Weekly #65: Why I’m Raising My TSMC Target Price After Earnings

Portfolio +8.0% YTD, 2.5x the market since inception. Plus I watched AGX pop after I closed the position for +166%, and updated my view on TSMC’s upside and risks.

Hello fellow Sharks,

While the S&P 500 pulled back this week, the portfolio had one of its strongest weekly performances. If you want to skip straight to the numbers, jump to the Portfolio Update.

I received the survey results, and thanks to everyone who filled it out. So far, 17 of you completed it, which is a 1.3% response rate. I read most of the responses, and the feedback makes sense. I’ll dedicate this week to figuring out the best way to address the key points. I already moved the Watchlist to the Top Bar since it was a common suggestion and a quick win.

Initially, I planned to share the results and my action plan today, but I realized I need more time to put together a solid plan. Since I’m not sharing the results yet, I’ll keep the survey open until Thursday. I’ll start building the action plan right after that, so if you haven’t filled it out yet, please do (fill out the survey). It’s a very short survey, and the more data I have, the better the action plan will be.

Also, quick reminder: I’m giving away 10 one-month premium passes to survey participants. With only 17 responses so far, the odds are honestly great that you get one. 🙂

In this weekly, I also go over what happened to AGX after I closed the position, break down TSMC’s latest earnings, and explain why I’m raising my target price for the ADRs.

As always, enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

On January 14, I closed the AGX position after a +166% gain.

Yes, I jinxed it.

In that article I literally said I’m a lousy market timer and the stock might pop right after I sell.

Surely enough, two days after that article on Friday, AGX jumped 16% in a single day.

Comedy. Pure comedy. 😂

I spent more time than I wanted trying to find the reason for the pop, but I couldn’t find anything concrete. Maybe it popped because on Jan 12 Trump floated the idea of shielding households from rising power costs by making big tech and data centers “pay their own way” as electricity demand ramps up. Still, it’s weird the pop happened on Jan 16 and not on Jan 12…

For now, my target price stays at $374, and I’m not reconsidering buying a position in AGX. As I said in the article, AGX stays on the watchlist, and I would reconsider entering if Mr. Market gives me a better entry point (below $225 🤔?) or if fundamentals change drastically. Trump’s idea is just that, an idea for now.

TSM Q4 2025 Earnings & Revised Target Price

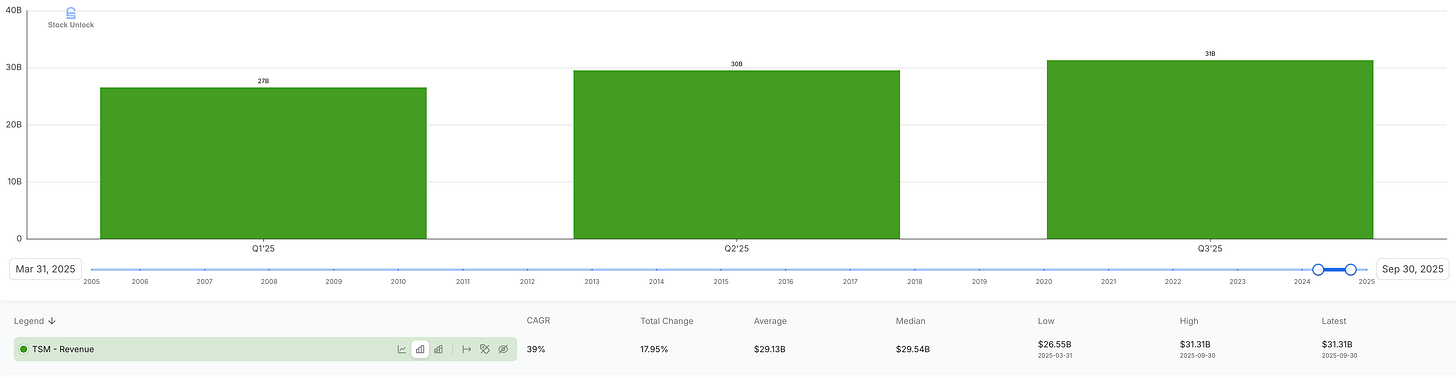

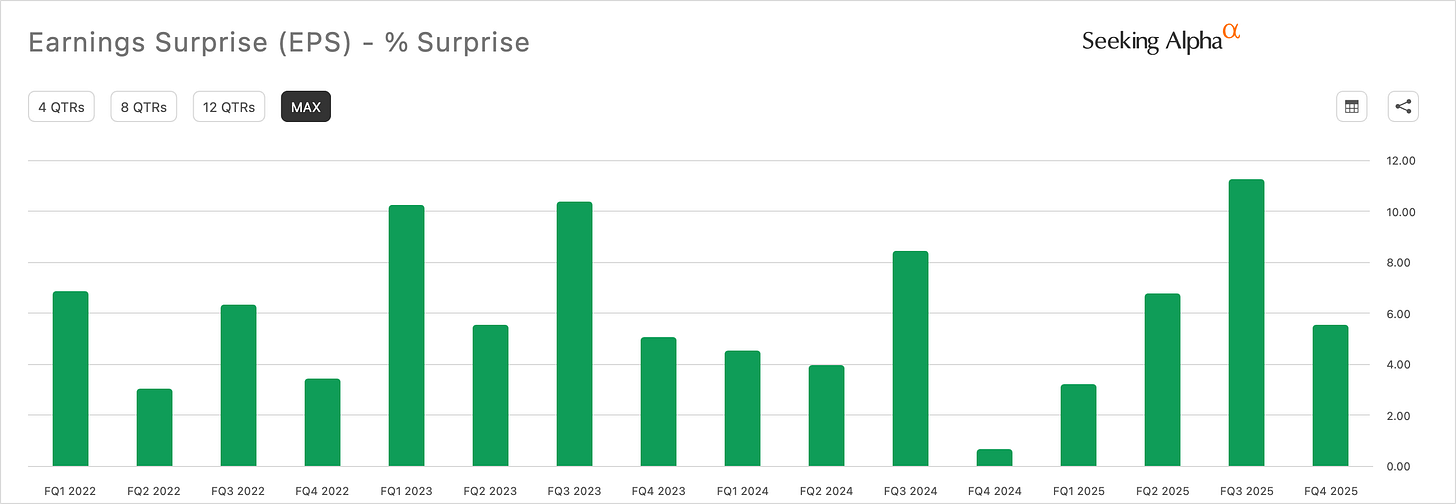

Last Thursday, TSMC [TSM 0.00%↑] posted Q4 results. The numbers beat consensus estimates on both top and bottom line.

This is nothing new as we are used to management being conservative and later beating the estimate.

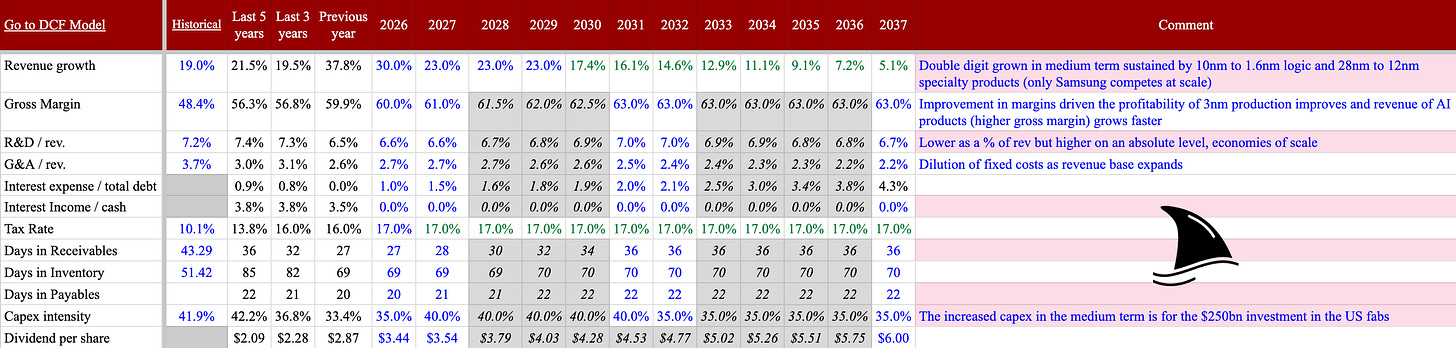

I am raising my target price from $370 to $565 per ADR. This update factors in higher revenue and slightly better gross margins. I also revised 2026 capex to be more inline with the new guidance.

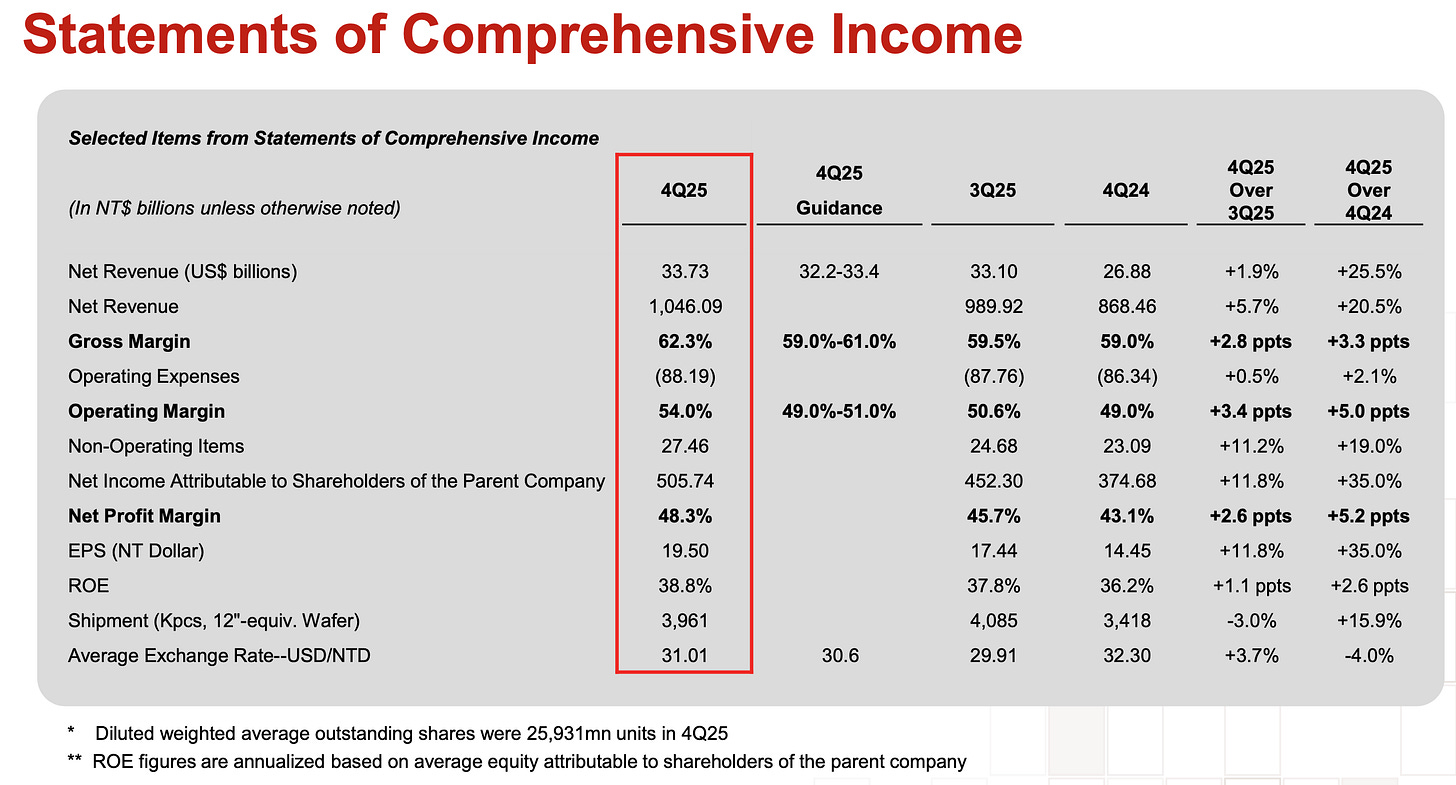

TSMC smashed every metric. Revenue jumped 25.5%, gross margin crossed the 60-mark to 62.3%, net margin widened by 5.2 points and ROE increased by 2.6 points.

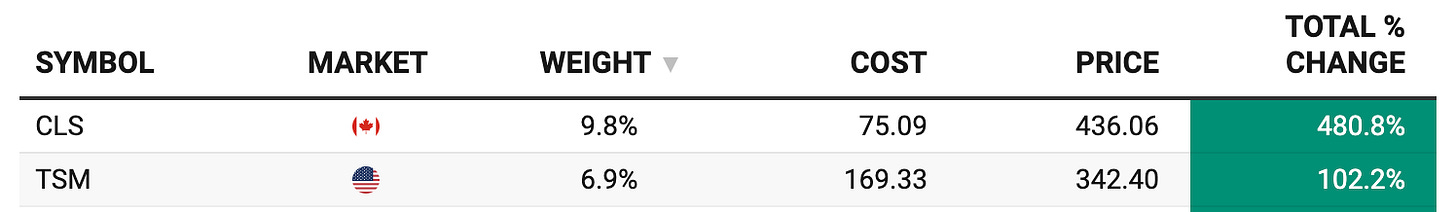

The position is up +102% and it is thee 2nd largest portfolio position just after CLS.

The AI Super Cycle is Real

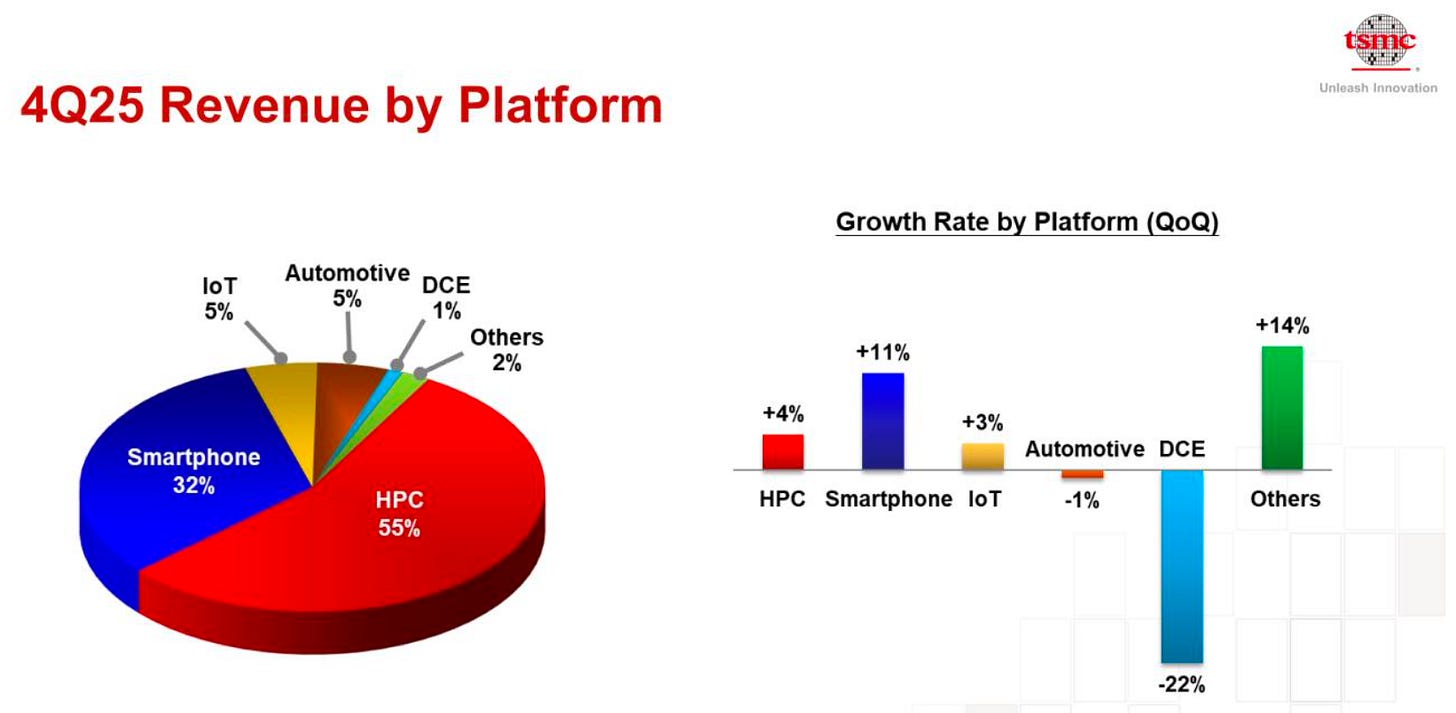

Management raised its long term revenue outlook. They now expect a 25% CAGR through 2029. AI accelerator sales will grow at a mid to high 50% rate over that same period. This just validates what I have been saying since I started this newsletter that this AI cycle is a super cycle.

We are seeing a clear spillover effect. Hyperscalers like Microsoft [MSFT 0.00%↑] and Meta [META 0.00%↑] are spending over $100 billion. This huge spending at the software level trickles down to the hardware level. Fab companies must build more capacity to handle the load. Foundries are now the main beneficiaries of this infrastructure grab.

My conviction on revenue growth comes from new visibility. Google is expanding the availability of its TPUs (read: The GPU vs TPU Debate Is a Distraction). Broadcom [AVGO 0.00%↑] is adding more customers too. These moves give me confidence that AI spending is durable and not a bubble.

And there’s still upside we haven’t modeled. If Tesla ever ramps Optimus toward Musk’s long-term goal of 1 million robots per year, the number of chips needed could get silly fast, even if each robot uses only a handful of AI processors. EVs showed the playbook. One company goes first, the rest scramble to follow.

Technological Monopoly and the Moat

TSMC owns the leading edge. If you need a refresher, read my TSMC deep dive, even after 10 months, it is one of my most popular deep dives.

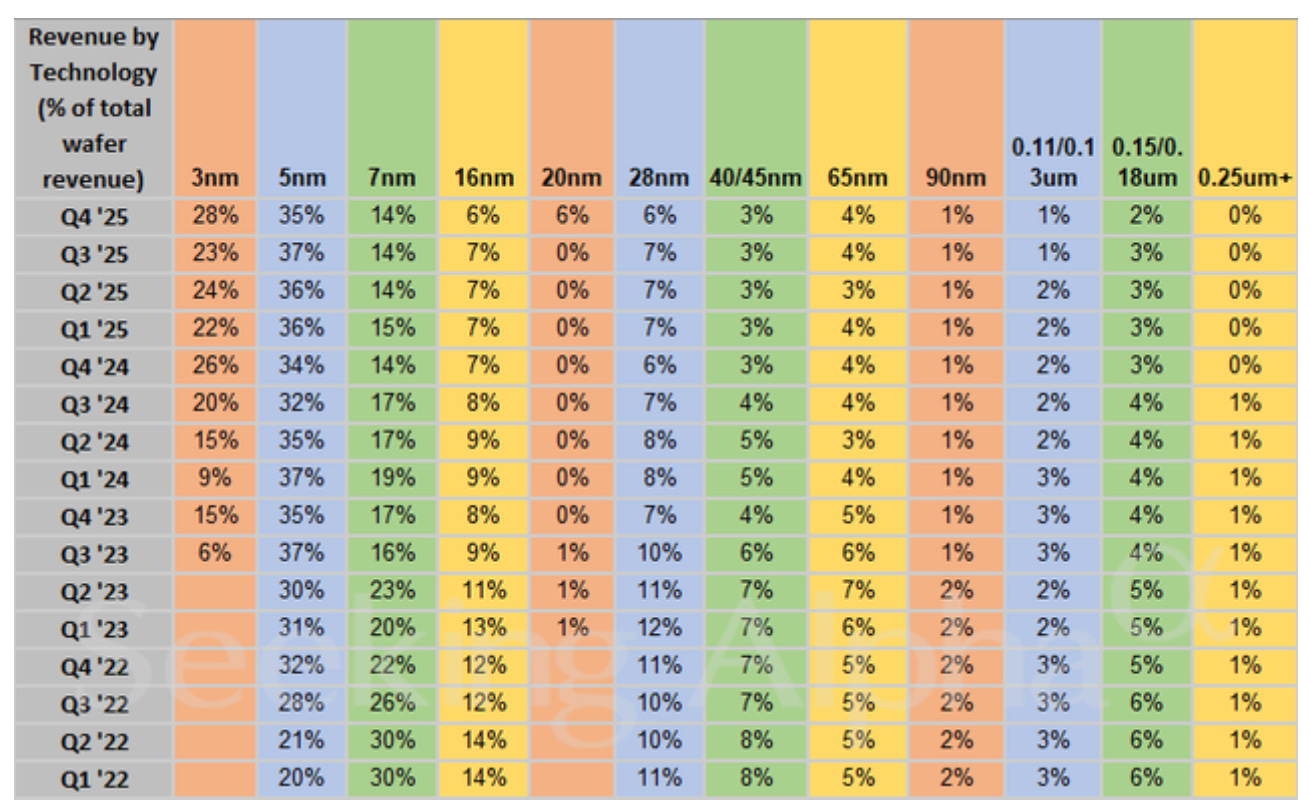

Advanced nodes at 7nm and below now drive 77% of wafer revenue. The 3nm node alone makes up 28% of sales. This node is high margin in nature.

The 2nm ramp is the next big catalyst. TSMC successfully started 2nm mass production in late 2025. Management expects a fast ramp in 2026. This node features performance and power benefits that innovators crave. It uses GAA nanosheet transistors to provide 10% to 15% speed gains.

TSMC has a technical monopoly on these chips. It holds 90% of the 3nm market. Samsung is the only other player at this level. However, Samsung has lost market share due to yield issues. Smaller foundries stopped at the 14nm or 28nm nodes years ago.

The moat is wider than just technology. TSMC has massive scale. It is 8x larger than Samsung’s foundry and 6x larger than Intel [INTC 0.00%↑] Foundry. This scale lets TSMC spread out R&D costs.

TSMC also benefits from a lack of conflict of interest. It does not have its own branded products. Customers like Apple [AAPL 0.00%↑] and Nvidia [NVDA 0.00%↑] trust TSMC because it does not compete with them. Intel and Samsung must firewall their own designs from client designs. This adds costs and creates a trust gap that TSMC avoids.

Profitability and Pricing Power

Gross margin reached 62.3% in Q4. This beat company guidance by 130 basis points. Higher utilization and productivity gains drove the expansion. Management expects margins to hit 63% to 65% in the next quarter.

TSMC has massive pricing power. Most customers are extremely dependent on this one vendor. Management is not afraid to use this leverage. I believe customers tolerate price hikes because no alternatives exist.

The unit economics for 2nm look even better than 3nm. Management is putting a bigger markup on 2nm relative to its cost. Customers are willing to pay because the power reduction and speed gains are so high. High demand and limited supply give TSMC extreme leverage.

Costs are rising too. The tools to build 2nm and A14 nodes are more expensive. Capex per wafer is going up. Management raised the 2026 capex budget to meet this challenge. They will spend $52 to $56 billion. I view this as a sign of strength. Higher capex always correlates to high growth opportunities in the following years.

Global Expansion and Geopolitics

The Arizona project is a key part of my updated target. The first fab is already in high volume production. Yields in Arizona match the results in Taiwan. TSMC just bought a second large piece of land in Arizona. This creates an independent giga-fab cluster.

A new trade deal between the US and Taiwan just changed the risk profile. The deal caps sector specific tariffs at 15%. This clears a major regulatory overhang. In exchange, Taiwanese firms will invest $250 billion in the US. TSMC might double its manufacturing size in the US soon.

Moving capacity to the US reduces supply chain risks but I think it increases the risk on a Chinese invasion of Taiwan. But US customers like Apple and Nvidia want this geographic diversification. They are willing to pay more to get chips made on US soil.

The Competitive Landscape

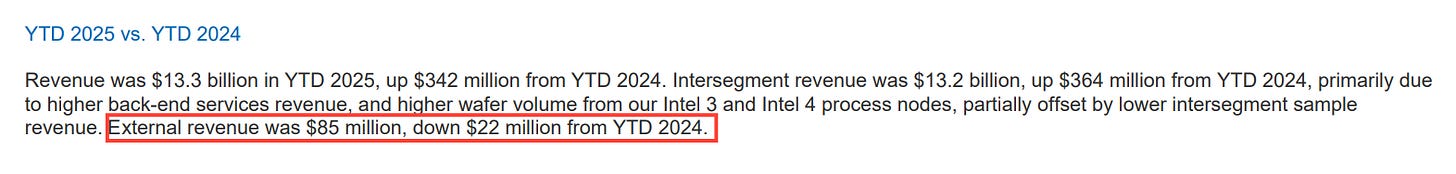

Intel is still a major talking point. I don’t see Intel competing with TSMC anytime soon. Their foundry business faces an uphill battle. Through the first three quarters of 2025, Intel reported only $85 million in external foundry revenue, which is actually a decline vs last year.

That is a rounding error for TSMC who had revenues of $88 BILLIONS for the same period.

Intel is actually a very good customer for TSMC. They rely on TSMC for their most advanced chip components. Intel is paying TSMC to produce its chips while it tries to catch up. This boosts TSMC’s revenue and locks Intel into the TSMC ecosystem.

Other rivals like Samsung are also lagging. Samsung lost market share due to yield issues at the 3nm node. TSMC currently holds 71% of the total foundry market share. No other fab is even close.

Updating the Model

I updated my revenue and margin assumptions. Revenue growth for 2026 should stay strong at 30%, in line with management’s guidance. Gross margins should stay above 60% as newer, higher-margin nodes make up a larger share of revenue.

I am factoring in the higher capex budget for 2026. While this spend is high, TSMC generates massive free cash flow. Free cash flow for 2025 hit $32 billion. The balance sheet remains a fortress with $98 billion in cash and marketable securities. TSMC is a cash printing machine. Management hiked the dividend by 20%.

Valuation and Upside

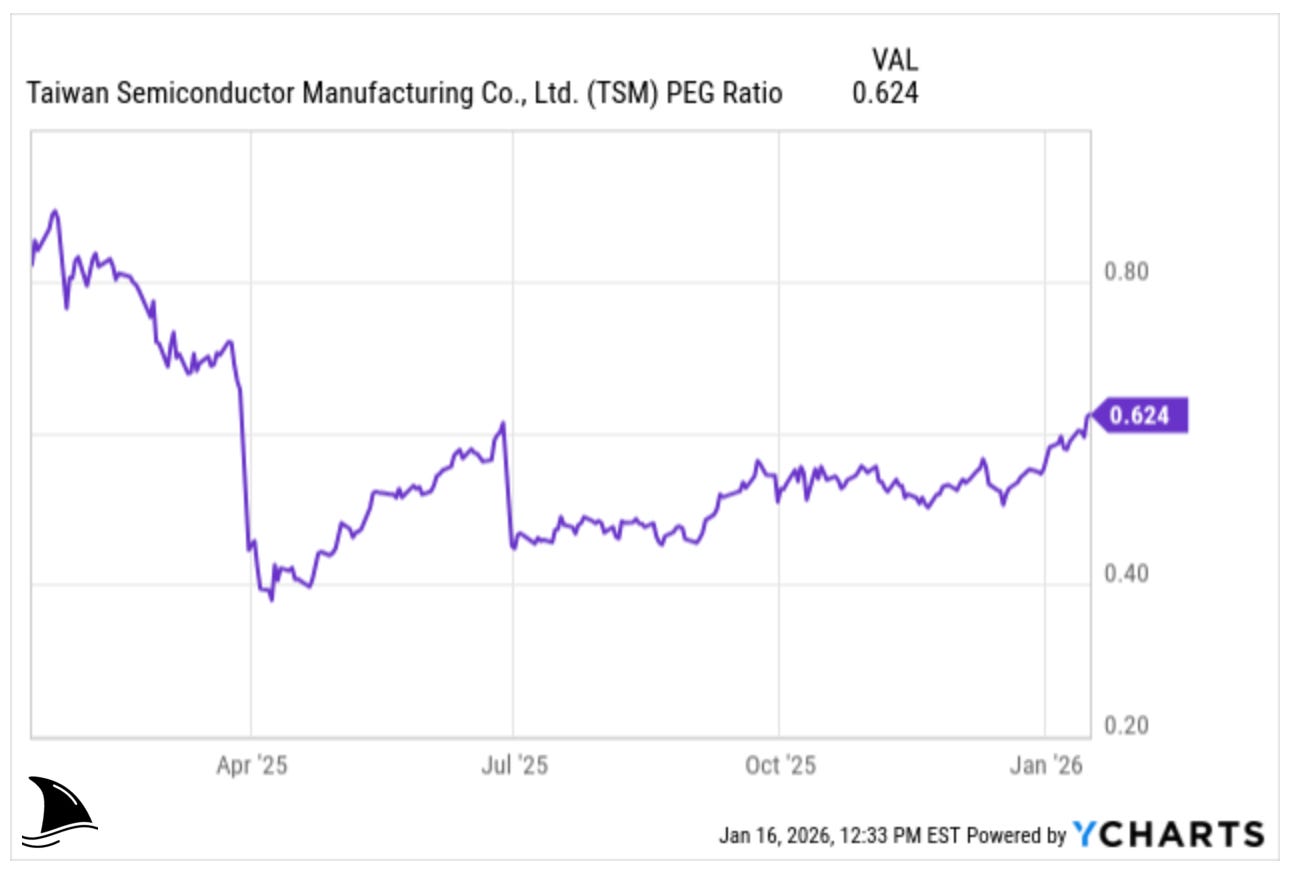

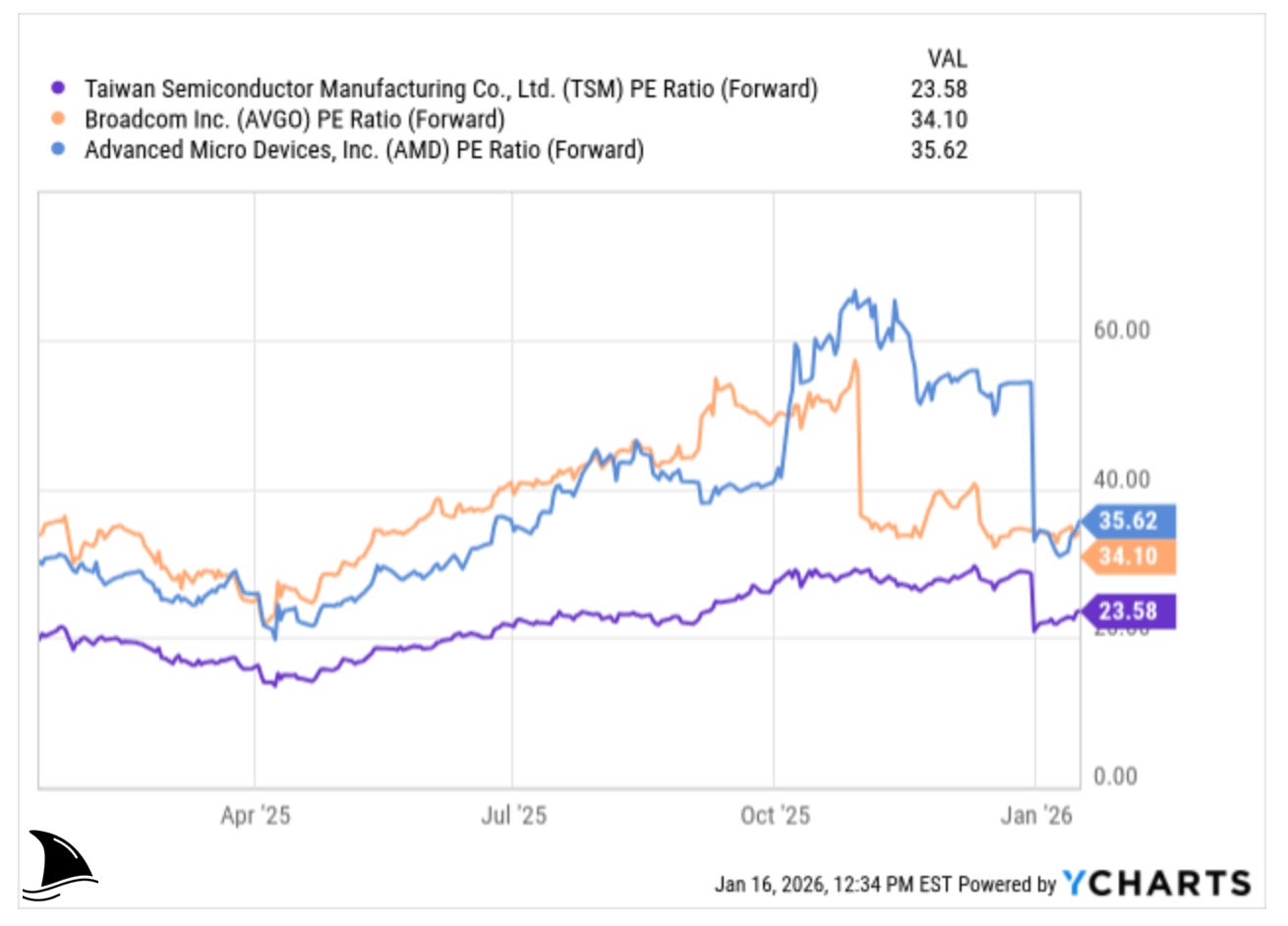

The market still underestimates TSMC. Shares trade at 23.6x 2026 earnings. This is a reasonable valuation given the growth profile and margin structure. Especially if you look at PEG (which adjusts for growth), it is just 0.6x.

Compare this to AMD or Broadcom which trade at 34x to 35x earnings. TSMC enables those businesses. It should not trade at a discount to them.

My new target price of $565 per ADR represents over 66% upside from recent prices. I used a discounted cash flow model to reach this number plugging the assumptions below.

I assumed durable AI spending and continued node leadership.

Risks to Monitor

I stay alert for risks. Consumer electronics face headwinds from memory shortages and price hikes; an upside for my 2026 top stock pick:

Higher component prices could slow down smartphone unit growth. Since smartphones are 32% of TSMC’s revenue, this is a valid concern.

However, TSMC supplies the high end of the market. High end demand is less sensitive to price changes.

Geopolitics remain the main wildcard. Any military action in Taiwan would be a disaster. And as TSMC produces more advanced nodes outside Taiwan, I think the risk of an invasion increases. But keep in mind that the world can’t afford for TSMC to go offline.

Portfolio Update

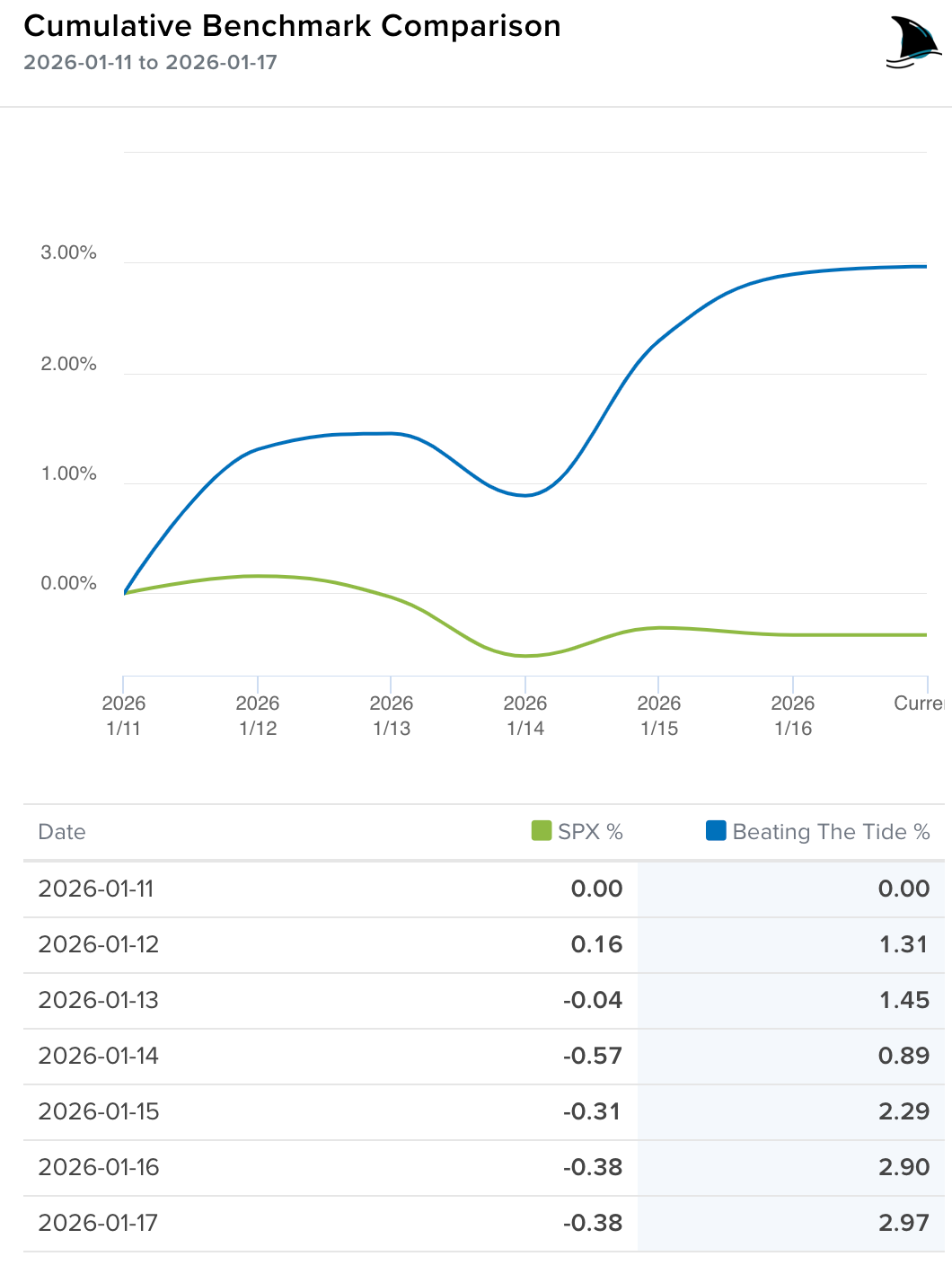

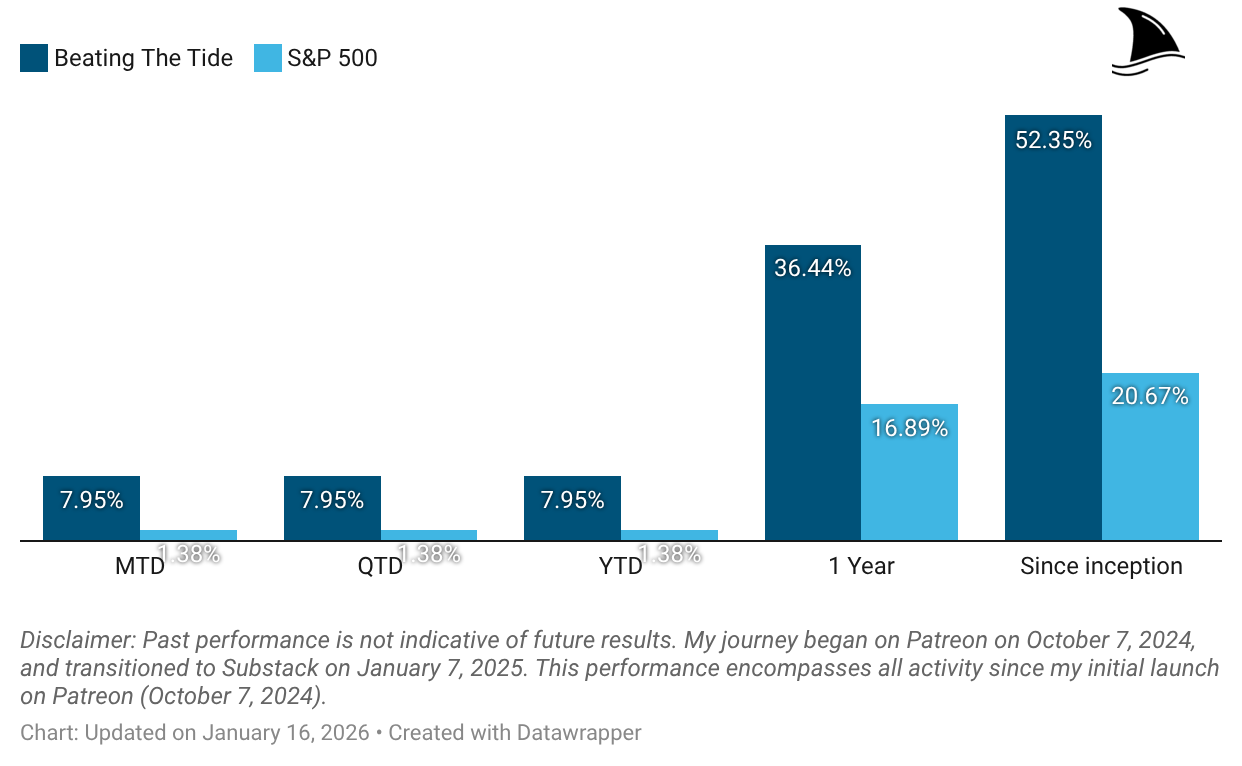

While the S&P 500 retracted this week, the portfolio had among the best weekly performances (despite having closed AGX before the pop 😉).

Month-to-date: +8.0% vs. the S&P 500’s +1.4%.

Since inception: +52.4% vs. the S&P 500’s +20.7%. That’s 2.5x the market.

Portfolio Return

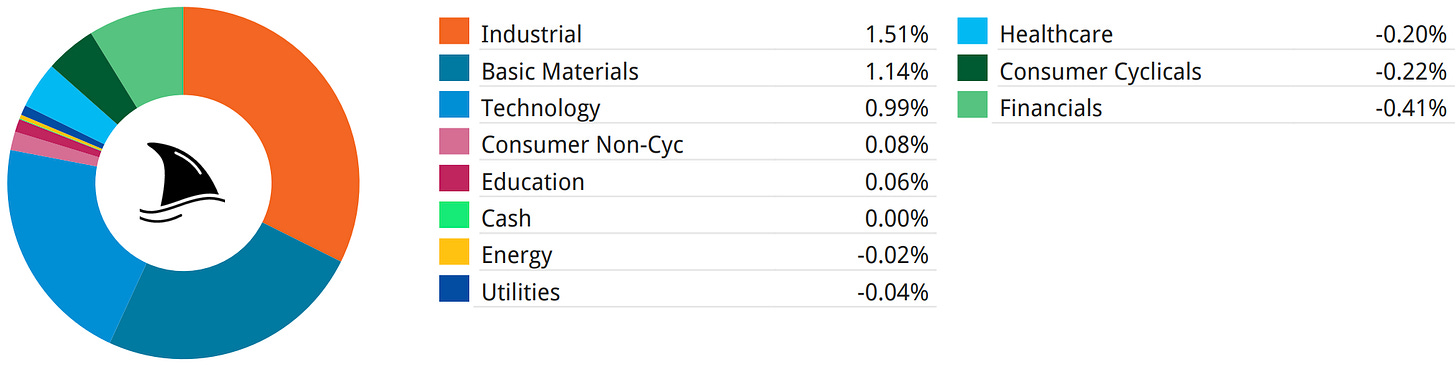

Contribution by Sector

Industrial, gold and tech led the positive performance partially offset by financials, consumer cyclicals and healthcare.

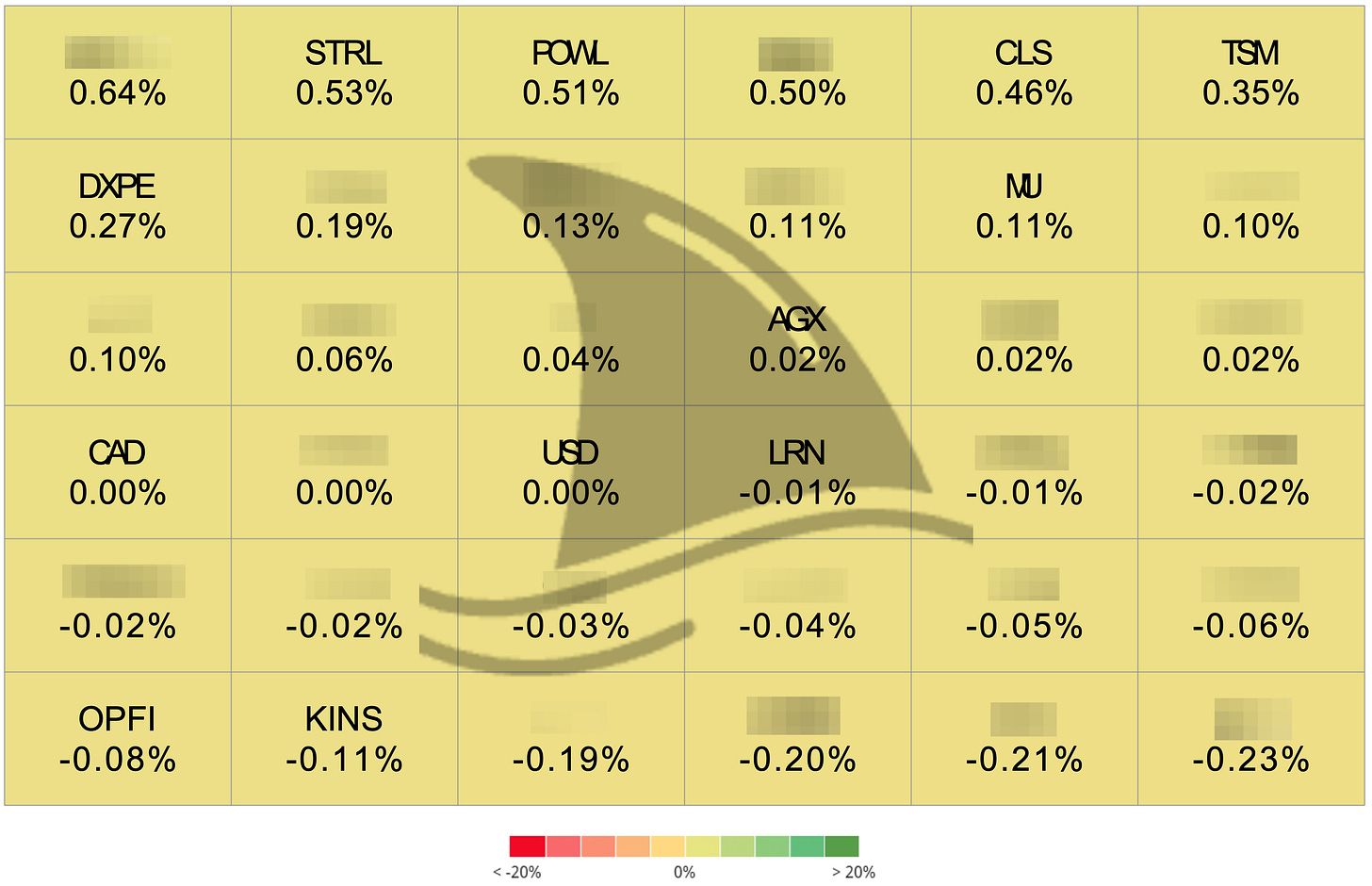

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+53 bps STRL 0.00%↑ (Thesis)

+51 bps POWL 0.00%↑ (Thesis)

+46 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

+35 bps TSM 0.00%↑ (Thesis)

+27 bps DXPE 0.00%↑ (Thesis)

+2 bps AGX 0.00%↑ (Thesis)

-1 bps LRN 0.00%↑ (Thesis)

-8 bps OPFI 0.00%↑ (Thesis)

-11 bps KINS 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

The combination of 3nm already at a meaningful scale, 2nm ramping with better unit economics, and hyperscalers essentially committing to massive CapEx makes the 25% CAGR guide through 2029 feel almost like a base case. Good info on the tension between de-risking the supply chain with Arizona, but also increasing the geopolitical incentive for a Taiwan shock.