QFIN Deep Dive: This AI-Driven Lending Powerhouse Is Hiding in Plain Sight

Behind the scenes of an Asian fintech that's quietly outpacing the competition on ROE, growth, and capital returns — all while trading below 7x earnings.

Updates:

Closed position on Dec9´25

I remember in the early 2000s when friends would give you a funny look if you mentioned you were trying online dating.

Then it started to catch on—you had sites like Match.com gaining traction. Fast-forward to the mid-2010s, and online dating wasn’t just accepted—it had gone mainstream. Actually, it became the main way people met.

I remember watching a YouTube video around that time. A guy, sick of online dating, went to a park somewhere in the UK and started asking women out in person. When they turned him down, he explained he was doing a social experiment. More than one of them replied with something along the lines of, “I go online for my dating needs.” (Apologies—I tried to find the video again, but after five minutes of searching, I gave up on that noble quest.)

Then came dating apps like Tinder—online dating on steroids. Just glance at a picture, swipe left or right, and you’re done.

In the not-so-distant future, I wouldn’t be surprised if the swiping is done by your AI. Your AI would talk to your potential match’s AI, and between the two of them, they’d figure out if the date is worth your time. All you’d have to do is show up where your AI booked the perfect spot.

And it won’t stop there. Our AIs will restock the pantry (based on the latest results from your urine sample—too much sodium? Sorry, no processed meats this week), book flights, buy presents for birthdays and anniversaries, and yes—even find the best loan for your needs.

We’re not quite there yet, but we’re getting closer.

While We Wait for AI to File Our Loan Applications…

One day soon, your AI assistant will realize you’re planning a big trip, notice a dip in your cash flow, and quietly apply for the ideal loan—comparing rates, reading the fine print, even booking the hotel—before you’ve even said “vacation.”

But we’re not there just yet.

For now, humans still hit the submit button—but AI is already embedded deep in the process. Imagine using Tinder, but instead of swiping for soulmates, you're swiping for loan applicants. Behind each match? A hyper-personalized algorithm evaluating whether someone deserves a credit line. Welcome to the age of algorithmic lending, where first impressions are judged not by selfies but by credit behaviour, digital footprints, and machine learning models.

The human is still in the loop—for now. But the AI is whispering in their ear.

And buried deep in Asia’s fintech jungle, one company is playing Cupid better than most. It doesn't operate in the U.S., yet it's listed on a U.S. exchange. It doesn’t chase headlines, but its numbers speak louder than words. Its returns on equity are eye-popping. Its buybacks are aggressive. And its platform, increasingly indispensable.

This is not your average U.S. fintech story.

This is an Asian fintech operating at the intersection of AI, lending, and platform economics — and yet trading below 7x earnings.

With a balance-sheet-light model, insider ownership, and a buyback machine humming at full throttle, this company is quietly compounding earnings while the market snoozes.

Want to find out what makes it so special — and why the market might be waking up soon?

👇 Let’s dive in.

Trade alert:

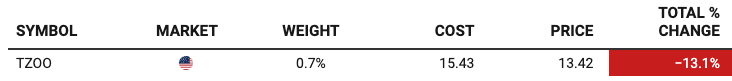

Close VIST & TZOO

Buy QFIN

I’m closing out VIST and TZOO to make room for QFIN. They’re currently the weakest risk/reward positions in the portfolio, so it’s time to let them go (at least for now) and redeploy that capital into stronger opportunities. Plus, both are up today—making this a good day to exit.

We gained +2.8% on VIST and lost -13.0% on TZOO.

Table of Contents:

Elevator Pitch

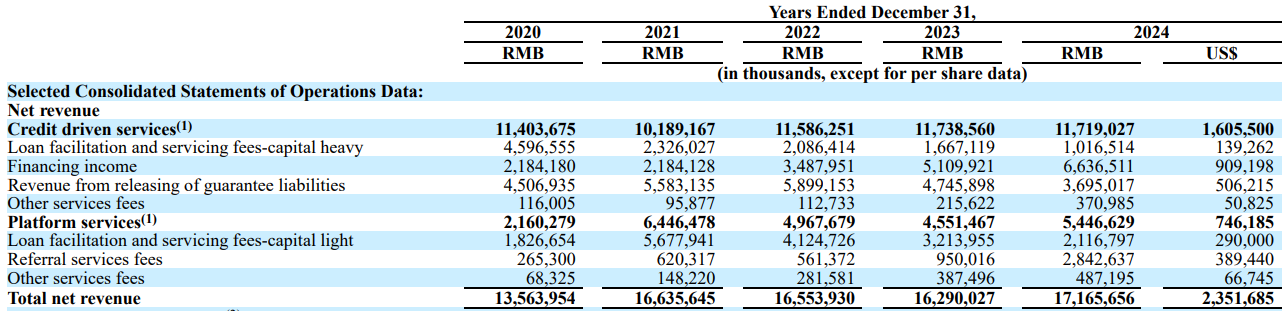

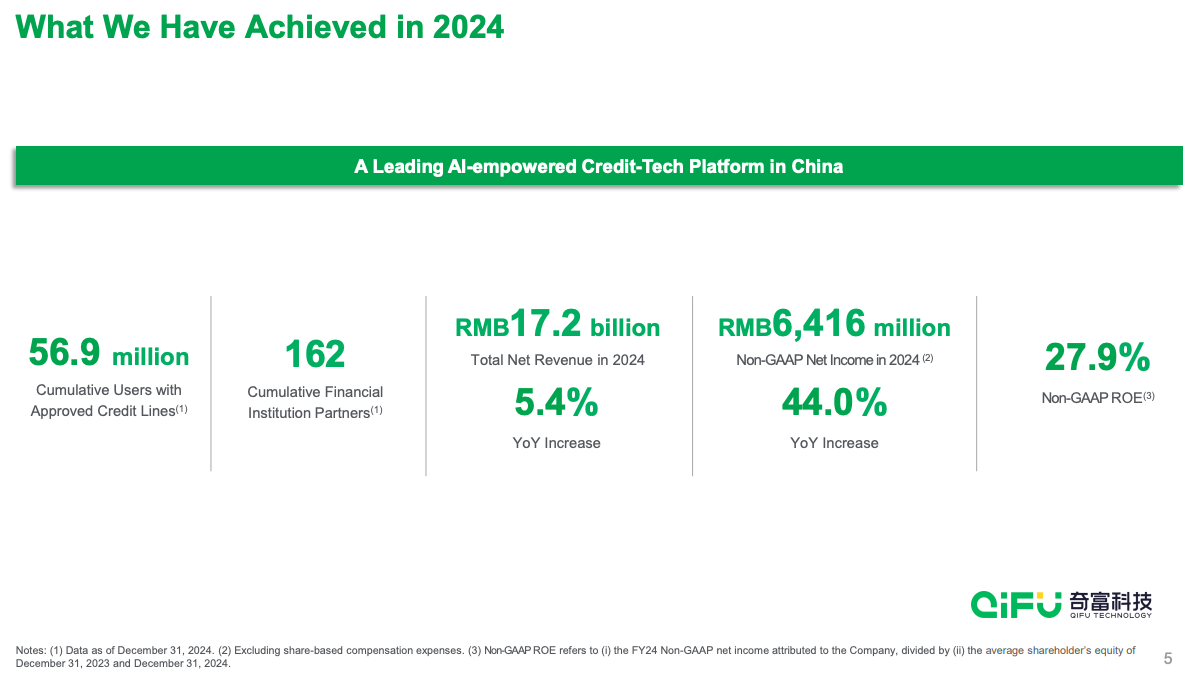

Qifu is a growing fintech leader with solid financials. It earned RMB17.2 billion in revenue in 2024 (up 5.4%) and RMB6.4 billion in net income.

Qifu turns record profits into cash returns — in 2024 it deployed over $400 million to buy back shares and paid $173 million in dividends. Its P/E (6.7x earnings) is in par with its Chinese peers. I believe China’s consumer lending is stabilizing under regulatory oversight, and Qifu’s data advantages (via parent Qihoo 360) and diversified loan model (about half on-balance-sheet, half capital-light) will drive further growth. If you’re skeptical or want details (and a few fun analogies), keep reading to get the full story and pack a snack, because we’re going on a hike longer than the Great Wall.

Business Model: Qifu’s “Loan Matchmaker” Platform

Qifu’s business is straightforward yet high-tech. It earns fees and interest by matching borrowers’ credit demand with partner lenders’ credit supply. Under China’s rules, foreign firms can’t directly own consumer finance companies, so Qifu uses a VIE structure: a Cayman parent contracts with a Chinese WFOE and local loan company (VIE) to capture economic benefits.

In practice, Qifu’s WFOE (named Qiyue) has agreements (voting proxy, equity pledge, etc.) to control the loan company. The Chinese VIE holds the loans and collects interest, but Qifu consolidates all the revenue. Nearly all (92–95%) of Qifu’s net revenue comes through these VIEs.

Qifu splits its services into two buckets: credit-driven services (facilitating and servicing loans) and platform services (technology products, big data services, etc.).

In 2024, about 68% of revenue came from credit-driven activities and 32% from platform/technology services.

Its lending model is half on-balance-sheet (“capital-heavy” loans where Qifu funds directly) and half via partners (“capital-light” loan facilitation). This mix allows Qifu to earn interest and fees while also collecting off-balance-sheet fees.

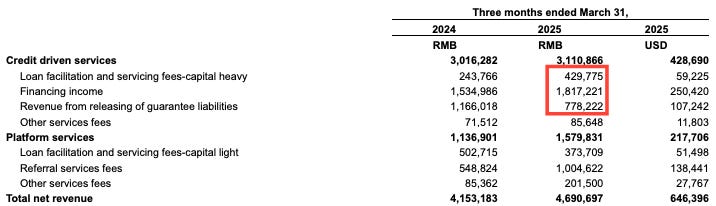

In Q1 2025, financing income (interest earned on loans) was RMB1.82 billion in 2024, and fee income from loan facilitation was RMB0.43 billion. Guarantee fees (from legally required loan guarantees) added RMB0.78 billion.

In short, Qifu is a fintech lending platform: it provides technology and risk management, services borrowers via an app (“Qifu Jietiao”), and works with over 160 institutional partners. It uses AI to underwrite loans quickly. Because of its roots in Qihoo 360, it also has data on hundreds of millions of consumers — a bit like giving Tinder an address book of active users. This data edge is a moat: Qifu can use non-traditional data (e.g. app usage, browsing behaviour) to assess credit risk, which is tougher to do in more regulated U.S. markets. Strict U.S. privacy and credit laws would likely forbid the level of data-mining Qifu does in China.

China Fintech Lending Context

To understand Qifu, we must view China’s lending market. In the 2010s, P2P lending boomed in China — thousands of small online lenders popped up. But regulators cracked down hard after frauds; by 2020 only ~29 of the original 6,000 P2P firms remained. Now, consumer lending is dominated by large tech-backed platforms. Think Ant Group (Alipay’s finance arm), Tencent’s WeBank, Alibaba’s financial affiliates, plus new players like Qifu (QFIN), LexinFintech (LX), FinVolution (FINV), and Lufax (LU). The government now insists that these fintech lenders partner with banks or securitize loans (asset-backed securities) instead of unsupervised online loans.

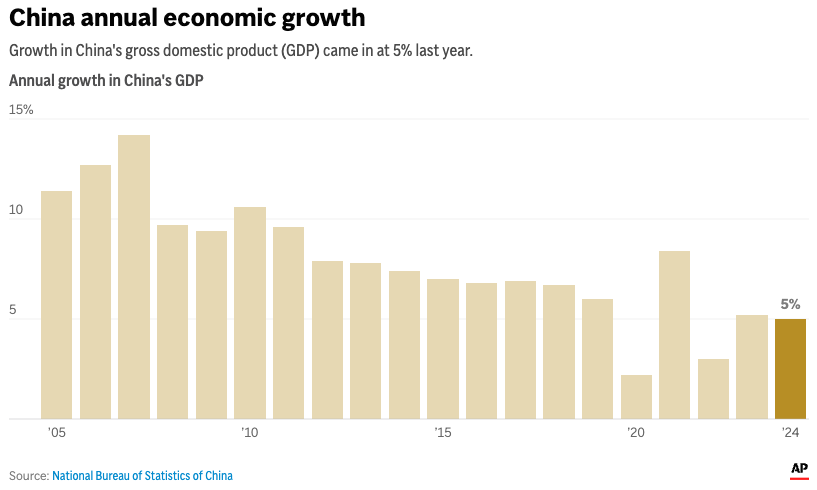

China’s economy has downshifted. After decades of double-digit growth, GDP settled around 5% in 2024, with forecasts for 2025 now ranging between 3.7% and 4.0%.

Property troubles and global trade tensions weigh on consumers. Qifu’s management notes that tariff-related uncertainties and slower consumer demand have slightly cooled loan volumes, though recent government stimulus has helped credit demand in early 2025.

The fintech industry outlook is thus mixed: growth is slower, but stable and in line with a shifting economy. We also see ongoing regulatory oversight in fintech — after P2P, China signalled it’s wary of “predatory lending” and data abuse. Qifu, however, primarily serves prime borrowers and the tech-savvy middle class, which may be less at risk than high-risk borrowers.

Competitive Advantages: Data and Tech

Qifu’s data advantage flows from Qihoo 360 (its indirect parent). Qihoo 360 is a Beijing-based internet giant known for security software and a search engine. While not strictly the same company, it illustrates Qihoo’s scale. In short, Qifu can tap Qihoo’s user ecosystems (e.g. 360 Search, browsers, apps) for marketing and data. This contrasts with many competitors who must buy lead data.

In the U.S., companies like Affirm (AFRM) or LendingClub (LC) have limited user data and must rely on credit bureaus; Qifu can analyze a borrower’s smartphone behaviour and other signals. However, such intense data use raises privacy concerns and likely won’t be acceptable in the U.S. due to GDPR/CCPA-like laws.

Another moat is technology. Qifu uses AI and machine learning to automate credit approval. According to investors’ calls, Qifu now uses LLMs and AI to refine credit scoring and personalize products.

We [Qifu] integrated large language models into our core capabilities and developed a standardized “Qifu AI-Copilot System” that has been deployed across key segments of our business, including risk management, telemarketing, loan collection, and customer service. The system enables intelligent human computer interaction through automatic speech recognition technology or ASR. It has currently achieved a recognition accuracy rate of 97% in our own collection scenarios, leading the financial industry standards.

Its partnership network is also a strength: as of March 2025, Qifu connected 163 institutional partners and 268.2 million potential consumers. Nearly half (49.3%) of loans at quarter-end were under the capital-light model, up 15% y/y, meaning Qifu is moving more originations off its balance sheet (a capital-light, lower-risk approach). This flexibility helps Qifu adapt to funding cycles. In Q1 2025, it issued a record amount of asset-backed securities (ABS) to fund loans, driving funding costs down.

Finally, Qifu’s regulatory licenses and experience are a competitive advantage — it is one of only a handful of licensed microlenders in China’s regulated financial system. This contrasts with the P2P firms of the past. Being regulated means Qifu’s growth is slower but more sustainable. During the Q4 2024 earnings call, the CEO emphasized that China’s regulators have signalled support for consumer lending to boost consumption, which bodes well for Qifu’s future compared to an outright fintech ban.

We believe this document and a very positive signal. And we are very encouraged. It is very clear that the government's direction is to boost consumption by encouraging the development of consumer credit industry. And I think there will be a series of policies to support that direction. I think we noticed three details in the document. The first, increasing the supply of consumer loans, which means support in terms of monetary policy and liquidity.

Financial Performance and Shareholder Returns

Qifu’s financials are robust. Revenue grew steadily to RMB17.2 billion in 2024, up 5.4% from 2023.

That capstone full-year revenue (all-time high) came after a slight dip in 2023.

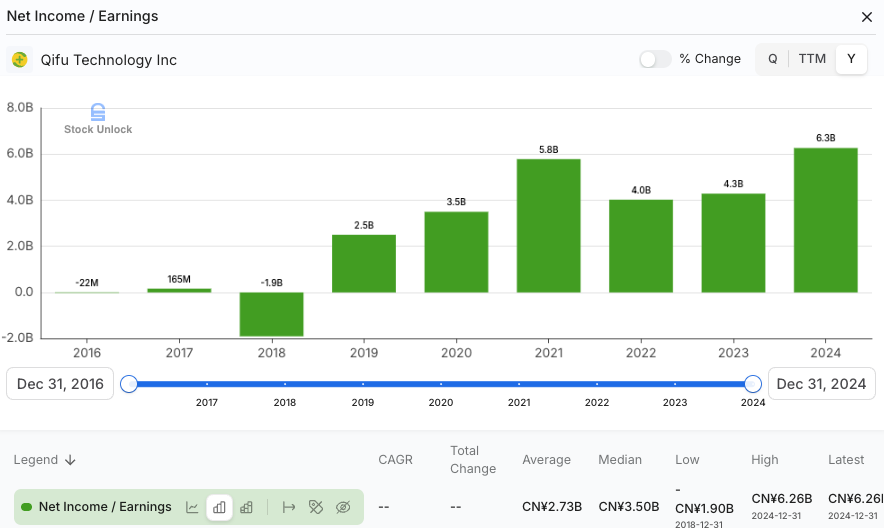

Meanwhile net income jumped to RMB6.25B in 2024, sharply up from RMB4.27B in 2023. In other words, Qifu is more profitable: net margin expanded from 26% in 2023 to 36% in 2024. The company attributes the profit surge to growth in higher-yield loans and strong cost control.

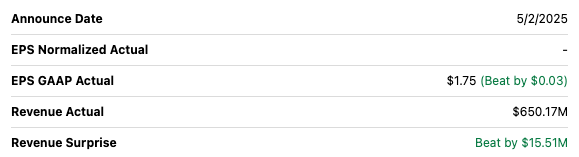

At the quarter level, Q1 2025 was solid and beat both revenue and EPS consensus estimates.

Total net revenue was RMB4.7B , up 13% y/y and slightly above Q4 2024’s RMB4.5B. Q1 net income was RMB1.8B (down modestly from Q4’s RMB1.9B) — this quarter had slightly higher provisions for seasonality, but still above Q1 2024’s RMB1.2B.

Q1 revenue growth was broad-based: credit-driven services (loans) earned RMB3.1B (vs RMB3.0B Q4 2024), while platform/tech services contributed RMB1.6B. Notably, interest income from Qifu’s on-balance loans was RMB1.8B in Q1, up 11% y/y (reflecting a larger loan book).

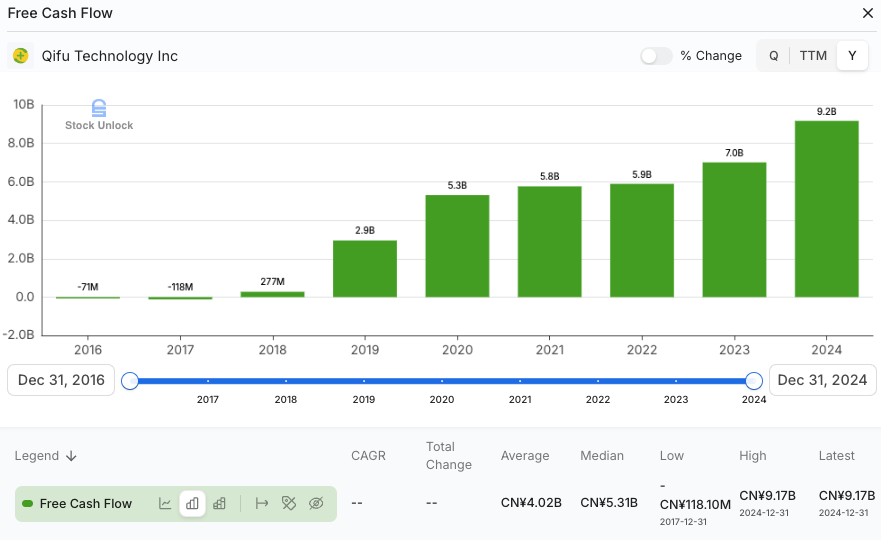

These results translate to very strong free cash flow. In 2024, Qifu generated a record RMB9.34B in operating cash, 50% more than the net income, reflecting conservative provisioning (more on that below).

Low capex and growing operating cash flows translate to solid, growing free cash flows.

Management didn’t just sit on its cash — it put it to work for shareholders.

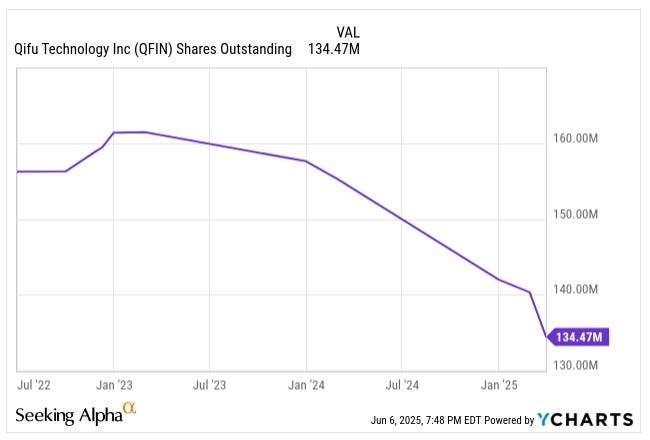

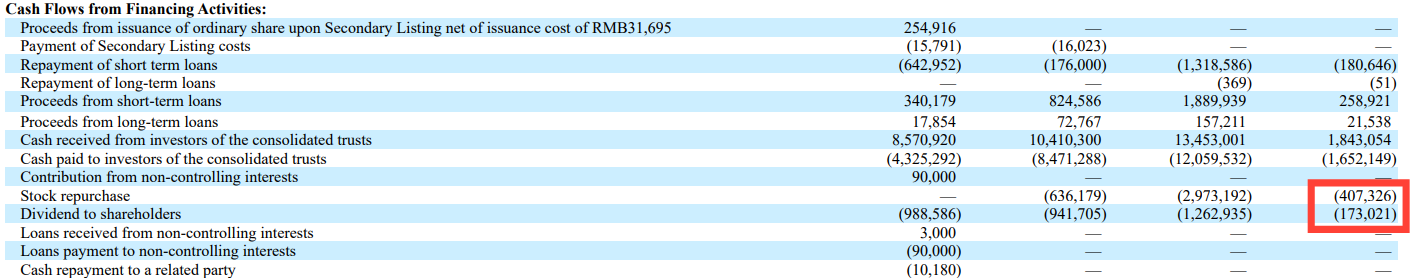

In 2024, Qifu executed its $350 million repurchase plan nearly to the dollar, buying back 15.11 million ADSs at an average price of $23.14. That’s a heavy dose of buybacks — and it didn’t stop there.

Under a fresh $450 million authorization for 2025, Qifu began scooping up more shares in January. By the end of February, it had already spent $69 million repurchasing 1.74 million ADSs at an average price of $39.50 — a big step up from 2024 prices, and a strong vote of confidence from management.

As a result, management has reduced the share count by ~17% in the last two years.

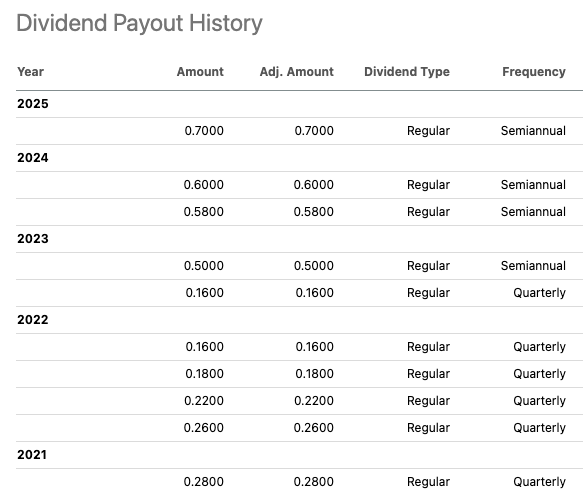

It also declared rich dividends. The board raised the semi-annual payout to $0.60 per ADS for H1 2024 and then to $0.70 in H2 2024 (the latter was announced alongside Q4 results).

In total, Qifu paid RMB1,252.7 million (~US$170M) in dividends for late-2023/early-2024 (covering 2H’23 + 1H’’24). By 2024 year-end, the company had returned over $400M in buybacks and $170M in cash dividends in that year alone.

These numbers blow away many peers. For example, LexinFintech (LX), a smaller BNPL lender, has spent far less on dividends ($22.5M) and no buybacks. The aggressive payout policy signals that Qifu’s board truly believes in the business: they only increase the dividend when results are strong, and they’ve pledged roughly 20–30% of net income as dividends under the new policy. (In fact, 2024 dividends were about 30% of adjusted net income.)

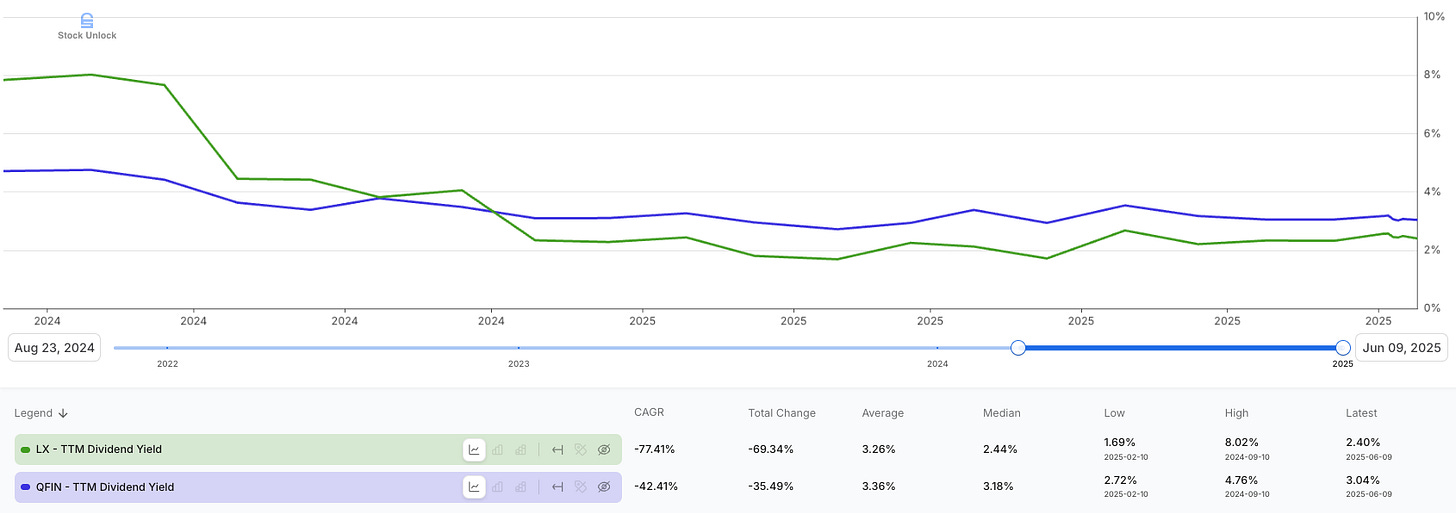

All told, Qifu is showering investors with cash. The current yield is around 3% vs. LX’s 2.4%.

Qifu’s management walks the talk on “returning value”. In essence, they treat the business like an already-mature enterprise (strong profits + buybacks) rather than a high-burn startup.

Loan Metrics and Risk Management

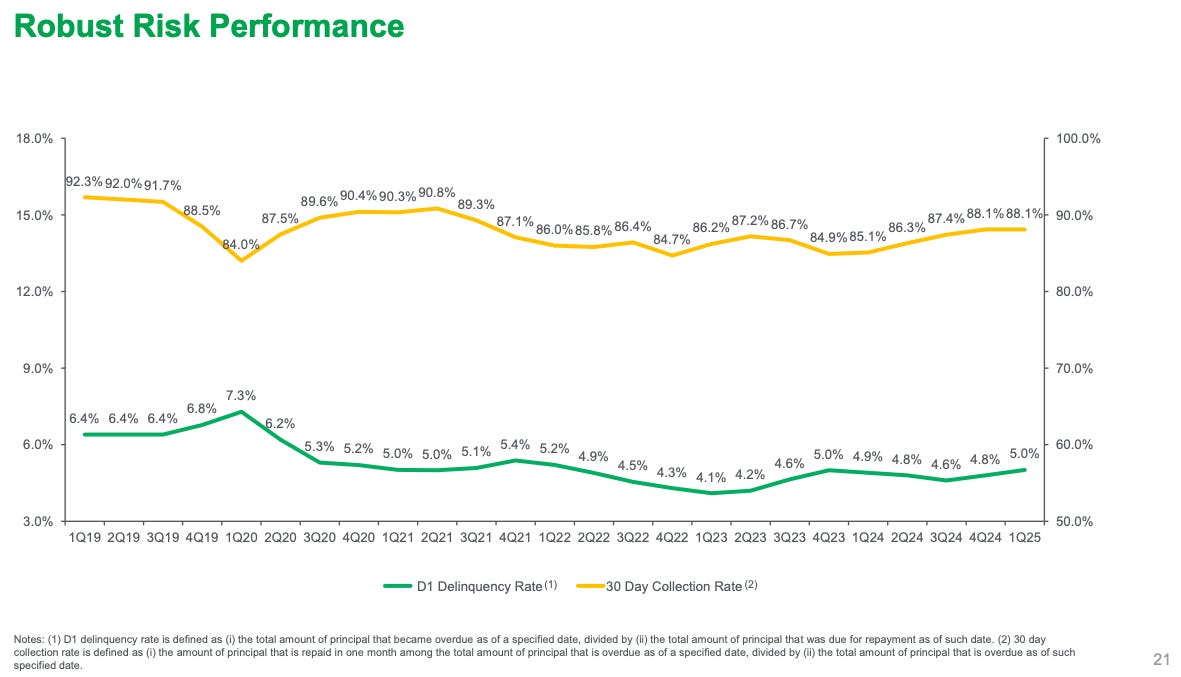

As a lender, credit quality is key. Qifu regularly reports three metrics: Day-1 delinquency, 30-day collection rate, and 90-day delinquency (C-M2).

Day-1 delinquency means the percentage of loans that fall overdue by one day after due date. It’s a leading indicator of stress. In Q1 2025 this was 5.0%, up slightly from 4.8% in Q4 2024. That is not alarming, Qifu says it’s “comfortable” and still better than the 6.4% it saw in early 2019.

The 30-day collection rate (percent of overdue loans paid in 30 days) was 88.1% in Q1, steady with Q4. This is lower than 2019’s 92%, reflecting more tightening, but it has improved recently (88% vs 86% in Q2 2024).

The 90-day delinquency (loans overdue 90+ days) is only 2.02% as of Q1 2025, actually lower than the 2.09% in Q4. A sub-2% 90-day rate is relatively low for fintech lenders.

Qifu takes a measured but conservative approach to credit risk. In Q1 2025, the company booked RMB823 million in provisions for loans receivable, up from RMB598 million in Q4 2024. It also set aside RMB39.9 million for financial assets receivable and RMB159.3 million for contingent liabilities. While Qifu doesn’t break out a formal “coverage ratio,” the rising provision levels, alongside a stable 90-day+ delinquency rate of 2.02%, suggest management is building a solid buffer.

This prudence aligns with what we’re seeing in early delinquency trends. The Day‑1 delinquency rate ticked up slightly in Q1, from 4.8% to 5.0%, a subtle signal of emerging credit stress. By boosting provisions ahead of the curve, Qifu is essentially saying: “We’d rather be early and overprepared than late and sorry.” It may trim reported profits in the short run, but it strengthens investor confidence when the credit cycle turns.

In sum, loan performance appears stable. Day-1 delinquencies ticked up slightly, but Qifu points out that’s due to more prime borrowers taking loans (they have thinner margins). The big picture: delinquency rates are roughly flat or improving over the years. Nevertheless, any rise in non-performing loans or slower collections (say if China’s economy weakens) is a risk to monitor. Qifu says it will “remain vigilant” and adjust underwriting as needed. For now, the loan book appears healthy, aided by technology and their large data set.

Share Structure and Liquidity

Qifu’s American Depositary Shares (ADSs) each represent 2 class-A ordinary shares. (So 1 ADS = 2 underlying shares.) This is important for investors to know when calculating yield or share counts. Qifu is dual-listed: its ADSs trade on Nasdaq (QFIN), and the same class-A shares trade on Hong Kong’s Exchange (3660).

The Hong Kong listing was strategic. In November 2022, Qifu completed a secondary listing in Hong Kong. This move gives mainland Chinese and Hong Kong investors direct access to the stock and provides a safety net against escalating U.S.-China tensions. Management underscored this in the Q1 2025 earnings call: if U.S.-listed ADRs ever faced delisting (a risk that flares up now and then), shareholders wouldn’t be stranded — they could simply trade the Hong Kong–listed shares instead.

Yan Zheng said during the earnings call:

… this ADR delisting basically resurface every few years … compared to early April, I think the delisting risk clearly kind of reduced by quite a bit. … in November 2022, we completed the secondary listing in Hong Kong. This basically has given our shareholders more flexibility… even in the worst-case scenario, where when our ADRs are forced to delist, investor would still be able to trade on our shares seamlessly in Hong Kong

But here’s the nuance: ADR holders can’t just start trading on the HKEX overnight. Each QFIN ADR and to access the Hong Kong listing, holders would first need to convert their ADRs into the underlying ordinary shares. This is done by instructing your broker or the ADR depositary (typically BNY Mellon) to cancel the ADRs and issue the Class A shares, which would then settle in Hong Kong via the clearinghouse (CCASS).

The process typically takes a few business days, and while there may be minor fees involved, it’s a well-established mechanism. The upshot? You wouldn’t lose your investment — you’d just be trading it on a different exchange, under a different wrapper.

Currently, nearly all liquidity is on the Nasdaq, but if ADRs were gone, Hong Kong trading would “naturally shift” there. Under HK rules, the HK listing would then convert from secondary to primary. In short, Qifu has hedged its regulatory risk by being listed in both markets.

VIE Structure (Risk)

Remember, the core credit business operates in China via the VIE. Qifu’s 20-F cautions that 92–95% of revenue in 2022–2024 was from the VIE entities, meaning China’s regulators hold most of Qifu’s fate. If PRC law ever prohibits VIEs in lending or declares the contracts invalid, the consequences could be severe: fines, license revocation, platform shutdown, or forcing onshore restructuring. This is not a made-up worry — the SEC filing explicitly warns that if Qifu loses VIE control it “may not be able to consolidate” its Chinese business, and ADS value could go to zero.

Such VIE risk exists for all US-listed Chinese fintechs, but it’s particularly acute here given how much revenue comes through the VIE. To mitigate this, Qifu re-negotiated its VIE contracts in 2022 (changed names, but same control terms). Investors should note: while none of Qifu’s actual loans are funded by foreign money (all are local RMB), our returns as ADS holders depend on Beijing continuing to tolerate the VIE schema. I view this as a material regulatory risk: if China ever forces consumer lenders to be 100% state-owned, Qifu shareholders would take a big hit. That said, as of 2025 China has shown no sign of banning VIEs outright — if anything, it has promoted fintech lending under regulated frameworks.

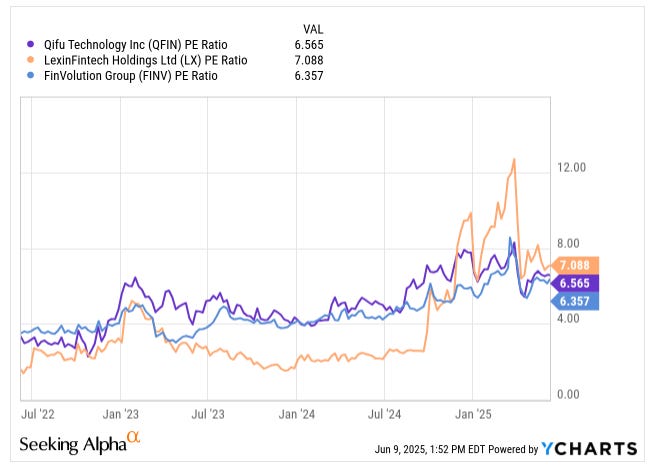

Valuation vs. Peers: Why This Fintech Still Looks Undervalued

Qifu operates in a crowded arena. Its closest peers include LexinFintech (LX), FinVolution (FINV), and the now-defunct China Rapid Finance. Lexin has made a name targeting younger, digitally native users with BNPL and installment plans, while FinVolution leans toward a balance-sheet-heavy model serving a broader swath of borrowers.

Qifu stands out. Not just for its fundamentals, but because the market is only beginning to price them in. As of June 2025, Qifu trades at a TTM P/E of 6.6x, roughly in line with FinVolution (6.4x) and just below LexinFintech (7.1x). In short, Qifu's valuation has firmed up, but it still doesn't reflect its superior financial profile.

But adjust for growth, and the gap looks absurd. Qifu’s PEG (Price/Earnings-to-Growth) ratio is just 0.1x, compared to Lexin’s 0.14x and FinVolution’s 0.24x. A PEG under 1 is usually a screaming value. At 0.1, it’s not just a value—it’s practically waving a flare gun.

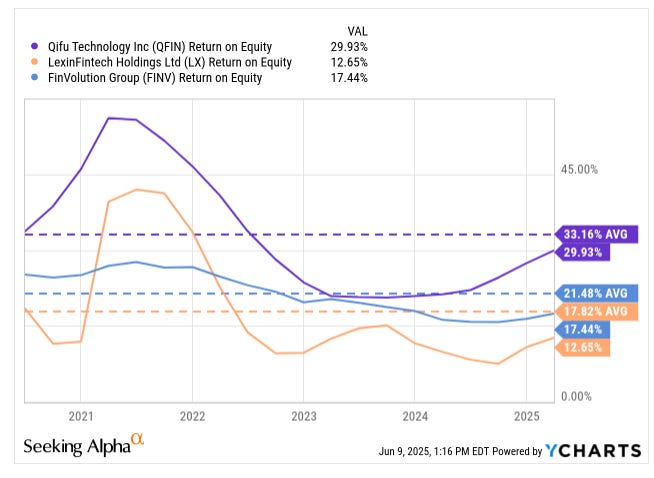

Qifu has consistently outperformed peers in ROE, delivering over 30% returns, while LX and FINV trail in the high teens and low 20s. It’s growing faster, scaling smarter, and returning more capital through buybacks and dividends. The current TTM P/E premium for Lexin suggests the market still hasn’t fully adjusted for those advantages.

Importantly, I believe the consensus 2025 EPS of $7.16 understates Qifu's true earnings power. My base case is $8.50 for three reasons:

Higher loan origination volumes: With capital-light facilitation reaching over 50% of total volume, Qifu can grow revenue faster without expanding its balance sheet.

ICE monetization: Its Intelligence Credit Engine platform continues to gain traction, boosting high-margin fee income.

Aggressive buybacks: With $450M authorized and ~$70M executed in Q1 2025 alone, the share count should decline meaningfully, lifting EPS mechanically.

If the market awarded it a 7.1x P/E, same as LX (even though, as I argued above, I believe QFIN should be trading at a premium), that would imply a share price of $60.35—or a 44% upside from current levels.

I believe this re-rating is not just possible, but very likely. When a business combines high ROE, platform leverage, buyback tailwinds, and rising institutional awareness, value tends to catch up fast.

And in investing, mispriced quality doesn’t stay mispriced for long.

Industry Dynamics and Outlook

The Chinese fintech ecosystem is evolving. After years of crackdowns on big tech and P2P, regulators are now in a transitional phase. In 2024, the government signalled more support for consumption-driven credit: local officials urged banks to expand lending, and even fintech funding tightened in a healthy way (funding costs fell in Q1 2025 after Qifu issued record ABS volume). Macro headwinds remain (property-sector drag, trade tensions), but the worst fears seem behind us for now.

For Qifu specifically, potential growth drivers include: improving risk tech (AI credit scoring, expected to lower losses over time), cross-selling financial products (credit cards, wealth management), and more Asian partnerships. They have also launched After-School GenAI learning courses (using their app platform) — an unusual diversification. While it earned negligible revenue in Q1, it shows Qifu’s desire to extend its ecosystem (perhaps spurring more user engagement).

Financially, if loan origination rebounds (Q1 loan volume was RMB88.9B, up 15.8% y/y after a 12% drop in 2024), Qifu could see revenue growth reignite. The outstanding loan balance is now RMB140.3B, +5.5% y/y, supported by nearly half the book being on partner-run pools (so actual balance sheet usage is tempered).

The dividends and buybacks suggest management expects sustained cash flow. If China’s economy improves, Qifu could easily increase its payout further.

Risks and Mitigants

Finally, a quick risk review:

Regulatory risk

As noted, VIE legality is a big X-factor. Also, any unexpected new lending curbs (the government may in future tighten microloan interest rate caps) could hurt margins. I monitor PBOC and CBIRC announcements. Mitigation: Qifu works closely with regulators and maintains high transparency (quarterly 6-K filings, HK disclosures).

Macroeconomic risk

A deeper China slowdown or new trade wars could reduce consumer borrowing. Mitigation: Qifu’s customers are generally middle-class, salaried workers; it doesn’t lend to property developers or distressed sectors. In Q1 2025, the CFO mentioned that only ~1% of Q1 loans were to tariff-exposed industries.

In Q1, those [loans] related to experts accounted for just around 4% of our total loan volume. Among them, only about 1% were in sectors likely to be significantly impacted by U.S. tariffs. For these users, we have already adjusted our transaction and asset allocation strategies to mitigate potential impact from tariffs.

Credit risk

If delinquency spikes beyond provisions, earnings would suffer. Mitigation: high coverage ratios and data-based underwriting help.

Market Sentiment

Chinese ADRs have erratic liquidity. Thankfully, Qifu now has an HK listing, and insiders (including Zhou) own a big stake, so management is aligned with shareholder value.

Verdict and Recommendation

This isn't a speculative moonshot or a turnaround story. This is a high-ROE, high-growth fintech that’s compounding cash flows, reducing share count, and expanding margins — all while trading under 5x my expected earnings for 2025.

I expect EPS to surprise the market at $8.50 and the shares should rerate closer to LX leading to a $60 share price, a 43% upside from current levels.

Mispriced, underfollowed, and quietly executing — this looks like one of those rare setups where the risk/reward tilts heavily in our favour.