Weekly #62: I Flagged Gold Early. Now Let’s Talk 2026.

Portfolio +34.5% YTD, 2.2x the market since inception. Rates, deficits, and mean reversion: how I’m thinking about gold, silver, and copper from here.

Hello fellow Sharks,

This week the portfolio gained some ground and widened the gap versus the S&P 500. If you want to skip straight to the numbers, jump to the Portfolio Update.

This Weekly will be relatively short because I am spending more time on the 2026 Stock Pick (I’m aiming to release it by Wednesday). So today I’ll answer a question some of you have been asking: my view on gold and silver.

While I don’t invest in commodities directly, I do allocate a small portion of the portfolio to cash flow producing miners. In today’s Thought of the Week, I’ll recap the 2025 performance of gold, silver, and copper (bonus!) and share my outlook for 2026.

This is the last Weekly of 2025. The next one will be a review of the portfolio’s 2025 performance.

And finally don´t forget to upgrade to paid before the price increase on January 1, 2026.

Have a happy New Year. I hope you and your family have a healthy and prosperous 2026!

~George

Table of Contents:

Thought of the Week: Gold, Silver and Copper, 2025 Recap and 2026 Outlook

While I avoid commodity-dependent companies in the portfolio, I always keep a 2.5% to 7.5% position in a gold/silver company. In June 2025 I issued a trade alert rotating out of IAG 0.00%↑ into another gold miner.

And even back in April I flagged gold as the asset class most likely to outperform because volatility regimes tend to favor it. When the VIX hits 45, gold has historically delivered strong 12-month returns with limited downside. That was the core of my call.

YTD, gold is up 70%…

… but my gold positions have been up +152% (32% with IAG and 91% with the new position that replaced IAG).

Silver and copper have been big winners too: silver is up over 160% this year…

… and copper has rallied 37%.

I’ll explain what drove this run and share my thinking about where each metal may go in 2026. I’ll also explain why I’m invested in miners, not bars: miners deliver operating leverage, so a 10% rise in a metal price can translate to a much bigger gain in a profitable mining stock.

I called gold early in 2025. Now I want to see where you think it goes next.

Why 2025 Was a Blowout Year for Metals

Gold: Safe Haven and Central Bank Demand

Several forces fueled gold’s rally: people worried about geopolitics (Middle East tensions, Ukraine, etc.), and they expected the Fed to cut rates next year. A weaker US dollar, weaker currencies abroad, and broad “debasement trade” flows boosted gold’s appeal.

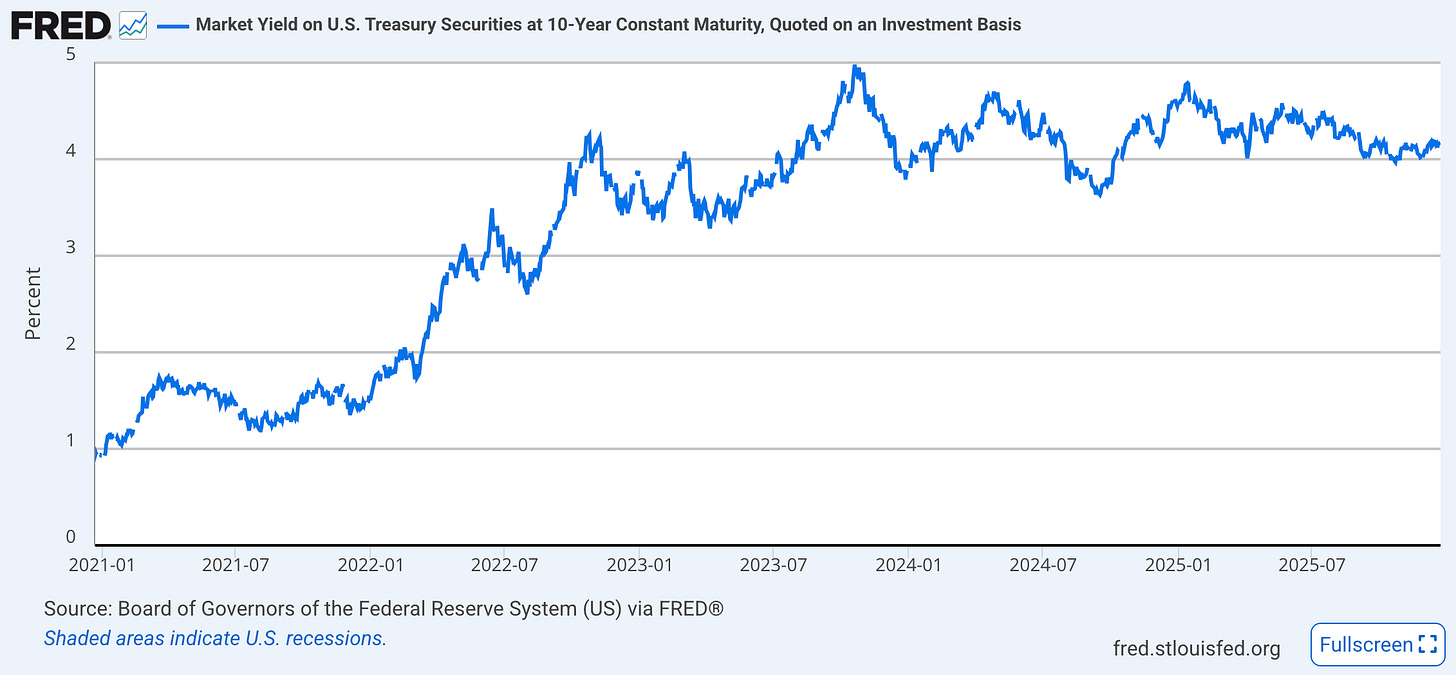

For example, bond yields around the world moved up…

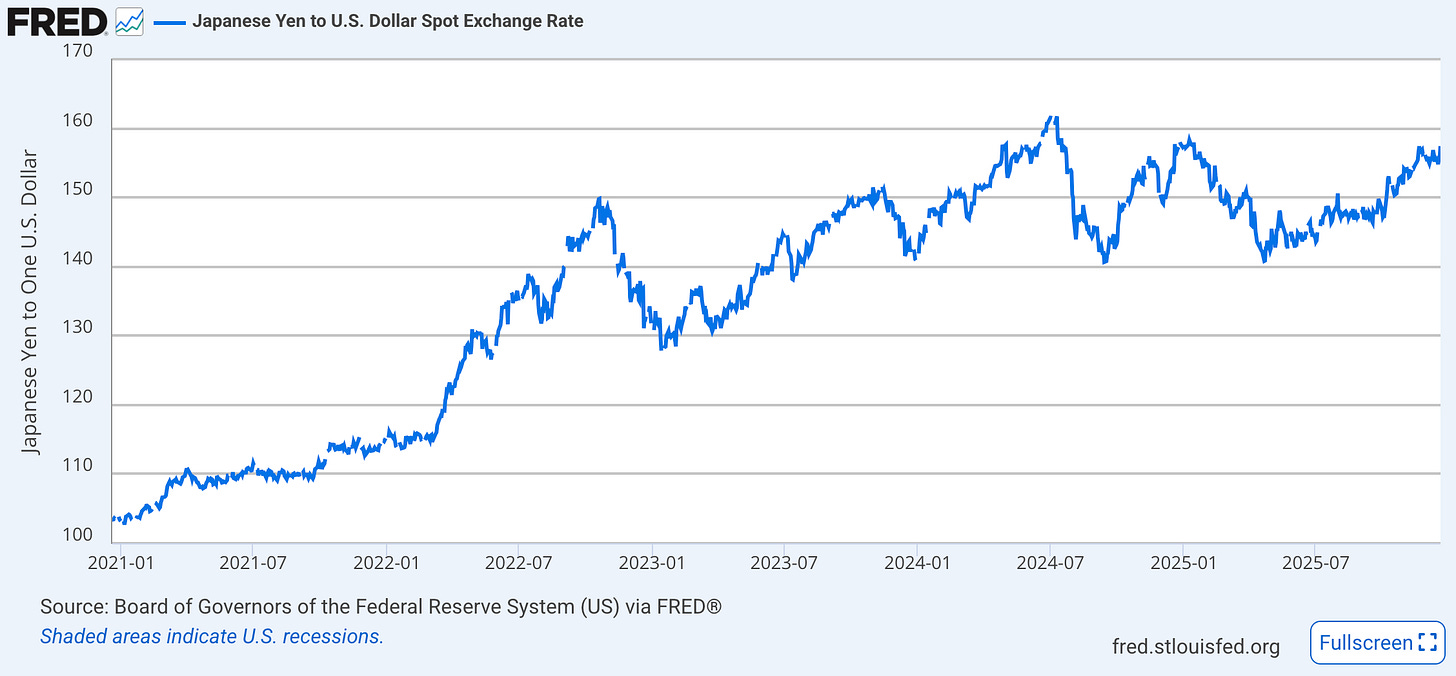

… while the Japanese yen weakened.

That combo revived the trend of moving money into hard assets and out of fiat currencies. Lower real interest rates and a softening dollar were already having a strong impact: the market has largely priced in an increasingly gold-friendly 2026 outlook, with lower rates and a potentially softer dollar acting as tailwinds.

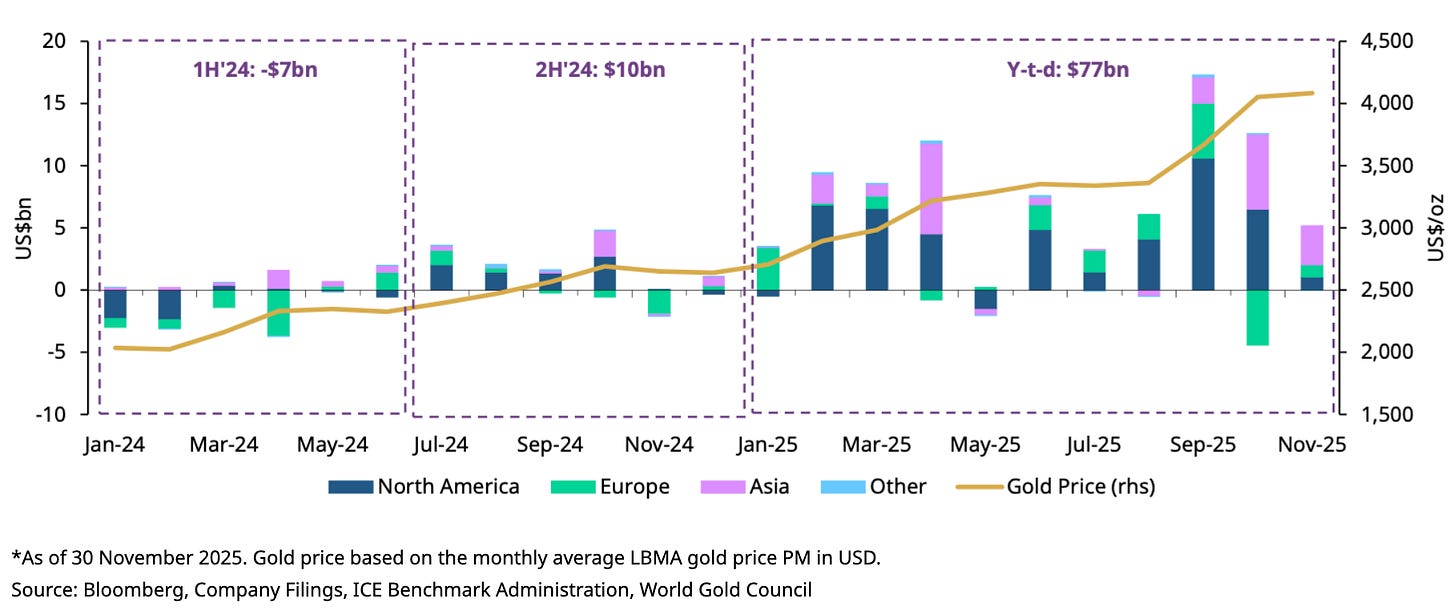

Central bank buying also mattered: national banks (e.g. Poland, others) lifted gold purchases in recent months. Even though central bank buying in 2025 (254 tonnes through October) was slightly slower than the prior three years, it remains high by historical standards and continues to underpin prices.

Silver: Leverage on Gold Plus Industrial Demand

Silver exploded even more in 2025. It passed $75/oz. Like gold, silver drew money as a safe asset amid Fed easing bets and geopolitical worry. But silver also has extra tailwinds. Industrial demand (for electronics, solar panels, EVs, etc.) is solid, and silver was officially designated a US “critical mineral” in 2025 raising its strategic profile.

Most importantly, silver fundamentals are extremely tight. According to the Silver Institute, 2025 is on track to be a fifth consecutive supply deficit year for silver. Even though global demand may dip slightly, production is barely rising, leaving a big shortfall that underpins prices.

By early Nov 2025, silver ETP holdings were up ~18% YTD (about 187 million ounces added), the largest inflows since the 2020 boom. In practice this meant huge ETF buys and physical buying (evidenced by backwardation and big Comex deliveries), all of which helped drive silver to all-time highs.

Copper: Supply Crunch and Green Energy Demand

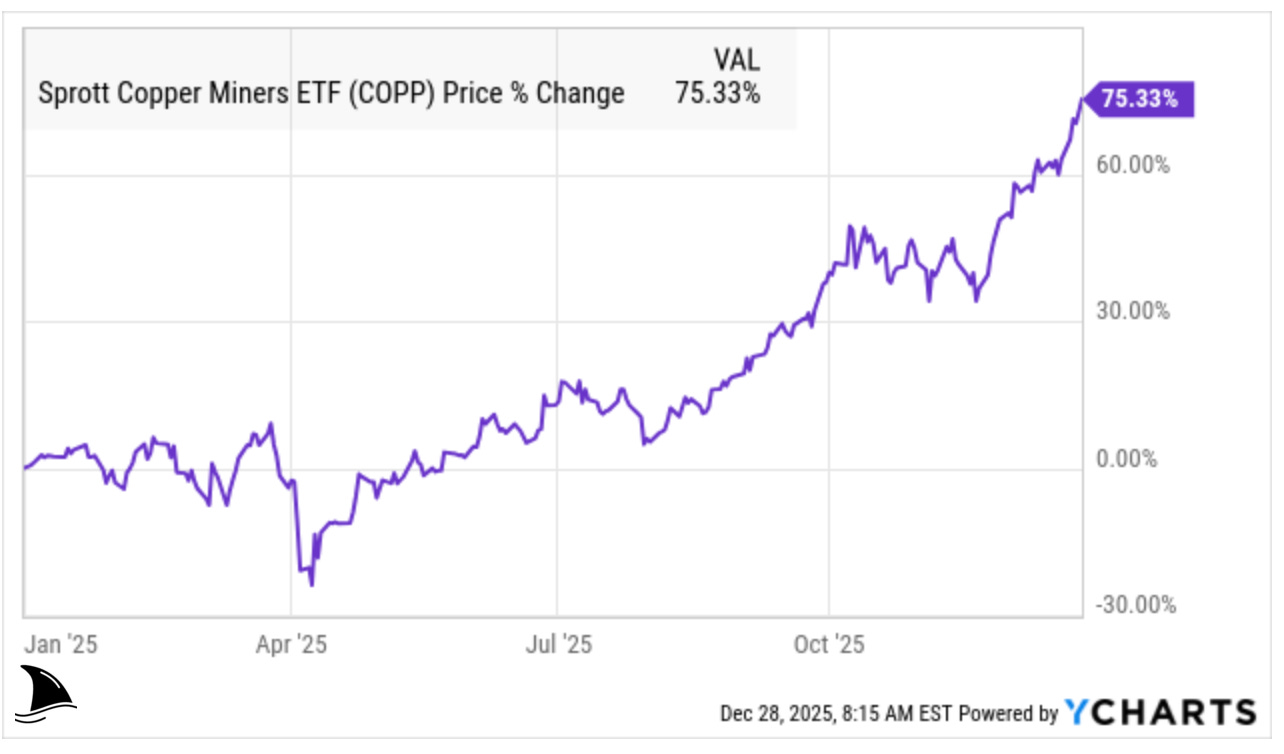

Copper had a huge year too. It has rallied 37% so far, on track for its biggest annual gain since 2009. The bull case was driven largely by supply-side problems paired with strong demand forecasts.

Expectations of soaring demand from data centers that power AI, and tight supplies has been the main driver. A Reuters survey found a 124,000-ton shortfall in 2025 and a 150,000-ton shortfall expected in 2026.

On the supply side, multiple events cut output: an accident at Freeport McMoRan’s Grasberg mine, production cuts by Glencore, and slower new mine starts. Meanwhile, trade and tariff issues disturbed flows. For instance, higher US tariffs led traders to ship large volumes into US exchanges, swelling Comex stocks to record highs, paradoxically increasing inventories even as global markets tighten.

Yet prices kept rising. Copper became the poster-metal for the clean-energy boom: electrification, EVs, renewable grid build-outs and even data centers all need vastly more copper (a single data center can use 1,000 tons).

Outlook for 2026

I remain bullish on the metals overall, but with caveats. 2026 will be shaped by the macro shifts I see brewing: Fed cuts vs. lingering inflation, growth vs. potential recession, dollar strength vs. weakening, and ongoing geopolitics.

Gold in 2026: Still a Key Hedge

Gold likely stays strong in 2026, though there could be volatility. The consensus is for the Fed to cut rates further (markets price 75 bps more easing by year-end).

If rate cuts happen and inflation cools to target, gold gets a double boost: lower yields and a softer dollar. Rates and the dollar are cyclically high, and historically gold benefits when they come down. Plus, geopolitical and financial market risks seem elevated: tail-risk events have become more frequent, and that usually means more demand for gold’s safe-haven role.

In a “soft-landing” or mild recession scenario, gold should rally further. Gold could rise another 10–20% in 2026 from current levels. Investment demand would likely surge (ETFs drove this year’s boom). Remember, global gold ETF holdings are still only about half of what they were in prior bull runs, so there’s room for more inflows. Central banks also aren’t done. Many emerging-market central banks have much lower gold ratios than advanced economies. If EM countries like China, India or others decide to catch up, it would support gold prices further.

A wildcard will be central bank recycling and loans. Gold used as collateral for loans is at record levels in India, which has helped remove supply from the market (people aren’t selling). If India’s economy slows sharply, some pledged gold might get liquidated, which could add supply. But in general, central banks still see gold as insurance, and many say they plan to buy more.

On the other hand, a risk to the rally is if the global economy really accelerates (“reflation”). In that case, the Fed might surprise by staying higher for longer. With fiscal stimulus or trade breakthroughs, growth could pick up and the Fed might pause or even hike rates again. That would raise yields and strengthen the dollar, draining money from non-yielding gold. In this bullish-growth, bullish-risk scenario, gold could correct 20%-30% from peak. We’d probably see big outflows from ETFs into equities and higher-yielding bonds in that case.

Balancing these, I lean toward gold maintaining higher levels in 2026. The macro trend I see is still inclined toward easing and uncertainty, which favors gold. But I’m watching inflation, Fed guidance, and any sudden geopolitical flashes. For now I remain “constructive” on gold.

Silver in 2026: A Bigger Leverage Play?

Silver’s fate usually follows gold’s lead, but with additional zigs and zags from its industrial ties. If gold stays in rally mode, silver will likely outpace it again in percentage terms as it did in 2025.

With inflation expectations moderating and Fed cutting, investors may continue to seek silver. ETFs or ETPs focused on silver are likely to see continued inflows if gold remains strong. Low interest rates still support both gold and silver demand.

Plus, industrial demand for silver is slated to keep growing. Applications in electronics, photovoltaics, and EVs should rise over time. While some silver demand (like jewelry) fell in 2025 due to high prices, demand in solar PV and EVs tends to be elastic and any economic rebound or clean-energy push could boost industrial silver use. Some forecasts suggest record global solar installations in 2025, which eventually lifts silver consumption (even after “thrifting” measures). And if AI and data center buildouts continue, silver could see extra demand there too.

However, silver can also be more volatile. If the Fed surprises on the hawkish side (keeping rates higher due to sticky inflation), that could drag silver down sharply. We should also watch the gold:silver ratio, which is near multi-decade lows after silver’s surge. Historically when that ratio tightens, silver eventually weakens relative to gold.

The ratio went above 100 in April and then collapsed to about 57 into year-end. That’s a huge move. It also means silver got very expensive versus gold.

If the ratio drifts back up toward a more normal zone, silver usually loses momentum versus gold. It can happen in three ways:

silver drops

gold rises faster

both happen, but gold wins the race

Two quick scenarios:

Scenario A: Gold stays at $4,530

Ratio back to 70 implies silver $64.7 (4,530 / 70)

Ratio back to 80 implies silver $56.6 (4,530 / 80)

Scenario B: Silver stays at $75

Ratio back to 70 implies gold $5,250 (75 × 70)

Ratio back to 80 implies gold $6,000 (75 × 80)

Copper in 2026: The Great Green Metal Race

For 2026, I remain bullish on copper. The overriding story is the persistent supply squeeze against surging green-energy demand. The IEA and others continue to warn that new copper projects are not coming online fast enough, while demand keeps climbing. Several analyses forecast refined copper deficits in 2026 on the order of 300–400k.

On demand, I expect growth to strengthen. China’s economy should continue its recovery and stimulus, and China remains the world’s biggest copper consumer. India is expanding power and infrastructure too. In developed markets, the push to electrify everything is still accelerating. A big new factor is AI and data centers, each hyperscale data center uses enormous copper. So I see structural global demand rising another few percent in 2026.

Supply looks tight. Recent output cuts won’t be reversed overnight. Peru and Chile still face political uncertainty (licenses, strikes, etc.), delaying mines. Cost inflation and delays are crimping new projects. Even if scrap supply (recycling) increases, it can’t fully offset the shortfall of mined copper.

Institutional positioning will also be key. Copper miners have been thrashing higher, e.g. the Sprott copper miners ETF is +75% YTD.

That speculative frenzy might cool, but it signals real money piling in. If 2026 starts well (no recession, Fed still dovish), I expect the copper bull to run. Even a mild global slowdown might only tame demand growth slightly, while supply issues would persist.

Investing Through Miners (Not Bars)

I don’t own gold/silver/copper directly1. Instead I invest in mining companies to play these metals.

Why?

Mining stocks offer operating leverage. If metal prices rise, mining profits can rise faster. For example, if gold goes up 10% but costs are fixed, a miner’s earnings might rise 30-50%. This can translate into much larger stock gains. In 2025 we’ve already seen this in action: many gold, silver and copper miners are up multiples of their metals’ moves.

Mining stocks also provide other benefits: they generate cash flow, pay dividends, or can be acquired. And as we saw during the rally, mining equities often move before bullion.

Portfolio Update

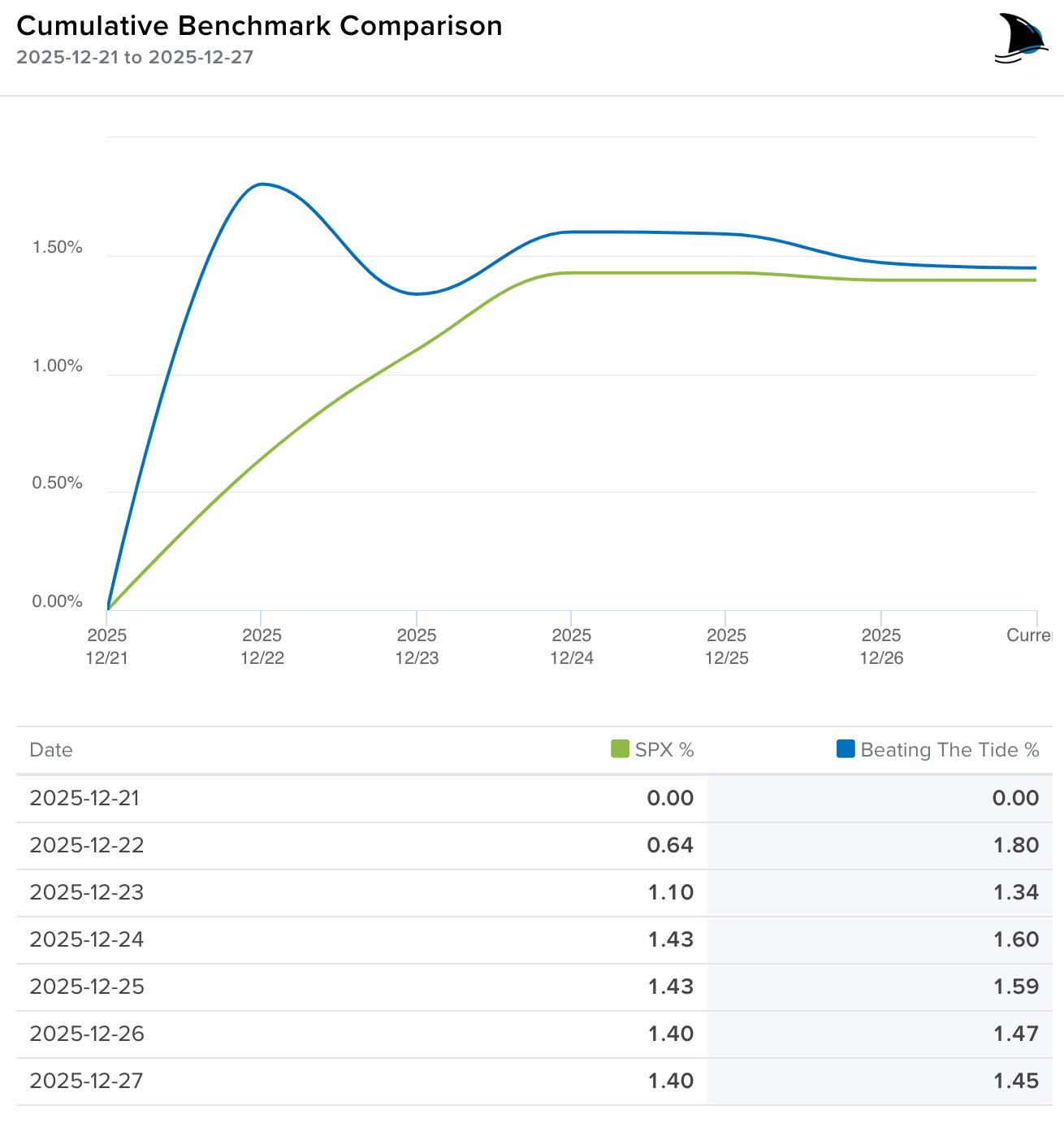

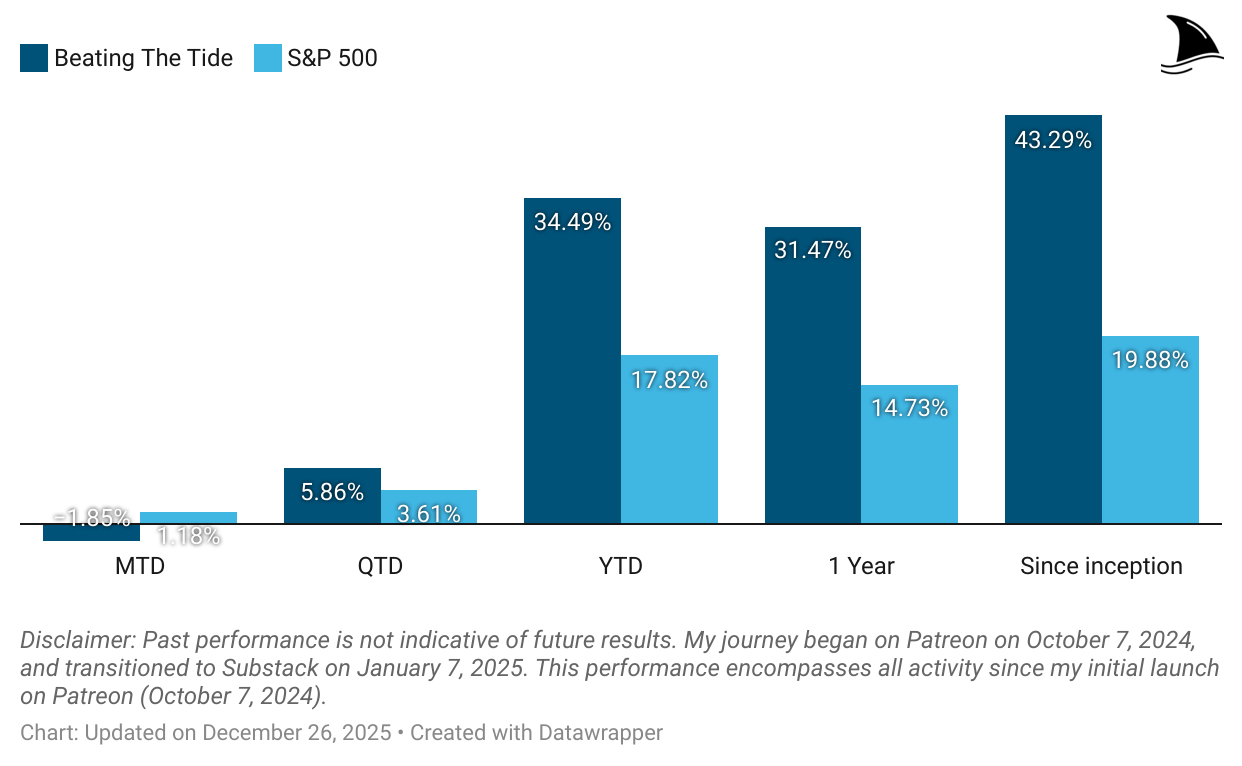

The portfolio ended the week higher than the S&P 500 expanding our out-performance.

Month-to-date: -1.9% vs. the S&P 500’s +1.2%.

Year-to-date: +34.5% vs. the S&P’s +17.8%, a gap of 1,667 basis points.

Since inception: +43.3% vs. the S&P 500’s +19.9%. That’s 2.2x the market.

Portfolio Return

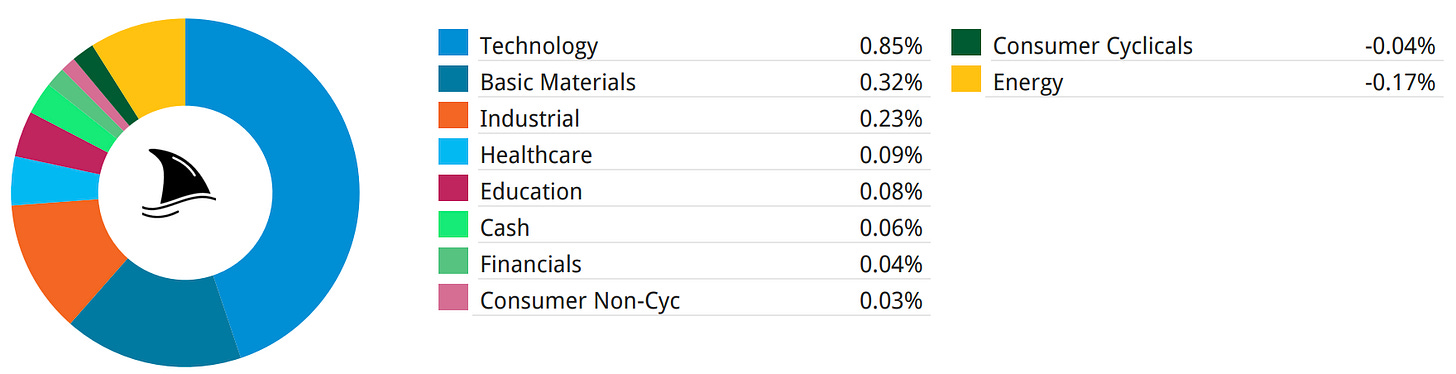

Contribution by Sector

Tech, gold and industrials led the gains partially offset by oil & gas.

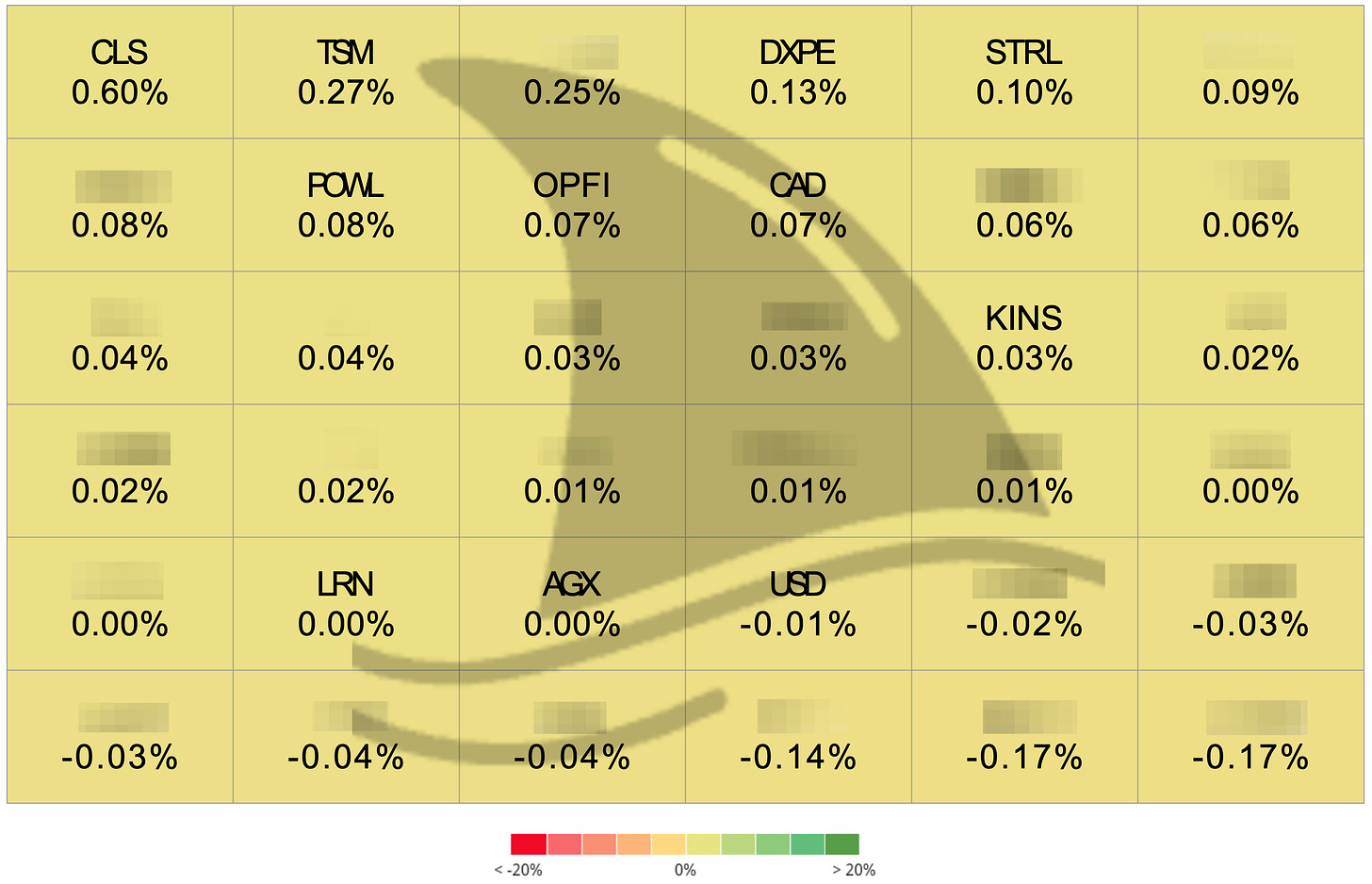

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+60 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

+27 bps TSM 0.00%↑ (Thesis)

+13 bps DXPE 0.00%↑ (Thesis)

+10 bps STRL 0.00%↑ (Thesis)

+8 bps POWL 0.00%↑ (Thesis)

+7 bps OPFI 0.00%↑ (Thesis)

+3 bps KINS 0.00%↑ (Thesis)

flat LRN 0.00%↑ (Thesis)

flat AGX 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Never Stop Asking Why, Using the “5 Whys” to Solve Problems and Pick Stocks

The Rise and Fall of Moats: When Walls Built to Protect Become Traps

How I Earn $3,000-$7,000 a Month While Waiting to Buy Great Stocks Cheaper

Besides my Rolex 16618