Weekly #53: Fast Feels Good. Slow Wins

Portfolio +32.4% YTD, 2.3x the market since inception. Do less; earn more. Discipline beats action; nine portfolio companies reported; only one missed EPS.

Hello fellow Sharks,

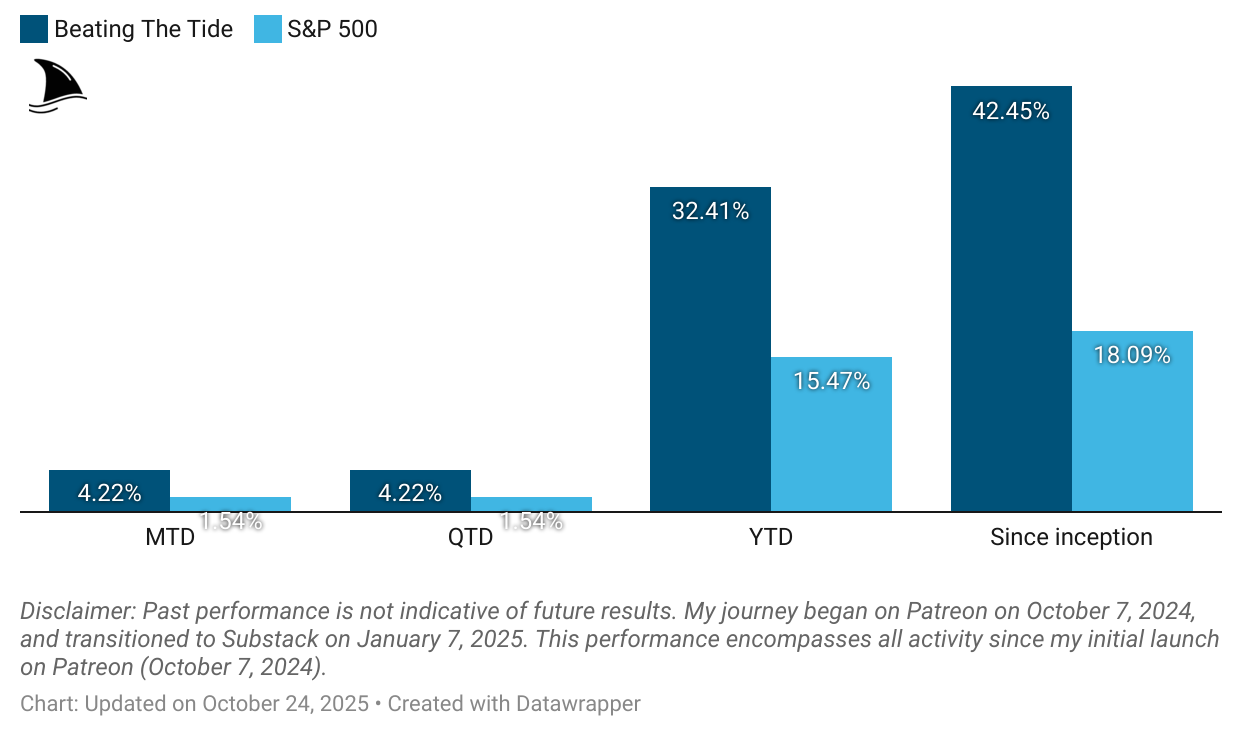

Portfolio hit an all-time high this week: +32.4% YTD and +42.5% since inception, 53 weeks ago. If you want, to skip straight to the numbers, jump to the Portfolio Update.

It happened in a noisy, volatile week; prices swung, headlines shouted, and patience paid. That’s the spark for this week’s thought: discipline beats action in investing; it usually beats it everywhere else too.

Since the last update, nine portfolio companies reported; only one missed EPS estimates.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

On October 22, I published a primer on how to read 10-K and proxy statements. It’s a must-read for anyone serious about fundamental analysis.

I broke down how to approach SEC filings without drowning in them, which sections matter, how to decode management’s tone, and where to find the buried details that move stocks before Wall Street catches up. The goal isn’t to read every page, but to learn how to read between the lines: from executive compensation signals to red flags in risk disclosures.

If you’ve ever opened a 10-K, felt overwhelmed, and closed it 5 minutes later, this piece will change how you see those documents. It’s about turning filings from a chore into one of the best edge-building tools an investor can have.

Earnings Update: 8 of 9 Companies Beat Estimates

Since the last update, nine portfolio companies released results. Two of them missed revenue consensus estimates and one missed EPS consensus estimates.

You can read my full take on TSM’s earnings here and AGX in here.

Thought Of The Week: Action vs. Discipline. Why Doing Less Can Lead to More

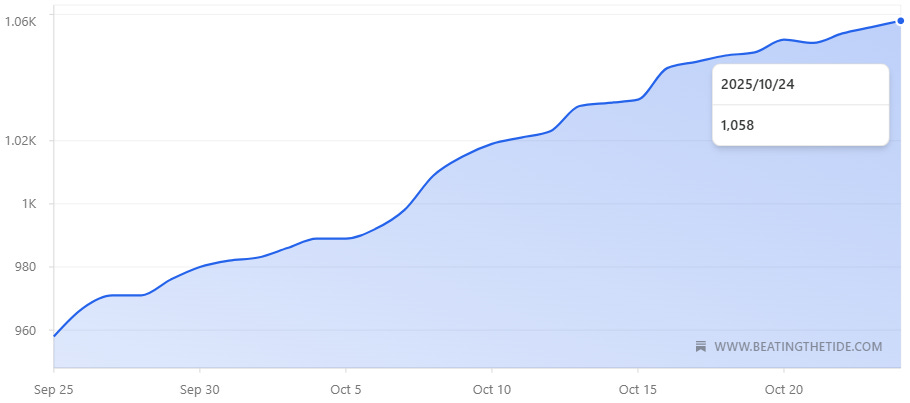

I started this newsletter just over a year ago, and I’ve 1,058 subscribers so far.

Meanwhile, I’ve watched other ‘investment’ newsletters explode from zero to 20,000 readers in a matter of months. It’s not that my newsletter lacks value (at least, I like to think it provides value); it’s that my approach seems boring compared to what else is out there.

My focus has been on disciplined, long-term investing while many popular newsletters promise action every day. They serve up exciting stock picks, breaking news, and constant trading ideas. In contrast, I preach patience and caution.

Let’s face it: discipline isn’t sexy; excitement sells. Sidney Sweeney’s ad for AEO 0.00%↑ sent the stock soaring from under $14 to $18. Excitement sells…no question about it.

Most people won’t admit it, but they crave action in the market. They might say they want a steady, disciplined portfolio of high-quality companies held for the long run. They might claim they admire a conservative strategy built on fundamentals. But that’s often like the guy who pretends he loves reading dense philosophy books, then secretly scrolls TikTok for hours when no one is watching.

In theory we admire patience and wisdom; in practice we reach for quick thrills. Many investors are drawn to the daily pulse of the market. The adrenaline of big moves, the thrill of chasing the next hot stock or reacting to every headline.

If a newsletter isn’t providing that daily jolt, some people feel it’s not worth their time. They gravitate toward sources that deliver constant action, like daily briefings on market movers and rapid-fire trading ideas. It gives the feeling of control and excitement, even if it’s mostly noise.

Why We Crave Action: The Psychology Behind It

Why do smart people so often prefer doing something over doing nothing, even when doing nothing would be wiser?

There’s a well-documented tendency known as action bias: it’s our impulse to favor action over inaction, even if there’s no solid evidence that action will lead to a better outcome.

We feel compelled to do something in response to events, purely because doing something feels productive. This bias can be dangerous. It pushes us to make trades just to feel in control, or to react to every market news item as if activity itself were progress.

Part of this urge comes from our evolutionary wiring. Our brains evolved to reward action and excitement. Modern studies using brain scans have found that making a trade can light up the same reward pathways as gambling (the brain’s dopamine-driven pleasure centers).

In our ancestral past, taking quick action (like escaping a threat or chasing food) often meant survival.

That bias towards action persists today: our brains give us a hit of “feel-good” chemicals when we act, especially under uncertainty. This is why doing something feels satisfying at a primal level, even if logically the situation doesn’t call for action.

The market taps into the same circuits that make gambling or video games addictive. We get a rush from checking prices, placing a trade, or seeing a stock jump, and that rush can override our rational, long-term plans.

There’s also fear and ego at play. We fear missing out (hello, FOMO) if we don’t act when others seem to be getting rich quick. We also tend to overestimate our ability to outsmart the market in the short term. Taking action gives a sense of control over uncertain outcomes, boosting our ego even if the control is an illusion.

Psychologically, doing nothing can feel like we’re being irresponsible or lazy. Not taking action makes us worry we’ll regret it later if things go wrong. This is why even investors who intellectually believe in discipline might still itch to trade on every bit of news.

Our fast, emotional thinking (what Daniel Kahneman in Thinking, Fast and Slow calls “System 1”) urges us to do something now, while our slower, rational mind knows we should probably sit tight.

The result is that most people seek action in the market. If they don’t get a daily “fix” of news and trades, they feel they’re not getting value. A newsletter that says “stay the course, be patient” can seem dull.

In contrast, one that shouts “Big breakout today – buy this now!” or “Urgent warning - sell now!” plays directly into our action bias. It triggers that impulse and feels more useful. But feeling productive and being productive are very different things in investing.

Sharks and Fish: Why Not Everyone Can Be Disciplined

Believe it or not, the fact that many people chase action is actually great news for those of us who choose discipline. In the stock market, to buy a share someone else has to sell it to you, and when you sell, someone else buys.

If everyone in the market was super disciplined and patient, calmly holding high-quality stocks for the long term, then it would be much harder for any of us to consistently beat the market as there’d be no obvious mistakes to capitalize on.

Not everyone can be a shark; the market needs plenty of fish. If every market participant were a savvy shark, who would be left to make the emotional, short-sighted decisions that we profit from?

We actually need a lot of short-term, impatient, reactive traders out there, because they create the mispricings and opportunities that patient investors can exploit. If the entire market followed the exact same disciplined strategy, there’d be no one on the other side of our trades.

The fact that not everyone has the temperament for discipline is what makes discipline profitable. A saying by Warren Buffet comes to mind:

The stock market is a device for transferring money from the impatient to the patient.

In plain terms, those who jump around acting on every whim often end up enriching those who stay calm and stick to a sound plan. It might sound predatory, but in the market, rash decisions are what patient investors feed on.

So I take the slow growth of this newsletter as confirmation that what I’m doing is different. And being different (in a sensible way) is necessary to outperform. If 100% of investors loved my “boring” approach, it would stop working. The very fact that many investors can’t help themselves, that they’ll ditch fundamentals for the latest flashy trade, means there’s alpha to be earned by doing the opposite.

Not everyone can be a shark; someone has to be the meal. As long as there are plenty of fish chasing shiny objects in the market, a focused shark can eat well.

A Week of Noise: How Chasing Headlines Can Hurt

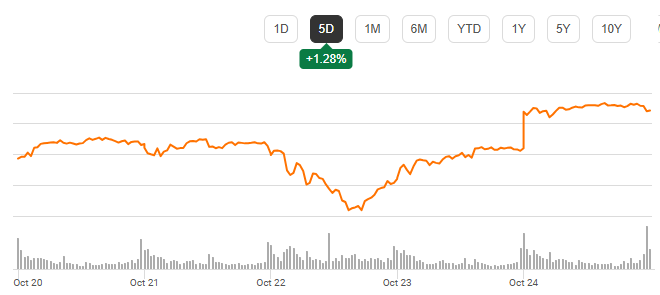

To illustrate the difference between chasing action and staying disciplined, let’s look at the wild ride of just one week in the markets. This past week was packed with headlines and big market moves exactly the kind of environment that tempts people to react impulsively. If you tried to trade on each day’s news, you likely got whiplash.

Tuesday. Gold prices plunged suddenly, shocking many investors. In fact, early this week gold had its sharpest one-day drop in over five years.

The narrative on Tuesday was that gold was “overstretched” after a huge run-up, and traders rushed to book profits. A stronger U.S. dollar also helped knock gold down. If you were holding gold or gold stocks, Tuesday’s news might have panicked you into selling to “cut losses” or avoid further decline.

Wednesday. The very next day, the focus shifted to tech stocks. The Nasdaq Composite fell almost 1% on Wednesday as shares of Netflix crashed over 10% after a disappointing earnings report and outlook.

Since NFLX 0.00%↑ is a heavyweight in many tech ETFs, its plunge dragged the whole tech sector down. Headlines blared about “Tech Selloff” and weak earnings. An action-biased investor might’ve dumped tech holdings on Wednesday in fear of more losses.

By Thursday, the winds changed again. Markets rebounded. All three major U.S. indices rallied, led by the Nasdaq.

What sparked optimism? For one, Tesla’s earnings call turned out better than feared. TSLA 0.00%↑ stock rebounded about 2.3%, helping lift market sentiment.

On top of that, a geopolitical development gave traders a jolt of optimism: Trump’s meeting with Jinping was confirmed for next week. That news about a Trump–Xi meeting injected hope that trade wars might cool off. The market, which was gloomy 24 hours before, suddenly turned sunny. If you had sold on Wednesday’s fear, you likely regretted it on Thursday when stocks jumped.

Friday. To cap off the week, we got a dose of macroeconomic news. On Friday the market climbed further after the CPI came in cooler than expected. Inflation rose just 0.3% last month vs. the 0.4% that analysts anticipated.

In other words, price pressures eased slightly, which bolsters hopes that the Federal Reserve will continue cutting interest rates. Slower inflation was a welcome surprise and stocks rallied on the news. By week’s end, equity indexes were up, not down.

Now imagine an investor who tried to time each of these moves: selling on Tuesday because gold was plunging, selling tech on Wednesday after the Netflix scare, then scrambling to buy back in on Thursday’s trade optimism, and maybe adding more on Friday’s CPI news.

What’s the likely result?

Most likely they sold low and bought high. They would be down for the week, or at best flat, despite all that effort. By selling into the drops and buying back into the rallies, they’d be trading on their back foot, exactly the wrong timing.

In contrast, I did nothing at all and come out ahead by Friday. I made zero portfolio moves during the week, and my holdings ended up +3.7% higher by week’s end.

Moral of the story: Discipline beats action.

This pattern happens over and over. Markets often move in zig-zags on a short horizon, driven by news bites or emotional swings. One day’s “taking profits” story becomes the next day’s “buying opportunity” story. If you chase each twist, you end up whipsawed buying high and selling low, again and again.

It’s exhausting and expensive.

A lot of the daily sound and fury is just noise that has little to do with the underlying value of companies. Acting on that noise is a fast track to poor results. As I’ve said many times: frequent action triggered by short-term news usually leaves you behind in the long run.

Below are some articles that are relevant to this topic:

Discipline Pays: Patience Outperforms Frenzy

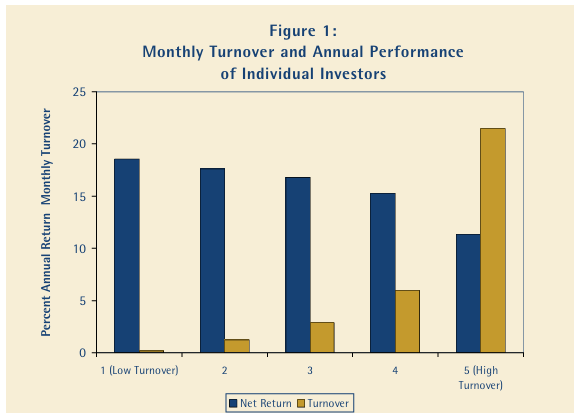

There’s a mountain of evidence that a disciplined, patient approach outperforms an action-packed one. One study of individual investors found that the more frequently people traded, the worse their results. In fact, the most active traders underperformed the least active traders by an astonishing 7.2% points per year on average.

Think about that: the busy-beaver traders, constantly buying and selling, lagged far behind the folks who mostly sat on their hands. All that effort, stress, and transaction cost for a significantly poorer outcome.

This is not just an isolated case. Multiple studies in behavioral finance show that overtrading is hazardous to your wealth. Every trade has costs (commissions, bid-ask spreads, potential tax hits) and, more importantly, every needless trade opens the door to mistakes. When you trade on impulse or “gut feeling” sparked by the latest news, you’re likely trading against someone who knows more or cares less (i.e., a shark taking advantage of the fish).

Jesse Livermore, one of the most famous stock speculators of the early 20th century, put it bluntly over a hundred years ago:

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!

In other words, his greatest gains came from doing nothing for long stretches, holding on to winning positions and resisting the urge to tinker rather than from frantic buying and selling. Livermore admitted that men who can be both right and sit tight (i.e. stick to their positions) are very uncommon, and that it was one of the hardest lessons he learned.

Warren Buffett (who, incidentally, is a big fan of inactivity) also champions patience. We already noted his quote about the impatient vs. the patient. Charlie Munger once said that:

a huge portion of success in life and investing comes from waiting.

Munger talked about sitting on your ass and doing nothing until a great opportunity presents itself. They built one of the world’s biggest fortunes largely by not doing what most investors do: they don’t trade in and out; they wait for fat pitches.

That really sums it up: most of the time, doing nothing is exactly the right thing. And on the rare occasions when something truly extraordinary happens (a market crash or a once-in-a-generation opportunity), what matters is keeping your head and acting rationally, not emotionally.

In short, discipline and patience are superpowers in the market. They’re rare, because they’re hard for our action-biased brains to maintain, but that’s exactly why they pay off. Success in investing often isn’t about making some brilliant prediction or complex maneuver; it’s often about avoiding the big mistakes that impulsive investors make.

By simply not overreacting, not chasing the crowd, and not getting suckered by every shiny object, you stack the odds in your favor. It’s a calm, confident approach: I’m not here to thrill you with constant moves, I’m here to quietly compound wealth.

When Action Matters: Being Slow and Fast

All this praise of inaction doesn’t mean you never take action. Discipline doesn’t equal paralysis. The key is knowing when to wait and when to strike. Think of a predator like a great white shark. Most of the time it glides slowly, conserving energy. It’s not constantly thrashing around chasing every fish it sees. It watches and waits. But when the perfect opportunity comes, say an unlucky seal crosses its path, the shark explodes into action with incredible speed and decisiveness.

Investing should work the same way.

Most of the time, you should move slowly. You research, you watch, you think long-term. But when the stars align, when a truly great opportunity lands in front of you, you act fast and with conviction.

I touched on this idea in a previous piece about “fast and slow” investing.

The best investors don’t fill their days with endless trades; they spend most days preparing, studying, and being patient. Then, occasionally, when a high-confidence situation appears (for example, a fantastic company’s stock price falls 50% due to a temporary panic), they move quickly to take advantage.

The best investors wait, and then when the right moment arrives, they strike fast like a great white shark that lurks calmly until it’s time to attack. The trick is to be fast when it counts and slow the rest of the time.

So yes, there are times you need to take action. Market crashes, deep corrections, or special situations can be golden opportunities to buy at a discount. In those moments, hesitation can be costly. (If you’ve done your homework and you know what you want, you pounce. Buffett in 2008 providing a lifeline to Goldman Sachs is a classic example. He was ready after years of preparation, and he struck a fantastic deal while others froze in fear.) But those scenarios don’t come along every week or even every year. They’re the exception, not the rule.

The disciplined investor is like a slow walker who occasionally breaks into a sprint at exactly the right time. By contrast, the chronic action-chaser is like a person sprinting in circles all day, eventually collapsing from exhaustion.

Knowing when to be fast and when to be slow is crucial. Many investors get it backwards: they are fast (impulsive) when they should be slow, jumping into dubious hype stocks or reacting emotionally; and they are slow when they should be fast, missing out on great buying opportunities because they’re overthinking or frightened. The goal is to reverse that: be generally slow and methodical, but be ready to act swiftly when a high-probability opportunity appears.

Patience is not the same as complacency; it’s active waiting. You stay alert, keep a wish list of stocks, do your research, and maintain liquidity or flexibility so that when the rare “fat pitch” comes, you can swing hard.

Tips for Cultivating Discipline Over Action

Staying disciplined in a world that constantly tempts you to take action isn’t easy. It’s like dieting in a candy store. But it can be done with the right habits and mindsets.

Tip #1. Limit Your Market Noise Intake

Constant news can trigger your impulse to react. Consider a “media fast” during turbulent times. Don’t check stock prices ten times a day. Maybe set specific times to review your portfolio (e.g., once a month) rather than reacting in real-time. By reducing how often you consume financial news or check your holdings, you’ll be less likely to make knee-jerk moves.

Tip #2. Have a Written Plan (and Stick to It)

Decide in advance what your investment strategy is and write it down. This acts as your rulebook (my book is my rulebook). When emotions run high, refer back to your plan. For example, if your plan says you only buy businesses that you’ve analyzed thoroughly, you won’t suddenly dump money into a random stock tip you read on Twitter. A clear plan gives you something to hold on to when the market is chaotic, so you’re not swept away by every new tide.

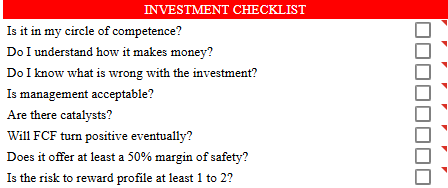

Tip #3. Use Checklists and Waiting Periods

To counter impulsiveness, build in speed bumps. For instance, if you’re itching to buy or sell based on some news, impose a cooling-off period (say 24 hours) before executing. Often, the urge will pass or you’ll uncover new information in the interim.

Another trick: use a checklist before any trade (“Have I re-checked the fundamentals? Does this align with my long-term thesis? Am I acting out of fear or greed?”). If the trade doesn’t satisfy your checklist, don’t do it. These techniques inject a bit of System-2 thinking (slow, rational thought) into moments when System-1 wants to run wild.

Here is part of my checklist if you need inspiration:

Tip #4. Focus on Process, Not Constant Outcomes

Reward following the plan, not headline-driven wins. Shift your satisfaction from the outcome of each trade to the process of good investing.

You can’t control short-term outcomes, but you can control your process (research, due diligence, risk management). Set process-oriented goals, like “I will thoroughly research any stock for a week before buying” or “I will diversify across at least 15 stocks” things that enforce discipline.

When you follow your process, give yourself a mental pat on the back even if that day’s result is boring or even negative. Over time, a sound process yields good outcomes.

As part of this, learn to embrace boredom. Good investing is often pretty dull. If you need excitement, find it outside of your portfolio, don’t turn your portfolio into a casino.

Tip #5. Remember the Big Picture

Whenever you feel the FOMO monster or panic gremlin coming on, zoom out. Remind yourself of why you’re investing and what the long-term horizon is. Look at a long-term chart of the S&P 500 or your favorite quality stock. I Like to see my historical performance 😊

See how minor the daily wiggles look in the context of years of growth.

I sometimes literally step away from my screen and recall that I’m aiming to build wealth over decades, not days. By the time I retire, will it have mattered that I missed a 5% swing due to some earnings report? Probably not. What will matter is that I stayed in the game and let compounding do its work. Keeping that perspective helps suppress the urge to act on every little blip.

Finally, consider a bit of wisdom from Jack Bogle: he liked to tell investors, “Don’t just do something, stand there!” It perfectly encapsulates the counterintuitive truth of successful investing. Standing there, doing nothing, when everyone else is hyperventilating takes courage and confidence. But it’s often the right move. No action is an action, in its own way; it’s a deliberate choice to stick to your strategy.

Conclusion: Calm Confidence Wins the Day

In a market culture that celebrates action, being disciplined can feel lonely. It might even feel wrong at times. Our instincts and the crowd yell at us to do something. But as we’ve explored, constant action usually undermines long-term success. Discipline isn’t flashy. It won’t make for thrilling headlines or skyrocketing subscriber counts in the short run. But discipline is effective. I firmly believe (and my experience so far reinforces) that a calm, patient approach will outperform the market over time, and do so with a lot less stress along the way.

So the thought I want to leave you with this week is this:

Action ≠ Progress

In investing, more activity does not mean more success and often it means less. The real value I aim to provide in this newsletter is help in separating the signal from the noise, and encouragement to stay the course when others are chasing squirrels. I’m more than happy for this publication to grow slowly with like-minded people rather than blow up quickly on the back of hype. After all, what’s true in investing is true here too: fast growth isn’t always sustainable growth, and the goal isn’t to get big fast, it’s to steadily beat the tide.

Stay disciplined, stay focused, and don’t let the sound of the market’s siren song lure you onto the rocks. Sometimes the most profitable thing to do is to sit quietly and watch. In the game of action vs. discipline, I’ll put my money on discipline every time and I invite you to do the same.

Portfolio Update

The portfolio hit its all-time-high this week.

Month-to-date: +4.2% vs. the S&P 500’s +1.5%.

Year-to-date: +32.4% vs. the S&P’s +15.47%, a gap of 1,694 basis points.

Since inception: +42.5% vs. the S&P 500’s +18.1%. That’s 2.3x the market.

Portfolio Return

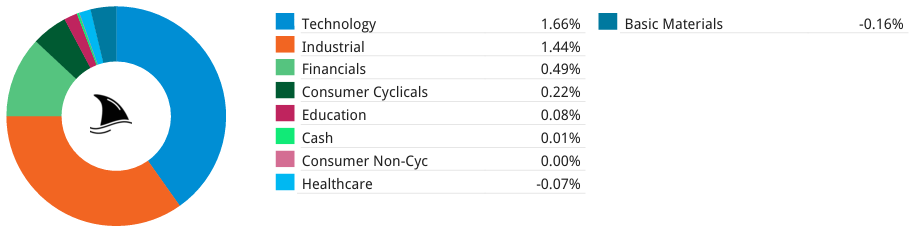

Contribution by Sector

The gains was driven by tech and industrials offset by gold.

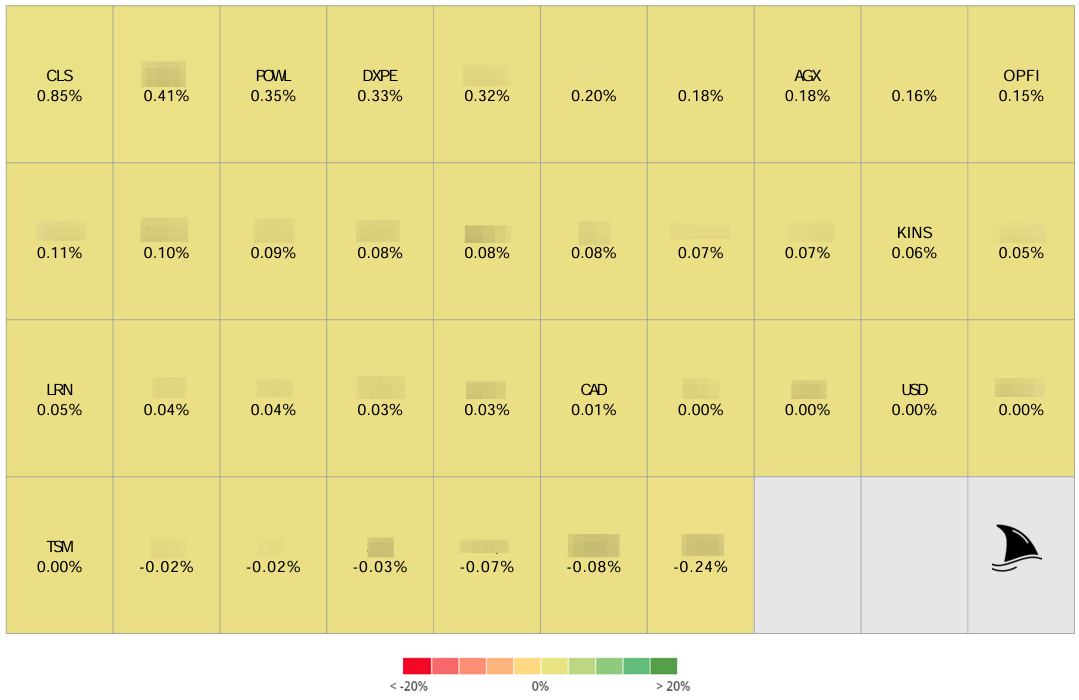

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+85 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

+41 bps POWL 0.00%↑ (Thesis)

+33 bps DXPE 0.00%↑ (Thesis)

+18 bps AGX 0.00%↑ (Thesis)

+15 bps OPFI 0.00%↑ (Thesis)

+6 bps KINS 0.00%↑ (Thesis)

+5 bps LRN 0.00%↑ (Thesis)

flat TSM 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: