Weekly #63: 2025 Recap and the Venezuela Event That Could Reshape South America

Portfolio +1.7% YTD, 2.3x the market since inception. Plus my early framework for what Venezuela’s reset could mean for migration, oil, and South American stocks.

Hello fellow Sharks,

This week the portfolio gained some ground and widened the gap versus the S&P 500. If you want to skip straight to the numbers, jump to the Portfolio Update.

This weekend, we went to Algarrobo, Chile, to visit some friends and went fishing (my first time fishing on a boat). On the first day we caught nothing. On the second day, we landed just a small one.

I am definitely better at catching fish in investing or at the poker tables 🙂

This week, I share my quick thoughts on what’s happening in Venezuela and the opportunities for investors. I also review 2025 and lay out my outlook for 2026.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

On December 30, I published my top stock pick for 2026, breaking down why Micron sits at the center of the AI memory bottleneck.

AI isn’t compute-constrained anymore, it’s memory-constrained. Micron’s DRAM and HBM are now mission-critical for GPUs and data centers, and management has already locked in pricing and volumes for all of its 2026 HBM output. That de-risks earnings, tightens supply, and reshapes the old boom-bust memory cycle. I walked through the industry setup, Micron’s positioning, and why my valuation points well above current prices.

My Quick Thoughts on Venezuela

We were heading to the boat when we heard about the attack in Venezuela. It took a while to confirm that Maduro had been taken. After our failed fishing morning, we watched Trump’s press conference. I’m glad Maduro is out, but I’m not thrilled with the approach or Trump’s “we’ll run Venezuela” framing. This isn’t a political newsletter, so I won’t get into motives. I’ll stick to what it might mean for investors.

Venezuela doesn’t really have investable capital markets in any normal sense, but the spillover to neighboring countries is very real. The number of Venezuelan migrants in places like Colombia, Brazil, and Chile is massive, and that has put pressure on services like healthcare and housing, and it’s created political and labor-market friction.

If Venezuela moves back toward something resembling a stable democracy, I expect at least some Venezuelans to return home over time. That would ease pressure on host countries, and it could improve labor-market tightness and public finances at the margin. One knock-on effect is that I’ll be paying closer attention to ADRs in South America for upcoming monthly picks.

Outside South America, the impact is mixed. In oil, more Venezuelan barrels (if sanctions loosen and production can actually recover) would be a tailwind for heavy-crude refiners. Venezuelan crude is mostly heavy and extra-heavy, and complex refineries are built for that kind of feedstock. The losers would likely be some heavy-oil producers elsewhere, especially those relying on higher-cost projects.

I also see potential winners outside oil. For example, POWL could eventually benefit if Venezuela opens up to large-scale power and industrial rebuild projects tied to energy and infrastructure.

Over the next few weeks I’ll dig into this more deeply and come back with a more grounded, actionable take.

Thought of the Week: A Review of 2025

Last year was a great one for me, both personally and professionally. Early in 2025 I became a dad. By far the best feeling I’ve ever experienced.

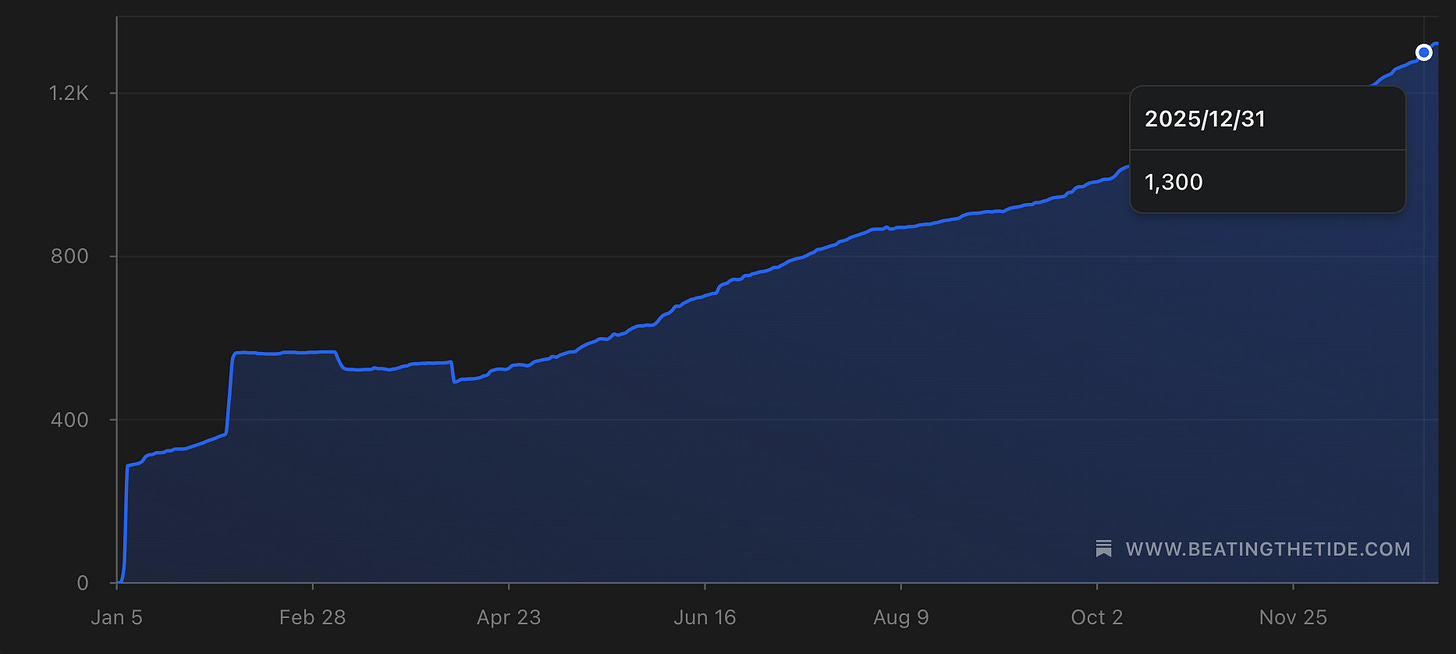

Professionally, I also launched this newsletter in January. I transferred roughly 400 subscribers from Patreon and Mailchimp and closed the year at 1,300 subscribers! Thanks to all that have joined me in this journey.

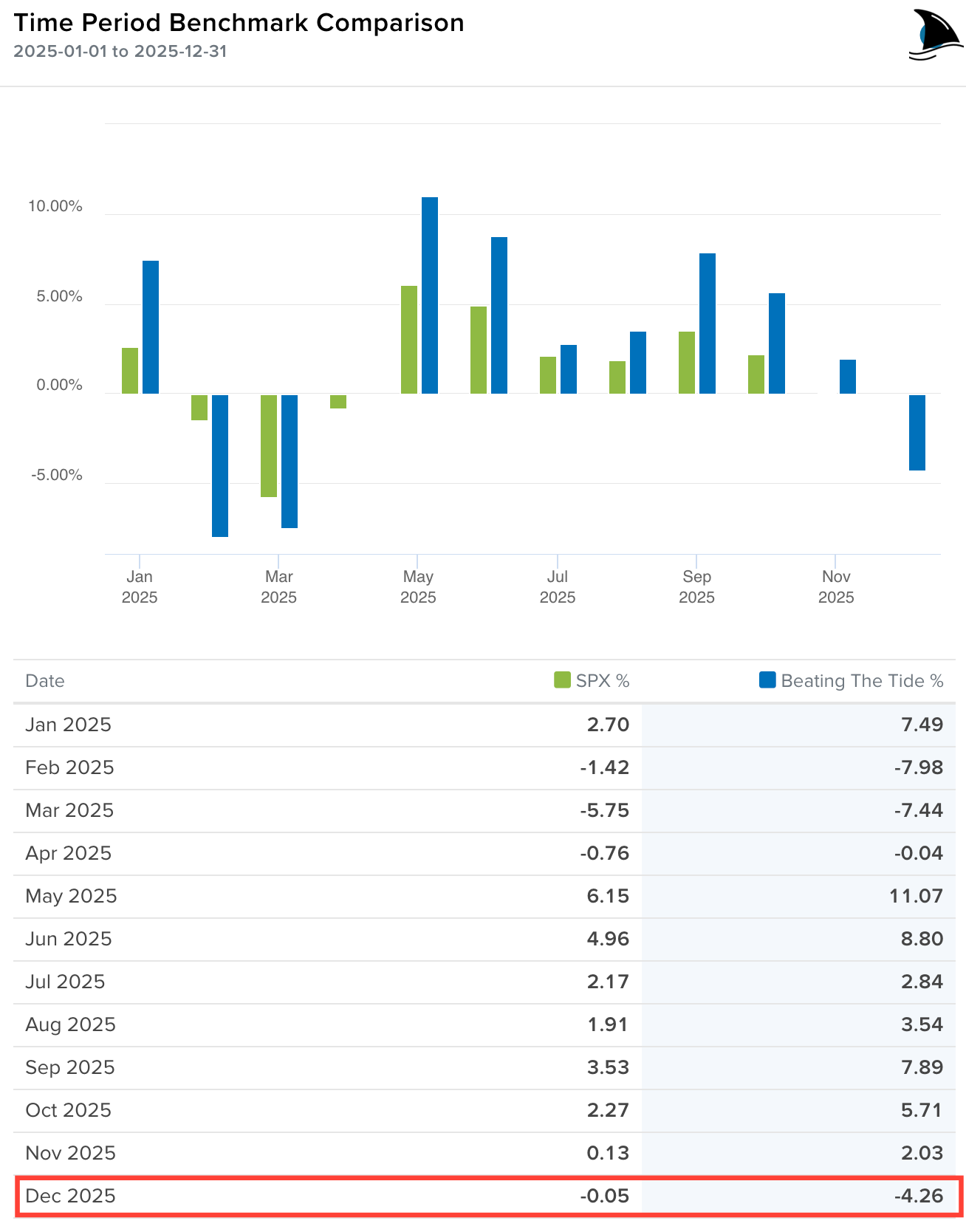

On the portfolio side, the year ended up +31.2%, roughly 1.9x the S&P 500.

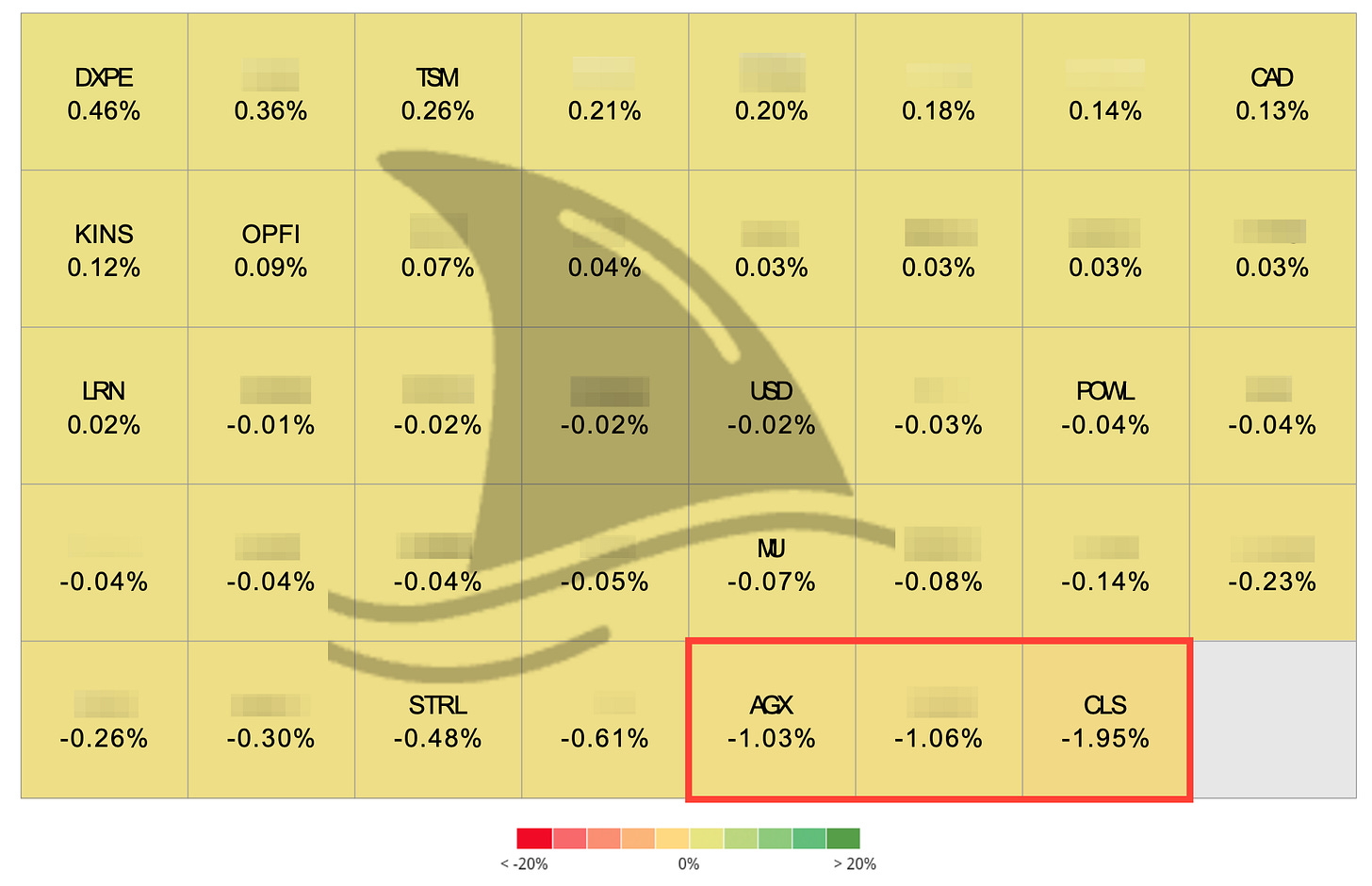

December, however, was rough. The portfolio fell 4.3% while the market was essentially flat at -0.1%.

The drawdown was mostly driven by three stocks.

I’m not concerned. I expect those names to outperform, as I detailed previously for AGX (here) and CLS (here).

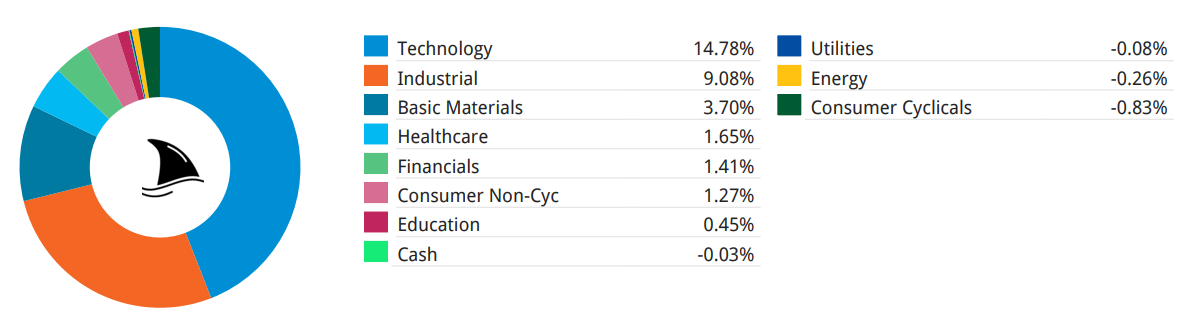

Sector-wise, tech, industrials, and gold accounted for 88% of the year’s gains, partially offset by consumer cyclicals and energy.

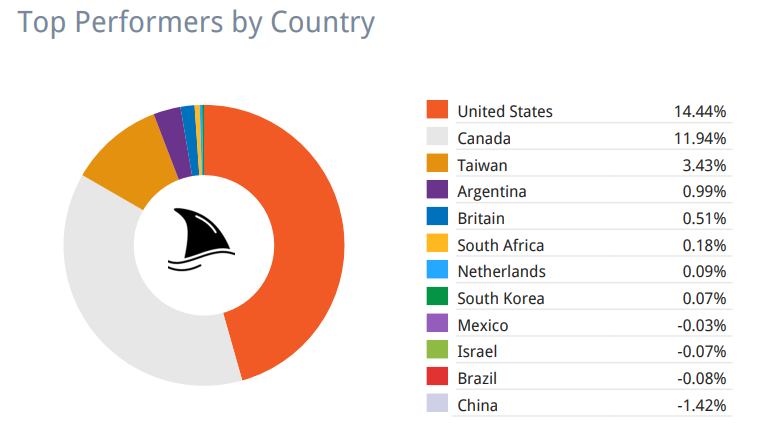

Geographically, U.S. and Canadian stocks contributed about 85% of performance, with Chinese stocks acting as a drag.

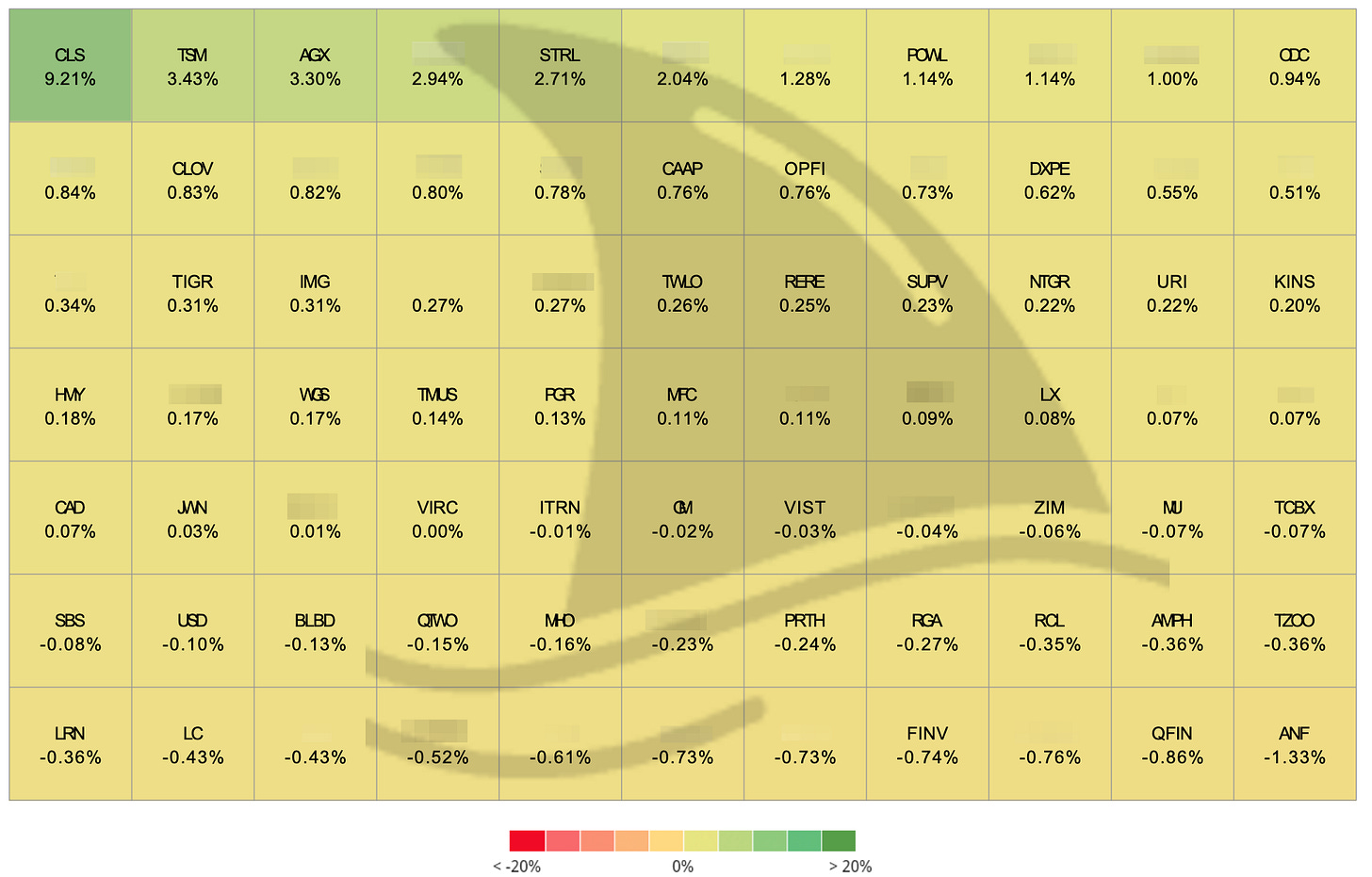

One thing I find especially important in this portfolio is the asymmetry. While there were several losers, each one contributed less than 100 basis points of downside. The winners, on the other hand, did the heavy lifting. That’s the entire game: control your losses and let your winners run.

A good example is QFIN and FINV. Both stocks fell about 50%, yet together they only detracted 160 basis points from the portfolio.

Looking ahead, while I don’t believe in New Year’s resolutions, I do have plans for 2026.

Personally, we’re considering a move from Canada to Europe. Nothing is set in stone, but we plan to visit a short list of finalist cities in 2026 with the goal of making a decision in 2027. For me, this is about opportunity cost. Each year, Europe looks more attractive as a place to raise a family. I’ve made similar opportunity-cost-driven moves before, and this feels like the same kind of decision (as I explained here).

Professionally, my focus remains fully on investing. In 2026 I plan to expand my Chilean wealth management business and significantly improve the user experience on this Substack. You’ll likely see a survey at some point. That feedback will directly shape how this newsletter evolves.

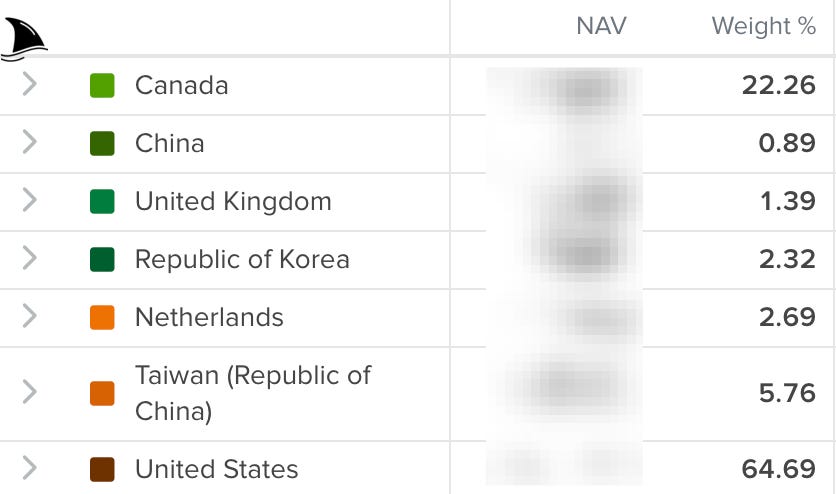

From a portfolio perspective, I’ve already started reducing U.S. concentration. The U.S. weight has fallen from 80% to 65%, and that trend will continue.

I expect new positions in Europe and South America, where I see increasing opportunity. In South America especially, the potential spillover from the possible end of Venezuela’s dictatorship could reshape the regional investment landscape.

Portfolio Update

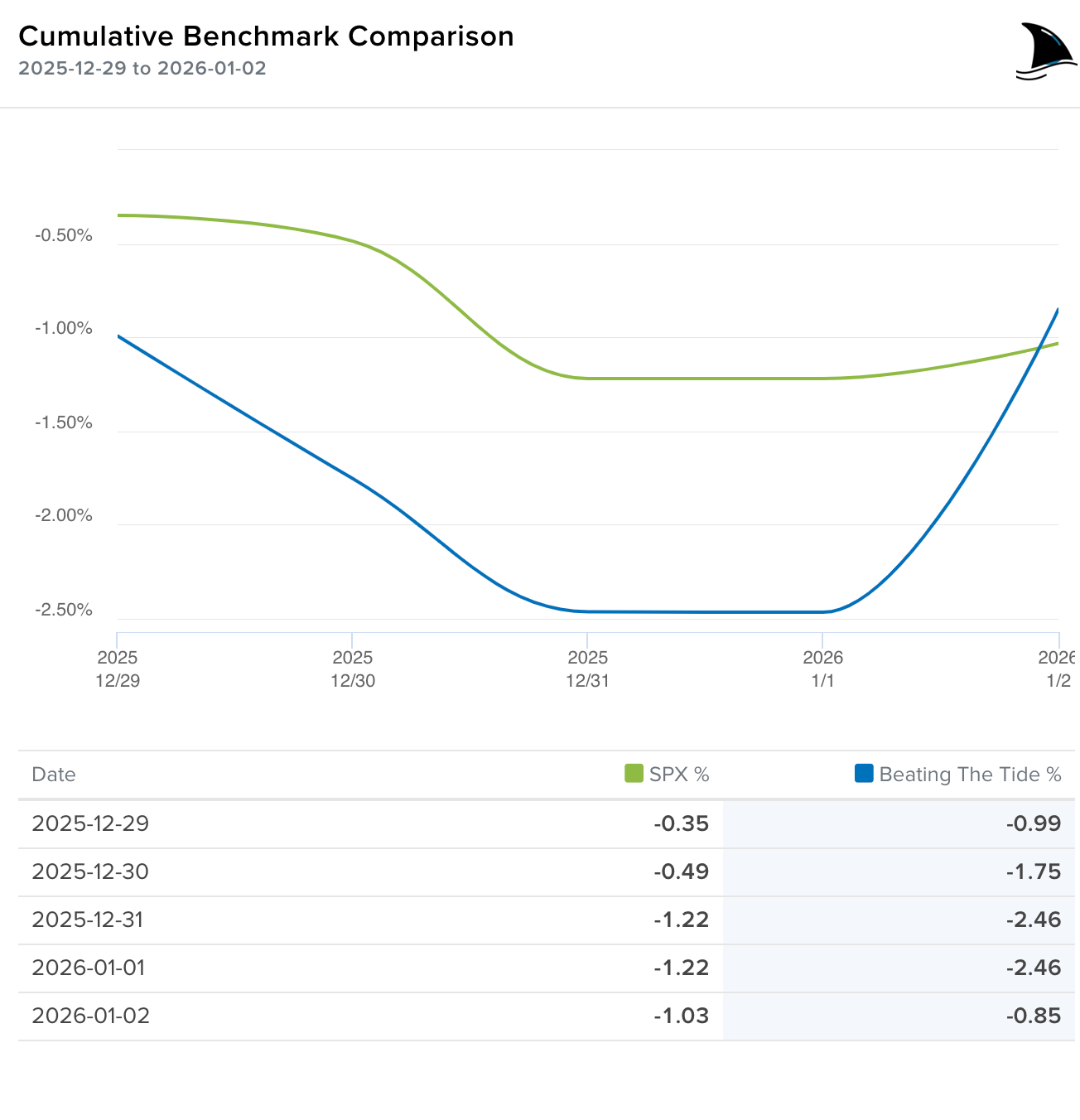

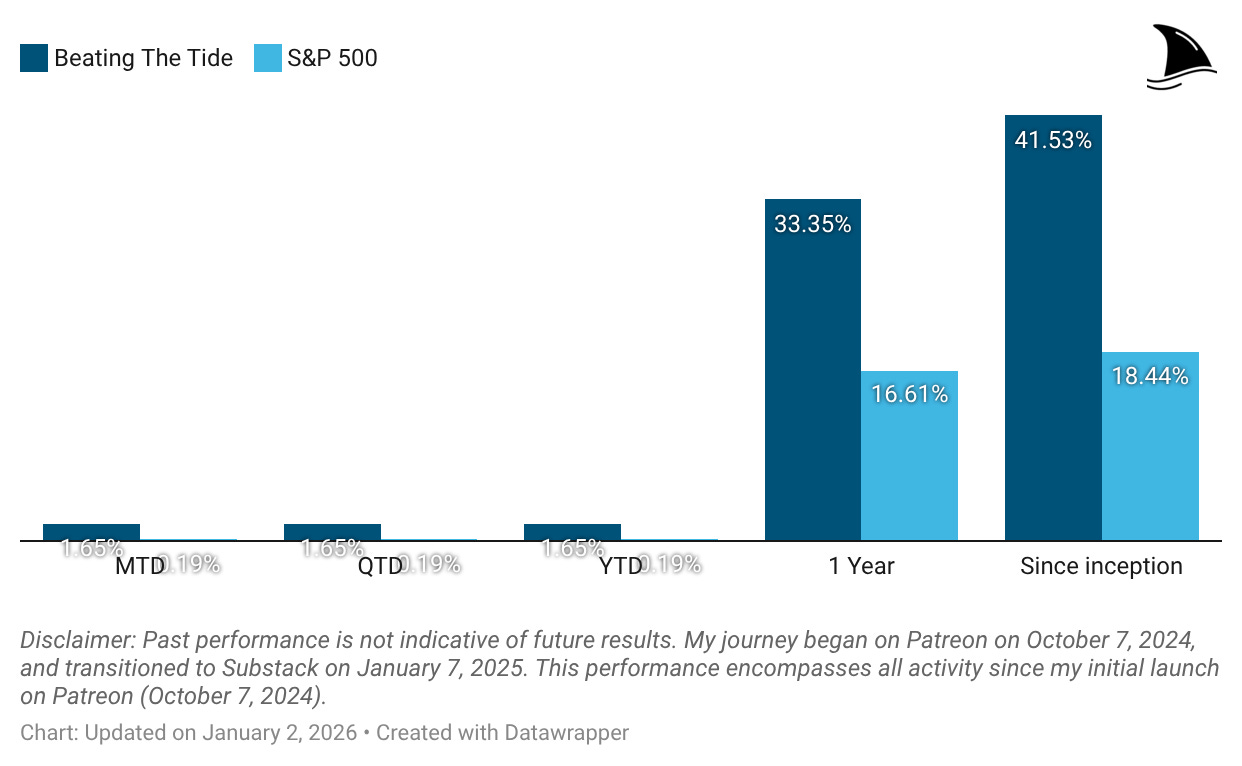

The portfolio ended the week higher than the S&P 500 expanding our out-performance.

Month-to-date: +1.7% vs. the S&P 500’s +0.2%.

Since inception: +41.5% vs. the S&P 500’s +18.4%. That’s 2.3x the market.

Portfolio Return

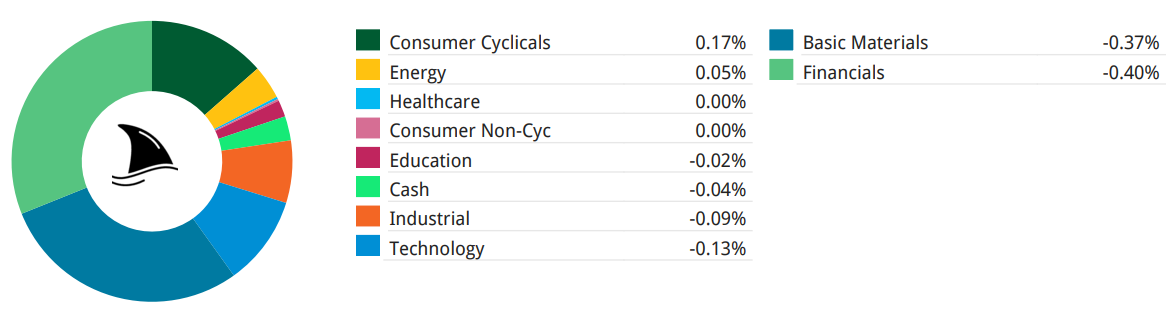

Contribution by Sector

Financials and gold led the negative performace partially offset by consumer cyclicals.

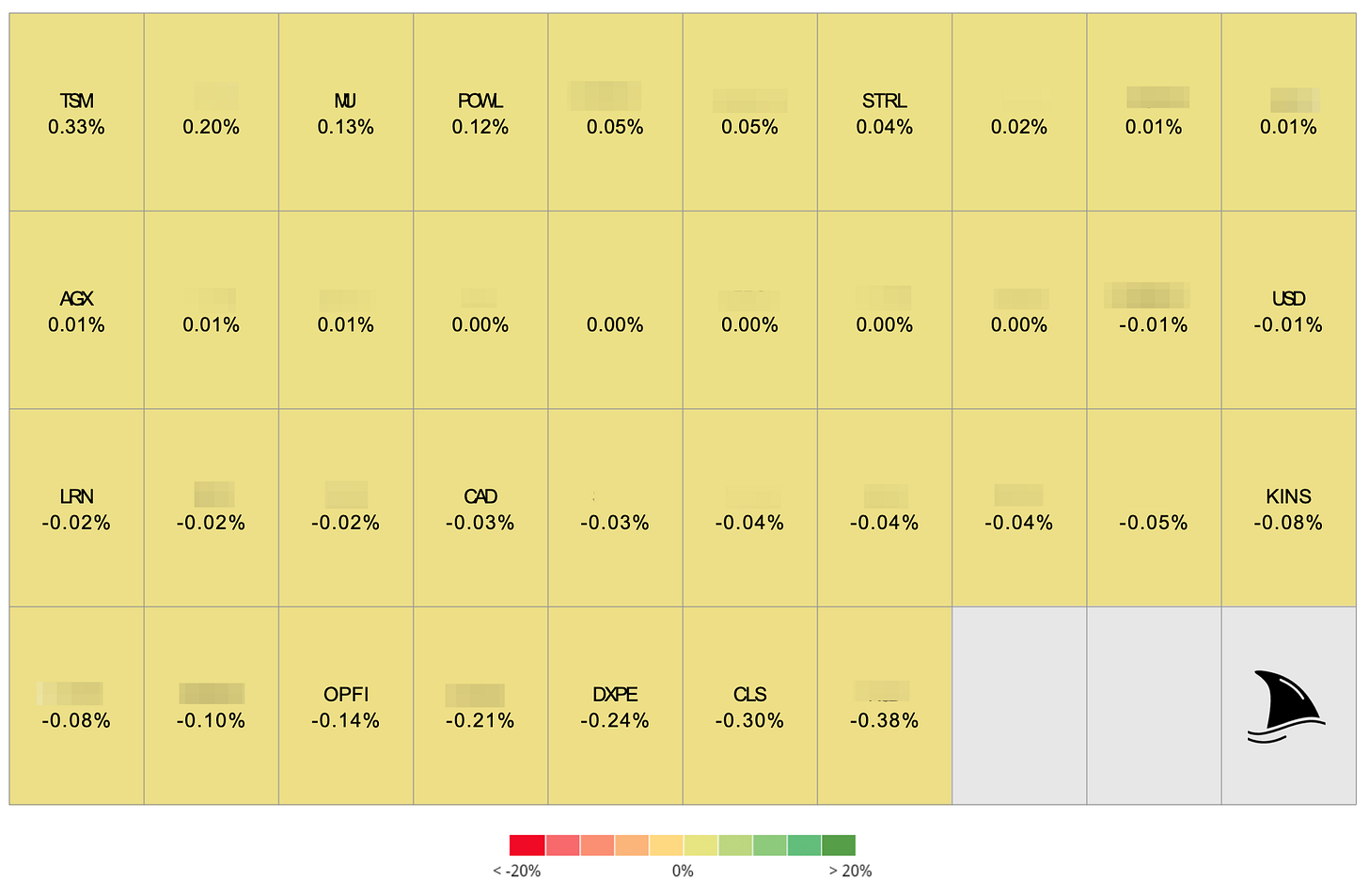

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+33 bps TSM 0.00%↑ (Thesis)

+12 bps POWL 0.00%↑ (Thesis)

+4 bps STRL 0.00%↑ (Thesis)

+1 bps AGX 0.00%↑ (Thesis)

-2 bps LRN 0.00%↑ (Thesis)

-8 bps KINS 0.00%↑ (Thesis)

-14 bps OPFI 0.00%↑ (Thesis)

-24 bps DXPE 0.00%↑ (Thesis)

-30 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: