Weekly #27: Trump Chickened Out and What It Means for the Stock Market

Table of Contents:

Forget the Noise — Here’s What Mattered This Week

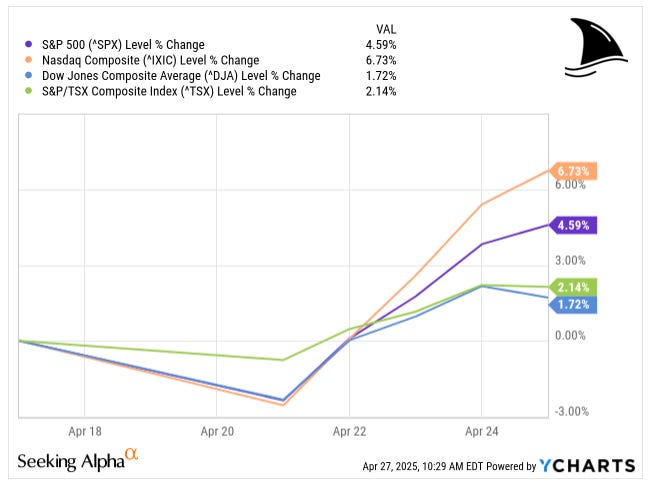

The Numbers First:

S&P 500: Up 4.6% for the week

Nasdaq: Rocketed 6.7%

Dow Jones: Gained 1.7%

TSX: Gained 2.1%

This past week felt like a breath of fresh air after weeks of tense tariff talk and Fed drama. Markets have moved away from extreme fear, and the stock market recovered, but further gains will need more concrete progress on trade.

Trump Chickens Out—and China Tightens the Screws

What a week. After months of shouting about tariffs, Trump chickened out. Facing tanking polls, mass protests, and even Fox News turning against him, he did what he does best—fold under pressure. He backed off his 145% tariff threats, now promising they’ll “come down substantially.” Translation: the market meltdown scared him straight. Meanwhile, China didn’t even bother to entertain the noise.

China isn’t just sitting back — it’s strengthening its global relationships. In Europe, China is working to revive stalled trade ties with the European Union, signalling plans to lift sanctions on several Members of the European Parliament. This move could reopen negotiations on the Comprehensive Agreement on Investment, deepening economic integration with Europe. In the Middle East, China struck a nearly $4 billion JV with Aramco, expanding refining and petrochemical operations in Fujian province. It’s a clear signal that China is locking in energy partnerships beyond the US sphere. And in Africa, the Kenyan President pledged closer ties with China. With Washington distracted, Beijing is clearly making moves to expand its influence where the US footprint is fading.

Beating the Tide delivers deep, fundamentally backed stock picks that have outperformed the S&P 500 since 2012.

The subscription is way cheaper than one panicked trade triggered by Trump's next tariff "strategy."

Trump chickened out. Beating the Tide doesn’t.

While China retaliated by increasing tariffs, the real lever that brought Trump to his knees was Beijing slapping export controls on critical rare earth minerals—the lifeblood of smartphones, EVs, and fighter jets. China controls 92% of the world’s rare earth processing. Good luck building F-35s or running tech factories without them. The US can try to play catch-up, but it’ll take years and billions. Beijing holds the cards—for now.

Back in the US, the chaos caught up fast. Trump's approval rating crashed to 39%. Protests erupted across major US cities. Even Fox News, usually a safe space, aired brutal polling showing him underwater. The man who once sold himself as the ultimate dealmaker—the “Art of the Deal” guy—has proven to be a lousy negotiator. He tried to bully China like it was a real estate contractor from Queens. Instead, China called his bluff, tightened its grip, and now Trump is the one asking for forgiveness.

And it gets worse.

While Trump was busy trying to play tough, Japan, Canada, and Europe quietly started selling off U.S. Treasuries. This pushed up yields. That spike in bond yields was the first crack in the wall—and it finally forced Trump to backpedal. Rising yields meant higher refinancing costs for the mountain of bonds and Treasuries set to mature soon, tightening the financial pressure on Trump.

If Trump wants a real lesson in "deal-making," he should study how Canada, Japan, and Europe just outmaneuvered him.

I would rather be reading 10-Ks, building models, or talking to fellow investors, but since Trump is back in office, I feel like I’ve been drafted as a political correspondent.

So what does this mean for us and our investments?

It’s very good news. Trump has lost what little political equity he had left, and I believe volatility will now come down. Some say he might backtrack—as he often does—and hike tariffs again. But I don't think that will happen this time. This time, it feels different. I expect final trade tariffs to be small (single digits) or full of exceptions, nullifying the tariffs (let’s hope I am right 😉).

Trump is facing real pushback. Elon Musk is stepping back from his DOGE circus, and even Trump’s media allies are starting to distance themselves.

With volatility cooling, I see our portfolio positions returning to their pre-tariff-crazy-talk era in a couple of weeks once we know the final tariff rates per country.

Earnings Season Started on a Good Note

Since the last update on earnings in Weekly #21, 12 companies in Portfolio USA have reported earnings; only 3 missed revenue estimates, and 4 missed EPS expectations. I spoke about TSMC ( TSM 0.00%↑ ) earnings here and AGX’s here ( AGX 0.00%↑).

Celestica (CLS) – Another Quarter Confirming Our Thesis

On April 24, Celestica ( CLS 0.00%↑ ) dropped Q1 2025 results, and let’s say they crushed it — again. Read my deep dive on Celestica in case you forgot why I am so bullish on this company.

Revenue was $2.65 billion, up 20% year over year and above the high end of their own guidance. Adjusted EPS hit $1.20, beating estimates by $0.08, and the adjusted operating margin reached a record 7.1%.

Both their ATS and CCS segments outperformed expectations, with CCS leading the charge thanks to monster demand from hyperscaler customers. They increased revenues for both segments and improved margins.

Here’s what matters:

Hyperscaler-driven HPS revenue nearly doubled year-over-year.

Celestica raised its full-year 2025 revenue guidance to $10.85 billion (previously $10.7 billion) and lifted its adjusted EPS outlook to $5.00 (from $4.75).

Free cash flow stayed strong at $94 million for the quarter, and the company bought back $75M worth of shares during the quarter, plus another $40M right after it ended.

For Q2, they’re guiding revenue between $2.575 billion and $2.725 billion, and adjusted EPS between $1.17 and $1.27.

On the earnings call, CEO Rob Mionis emphasized that hyperscaler demand remains rock solid, especially around 800G networking switches. Meanwhile, CFO Mandeep Chawla highlighted how Celestica’s diversified footprint and regional supply chains are insulating them from major tariff risks.

Bottom line: These results back up our bullish Celestica thesis perfectly.

Demand from hyperscalers is still accelerating. Margins are expanding. Profitability is hitting record highs. And management is handling potential risks (like tariffs) with playbook precision.

Portfolio Update

Portfolios continued the path to recovery. Portfolio USA’s performance improved more than the S&P 500’s, narrowing the gap from -230 bps to -162 bps YTD. The recovery in Portfolio Canada’s performance follows the TSX’s slightly narrowing the performance gap from -261 bps to -259 bps YTD.

Industrial, tech and consumer cyclicals led the recovery of Portfolio USA. Financials, tech and industrials led the recovery in Portfolio Canada, offset by a decline in gold.

Contribution by Sector - Portfolio USA

Contribution by Sector - Portfolio Canada

Here’s the weekly stock performance for each portfolio: Weekly Stock Performance Tracker

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Why you should aim to make a living rather than making a killing

What Does It Mean for a Market to Be Efficient? (And Why It Matters for Stock Investing)

Completely agree that Trump’s tariff reversal is a short-term win for market stability. But long term, the structural issues — like U.S. dependency on critical materials, China’s growing alliances, and our own debt-driven fiscal vulnerability — are still there. Feels like we bought some breathing room, but the real storm clouds haven’t cleared yet.