Trade alert: Closing position in PYPL

Ripping the band‑aid: cutting PYPL fast instead of dragging out the pain.

Hi fellow Sharks,

We can’t win them all. While PYPL may look like a value play on paper, the earnings call was not very encouraging. I think the stock will be range‑bound (if not drifting lower) in the medium term, so I’d rather close the position and relocate the capital.

Usually, I don’t like selling when everyone else is bailing (like today), since more often than not the shares rebound a bit. But when I don’t like the story anymore, I prefer to rip the band‑aid quickly and move on, even if it means leaving a couple of dollars on the table.

Full rationale and post‑mortem coming in the days ahead.

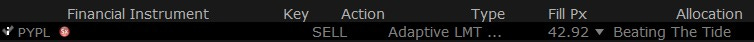

Trade alert:

Close PYPL

PYPL was the first monthly pick of the newsletter, and we are closing with a 52% loss. But it was a small position of the portfolio, so the impact was immaterial.

Here is the updated track record of the monthly picks (paid members can click here). The good part is that the winners outpace the losers in both count and magnitude.

Solid decision to cut quickly rather than averaging down hoping for a turnaround. That earnings call signaled weak fundamentals rather than just short term noise. The 52% hit stings but protecting capital and redirecting to stronger setups is what seperates good traders from bagholders. Position sizing saved this from being a portfolio killer.