Weekly #70: The Pendulum Never Stays Up

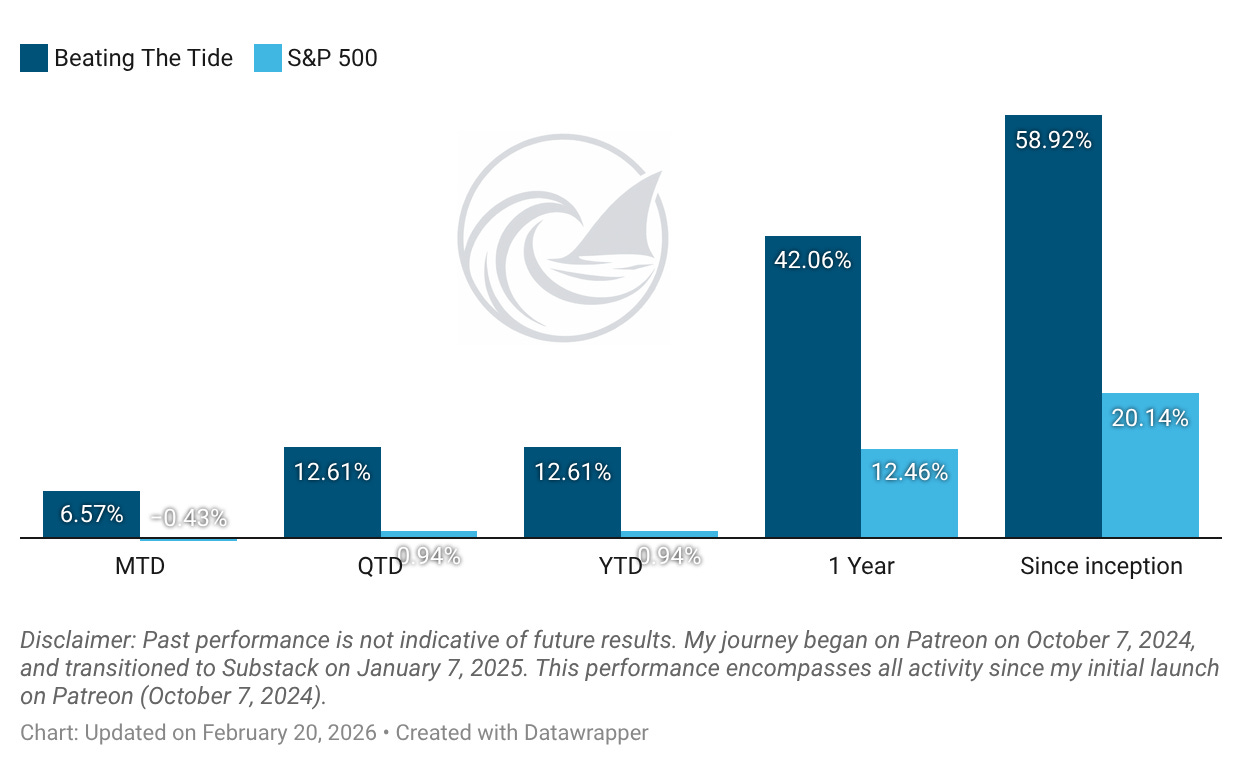

Portfolio +12.6% YTD, 2.9x the market since inception. Plus markets move in cycles, even when stories say otherwise.

Hello fellow Sharks,

This week, we continued expanding our outperformance over the S&P 500. If you want to skip straight to the numbers, jump to the Portfolio Update.

I have been posting fewer updates during the week as I have been focusing on the February Stock Pick and preparing to share the DCF in the deep dive.

Also, this week I was playing around with some tools and changed the logo for Beating The Tide.

This week I was inspired by an article by Joseph Politano discussing the US gamble on AI (here is the article). People (including myself) tend to linearly extrapolate the present into the future, but my +40 years on this Earth has taught me that life is more like a pendulum than a straight line road. This week, I will introduce the pendulum effect, the first article in my “Physics of Investing” series.

Enjoy the read, and have a great Sunday.

~George

Table of Contents:

Thought Of The Week: The Pendulum Effect & The Straight Line Trap

In school, I loved physics. I solved problems for fun.

I scored 99% on the final exam. Highest mark in my province. I felt proud, then confused. I asked for a re-check because I was sure I made no mistakes. They agreed I made no mistakes, but “per policy,” they do not give 100%.

Physics was one of the reasons I pursued mechanical engineering (specialized in mechatronics). I enjoyed school, less so engineering work (maybe a topic for another Weekly 🤔?). I left engineering about 20 years ago, but I never left science.

My favourite podcast is StarTalk.

I know it is not everyone’s cup of tea, but I listen because science keeps my thinking and asking, “What must stay true?”

That matters in investing.

I spend my days searching for companies I think the market is not valuing properly. I also spend my days watching people tell stories about the future. Those stories often break one simple rule.

They forget the pendulum.

The physics of investing series

I’ve wanted to write a series on the physics of investing for a long time. The problem is simple: life keeps showing up. So instead of forcing this into a perfect multi-week sequence, I’ll publish these essays whenever the timing makes sense.

Today’s topic: the pendulum effect.

How the pendulum in a clock keeps moving

Picture a grandfather clock.

You see that pendulum swing left, then right, then left again. It looks calm. It looks steady. It looks like it could do that forever. Physics explains why the motion feels so smooth.

A pendulum keeps swapping energy back and forth. At the ends of the swing, it holds energy as height (potential energy). Near the middle, it turns that energy into speed (kinetic energy). Then it climbs again and trades speed back into height. In the ideal case, energy does not leak out, so the swing repeats without fading.

Real life adds friction (friction will be the second essay in this series). Energy leaks away. No real pendulum swings forever.

So why does a clock pendulum keep going?

Because the clock feeds it energy.

A mechanical clock stores energy in a weight or a spring. The escapement controls how that stored energy flows into the gear train and the timekeeper. The escapement gives the pendulum a small push at the right moment to replace the energy that friction stole.

That push does two jobs at once. It keeps the pendulum moving, and it lets the gears advance in small, regular steps.

So the pendulum does not “park” at the left. It does not “park” at the right. It does not “park” in the middle.

It moves and keeps moving.

Investors love straight lines

Investors love a clean trend. Up and to the right.

That habit has a name. Behavioural finance calls it extrapolation. Researchers find that when markets rise, people tend to expect higher returns going forward, even when the math no longer supports the optimism.

I call it the “straight-line brain.” The straight-line brain sees the pendulum near one side and assumes it will stay there.

It never does.

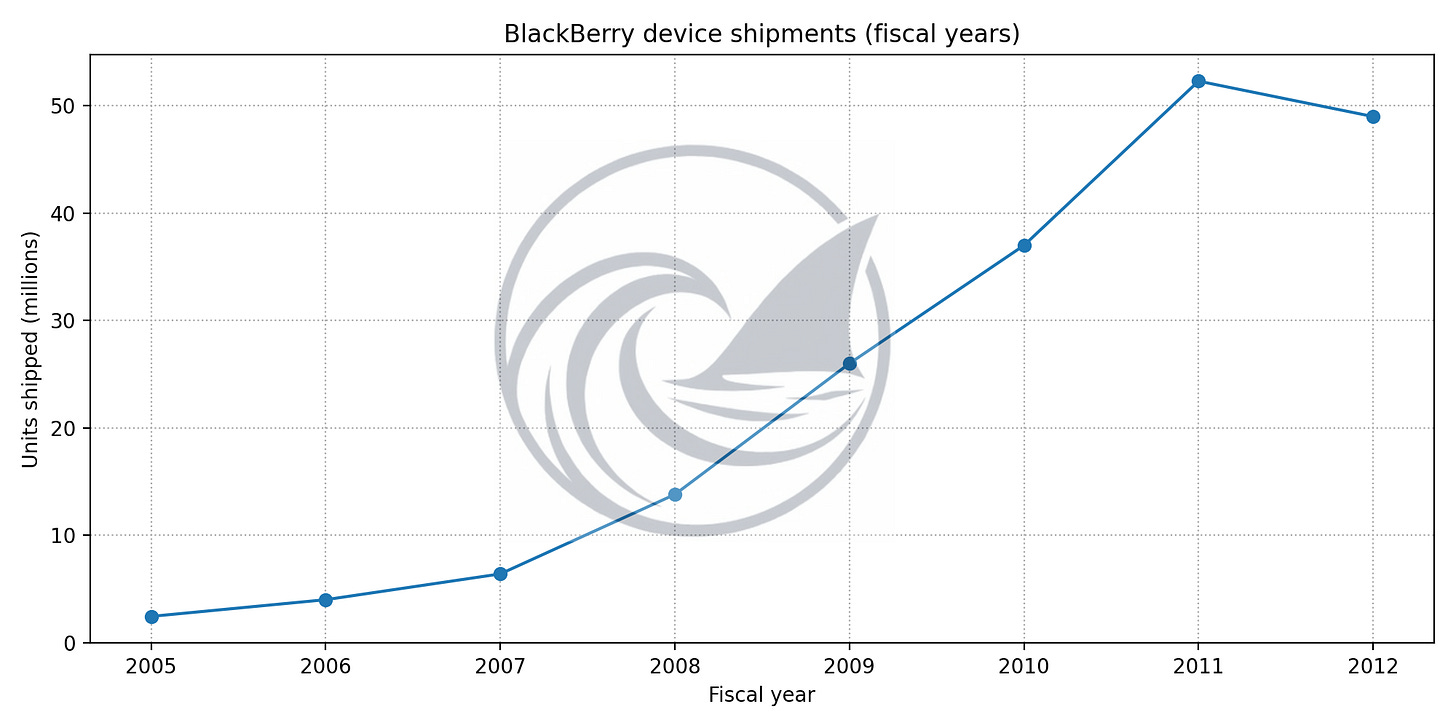

Phones, BlackBerry, and the danger of “forever”

There was a time when more people bought BlackBerrys each year. The trend looked strong, and the story felt obvious.

Then Apple introduced the iPhone on January 9, 2007.

That launch did not kill BlackBerry overnight. In fact, BlackBerry kept growing for a while after the iPhone arrived. Gartner data shows BlackBerry’s market share rose from 2007 to 2009, then the decline started.

That is the pendulum in one sentence.

The story felt permanent at the left edge. Then the swing began.

Now look at the phone size.

In the 1990s, phone makers chased smaller. Motorola sold the StarTAC in 1996 and marketed it as “wearable.” People talked about it because it felt tiny for its time.

Then the pendulum swung.

Screens grew. The internet moved into our pockets. Bigger screens won.

Today, Samsung sells foldables like the Galaxy Z Fold7 with an 8.0-inch main screen when you open it.

If you want the extreme left edge, you can even buy the Zanco Tiny T1, a “world’s smallest phone” style device that shrinks the idea to a novelty.

Tiny to huge.

Huge to tiny.

Then back again.

The pendulum never parks.

The pendulum swings in culture and policy, too

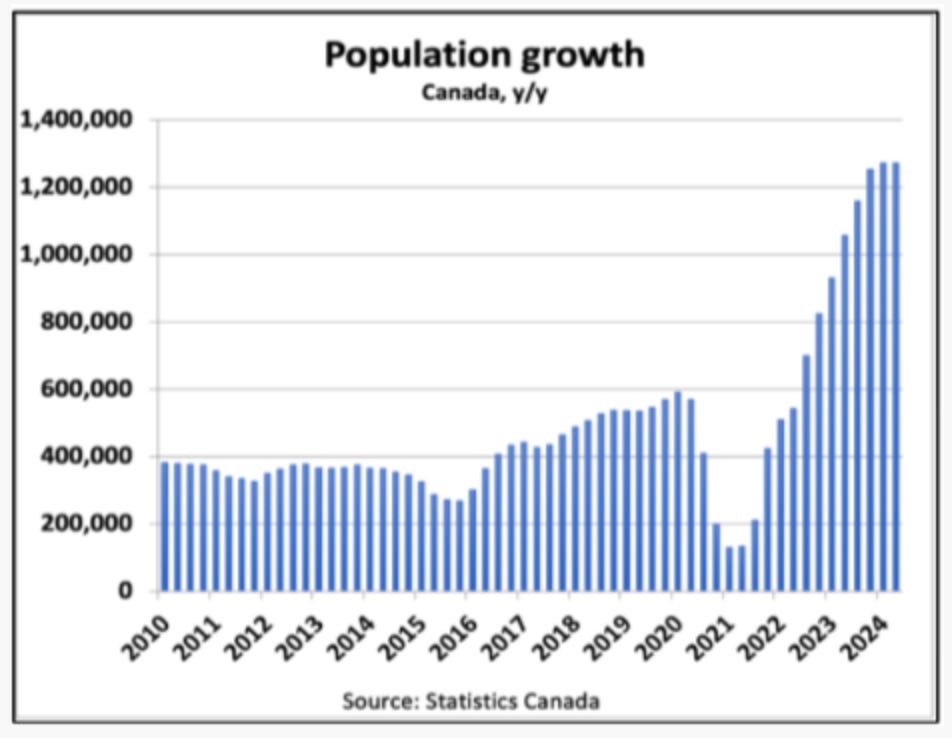

Now take immigration.

For years, Canada leaned into high inflows. The country used immigration to fill jobs and grow fast. After COVID, the numbers surged. In 2023, Canada logged its fastest population growth since 1957, driven almost entirely by international migration.

Then politics caught up with math.

Ottawa now aims to shrink the share of temporary residents to 5% of the population by the end of 2026. It also capped international students and cut study permit targets.

That is the swing.

The debt supercycle is the pendulum at work

Ray Dalio calls it the long-term debt cycle. I think of it as the pendulum working at the macro level. Credit expands, borrowing feels easy, asset prices rise, and risk starts to look like something that happens to other people.

In that phase, the story always sounds clean. Growth feels stable. Profits feel predictable. Valuations feel justified. The crowd starts to treat the current conditions as the natural state of the world.

Then the swing reverses.

Debt grows faster than income, rates rise, or liquidity tightens, and the system starts demanding cash instead of confidence. Lending standards snap tighter, weak balance sheets get exposed, and asset prices stop behaving.

The talking heads on TV call it a surprise, but it is not. It is the same pendulum coming back through the middle, with speed.

Debt does two things at once. It pulls future spending into the present, so booms feel stronger than they should. Then it becomes the weight that drags on the system when the cycle turns. In that sense, debt is not the clock. It is the stored energy and the extra load.

That is why I try not to anchor on today’s conditions. I try to locate the cycle. If the pendulum sits on the easy-money side, I ask what breaks when it swings back. If it already swung hard the other way, I ask what becomes cheap because fear feels permanent.

That is the habit. Credit moves in waves, and waves always come back.

I see the same cycle elsewhere. Companies pushed remote work hard. Then many pushed for return-to-office.

I am making a pattern point.

People treat the current direction as permanent. Policy, like markets, moves in cycles.

Markets swing, even when the headlines feel permanent

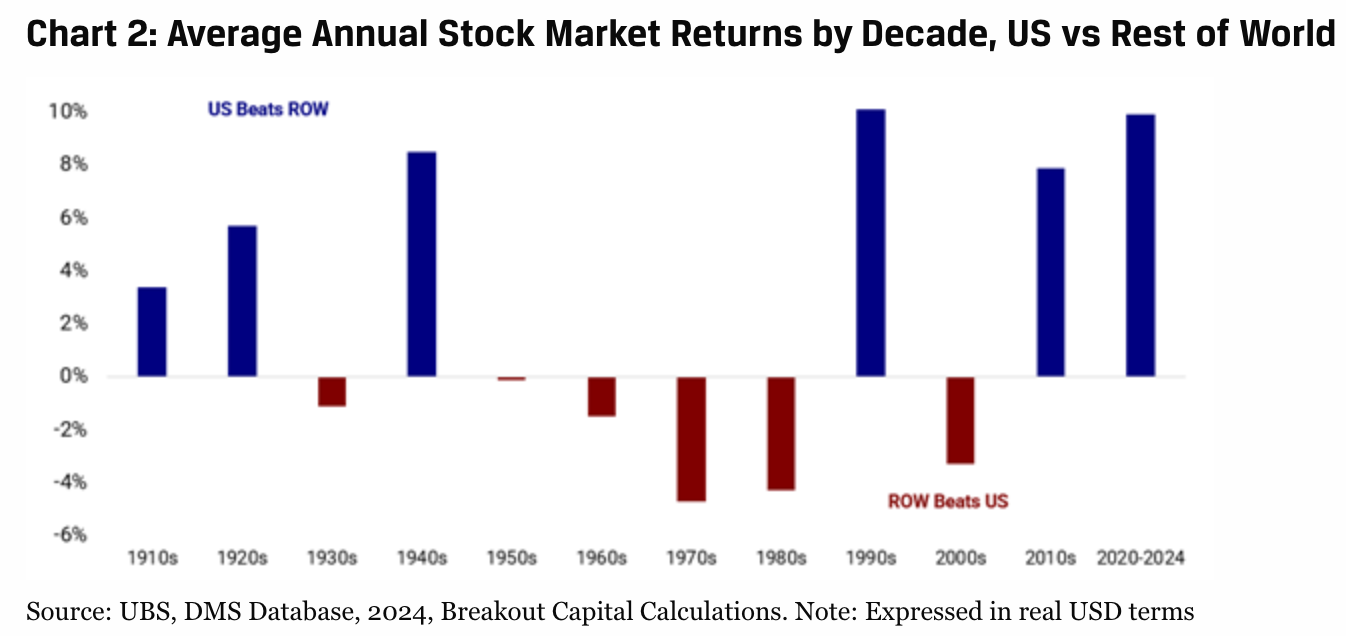

Now let’s bring the pendulum back to investing.

A lot of investors spent the last decade believing one core idea: “Just buy the US”

And yes, US equities dominated for a long stretch.

But CFA Institute published a January 2026 piece that makes the simple point many investors forget: market leadership is cyclical, not permanent. They argue that international equities outperformed US stocks by roughly 17 points in 2025, and they also cite long-run data suggesting the U.S. has lagged international peers about half the time since the 1900s.

That is the pendulum again.

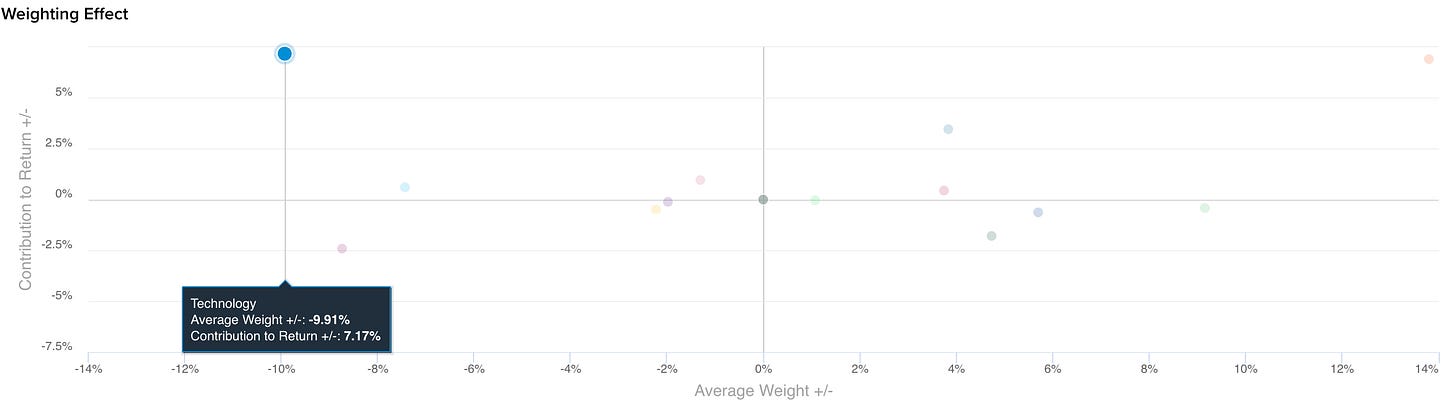

The same thing shows up inside the US market.

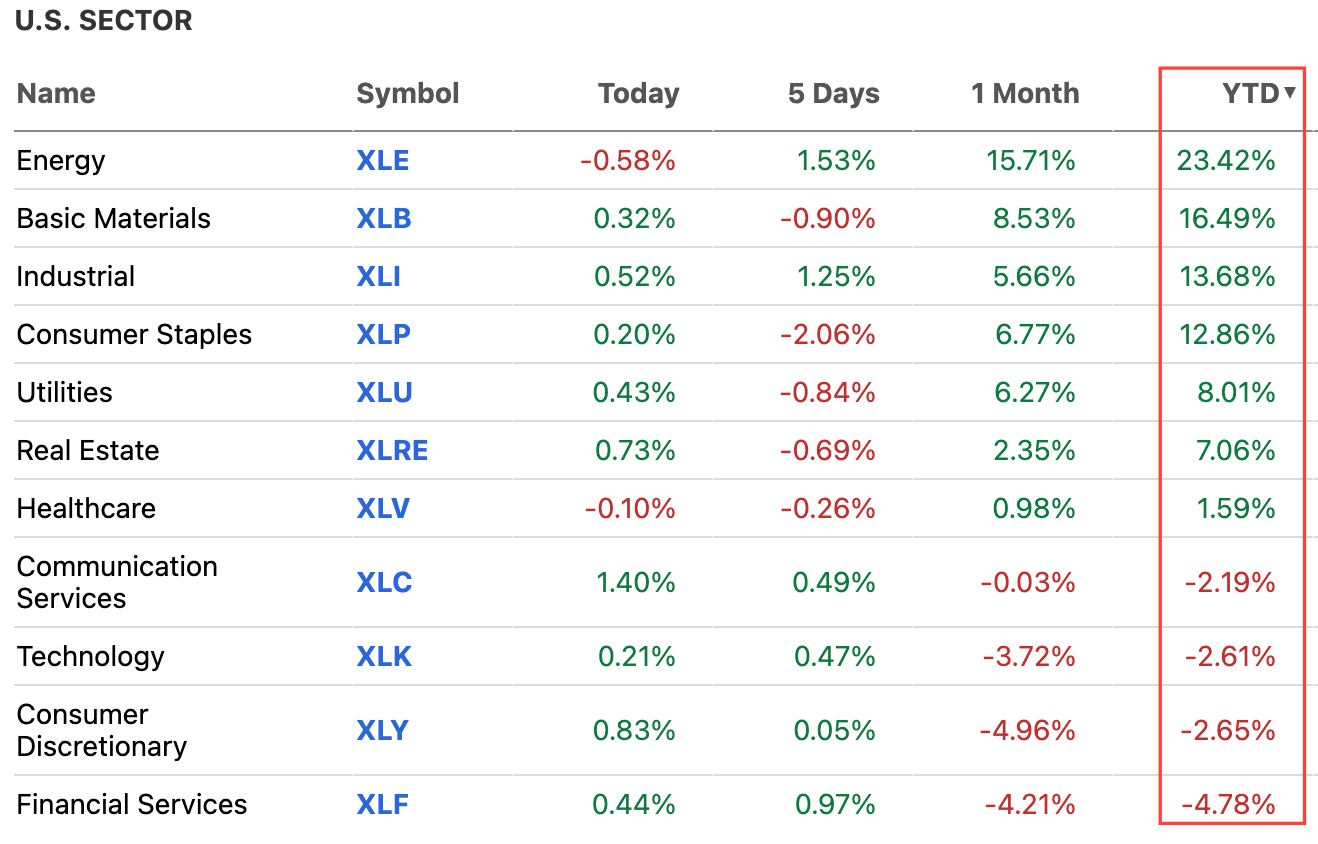

Last year, many crowded into tech and ignored energy…including myself. (To be fair, I was still underweight tech versus the S&P 500, but I still outperformed through stock selection 😉).

I wrote about that in my Weekly #58 piece, where I pointed out how cheap energy looked versus its own history while the mega-cap narrative swallowed the index.

Then 2026 started, and the swing showed up fast.

Energy is the best sector YTD (+23.4%) while Tech is losing -2.6%.

The pendulum never parks.

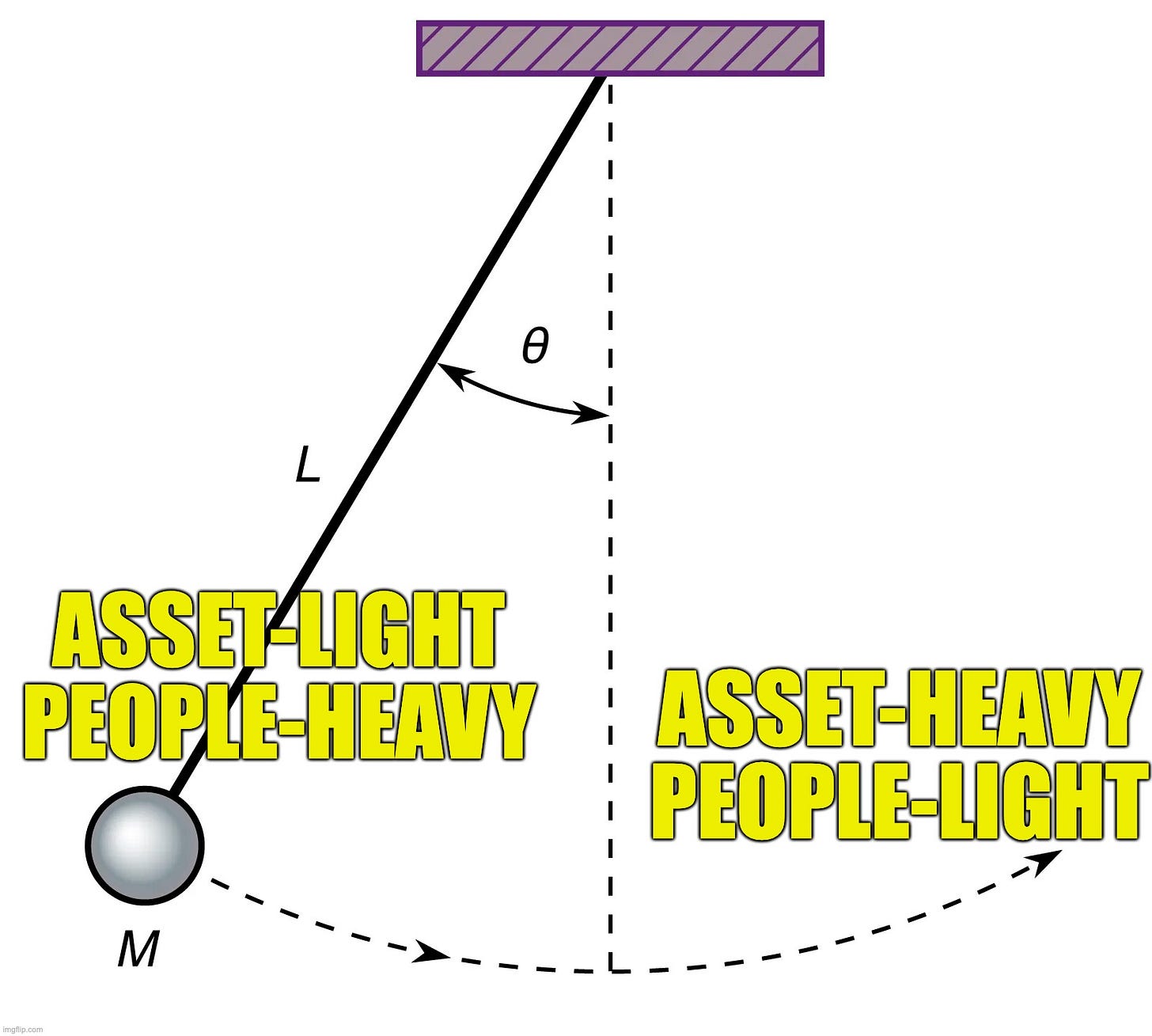

Asset-light is swinging toward asset-heavy

For decades, markets loved asset-light business models. Software. Ad platforms. Marketplaces. Considering that ROIC is simply margin over invested capital, that logic made sense. Low capital spending (a lower denominator) and high margins driven by smart people (a higher numerator) would increase ROIC forever.

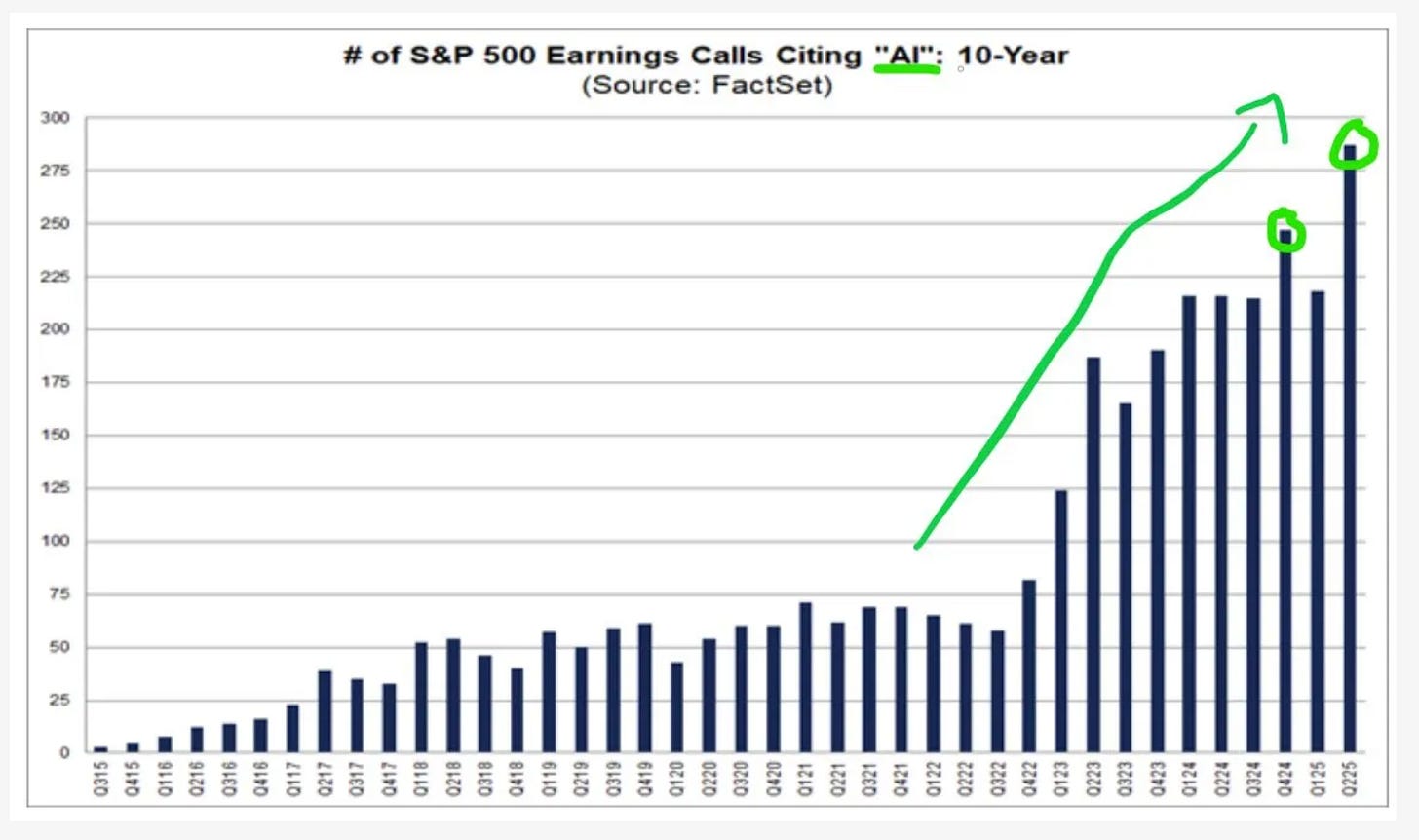

Now AI starts to change the shape of that trade.

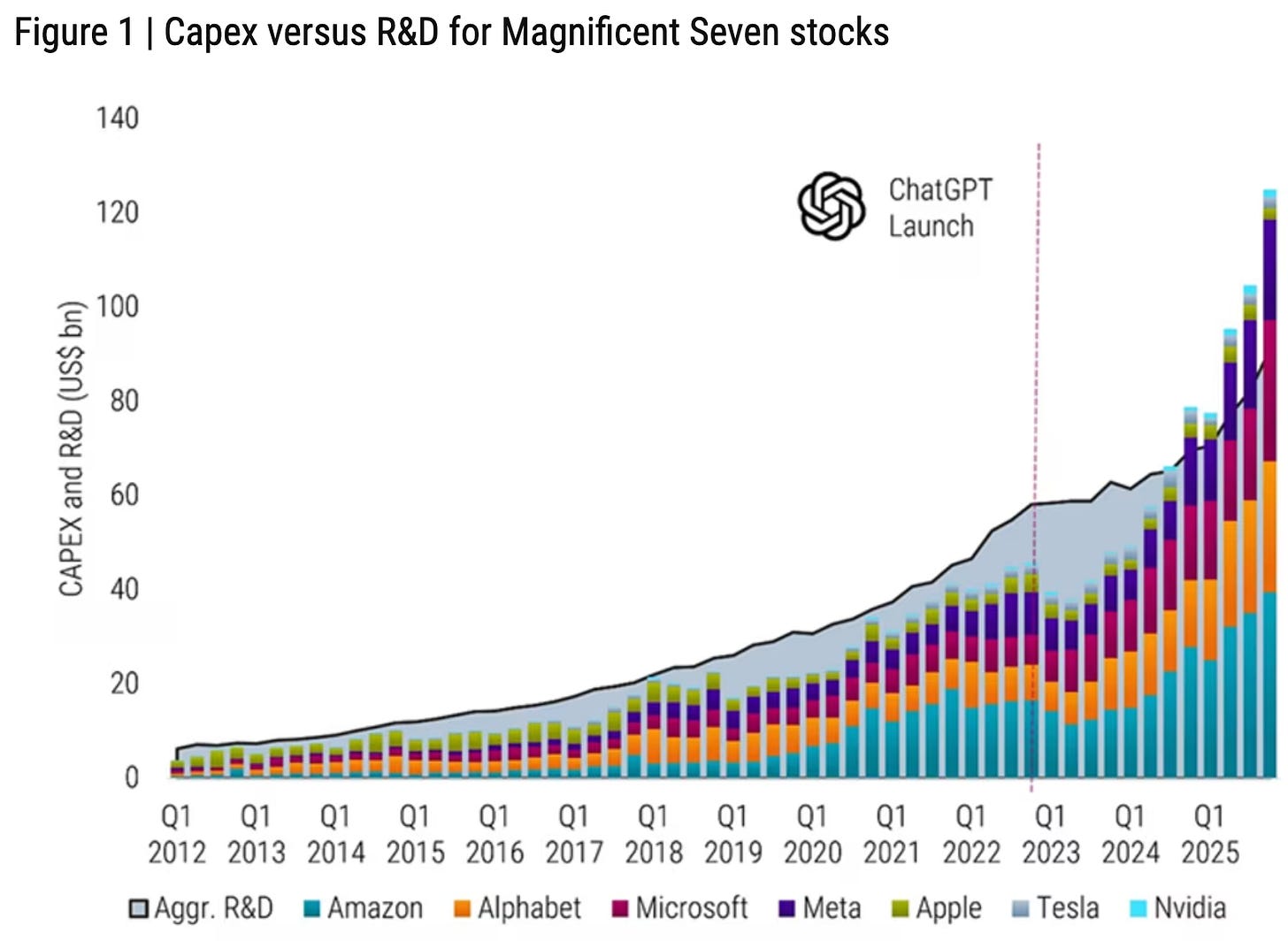

Robeco published a February 18, 2026, note that frames it well. They describe the rise of the “intangible economy” and then point to a recent shift: AI has pulled spending back toward physical buildout.

Capex accelerates since 2023 as firms expand data centres and compute, with capex surpassing R&D around mid-2024. That is a cost structure change.

You can see it in company plans and guidance.

I will borrow a chart from Maverick Equity Research that I found spectacular…

While AI was cited less than 75 times in earnings calls before ChatGPT, now it is mentioned close to 300 times!

So the pendulum swings from “asset-light” toward “asset-heavy,”.

Now watch the other side of the equation.

If AI scales, companies need fewer people for some tasks.

Amazon’s CEO wrote in June 2025 that as the company rolls out more generative AI and agents, it expects to need fewer people in some roles, and that this could reduce the total corporate workforce over the next few years as efficiency improves.

Reuters also reported job cuts and restructuring across large firms in 2025 and early 2026, often alongside AI adoption and efficiency pushes.

So I see two swings at once. Capital intensity rises while headcount intensity falls.

That is a real pendulum move. And it raises my favourite kind of investing question.

How high does it swing?

If the winners of the last decade start to look more like the industrial giants they disrupted, what happens to margins, FCF, and valuation frameworks?

I do not know the exact answer. But I know the right habit.

When the crowd tells me “this time it’s different,” I ask one thing.

Where is the pendulum right now?

Portfolio Update

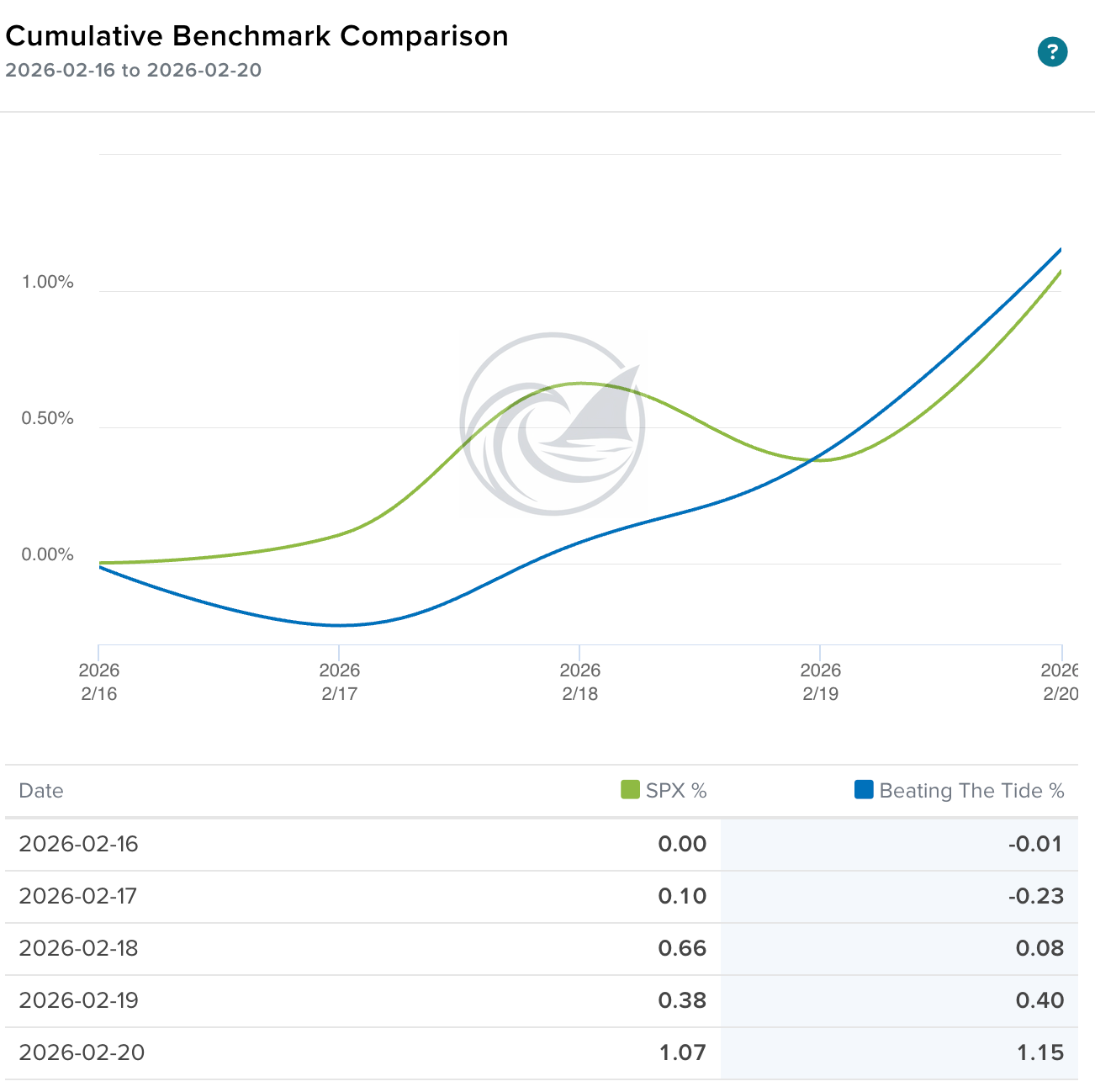

The portfolio started the week lagging behind the S&P 500, but we ended the week outperforming the index again.

Portfolio Return

Month-to-date: +6.6% vs. the S&P 500’s -0.4%.

Year-to-date: +12.6% vs. the S&P 500’s +1.0%. That is a gap of 1,167 points.

Since inception: +58.9% vs. the S&P 500’s +20.1%. That’s 2.9x the market.

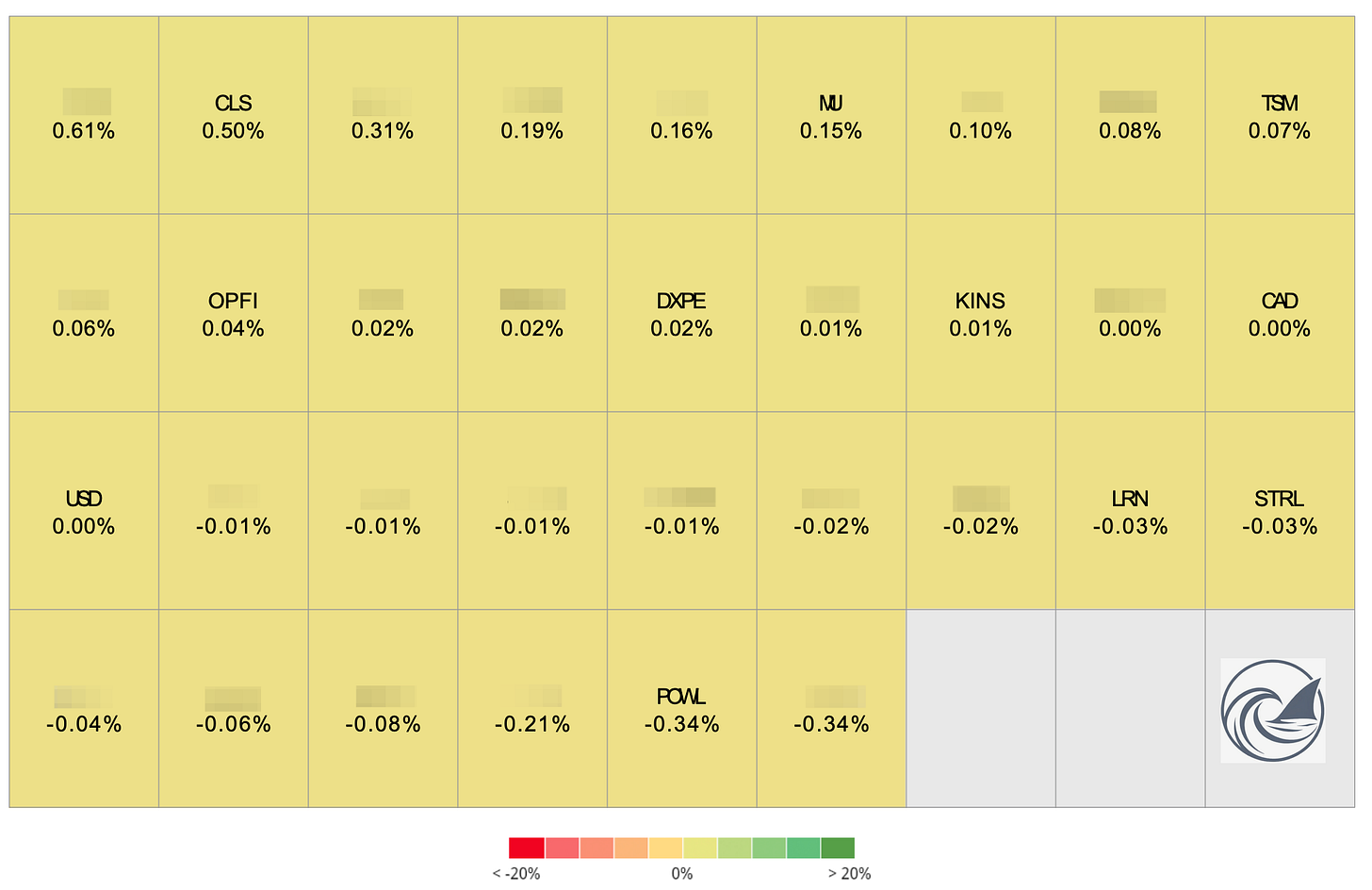

Contribution by Sector

Tech and gold led the portfolio gains, which were partially offset by consumer cyclicals and industrials.

Contribution by Position

(For the full breakdown plus commentary on earnings results and the big movers, see Weekly Stock Performance Tracker)

+50 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

+7 bps TSM 0.00%↑ (Thesis)

+4 bps OPFI 0.00%↑ (Thesis)

+2 bps DXPE 0.00%↑ (Thesis)

+1 bps KINS 0.00%↑ (Thesis)

-3 bps LRN 0.00%↑ (Thesis)

-3 bps STRL 0.00%↑ (Thesis)

-34 bps POWL 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: