Weekly #58: The S&P 500 Isn’t as Expensive as You Think… and One Sector Is Still Cheap

Portfolio +37.0% YTD, 2.5x the market since inception. Strip out seven mega-caps and the market looks almost normal. Look closer and you’ll find one sector priced like it missed the entire rally.

Hello fellow Sharks,

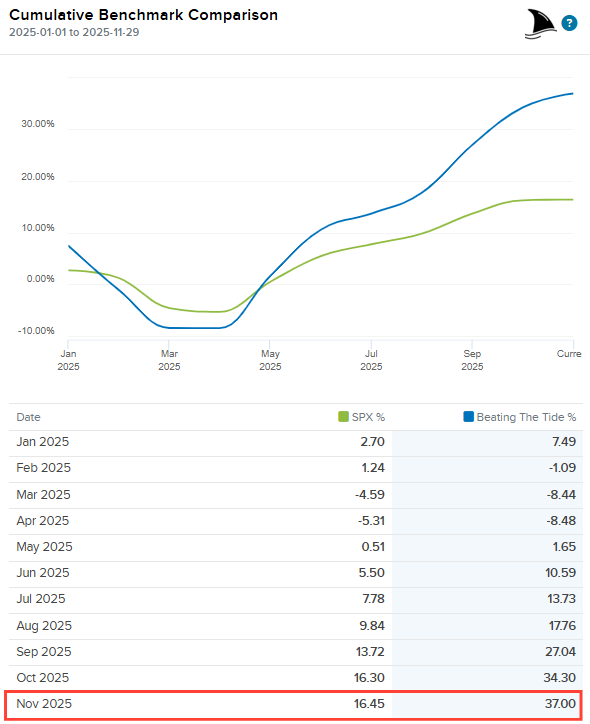

The portfolio hit a new high for 2025 this week. We’re up +37% YTD and +47% since inception (2.5x the market). If you want, to skip straight to the numbers, jump to the Portfolio Update. This performance is despite having no position in the Mag 7. Better performance without the seven most crowded trades in the index feels good.

In this week’s Thought of the Week, I dig into S&P 500 valuations. Everyone keeps saying the market is wildly expensive. But that headline is mostly a Mag 7 story. Strip out only seven companies and the rest of the index screens only slightly above its long-term average.

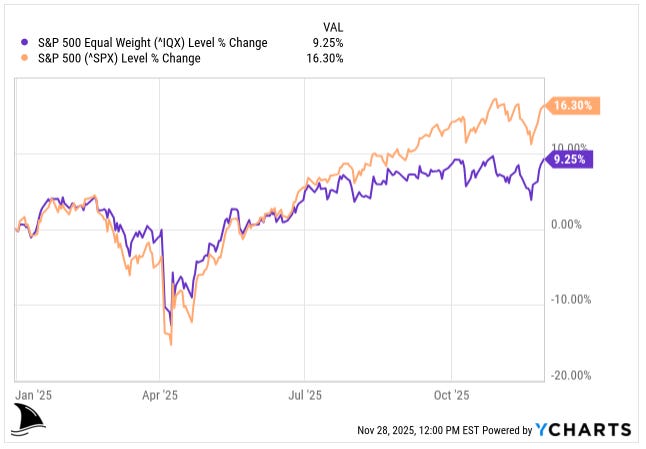

Two things caught my attention. First, our +37% YTD performance compares to +16% for the S&P 500 and +9% for its equal-weight version. We’re widening the gap while avoiding the giants that have driven most of the index’s gains. Second, while every major sector in the S&P trades above its 10-year valuation average, one exception stands out: energy. It trades at roughly 60% of its historical valuation. I currently hold zero oil and gas stocks. That looks like an opportunity worth exploring.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

Earlier last week, I published a full CAAP 0.00%↑ deep dive where I walk through why I am exiting Corporación América Airports after a +52% gain. I go back to my early airport days at Moneda and then show how CAAP’s traffic, revenue and share price all took off after COVID, yet margins, ROIC and country risk never quite caught up.

Argentina is still a wild runway, with high inflation, FX noise and a regulator that drags its feet, while peers like OMAB 0.00%↑, ASR 0.00%↑, PAC 0.00%↑ and Aena (ANYYY) earn far higher returns in calmer markets. At today’s peak multiples, I see more downside than upside, so I am locking in profits and redeploying the capital into cleaner risk reward ideas.

Thought of the Week: The S&P 500 Isn’t as Expensive as You Think… and One Sector Is Still Cheap

Lately you hear a lot of people say “the market is insanely overvalued” when they look at long-term charts of the S&P 500.

That headline is mostly a Mag 7 story.

If you strip out just seven stocks (1.4% of the index by count but roughly a third of the market cap) the rest of the S&P 500 screens only slightly expensive versus its own history. In this Thought of the Week, I zoom in on what makes the Mag 7 so dominant, and I also flag one sector that actually looks cheap versus history (energy).

It’s cheap for reasons from cyclicality, ESG headwinds to uncertainty about long-term oil demand, but it’s cheap nonetheless, and I’ll be reviewing energy names because we currently have zero exposure in the portfolio.

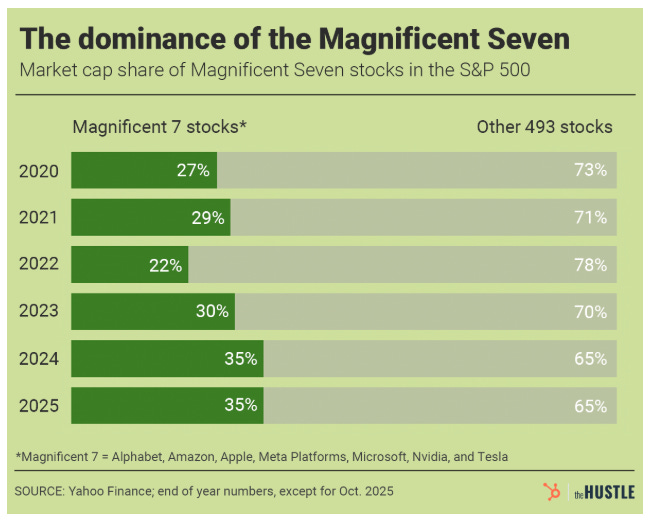

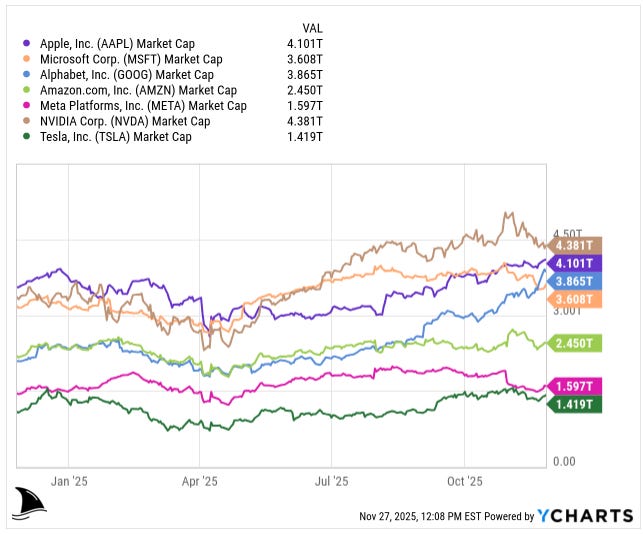

The Magnificent Seven (Apple [AAPL 0.00%↑], Microsoft [MSFT 0.00%↑], Google [GOOG 0.00%↑], Amazon [AMZN 0.00%↑], Meta [META 0.00%↑], Nvidia [NVDA 0.00%↑], and Tesla [TSLA 0.00%↑]) have grown so large that together they now make up over one-third of the S&P 500’s total value.

In other words, 7 companies out of 500 account for more than a third of the index. This makes the S&P 500 very “top-heavy”. For comparison, the median S&P 500 company is worth about $30 billion, but the Mag 7 companies are now trillions of dollars in size.

Because the S&P 500 is weighted by market capitalization (company size), these few mega-companies have a huge influence on the index’s performance.

If the Mag 7 were a country, Mag 7 would represent 70% of the US economy. The nation of NVDA would be larger than Japan’s.

Passive Investing Flows Fuel Dominance

A key reason the Mag 7 have become so dominant is the rise of passive investing (index funds and ETFs) as I explained in Weekly #56.

When millions of investors pour money into S&P 500 index funds (often through 401(k)s or other retirement plans), those funds automatically buy stocks in proportion to their size in the index. That means a large chunk of every new dollar goes into the biggest companies, chiefly the Mag 7.

This creates a feedback loop: the more these stocks go up, the larger weight they have, and the more index funds must buy them. Higher returns attract more flows, and more flows push it even higher. Over time, this passive flow of money has “warped” the market by boosting the same handful of stocks simply because they are already big.

This helps explain why the S&P 500 has been “asymmetrically driven” by the Mag 7 in recent years. It’s great when these stocks are rising, but it also means the market’s fate is heavily tied to a few names. If those seven were to fall sharply, index investors would feel an outsized hit because so much of their money is concentrated there.

Mag 7 vs. the Other 493: Performance Gap

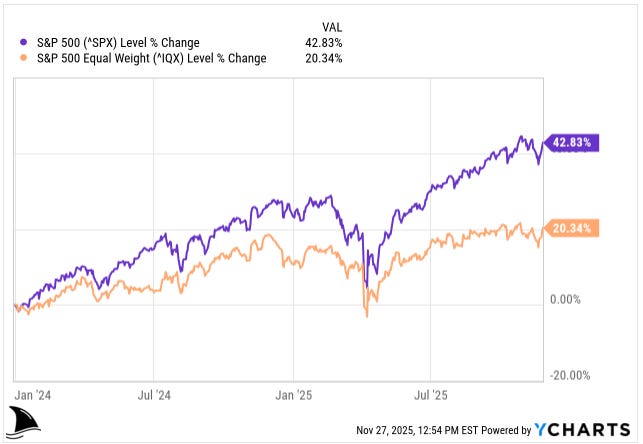

The S&P 500’s impressive gains in recent years have largely been powered by these seven super-stocks, while the “other 493” companies have lagged behind.

For example, since 2024, the S&P 500 has climbed 43%, but if you weighted all 500 companies equally (so the Mag 7 don’t overpower the result), the index was up only 20%.

That’s a huge gap. The market-cap weighted index beat the equal-weight index by over 23 percentage points (more than double), almost entirely due to the Mag 7’s outperformance.

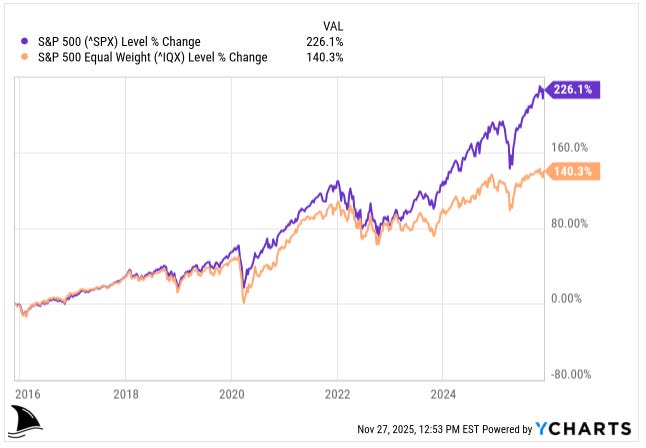

Looking over longer periods, the trend is similar: the S&P 500’s 10-year return was about +226%, but the equal-weight S&P 500 was up only 140% in the same decade. This shows how much of the index’s gains were driven by the biggest tech names.

It’s not that the other 493 companies haven’t grown (many have) but the Mag 7 have grown at a vastly faster rate.

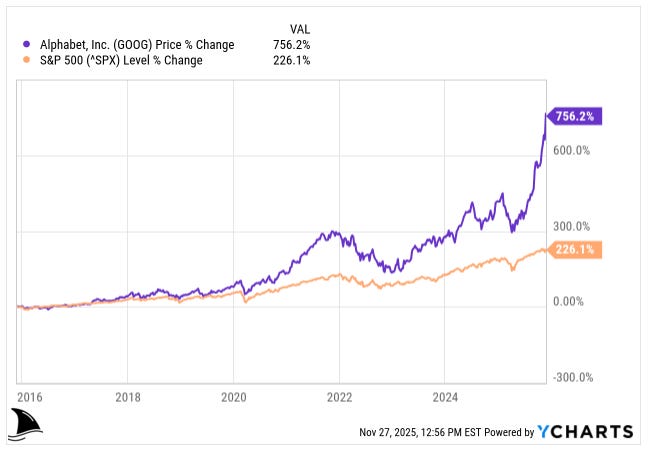

For instance, Apple’s stock rose over 750% in the past 10 years, far outpacing the S&P 500’s gain.

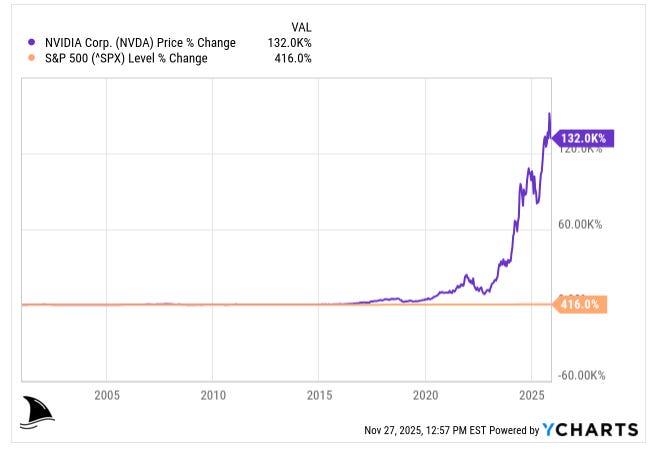

Nvidia has skyrocketed 130,000% since 2001.

These extraordinary runs by the tech mega-caps mean that investors holding those stocks reaped huge rewards, and the index itself looked very strong. Meanwhile, an investor who held everything except those top stocks would have seen much more modest gains.

In mid-2023, market breadth was extremely narrow. At one point, only about 1% of S&P stocks (just 5 companies) were outperforming the Mag 7’s average return. That was the peak of concentration.

By late 2024 and 2025, there has been some broadening of performance (more stocks contributing to gains), but the Mag 7’s influence is still remarkable.

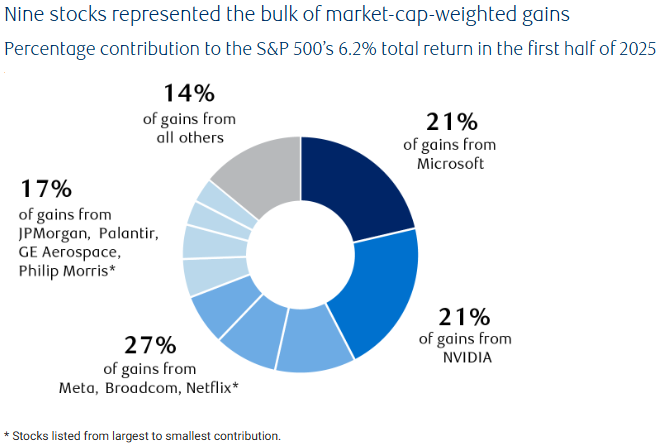

To illustrate the concentration, for the first three years of the 2020s, the Mag 7 accounted for the majority of the S&P 500’s annual returns. Even in H1 2025, as the rally broadened, only Microsoft and Nvidia contributed 42% of the index’s gains.

Add a few more big winners (Meta, Broadcom [AVGO 0.00%↑], Netflix [NFLX 0.00%↑], JPMorgan [JPM 0.00%↑], Palantir [PLTR 0.00%↑], GE Aerospace [GE 0.00%↑] and Philip Morris [PM 0.00%↑]), and nine stocks contributed 86% of the index’s gains in H1 2025.

That left all the other 491 stocks combined accounting for only 14% of the gains. This starkly shows how dependent the index’s performance has been on a tiny group of companies. Excluding the Mag 7 from one’s portfolio would have made the S&P 500’s recent outperformance evaporate, turning it from a stellar year into a much more ordinary one.

You can see the same pattern in 2025. YTD, the cap-weighted S&P 500 is up about 16.3%, while the equal-weighted S&P 500 is only up around 9.2%.

My portfolio is up 37% over the same stretch, and the fun part is that we’ve done it with no position in any of the Mag 7 names. Better returns, without riding the seven most crowded trades in the index.

Valuations: Expensive Titans vs. the Rest of the Market

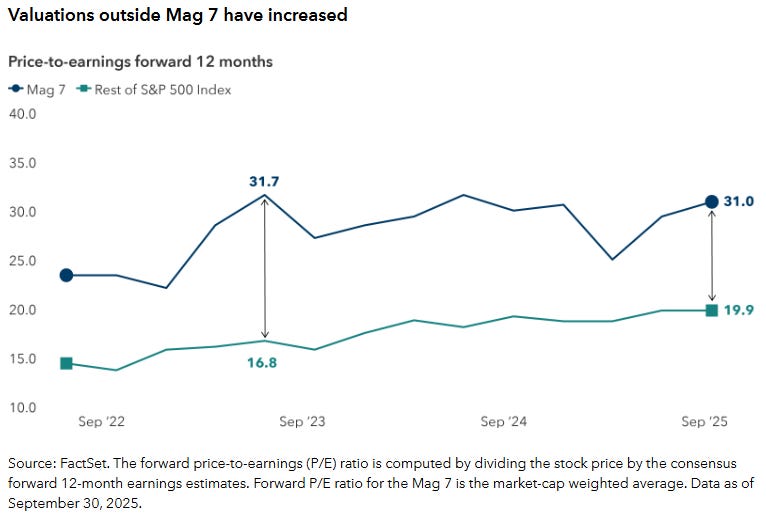

Investors keep paying a premium for the Mag 7. Their stocks cost more relative to the earnings they generate. One simple way to see this is the forward price to earnings ratio, which uses expected profits over the next year.

As of late 2025, the Mag 7 trade around 31x forward earnings, while the other 493 companies in the S&P 500 trade near 20x.

That is a wide gap. A year earlier the spread was even more extreme. In September 2023, the Mag 7 peaked near 32x, while the rest of the index sat closer to 17x. The exact numbers have moved up and down over the last few years, but the pattern holds. The largest tech names remain much more expensive than everything else. Investors pay a high price for each dollar of earnings from those seven companies compared with the typical S&P 500 business.

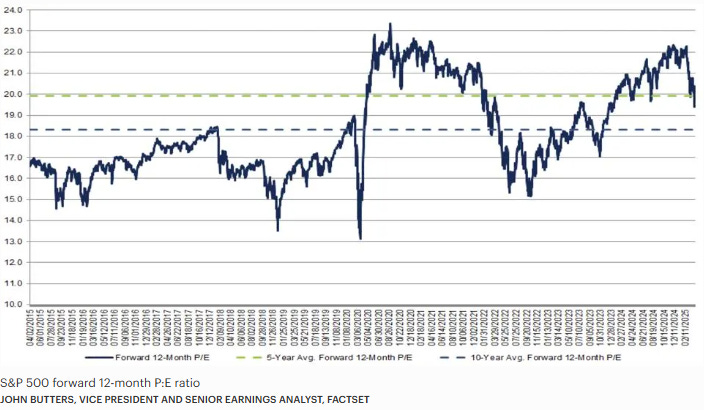

It’s notable that even the “S&P 493” are not exactly cheap by historical standards. A forward P/E around 19–20x for the non-Mag 7 stocks is slightly above their long-term average. For context, the 10-year average P/E for the S&P 500 is about 18.5x.

This means the overall market (even excluding big tech) is priced on the high side. But the Mag 7 have a much higher valuation premium. In late 2025, the Mag 7 group’s P/E is roughly 1.6x the rest of the market’s P/E.

Another way to look at it: those seven companies make up 35% of the index’s market value but only around 20% of its total profits. That imbalance (lots of market cap, a smaller share of earnings) is why their collective P/E is so elevated. By contrast, the other 493 companies produce about 80% of the earnings while representing 65% of the market cap.

Historically, such a wide valuation gap between the biggest stocks and the rest was seen only during extreme episodes like the dot-com bubble. That doesn’t necessarily mean a crash will follow, but it underscores how much optimism (and perhaps hype) is built into the prices of these tech behemoths.

The high valuations imply investors expect strong growth to continue from the Mag 7. If those growth expectations falter, these stocks could be vulnerable to larger drops given their lofty pricing.

Meanwhile, the rest of the market, at 20x earnings, is closer to normal (though still a bit above average). As investors in late 2025 start to seek opportunities beyond the Mag 7, there are signs the valuation gap has begun narrowing a bit.

For example, during 2024–25, many other stocks’ P/E ratios have risen as their prices climbed and confidence returned to more sectors. This “valuation convergence” means the broader market is catching up somewhat (in pricing) to the mega-caps, which could indicate a healthier, more balanced market going forward.

Earnings Growth: Mag 7 vs. the Pack

The Mag 7 have not only led on price performance but they’ve also shown stronger earnings growth recently, though the rest of the S&P 500 is no slouch either. For the quarter ending September 2025, the Big Tech names saw their combined earnings (net profits) grow about 18% y/y, compared to about 12% growth for the other 493 S&P companies, according to Reuters.

In other words, both groups are seeing profits rise (contributing to an overall S&P earnings growth), but the Mag 7’s earnings grew roughly 1.5x faster than the rest. This uneven distribution of earnings growth has been a pattern: throughout 2023 and 2024, many of the headline-grabbing profit increases came from the tech giants, while more traditional sectors saw slower growth or even declines.

However, there are signs of broadening earnings contributions too. By late 2025, a larger share of companies outside the top 7 have been exceeding expectations and contributing to overall profit gains.

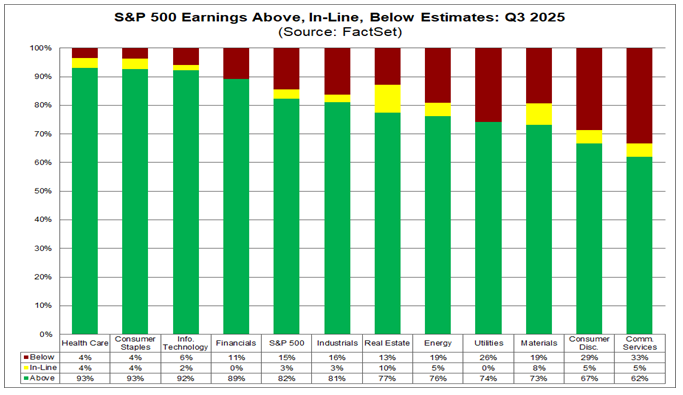

In fact, in Q3 2025, the majority of S&P 500 firms (82%) beat their earnings estimates, a higher rate than usual.

S&P 500 profit margins have been healthy across the board, not just in Big Tech. For example, industrial companies, airlines, banks, and others have managed to improve efficiency, keeping earnings growing even with only modest revenue increases. The Mag 7 still generally outpace the average but I think that the gap may narrow as other sectors rebound.

A noteworthy point is that, despite their huge market values, the Mag 7 only generate about 1/5 of the total earnings of the S&P 500. They’re extremely profitable companies, but the majority of corporate earnings still come from outside this group.

The fact that the Mag 7’s stock prices have run far ahead of their share of earnings (as discussed in valuations) means investors are banking on their future earnings growth to justify those prices. In 2024 and 2025, those bets seemed to be paying off as Big Tech delivered strong results (for instance, surging demand for AI chips massively boosted Nvidia’s earnings, and cost-cutting helped Meta and Alphabet improve profits). Meanwhile, many of the other 493 companies have had more modest earnings trends.

A Notable Valuation Outlier: The Energy Sector

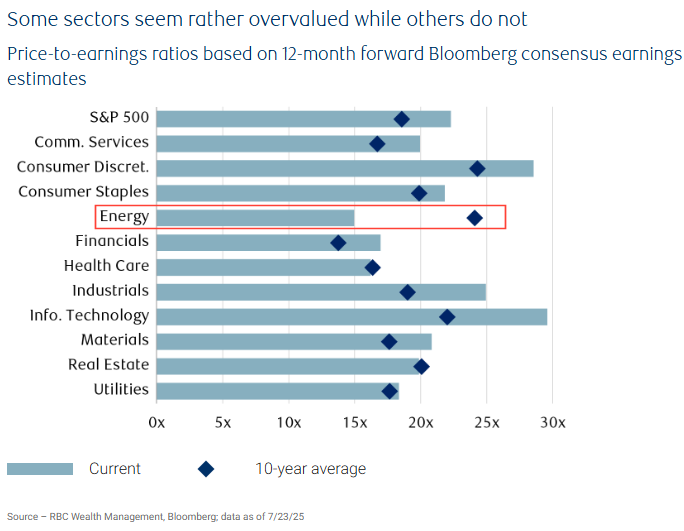

While most sectors of the S&P 500 have seen their valuations rise above historical norms (thanks to strong stock gains and optimistic outlooks), energy stocks stand out as an exception. In fact, the Energy sector is the only S&P 500 sector currently trading below its 10-year average P/E ratio.

To put numbers on it: as of mid-2025, S&P 500 Energy companies had a forward P/E of around 14.9x, compared to their 10-year average of about 24x. That means relative to their own past valuation levels, energy stocks are historically cheap.

By contrast, nearly every other sector is priced above its 10-year average P/E in late 2025. Even Real Estate, another laggard sector, is roughly in line with its historical P/E.

Why are energy stocks so undervalued?

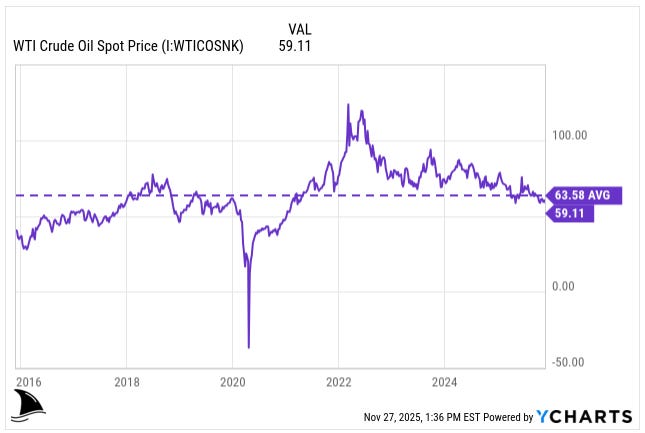

A big factor is the cyclicality of oil and gas prices. Energy company earnings surged in 2022 when oil prices spiked well over $100/barrel, leading to very low P/E ratios (prices didn’t rise as much as earnings did). Since then, oil prices have moderated. In November 2025, crude oil hovers around the $60 range and the market anticipates energy profits will come down from their peak.

People may also be cautious on energy due to longer-term transitions (like renewables and ESG trends) and the volatile nature of commodities. All this has kept energy stock prices relatively in check, even as earnings stayed strong, resulting in low valuation multiples. Essentially, the market is not putting a big growth premium on oil & gas companies.

For me, this is intriguing: energy is the cheapest sector by forward P/E, and it’s alone in trading below its decade average valuation. High oil prices in the recent past fattened profits, but stock prices didn’t fully keep up, so energy stocks look “on sale” in valuation terms.

Of course, one has to consider the context. If oil demand or prices fall further, those earnings could drop, making the low P/E less attractive. Still, the contrast with other sectors is stark. Technology, for instance, trades around 30x forward earnings vs a 22x historical average, making it one of the pricier areas. Energy at 15x vs a 24x history is a clear outlier on the low side.

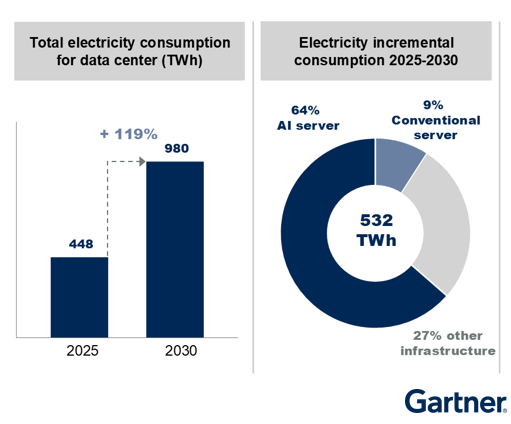

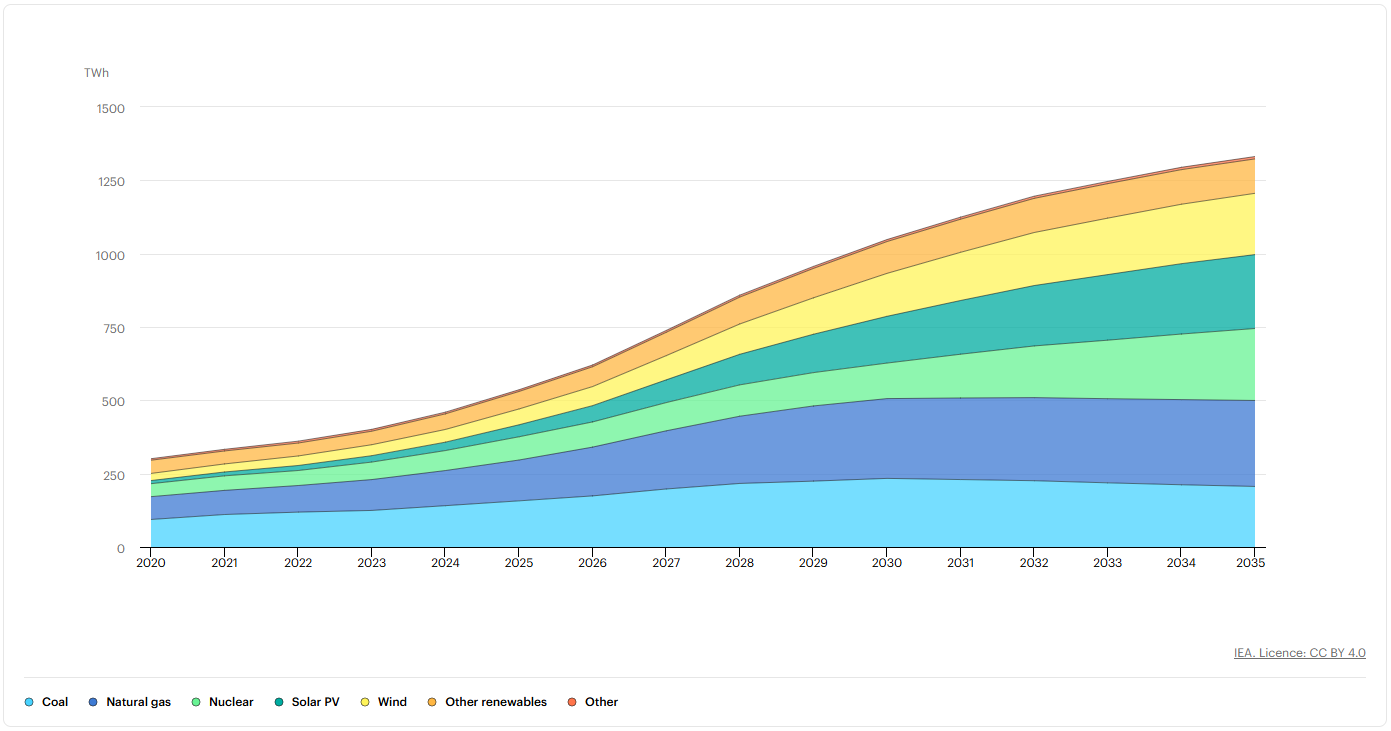

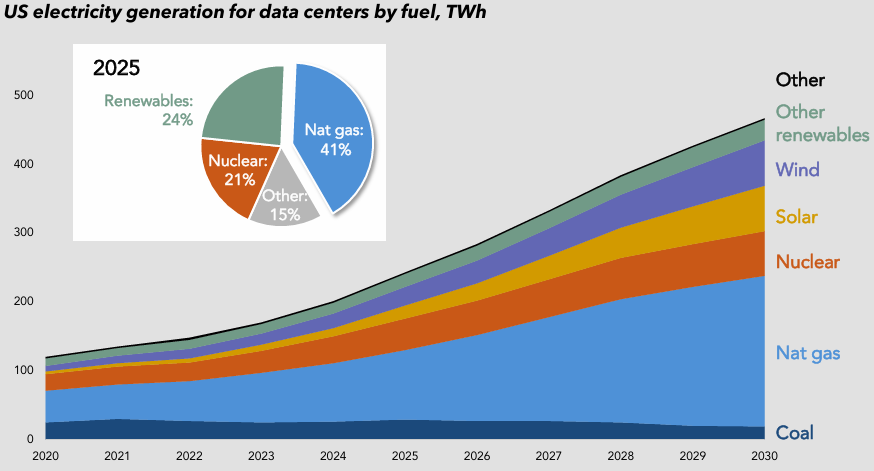

There are also real reasons to be optimistic about energy, not just because it looks cheap on a chart. Global electricity demand from data centers is expected to roughly double by 2030 as AI workloads scale, which is like adding another large power-hungry country to the grid.

In the near term, natural gas and coal are expected to supply more than 40% of that extra power before renewables catch up, which keeps a solid floor under hydrocarbon demand.

Think of AI as a new industrial load that never sleeps. Most big US data centers still rely on natural gas for over 40% of their electricity.

One study estimates that AI-driven data centers could lift US natural-gas production by 10% to 15% over the next decade, and that the productivity gains from AI could add energy use equivalent to about five billion barrels of oil over that period. More drilling for gas usually brings more associated oil and liquids, and a richer economy tends to fly more planes, ship more goods, and burn more fuel. So the AI boom is not only a software story; it quietly supports long-dated demand for real molecules.

Layer that on top of the usual drivers. Emerging markets still industrialize, aviation and shipping still grow, and the global system cannot flip its energy mix overnight. Even in aggressive transition scenarios, oil and gas carry a meaningful share of the mix well into the 2030s. That blend of low valuations, strong cash generation, and a credible demand story is why I see energy as more than just a short-term trade.

It’s worth noting in this context that my portfolio contains no oil & gas stocks. That means we currently have zero exposure to the one sector that appears undervalued relative to its history. When I scan my watchlist, I already see a handful of oil and gas names trading below the sector’s 15x forward P/E, with better return metrics than the index. I am even eyeing one name at under 8x forward earnings, which feels out of line with its balance sheet and cash flow.

If the energy sector were to mean-revert (move back up toward typical valuation levels) say due to supply constraints, geopolitical factors, or simply renewed investor interest, those stocks might outperform.

Already, energy companies have solid cash flows (many pay hefty dividends) and relatively low expectations baked into their prices. With oil prices still providing decent revenues (even at $60, many producers are profitable) and global demand steady, one could argue the sector has upside if sentiment shifts.

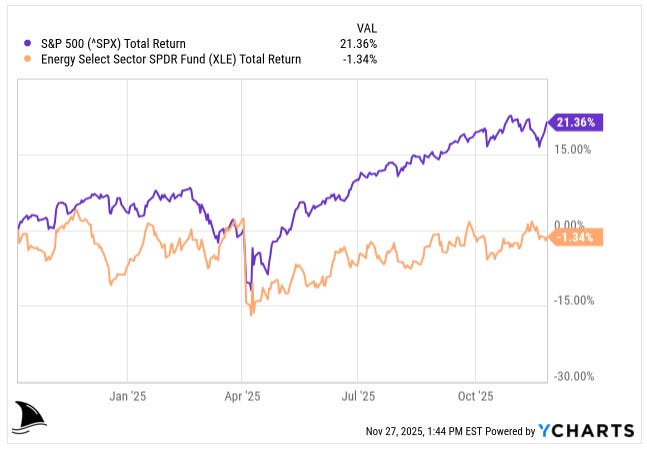

On the other hand, lacking energy in the portfolio has so far not hurt performance as the sector has gone nowhere since October 2024 (when I launched this newsletter).

This will be a key consideration for my next monthly pick: whether to incorporate an energy stock to take advantage of this valuation disconnect. I have a dozen or so energy stocks in my watchlist, including that sub-8x forward earnings name, that I will be reviewing over the coming weeks. If you have any energy stock in mind that you would like me to consider, drop the name and your rationale in the comments.

Portfolio Update

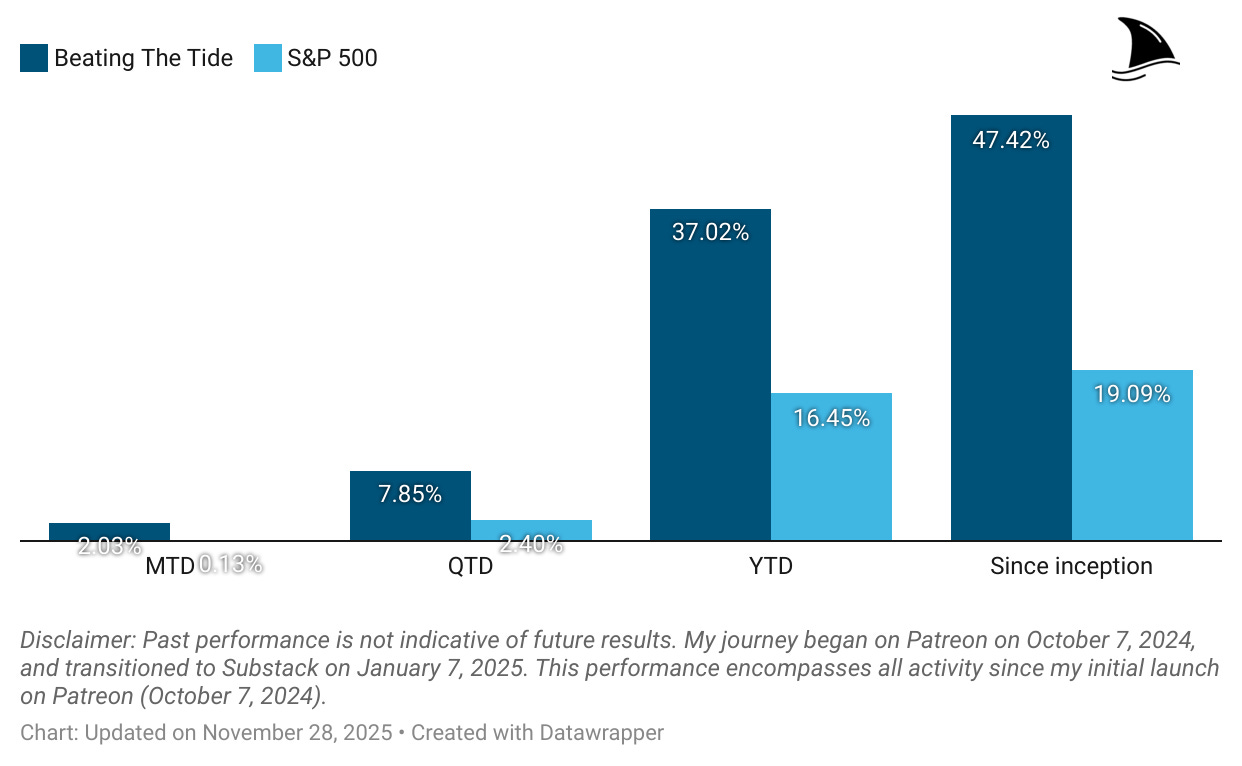

The portfolio had a strong week and its lead over the S&P 500 is now the largest it has been since inception.

Month-to-date: +2.0% vs. the S&P 500’s +0.1%.

Quarter-to-date: +7.9% vs. S&P 500’s +2.4%.

Year-to-date: +37.0% vs. the S&P’s +16.5%, a gap of 2,057 basis points.

Since inception: +47.4% vs. the S&P 500’s +19.1%. That’s 2.5x the market.

Portfolio Return

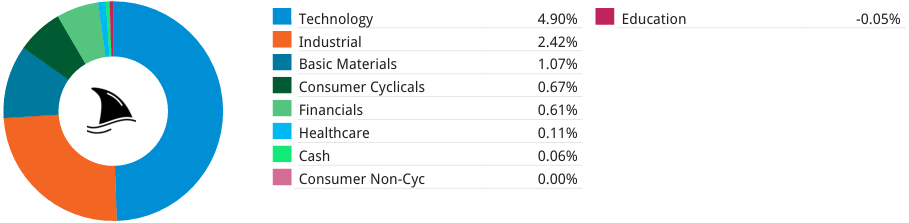

Contribution by Sector

Technology and industrials pulled most of the gain in the portfolio with a slight offset by education.

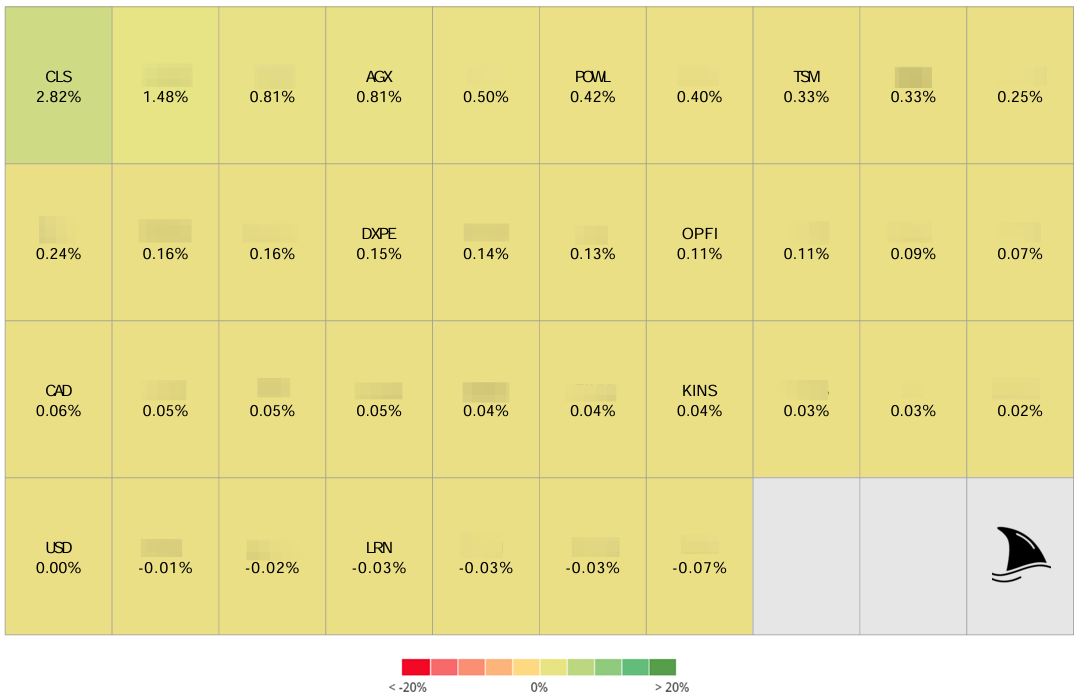

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+282 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

+81 bps AGX 0.00%↑ (Thesis)

+42 bps POWL 0.00%↑ (Thesis)

+33 bps TSM 0.00%↑ (Thesis)

+15 bps DXPE 0.00%↑ (Thesis)

+11 bps OPFI 0.00%↑ (Thesis)

+4 bps KINS 0.00%↑ (Thesis)

-3 bps LRN 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Hi George, great read today. Been watching these energy companies and maybe you are considering them too: CCJ, EFR:CA, UROY, LEU, BWXT, OKLO, SMR, DUK, D (Dominion Energy). Thanks!