United Rentals (URI) Deep Dive: Why I’m Taking Profits on This Equipment Rental Giant

An in-depth stock analysis of United Rentals — including my original thesis, what played out, where I went wrong, and why the upside no longer justifies the risk at $725.

Yesterday, I sent out a trade alert to close our position in United Rentals (URI). Today’s deep dive stock analysis is my detailed post-mortem on the investment—an essential practice I've emphasized multiple times before, such as in Weekly #22 and Weekly #29.

Post-mortems aren't just for our losing trades (like my experience with AMPH); they're equally important for our winners. They help sharpen our investment process over time.

Here are some deep dives and post-mortems for winning trades.

With URI, the reason I’m going particularly deep is that, as you’ll soon discover, the cyclical nature of this business could present another attractive entry point down the road. Developing a thorough understanding now will position us to act fast when Mr. Market inevitably overreacts.

Ok, so let’s get started!

Table of Contents:

The Equipment Rental Industry: Trends and Competitive Landscape

Why I’m Closing the URI Position at ~$725 – Valuation & Outlook

Background

I added United Rentals (NYSE: URI 0.00%↑) to my personal portfolio in April 2023 and wrote a Seeking Alpha article about my investment thesis. When I started this newsletter, I added URI to the portfolio from day one at around $545.

My position was betting on a booming equipment rental industry and URI’s unique strengths. Two years later, URI’s stock has doubled, handily beating the market, as my thesis largely played out. Now, with shares near $725, I’m closing the position to redeploy capital into higher-upside, lower-downside ideas. URI remains a best-in-class operator benefiting from secular growth in equipment rental, but much of the good news appears priced in at these levels.

Enjoying this level of in-depth stock analysis?

Consider subscribing for more high-conviction stock picks. Paid subscribers get real-time trade alerts – including our next one: an under-the-radar $250 million company in an “unsexy” industry that I believe could be worth 4–6x its current price.

Don’t miss out on the next deep dive and stock pick — subscribe now for the latest actionable investment ideas!

Why I Bought United Rentals at $350 (and Again at $545)

United Rentals is the world’s largest equipment rental provider, with a network of over 1,500 branches across North America. The company rents out a vast array of equipment — from bulldozers and backhoes to power generators and trench safety boxes — serving construction and industrial firms, utilities, municipalities, and even DIY homeowners. In April 2023, I saw URI as a compelling opportunity: a fundamentally strong business in a dull industry that the market was underestimating.

My bullish stance was rooted in a few key points:

Secular Growth in Equipment Rental

The equipment rental industry was poised for steady growth, driven by a shift in customer preference from owning equipment to renting it. Contractors wanted to cut costs and increase flexibility by renting instead of buying and maintaining their own fleets. Rental “penetration” — the percentage of equipment on job sites that is rented rather than owned — had been rising for years, reaching about 55% in North America (versus ~64% in the UK, indicating room for further adoption). Along with a post-pandemic recovery in construction and industrial activity, this trend created a favourable demand backdrop. I expected industry growth of roughly 4–5% annually from a combination of increased rental adoption and normal economic growth.

URI’s Scale & Market Leadership

United Rentals was (and still is) the #1 player in a highly fragmented market. At the time, URI held about 16% market share in North America — roughly equal to the next two competitors combined. The rental industry had been consolidating, with the top 3 players growing their share from just ~10% in 2009 to ~30% by 2023. URI’s acquisition-driven growth strategy was a big part of this: for example, in late 2022, URI acquired Ahern Rentals, a major regional player, which significantly expanded its fleet and branch footprint. My view was that URI’s scale gives it cost advantages (buying power for equipment, nationwide branch network, technology systems) and that further consolidation would allow URI to grab even more share in the coming years. This has indeed been a trend — Ashtead (Sunbelt Rentals) (Pink: ASHTF) and URI both predict the top 3 companies could control over 50% of the market in the future.

Specialty Rental Expansion

A core part of my thesis was URI’s push into specialty equipment segments. Traditionally, United Rentals was known for general construction equipment (think backhoes, forklifts, aerial lifts). Over the past decade, however, it has deliberately expanded into specialty niches like power & HVAC solutions (portable generators, AC units), trench safety (shoring equipment), pump and fluid solutions, tools, and onsite services. These specialty offerings tend to be higher-margin and less cyclical, and they allow URI to be a one-stop shop for customers. In 2023, specialty rentals were growing 3x faster than the general rentals segment, helping reduce the company’s overall cyclicality while boosting profitability. At the time of our initial investment, specialty services made up about one-quarter of URI’s revenue; management’s goal was to keep growing that mix. I believed this focus on specialty rentals would give URI an edge by diversifying its revenue and supporting margin expansion over the medium term.

Improving Fundamentals and Valuation

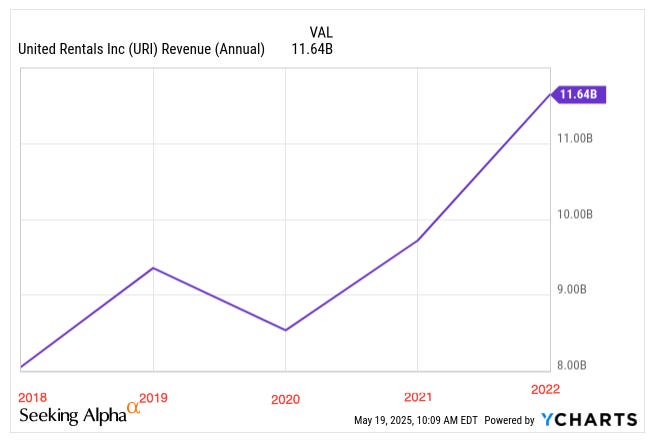

United Rentals was firing on all cylinders financially. In 2022, URI’s revenue had jumped ~20% to $11.6 billion, rebounding strongly from the 2020 slump.

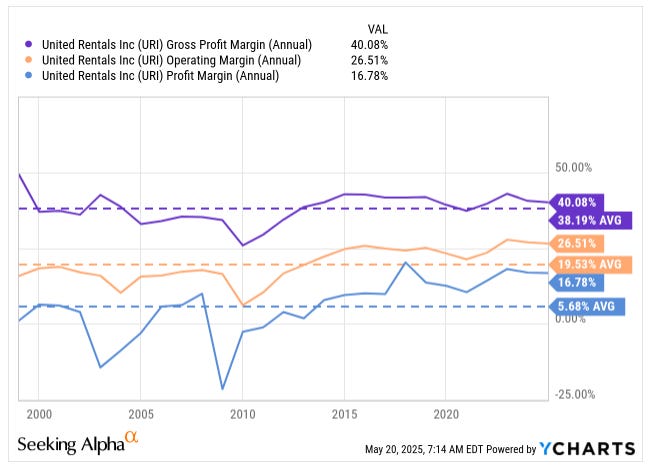

Profitability was robust, with EBITDA margins in the high-40% range and net income margins around 17–18% — excellent for an industrial company.

Importantly, a lot of this growth was translating into free cash flow. By 2022, URI generated over $1.7 billion of free cash flow, which it was using to pay down debt and, for the first time, initiate a dividend (more on that later). Yet despite these strengths, the stock was trading at only ~8.9x forward earnings in early 2023 — a bargain valuation if the growth trajectory held.

In my April 2023 Seeking Alpha article, I put a fair value on URI around $410/share, about 17% above the $350.

Taking all this together, I published a “Buy” recommendation on URI at $349.99 in April 2023. The idea was simple: a best-in-class operator in a growing industry, trading at a low multiple due to overblown recession fears. This was a classic “boring” stock that I believed could deliver returns.

URI quickly proved me right. The stock climbed steadily through 2023 as earnings came in strong and investor sentiment on industrials improved. By the fall of 2023, URI was trading around the mid-$500s. I reiterated my conviction and revised the fair value to $680. When I started Beating The Tide, I included it in the newsletter portfolio at ~$545, as the fundamental thesis was very much intact (and arguably even stronger, given accelerating specialty growth and the announcement of a dividend).

What Went Right (And Wrong) With My URI Thesis

When a stock doubles in ~2 years, clearly a lot has gone right. In the case of United Rentals, the company delivered on the key pillars of my thesis:

Industry Tailwinds Materialized

The equipment rental market remained robust through 2023–2024. Non-residential construction and infrastructure projects have been strong (helped by government spending programs and the reshoring of manufacturing), and industrial maintenance activity picked up. This drove healthy demand for rental equipment across both construction and industrial end-markets, exactly as I anticipated.

Rental penetration in North America continues to tick up as more customers opt to rent, especially in uncertain times (interestingly, rental penetration often increases during periods of economic uncertainty, as companies become more cautious about capital spending). The American Rental Association noted that the industry remained “resilient” despite recession worries, and the latest data show global construction equipment rental revenue still growing in mid-single digits annually. In short, the rising tide I bet on did come in, lifting URI’s financial results.

Specialty Segment Outperformance

URI’s emphasis on specialty rentals has paid off even better than expected. The specialty segment (which includes power, HVAC, trench, tools, etc.) grew 30% in 2024 (18% growth even excluding the impact of acquisitions) — far outpacing the ~2% growth in general rentals. Specialty now accounts for roughly one-third of total revenue, up from about 29% when I initiated the position.

This mix shift has provided a boost to margins and helped smooth out the business. Specialty services tend to have more stable demand (some are tied to maintenance, emergency response, utility work, etc.) and often carry a higher ROIC.

Management remains extremely bullish on this segment — on the Q1 2025 earnings call, URI noted that even its more mature specialty businesses are growing double-digits, and newer specialty lines (in newer regions or product categories) are growing even faster. CEO Matthew Flannery said during the call that,

…specialty businesses, we're growing double digits. So each quarter, it may be a little more choppy, but you'd have to think about the newer platforms with more white space and more cold starts are going to grow faster. But power being, I think, one of our most mature, continues to be one of the leaders in the pack on growth. So it's across the board. It's partly driven by penetration and a big part of it driven by our go-to-market, right? So between the white space and our go-to-market are continuing to sell into our targeted customers, we are probably taking share as they maybe were using a myriad of smaller type providers. And I think the fact that we can bundle it's a big advantage for us and why we're seeing that growth and have confidence in that future growth.

That’s a powerful growth engine layered on top of the core rental business. My thesis that “specialty will be a game changer” has undeniably proven true.

Smart M&A, Though Market Share Gains Have Slowed

United Rentals continued to execute smart acquisitions and integration. The 2022 Ahern Rentals acquisition (which added ~$300 million of annual revenue) was digested smoothly, contributing to growth and synergies in 2023. In March 2024, URI acquired Yak Access (a supplier of temporary access roads and mats for construction sites) to bolster its specialty offerings, again demonstrating its strategy of bolt-on deals in niche areas.

However, while URI has grown in absolute terms, its market share gains have plateaued. As of 2024, the top three players—URI, Sunbelt, and Herc—collectively hold about 30% of the North American rental market, with URI accounting for just over 15%. That’s roughly flat compared to 2022 (~16%), suggesting that faster-growing peers—especially Sunbelt—have gained relative share as the overall industry expanded rapidly. URI remains the market leader, but the pace of share expansion has cooled.

I predicted continued consolidation, and indeed the industry saw a major development in early 2025: URI announced a deal to acquire H&E Equipment Services (another top-10 rental firm) for $4.8 billion, which would have added ~10% to URI’s revenue.

In a twist, Herc Holdings ( HRI 0.00%↑ ) swooped in with a higher bid, ultimately scuttling URI’s deal. While URI didn’t end up closing H&E, it will receive a $63.5 million breakup fee for its troubles, essentially getting paid after Herc outbid them. The H&E saga aside, the bigger picture is that URI has further solidified its leadership position. The company’s growth from $8.5 billion rin evenue in 2020 to over $15.3 billion in 2024 has been fueled by both organic gains and over $4 billion in acquisitions during that period. I correctly anticipated that URI would keep using M&A to extend its dominance.

Financial Results Exceeded Expectations

URI’s actual financial performance surpassed even our optimistic scenario. Consider this: In 2022, we valued the stock at $410 based on certain growth and margin assumptions. Fast forward to 2024, and URI earned $38.69 in diluted EPS — meaning the stock hit our former price target while still trading at only ~10x earnings!

Revenues reached $15.3 billion in 2024, 7% higher than in 2023. Adjusted EBITDA for 2024 was roughly $7.2 billion, giving an EBITDA margin of 46.7%. Operating profit grew to $4.1 billion in 2024 at a 26.5% operating margin. By most measures, URI’s growth has been above what I modelled.

Crucially, this growth translated into shareholder returns: URI generated over $2.2 billion of free cash flow in 2023 and $1.9 billion in 2024. The company even initiated a dividend in 2023 (paying $5.92/share that year) and raised it by 10% for 2024 (to $6.52/share).

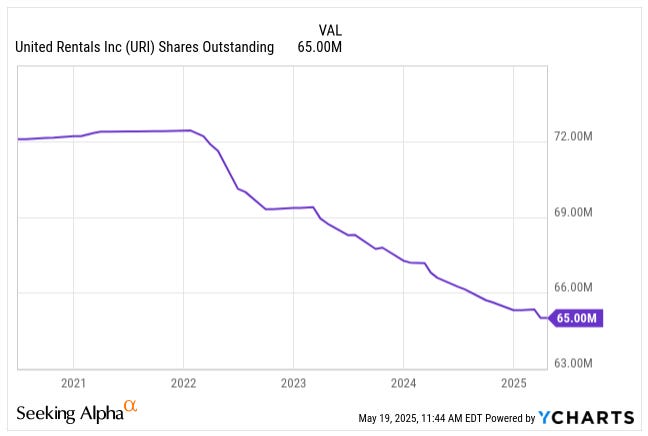

It also repurchased ~$1 billion of stock in 2023 and ~$1.5 billion in 2024, reducing the share count from over 72 million shares to 65 million shares, which is almost a 10% reduction in outstanding shares.

These moves were icing on the cake — I hadn’t counted on immediate capital returns like dividends, but URI’s cash generation enabled management to start rewarding shareholders directly. The strong results validated the quality of the business and management’s discipline.

So, with the benefit of hindsight, what (if anything) did I get wrong? There are a few areas where reality differed from my initial expectations:

Underestimating the Upside

Clearly, my original $410 price target was too conservative. URI smashed through that level within a year and just kept climbing, eventually breaking $700. In hindsight, I underestimated the long-term growth runway for URI’s cash flows—and how much the market would reward a well-run, cash-rich industrial in a world starved for quality. Part of the re-rating came from the very trends we identified early on: secular rental adoption, specialty growth, and operational resilience. But some of it, I’ll admit, was just the market catching on—and perhaps a lack of better alternatives elsewhere.

Still, this wasn’t a case of setting a target and walking away. When URI hit $410, I didn’t sell—I paused to reassess. As the thesis kept playing out and fundamentals strengthened, I upgraded my fair value estimate in stages: first to $550, then $645, and eventually $700. Each raise was grounded in updated numbers, not market euphoria. And that brings us to today, with the stock now at $725, brushing up against my most recent fair value. It’s a natural point to re-evaluate once more.

Margin Expansion Was Modest

I expected that URI’s margins would expand meaningfully as volume grew (operational leverage) and specialty mix increased. In reality, EBITDA and operating margins are roughly flat to slightly down from 2021 levels. For instance, adjusted EBITDA margin was ~48% in 2022, and about 46–47% in 2023–2024. Gross margins on rentals dipped a bit in late 2024 (down ~130 bps y/y to ~40%) due to a higher mix of lower-margin revenues like used equipment sales and some inflation in operating costs.

So, URI didn’t see a big margin break-out. However, it’s worth noting margins stayed very healthy and stable, even with some cost headwinds, which is a testament to URI’s execution. The slight margin pressure came from things like rising wages, higher transportation/fuel costs, and growth in ancillary services (like re-renting equipment from third parties to meet overflow demand, which carries a lower margin).

These factors offset the margin benefits of more specialty revenue. Net-net, URI’s profitability is excellent, but I was a bit optimistic in assuming margins would increase; instead, they have been maintained. I’ll take a stable +45% EBITDA margin from a company growing this fast any day.

No Severe Downturn (Yet)

In formulating my risk/reward, I of course considered the possibility of a recession or construction downturn in 2023–2024 that could hit URI’s utilization and pricing. Thankfully (for URI and for us), that hasn’t materialized — at least not yet. The feared “2023 recession” never really arrived, and in fact many of URI’s end-markets (infrastructure, manufacturing, data centers, energy, etc.) have been buoyant.

This is somewhat a matter of luck/timing rather than analysis. It’s a reminder that macroeconomic predictions are hard, and sometimes the best course is to focus on company quality and secular trends and ride out the bumps. URI’s resilience in part reflects how the rental model can still generate cash even in slower times (equipment can be idled to save costs, sold for cash, etc.), but it also reflects that the downturn case simply hasn’t tested the company yet in this cycle. I was prepared for volatility, but URI ended up enjoying a relatively smooth ride. If anything, this left us over-hedged mentally — we could have been even more aggressive given how well things panned out.

Overall, I’d categorize my URI call as a win. I identified a high-quality, “boring” business with strong cash flows and a long growth runway, bought it at a cheap valuation, and my thesis played out with only minor deviations. The stock’s performance speaks for itself. This kind of result is what we aim for with Beating The Tide: find value off the beaten path, have conviction, and let the fundamentals do the work.

How United Rentals Makes Money — Simplified

United Rentals’ business model is straightforward on the surface: rent heavy equipment to customers and provide related services. But there are a few moving parts worth breaking down:

Core Equipment Rentals

This is ~85% of URI’s revenue and the heart of the business. URI owns a fleet of equipment with an original cost (OEC) of over $21 billion (as of early 2025). This fleet includes everything from aerial work platforms (boom lifts, scissor lifts) to earthmoving machines (excavators, loaders), forklifts, generators, trench shoring systems, portable storage containers, and more.

Customers (construction contractors, factories, utilities, etc.) rent these assets for periods ranging from a day to many months. Rental contracts can come with or without operators (mostly without — the customer provides the labour). URI’s value-add is providing availability (any equipment you need, when you need it, delivered to your job site), maintenance (they service and repair the fleet), and flexibility (rentals can be scaled up or down as projects require).

Because URI has the largest fleet and branch network, it can serve national contractors with consistent service across locations — a big competitive edge over local rental shops. Rental revenue is further categorized into: owned equipment rentals (fees for URI’s own fleet usage), re-rent revenue (fees when URI procures equipment from a third party to rent to a customer — usually to meet excess demand), and ancillary revenue (charges for delivery, fuel, damage waivers, etc.). Owned equipment rental is by far the largest component.

Sales of Equipment (New and Used)

About 10–12% of revenue comes from equipment sales. There are two pieces here: used equipment sales (~10% of rev) and new equipment sales (~2%). Used sales are a natural part of the model — URI continuously rotates its fleet by selling older machines (typically after 5-7 years of use) in the secondary market. This helps refresh the fleet and recover capital.

In 2024, URI sold $1.52 billion of used rental equipment (about the same as in 2023). Notably, they often sell equipment at a gain relative to its depreciated book value — in 2024, gains on the sale of rental equipment were $710 million.

This indicates that used equipment prices have been strong (partly due to high demand and inflation for new equipment).

Interestingly, this pattern resembles dynamics highlighted by Yet Another Value Blog regarding the rental car industry. Post-COVID, rental car companies benefited significantly from elevated used car prices due to supply-chain disruptions.

While a similar effect is visible here, it's worth noting that URI consistently realized gains from equipment sales even before COVID. The difference now is largely due to the expanded fleet size, driving higher absolute gains.

New equipment sales (only $282 million in 2024) occur when URI acts as a dealer for certain manufacturers or when they sell equipment they’ve purchased specifically for resale (this is not a big strategic focus, more a service for customers who may want to buy some items).

Other Services & Supply Sales

The remainder (~3–4% of revenue) comes from sales of contractor supplies (think small tools, safety gear, parts) and services such as training, repairs, or software solutions. URI’s goal is to be a one-stop solution for customers’ job-site needs. For instance, they offer on-site equipment maintenance services for customer-owned fleets and safety training courses for operators. These are small but help deepen customer relationships.

Put simply, URI buys a lot of equipment, rents it out repeatedly, and eventually sells it — and in doing so, it aims to extract more cash from the equipment over its life than the equipment’s cost. This is where unit economics come in: imagine URI purchases a boom lift for $100,000. They might rent it out at roughly, say, $200 per day. Even with utilization around 70% (typical for many categories), that lift could generate ~$50,000+ in rental revenue per year. Over 5 years, it might earn back $250,000 in rental fees, and then URI can still sell the used lift for perhaps $40,000. In this hypothetical, URI spent $100k, got $250k in rent, $40k back in resale — a very attractive return (though we must account for maintenance, logistics, and overhead costs too).

While every category and item differs, this illustrates how rentals turn capital into cash flow. URI’s fleet utilization (time rented divided by time available) and rental rates are key drivers. They manage utilization by shifting equipment across locations as needed and flexing pricing. In Q1 2025, URI’s fleet productivity (a metric combining rental rates, utilization, and mix) was up 3.1% y/y, meaning they squeezed more revenue out of the fleet than the prior year, a positive sign.

Another important aspect: customer mix and contracts. URI serves ~20,000+ customers, from giant construction firms to small contractors. No single customer is more than 2% of revenue. Many large customers are on national accounts with URI, negotiating enterprise agreements that give them priority service and volume-based rates.

About 68% of URI’s rental revenue comes from these key accounts (often large construction/industrial companies). The rest are local contractors and individuals. Large accounts provide some stability (repeat business) and volume, while small accounts often pay higher rates on shorter rentals. URI balances the mix to maximize fleet yield and maintain strong relationships.

It’s worth noting that rental is a cyclical business, but less so than in the past. During downturns, construction slows and demand for equipment falls. However, because rental saves customers money versus owning, a weak economy can actually push more firms to rent (they sell their own equipment to raise cash and rent instead). We saw this dynamic in past recessions.

Additionally, URI’s expansion into industrial and specialty areas (serving factories, utilities, emergency response, etc.) has reduced its reliance on pure construction cycles. This diversification was a deliberate strategy by management to make URI “cycle-resistant.”

While it’s not recession-proof, URI today is far more resilient than it was in, say, 2008. Even in a severe downturn, URI can pull levers like cutting capex (no need to buy new equipment if demand is soft) and selling a bit more of its fleet to generate cash. In the 2020 COVID shutdown, for example, URI remained profitable and cash-flow positive by quickly adjusting fleet size and costs.

To summarize, United Rentals makes money by renting equipment and providing solutions that save customers the hassle and expense of ownership. Its scale and scope allow high utilization and a broad offering, which smaller competitors can’t match. This translates into strong margins for URI and a compelling value proposition for customers (why buy a $100k machine plus pay maintenance/storage, when you can rent as needed from URI?). As long as contractors continue to “outsource” their equipment needs, URI will keep the cash flowing.

The Equipment Rental Industry: Trends and Competitive Landscape

United Rentals operates in a large but evolving industry — one that has been around for decades but is still changing in ways that favour the big players. Let’s break down some key industry dynamics:

Continued Shift Toward Renting (Rental Penetration)

As mentioned, more companies are choosing to rent instead of own. In North America, rental penetration of construction equipment is roughly 55% today, up from maybe ~40% two decades ago. Culturally, the construction industry has become more accepting of renting — it’s no longer seen as a niche or last resort.

In the U.K., rental penetration is even higher (~64%), while in parts of Europe it is lower (~35%), indicating different market maturity. The U.S. still has room to grow, and URI frequently cites this as a secular tailwind. Why do companies rent instead of buy? The reasons include: flexibility (use equipment only when needed, return it when done), no maintenance or storage headaches (the rental company handles that), access to the latest equipment/technology, and better financial management (renting is opex, purchasing is capex — some firms prefer not to carry depreciating assets on their books).

As projects become more complex and timelines become uncertain, renting offers agility. Interestingly, during uncertain economic times, rental costs can increase because companies avoid big capital outlays — we saw this in 2020 and could see it in any future slowdown. All told, the secular trend of “rental gaining share” underpins a steady mid-single-digit growth rate for the industry. It’s not a blistering growth industry, but it’s reliably outpacing general GDP growth.

Highly Fragmented Market, Consolidating Fast

The equipment rental industry historically was mom-and-pop — lots of local rental yards and small regional players. That is changing. Scale has become more important (customers demand consistency and large inventory), and large players have been rolling up smaller ones.

United Rentals essentially started this trend in the late 1990s and 2000s, acquiring hundreds of small outfits. Its largest competitor, Ashtead Group, has also aggressively acquired companies. Another competitor, Herc Holdings (spun off from Hertz years ago), is now scooping up rivals (including its pending purchase of H&E Equipment). The result: the top 3 companies control 30% of the +$65 billion North American market, up from just 10% in 2009.

Ashtead projects that the top 3 share could exceed 50% in the coming years. From an investor perspective, consolidation is good — larger networks have efficiency and pricing advantages, and competition becomes more rational as there are fewer big rivals. URI, Sunbelt, and Herc tend to avoid destructive price wars and instead focus on service and strategic growth.

That said, competition is still intense at the local level. Thousands of small rental firms remain, often specializing in one category or region (for example, a family-owned aerial lift rental company in one city). These smaller guys often compete on price and relationships. URI has to continually earn business by being more reliable and offering a wider selection.

In many markets, URI’s biggest competitor might be Joe’s Rentals down the road. But over time, I expect the big fish to keep eating the little fish — URI itself has done dozens of small bolt-on acquisitions in the last decade (the recent Yak Access buy is an example in a niche area). Scale economies in areas like fleet procurement, IT systems (for tracking equipment and optimizing utilization), and financing costs give giants like URI an edge that independent shops can’t match.

Sunbelt and Herc – The Other Giants

Sunbelt Rentals, owned by UK-based Ashtead Group, is United Rentals’ biggest rival in North America. As of 2025, Sunbelt operates over 1,200 locations across the U.S., with a particularly dense footprint in the Southeast. That regional strength has given it an edge in high-growth Sun Belt states like Florida, Texas, and Georgia.

Ashtead’s market cap is about $25.6 billion, while URI sits significantly higher at $47.1 billion—a gap that has widened over the past two years, as URI outpaced Ashtead in stock performance. While Ashtead isn’t closing the gap just yet, they’ve made it clear they’re playing offence.

They’ve been aggressively expanding, targeting 300–400 new store openings over five years. Ashtead has described this growth push as turning Sunbelt into a kind of “Amazon of rentals”—not a direct quote, but the sentiment’s been echoed in interviews and presentations. They want to be everywhere their customers are and offer everything they need, fast.

Compared to URI, Sunbelt has grown slightly faster in some years, particularly in organic terms. They’re also making a big push into specialty rentals, building out product lines in areas like climate control, power, flooring, and tool management. The playbook is similar: own the full rental wallet, not just the core equipment.

Herc Holdings is a distant third in size — about one-fifth of URI’s revenue — but is trying to change that via acquisitions.

Herc’s surprise move to outbid URI for H&E in 2025 was bold; it will roughly increase Herc’s size by ~50% if it closes. Even after that, Herc will still be much smaller than URI/Sunbelt. The competitive interactions are interesting: URI and Sunbelt rarely openly clash, but you can be sure they monitor each other’s pricing and expansion plans.

All three big players are expanding their specialty segments aggressively, because that’s where they can differentiate. For instance, all have power/HVAC divisions, all rent trench shoring equipment, etc. I’m essentially seeing an arms race to build the broadest “one-stop” rental offering. The big three also compete in technology, e.g., mobile apps for customers to manage rentals, IoT telematics on equipment, etc. URI has an edge as the first mover with the largest IT investment, but Sunbelt isn’t far behind.

Specialty and Niche Competition

Aside from general equipment competitors, URI faces competition in specific verticals. For example, in aerial lifts, the major manufacturers (JLG, United’s largest supplier, and Genie/Terex) sometimes rent directly or finance rentals through dealerships. In power generation rentals, there are niche companies that focus on events or disaster relief. In portable storage (an area URI entered by acquiring General Finance in 2021), there are specialized storage container leasing firms.

However, URI’s breadth often wins out — customers prefer to deal with fewer vendors, so the more URI can offer everything under one roof (one contract), the better. URI’s management likes to highlight cross-selling: the idea that a construction customer who came to rent an earthmover can also rent their portable power generators and onsite storage units from URI, instead of calling three different companies. This “one-stop shop” approach is bolstered by URI’s acquisitions (Yak Access for environmental mats, General Finance for storage boxes, etc.). The strategy is working — cross-selling has increased wallet share with key accounts.

Cyclical but Multi-End-Market

Industrial and manufacturing customers are URI’s largest end market (think refineries needing pumps, factories needing maintenance equipment, utilities doing infrastructure work), but by no means the only one. Construction (especially non-residential) customers make up a big portion, too. URI’s customer base is roughly: industrial ~49%, commercial construction ~46% and residential ~5%.

Residential construction is a small piece (and URI tends to serve that indirectly via tool rentals to contractors, etc.). This mix shielded URI in 2023-2024 when residential building was in a downturn, strength in industrial and infrastructure took up the slack. The U.S. government’s Infrastructure Bill and Inflation Reduction Act have created a pipeline of projects (roads, bridges, renewable energy facilities, semiconductor plants, EV factories, etc.) that should underpin equipment demand for several years.

On the Q1 2025 call, CEO Matthew Flannery noted “we saw growth across both our industrial and construction end-markets” and that customers “continue to feel good about their own projects”. That’s an encouraging snapshot of the current environment. Over the next decade, trends like infrastructure rebuilding, energy transition, and supply-chain re-shoring all likely benefit the rental business. Of course, if the general economy contracts sharply, construction and industrial activity could dip — but as discussed, rental may take share even in that scenario.

In summary, the industry is attractive for scale leaders like URI. The pie is growing steadily, and the biggest slices are being taken by those with the scale to serve customers nationally. While competition exists at every level, URI’s size (+$15 billion revenue) gives it resources to stay ahead — it can invest in fleet (over $3.7 billion gross capex planned in 2025), technology, and strategic acquisitions without straining itself. Smaller players will continue to exist, but many will likely either specialize in tiny niches or eventually get absorbed. This landscape bodes well for URI’s long-term positioning — it should enjoy a “network effect” where its value to customers increases as it expands its offerings and geographic reach, making it ever harder for competitors to match.

That said, I should emphasize that URI does not have an official “moat”, meaning there’s no unbreachable barrier to competition. The rental business, at the end of the day, is about operational excellence and scale, but equipment can be bought by anyone with capital. URI can’t stop a well-funded new entrant or an aggressive regional rival from trying to steal share. The flip side is that achieving URI’s scale would take decades and tens of billions of dollars, so the competitive field is naturally limited. We’ll discuss this “no-moat but high scale” issue more in the valuation section — it’s one reason why URI’s stock doesn’t get a tech-like multiple despite its strong performance.

High-Margin, Cash-Rich Business — By the Numbers

One of the most appealing aspects of United Rentals is its financial profile — a mix of solid growth, strong margins, and significant free cash flow.

Revenue Growth

URI has grown rapidly, both organically and via acquisitions. From 2019 to 2024, revenues roughly doubled (from $9.4 billion to $15.3 billion).

Even excluding big acquisitions, the industry tailwind has driven mid-to-high single-digit organic growth. In 2024, URI’s total revenue grew by +7.1% to $15.345 billion, on top of a +23% jump in 2023 (boosted by the Ahern acquisition).

For 2025, management is guiding to $15.6–16.1 billion of revenue, about 1.7% to 4.9% growth, reflecting a more moderate outlook as the post-pandemic boom normalizes. This outlook does not include the H&E acquisition (since that deal fell through).

In other words, URI expects continued growth even without major M&A, albeit at a slower pace than the last two frenzied years. A ~3% growth might seem low compared to +20%, but remember that’s on a much larger base now, and it’s roughly in line with the industry’s secular growth rate plus a tad of share gain. If macro conditions stay favourable, URI could surprise to the upside (their guidance tends to be conservative).

Conversely, if we hit a soft patch, low-single-digit growth or even flat revenue is possible for a year. Over the long term, I still foresee URI growing in the mid-single digits annually, thanks to rental penetration gains and periodic acquisitions.

Profit Margins

URI’s profitability is excellent for an industrial company. In 2024, gross profit was $6.2 billion, a 40% gross margin. The operating profit was $4.1 billion, a 26.5% operating margin. Net income was $2.6 billion, a 16.8% net margin. These margins are above URI’s historical averages.

Importantly, URI’s EBITDA margins remain high. Adjusted EBITDA margin (excluding one-time items and stock comp) was 46.7% in 2024, down slightly from 48.3% in 2022. On a trailing twelve-month basis, the margin has ticked lower to 45.3%, as shown in the chart below.

The decline isn’t alarming, but it’s worth watching. Several factors are contributing here: rising labour and transportation costs, a slightly higher mix of lower-margin revenue streams (like re-rents and used equipment sales), and some normalization in rental pricing now that post-COVID supply constraints have eased. Put simply, URI isn’t losing control of its cost structure—it’s just operating in a more balanced environment, where incremental margin expansion is harder to squeeze out.

That said, maintaining EBITDA margins north of 45% while still growing the top line is no small feat. Most industrial companies would kill for those numbers. URI has room to flex pricing, shift fleet mix, and optimize utilization if the environment tightens. For now, this soft decline in margin looks more like normalization than a red flag.

Return on Invested Capital (ROIC)

In a heavy capex business like URI, ROIC is a critical marker of quality. According to YCharts, URI posted an ROIC of 11.9% in 2024, down slightly from peak levels above 12.5% in 2023.

By my own calculation (using 2024 NOPAT of ~$3.2 billion and total invested capital of ~$20.7 billion1), URI’s ROIC lands closer to the mid-teens range (~15%). The difference largely comes down to methodology: YCharts averages invested capital across periods and may apply a standardized tax rate and EBIT definition, whereas my approach uses 2023 year-end figures and URI’s reported operating income.

That level is above the company’s weighted cost of capital (which I estimate at 9.1%2), indicating URI does create real economic value, but it’s not sky-high like a software company. This is where that “no economic moat” view comes in: if competition or cyclicality push ROIC down closer to the cost of capital in a downturn, it means URI’s advantages are good but not unassailable. Still, mid-teens ROIC through a cycle is quite solid for such an asset-intensive business.

One metric URI itself tracks is “cash-on-cash return” for its fleet purchases – essentially, how much gross profit they earn relative to the cost of equipment. That metric has been strong lately because equipment demand is high and resale values are up (boosting returns). The fact that URI can sell used gear for a gain (as mentioned, a $710 million gain on sales in 2024) means they’re depreciating their fleet conservatively, and the assets are holding value well. That supports good ROIC.

Free Cash Flow and capex

United Rentals is a cash machine, but it also requires heavy capital investment. Its business has a sort of self-funding cycle: Each year, URI spends billions on new rental equipment (to expand the fleet or replace aging units). These are growth and maintenance capex.

In 2024, URI’s gross purchases of rental equipment were $3.75 billion. But it also receives cash from selling used equipment — $1.52 billion in 2024. So the net capex (purchases minus sales) was around $2.23 billion.

Meanwhile, URI’s operating cash flow was $4.55 billion. After funding capex, FCF was about $2.06 billion for 2024.

For 2025, URI reaffirmed guidance for $2.0–2.2 billion of free cash flow (after ~$3.65-3.95 billion of gross rental capex). So FCF is expected to be roughly flat or a bit up, reflecting steady capex. Why isn’t FCF growing as fast as earnings? Because URI is choosing to reinvest a lot in fleet growth (capex is way up from, say, 2019 levels).

As the figure shows, URI’s capex stepped up significantly as the company expanded its fleet post-2021, but free cash flow has remained robust and fairly steady in the ~$2 billion range. This highlights a key point: URI’s growth is largely self-funded. Unlike some companies that need external financing to grow, URI uses its internally generated cash to buy more equipment, which then generates more revenue — a virtuous cycle, as long as the investments earn a good return.

Management has been seeing opportunities to deploy capital at good returns, so they’ve plowed cash into new equipment (as well as acquisitions). The beauty is that, even after aggressive capex, URI still has +$2 billion annually to allocate to other uses like debt paydown, buybacks, and dividends. This speaks to the strong cash generation of the model — high EBITDA, relatively low working capital needs (customers usually pay promptly or even upfront on rentals), and the ability to flex capex if needed. In a downturn, URI could slash capex to, say, $1 billion, and suddenly free cash flow would balloon, even if EBITDA fell somewhat. In 2020, for example, URI cut net capex drastically from $1.5 billion to $300,000 as cash flow from operations declined from $3 billion to $2.7 billion and was able to maintain solid free cash flow (actually higher than the previous year) despite lower revenue. This flexibility is a great safety valve for the business.

Balance Sheet & Leverage

Given the capital-intensive nature, URI carries substantial debt. At the end of 2024, total debt was about $12.9 billion ($14 billion including leases).

The company’s targeted leverage ratio of 1.5x–2.5x Net Debt/EBITDA.

After the flurry of acquisitions, they’ve been near the lower end of that range — net leverage was 1.6x in 2024. Had the H&E acquisition closed, leverage would have bumped to 1.9x, then management planned to dial it back down with no buybacks for a year.

With H&E cancelled, URI actually finds itself in a deleveraging position now, especially as earnings grow. They have plenty of liquidity (+$3 billion available) and well-timed-out debt (no major maturities until late this decade).

About 71% of their debt is fixed-rate bonds (locking in relatively low interest from prior years), and the rest is floating (asset-backed loans, etc.). Interest expense in 2024 was $691 million — very well covered by EBITDA (~6.6x coverage). One thing to monitor is rising interest rates: URI’s average cost of debt will tick up as they refinance or if they draw more on floating facilities, which could add a bit to interest expense (and thus slightly reduce net income).

For instance, 2024 interest expense was up from 2023 due to rate hikes. But overall, URI’s debt is manageable and arguably conservative for an industrial company with steady cash flow. They intentionally keep some leverage because it’s efficient for a company that owns lots of depreciating assets (tax benefits, etc.). I’m comfortable with URI’s balance sheet, and the credit markets are too (the 2024 term loan for URI was rated investment grade by S&P).

Shareholder Returns

As noted, URI initiated a dividend in 2023 — the first in its history. The initial quarterly dividend was $1.48 per share; it was increased 10% to $1.63 and then to $1.79 per share in early 2025.

That works out to a 0.94% dividend yield at the current share price — not huge, but a nice addition to the total return.

Management’s move to start a dividend signals confidence in the cash flow stability (you don’t start a dividend if you think you’ll need to cut it in a downturn). They’ve stated they intend to grow the dividend over time. Additionally, they repurchased $1.1 billion of shares in both 2022 and 2023 and $1.6 billion in 2024.

In Q1 2025 alone, URI bought back $289 million worth of stock and paid $118 million in dividends. The board authorized a fresh $1.5 billion share repurchase program in April 2025. At the recent share price, that could retire another ~3% of outstanding shares. It’s clear that URI is now returning excess cash aggressively, since organic growth doesn’t consume all of it.

For shareholders, this is great: we’re getting a growing dividend and anti-dilution (even slight accretion) from buybacks — all funded by the company’s own cash flow. In effect, URI has transitioned from a pure growth roll-up story (reinvest everything) to a more mature phase of “growth + income.” I would compare it to how tech companies eventually start dividends; URI’s done the same as it reached a certain scale. This adds to the stock’s appeal for long-term holders.

Why I’m Closing the URI Position at ~$725 – Valuation & Outlook

Given all the positives outlined, one might ask: why sell now?

The decision to close the United Rentals position at $725 is not due to any newfound pessimism about the company. Rather, it’s about opportunity cost and prudent risk management at this stage of the investment.

Reason #1. The Easy Money Has Been Made

I bought URI when it was clearly undervalued at ~10x earnings and underappreciated. Today, after doubling, the stock’s valuation looks much fuller. At ~$725, URI trades at 18.8x trailing earnings. Its EV/EBITDA is 8.4x.

These multiples are not outrageous, but they’re also no longer a bargain. By comparison, Ashtead (Sunbelt) trades closer to 6.7x EV/EBITDA, and Herc (pre-H&E deal) around 6.1x EV/EBITDA.

URI has a superior track record, but if anything, it might now deserve a lower multiple than its peers, given its sheer size and law-of-large-numbers growth rate.

But also on an absolute basis, the shares seem slightly overvalued (~10%) based on my updated DCF. The inputs reflect a more conservative base case than previous versions, accounting for slower growth (more on that below in Reason #2), slightly lower margins, and evolving industry dynamics. I continue to use a 9.1% WACC as I detailed earlier.

What changed?

First, I trimmed long-term revenue growth assumptions to the 3–4% range post-2025. That’s slower than historical averages, but more realistic in a maturing industry where consolidation, saturation in core regions, and macro normalization all start to limit upside. Rental penetration may still have room to run, but the early innings of structural growth are behind us.

Second, I adjusted margins downward. The company’s guidance implies a drop in EBITDA margin.

Why?

A combination of factors: higher inflation in operating costs, a growing mix of ancillary services (which often carry lower margins), and the natural dilution that happens when integrating acquisitions with lower margin profiles. Bigger companies tend to experience this as they scale.

Still, a mid-40s EBITDA margin is very strong in this industry. For context, Sunbelt (Ashtead) runs at around 45%, and Herc is closer to 40–41%. URI’s consistent pricing discipline and cost control remain best-in-class. And as the specialty rental mix increases over time, we could see some margin tailwinds — but that will likely play out gradually.

With these updated assumptions, my DCF yields a fair value of ~$650/share.

That’s roughly 10% below current levels and suggests the market has priced in much of URI’s near- to medium-term upside. URI is a high-quality operator, but not immune to economic swings, pricing pressure, or competition. It doesn’t warrant a peak-cycle multiple near 20x earnings without a clear runway for multiple expansion or margin gains.

I’d rather take chips off the table and redeploy into a smaller name with more asymmetry. That’s why I closed the position.

Reason #2. Slower Growth Ahead (What’s “Priced In”)

Part of my original thesis was multiple expansion — that has now occurred. Looking forward, URI’s growth will likely moderate. The company is guiding for only ~3% revenue growth in 2025 (organically, without H&E). EBITDA is expected to grow ~3% at the midpoint (and EBITDA margins compress slightly). This implies EPS growth in the single digits for 2025. Maybe EPS growth could be in the high single digits if they repurchase $1 billion worth of shares. But even so, the days of +20% growth are not in the near-term forecast (barring another big acquisition or unexpected boom).

Now, URI might well beat these conservative targets — they often do — but it’s unlikely to surprise with, say, 20% growth. Meanwhile, the stock is already reflecting a lot of optimism. At $725, URI trades at about ~8.4x enterprise value to TTM EBITDA. For a cyclical industrial, that’s on the higher side of historical ranges. If growth stays ~4% and margins are steady, that multiple likely won’t expand further; in fact it could contract if investors demand a margin of safety in a cyclical name.

The market seems to be pricing URI as if its recent boom times (record revenues, high utilization, high used equipment prices) will persist indefinitely. That may prove too rosy if end markets cool or if increased equipment supply leads to lower rental rates.

In short, upside from here looks limited — I might estimate maybe 10-15% upside to a bull-case fair value (perhaps a ~$800 stock if everything goes perfectly). But the downside risk if something goes wrong (e.g., a recession or a stumble in execution) could be 30–40% or more in the stock. When upside and downside are skewing in the wrong direction, it’s time to secure gains.

Reason #3. Signs of Cycle Peaking (Margins & Capex)

While URI is not showing any severe cracks, there are subtle signs that we’re nearer the top than the bottom of the cycle. Profitability, as discussed, has plateaued or slightly dipped — e.g., rental gross margins down ~130 bps in late 2024, EBITDA margin guided to dip in 2025. This hints that cost pressures (labour, maintenance, etc.) are catching up, and rental rate increases aren’t as dramatic now that fleet supply has normalized post-pandemic.

Additionally, the company is pouring a lot into capex (nearly $4 billion gross in 2023 and 2024 each). This is fine as long as demand absorbs it, but if demand falters, the industry could end up slightly oversupplied with equipment, which would hurt rental rates and utilization. The fact that used equipment sale prices were so strong in 2021–2022 (even yielding gains for URI) indicates an environment of equipment scarcity. As supply chains have improved and manufacturers catch up on production, that tailwind will fade — used equipment values could soften, removing one source of extraordinary profit for URI (remember that $710 million gain on sales in 2024? That could shrink if used prices normalize).

That is a caution flag. It suggests we may be at a point where revenue can still grow, but costs and competitive factors keep the incremental profits lower. For a stock that’s doubled, that scenario is not as attractive as when we bought during expanding margins and low expectations.

Reason #4. Execution and Strategic Uncertainties

United Rentals’ management has been excellent, but they are not infallible. The attempted H&E acquisition is a case in point. URI offered $92/share in cash for H&E, a rich price leaving little room for error in terms of synergies and execution.

Herc then bid even higher (a mix of cash and stock), essentially outplaying URI in a bidding war. I think URI got lucky — they avoided likely overpaying (Herc’s offer equated to ~7.4× EBITDA for H&E, still lower than URI’s multiple but high for an acquisition), and they collected a breakup fee for walking away.

The episode shows that URI was ready to lever up and swing big to maintain its growth. If Herc hadn’t intervened, URI would have closed H&E and taken on ~$1.4 billion of H&E’s debt, pushing net debt/EBITDA to ~2.1x.

It also would have paused buybacks for a while. That might have been fine long-term. The fact that Herc was willing to buy H&E suggests competitive pressures — Herc is aggressively trying to gain share, which means URI may face stiffer competition in some regions once Herc+H&E integrates.

I wouldn’t ring alarm bells — URI still dwarfs Herc — but it’s a reminder that others are fighting for the pie. Additionally, as URI gets larger, finding accretive acquisitions gets harder (few targets move the needle, and those that do, like H&E, may command rich prices). Management might shift focus to more buybacks and dividends, which is good for returns but means organic growth has to carry more weight. There’s nothing wrong with that, but it typically warrants a lower multiple when a growth story matures.

Reason #5. Better Opportunities Elsewhere

Perhaps the biggest reason for selling URI now is simply that I see more upside in other stocks at this moment. One must always consider the next dollar of investment — where will it earn the highest return relative to risk? While I still like URI as a company, I can’t ignore that my new ideas have even more compelling valuations or growth prospects. As I teased at the start, I have my eye on a small-cap stock in an unloved industry that’s trading at a fraction of its intrinsic value.

Compared to URI’s 8.4x EBITDA and ~5% growth, this new idea is trading under 5x EBITDA — a classic asymmetrical setup. By selling URI, we free capital to deploy into that higher-upside, lower-downside pick. This is a crucial part of our strategy: know when to cash in and rotate. We don’t want to fall in love with a stock and overstay when the valuation no longer screams “buy.”

As much as I admire URI’s business, at $700+ it doesn’t scream “deep value” like it did at $350. If the stock trades down to a bargain level again in the future (never say never — cyclicals can swing), I’ll happily reconsider it. But right now, our money will work harder elsewhere.

To put it another way: we aim to beat the market (or should I say Beat The Tide 😉) by buying where others are skeptical and exiting when the crowd finally appreciates the stock. With URI, the crowd is on board now — many analysts are bullish, the narrative is positive, and the valuation reflects that optimism. This is usually the phase where future returns moderate. Indeed, at $725, I would project URI might deliver total returns (including dividends) in the mid-single digits annually over the next few years, which is okay but not special. Contrast that with the potential multi-bagger returns — the choice becomes clear.

It’s worth noting that even URI’s management seems to be signalling “we’re a mature company now” by initiating dividends and massive share buybacks. Those are great for stability, but companies do that typically when hyper-growth opportunities are fewer. They are essentially saying: “We’re generating more cash than we can reinvest at high returns, so we’re giving it back to shareholders.” Again, not a negative, but for us as opportunistic investors, we hunger for the next underappreciated growth story.

Conclusion — A Farewell to URI and an Invitation

I invested in this “boring” industrial stock when it was out of favour back in 2023 and when I started this newsletter at the end of 2024, I added it to our portfolio as I had conviction in the underlying fundamentals (rental industry growth, URI’s strategic moves), and we patiently held on as the market came around.

As a result, URI became one of our best stock picks of the last two years, delivering triple-digit returns and significantly outperforming the tide of the broader market. We got to witness firsthand how a company can execute well — growing revenue, expanding into new segments, and returning cash to shareholders — and be rewarded with a surging stock price.

Now, however, our journey with URI reaches its planned destination. The thesis has been realized, our catalysts (like increased specialty mix and operational improvement) are now broadly recognized, and the valuation is no longer the deep value it once was. In investing, knowing when to sell is just as important as knowing what to buy.

To be clear, this isn’t goodbye forever to URI — I will continue to follow the company closely. It’s possible that down the line, if the stock pulls back or hits another rough patch, we may get another chance to go against the tide and scoop it up. URI remains a high-quality franchise in my eyes, and I wouldn’t bet against its management. But as of today, I see a richer menu of options elsewhere with more mouth-watering upside.

For members, I hope this deep dive has not only updated you on the URI investment case but also illustrated the thought process behind position management — why I’m reallocating and how I weigh risks vs rewards. If you’ve enjoyed the depth and clarity of this analysis, I invite you to stick with me for the next one. The upcoming trade alert features that $250 million market cap company I mentioned — it’s in an “unsexy” industry (just like equipment rentals once was) and I believe it has 4–6x upside over the next few years. This is exactly the kind of under-the-radar, high-conviction idea that Beating The Tide is that you won’t hear about in the mainstream financial media or the average stock newsletter.

Don’t miss out on our next big winner.

If you’re not yet a paid subscriber, now is the perfect time to upgrade. You’ll receive the new deep dive stock analysis as soon as it’s released, along with all my real-time trade alerts, weekly updates, and access to the portfolio.

Join a community of savvy investors who want more than hype — they want rigorous research, actionable stock advice, and market-beating returns. Subscribe today and catch the next wave. After all, the tide is always moving — let’s continue to beat it together!

I am using 2023 as the year for the capital base.