Weekly #34: The Art of Knowing When to Sell a Stock (And When to Sit Tight)

Portfolio is up +2.9% YTD, with 88% of holdings beating or meeting EPS estimates. When to close a position, how I decide when to sell, and the 3 reasons I ever hit the sell button.

Hello fellow Sharks,

The market was up until Thursday but ended the week in the red following reports of an Israeli strike in Iraq. As a result, oil and gold soared.

We are still up +1.3% for June and +2.9% YTD. (If you want to skip ahead to the Portfolio Update, click here)

This week, I will tackle a topic not many discuss in detail: when to close your positions, and I will provide an update on how our portfolio companies reported earnings.

Let’s dive in.

Table of Contents:

Thought of the Week: The Art of Knowing When to Sell a Stock (And When to Sit Tight)

Earnings Result Update: 88% met or exceeded EPS consensus estimates

In Case You Missed It

This AI-Driven Lending Powerhouse Is Hiding in Plain Sight

This week, I released a trade alert and deep dive. This deep dive uncovers an AI-powered Asian fintech that’s quietly compounding earnings at +30% ROE while trading under 7x earnings. Think of it as the Tinder of lending, using machine learning to match borrowers with capital in real time. It’s off the radar, listed in the U.S., and buying back shares like there’s no tomorrow. I rotated out of VIST and TZOO to make room for this one.

Thought of the Week: The Art of Knowing When to Sell a Stock (And When to Sit Tight)

I’ve had a few subscribers ask why I don’t just take profits when a stock goes up … you know, before it drops again.

Short answer? I’m not psychic. I can’t time the market, so I stick to my long-term view.

Long answer? Grab your chai, settle in, and let’s talk it through.

First, let’s start with the two positions that triggered some subscribers to ask me about this.

The first one is KINS 0.00%↑.

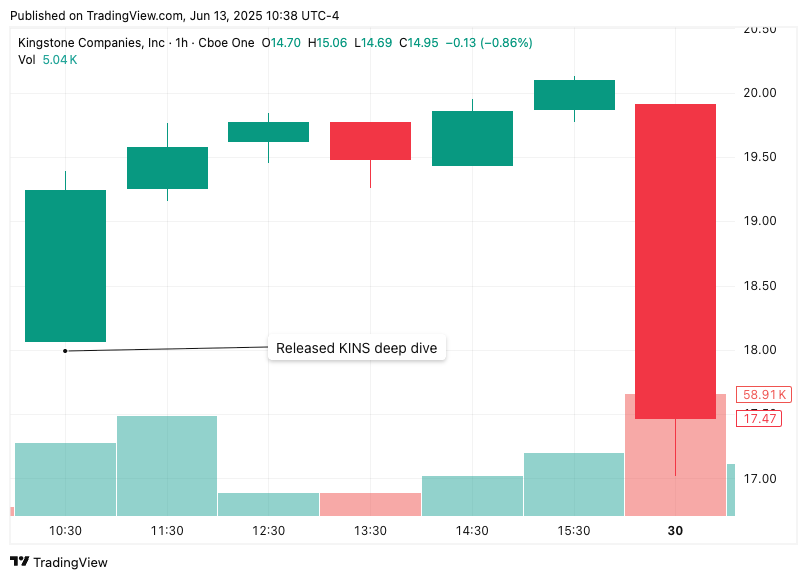

After releasing the deep dive, the stock price surged to $20, but I did nothing. The next day it dropped to $17.42, and still I did nothing.

Then fast-forward to May 6, when the company released strong earnings, as I summarized here. I didn’t sell. I didn’t move.

Then this happened.

So naturally, some said, “If you had sold at $22, we’d be up 22% instead of down 16%.”

The second example is AGX 0.00%↑.

Also, after strong earnings results, the stock jumped. I explained the results here and that I would be reviewing my position, but no moves yet.

Then this happened.

So some subscribers said, “We could have sold at $243 and bought back at $211”.

I hope the section below answers those questions and gives you a look into my philosophy on when I close positions.

It's interesting to note that while many resources focus on how and when to buy stocks, few address the critical topic of when to exit a position. The lack of discussion regarding when to sell may be due to the psychological difficulty of selling. Holding onto a losing position and rationalizing it with the hope of recovery can be tempting. I, myself, have fallen victim to this mistake in the past. On the other hand, if the position is performing well, people tend to sell too soon, missing out on potential profits.

The decision of when to exit a position is just as crucial as when to enter, yet it often receives less attention. It's time to give this topic the consideration it deserves and answer questions some of you might have. Knowing the limitations of our human condition and the disadvantageous effects of our emotions, I will provide you with a methodological way to exit positions which eliminate emotions.

Why Selling is So Damn Hard

Selling triggers a psychological cocktail of fear, hope, and regret. If you're sitting on a loss, your brain whispers, “Don't worry, it'll come back,” and you start praying.

If you’re up big, that same brain says, “You don’t want to miss out on more upside, do you?”

Peter Lynch put it bluntly:

Selling your winners and holding your losers is like cutting the flowers and watering the weeds.

But we do it anyway. Because emotion clouds logic. And the market, with its daily noise, doesn’t help.

That’s why I rely on a simple framework to eliminate the noise and the feelings. Remember, there is no place for emotions in stock investing. While investing requires judgment, selling should follow a process.

Let’s walk through that process. I’ll even throw in an example with numbers and taxes (everyone’s favourite combo, I know).

The Only 3 Reasons to Sell a Stock

In my process, there are only three valid reasons to close a position:

Reason #1: The stock hits your target, and the story hasn’t improved

Just because a stock reaches your price target doesn’t mean you should automatically sell. Before hitting the sell button, revisit the thesis.

Has the story improved? Has the company secured a game-changing customer? Expanded margins? Made a brilliant acquisition?

If so, maybe your original target was too conservative. Consider reviewing your thesis. But if the story hasn’t changed or has weakened, then sell. Period.

For example, take United Rentals (URI 0.00%↑), here is what I wrote about it in my URI deep dive:

In my April 2023 Seeking Alpha article, I put a fair value on URI around $410/share, about 17% above the $350.

…

URI quickly proved me right. The stock climbed steadily through 2023 as earnings came in strong and investor sentiment on industrials improved. By the fall of 2023, URI was trading around the mid-$500s. I reiterated my conviction and revised the fair value to $680. When I started Beating The Tide, I included it in the newsletter portfolio at ~$545, as the fundamental thesis was very much intact (and arguably even stronger, given accelerating specialty growth and the announcement of a dividend).

As you can see, when URI’s stock price crossed my target price of $410, I didn’t hit sell indiscriminately. Instead, it triggered me to review my case, which happened three times with URI. The first two led me to revise my target price upward. The third review triggered me to sell my position as explained in URI’s post-mortem.

Reason #2: The thesis breaks

This is the big one. Something structural changes in the business or industry that invalidates your core thesis. Being unwilling to re-evaluate a thesis is the downfall of many investors.

You need to distinguish between noise (a bad quarter) and signal (loss of a competitive moat). Use your original investment memo or checklist. If the key drivers of your original thesis no longer hold, close it.

For example, when I realized my thesis on AMPH was flawed, I closed the position at a 50% loss, as I explained here. I did not wait for the stock to rebound or falsely convince myself that my initial thesis is correct; I coldly pressed the sell button and called it a day for AMPH 0.00%↑.

Reason #3: You’ve found a materially better idea

Joel Greenblatt talks about comparing your opportunity set. If you’re holding something with a 12% expected return and you find a new stock that offers 45%, it’s time to make a swap.

But here’s the twist: if you’re investing in a taxable account, you have to factor in the cost of realizing gains.

Let’s break that down with an example.

In Scenario A, you sell now at $220, pay $30 in tax, and walk away with $190.

In Scenario B, you believe the stock has 10% more upside to $242. At that point, you pay $36 in tax and walk away with $207.

In Scenario C, you’re comparing it to a new investment. To match that $207 net proceeds as Scenario B, the new stock has to go from $190 to $212, that’s an 11.6% gain.

So, unless your new idea offers at least 11.6%, it might make more sense to hold the original position and capture that extra 10%.

Beyond the potential upside, I also weigh the risk-reward profile of each opportunity. Maybe the 12% opportunity comes with just 3% downside — a 1:4 risk-reward. But the 45% opportunity might carry a 90% downside — a 1:0.5 profile. In that case, I may stick to the 12% opportunity.

This kind of decision-making isn’t sexy. But it’s real.

Selling is all about expectations. Are you expecting more upside from your current holding than what’s reasonably likely elsewhere?

The answer shouldn’t rely on gut feel. It should come down to:

Price vs. intrinsic value

Risk-adjusted upside

Second-level thinking asks: What’s priced in? Is the market already assuming the upside you’re hoping for?

If so, maybe the party’s over. If not, you might want to hold on.

Final Thoughts: Selling is a Skill — Practice It

Here’s what I’ve learned the hard way:

Selling too early caps your upside

Selling too late exposes you to avoidable losses

Not selling at all when you’ve got a better idea is just bad capital allocation

This isn’t just theory. It’s how I manage my own portfolio, with a running checklist and calculated trade-offs.

Below is a screenshot from the spreadsheet I use to track the upside potential and risk profile of the +200 stocks I follow. Every portfolio decision I make starts with this sheet; it helps me compare ideas objectively and stay grounded in the data.

The next time you're itching to hit sell, pause. Check your thesis. Check your alternatives.

Investing isn’t just about buying great businesses. It’s about holding them with conviction and letting go with clarity.

What’s your selling strategy?

Earnings Result Update: 88% Met or Exceeded EPS Consensus Estimates

Since the last update, eight companies reported earnings, and only one missed the EPS estimate, while two missed the revenue consensus estimate slightly by 0.05% and 2%. That’s a strong hit rate and a good sign that fundamentals remain solid across the board.

In case you missed it, I wrote a detailed breakdown of AGX’s results. Read it here.

Portfolio Update

So far in June, the portfolio is up +1.3%, edging out the S&P 500’s +1.1% gain.

Quarter to date, we’ve surged +12.4%, nearly doubling the S&P 500’s +6.5%.

Year to date, the portfolio has climbed +2.9%, compared to +1.6% for the S&P.

And since launching Beating the Tide, we’re up +10.7%, nearly triple the S&P 500’s +3.9% return over the same period.

Contribution by Sector

The Israel–Iran conflict pushed gold and energy into the green. Both sectors benefited from safe-haven flows and a spike in oil prices. The rest of the portfolio dipped slightly, led by industrials, tech, and education, mostly due to broad market softness and some company-specific cooling after recent strength.

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+30 bps CLS 0.00%↑ (TSX: CLS)

+16 bps TSM 0.00%↑

+8 bps IAG 0.00%↑ (TSX: IMG)

+2 bps VIST 0.00%↑

-1 bps LRN 0.00%↑

-1 bps TZOO 0.00%↑

-3 bps KINS 0.00%↑

-4 bps POWL 0.00%↑

-11 bps DXPE 0.00%↑

-15 bps MFC 0.00%↑ (TSX: MFC)

-41 bps AGX 0.00%↑

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Really appreciate the detailed response! This is exactly the kind of grounded thinking that helps cut through the noise.

Your point about watching how management’s narrative evolves over a couple quarters really stood out. It’s so easy to overreact to one data point, but trends take time to validate. And yes, multiple confirming sources definitely help separate signal from noise.

Also love the distinction you made between short-term headlines and long-term fundamentals. Markets often move faster than reality, but that doesn’t mean our decisions should. Thanks again for sharing!

Great insights here! How do you personally balance sticking with a conviction versus cutting losses when market tides start turning? Would love to hear your approach.