Powell Industries Q4 Earnings Review: Margins Hit Records While Growth Catches a Breath

Record margins, a bigger cash pile and a utility-heavy backlog give Powell a solid setup for 2026 despite softer oil and petrochem.

POWL 0.00%↑ just wrapped up fiscal 2025 with a solid finish to a record year. The company’s growth cooled off a bit from the breakneck pace of 2024, but it strengthened its profitability and positioned itself well for the future. I see this as POWL catching its breath after a sprint. Revenue didn’t leap as dramatically as last year, yet the business got leaner and more efficient in the process.

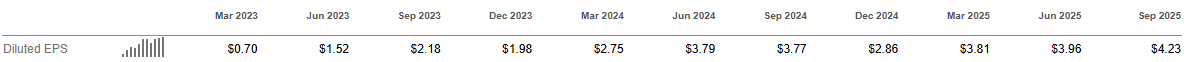

In Q4 alone, Powell earned a record $4.23 per share…

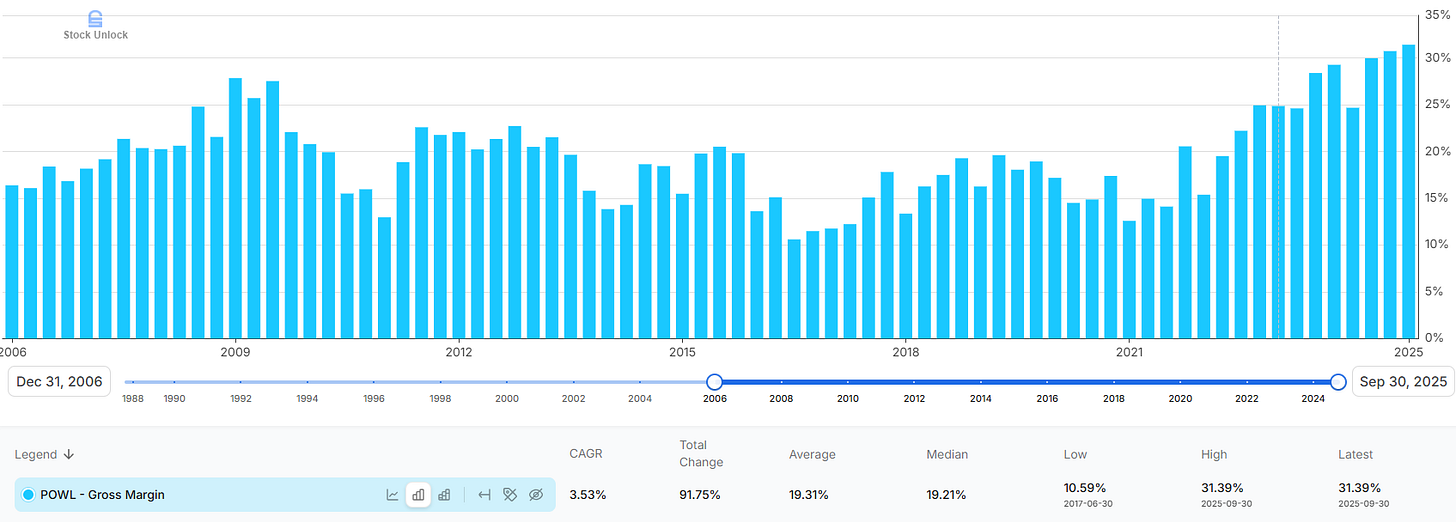

… while achieving its highest-ever gross margin of 31.4%.

Here’s my review of Powell’s latest quarterly and annual performance, with a look at what drove the results and what tailwinds lie ahead.

Growth Slows, But Profit Margins Climb

It’s no surprise that Powell’s revenue growth in 2025 was more modest than the prior year as 2024 was a tough act to follow. Q4 2025 revenues came in at $298 million (+8% y/y). In contrast, the same quarter a year earlier saw revenues surge 32% (thanks to some huge projects then).

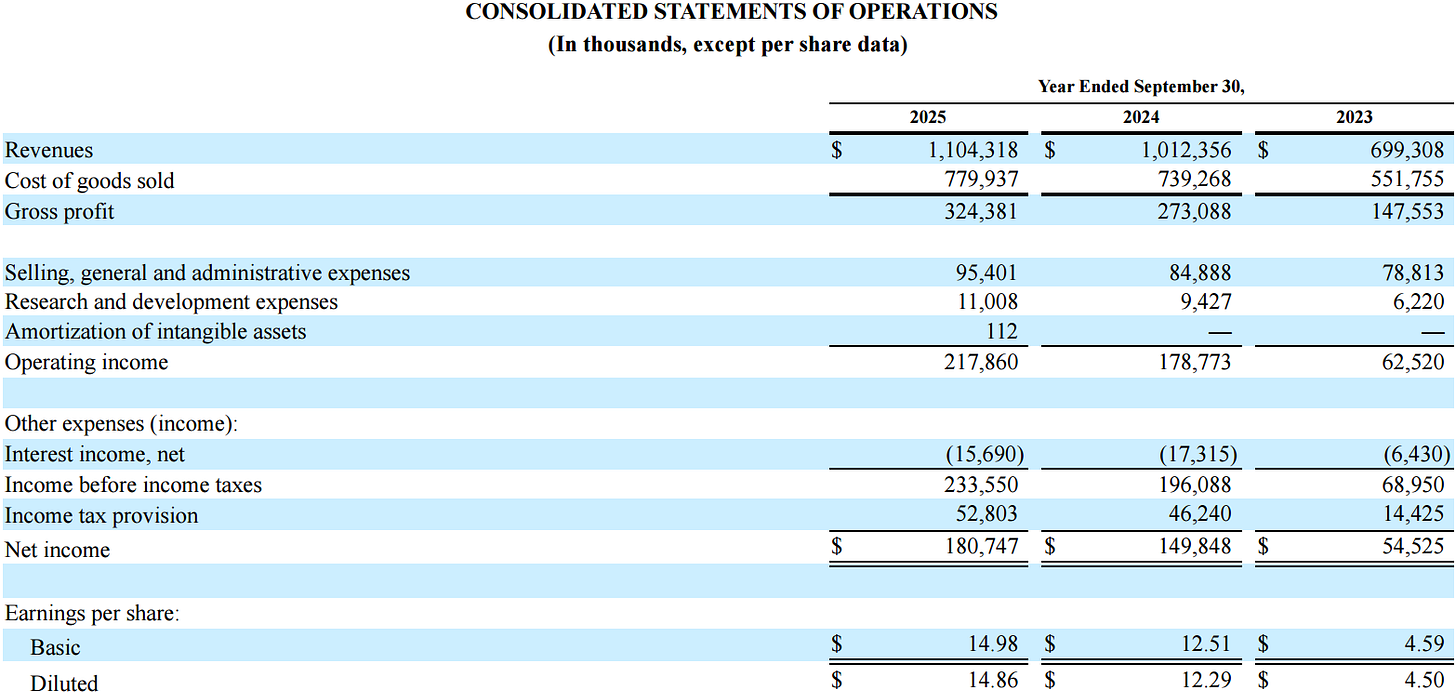

So this year’s single-digit growth was expected. For the full fiscal year 2025, Powell’s revenue reached $1.10 billion, +9% vs2024. That’s a healthy growth rate, even if it’s a step down from the prior year’s rapid climb.

What really stands out is how much more profit Powell squeezed out of each dollar of sales. In Q4, gross profit jumped 16% to about $94 million: double the rate of revenue growth. Executives credit “favorable volume leverage and strong project execution” in a stable pricing environment for this improvement. I interpret that as POWL managing its costs well and executing projects efficiently, even as growth moderated.

For the full year, gross margin rose to 29.4%, up from 27.0% in 2024. A clear sign that the company became more profitable and operationally disciplined. Net income for fiscal 2025 was $180.7 million, up 21% from last year. In other words, profit grew more than twice as fast as revenue, thanks to those fatter margins and good cost control.

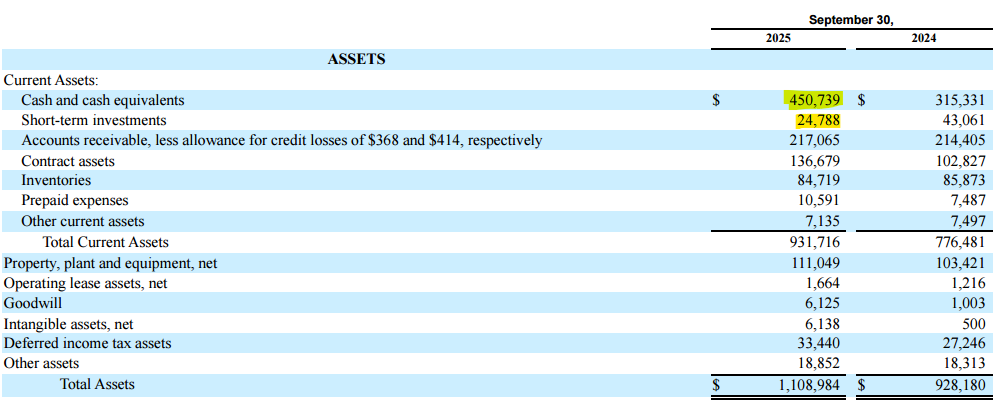

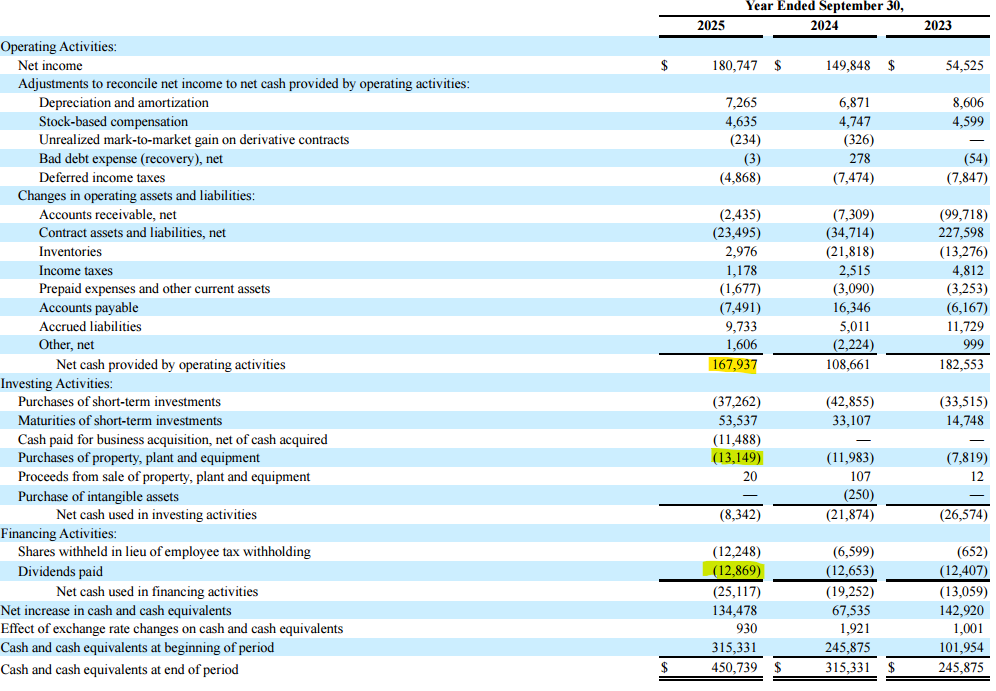

EPS hit new highs as well. Q4’s $4.23 diluted EPS was the highest quarterly EPS in the company’s history. For the full year, EPS was $14.86, up from $12.29 the year before. This strong bottom-line performance underscores what I saw in the results: Powell is running a tighter ship. The company even generated $61 million of operating cash flow in Q4 alone, bolstering its cash reserves. By fiscal year-end, Powell’s cash and short-term investments swelled to $476 million, up from about $358 million a year prior, giving it a very solid financial cushion.

Electric Utility & Light Rail Surge as Oil/Gas Lags

A closer look at its markets reveals a tale of two worlds. On one side, Electric Utility and Light Rail projects boomed in 2025; on the other, traditional Oil & Gas and Petrochemical orders slowed down. This shift toward infrastructure and transit work and away from refining and petrochem was evident in the numbers.

In Q4, Powell’s revenue growth was entirely driven by the electric utility and light rail traction segments, which saw sales double and jump 85% y/y, respectively. That is huge growth by any measure. Utilities are clearly investing heavily in power systems, and POWL benefited as a key supplier of custom electrical gear for the grid.

Likewise, demand from light rail and transit projects surged. Full-year figures show the same trend: over fiscal 2025, Electric Utility revenues grew about 50%, and Light Rail Traction Power was up 87% compared to 2024. These are remarkable increases. I suspect they reflect a mix of government infrastructure spending (e.g. upgrades to the electric grid and transit systems) and utilities upgrading equipment to handle new loads (like renewables or just replacing aging infrastructure).

As the CEO puts it, the company saw “strong growth in our non-industrial markets” meaning sectors like utility, transit, and general industrial, which have been a strategic focus in recent years. This diversification is paying off, since five years ago POWL was far more dependent on oil and gas projects.

On the flip side, Oil & Gas and Petrochemical activity fell in 2025. Powell’s Q4 revenue from Oil & Gas projects was down 10% from a year ago, and Petrochemical (think chemical plants, refineries) was down 25%. Essentially, these segments gave back some of the big gains they had in late 2024, when POWL delivered several large energy sector projects. Management noted “softness in portions of our traditional oil and gas and petrochemical markets such as refineries and polyethylene and polypropylene facilities.”

That is, orders from refinery and plastics plant projects have been slower lately, which put a dent in the petrochem revenue. Part of this is simply tough comparisons as last year had unusually large jobs that boosted the numbers, and those didn’t repeat.

So, is this energy-related weakness a reason to worry?

I don’t think so.

For one, it’s already being offset by strength in other areas. POWL said utility, data center, and natural gas power projects (including LNG export terminals) are picking up the slack and “offsetting some softness” in traditional oil & gas.

In fact, Powell’s full-year new orders for 2025 increased 9% to $1.2 billion, thanks in part to big orders in the Oil & Gas sector despite the revenue decline.

This indicates that while deliveries for certain energy projects were down in 2025, the pipeline of future energy work is still healthy.

Looking ahead, there are good reasons to expect the Oil & Gas and Petrochemical segments to regain momentum. As I explained here, global energy demand isn’t going away. If anything, emerging trends are bolstering it.

A striking example is the rise of AI and data centers, which are extremely power-hungry. Worldwide, electricity usage by data centers is expected to roughly double by 2030, akin to adding another large country’s worth of demand. In the near term, over 40% of that extra power is projected to come from natural gas and coal plants (until renewables catch up).

What does that mean? It means hydrocarbons, especially natural gas, will play a critical role in keeping the lights on for all those servers. This should put a firm floor under demand for gas infrastructure.

If energy sector sentiment improves or supply tightens (say due to geopolitics or years of underinvestment), oil and gas companies could boost spending. They’re already generating solid cash flows and many are profitable even at $60 oil. I believe this creates a setup for a rebound: as energy firms regain confidence, they may greenlight more projects such as LNG export terminals, gas-fired power plants, petrochemical expansions, etc.

Powell is directly exposed to that upside. I’m bullish as I see a strong and extended cycle of LNG projects over the next 3–5 years. LNG is essentially super-chilled natural gas for export, and with global demand rising, a wave of new U.S. export facilities is expected. Powell supplies the electrical control systems for these massive complexes.

To ensure it can meet this coming demand, POWL is expanding its factory floors. POWL announced a $12.4 million expansion of its Jacintoport facility in Houston, which will add 335,000 square feet of production space (a 62% increase) and double the site’s shoreline bulkhead to 1,150 feet. Jacintoport sits along a shipping channel, and the added shoreline means POWL can load out more and larger modules onto barges or ships. This expansion is “primarily focused on supporting…the incoming wave of anticipated LNG project work” in the next few years.

The production and export of U.S. LNG will play a critical role in the global energy landscape, and this investment ensures POWL can keep leading in power distribution solutions for these projects. The expanded yard should be ready in the second half of fiscal 2026, just in time for that LNG boom. I find it encouraging that Powell is proactively adding capacity. This move positions Powell to capture as much of the LNG infrastructure wave as possible.

Orders and Backlog: Strong Pipeline into 2026

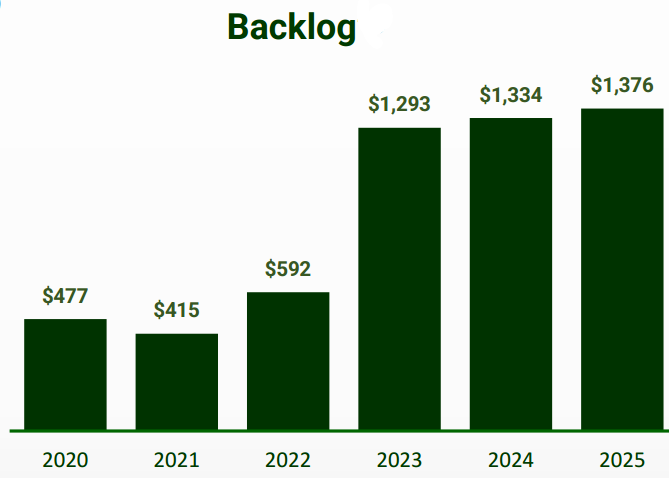

One of POWL’s strengths is its backlog. The queue of orders waiting to be filled. At the end of 2025, backlog stood at $1.4 billion, up 3% from a year prior and roughly equal to about 15 months of sales.

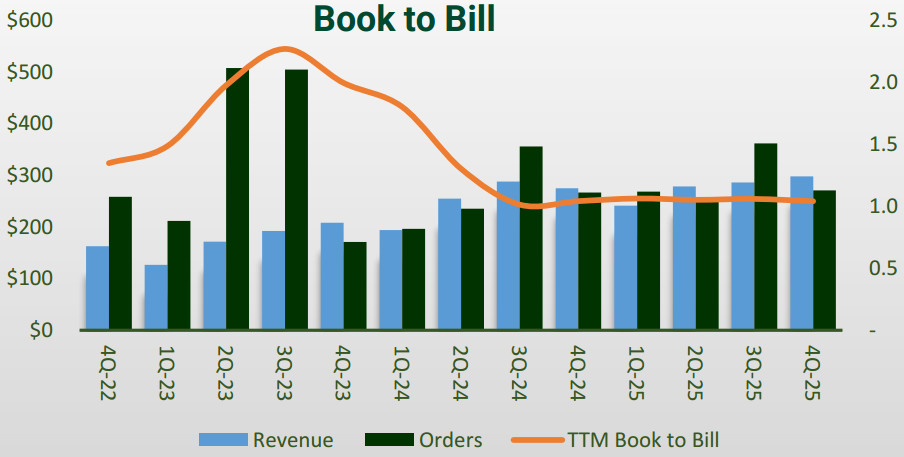

This near-record backlog gives Powell a nice revenue cushion going forward. It’s like having a full book of business already on the calendar. During Q4, new orders were $271 million, roughly flat (+1%) y/y. That put the book-to-bill ratio (orders divided by revenue) at around 0.9 for the quarter, meaning the backlog shrank just a touch sequentially (as Q4 shipments slightly outpaced new bookings). However, for the full year, book-to-bill was 1.0 as it booked $1.2 billion of orders against $1.1 billion revenue.

Essentially, the company replenished its backlog as fast as it burned it, which is a good sign of balanced demand.

Digging into order trends: POWL noted that Q4 didn’t include any “mega projects,” unlike some previous quarters. Instead, the order book was filled with a higher volume of small to medium-sized projects across various sectors. This diversification can be healthy as it means the company isn’t relying on one or two giant contracts, and it keeps its factories busy with a mix of work. Notably, the Electric Utility and Commercial & Other Industrial markets led the order intake in Q4. Meanwhile, full-year orders were up across Oil & Gas, Electric Utility, and Light Rail markets, even as Petrochemical orders lagged. This aligns with the revenue story we discussed: utilities and infrastructure are driving growth, offsetting softness in refining/chemicals.

The composition of the backlog has also shifted favorably, in my view. Thanks to the diversification efforts, nearly half of the backlog (48%) is now made up of utility and other industrial projects, up from under 20% five years ago. That’s a dramatic change. It means Powell is much less dependent on volatile oil/gas cycles than it used to be, and more plugged into secular trends like grid upgrades, transit, and data center power (all of which tend to have multi-year investment cycles).

Management commented that future order visibility is “very good,” with strength in electric utility, data center, and natural gas opportunities offsetting the weaker traditional oil & gas areas. I interpret this as POWL having a solid line of sight on new projects. Utilities continue to order equipment, the data center boom is creating new power infrastructure needs, and LNG/gas projects are in the pipeline. This bodes well for the backlog staying robust.

Financially, a large backlog with improved margin profile is a powerful combination. The CFO highlighted that the current backlog’s composition, margins, and schedule are all favorable. Essentially, the orders in hand are profitable ones (no legacy low-margin deals dragging it down) and are slated for execution on a reasonable timetable. This sets the stage for POWL to deliver solid results in 2026 even if the macro economy wobbles, because a lot of their revenue is already “baked in” via backlog.

I also want to point out the cash position again here. With $476 million in cash on the balance sheet, the company has ample liquidity to fund its projects and growth initiatives.

POWL paid about $13 million in capex in 2025 and also paid dividends to shareholders (around $12.9 million).

Even after these uses, the cash pile grew significantly. This gives POWL flexibility as it can self-fund the Jacintoport expansion, pursue strategic acquisitions, or simply have a buffer for working capital as the backlog turns into shipments. For a manufacturing firm, having this financial strength is reassuring. It means they can confidently take on large projects or ramp up production without worrying about stretching the balance sheet.

Strategic Moves: Automation Boost (Remsdaq) and LNG Leverage

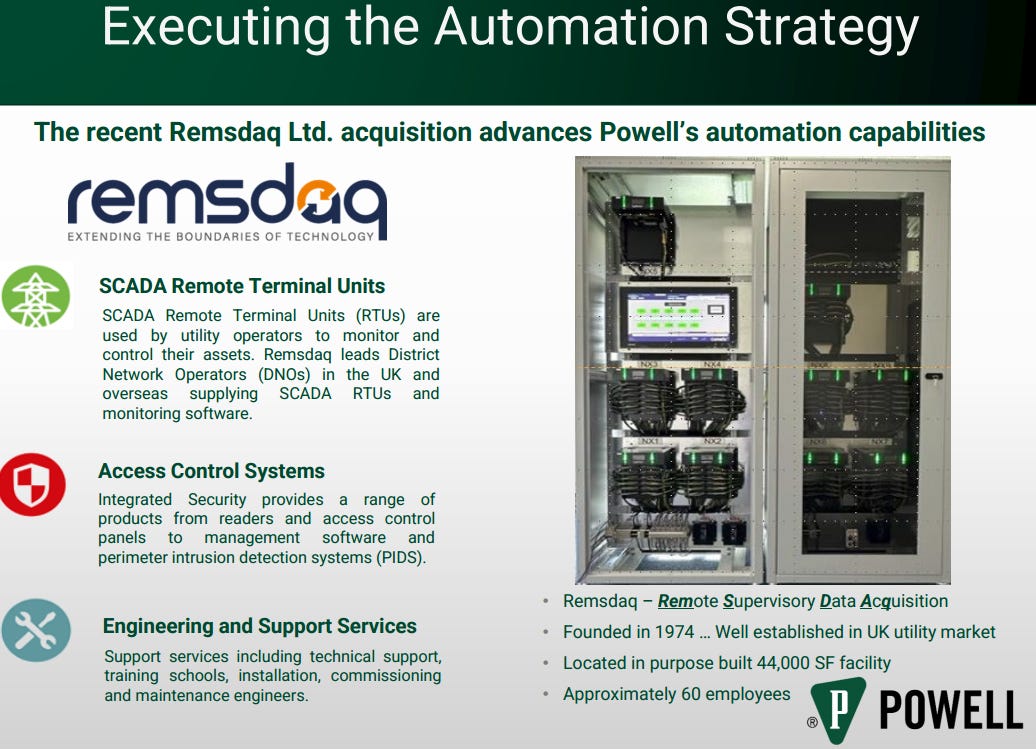

Beyond the quarter’s numbers, POWL made two strategic moves in 2025 that I believe add significant long-term value: the acquisition of Remsdaq and the expansion at Jacintoport, which we discussed. Both tie into key growth areas (automation and LNG infrastructure) and show POWL investing for the future.

Remsdaq is a UK-based manufacturer of SCADA and remote terminal units. Essentially the brains and sensors for controlling electrical substations and other equipment. POWL completed the acquisition of Remsdaq in Q4, paying roughly $16 million for the company.

This might seem like a small deal, but strategically it’s quite important. By folding Remsdaq into its business, Powell can now offer more advanced automation and control solutions alongside its traditional electrical hardware. Think of it as Powell moving up the technology stack: instead of just selling the “muscle” (switchgear, transformers, etc.), it’s also selling the “brains” (software and controllers that monitor and manage electrical systems).

Combining POWL’s rugged electrical equipment with Remsdaq’s SCADA tech creates a “highly synergistic” platform to meet the growing demand for smarter, more digital power systems. Utilities, for instance, increasingly want automation to improve reliability and to predict failures before they happen. Remsdaq’s devices and software provide exactly that as they can collect data from substations, integrate with security and dispatch systems, and even provide predictive analytics on equipment health.

POWL’s CEO put it this way: Remsdaq has proven technology with a long presence in the utility market, and together we can give customers enhanced automation solutions and valuable predictive analytics to extend the life of their gear. I share his enthusiasm. This acquisition essentially plugs a gap in Powell’s offerings. It makes POWL more of a one-stop shop for electrical distribution and control needs. Importantly, management expects Remsdaq to be margin-accretive as the sales from Remsdaq’s products should carry higher margins than Powell’s current average. Higher-tech gear often has better profit margins than heavy fabrication, so this could gently boost Powell’s profitability over time.

We’re already seeing integration in progress: POWL started quoting Remsdaq’s products to North American customers in Q4, and interest is coming from multiple markets including electric utilities and data centers. Essentially, POWL is introducing Remsdaq’s automation tech to its large U.S. customer base, which could unlock new revenue streams. I find this akin to adding a new high-tech tool to the toolbox as it can now tackle more sophisticated projects and offer clients a fuller suite of solutions (from big electrical panels all the way to the control software). Given the industry trend toward smart grids and digitization, this looks like a well-timed move.

The Jacintoport expansion we covered earlier is another strategic bet This one on the physical side of the business. It’s all about scaling up capacity to meet an anticipated rush of LNG-related orders. Once complete in late 2026, Jacintoport will significantly boost Powell’s ability to fabricate large, engineered-to-order power modules for energy projects. The expansion basically ensures Powell won’t be bottlenecked when LNG projects ramp up. The CEO highlighted that U.S. LNG export growth is “clearly going to play a critical role in the global energy landscape,” and Powell wants to “advance our industry-leading role” in supplying the electrical systems for it. I view this investment as a strong vote of confidence in Powell’s backlog prospects. You don’t expand capacity if you don’t foresee demand to fill it.

One detail worth noting: the Jacintoport yard expansion will double the shoreline and add multiple ship lanes. This is a subtle but important point. Many of Powell’s large power modules (like Power Control Rooms or skids) are so bulky that transporting them by truck is impractical; instead, they’re loaded onto barges or ships at the yard and delivered via waterways. By doubling the dock length, they can handle more (or larger) shipments in parallel, which improves its ability to meet tight project schedules for big offshore or international projects. This should translate into better customer service (faster deliveries) and the ability to take on multiple mega-projects simultaneously.

Outlook: Riding Market Tailwinds into 2026

As we head into fiscal 2026, I feel optimistic about Powell’s positioning. The company itself sounds upbeat. Management expects “another year of solid financial results” in 2026, supported by the healthy backlog and continued strong order activity in its largest markets. They even stated that the profit margin profile achieved in 2025 is sustainable going forward, given stable pricing and efficient execution.

In other words, those higher margins aren’t a one-off and they believe it can keep them up as it works through its backlog. That confidence speaks to a favorable environment: input costs and pricing are steady, and POWL has learned to execute well, so there’s no obvious reason margins should slip back down.

The demand backdrop is also encouraging. Multiple tailwinds are at Powell’s back right now. The Electric Utility sector remains robust as utilities are investing in modernizing the grid and adding capacity, partly driven by the broader electrification trend (more EVs, more renewable energy hookups, etc.). Management described the wave of electrical infrastructure investment as “broad and durable,” expecting another strong year for the utility market in 2026.

I share that view: utilities often plan capital projects over many years, and government support for grid resiliency and green energy integration (through various infrastructure bills and incentives) should keep this sector buoyant for POWL.

Another tailwind is the data center boom, which we touched on earlier. Powell specifically called out data centers as a “strategic market” with growing opportunities. Running giant server farms requires an enormous amount of reliable power and companies building these facilities need switchgear, backup systems, and automation to manage it.

Powell, now armed with Remsdaq tech and its core products, can cater to these needs. Power availability and reliability are key constraints for AI data center expansion (as I elaborated here), and it’s seeing elevated activity as operators address those constraints. I think of AI data centers as the factories of the digital age and Powell sells the electrical “factory equipment” they need. With AI and cloud computing growing, this is a secular tailwind that could benefit Powell for years.

Then there’s the Oil & Gas/Natural Gas side. While parts of that market were soft in 2025, the fundamentals point to improvement. The outlook for oil & gas orders remains positive, underpinned by strong fundamentals in the natural gas market and the pipeline of LNG projects coming up. Energy companies continue to need new infrastructure (especially for gas), and I expect POWL to win its share of that work. Additionally, the energy sector’s low valuations could eventually spur more capital investment as companies seek growth opportunities (as discussed earlier with the energy sector being “cheap” historically).

One risk worth watching is the timing of orders. POWL did note some seasonal softness is typical in Q1 (the quarter we’re in now) due to holidays and project timing. So we might see a lighter first quarter, but that’s normal and not indicative of the full year. The key is that on a total year basis, Powell expects to grow again in 2026 and maintain its margins. They’ve essentially guided that 2026 will look similar to 2025 in terms of financial profile, which if achieved, would mean another year of record earnings.