Weekly #51: Tariffs Again? I’ll Stick to Process

Portfolio +23.7% YTD, 2.4x the market since inception. Tariff headlines, a faster research playbook & an ODC earnings check.

Hello fellow Sharks,

This week was shaping up to be another great one for the portfolio, but by the end of the week, we gave back the gains…and then some. (If you want to skip straight to the numbers, jump to the Portfolio Update.)

The drop came after Mr. Trump threatened to impose higher tariffs on China. Keep in mind that an appeals court ruled those tariffs unlawful, so this is mostly noise. Here’s what I wrote after ‘Liberation Day’:

If you’ve followed me for a while, you know my stance. This is a good time to pick up quality stocks at a discount. That was our playbook in April, and it worked. So I may send a rebalancing alert next week. Stay tuned.

Thank you for helping me cross the 1,000-subscriber milestone.

This journey has been more fun than I expected. I started this newsletter because I was disappointed by changes at Seeking Alpha that limited what analysts could publish.

I’ve been pleasantly surprised by the traction Beating The Tide is getting. Not just the subscriber count, but also the emails many of you send and the community of fellow analysts who exchange ideas, challenge my thinking, and have become friends. Let’s see how far we go. 😊

This week, I share my take on ODC’s earnings, and the Thought of the Week explains how I’ve optimized my process to complete deep dives in four to five weeks, a fraction of the time big shops need. This process is replicable for any project, not just investing, so I hope it’s useful to you.

The old me chased more hours. The new me chooses better hours. I pick the right job first. I put my best time on the right tasks. I built a library that pays compound interest. I listen to people who see the world from a different seat. I let go fast when the story breaks, and I keep the learning.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

On Oct 6, I issued a trade alert for a new position in the portfolio.

On Oct 8, I followed up with a paid deep dive on the opportunity.

It’s a frontier-market telco most investors wrote off after geopolitics went sideways. It cleaned house, sold non-core assets, and is leaning into digital. The core business is growing double-digits in local currency, digital is scaling, and tower sales are shifting it asset-light. Management executes and aligns capital with shareholders. It still trades at <4x EBITDA and ~5x forward earnings.

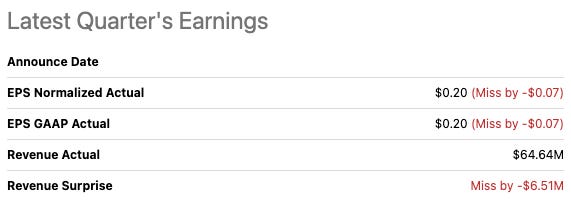

Why Oil-Dri (ODC) Jumped After a Slight Earnings Miss

Oil-Dri Corporation of America (ODC 0.00%↑) just reported its fourth-quarter and full-year 2025 earnings, and the results were a mixed bag. In absolute terms, the company delivered record-breaking performance, but both revenue and EPS came in a bit shy of what analysts had hoped.

Management also struck a cautious tone about the near-term future. Despite that, Mr. Market’s reaction was positive as ODC’s stock jumped roughly 10% after earnings. Here’s my take on why that happened and how it fits with my original thesis and decision to sell the stock in September.

Q4 FY2025: Strong Finish, But Below Expectations

By the numbers, Q4 was solid. It marked Oil-Dri’s 17th consecutive quarter of y/y sales growth and the highest fourth-quarter net income in the company’s history. Key highlights from the quarter and fiscal year include:

Q4 Sales: $125.2 million, up 10% y/y. This was a record fourth-quarter revenue, driven mainly by higher volumes and a better product mix. (The Business-to-Business segment shone with 24% growth, while Retail & Wholesale was up about 3%.)

Q4 Earnings: Diluted EPS of $0.89, up 51% from $0.59 a year ago. Net income jumped 53% y/y to $13.1 million.

Full-Year FY2025: Record net sales of $485.6 million (an 11% increase) and net income of $54.0 million (up 37% from FY2024). EBITDA hit $90 million, up 29%. All-time highs on all these metrics.

Those are impressive results, but they fell slightly short of consensus estimates on both the top and bottom line. Coming off the prior quarter’s blowout performance, expectations were running high. The double-digit growth in Q4 was actually a bit lower than some had anticipated. In other words, ODC delivered great numbers, just not quite as great as the market had expected.

Management acknowledged some headwinds. On the earnings call, Dan reminded investors that the first half of fiscal 2026 will face “challenging comparisons” against last year’s record first half.

In fact, this was explicitly noted in the guidance language: the company will be lapping an especially strong period, which means growth may stall in the next couple of quarters. Jaffee was upfront that “first half is going to be challenging” and that they’ll be up against “gangbusters” results from a year ago. This tough comp was something I had anticipated when I originally analyzed ODC. The company had an extraordinary run in early 2025, so a slowdown in early 2026 was always likely.

Even so, management remains confident about the full year. Jaffee stated that the team expects to “deliver a year that beats last year” despite the slow start. In other words, they’re aiming for FY2026 earnings to exceed the record FY2025, with growth weighted toward the back half of the year. This optimism is backed by ODC’s ongoing mix shift toward higher-margin products. The CFO highlighted how B2B products (like agricultural carriers and filtration clays) are driving much of the growth and carry higher margins than the legacy cat litter business. The strategy of turning “dirt into dollars” by focusing on value-added uses for Oil-Dri’s sorbent minerals is clearly still on track.

Why the Stock Popped on an Earnings Miss

Given the slight miss on estimates and cautious outlook for early FY2026, one might expect the stock to trade flat or even down. Instead, ODC’s shares rose about 10% after the earnings release.

So what explains the market’s upbeat reaction? In my view, there are a few reasons:

Results Were Strong in Context: While ODC didn’t blow past expectations this time, the quarter was still very robust in historical terms. Hitting record sales and profits even as costs rose and the company executed facility upgrades is no small feat. Investors likely took comfort that the business momentum continued through Q4 (17 straight quarters of revenue growth and 14 straight quarters of gross profit growth). The slight top-line miss doesn’t negate the fact that ODC’s core businesses (especially the B2B segment) are performing exceptionally well. In short, the fundamentals remain healthy.

Bad News Was Priced In: ODC’s stock had pulled back significantly heading into this earnings report (could it be due to my exit recommendation 🤔???). After my trade alert, the shares slid down into the low-$60s and even went under $60 at one point. A lot of pessimism about clay litter demand, cost inflation, and those tough comps was likely baked into the price already. So when the company’s results and guidance turned out okay (not amazing, but okay), it created a relief rally. Essentially, the market expected a potential disappointment, and got a decent quarter instead. That dynamic can send a stock up, as pessimistic shorts cover and value investors step in.

Management’s Confidence and Moves: Despite warning about the first half, management sounded calm and confident about Oil-Dri’s trajectory. Jaffee and team aren’t acting like a company in trouble. On the contrary, they increased the dividend by 16% earlier this year, paid down debt, and reported over $50 million in cash on the balance sheet. These are shareholder-friendly moves that signal strength.

Broader Context: It’s worth noting Oil-Dri is a thinly traded small-cap. The stock’s big upward move might partly reflect its low liquidity. When there’s good news or a shift in sentiment, the price can gap up quickly.

From Thesis to Trade: Perspective After the Rally

For me, this latest development with ODC is gratifying to see as it largely validates the thesis I had back in April.

In my deep dive, I called Oil-Dri a “quiet compounder” with a vertically integrated model and a mix shift toward higher-margin niches that would inflect profitability. That’s exactly what happened: earnings and cash flow surged as the company expanded its premium product lines, and the market finally took notice.

The Q4 and FY2025 results underscore how strong that transformation has been. Gross margins hit multi-year highs, EPS for the year was $3.70 (up from $2.72 in 2024), and return on capital improved all confirming the “dirt into dollars” story was real, not just a catchy phrase.

Back in April, I estimated ODC’s fair value around $64/share, and the stock was in the low $40s. Fast forward five months, and ODC rallied more than 57% to trade in the high $60s. By mid-September it had essentially reached my target price, so after reviewing the story, I made the tough decision to close the position and lock in the gain. At the time, I wrote that most of the good news was priced in around $68 and that the stock was no longer a glaring bargain.

I also noted the looming tough comparisons in the coming quarters as a reason to be cautious. In other words, upside seemed limited relative to downside risk, so it was a classic case of “time to take profits.”

None of this is to say I’ve soured on ODC as a company. Far from it. I still consider Oil-Dri a well-run, cash-generative enterprise with a long runway. Dan Jaffee’s focus on long-term decision-making (their data-driven approach to running the business ) and the Jaffee family’s shareholder-friendly stewardship remain big positives in my book. ODC has proven it can turn boring clay into high-value products and do so profitably year after year. That’s the essence of a compounder.

However, at the current mid-$60s price, the stock is fairly valued relative to its prospects. My updated valuation ($74 per my September note) implies only modest upside from here. With the first half of FY2026 likely to show little growth (if not slight declines versus last year), I’m content to stay on the sidelines for now.

As I mentioned in my sell note, I’m not “breaking up” with Oil-Dri forever. The company remains on my watchlist, and if Mr. Market overreacts and sends the stock back into undervalued territory, I’d gladly consider getting back in. In the meantime, I’ll be rooting for ODC from afar.

Thought Of The Week: How I Cut Deep-Dive Research From 600 Hours To 175 Without Cutting Corners

A friend of mine runs money in emerging markets. The other day he asked me how long it takes me to fully research a company in a frontier or EM market. I told him four to five weeks. He said that is not enough time to do proper work. That surprised me.

I used to sit in a similar shop. I know what “fifteen weeks” looks like from the inside. Smart people. Good intentions. Lots of moving parts. Also lots of meetings, status updates, HR tasks, and side projects that pull attention. In a big shop, the calendar eats the day before the work starts.

I do not have that. I am a one-man shop most days. Some days, my daughter joins me at the desk and spills my coffee. Either way, the work gets done.

For me, four to five weeks translates to approximately 200 to 250 hours of total effort. Around 70% of that goes to the new project. The rest supports the machine I already run. That includes models I maintain, coverage I update, portfolio decisions I make, client accounts I manage, and a few growth projects on my plate. Seventy percent of 200 is 140. Seventy percent of 250 is 175. So I spend about 140 to 175 hours on the deep dive itself.

That used to be 400 to 600 hours. I did not get faster by skipping steps. I got faster by building a better process.

Knowledge compounds. So do systems.

If I learn how a semiconductor supply chain works once, I do not relearn it each time. I just keep up with the changes.

When I taught myself the semiconductor chain, I did not start with one firm. I started with the map. Design. Foundry. Assembly and test. Gear. Materials. Then I picked one company in each link and ran a short sprint. That gave me four anchors. The next deep dive took half the time because the base work was done. Then I kept the map fresh with small updates. One note per new node. One chart per capex wave. One line per price shift. The cost to stay current fell to a few hours a month.

That is the compounding effect of the process. You do more now, so you can do less later and still be better.

This thought of the week is about the five dimensions that helped me cut the time without hurting the quality. These apply to stock research, but they also help if you are building a business or even architecting your life. Think of it as a blueprint you can copy and adapt.

Below, I start with the core idea that changed the most for me, then move through the other pieces that lock it in.

1) Define The Right Thing Before You Do The Thing

In the past, I would open a PDF, hit play on a call, and start highlighting.

Now I start by asking a simple question. What do I want to know at the end of this research block that I do not know now?

For a semiconductor company, my answer looks like this:

The map. Who designs chips? Who fabricates them? Who assembles and tests them? Who sells the gear and the materials?

The drivers. What moves revenue and margin for each link in the chain?

The moat. What makes a player hard to copy? Scale. Process learnings. Customer trust. Switching costs.

The triggers. What could double this business? What could break it? What moves the stock in the next two to three years?

The base case. What “normal” looks like across a full cycle.

That is the frame. Once the frame is set, every piece of information lands in the right place. A quote on an earnings call is not just noise. It either plugs a hole in the map or it does not. A supply shortage is not just drama. It either hits a driver or it does not. I waste less time because I know what I am hunting.

This is the same idea you find in good operations books and in clear strategy writing. Decide the job to be done first. Then work the plan. Peter Drucker said it in many ways. So did Andy Grove. Decide the right work before you do the work.

Try this on any project:

Write a one-sentence North Star.

Example: “I want to know if Company X can grow free cash flow per share 15% a year for five years without extra leverage.”

List five “unknowns that matter.”

Example: long-term margin range, pricing power, customer stickiness, capacity plan, capital intensity.

List five ways the thesis could fail.

Example: a new rival, regulation, input cost shock, key customer loss, bad capital allocation.

Convert each item into a concrete check.

Example: “Call two former customers to test stickiness” or “Back test 10 years of margins vs input costs.”

When I skip this step, my time expands. When I do it well, I cut hours because I cut detours.

2) Work Smarter So Your Hard Work Lands Where It Counts

I used to think more hours meant better work. Then I spent time at Anheuser-Busch on an exercise that cut “dead money” and moved it to “working money.” Office fluff went down. Marketing went up. Sales moved. That stuck with me. If you shift dollars from dead to working, output goes up without a bigger budget.

Time works the same way.

I started to cut dead time and move it to working time. Dead time is the stuff that repeats and adds little value. Working time is where you learn, think, write, call, and decide.

Here is what I moved to “automatic” so I can spend more time on high-value work:

Portfolio tracking. Screens and dashboards update automatically.

Budget and admin. Bills and saves run on autopilot.

Data pulls. I keep one clean DCF template and one clean comp sheet. Inputs are standardized.

Meeting blocks. Calls sit in fixed windows so they do not break my best thinking time.

Note capture. I use one input funnel with clear tags and fields. More on that below.

I also guard focus blocks. I keep a simple rule from Cal Newport’s work front of mind. Deep work beats shallow work. I pick two to three blocks per day when I do not take calls or check feeds. I put my phone in a drawer. I set a timer. I write, research, or model. One block before I go to the gym (5 am-6:30 am). One block late morning (10 am-12 pm). One light block after lunch (1:30 pm - 3:30 pm). Short breaks in between. As you can tell, I am a morning person; adjust the times to when you have peak energy.

If you get three clean blocks a day, five days a week, you can ship a lot. The math is simple. My three blocks translate to 5.5 hours a day of deep work, that converts to 27.5 hours a week and 137.5 hours over 5 weeks. Layer calls and channel checks around that, and you hit 175 hours fast.

A few simple tools help:

A “stop doing” list next to the to-do list. If it does not serve the North Star, I drop it.

A “next action” note at the end of each work block. When I sit back down, I know the first move.

A default calendar. Research mornings. Calls early afternoons. Reviews, email replies and low-effort work late afternoons.

A weekly review. I ask one question. What two actions last week moved the thesis? Then I do more of that.

If you run a business or manage schoolwork, the same idea works. Cut dead time. Move time to the work that moves the goal. You can even label your day with two buckets. “Working time” and “support time.” Try to increase the first bucket by an hour each week for four weeks. Then lock it in.

3) Build A Knowledge Base You Can Search In Seconds

Saving a link is easy. Finding it later is hard. If you cannot retrieve it fast, you did not save it. You buried it.

I stopped “archiving” and started curating. Each item I save gets four tags right away:

Type: Article. Video. Transcript. Meeting note.

Company: Ticker if I have one.

Industry: A small set of buckets I use all the time.

Area: Work. Health. House. Personal finance. Whatever it is.

I keep it simple. No more than a handful of tags per item. I also added a one-line summary in my own words. Future me will thank past me for that one line.

AI makes this stronger. I record calls and meetings, with permission. I use Otter (if you use my link, you get 1 month of PRO for free). It gives me a transcript and a short summary. I drop the summary into my database with clear tags. I add the action items and next steps in the same note. Now the meeting is searchable by name, topic, and task. During the call, I can focus on the person, not on typing.

This sounds small. It is not. It turns my notes into a real library. When I start a new deep dive on a chip firm, I can pull two years of relevant notes in seconds. Supplier calls. History on the node roadmap. Comments from competitors. Cycle charts. My own prior work. Eighty percent of the base material is there. I just fill the twenty percent gap, then update the rest.

A few small habits help the most:

Ask to record at the start of each call.

Name files in a clean, consistent way.

Example: “250712_TSM_Q2_transcript.pdf.”

Write a one-line why for each item.

Example: “Evidence that ABF substrates stay tight through 2026.”

Link related notes.

Example: tie a customer call to the related supplier deck.

Use simple queries.

Example: search “Company X + margin + pricing + contract length.”

Save the AI summary, action items, owners, and due dates in the note.

Link the meeting to the company page and to any open tasks.

This is close to what you find in systems like Zettelkasten or in the way knowledge workers track learning in good labs. Keep it light. Keep it uniform. Build a place where your future self can find what your past self learned. Over time, your costs fall because your base grows.

I use Notion as my database, but you can adapt any app (a friend of mine does all this on Apple Notes!).

4) Learn From Other People On Purpose

To beat the market, you cannot copy the crowd (remember Unpopular But Profitable: Why Contrarian Investors Outsmart the Herd). Still, you should hear the crowd. Other views test your ideas.

A fresh angle gives you a clue you did not have. I aim to talk to people across the ecosystem. Suppliers. Customers. Former employees. Rivals. Investors. Sometimes, even regulators, if possible.

I set a small goal for channel checks on each project. I try to run at least six outside conversations in a four-week block. More if the company is complex. Less if the story is simple and data-rich.

Here is the rough map I use:

Two current or former customers.

Goal: test stickiness, service levels, price vs value.

One supplier.

Goal: check terms, lead times, and capacity notes.

One former employee.

Goal: culture, product cycle, talent bench, process truth.

One competitor or channel partner.

Goal: price discipline, win rates, renewal dynamics.

One investor who holds the opposite view.

Goal: a clean shot at my blind spots.

I also run a “red team” on my own work. I try to break my thesis with three simple tests:

If I had to short this stock, what would be my case?

What base rate in history says my case is too rosy?

What real-world test could disprove my main claim?.

This comes from a mix of forecasting research and good strategy practice. Use base rates (read The Power of Base Rates: How Bayesian Thinking Beats Gut Feel). Ask for the outside view. Run pre-mortems. Make falsifiable claims. You will make fewer mistakes, and when you do, you will catch them sooner.

A quick tip for outreach. Keep your message short. Say what you are trying to learn. Offer to keep names off the record. Ask one or two clear questions. Offer something in return. People like to help when they sense a real question and a respectful tone.

A sample note:

“Hi, I am researching Company X. I am trying to understand renewal drivers and contract terms in the mid-market. If you have ten minutes, could I ask two questions about your experience as a customer? I can keep your name off the record. If now is not a good time, no stress.”

Short and Clear. You will be surprised how often that works.

5) No Work Is Wasted, Even When You Walk Away

The sunk cost trap is real. It is easy to keep going because you already spent the hours. Each extra hour makes you more attached. I fixed this by using a simple stop rule.

If a key driver breaks, I stop. I write a “proud no” memo, capture what I learned, file the notes, and move on.

A recent case was Mueller Industries.

It passed my screens and the setup looked fine at first. Deeper work showed profits riding a copper spike. Price spreads and mix lifted margins above what I see as mid-cycle. End-market demand was okay, but the conditions were not durable. I passed.

The work still paid off. I gained:

A cleaner map of the copper supply chain

A better feel for working capital in these businesses

Clear limits on pass-through pricing

A quick spread check to pull margins back to mid-cycle in my models

This approach lets me cut weak projects earlier, saves hours, and keeps the portfolio clean.

The MLI research did not become a position. It did earn a spot on my watchlist with clear triggers, sharpen my view of copper and HVAC cycles, and refine my checks for spread-driven margins. It also helped other investors understand the setup. That is time well spent, even without a trade.

How The Five Pieces Fit Together

These five ideas are not five isolated tips. They form a loop:

Clarity about the job to be done points your time at the right questions.

Smart work habits create the blocks to answer those questions.

A curated library makes each new deep dive faster.

Outside views test your ideas before you commit.

A no-waste mindset lets you drop weak ideas fast and bank the learning.

Run the loop again. Each pass gets tighter. Your hours fall. Your quality rises.

A Brief Return To The Coffee Spill

I joked that my daughter sometimes joins me and spills my coffee. That is true. It also keeps me honest.

Life intrudes. You can plan. You cannot control.

That is why I love the process. A good process bends. It does not break. When I lose an hour to a spill or a surprise, my system catches me up. The map tells me what to do next. The library gives me the notes. The calendar protects the next block. I do not need a perfect day. I need a steady one.

Portfolio Update

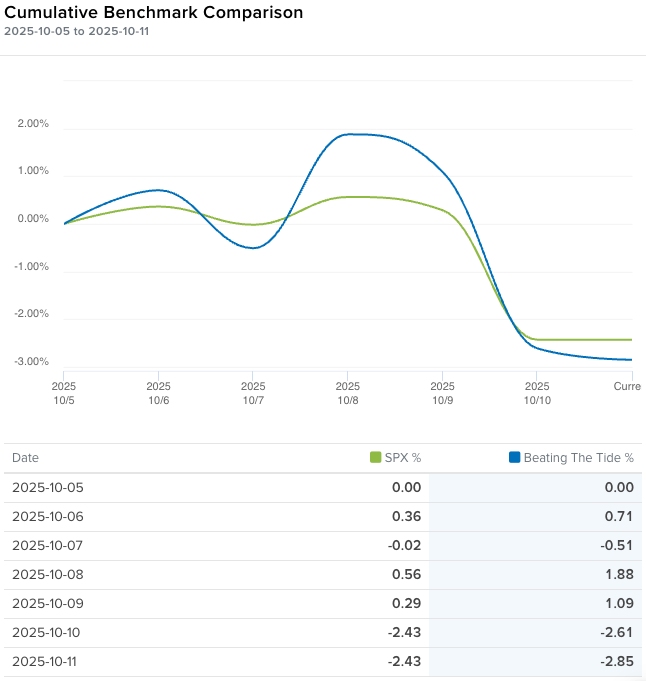

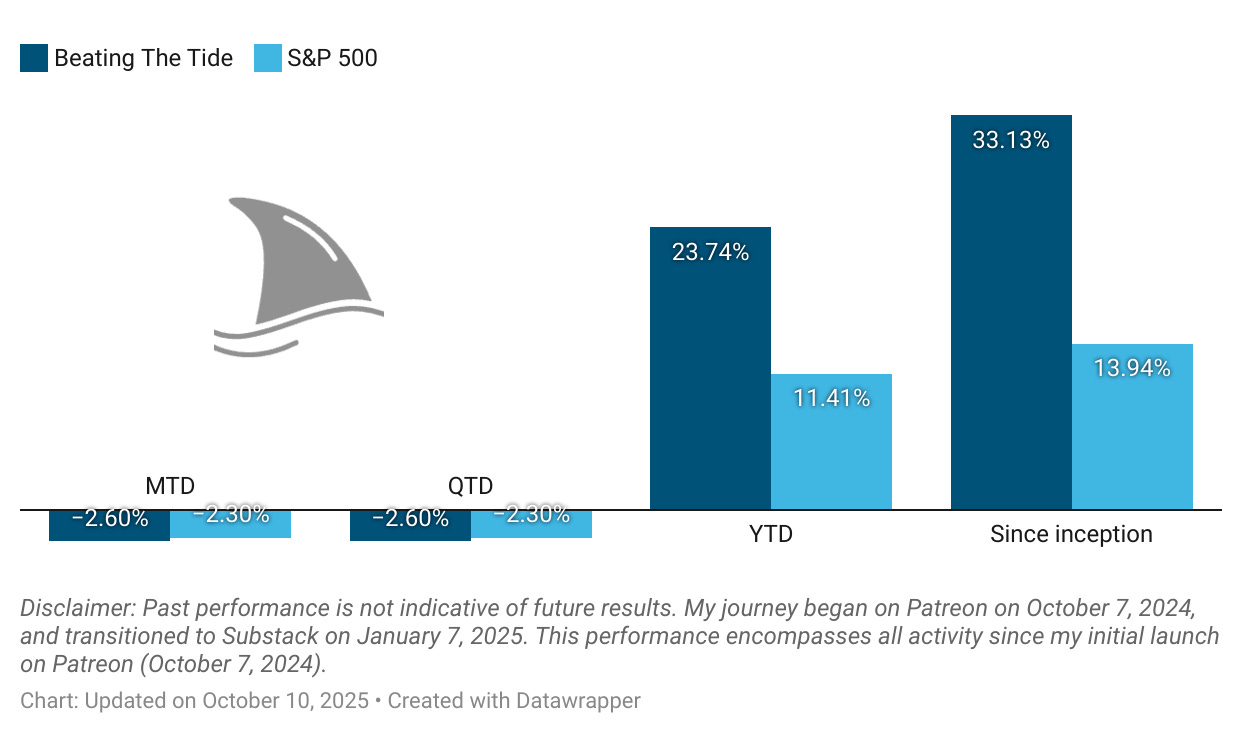

The portfolio ended in the red this week.

Month-to-date: -2.6% vs. the S&P 500’s -2.3%.

Year-to-date: +23.7% vs. the S&P’s +11.4%, a gap of 1,233 basis points.

Since inception: +33.1% vs. the S&P 500’s +13.9%. That’s 2.4x the market.

Portfolio Return

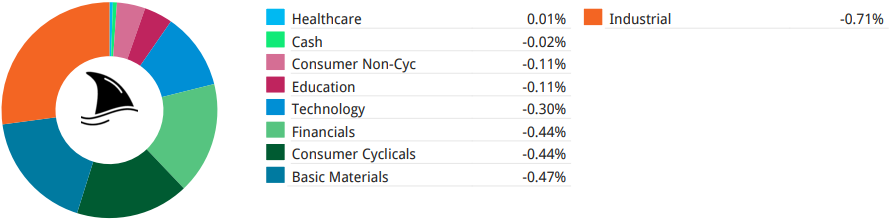

Contribution by Sector

The decline was driven by industrials, gold, consumer cyclicals and financials.

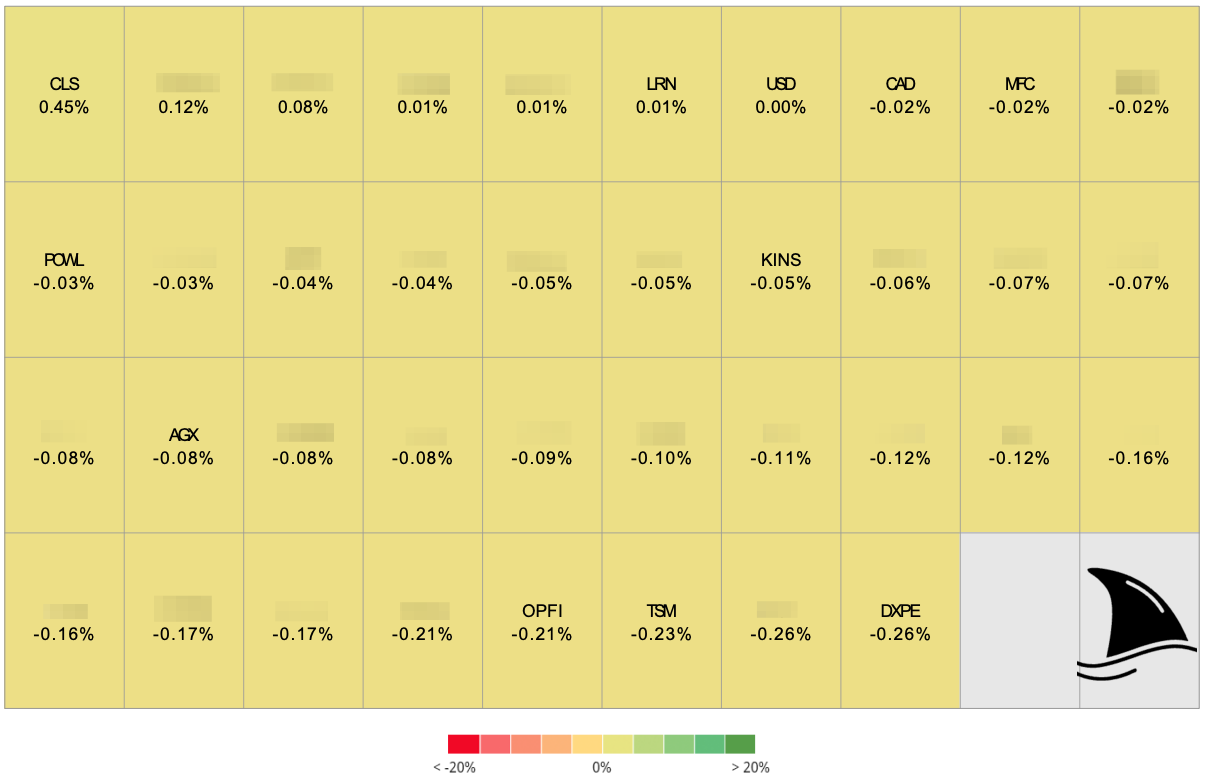

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+45 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

+1 bps LRN 0.00%↑ (Thesis)

-2 bps MFC 0.00%↑ (TSX: MFC)

-3 bps POWL 0.00%↑ (Thesis)

-5 bps KINS 0.00%↑ (Thesis)

-8 bps AGX 0.00%↑ (Thesis)

-21 bps OPFI 0.00%↑ (Thesis)

-23 bps TSM 0.00%↑ (Thesis)

-26 bps DXPE 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: