Weekly #60: Why I Sold My Chinese Fintech Stocks

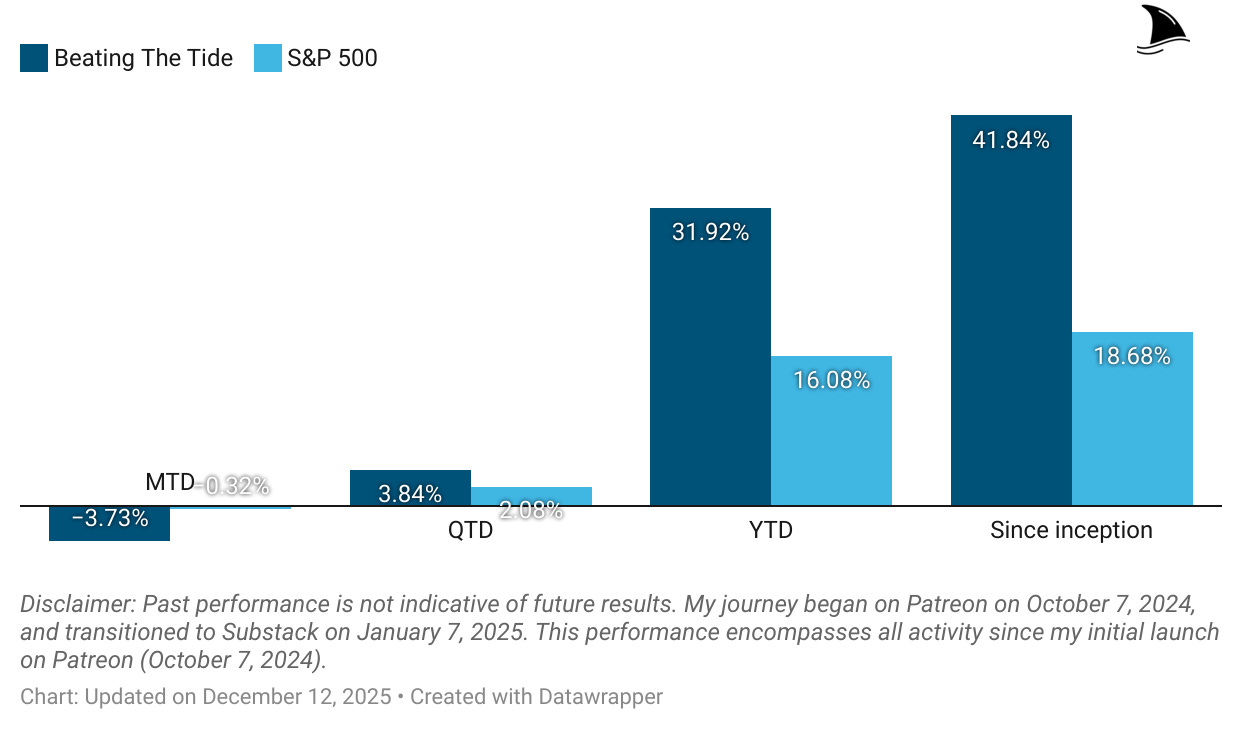

Portfolio +31.9% YTD, 2.2x the market since inception. A detailed breakdown of why I closed FINV and QFIN, what I got wrong.

Hello fellow Sharks,

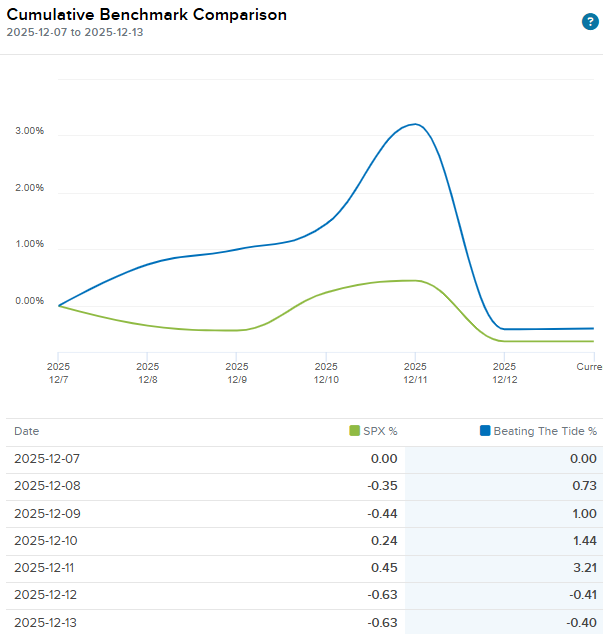

By Thursday, the week’s performance was +3.2% versus 0.5% for the index, but on Friday AVGO’s earnings and Oracle’s news about delaying delivery of a data center brought all AI and AI-related stocks down.

As we have seen before, this market volatility provides a good opportunity to pick up stocks at a discount.

If you want to skip straight to the numbers, jump to the Portfolio Update.

As promised last week, I discuss in this Weekly why I decided to close my positions in two Chinese fintechs.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

Trade alert: I closed two Chinese fintech positions

I sent paid subscribers a trade alert explaining why I exited my Chinese fintech positions. Short version: I still see value, but I don’t like the medium-term setup. The full rationale, including what changed, is laid out in today’s Weekly.

Earnings review : POWL Q4 + full-year recap

I published a standalone earnings review walking through the quarter, what actually moved, and what it means for the thesis going forward.

Why I Closed My FinVolution (FINV) and Qifu (QFIN) Positions

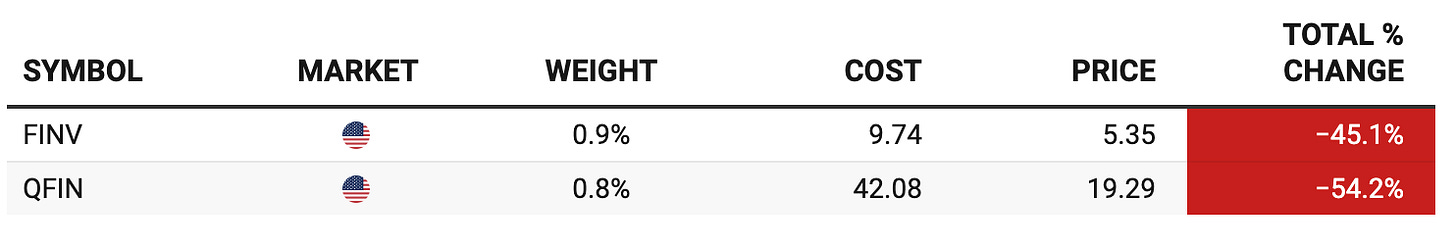

As I mentioned above, on December 9, I alerted my paid subscribers that I was closing out my positions in FinVolution (FINV 0.00%↑) and Qifu Technology (QFIN 0.00%↑).

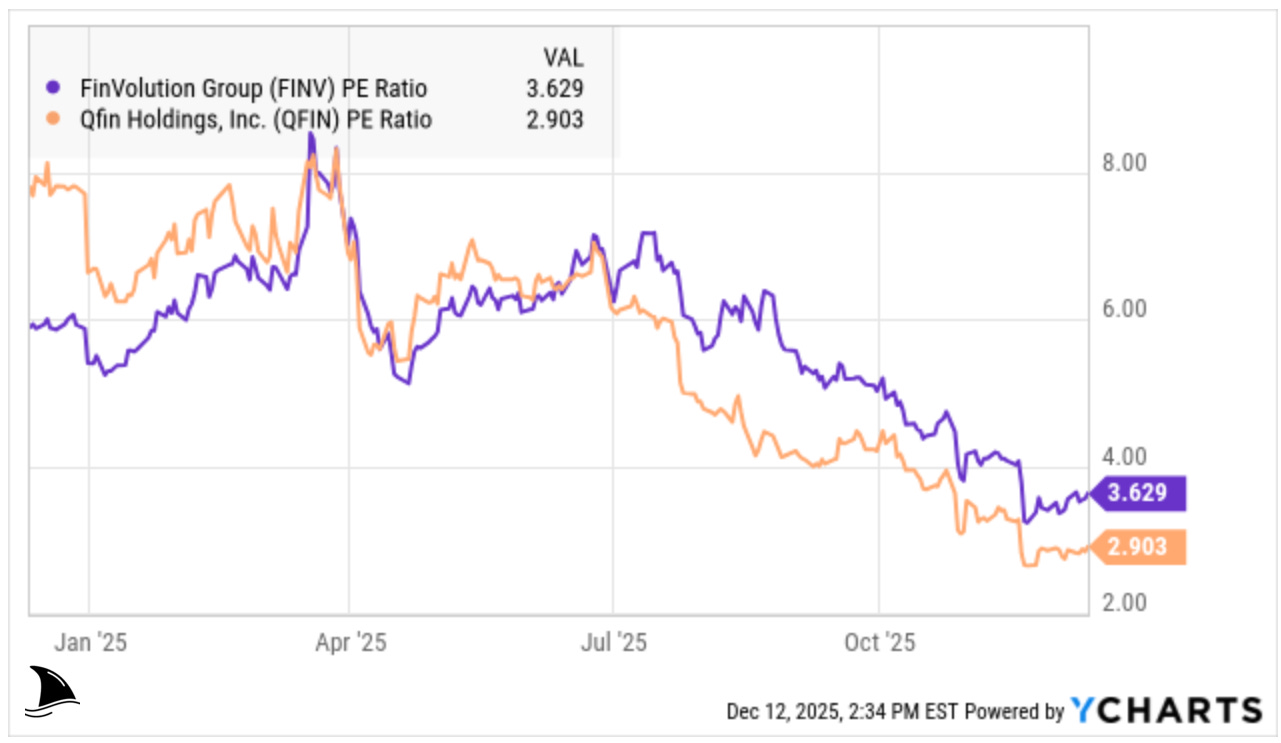

I still believe these companies have real value. However, I see their stocks remaining range-bound over the medium term. The reasons are clear: toxic investor sentiment toward Chinese fintech stocks, rising credit risks in their loan portfolios, squeezed profit margins under new regulations, and very weak forward guidance from management. Given these headwinds, I’m exiting primarily to redeploy my capital into more attractive opportunities elsewhere.

Both positions are roughly down 50% from where I bought them.

I’m not losing sleep over it. They were deliberately small bets in my portfolio. My winners still outnumber the losers, both in sheer count and in the magnitude of gains versus losses.

These two laggards taught some lessons, but they haven’t derailed the overall performance. In the end, I’d rather free up the cash and put it to work in stocks with clearer upside catalysts than wait indefinitely for a turnaround here.

My Original Thesis: What I Got Right and Wrong

I held FINV since I started this newsletter. I added QFIN more recently in June 2025 as that month’s pick.

At the time, my thesis for both names had a lot in common: they were profitable, well-capitalized Chinese fintech platforms trading at dirt-cheap valuations. Both had competitive advantages that I thought could drive growth despite the broader tech crackdown in China easing off.

For QFIN, I was impressed by its structural funding advantage and deep AI integration. The company has an AI-driven risk management system and strong ties with institutional funding, which underpin high profitability and solid credit performance. Growth was coming from capital-light lending, “embedded finance” partnerships, and a rapidly expanding tech solutions segment, all of which were supposed to boost margins and command higher valuation multiples.

In short, QFIN looked like a fintech that could grow without taking on too much balance sheet risk, thanks to its AI credit-scoring and its model of matching borrowers with banks (instead of lending out its own capital). I rated it a buy for those reasons.

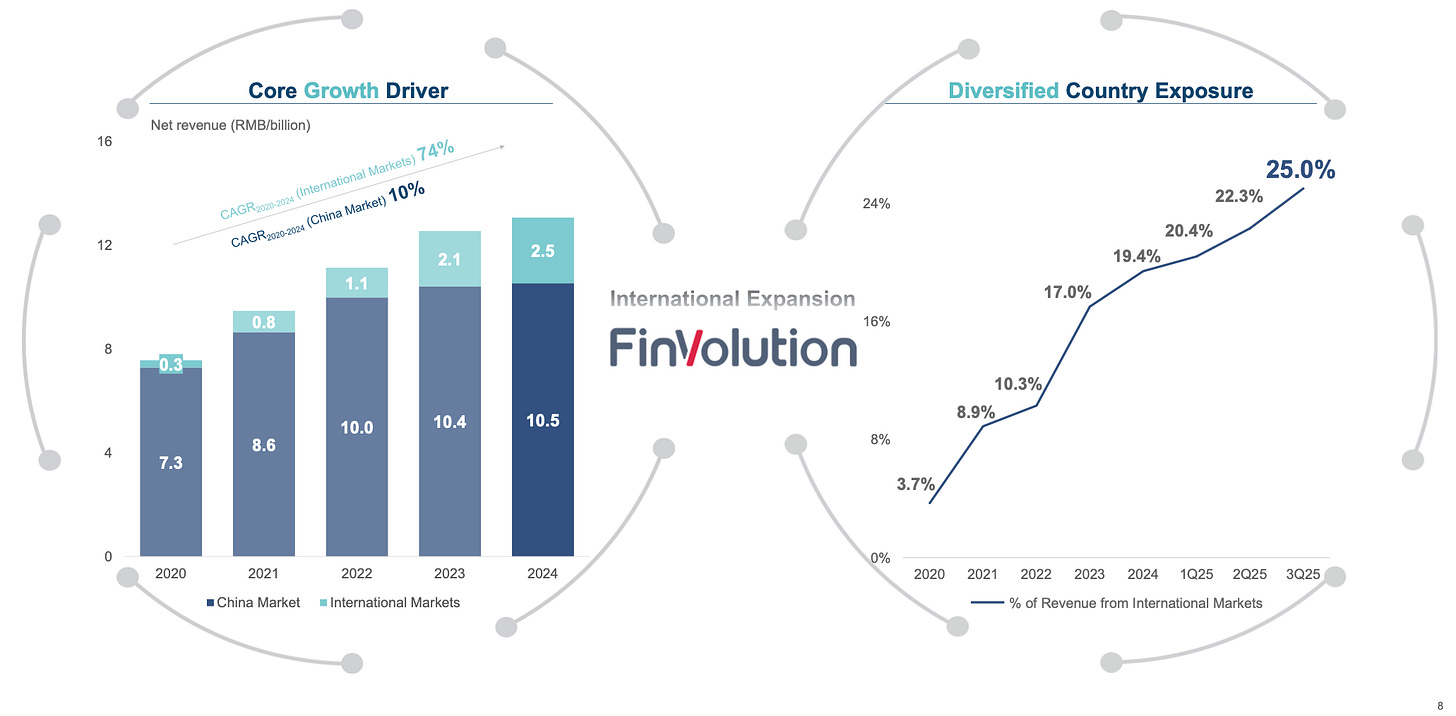

For FINV, my original case was that it’s a more mature platform that had successfully navigated China’s P2P lending cleanup and transformed into a regulated loan facilitator. FINV was consistently profitable, paid solid dividends and buybacks, and was diversifying beyond China.

By Q3 2025, FINV’s international expansion (mostly in Southeast Asia) was bearing fruit as overseas revenue was up 37% y/y and had grown to 25% of total revenue. My view was that this overseas growth and FINV’s advanced data/AI risk modeling would offset the headwinds in China’s credit market. I also saw FINV as undervalued as it was trading around 4.5x earnings.

Some parts of these theses did play out. Both companies continued to post decent financial results through mid-2025. For QFIN, funding costs stayed at historic lows and they even issued ¥4.5 billion in asset-backed securities in Q3 (29% more y/y) to bankroll loans. QFIN’s tech-driven “capital-light” business (connecting borrowers to third-party lenders) saw explosive growth as loan volume from its technology solutions jumped 218% sequentially in Q3. This showed its pivot to an AI-powered, fee-based model was gaining momentum.

FINV, meanwhile, kept expanding internationally and leveraging its AI credit models. By Q3, FINV’s total revenue rose 6.4% y/y to ¥3.49 billion, with international revenues now contributing a full quarter of the pie.

Both firms remained profitable in 2025 despite China’s economic softness. FINV made ¥641 million net profit in Q3, and QFIN earned ¥1.51 billion net income in the same quarter. These numbers affirmed that their core business models were resilient even under pressure.

However, I got some big things wrong. Chiefly, I underestimated the regulatory and macroeconomic risks that hit in late 2025. I had expected the regulatory crackdown to be largely over by now (in line with high-profile signals from Beijing mid-year).

Instead, regulators introduced new rules that upended the economics of consumer lending. I also didn’t foresee how quickly consumer credit quality would deteriorate in a slowing economy.

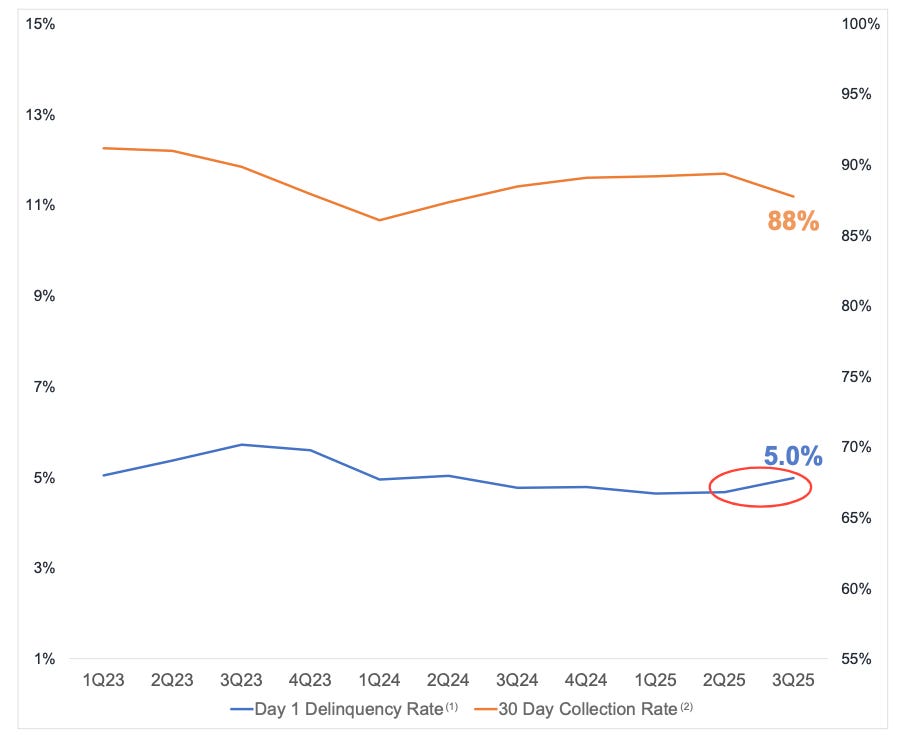

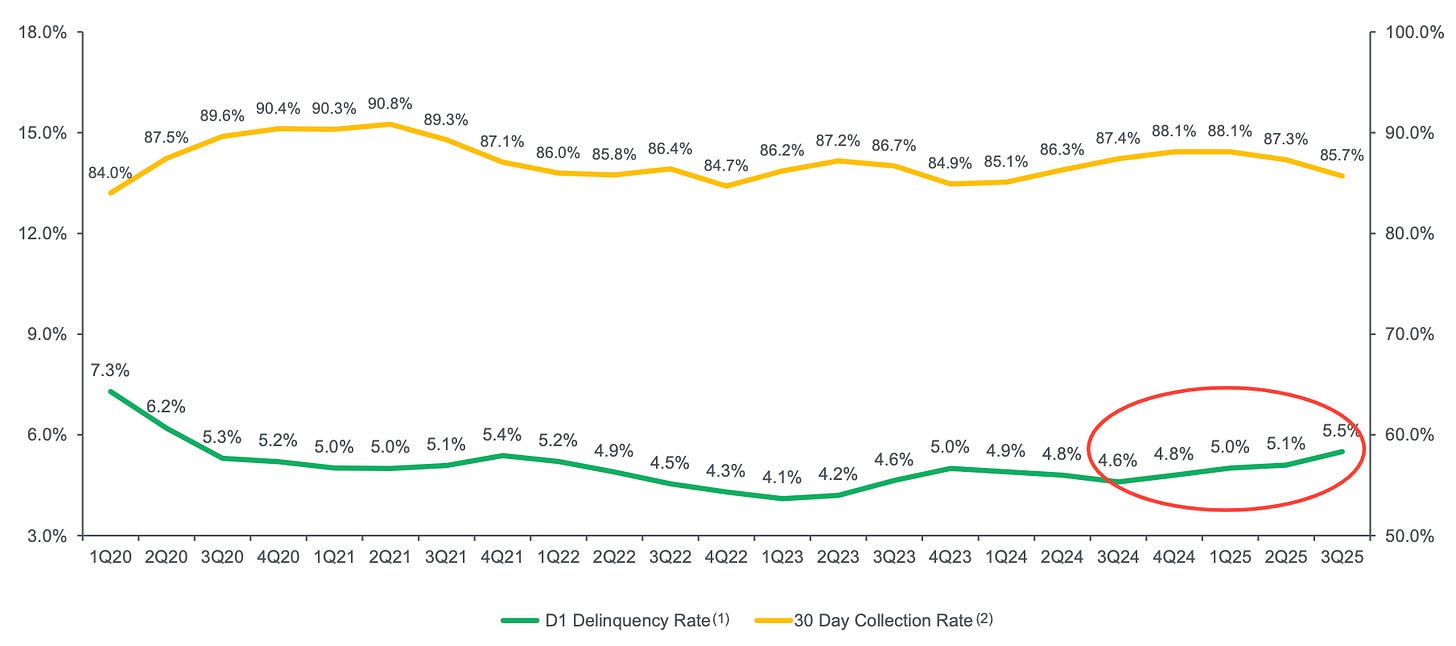

Both QFIN and FINV saw a spike in loan delinquencies…

… and had to tighten their lending standards, which started to choke off growth.

In hindsight, I overestimated the near-term growth potential and underestimated how “toxic” investor sentiment would remain toward Chinese ADRs. These stocks were (and are) deeply discounted for a reason: international investors simply don’t trust Chinese financial names right now, given all the policy unknowns and geopolitical clouds overhead.

The rest of this article will delve into those broader issues that ultimately led me to throw in the towel on these two positions.

Regulatory Storm Hits Chinese Fintech

New Rules Cap Interest Rates and Shrink Margins

The Chinese authorities rolled out a new consumer finance regulatory framework, which took full effect around October 2025. This has been a game-changer for fintech lenders. In a nutshell, regulators are forcing consumer loan pricing lower across the board.

Formally, China’s private lending rules cap the annual interest rate at 24% (anything above that is not enforceable in court). But now there’s additional “window guidance” (unofficial instructions) pushing an even lower cap of ~20%.

Management did not cite a formal change to the statutory 24% interest cap. However, QFIN’s average IRR has already drifted down to ~20.9% in Q3 2025, and management acknowledged ongoing regulatory-driven pricing adjustments and tighter credit standards. Market participants broadly interpret this as informal pressure to keep pricing closer to 20%, even without a written rule. In practice, this means fintech platforms have had to cut the rates charged to borrowers, which in turn squeezes their take rates and margins.

For companies like QFIN and FINV, who operate loan facilitation models, a lower APR cap directly hits revenue per loan. In earlier years they could price higher-yield loans (often 24–30% APR for riskier borrowers). Now they’re effectively constrained to ~20%.

That’s a big reduction in the pricing headroom. Management themselves acknowledged this in guidance. FINV said the new regulation has created “short-term uncertainties over volume, revenue, and risk metrics” in China. In QFIN’s words, they had to “adjust operations to cope with ... the latest regulatory changes” as the industry transitions to a new structure.

The upshot is that profit margins are getting reset to a lower level. Fintechs can no longer rely on sky-high APR loans to drive profit. They must either find more efficient ways to operate or accept lower profitability per loan. This was a key reason I lost conviction: the business model is being forced into a lower-yield, more utility-like zone.

Banks Tighten Their Grip and Fee Streams Dry Up

Another aspect of the regulatory shift is the increased role of traditional banks in the lending chain. Over the past few years, fintech platforms in China have been pushed to partner with banks and licensed consumer finance companies for funding.

Now, with the new rules, banks (and regulated lenders) are taking over key parts of the loan process that fintechs used to handle and they’re bargaining down the fees paid to fintechs. It’s not just about the interest cap, banks have gained leverage. Fintechs that used to earn fat referral fees or profit share on loans facilitated are seeing those economics trimmed by their bank partners.

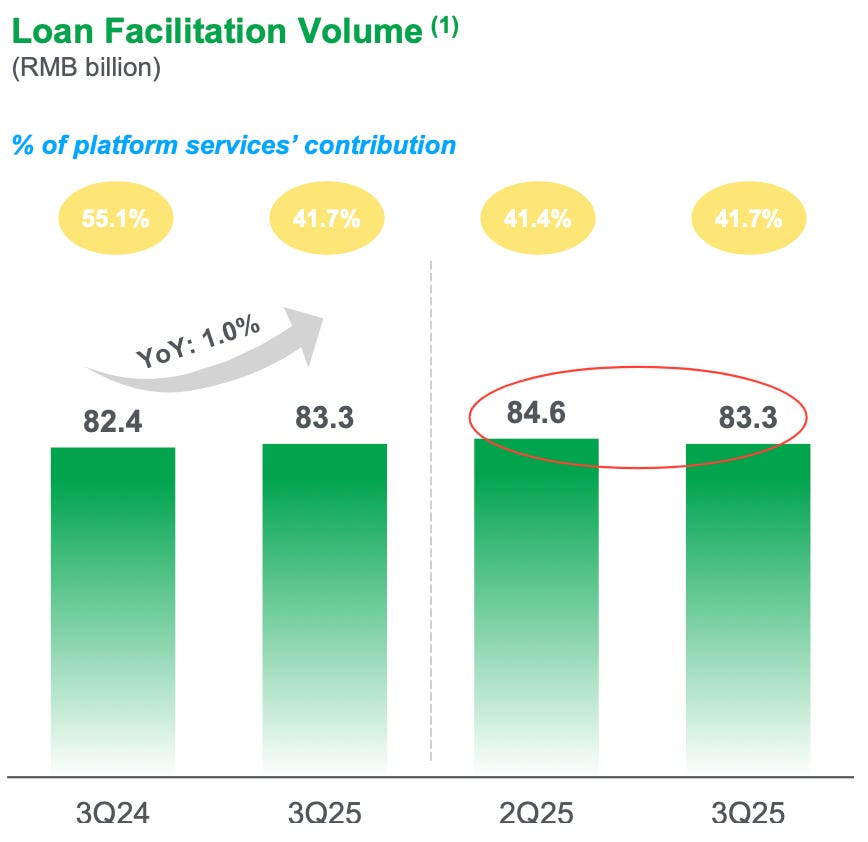

This trend was evident in QFIN’s latest results. QFIN’s platform service revenue (the capital-light/fee side) dropped noticeably as a share of the business. In Q3, revenue from the purely platform services (no balance sheet risk) fell to ¥1.34 billion, down from ¥1.65 billion in Q2.

Why?

Because the loan facilitation volume through their “ICE” platform and other capital-light channels fell as banks tightened credit and pricing. The take rates on those transactions likely fell too under the new fee limits. FINV’s management likewise cited the new framework as a headwind. They warned of potential P&L impacts from risk upticks and tightened loan origination. In other words, they expect lower revenue per loan and higher credit costs near-term.

Effectively, the fintechs are now playing on the banks’ turf. The gold rush era of fintechs charging high fees for matchmaking and using their own risk models is ending. Smaller online lenders who specialized in high-APR loans are struggling or exiting.

Management said that since regulatory adjustments were introduced earlier this year, the industry has entered a period of structural change. Loan volumes have contracted in higher-risk segments, and platforms with weaker risk management are under increasing pressure. In practice, this has led to a sharp pullback in higher-priced lending and an industry shakeout.

Larger players like QFIN and FINV are moving down-market (serving borrowers at lower rates) which puts them in more direct competition with banks. This dynamic means fintechs must accept lower fee yields and focus on scale and efficiency.

Credit Quality Deteriorates (Rising Delinquencies)

At the same time as their margins are getting squeezed, these companies are facing rising credit risk among borrowers. The second half of 2025 brought a wave of stress in China’s consumer credit.

We saw this clearly in Q3 numbers: early delinquencies spiked to uncomfortable levels. QFIN reported that its day-1 delinquency rate hit 5.5% in Q3 2025, up from 5.1% in the prior quarter. FINV saw a similar jump as management noted the day-one delinquency rate rose to about 5% in Q3 (up 30 basis points q/q). For context, a 5% day-one delinquency means one in twenty new loans is missing its first payment, a red flag that can presage a much higher default rate down the line.

Other risk metrics confirmed the strain.

QFIN’s 90-day delinquency ratio rose to 2.09% as of Q3, up from 1.97% in Q2. Likewise, FINV’s 90-day delinquency reached 1.96% (excluding its off-balance-sheet “capital-light” loans). Both companies had to increase provisions for loan losses. QFIN’s provision for loan receivables jumped to ¥838 million in Q3 (up from ¥478 million a year prior).

Management teams candidly acknowledged the worsening credit trends. QFIN’s Chief Risk Officer said there were “increased fluctuations in portfolio risk” due to macro headwinds and liquidity issues for high-risk borrowers. FINV’s CFO similarly pointed out that risk uptick continued into early Q4 as they saw further deterioration in October before some tentative improvement in November.

Chinese consumers are under strain (amid slower economic growth and property market woes), and more are missing loan payments. That puts fintech lenders in a tough spot: they can tighten lending to control defaults (but that hurts growth), or loosen up to chase volume (but then eat more losses). QFIN and FINV chose the prudent route and they tightened credit in Q3 and Q4 to defend asset quality. The trade-off is slower growth in loan volume and revenue.

Rising delinquencies are toxic for sentiment. These stocks tend to trade like banks: any sign of credit deterioration spooks the market. The spike in day-1 defaults was especially alarming because it suggested the newest vintage of loans was immediately underperforming.

That was a key factor in my decision: I’m not comfortable sticking around when leading indicators of credit risk are flashing red. Yes, both firms are still profitable and have strong capital buffers, but surging defaults can eat into earnings quickly if not arrested.

Weak Guidance and Range-Bound Outlook

Given the above challenges, it’s no surprise that guidance from both companies turned very weak. This was the final straw for me. After Q3 earnings, QFIN’s management issued a grim outlook for Q4 and beyond. They guided that Q4 2025 non-GAAP net income would be only ¥1.0 to 1.2 billion. That is about 39–49% lower y/y (Q4 2024 saw roughly ¥2.0 billion).

In other words, they expect profit to effectively be cut in half in the fourth quarter. They cited “cautious business planning amid economic uncertainties and regulatory changes” alongside that forecast. Basically hunkering down until the dust settles. This kind of plunge in earnings guidance is not what you want to see after a stock has already been crushed. It tells me there’s likely more pain in the next couple of quarters.

FINV likewise tempered expectations. In Q3 it lowered its full-year 2025 revenue growth guidance to a meager 0–5%. Earlier in the year FINV was expecting double-digit growth. Now they’ll be lucky to break even with last year’s revenue. Management blamed the new consumer finance rules and the need to be more conservative in loan origination. Essentially, all the growth has been sucked out of the near-term story.

If a stock is going to rebound strongly, you usually need a catalyst like accelerating growth or improving margins on the horizon. Here we have the opposite. QFIN is guiding a near-50% earnings drop; FINV is guiding almost zero revenue growth and likely lower profits (since Q4 margins will be under pressure). With such guidance, it’s hard to see these stocks staging a big rally anytime soon. They start to look like “value traps”: cheap for a reason, with that reason being no growth to unlock value in the medium term.

Different Strategies, Same Headwinds

It’s worth noting that QFIN and FINV are not standing still in response to these challenges. Each is trying to pivot in its own way, but neither can fully escape the macro and regulatory headwinds.

QFIN continues to emphasize its capital-light and technology solutions strategy. In Q3 2025, loans facilitated under the capital-light model and technology solutions totaled RMB 34.76 billion, representing 41.7% of total loan facilitation volume. Management has stated that this mix reflects a strategic focus on reducing balance-sheet risk and expanding fee-based services. The company is effectively acting more as a fintech service provider rather than a lender.

QFIN is also leveraging AI to the hilt: for example, it developed AI chatbot “agents” to handle collections and customer service, and is marketing its AI credit decision tools to more institutions. The goal is to earn fees from technology and risk management expertise, which could eventually become a more stable, regulation-friendly income stream. This strategy makes sense: it uses QFIN’s strengths in data and scale, and it’s less capital-intensive.

However, in the near term, even the capital-light revenue has been shrinking (as noted earlier) because overall loan demand is down and banks themselves have leverage to negotiate fees. QFIN is also paying steady dividends and continuing share buybacks, which signal confidence. The CFO reiterated their commitment to returning 20–30% of earnings as dividends and executing the remaining $170 million of buybacks authorized. Those actions are shareholder-friendly, but they haven’t buoyed the stock given the bigger issues.

FINV, on the other hand, is leaning heavily into overseas expansion to find growth. The company has built significant operations in Indonesia and the Philippines, offering consumer loans and “buy now, pay later” services there.

This international push has been a bright spot: transaction volumes in Indonesia and the Philippines grew 14% and 18.6% y/y respectively in Q3. FINV now has 10 million cumulative international borrowers and added over 1.3 million new overseas customers in Q3 alone. The CEO has set a target for 50% of revenue to come from international markets by 2030. The idea is that growth in less regulated, less saturated markets can compensate for the slowdown in China.

So far, the strategy is yielding revenue diversification and some profit (management noted the overseas business is already profitable). But there are two catches: first, these are relatively small markets compared to China, so it will take time for overseas growth to truly move the needle. Second, expanding abroad comes with its own risks (execution, foreign regulatory environments, currency risk, etc.) and investors tend to heavily discount those foreign earnings. Still, I give FINV credit for not just sitting on its hands as they are pushing into new frontiers to seek growth that’s not tied to Chinese policy whims.

In essence, QFIN is trying to become more of a fintech SaaS/platform company, and FINV is trying to become more of an international player. These are logical responses to a challenging environment. They could very well pay off in the long run. My decision to exit isn’t because I think QFIN or FINV will fail. In fact, I suspect both will survive this industry shakeout and eventually stabilize their businesses.

The problem is the timeline and opportunity cost.

These transitions (to more tech-driven, overseas-driven models) could take a few years to bear fruit. Meanwhile, the stocks could easily stagnate or drift lower. There’s also uncertainty if further regulatory moves will throw new curveballs (for example, could the cap go even below 20%? Will more data usage restrictions hit their AI models? etc.). Both companies acknowledged that the environment is “rapidly changing” and they need to remain prudent and flexible. That doesn’t inspire confidence for a quick turnaround.

Conclusion: Redeploying Capital for Better Risk/Reward

After weighing all these factors, I decided that closing out FINV and QFIN now is the prudent move. The fundamental business models aren’t broken, but they are being reset by regulators. What was once a high-growth, high-margin industry has turned into a lower-margin, tightly regulated utility-like sector…at least for the time being.

QFIN and FINV happen to be two of the stronger players in that sector, and I wouldn’t be surprised to see them emerge relatively stronger after the shakeout (especially if smaller competitors fall away, as I think it is a very likely scenario). However, being strong in a troubled sector still means the stocks can go nowhere for a long time. I’ve concluded that my capital will work harder elsewhere.

Sure, at some point value investors might jump in recognizing a sub-4x P/E bargain, or the companies might find a way to re-accelerate growth.

But that could be a long wait. In the meantime, there are other stocks in other industries with more immediate catalysts and far less overhang. I’d rather deploy the freed capital into areas with clearer growth trajectories or where the risk/reward is more favorable. The Chinese fintech sector is undergoing a painful reset. Rather than endure a waiting game there, I choose to invest in places where the outlook is clearer. Sometimes the best decision is to cut your losses, learn from what went wrong, and refocus on the next opportunity…

… and that’s exactly what I’m doing here.

Portfolio Update

The portfolio retreated a bit this week but less than the S&P 500 widening the outperformance versus the market.

Month-to-date: -3.7% vs. the S&P 500’s -0.3%.

Quarter-to-date: +3.8% vs. S&P 500’s +2.1%.

Year-to-date: +31.9% vs. the S&P’s +16.1%, a gap of 1,584 basis points.

Since inception: +41.8% vs. the S&P 500’s +19.5%. That’s 2.2x the market.

Portfolio Return

Contribution by Sector

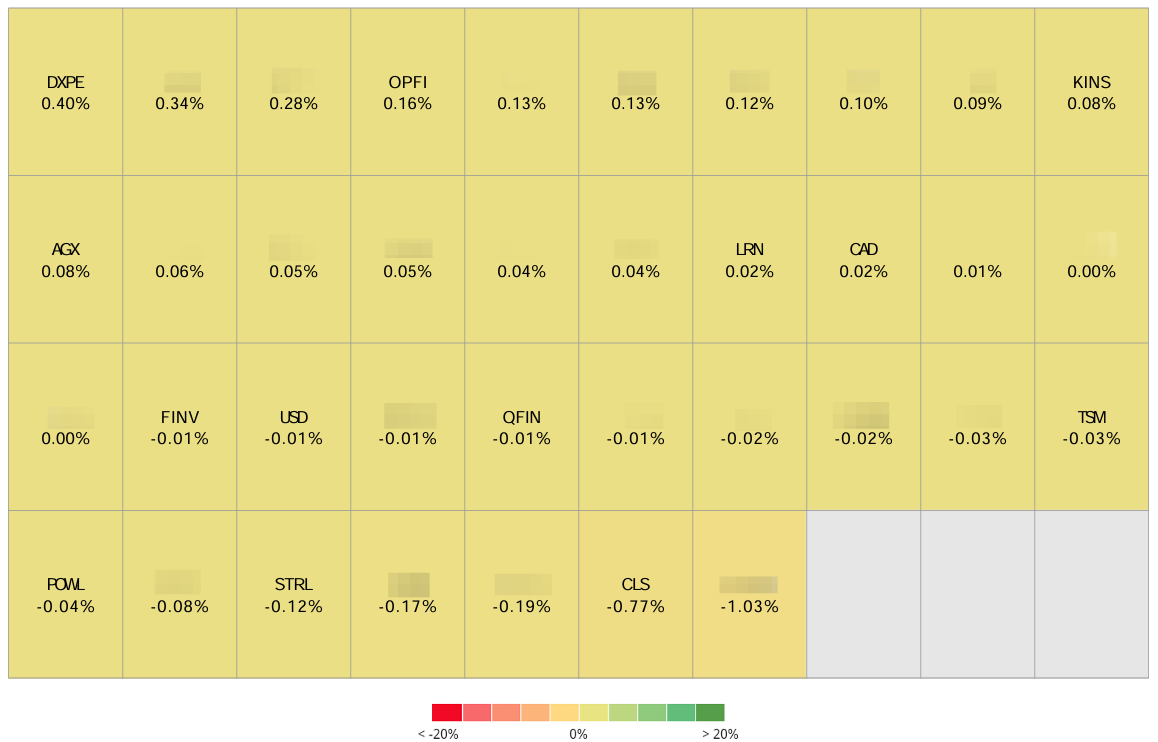

On Friday, most AI stocks were hit by AVGO’s (AVGO 0.00%↑) earnings and Oracle’s (ORCL 0.00%↑) delay in a data center delivery for OpenAI from 2027 to 2028. The losses were offset by gains in financials, consumer cyclicals, and industrials.

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+40 bps DXPE 0.00%↑ (Thesis)

+16 bps OPFI 0.00%↑ (Thesis)

+8 bps KINS 0.00%↑ (Thesis)

+8 bps AGX 0.00%↑ (Thesis)

+2 bps LRN 0.00%↑ (Thesis)

-3 bps TSM 0.00%↑ (Thesis)

-4 bps POWL 0.00%↑ (Thesis)

-12 bps STRL 0.00%↑ (Thesis)

-77 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: