Weekly #12: Let's be sharks

+7.3% vs. +1.3% for the S&P

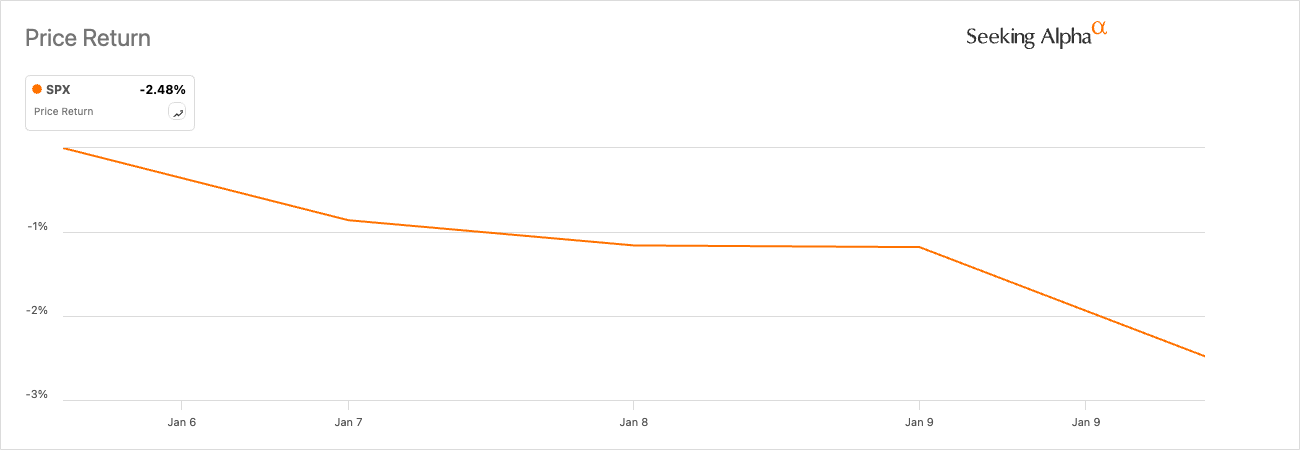

This week the S&P 500 lost 2.48%. Interestingly, the drop was because of strong economic data. The labour market was stronger than expected in December, raising concerns that the Fed may reduce rate cuts.

While a stronger economy may slow Fed rate cuts, it’s important to consider the broader system. A stronger economy means more people working, which ultimately supports growth.

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine."

~ Benjamin Graham

This means that in the short term, market prices react to sentiment, news, and emotions. However, over the long term, the market tends to reflect the true value and fundamentals of businesses.

Fundamentals ultimately drive markets

While political shifts and central bank policy remain focal points, fundamentals ultimately drive markets. The resilient labour market supports consumer confidence and spending. Analysts expect S&P 500 earnings to grow over 10% in 2025. Although rate cuts may be more modest than anticipated, lower rates continue to provide support.

Moments like this separate the sharks from the fishes

I know many people who would have read the headlines and liquidated their portfolio out of fear - I would call them fishes1. Sharks would leverage pullbacks as opportunities to rebalance and add quality investments. Sharks stay focused on long-term financial goals, especially during periods of volatility.

But I love fishes. Without fishes, sharks would not survive. We need someone to sell their shares at a discount so we can grab them.

Share the Love! Invite friends to join our community and earn rewards!

PORTFOLIO PERFORMANCE

(Please read this for the change in reporting)

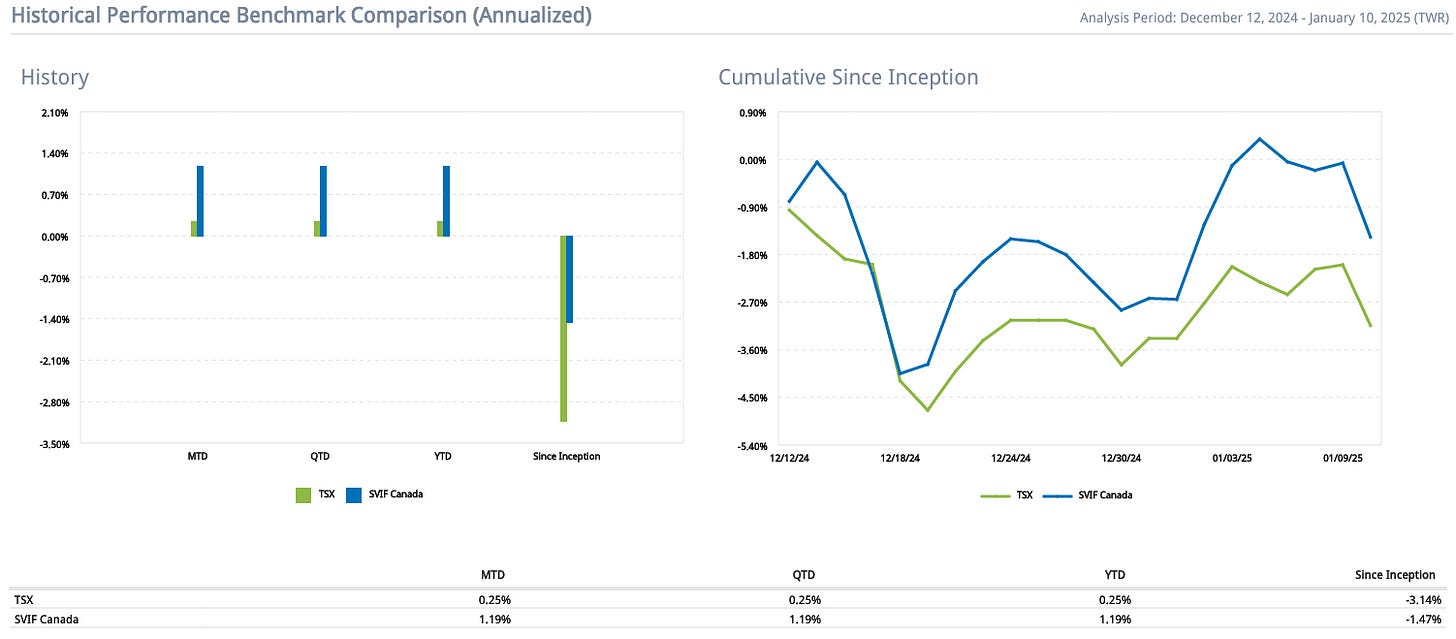

Since launching SVIF on October 7, 2024, the SVIF USA portfolio has gained 7.3% vs. 1.3% for the S&P.

Since launching SVIF on October 7, 2024, the SVIF Canada portfolio has gained 3.6% vs. 3.3% for the TSX.

To view the holdings of each portfolio click below:

WHAT HAPPENED THIS WEEK IN THE MARKET?

The US and Canadian economies started 2025 on a strong note, with resilient labour markets and positive fundamentals.

December labour data exceeded expectations in the US and Canada

US Nonfarm payrolls increased by 256,000, nearly 100,000 above expectations. The unemployment rate fell to 4.1%, its lowest level since mid-2024, and average hourly wages rose 3.9% year-over-year.

Canadian employment surged by 91,000 (vs. 25,000 expected), with unemployment ticking down to 6.7%. Wage growth eased to 3.7%, signalling improving inflationary dynamics.

US stock indexes declined this week due to rate-cut concerns

Despite strong labour data, major stock indexes in the US struggled last week, with mounting concerns over a slower pace of central bank rate cuts. The S&P 500 recorded its fourth negative week out of the past five, falling more than 4% from its record high on December 6. Major indexes declined roughly 2% for the week, marking their second consecutive weekly losses.

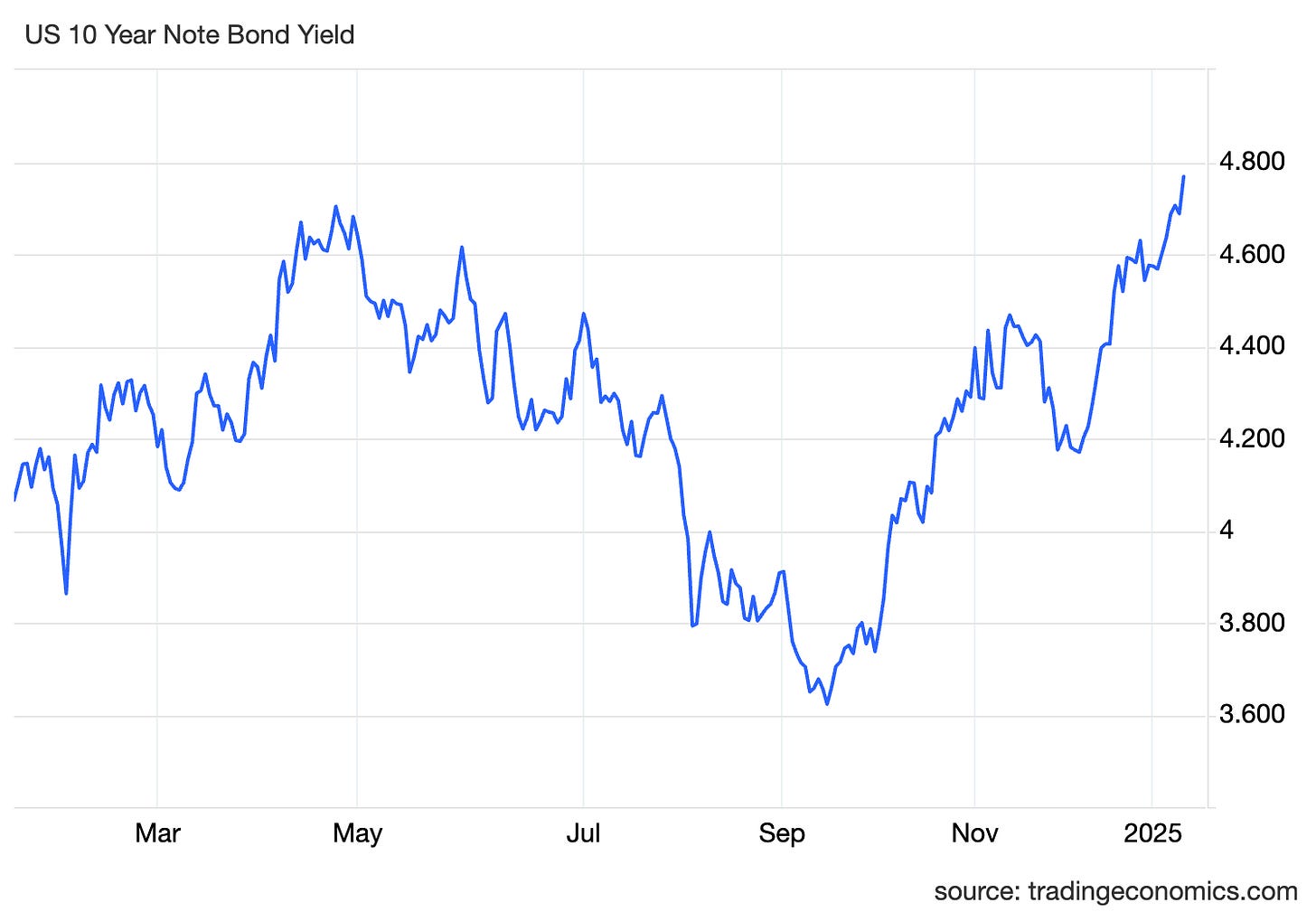

Highest bond yields in 14 months

The yield on the 10-year US Treasury note surged to 4.79% on Friday before settling around 4.77%.

Optimistic Earnings Season Outlook

The US corporate earnings season is set to kick off with major banks reporting quarterly results. Analysts estimate an 11.7% year-over-year increase in S&P 500 earnings per share for Q4, even though 71 companies recently lowered guidance, compared to 35 that issued positive forecasts.

Oil and gold are up this week

US crude oil prices rose for the third consecutive week, climbing to nearly $77 per barrel, up over 10% in three weeks. Gold futures also gained for the second week, reaching $2,717, less than 3% shy of their record high.

CPI Report Expected Wednesday

The CPI report, due Wednesday, will provide insights into whether inflation remains hotter than expected. November’s CPI showed an annual rate of 2.7%, up from 2.6% in October, suggesting uneven progress toward the Federal Reserve’s 2% target.

Political transitions add uncertainty

Both the US and Canada are experiencing shifts in political leadership. President-elect Trump’s inauguration on January 20 has markets waiting for clarity on policy priorities such as tariffs, energy reform, and tax cuts. Uncertainty about which policies will take precedence may weigh on investor sentiment.

Prime Minister Trudeau’s resignation and Parliament’s suspension until March 24 have delayed key legislation, including potential tax changes. A federal election looms later this year, adding to political uncertainty.

STOCK IDEAS

Three stocks I reviewed this week were MMM 0.00%↑, POWL 0.00%↑ and RAIL 0.00%↑. You can read the full analyses below:

Downgrading 3M Due To Persistent Litigation Risks And Stagnant Sales Growth

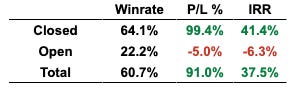

SEEKING ALPHA STOCK PICKING TRACK RECORD

I have kept a record on Google Sheets of how my recommendations on Seeking Alpha have performed.

I know the typical plural for fish is fish but I like to use fishes