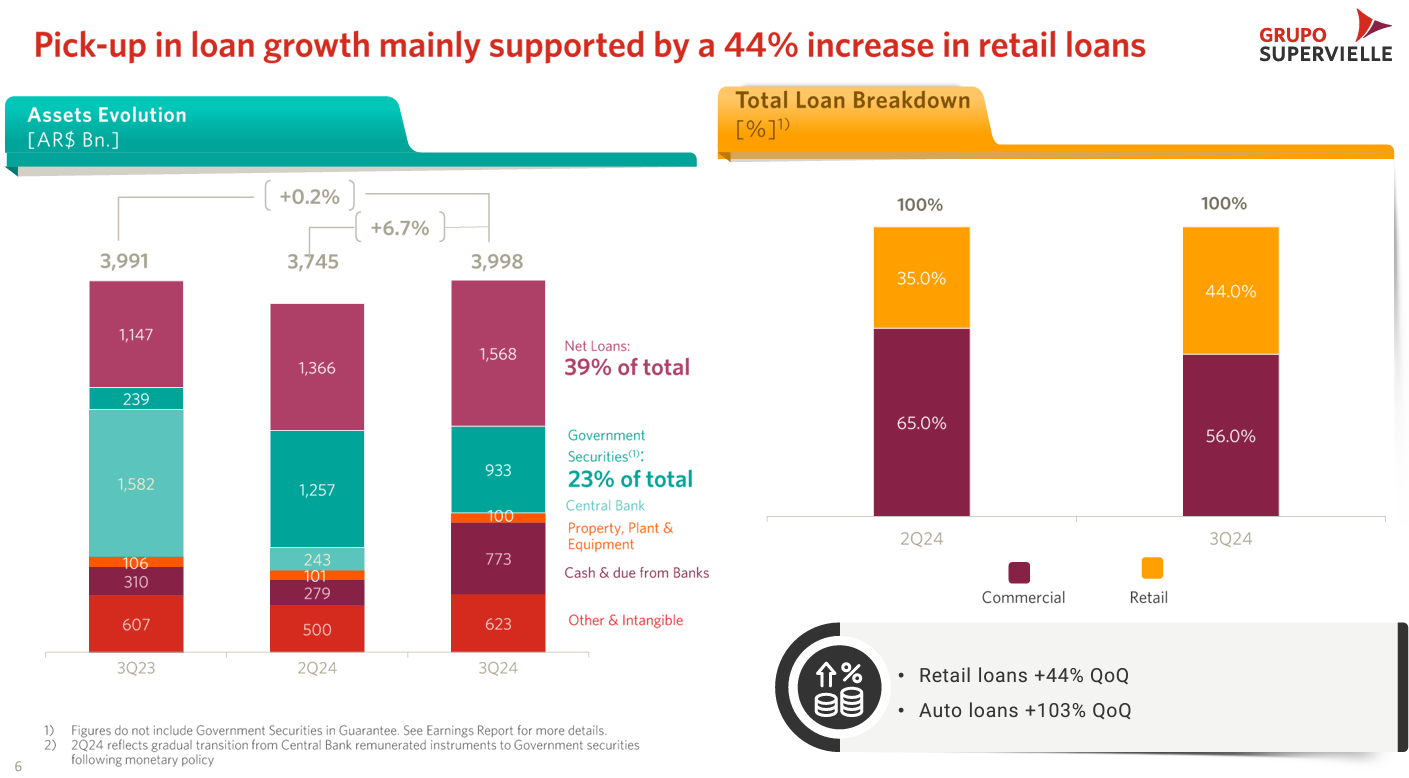

Reason #1: Impressive Loan Growth

The bank has achieved significant expansion in its loan portfolio, with a 60% year-to-date increase.

Meanwhile, the sector grew by 53%, implying SUPV gained market share in that space.

Financial sector loans growing in real terms

The growth in loans is driven by SUPV’s product offerings and risk management. Moving forward, the loan portfolio should continue growing thanks to offering attractive products to clients while maintaining high asset quality through enhanced risk management.

Enhanced Risk Management

By implementing robust credit assessment and risk management practices, Supervielle has maintained asset quality while expanding its loan portfolio. This prudent approach has built customer confidence and supported sustainable growth.

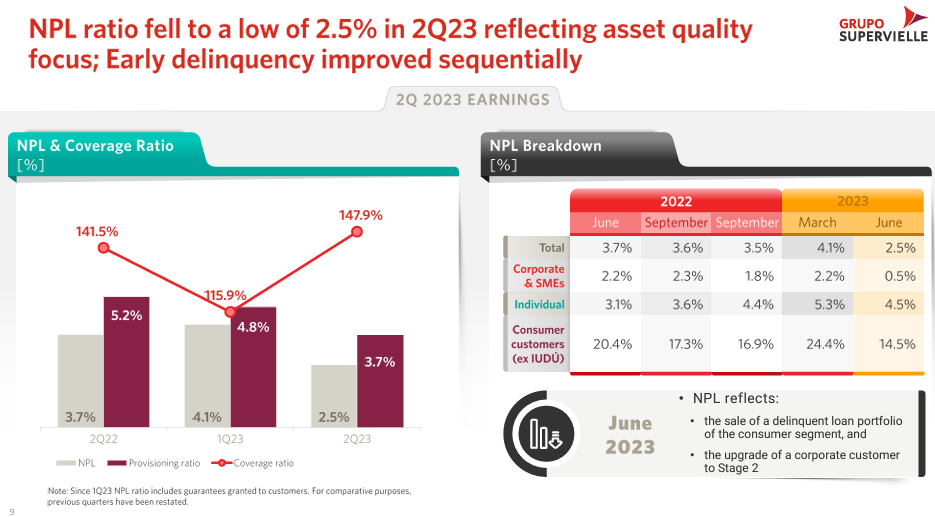

As SUPV has a more lax salary requirement, you would assume that they would have a high NPL; however, it is among the lowest. SUPV’s NPL stands at 0.80%, while BMA is at 1.15%, BBAR at 1.18%, GGCA at 2.66%

I see this as a significant achievement, as NPL has consistently declined from 4.1% in Q1 2023.

Competitive Product Offerings

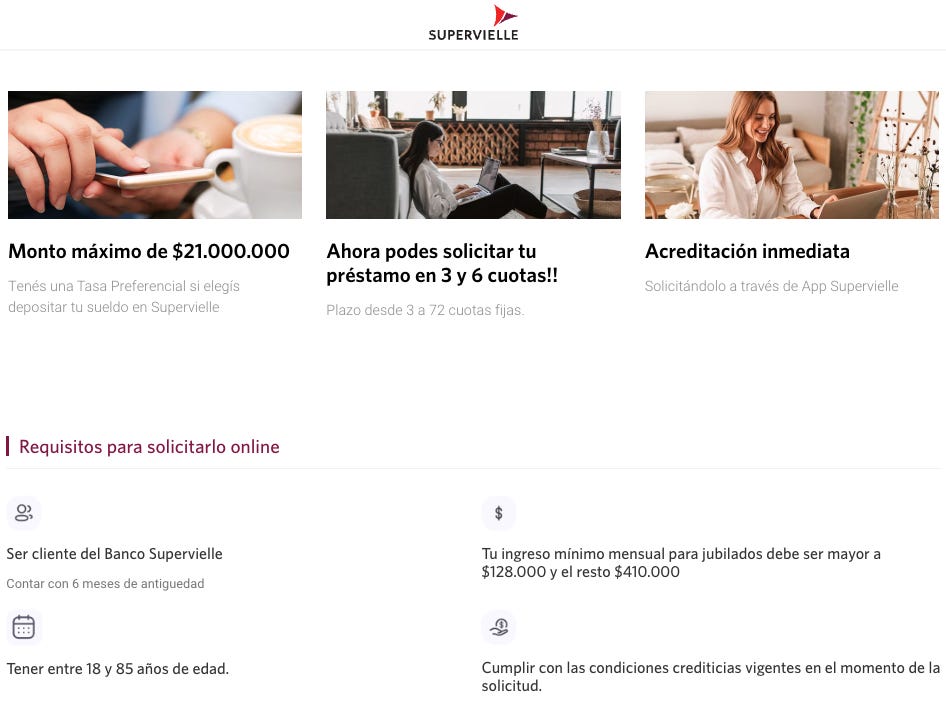

Supervielle has tailored its loan products to align with customer needs, offering competitive rates at flexible terms.

For example, the website offers loans of up to 21 million Argentinian pesos, or about 20 thousand dollars at the official rate. Payments could be in up to 72 installments, and applicants have to be between 18 and 85 years old with a minimum income of 128,000 pesos.

The maximum loan size for SUPV is lower than the other three banks2. Only GGCA offers the same number of installments; the others have a shorter period of 60 installments. Regarding salary requirements, SUPV’s is the lowest, as the others require almost double (240,000 to 280,000 pesos).

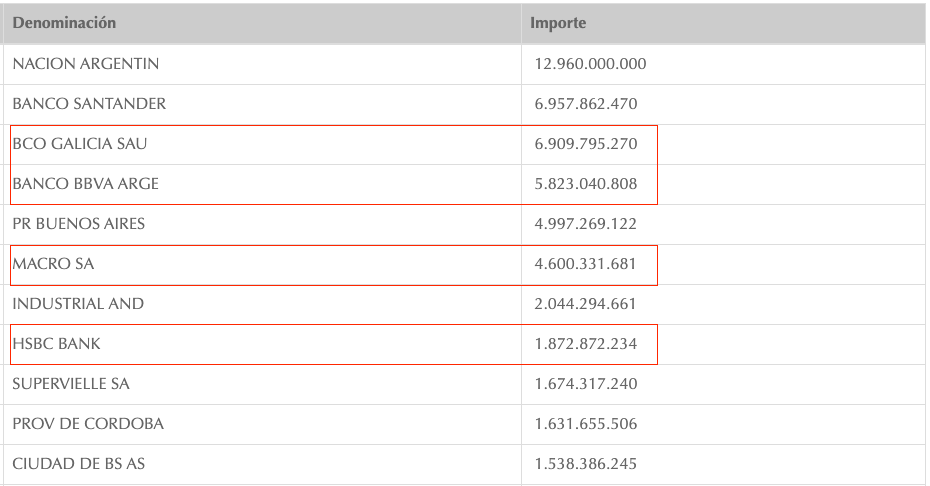

Significant room to capture market share

SUPV’s loan portfolio is the 9th largest in Argentina, trailing behind our three selected peers. SUPV has room to capture market share. SUPV’s current portfolio is a quarter of the size of the second and third largest players, meaning there are still low-hanging fruits from which to grab market share.

Reason #2: Strategic Focus on Private Loans

Grupo Supervielle’s shift toward private loans has proven successful. Over the past year, net loans shot up by 37%, mostly thanks to retail loans, with auto loans more than doubling.

Reason #3: Benefiting from Economic Recovery

The recovering Argentine economy provides a tailwind for increased lending and borrowing activity. Argentina's recent economic indicators present a compelling case for a bullish outlook on its banking sector.

The trade and government are in a surplus, and inflation is decreasing. The country achieved a record trade surplus, and the government recorded its first budget surplus in 14 years, amounting to 1.76 trillion pesos, or 0.3% of GDP. The IMF commended Argentina's "impressive" progress in reducing inflation. The IMF projects a solid economic recovery, anticipating GDP growth of 5% in both 2025 and 2026, following a 2.8% contraction in 2024.

Valuation—The reason I am closing my position in SUPV

As I demonstrated earlier with YPF, whenever I invest in Argentina, I am prepared to exit at a moment's notice.

Currently, the valuation for SUPV appears stretched. My DCF analysis suggests a fair price of $15.75, and even on a relative basis, the shares seem expensive.

On a trailing P/E basis, SUPV appears slightly cheaper than BBAR.

P/E [TTM]

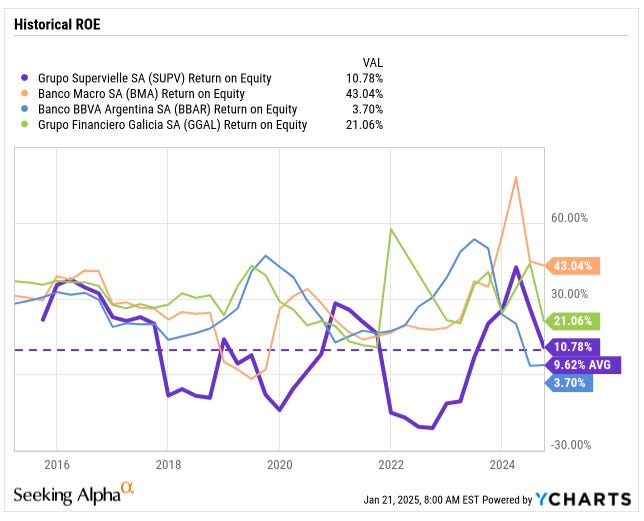

However, when we factor in ROE, it is among the lowest returns among the four banks.

On the positive side, on a PEG basis, SUPV seems cheaper than GGAL (0.30 vs. 0.42) but more expensive than BMA (0.30 vs. 0.16).

Don’t get me wrong, I see a path for SUPV shares to appreciate to $25, however, the risk-reward is not that attractive anymore.

Conclusion

While I still like SUPV and believe in Milei’s transformation of Argentina’s economy, I learned long ago that investing in Argentina comes with significant volatility.

Perhaps all the good news is already priced into the market, or perhaps there’s still upside and I’m leaving money on the table (as with my YPF trade in early 2024).

I’d rather redeploy that capital into opportunities with a more favourable balance of risk and reward.

Remember, Sharks aren’t greedy; we fish where the risk-reward is better.

This is the path of the Shark. This is the Way.

However, due to security concerns, it was later announced that President Milei would no longer fly commercial. This decision followed recommendations from Security Minister Patricia Bullrich to enhance the President's protection

BBAR offers 40 million pesos online and 70 million pesos in branches, BMA: 32 million pesos, and GGCA 22.4 million pesos.