Weekly #68: POWL Grabs the Crown as the Portfolio’s New Top Performer

Portfolio +12.0% YTD, 2.8x the market since inception. Plus POWL’s Q1 2026 recap, the $439M order surge and $1.6B backlog, what changed in my valuation and why I’m still holding.

Hello fellow Sharks,

What a week. The S&P 500 is retracted to 1.3% YTD, while the portfolio sits at +12.0% year-to-date. If you want to skip straight to the numbers, jump to the Portfolio Update.

Quick reminder for paid subscribers: bookmark the weekly portfolio tracker page. For a couple of weeks now, I keep it updated with earnings summaries, and the biggest weekly movers.

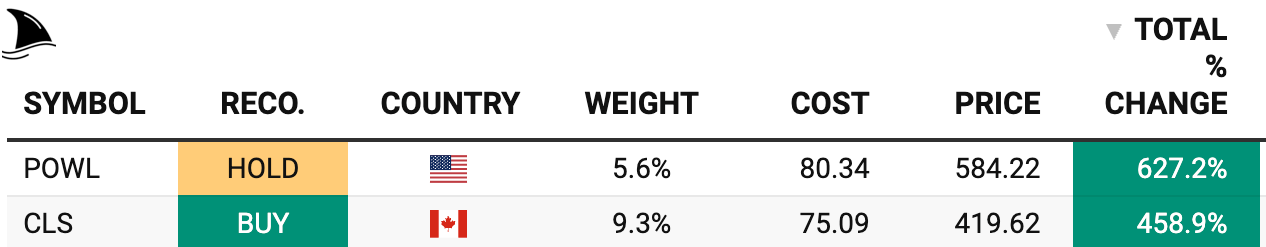

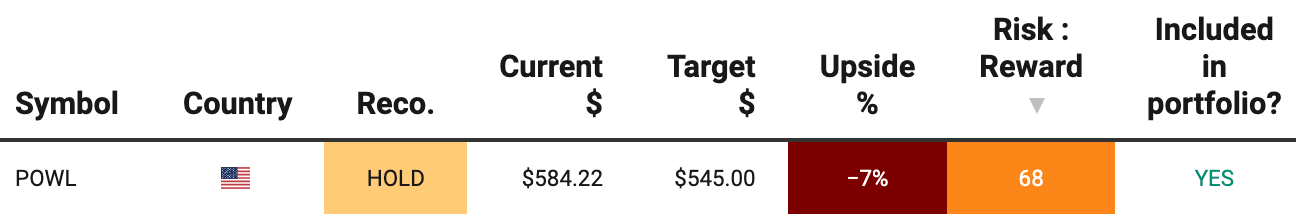

This week, POWL took the crown from CLS as the top performer in the portfolio, helped by strong results and a solid outlook.

The stock now trades a bit above my revised fair value, but I am still holding. I walk through the why below.

Enjoy the read, and have a great Sunday.

~George

Table of Contents:

In Case You Missed It

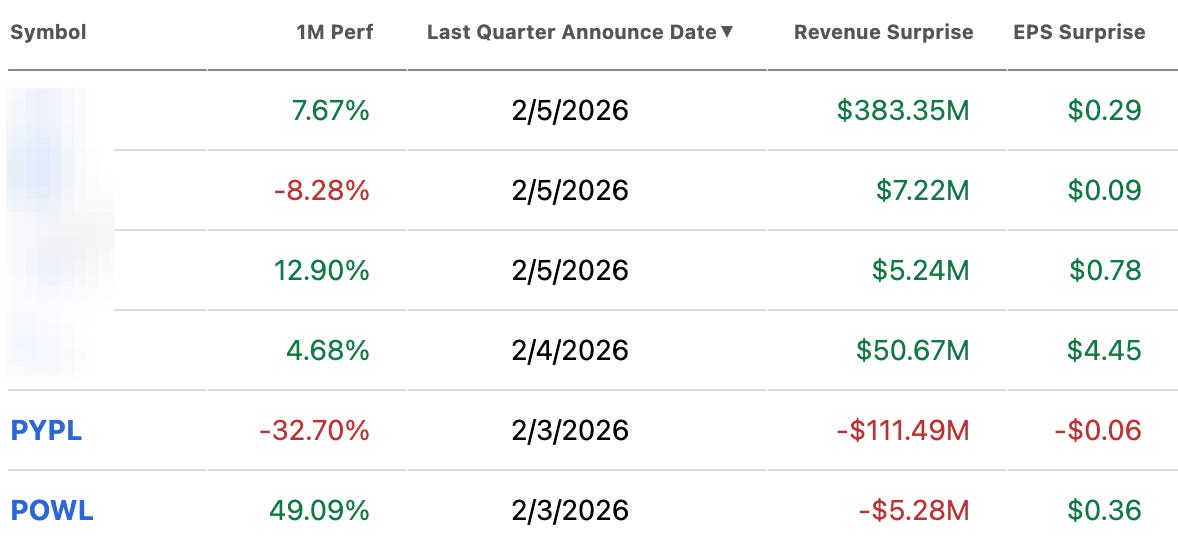

On February 3, I sent out a trade alert closing my PYPL 0.00%↑ position.

This wasn’t a panic sell or a reaction to a bad headline. It was a decision driven by a clear-eyed reassessment of where the thesis broke.

The next day, I published a full post-mortem walking through the decision in detail.

I broke down what worked, what didn’t, and why holding on would have meant anchoring to the past instead of reallocating toward better setups.

Earnings Results: 5/6 EPS Beats and 4/6 Revenue Beats

Only one out of the six companies reporting this week missed consensus EPS, and two missed revenues. For the full list and analysis, click here.

Thought Of The Week: Powell Q1 2026: Data Center & LNG Booms Power a Backlog Surge

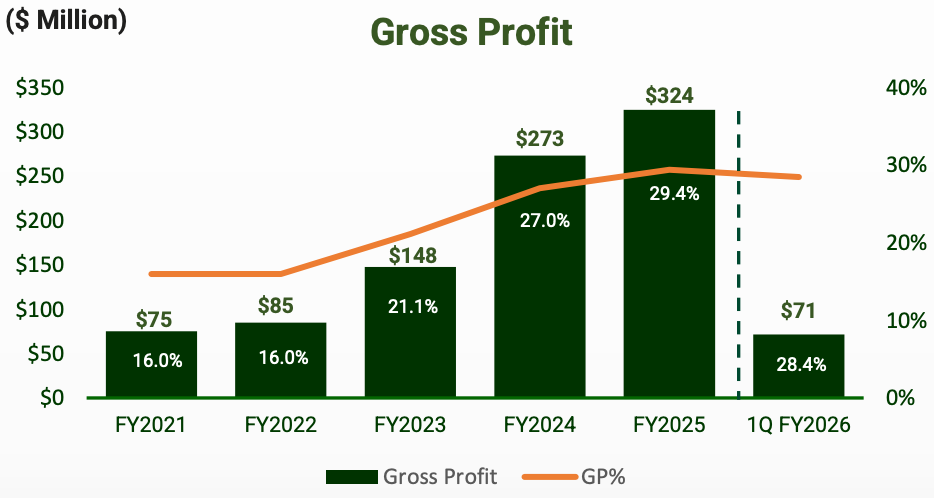

Powell Industries [POWL 0.00%↑] kicked off fiscal 2026 with a solid if mixed quarter. Revenue in Q1 2026 was up only 4% y/y. This modest revenue gain was a far cry from the 24% surge POWL posted in Q1 2025, but it came as no surprise that growth would normalize after 2024’s breakneck pace.

Importantly, profitability improved markedly despite the slower sales. Gross profit jumped 20% to $71 million, lifting gross margin to 28.4% (380 basis points higher than a year ago).

Even with typical first-quarter seasonality and lower volumes, POWL maintained an upper-20s gross margin, showcasing much better pricing and execution than early last year. Net income accordingly climbed 19%, another quarterly earnings record for the company.

A deeper look at revenues by end market shows a mixed picture. Electric utility sales soared 35% as utilities continued modernizing the grid. Oil and gas (excluding petrochemicals) held flatish (up 2%) reflecting steady LNG project activity. Transit/rail was up 5%.

Meanwhile, two historically important segments pulled back: Petrochemical revenues fell 31% as a major multi-year petchem order nears completion. Commercial & Other Industrial revenues dipped 8%. These declines stem from the wind-down of older backlog in petrochemicals and lulls in non-energy industrial orders. Notably, “all other” smaller markets combined grew 36%, indicating broad-based demand outside the few weak spots.

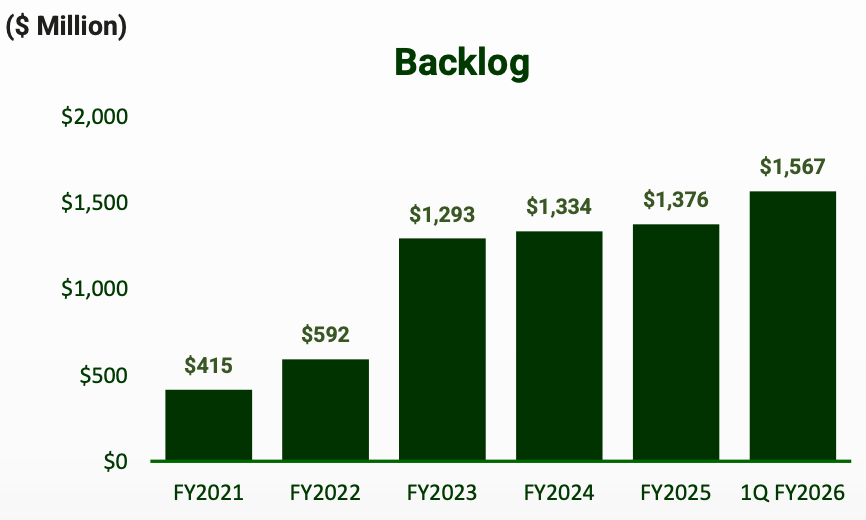

The order book was the true highlight of Q1. POWL racked up $439 million in new orders. That is a 63% spike y/y and the highest quarterly bookings in over two years. For context, orders in the prior quarter (Q4 2025) were $271 million, so activity accelerated dramatically. One more way to frame it: Q1 2026 orders alone basically matched POWL’s entire FY2021 orders.

Management credited two mega-awards for the blowout bookings: a single LNG project worth over $100 million, and a $75 million data center project, one of Powell’s largest-ever data center wins. Underlying demand was strong across nearly every market: the CEO noted robust order activity in oil & gas (especially LNG), electric utilities, and data centers as key drivers.

This influx of business pushed the backlog to $1.6 billion, up 16% from the prior year and up 14% just since the end of Q4. In one quarter, the backlog swelled by over $200 million, ensuring more than a full year of revenue visibility ahead.

In fact, roughly $933 million of this backlog is scheduled to convert to revenue over the next 12 months, giving POWL high confidence in hitting its 2026 targets.

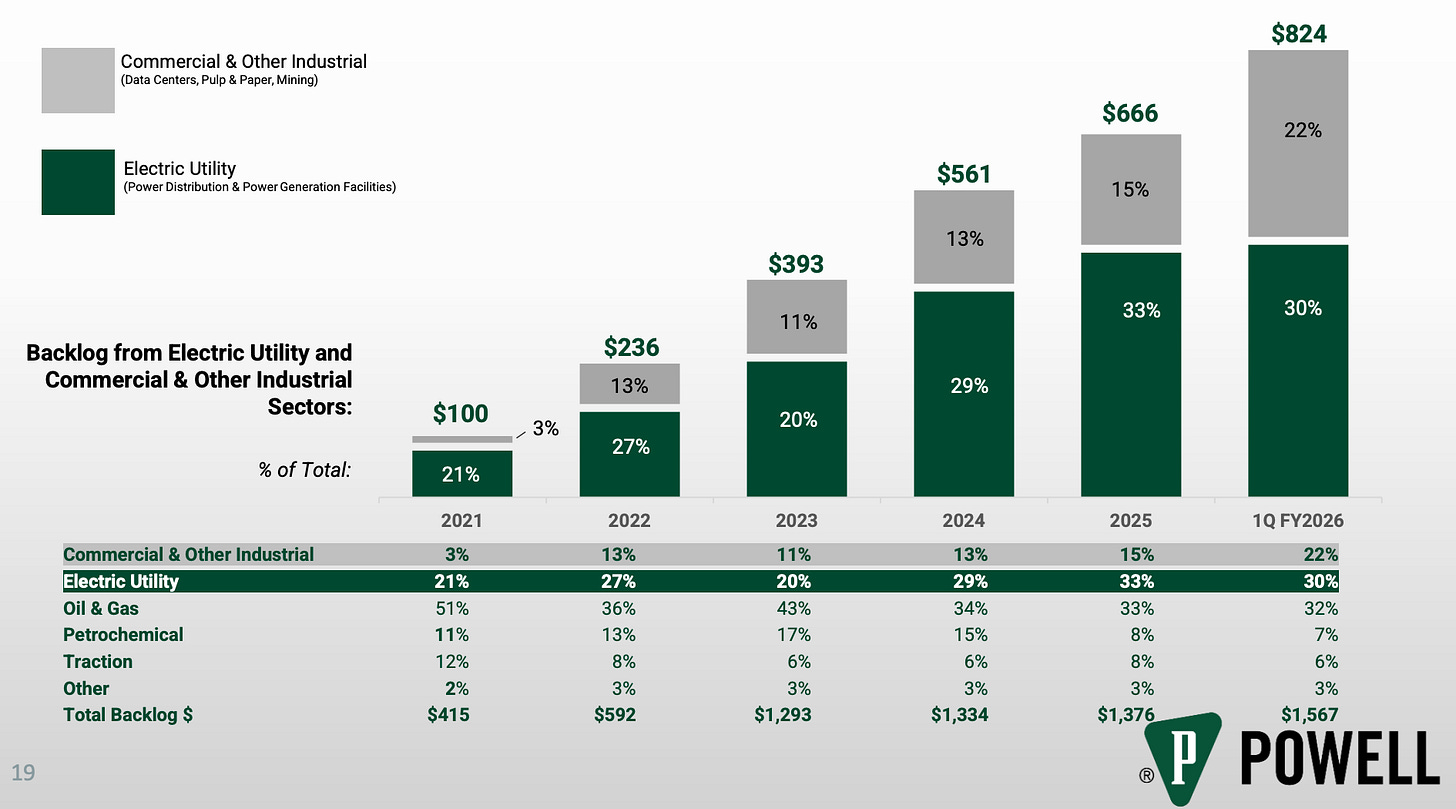

POWL’s strategic pivot toward utilities, data centers, and diversified industrials is clearly evident in the Q1 backlog mix. As of quarter-end, oil & gas projects (excluding petrochemicals) made up 32% of backlog, electric utility projects 30%, and commercial/other industrial 22%. The remaining 16% is largely petrochemical.

This is a far cry from years past when oil, gas, and petrochem dominated the book. In fact, thanks to diversification efforts, nearly half of the backlog (48%) was utility and industrial by late 2025, versus under 20% five years ago. Now in Q1 2026, that shift has progressed even further. Management highlighted that data center projects alone account for 15% of total backlog, a record level. The “Commercial & Other Industrial” category (which includes data centers) now represents 22% of backlog, its largest share ever. This richer mix matters because these newer verticals (like utility and tech infrastructure) generally carry healthier margins and multi-year secular growth tailwinds, whereas legacy petrochemical work is winding down. The CFO affirmed that the backlog’s margin profile and schedule are very favourable, with no low-margin legacy deals dragging down future earnings.

On the profitability front, the Q1 results underscore that its margin expansion is durable. Gross margin of 28.4% was below Q4’s peak of 31.4% (as expected seasonally), but still far above the 24.7% in the year-ago quarter. The company has effectively reset its baseline profitability higher.

In the earnings call, analysts pressed on margin sustainability after the recent string of record gross margins. Metcalf explained that maintaining a “base level” margin in the upper-20s is reasonable going forward, with potential +150–200 bps upside in good quarters from favourable project close-outs. I find this reassuring as management isn’t guiding for a reversion to mid-20s margins; they believe the efficiency gains and pricing discipline achieved in 2025 can persist.

As the CEO put it, there’s no reason those higher margins should “slip back down” now, given stable input costs and the improved execution. Net margin this quarter was 16%, up from 14% a year ago, reflecting the flow-through of gross margin gains.

Operating expenses remain well-controlled, and the balance sheet is pristine. Cash and short-term investments topped $500 million this quarter, with zero long-term debt. This war chest gives POWL flexibility to invest in capacity, R&D, and strategic M&A while weathering any bumps.

Delivering on the Thesis: How Q1 2026 Stacks Up Against Expectations

This first quarter provides a great checkpoint to evaluate my original thesis and prior forecasts.

Where did results align with my expectations, and where did they surprise?

Backlog & Orders: Exceeding Expectations.

One of the pillars of my investment thesis was the massive backlog and visibility. At the start of 2025, I cheered the company’s growing demand backlog and highlighted how it ensured a multi-year growth runway.

Coming into 2026, I anticipated strong orders, but the $439 million booked in Q1 blew me away. I had some caution after Q4 2025’s book-to-bill was under 1.0, but POWL more than made up for it. New orders jumped 63%, and backlog hit $1.6B.

This record backlog not only validates my confidence in the pipeline, but it exceeded what I thought likely in one quarter. In the original thesis, I noted POWL’s “growing demand backlog” and status as a go-to partner in critical projects from oil & gas to data centers.

That’s exactly what played out: they landed marquee contracts in LNG and a mega data center, reinforcing its go-to partner reputation. Frankly, I underestimated how quickly the backlog could re-accelerate. I was aware of potential LNG projects and data center wins, but a +$100M order materializing this quarter is a pleasant upside surprise. It assuages the concern I voiced a year ago when analysts fretted about LNG project permitting delays slowing orders.

POWL managed to convert LNG opportunities despite regulatory noise. That’s a testament to the “secular and durable” nature of this demand, as management says.

Revenue Growth: A Bit Soft, but Understandable.

I expected revenue growth to moderate in 2025-2026 compared to the “breakneck” 2024 pace, but Q1’s mere 4% rise was even a tad lighter than I hoped. In my Q4 2025 review, I described POWL as “catching its breath” with more modest growth, and indeed Q1’s top-line barely inched up.

Part of this is timing: shipments in petrochem and industrial were down as some big projects roll off, and Q4 2025 was an unusually high revenue quarter. Q1 has seasonal weakness too. Given the huge backlog and 63% jump in orders, I suspect growth will pick up later in fiscal 2026 as POWL works through the new bookings.

So while Q1 revenue was a touch below my expectations, it’s not due to demand issues and more a lull in the delivery schedule. I noted previously that the 2025 growth cooled from 2024’s torrid pace; now I see 2026 shaping up as a year of back-half weighted growth.

Big picture, the company is still on track to post another year of record revenue. Management essentially guided that 2026 should look similar to 2025’s financial profile, which implies another record earnings year if achieved. I’m content to be patient here, especially since the leading indicators (orders) are so strong.

Margins: Aligned or Better.

A key part of my thesis was that they could maintain or even improve its profit margins despite inflation and supply chain challenges, thanks to pricing power and efficiency.

Earlier, I highlighted their “knack for improving margins and keeping costs in check” which drove steady earnings growth. However, I did caution myself not to “straight-line +30% margins forever” after seeing some one-time project closeout boosts in mid-2025.

Q1 2026 played out in line with that calibrated view: gross margin was 28.4%, not the 31% of last quarter (no one-off windfalls this time), but importantly it was up 3.7 percentage points y/y. This confirms the underlying margin improvement is real and sustainable. Management’s commentary reinforced what I wrote in Q3 2025, that we shouldn’t expect +30% every quarter, but high-20s with occasional boosts is the new normal.

They literally guided to maintaining upper-20s base margins, with 150-200 bps extra from favorable close-outs when they happen. That is exactly the scenario I modeled in my head. Q4 2025 gross margin hit a record 31.4%, and I suspected it was partially timing; Q1’s step down was expected due to seasonality, so no disappointment there.

If anything, margins are a tad better than I’d forecasted on a y/y basis. The fact that even in a lighter revenue quarter POWL held nearly 28-29% gross margin (versus 25% a year ago) is a big win. It suggests my thesis of POWL having stronger pricing power, better project execution, and a more favorable sales mix (fewer low-margin projects) is playing out in reality.

A year ago I might have underestimated how much margin uplift they could achieve. I talked about inflation risks and such, but the company has clearly proven it can price through cost increases and run lean. I’m now more confident that 28-30% gross margins can be sustained, given stable supply costs and the high-margin backlog in hand.

Backlog Composition & Market Mix: Right on Track (if not ahead).

One thesis point I’ve hammered since my original article is its evolution beyond its oil & gas roots. I noted that POWL was expanding into data centers, utilities, and renewables, and that these efforts would pay off.

By Q4 2025, I was already impressed that nearly half the backlog was utility/industrial, calling it a favourable shift that de-risks the business. Q1 2026 has accelerated that trend even more than I anticipated. The data center chunk of backlog is higher than I would have guessed a year ago.

I knew they were gaining traction in data centers (they acquired an automation firm, Remsdaq, aimed at utility/data center solutions), but seeing a single $75M data center order and record backlog contribution confirms that POWL is successfully riding the AI/datacenter wave.

The electric utility share (30% of backlog) and oil & gas share (32%) are roughly as expected. I figured utilities would rival oil & gas by now, and they do. One surprise is how quickly petrochemical work has dwindled (just 16% of backlog); I anticipated petrochem would fade as a percentage, but the drop-off with that 2023 mega-project finishing is even sharper than thought.

Fortunately, diversification meant other markets filled the gap. For instance, the “commercial & other industrial” backlog (22%) is largely data centers and domestic manufacturing projects now, which picked up the slack. I’d call this very much in alignment with my thesis. Possibly even ahead of schedule in terms of transforming the backlog mix.

I previously wrote that the future growth would be driven by broad electrification and digital infrastructure trends, not just oil/gas, and here we are: data centers, utilities, and LNG export all driving orders. It’s gratifying to see the company I championed as a “pick-and-shovel” play on AI and grid upgrades actually delivering on that promise.

Market Dynamics and Execution: Better Than Expected.

In mid-2025, I turned a bit cautious because I saw signs of order growth slowing and backlog flattening. I even mused that the risk-reward was shifting and “heightened vigilance” was warranted. The concerns raised was around LNG tariffs/regulations and capacity constraints have thus far not impeded growth.

Management acknowledged some risk of order timing and cancellations, but the Q1 results show demand is durable. LNG orders are coming through despite regulatory noise, and Powell is successfully expanding capacity (e.g. the Houston/Jacintoport expansion remains on schedule). I had also noted that pricing on large projects was “stable but not improving” in 2025.

Essentially, POWL couldn’t count on price inflation to juice growth and needed flawless execution. They’ve delivered on that: project execution has been excellent (hence the margin gains), and while pricing hasn’t spiked, it’s holding steady in a stable cost environment, which is just as good.

Another point I previously underestimated was how strong the data center “frenzy” would get. It’s one thing to say AI will require more power gear, it’s another to see tangible +$50M orders materialize. Management now calls the data center and commercial segment a “strategic shift”, and they’re leaning into it with additional manufacturing capacity and R&D.

If anything, I might have overestimated the near-term risk from things like LNG policy or petrochem weakness, and underestimated the positive momentum in new markets like data centers. The net result is that execution and end-market durability have so far exceeded my expectations, and my overall bullish thesis remains very much intact.

Outlook: Tailwinds Strengthen in Utilities, LNG, and Data Centers

Zooming out, the broader industry backdrop underpinning POWL’s success looks as strong as ever. The company’s core end markets are each benefiting from powerful secular tailwinds as we move through 2026. Recent research and developments in these sectors give me even more confidence (with a dash of caution) about POWL’s forward trajectory.

Electric Utility Boom (Grid Modernization & Electrification)

Utilities are in the midst of an infrastructure super-cycle. Power demand is climbing to unprecedented levels, driven by electrification, economic growth, and the energy transition.

In fact, the US electric utility sector faces “unprecedented load growth” in 2026, which is straining grid infrastructure and forcing utilities to invest heavily in upgrades and expansion. One industry outlook noted that, facing aggressive demand forecasts, utilities are “rolling out massive spending plans” on transmission and distribution capacity. This is exactly the kind of environment where POWL thrives. Utilities need new switchgear, upgraded substations, and more advanced power control systems to handle the load.

The Q4 2025 call described the wave of electrical infrastructure investment as “broad and durable,” with utilities modernizing grids and adding capacity to support EV charging and renewables. That trend is clearly continuing into 2026.

The utility spending boom is multi-faceted: federal initiatives (grants and reliability standards), the push for renewables integration (requiring grid enhancements), and even the AI/data center build-out influencing utilities (large data centers demand huge power feeds, spurring new power generation and distribution projects). All signs point to another strong year for utility orders.

This aligns with POWL’s report of utility sector revenue up 35% in Q1 and management’s confidence that the utility market strength will persist in 2026. I believe the backlog composition is a sweet spot: utilities tend to place big, lengthy orders and are less cyclical than oil/gas.

As long as utilities are spending on the grid at high levels (and it appears they will, given policy support and the necessity of replacing aging infrastructure), POWL should see a steady flow of high-quality projects.

In my original thesis I highlighted grid modernization and electrification as key tailwinds, and that’s even more true today. There’s some caution in that utilities have to balance spending with ratepayer impacts as they can’t spend infinitely without regulatory approval. But the need is so palpable (some experts1 say reliability and load issues make these investments non-negotiable) that I expect grid capex to remain elevated for years.

LNG Exports, A Second Wave Underway

POWL’s exposure to LNG projects was a big part of my investment case and also a point of concern at times. After Russia’s invasion of Ukraine in 2022, global LNG demand surged, and I believed US exporters would scramble to build new capacity (good for POWL’s high-voltage equipment business).

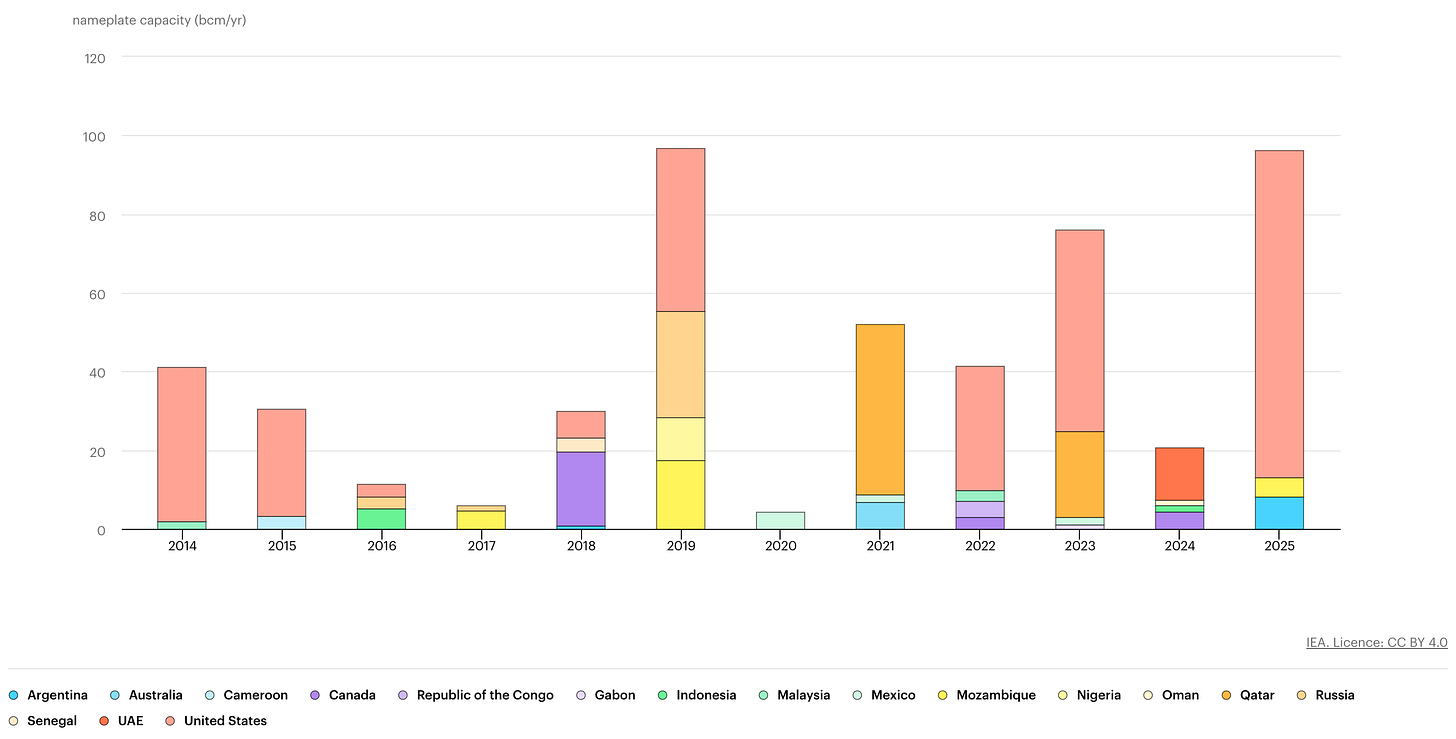

However, in early 2025, I worried that permitting delays and tariffs could slow the pace of LNG projects. The latest data suggests the LNG expansion is pressing ahead strongly. According to the International Energy Agency, global natural gas demand and LNG supply are on track to hit record highs in 2026. North America (especially the US Gulf Coast) remains “the engine of global LNG growth,” expected to deliver over 85% of new LNG supply in 2026. In other words, a huge wave of LNG export terminal construction is kicking into gear, centred in POWL’s backyard (Texas/Louisiana).

Crucially, 2025 saw a flurry of LNG project approvals (FIDs) after a slow 2024. In fact, 2025 was the second-strongest year ever for LNG project FIDs, with over 90 billion cubic meters of new capacity sanctioned, more than double the annual average in prior years.

Over 80 bcm of that was US projects, a new record. This came after a regulatory pause in 2024 was reversed, unleashing pent-up development.

What does this mean for POWL?

It means a new wave of LNG export terminals and expansions is now funded and moving forward, many scheduled to start heavy construction in 2026-2027. POWL just captured a >$100M LNG order in Q1, likely related to one of these big projects, and I suspect more orders could follow as other terminals reach equipment procurement stages.

The IEA projects US LNG capacity will keep expanding such that America’s share of the global LNG market rises from 25% to 33% by 2030. The Gulf Coast is essentially a boomtown for engineering firms and suppliers like POWL.

Of course, LNG projects are large and lumpy and any given quarter can be feast or famine. But the overarching trend is that LNG infrastructure demand remains durable and politically supported. Trump has emphasized energy exports and “dominance” (in 2026, policy is quite favourable toward gas development). Europe’s continued pivot away from Russian gas and Asia’s growing gas needs mean these export terminals have eager customers waiting.

For POWL, this translates into sustained opportunities for high-voltage electrical systems, generator enclosures, and related gear at these massive facilities. I’ll keep an eye on any specific project delays or cancellations (LNG is capital-intensive and not immune to cost inflation), but so far the risk of widespread LNG slowdown appears low. If anything, I might adjust my outlook on LNG from “cautiously optimistic” to “solidly optimistic” as the order flow could be stronger for longer than I conservatively assumed a year ago, given the sheer volume of capacity slated to be built.

In Q2 2025 I noted that analysts were worried about LNG project sustainability, but the data now indicates LNG is entering a multi-year growth phase that should keep Powell busy.

Data Centers & AI, Powering a Digital Construction Surge

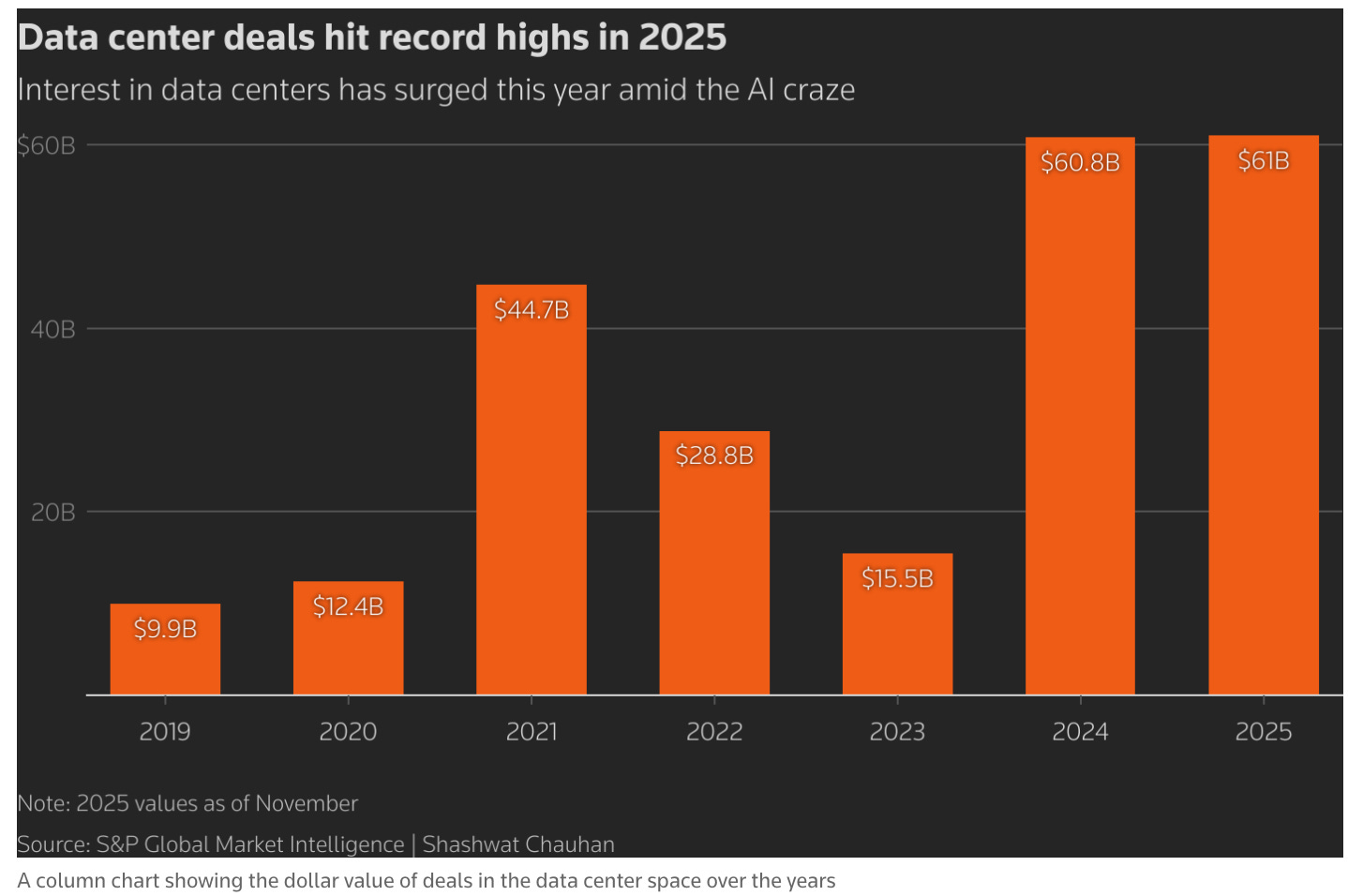

If there’s one trend that has surprised even me with its intensity, it’s the data center construction boom fueled by AI and cloud demand. I was bullish on POWL’s prospects in data centers (I wrote about the “AI revolution’s backbone” and POWL’s role in it), but the numbers coming out of 2025 and into 2026 are astounding.

We are truly in an AI data center frenzy. Hyperscale cloud providers and AI firms are pouring capital into new data center capacity at an unprecedented rate. Consider that worldwide, investment in data center infrastructure hit a record $61 billion in 2025, far above any prior year.

In the US, data center construction spending skyrocketed. By mid-2025, the annualized construction spend was around $41 billion, up from just $1.6B per year in 2014 (a testament to how quickly this industry scaled).

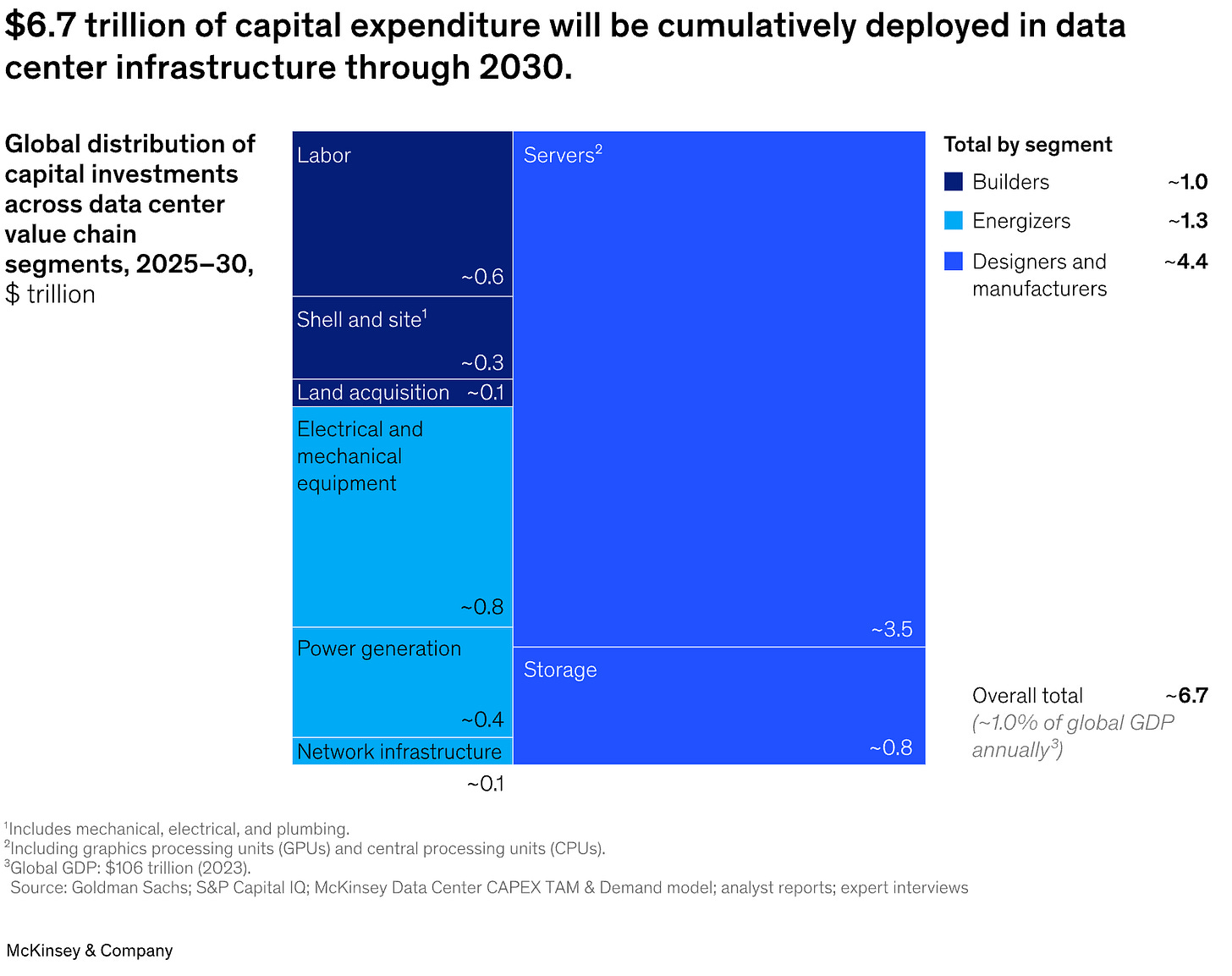

Looking ahead, analysts project that this growth is nowhere near finished. McKinsey forecasts that by 2030, companies will invest around $6.7 trillion globally in data center infrastructure, with more than 40% of that in the US.

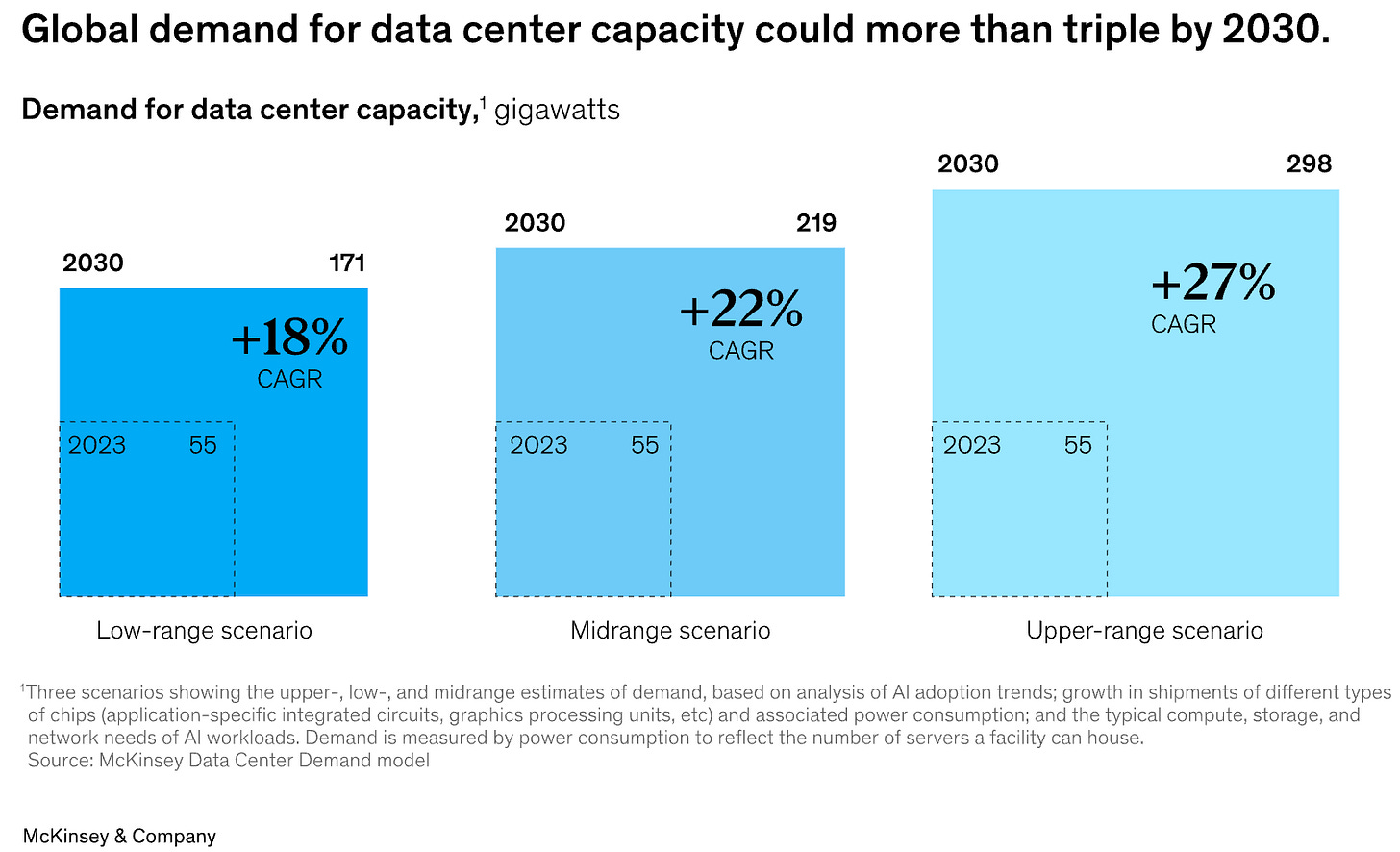

That implies triple-digit billions per year in capital spend for the rest of the decade. They also estimate that global data center capacity demand could more than triple by 2030 (22% CAGR), with U.S. demand growing 20-25% annually.

These are staggering figures. In the near term, JLL reported a “data center availability crisis” in 2025 as vacancy hit record lows and power availability has become the key constraint for new data centers, not demand. North America could see $1 trillion of development between 2025 and 2030, adding over 100 GW of new capacity if forecasts hold.

For POWL, all this translates into a massive new market opportunity that barely existed at this scale a few years ago. Every new 50MW or 100MW data center campus needs robust power distribution: switchgear, bus ducts, backup power integration, etc. POWL specializes in custom electrical gear for exactly these kinds of critical facilities.

The Q1 call explicitly noted that the acceleration of orders was driven by data centers, and management is now placing greater emphasis on the data center market as a growth driver. The fact that data centers are 15% of backlog (roughly $240M) shows POWL has already carved out a meaningful share in this sector. And given industry trends, I expect that share to grow. I won’t be surprised if by late 2026, the backlog is 20-25% data centers, especially as they integrate the Remsdaq acquisition to offer more automation and controls for these customers.

One caveat…

The data center boom is intense and could be subject to some cyclicality or digestion periods. We’ve seen record investment in 2025; it’s possible that at some point, hyperscalers pause to absorb capacity, or if interest rates stay high, financing could tighten.

There are also challenges (and opportunities) around power availability. Data center developers are literally constrained by how fast utilities can supply them with power. This actually circles back to POWL’s utility business (e.g. Dominion Energy building new substations for “Data Center Alley” in Virginia).

So far, demand is so high that any delays are more due to supply bottlenecks (land, power, equipment) than a pullback in the desire to build. I will watch for any signs of oversupply, but given AI’s early innings, my inclination is that 2026 will be another strong year for data center build-outs. Hyperscalers are taking unusual steps like partnering with AI labs and raising record debt to finance data center expansion, underscoring how critical it is to get these facilities up and running.

From POWL’s perspective, the company just needs to continue executing to capture this wave. That means scaling production capacity (which they are doing with new facilities and leasing extra space), managing supply chain lead times, and perhaps innovating in modular data center electrical solutions.

The tailwind is at POWL’s back: as long as the big tech players are racing to build data centers, POWL will have a seat at the table as a supplier of the “pick-and-shovel” equipment.

My outlook on this segment has actually become even more bullish after seeing the recent data. I initially saw it as a nice supplement to POWL’s core business, but it’s quickly turning into a core pillar of growth in its own right. The secular drivers (cloud services, AI training, digitalization) are so strong that I’m comfortable with POWL leaning into this market. If anything, the challenge will be ensuring they maintain quality and delivery times amid such high demand … a good problem to have.

Valuation Check: Better Business, Less Margin of Safety

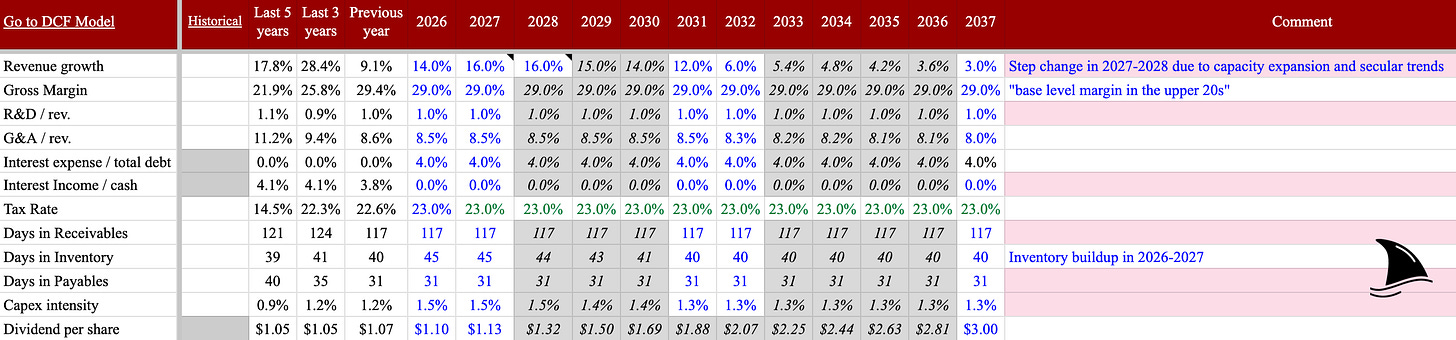

I refreshed my valuation after Q1 using updated operating assumptions. The result is a higher fair value, but not enough to justify today’s price.

My updated target price moved from $400 to $545. The stock trades around $580, or roughly 6% above my estimate of fair value.

Here are the main assumptions used in the DCF model:

On the top line, I assume mid-teens revenue growth through 2028, driven by capacity expansion, LNG project normalization, utility spending, and a step-change in data center exposure. Growth then decelerates gradually into the low single digits by the mid-2030s as the business matures.

On margins, I model a 29% gross margin as a steady-state level. That aligns with management’s repeated comments around a “base level margin in the upper 20s” and reflects a structurally better mix, better execution, and fewer low-quality legacy projects.

I keep R&D at 1% of revenue and G&A drifting modestly lower over time due to economies of scale. Capex runs slightly elevated in the near term at around 1.5% of revenue, reflecting capacity investments in 2026 and 2027, then normalizes closer to 1.3%.

Working capital assumptions stay conservative. I model a temporary inventory build as capacity ramps, then a return to historical efficiency once new facilities stabilize.

For the discount rate, I use a WACC of 8%. That includes an unlevered beta of 1.19 for electrical components. I see no reason to push that lower, given where rates sit today.

Put together, these assumptions support a materially higher intrinsic value than my prior model. They also leave less room for error.

At $580, Powell trades above my fair value. Not egregiously. But enough that the margin of safety is gone.

That said, I am not selling here.

I am comfortable holding a great business slightly above my fair value when the company continues to surprise to the upside. POWL has earned that flexibility through execution, backlog quality, and balance sheet strength.

Still, discipline matters. If I need capital for a new position, POWL would likely be the first candidate. Not because the story broke. Because the valuation now reflects most of what I already know.

Portfolio Update

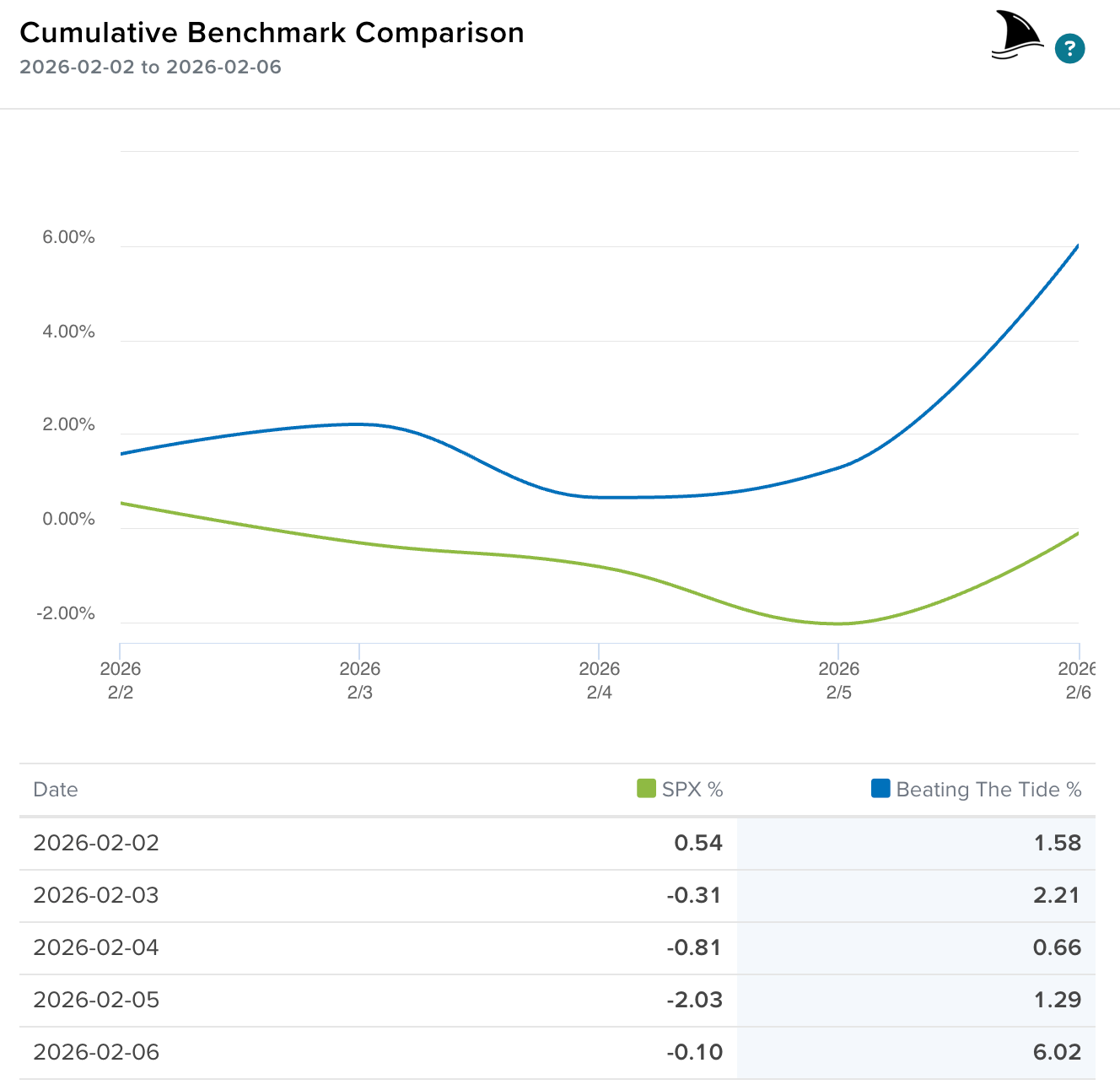

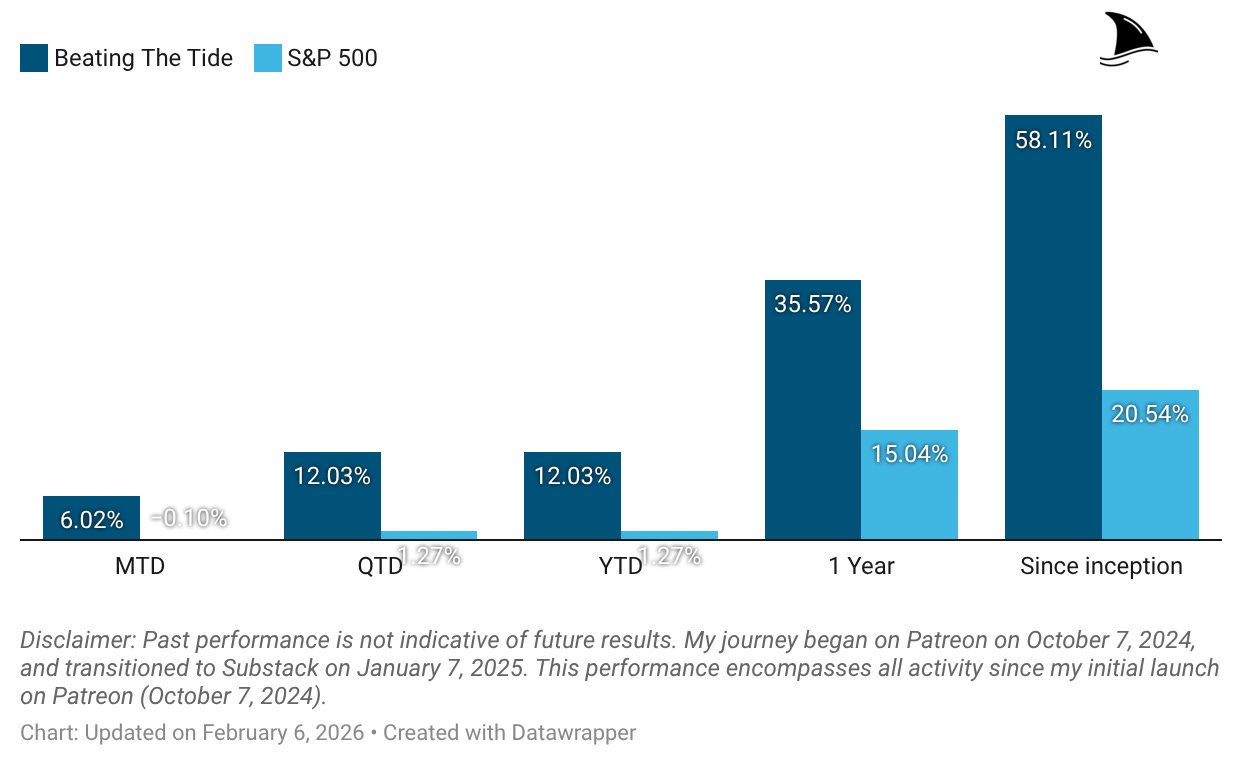

It was an outstanding week for the portfolio, where we widened the gap vs. the S&P 500.

Portfolio Return

Month-to-date: +6.0% vs. the S&P 500’s -0.1%.

Year-to-date: +12.0% vs. the S&P 500’s +1.3%. That is a gap of 1,076 points.

Since inception: +58.1% vs. the S&P 500’s +20.5%. That’s 2.8x the market.

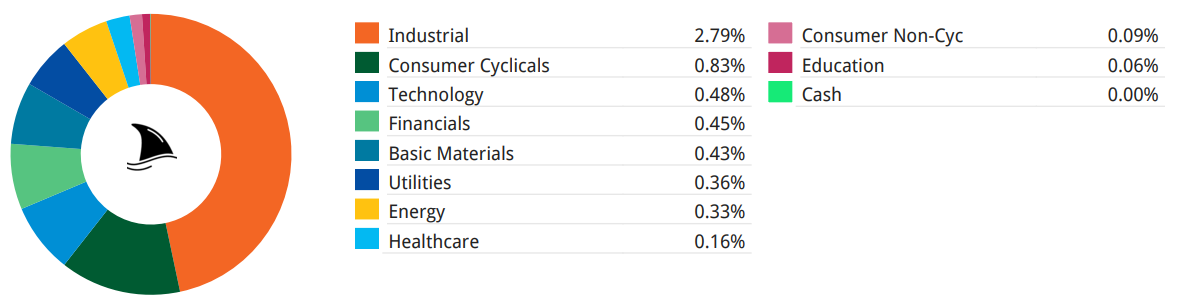

Contribution by Sector

Industrials and consumer cyclicals led the gains this week.

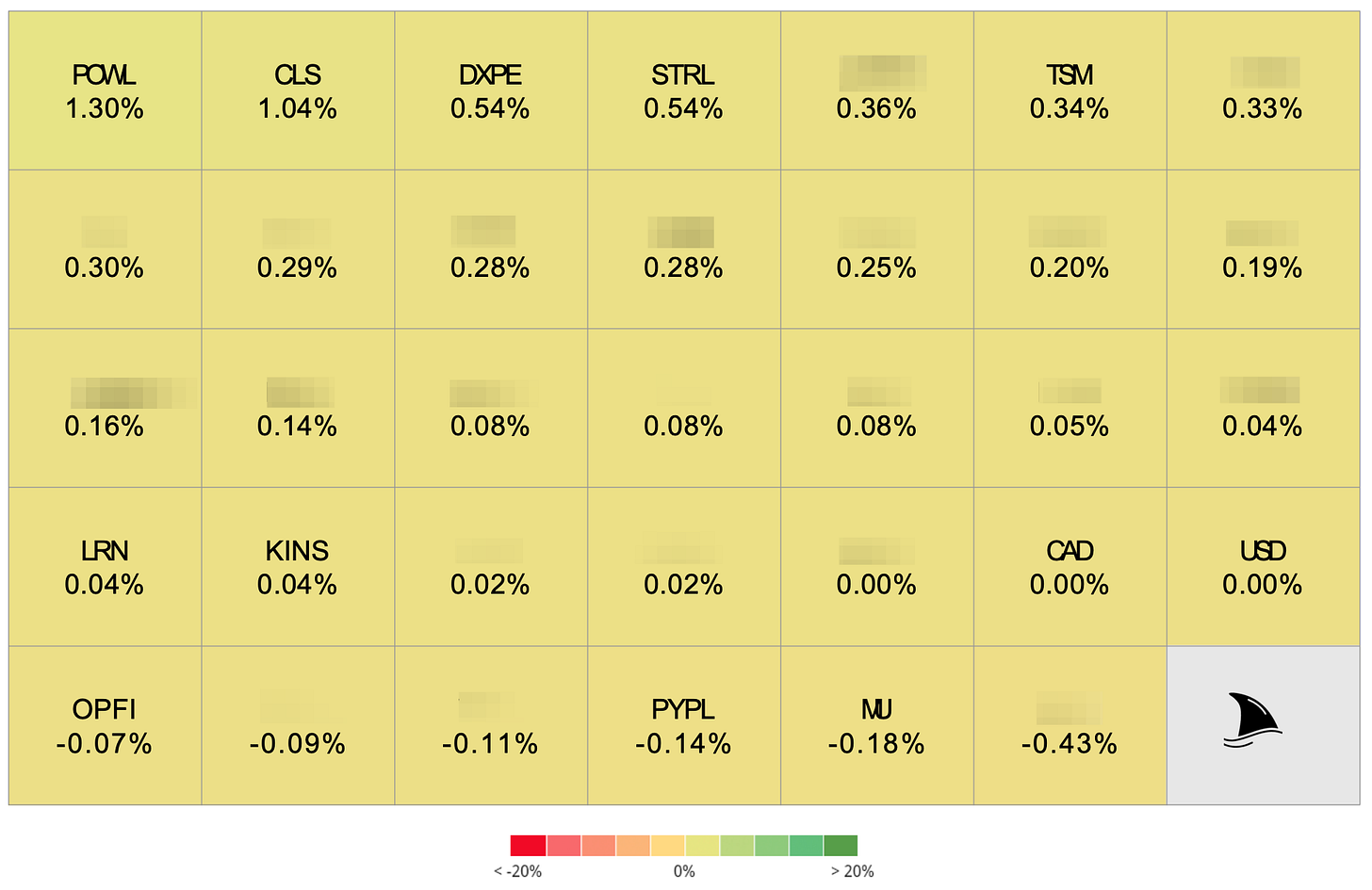

Contribution by Position

(For the full breakdown plus commentary on earnings results and the big movers, see Weekly Stock Performance Tracker)

+130 bps POWL 0.00%↑ (Thesis)

+104 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

+54 bps DXPE 0.00%↑ (Thesis)

+54 bps STRL 0.00%↑ (Thesis)

+34 bps TSM 0.00%↑ (Thesis)

+4 bps LRN 0.00%↑ (Thesis)

+4 bps KINS 0.00%↑ (Thesis)

-7 bps OPFI 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Never Stop Asking Why, Using the “5 Whys” to Solve Problems and Pick Stocks

The Rise and Fall of Moats: When Walls Built to Protect Become Traps

How I Earn $3,000-$7,000 a Month While Waiting to Buy Great Stocks Cheaper

https://www.utilitydive.com/news/utility-electricity-trends-outlook-2026/810990/

https://www.utilitydive.com/news/utility-power-sector-trends-2026/808782/

https://www.rtoinsider.com/125018-aceee-report-urges-greater-efficiency-flexibility-grid-demand-grows/

https://www.ubp.com/en/news-insights/newsroom/the-rise-of-power-demand

Another detailed and thorough weekly. Very interesting insight on POWL. Thank you. So no sneak preview of the new position I see, not even a hint? :P