Weekly #55: The All-or-Nothing Market

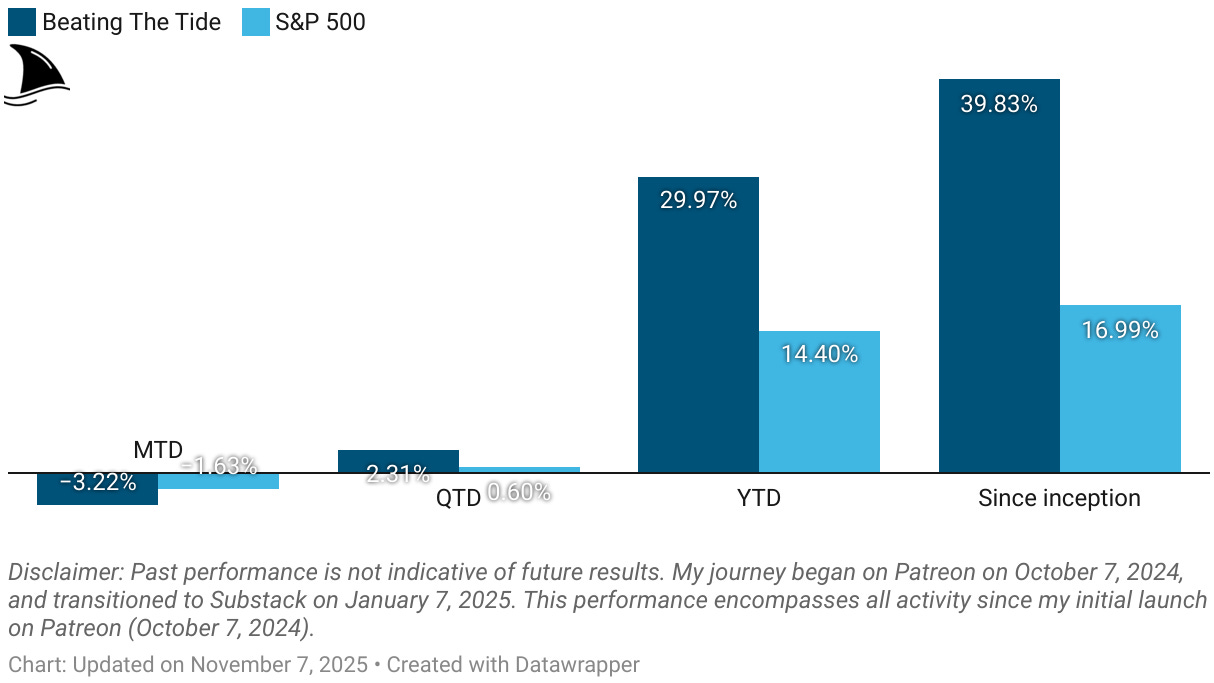

Portfolio +30% YTD, 2.3x the market since inception. This week showed how quickly sentiment swings from optimism to panic. But in markets and in life, there’s profit in thinking beyond the binary.

Hello fellow Sharks,

In the first week of November, the portfolio retracted a bit but we’re still sitting comfortably at +30% YTD. If you want, to skip straight to the numbers, jump to the Portfolio Update.

Last week was pretty interesting. The market is swinging hard, overreacting to small earnings misses or cautious outlooks while barely rewarding solid beats. It feels like investors have shifted into an all-or-nothing mindset, where a single headline defines a company’s worth.

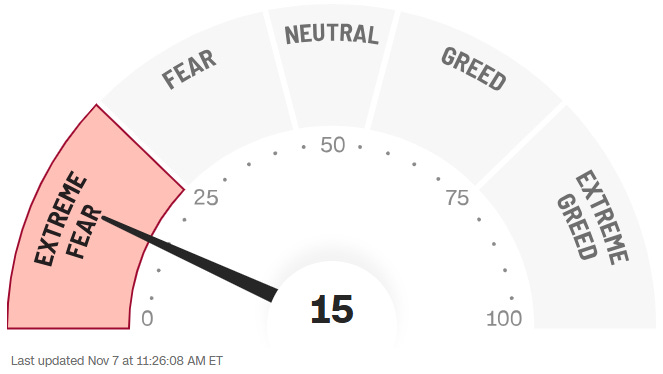

I suspect it’s tied to the current fear dominating sentiment. When the CNN Fear & Greed Index sits in “extreme fear” territory, logic tends to take a back seat. People start thinking in absolutes: good or bad, buy or sell, success or failure and nuance disappears.

That’s exactly what I unpack in this week’s Thought of the Week: how all-or-nothing thinking clouds judgment in markets and in life, and how learning to see the gray in between can make us better investors.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

On November 5th, I published a primer on reading the balance sheet. It’s a back-to-basics piece that shows how to read a balance sheet like an investor, not an accountant. I break down assets, liabilities, and equity into plain English and show what each line really tells you about a company’s health.

More importantly, it teaches how to connect the dots of how leverage, working capital, and retained earnings reveal the quality of management decisions over time.

If you’ve ever skimmed past the balance sheet to get to the income statement, this one’s for you.

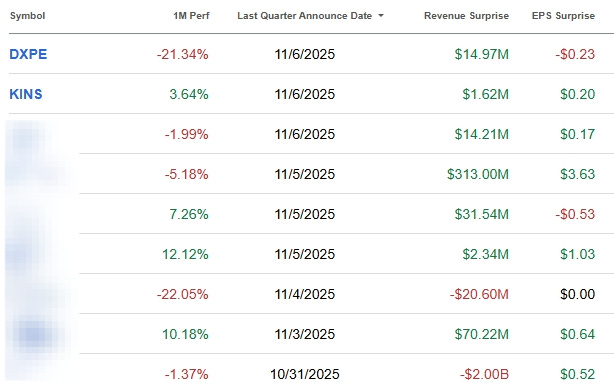

Earnings Update: 7/9 companies beat EPS Estimates

Since the last update, nine portfolio companies released results. 7/9 companies beat revenue and EPS estimates. I will be sending detailed reviews for DXPE and KINS later next week.

Thought of the Week: Breaking Out of Black-and-White Thinking

Years ago, I went to see a behavioral psychologist. I had been forced to slow down my physical activity due to health issues, and my weight kept creeping up.

Our first session was enlightening.

The psychologist pointed out a simple fact about my thinking that changed my life. Not just my eating habits, but how I approached everything. Up to that point, I hadn’t realized that I saw the world in very black-and-white terms. In my mind, one slip-up meant total failure. If I ate a single chocolate square, I thought I had ruined weeks of healthy eating. I figured my diet was wrecked, so why bother eating healthy for the rest of the day?

This is a classic example of all-or-nothing thinking, a common cognitive distortion where we view our experiences in extremes: success or failure, with no middle ground. One small indulgence made me feel like “my diet is a total failure”. This mindset was sabotaging my efforts.

Coming to this realization was like turning on a light. I saw that I was applying the same all-or-nothing thinking to many parts of my life without even knowing it. Psychologists actually have a name for this: dichotomous thinking, also known as black-and-white thinking. It means seeing things as all good or all bad, with nothing in between. It’s the tendency to interpret situations in absolute terms, ignoring any nuance or middle ground. I was definitely guilty of that. And once I became aware of it, I started noticing it everywhere.

Seeing the World in Black and White

After that “aha” moment in the therapist’s office, I realized how dichotomous my view of the world had been. I tended to put things and people into strict categories. In my mind, you were either a Republican or a Democrat, an introvert or an extrovert, a value investor or a growth investor as if you had to be one or the other, with no overlap.

Was I entirely to blame for thinking this way?

I don’t think so. Our broader culture often encourages black-and-white thinking. We constantly see stark dualities in society: you’re either a terrorist or a peacemaker, you either love Trump or you hate him, you’re either a capitalist or a socialist. There’s little room for a nuanced view.

Think about how polarized conversations can get. In politics and social issues, people frequently retreat into an either-or mentality. It feels like there are only two opposing options and you must choose a side. Social media and cable news often amplify this: complex topics are reduced to soundbites and binary choices. This mindset doesn’t leave much room for uncertainty or flexibility.

Even our technology is built on binary foundations. Consider computers, the devices running everything from elevators to our smartphones. Computers operate using bits of information that are either 1 or 0. Every program, every app, and indeed much of modern life is built on these binary digits. It can’t get more black-and-white than that. We live in a world literally driven by ones and zeros, so it’s no wonder that binary thinking feels ingrained. Our brains, too, have an innate tendency toward simplifying things into two choices. Neuroscientists say that this binary thinking is a mental shortcut, a heuristic that helps us make quick judgments by categorizing things as good or bad, right or wrong.

In fact, from an evolutionary perspective, seeing things in black and white had a survival benefit. When faced with a snapping twig in the dark forest, our ancestors didn’t pause to ponder nuance, their brains immediately asked “Friend or foe? Safe or dangerous?” and reacted accordingly. The amygdala, the brain’s fear center, quickly labels stimuli as “good” or “bad” before our rational mind even gets a chance to weigh in. This snap judgment helped our ancestors react to threats without hesitation, but in today’s complex world it often oversimplifies reality.

Once I recognized this habit of extreme thinking in myself, I became determined to change it. I saw how limiting it was. Life is rarely purely black or white as there’s a lot of gray in between. Few things are “always” or “never” one way. A day with one mistake isn’t a completely ruined day as there can still be positive moments. As Simply Psychology put it,

“in reality, few things in life are truly black or white”

I had to start recognizing the shades of gray I was ignoring.

Broadening My Approach to Investing

You might be wondering why I’m talking about all this. Well, once I saw my all-or-nothing thinking for what it was, I realized it was holding me back in other areas such as in my investing strategy. By not thinking in 1s and 0s, I began to get much better results in the stock market. Let me explain how.

Back then, if you had asked me what type of investor I was, I would have proudly said, “I’m a value investor.” I had convinced myself that value investing was the only way to go for me. That meant I would only buy companies that looked dirt-cheap by traditional metrics; things like a very low P/E, P/B or P/FCF ratio. If a stock’s valuation was anywhere close to average market levels, I wouldn’t even consider it. In my black-and-white view, either a stock was a screaming bargain or it was not worth my time. That was it…no middle ground.

The flaw in that approach became clear once I challenged my binary thinking. By insisting on only the most extreme “cheap” stocks, I was ignoring a huge portion of the market. I was passing on plenty of mispriced companies that might not have been ‘cheap’ in traditional views, but were still undervalued or promising. Many of these companies were ones I actually understood well and where I had insight. Some had solid growth prospects or were temporarily misunderstood by the market, yet I ignored them because they didn’t fit my narrow definition of a value stock. In other words, my rigid mentality made me blind to many opportunities.

Once I let go of the “value versus growth” dichotomy, I opened up a much broader spectrum of investments. Today I invest across the entire range from deep value plays (super underpriced stocks) to traditional value stocks, to GARP stocks (Growth At a Reasonable Price), and even some pure growth stocks when they make sense. I’ve learned that great opportunities come in different forms. If you pigeonhole yourself as only one type of investor, you’re likely leaving money on the table.

Even Warren Buffett, perhaps the world’s most famous ‘value investor’, emphasizes that the line between value and growth is artificial. He wrote that the two approaches are “joined at the hip”, since growth is simply a component of determining a business’s value. In Buffett’s view, calling oneself a “value investor” is actually redundant as all investing should be about seeking value relative to price.

A company with high growth prospects can still be a “value” buy if its price is low relative to its future cash flows. Conversely, a stock with a low P/E ratio might not be a true bargain if its business is in decline. Buffett confessed that earlier in his career, he too fell into the trap of seeing “value” and “growth” as opposed, but he later recognized that was “fuzzy thinking” on his part. He came to understand that growth and value are not mutually exclusive categories but they blend together. That insight has certainly proven true in my own investing journey.

Building an Arsenal of Tools

Another advantage of escaping binary thinking is that I became more flexible in how I analyze investments. I know investors who rigidly rely on one set of tools or indicators to make all their decisions.

For example, I know a couple of investors who will only consider companies with a P/FCF lower than 5. If a company’s P/FCF is 6, they won’t even give it a look. They’ve set an arbitrary line in the sand: below 5 = good, above 5 = bad. This kind of fixed rule is a symptom of that same black-and-white mindset. It makes investing seem like an on/off switch, but reality is more nuanced. There could be perfectly good businesses with a P/FCF of 6 or 7 that they’re missing out on, and some companies under 5 that are actually risky (why is it so cheap? maybe the business is in trouble). By focusing on a single metric, these folks could fall into a trap. They might catch some bargains, but they’ll also miss or misjudge many situations.

I realized I was doing something similar myself. For a while, I had a favorite metric and strategy I kept using over and over. My go-to approach was to compare a company’s EV/IC (enterprise value to invested capital) to its ROIC minus WACC, and invest if the numbers suggested a mispricing.

In simplified terms, I was looking for cases where a company’s market value was low relative to the returns it was generating above its cost of capital. Now, this can be a useful analysis. And indeed, it worked for me in most instances. But I came to see that I was limiting myself by relying only on that one framework. The stock market is complex; no single formula or metric can capture everything. By insisting on using just one tool, I was like a carpenter using only a hammer: it might work for nails, but what about screws or bolts?

So I gradually expanded my toolkit. Now I use an arsenal of tools when evaluating investments. I still look at metrics like EV/IC and ROIC and WACC, but I also examine FCF, growth rates and ROIIC, you name it. Each tool highlights a different angle of a business’s health and prospects. By using multiple lenses, I get a fuller picture and can make more balanced decisions.

Importantly, I stay flexible. I match the metric to the business. If I am looking at a high-growth tech name, traditional earnings ratios can look expensive, yet cash flow and the growth trajectory can justify the price. If I am evaluating a slow-growing manufacturer, asset-based metrics and ROIC matter more. The tool must fit the job.

For November’s monthly pick (coming out Wednesday the 12th), I checked growth, EV/IC and ROIC, but I anchored the thesis in the balance sheet. The market is pricing it at 0.7x book. That gap makes little sense once you look at the contracted cash flows and recent deleveraging. The company has a sizable revenue backlog that adds visibility, a meaningfully stronger balance sheet after debt paydown, and a healthy cash return to shareholders. In plain English, the assets and contracts on the books argue for something closer to intrinsic value.

Context matters for returns. The current ROIC and ROE look high, but they are elevated by timing effects that will not last forever. Returns should trend toward the cost of capital as today’s above-normal spreads roll off. That is normal in cyclical businesses and in any company that enjoyed a period of unusually rich economics.

This flexibility led me to two conclusions. First, valuing the business on today’s economic spread, ROIC minus WACC, likely overstates fair value because the spread is not sustainable. But on the other hand, the current 0.7x P/B understates fair value given the quality of the assets, the contracted cash flow, and the competitive position. With a lighter balance sheet, visible cash generation from the backlog, and buybacks executed below book, I expect ROE to sit above the cost of equity through the cycle, which justifies a P/B above 1.0.

You see, I still used EV/IC, ROIC, WACC, FCF, and ROIIC. I just let the balance sheet lead when the balance sheet is the edge.

That is the point. Use the right tool for the right task. Avoid one-size-fits-all rules.

There is no one-size-fits-all rule. Abandoning binary thinking means I no longer say “I only invest in X type of stock” or “I only use Y metric.” Instead, I ask, “What combination of factors makes this an attractive investment?” This open-minded approach has improved my investing outcomes significantly. It also makes the process more interesting as I’m constantly learning and adjusting, rather than following a rigid formula.

The Market’s Extreme Mood Swings

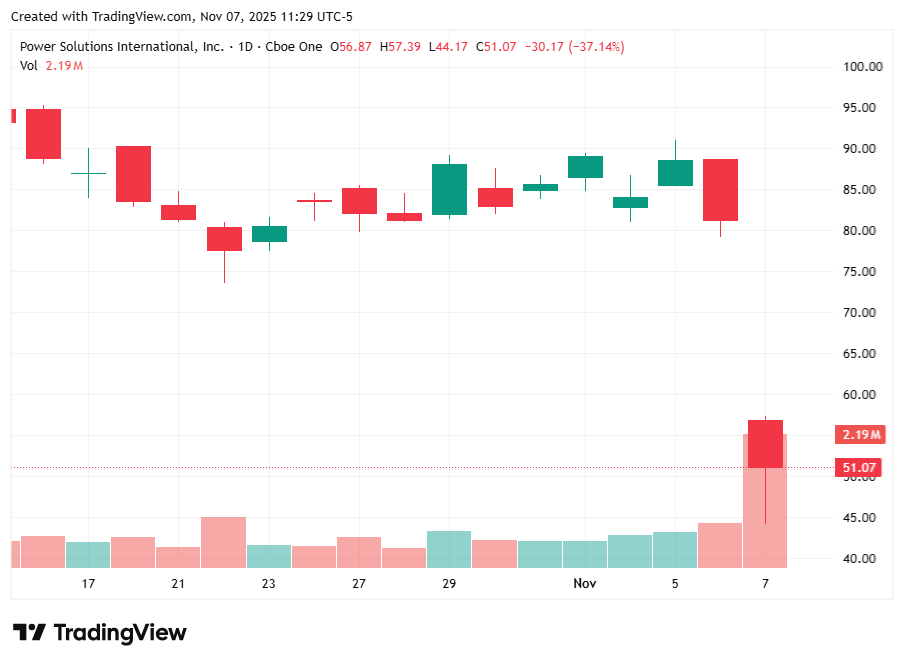

Also, I’ve observed that the market itself often thinks in a very dichotomous way, especially in turbulent times. Stock prices can swing to extremes based on short-term news, as if a company is either fantastic or terrible with nothing in between. This past week provided a vivid example of the market’s black-and-white mindset. We saw several companies get hugely punished for relatively minor disappointments.

The split brain showed up everywhere.

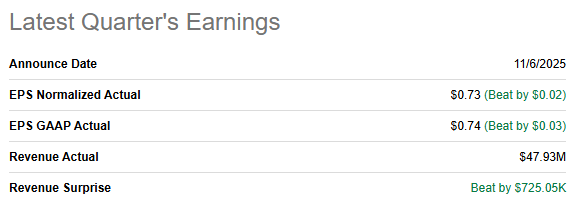

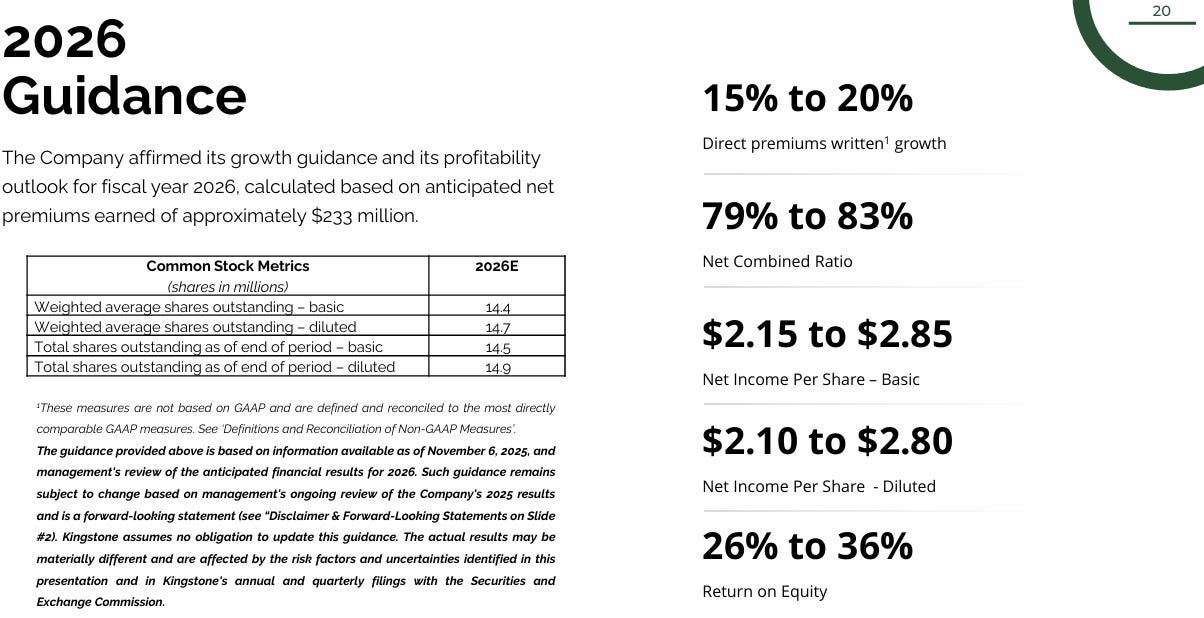

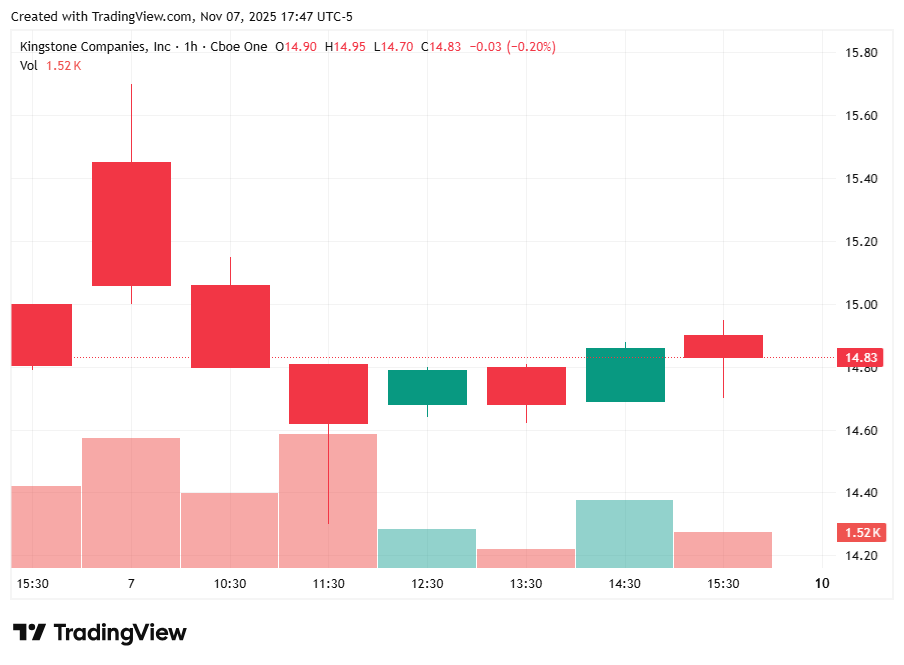

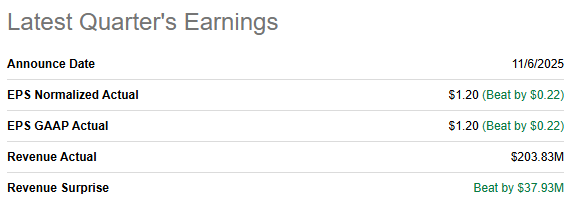

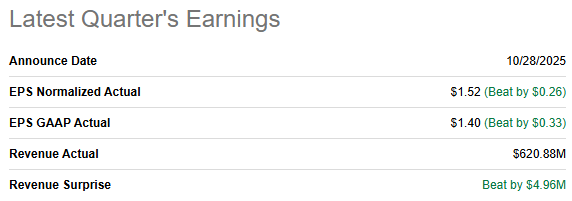

KINS beat EPS and revenue consensus estimates.

And provided very good 2026 guidance.

But the stock barely moved.

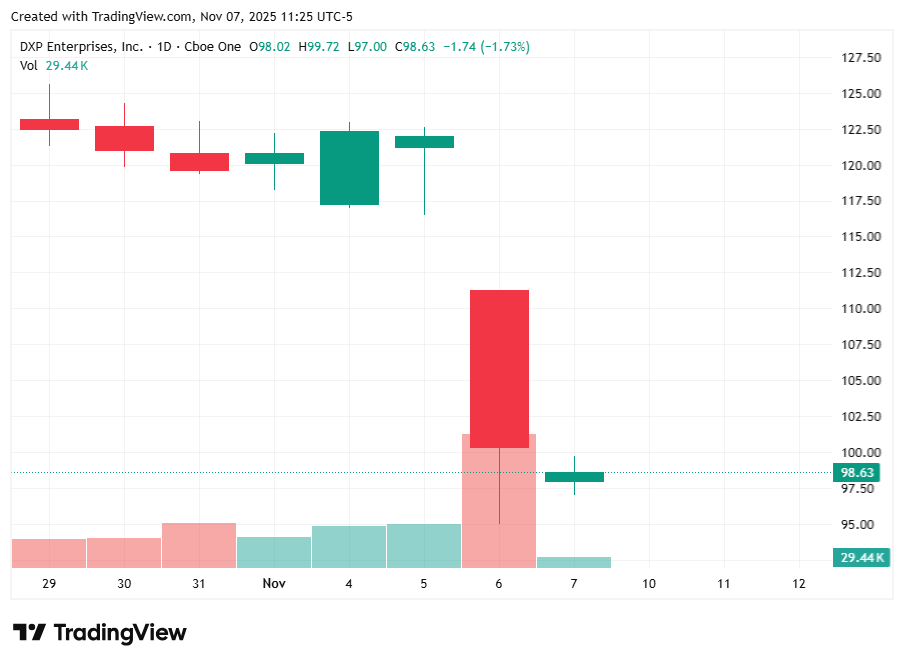

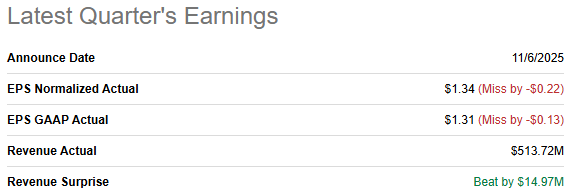

On the other side, DXPE’s share price dropped 23% after its earnings report.

In DXPE’s case, they missed the earnings expectation.

It wasn’t a huge miss, but the stock still got walloped. Again, the reaction was binary: meet the target or else. The market treated an earnings miss as if the company had fundamentally failed, rather than just having a slightly weaker quarter.

And then there’s PSIX, a non-portfolio company but that I follow. They actually beat their earnings estimates.

Yet their stock price plunged roughly 40% as well, because management issued a weaker outlook.

Then you have LRN which saw its stock plunge nearly 50%.

It wasn’t because the company was falling apart. In fact, Stride’s latest quarterly earnings beat analysts’ estimates.

But they also reported a technical glitch in their enrollment system and gave a slightly lower forecast for next year. In response, investors dumped the stock en masse. A technical hiccup and cautious guidance led to an extreme all-or-nothing reaction, with Stride’s value cut in half overnight.

It’s as if the market collectively said, “Either everything is perfect, or this company is worthless.” Obviously, the reality is more nuanced as a temporary glitch doesn’t permanently impair the business, and a conservative outlook doesn’t mean zero future growth.

That is why I doubled our position in LRN as I elaborated in last week’s Weekly.

Investors focused only on the downbeat guidance and essentially erased nearly half of the company’s market value in a flash. Good recent performance was ignored; all that mattered was the outlook wasn’t as rosy as hoped. It’s that same all-or-nothing thinking: either the future is bright, or the sky is falling. There was no middle interpretation like “the company is doing well but facing some headwinds; perhaps the stock should be down a bit, but not this much.”

What’s driving these wild swings and harsh penalties? I suspect a lot of it has to do with the fear in the market. When overall sentiment is fearful, investors become very risk-averse and quick to jump to negative extremes. They are primed to shoot first and ask questions later.

The CNN Fear & Greed Index is in “Extreme Fear” territory recently, with a reading of 15 out of 100.

At times like that, any piece of bad news can trigger a stampede for the exits. When fear is high, it exerts downward pressure on stock prices as people tend to panic-sell at the slightest provocation. A company slightly missing an estimate or giving cautious guidance is interpreted in the worst possible way.

It’s almost like the market collectively thinks, “If it’s not great, it must be awful.” This leads to overreactions: sharp sell-offs that may overshoot what the news really justifies.

I remind myself not to get caught up in this emotion-driven whipsaw. It’s critical not to make portfolio decisions based on fear or other emotions. In moments of extreme sentiment (whether fear or greed), sticking to a rational game plan is key. Before I trade on a headline, I ask: Has the fundamental thesis for why I own this investment actually changed? If a company’s long-term prospects remain solid and the recent news doesn’t truly damage that, then a price plunge might be a buying opportunity rather than a reason to sell.

On the other hand, if the thesis has changed, say the company’s competitive position is deteriorating or a growth engine is broken, then sure, it could be time to exit. But the decision should be based on facts and analysis, not the ambient fear in the air. Emotional reactions are exactly what all-or-nothing thinking produces, and they usually aren’t profitable. In times of “extreme fear,” it helps to recall Warren Buffett’s famous advice:

“Be fearful when others are greedy, and be greedy when others are fearful.”

In practice, that means I try to keep a cool head and even look for the opportunities that these exaggerated sell-offs create, rather than joining the panic.

Embracing the Gray Area (and Thinking in Quantum)

Is there light at the end of this tunnel of binary thinking? I believe so. One promising development (both as a literal technology and as a great metaphor) is the rise of quantum computers. (Don’t worry, I’m not suggesting anyone invest in quantum computing stocks just yet … that’s a topic for another day!)

The reason I bring up quantum computers is that they fundamentally break away from the 1s-and-0s framework. Traditional computers, as we discussed, operate strictly in binary: every bit is either 0 or 1. Quantum computers, on the other hand, are built on quantum bits or qubits, which can exist in a superposition of states.

In simple terms, a qubit isn’t limited to being just 0 or 1 and it can be 0, 1, or a mix of both at the same time. It’s as if instead of a light switch that’s either off or on, you had a dimmer that could hold any value between fully off and fully on.

This means quantum computers can encode information in a much more nuanced way. They can consider many possibilities simultaneously. In fact, two qubits together can represent four combinations at once, three qubits can represent eight, and so on, the potential states grow exponentially. The result is a “smarter” computer for certain tasks: one that doesn’t crash into a wall of either/or, but rather explores a range of possibilities at once.

To me, this is a beautiful analogy for how we should train our minds to think. Rather than seeing the world as binary choices, we can strive to consider the spectrum of possibilities, the whole probability distribution, if you will, not just the extremes of 0% or 100%.

Conclusion: Living in Color, Not Just Black or White

Stepping back, I can say that breaking out of binary thinking has made me calmer, more confident, and more successful in what I do. It doesn’t mean I never take a strong stand or that I’m wishy-washy. It means I allow myself to hold nuanced views. I can like some ideas from one political party and some from another, without having to slap a single label on myself. I don’t consider myself strictly Democrat or Republican (or Liberal vs Conservative here in Canada); I evaluate policies on their merits and pick what makes sense to me from each side.

Likewise, I no longer identify rigidly as either a “value” or “growth” investor. There are good opportunities everywhere, and I intend to exploit opportunities wherever I see them regardless of which style box they supposedly fit in.

I refuse to put on intellectual blinders that say I can only invest one way. I also don’t cling to one “go-to” analytic tool or metric. I maintain a whole arsenal of tools, and I try to choose the right tool for the right task.

Life is richer and decision-making is wiser when we embrace the full spectrum of possibilities. Very few situations are purely black or white. When we realize that, we give ourselves the freedom to adapt, to learn, and to make better choices. It’s a continuous effort and I still catch myself sometimes slipping into all-or-nothing thoughts (it’s human nature, after all). But now I have the awareness to step back and remind myself: find the gray. Or to put it another way, think like a quantum bit and consider the 0 and the 1 and everything in between, before collapsing on an answer.

Portfolio Update

The portfolio started November in the red.

Month-to-date: -3.2% vs. the S&P 500’s -1.6%.

Quarter-to-date: +2.3% vs. S&P 500’s +0.6%.

Year-to-date: +30.0% vs. the S&P’s +14.4%, a gap of 1,557 basis points.

Since inception: +39.8% vs. the S&P 500’s +17.0%. That’s 2.3x the market.

Portfolio Return

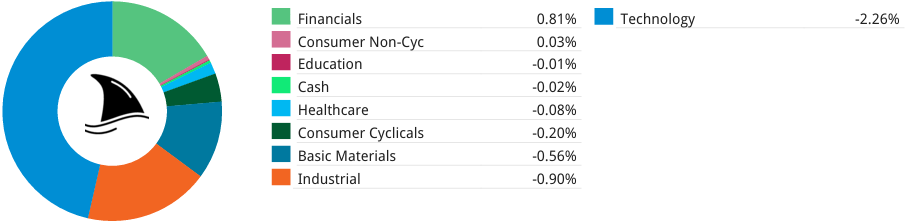

Contribution by Sector

The gains were driven by tech, industrials and healthcare partially offset by education (mainly due to the LRN sell-off).

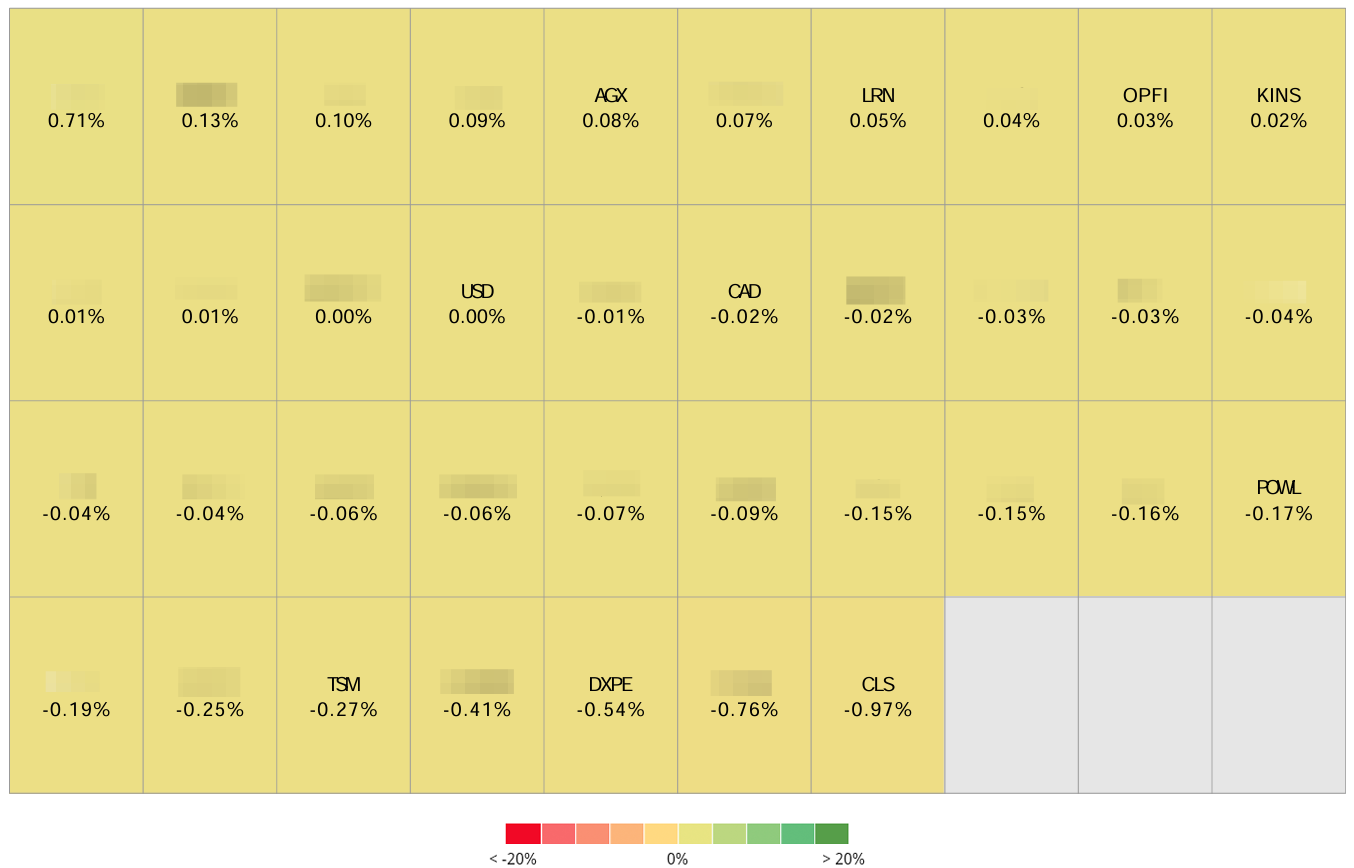

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+8 bps AGX 0.00%↑ (Thesis)

+5 bps LRN 0.00%↑ (Thesis)

+3 bps OPFI 0.00%↑ (Thesis)

+2 bps KINS 0.00%↑ (Thesis)

-17 bps POWL 0.00%↑ (Thesis)

-27 bps TSM 0.00%↑ (Thesis)

-54 bps DXPE 0.00%↑ (Thesis)

-97 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Sentiment swings are often the biggest tell for what comes next in marqets. Once everyone agrees on the narrative, reality usualy starts to diverge. The portfolios that outperform are the ones that can handle greyness instead of all or nothing positions. Your point about thinking beyond binary really resonates with how succesful traders operate over longer time horizons.

It's interesting how you connected market swings to the broader idea of all-or-nothing thinking clouding judgement in markets and in life. Do you think this binary approach is becoming more prevelant in other complex systems too?