Weekly #59: Argan Q3 2026 Earning Review, Backlog Booms to $3B as Revenue Dips, Shares Slip

Portfolio +32.5% YTD, 2.2x the market since inception. AGX earnings breakdown, backlog explosion, and a fresh target price... all in a quicker Weekly while I escape Canada’s Night-King weather.

Hello fellow Sharks,

The portfolio retreated this week but we are still +32.5% YTD. If you want, to skip straight to the numbers, jump to the Portfolio Update.

By the time you read this, I’m probably on a plane to Chile. It’s getting pretty cold in Toronto, so we’re swapping Canada’s winter for Chile’s summer. This Weekly will be a bit shorter than usual.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

I published on Dec 4 why I’m still bullish on STRL despite the +337% run. I break down how STRL has morphed from a boring old road-paver into a high-stakes “site-prep + electrical buildout” powerhouse for mega data centers, semiconductor fabs and other digital-era infrastructure, and why that pivot matters big time.

With the global AI/data-center build-out just ramping up and STRL’s backlog, margin profile, acquisitions (hello CEC!), and disciplined capital allocation all trending favorably, my DCF shows further upside to my target price of $455/share.

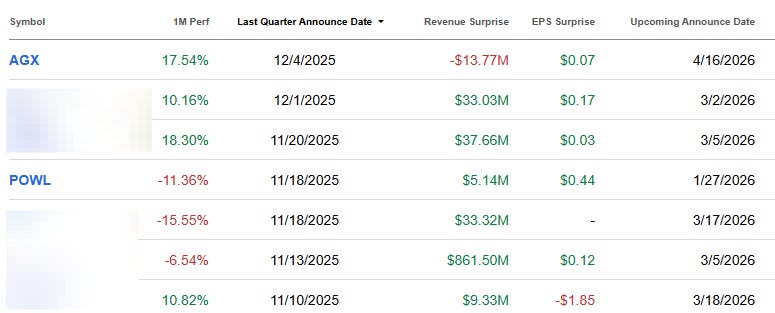

Earnings Update: 6/7 companies beat EPS Estimates

Since the last update, seven portfolio companies released results. 6/7 companies beat revenue and EPS estimates. Below is the earnings review for AGX and I will be sending review for POWL later next week.

Argan Q3 2026: Backlog Booms to $3B as Revenue Dips, Shares Slip

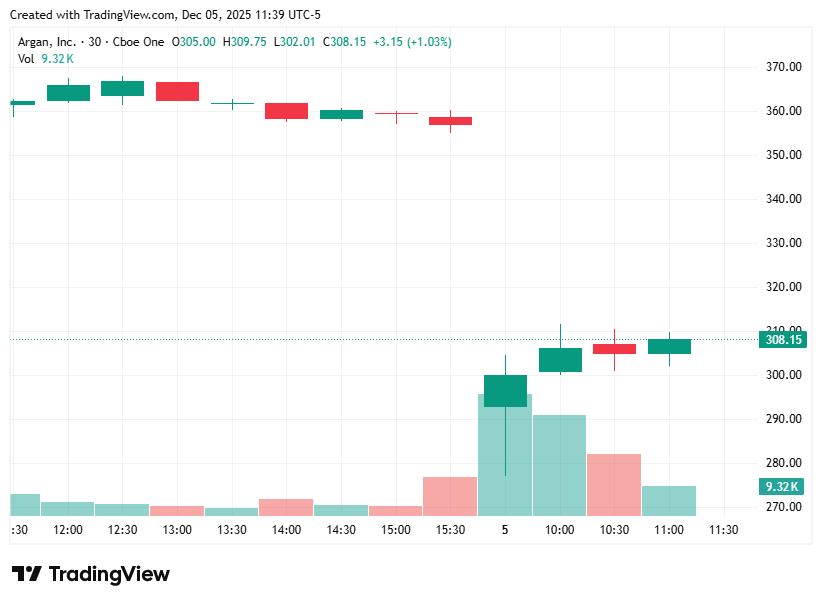

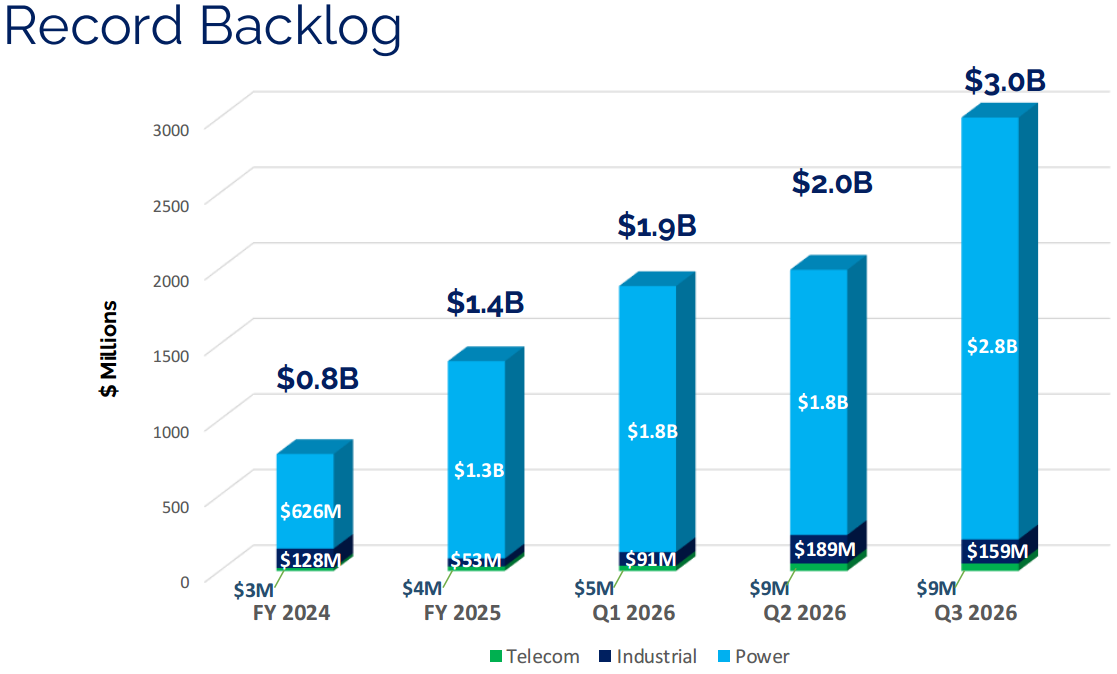

Last Thursday, AGX reported its quarterly earnings, and the numbers paint an interesting picture. On one hand, the company’s order backlog swelled to a record $3.0 billion, double the backlog from the start of the year and 50% more than last quarter.

Profitability also improved, with fatter margins, higher earnings and dividends per share. But revenue actually fell slightly from a year ago and the stock market’s reaction was brutal.

The stock plunged from $357 to $300 after the report, despite the strong bottom-line results. I want to unpack why AGX’s quarter was better than the sell-off suggests, digging into the backlog surge, the revenue dip, and what it all means for the company’s outlook (and my valuation).

Record Backlog Powers Future Growth

AGX’s backlog hit an all-time high of $3 billion at quarter-end. That’s up dramatically from $2.0 billion just one quarter earlier and more than double the $1.4 billion backlog at the start of the year.

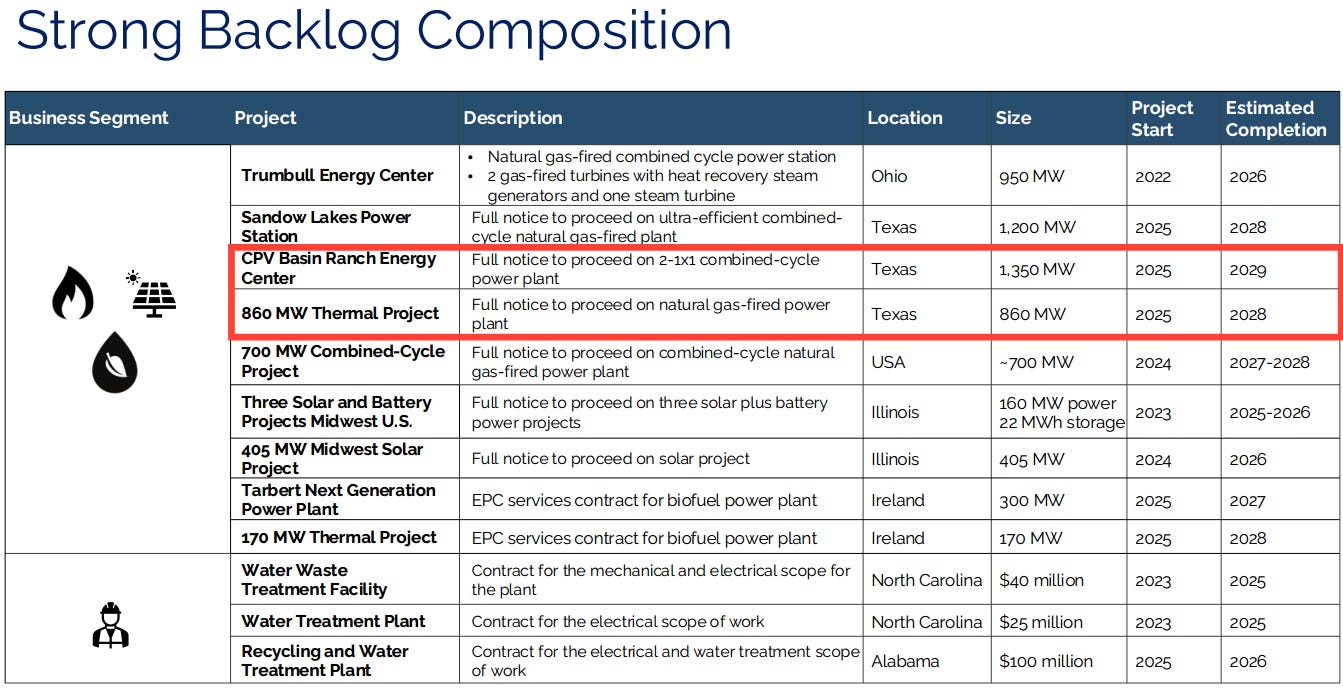

The leap was driven by two massive power plant contracts in Texas. Specifically, AGX won the 1.4 gigawatt (GW) CPV Basin Ranch Energy Center in West Texas, and another 860 megawatt gas-fired plant in the ERCOT market (also Texas).

These two projects alone added roughly $1 billion of work. To put it in perspective, AGX is now under contract to build about 6 GW of new power capacity, all in one go. That’s a huge workload, like a fully booked calendar of big builds for the next few years.

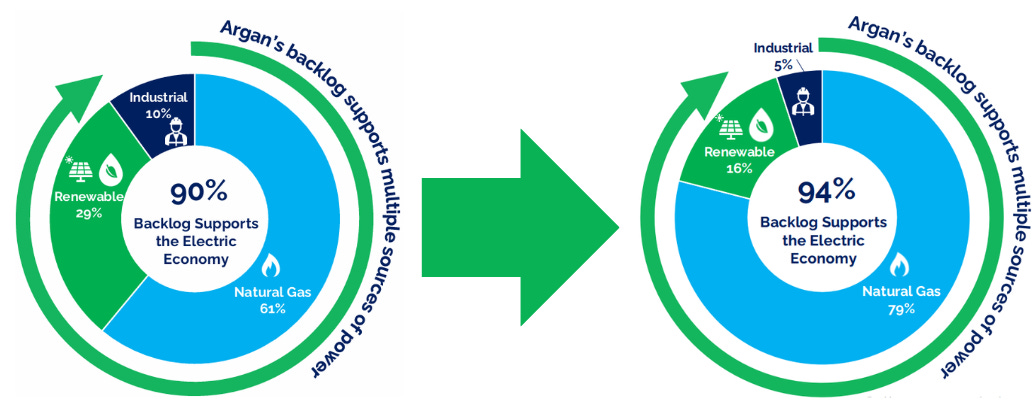

This backlog isn’t just big; it’s also high-quality and heavily focused on power plants. Over 94% of Argan’s backlog is related to power projects (gas or renewables), with only a sliver from industrial jobs. (At the end of Q2, power was 90% of the backlog, so the new awards made the mix even more power-heavy.)

Power projects tend to be AGX’s bread and butter and typically carry solid margins, so a “power-heavy” backlog is good news for profitability. Management also noted that these contracts are fully funded and underway. In other words, they aren’t just theoretical wins sitting on a shelf. The projects have received notices to proceed and are actively in progress (or about to start).

The CEO sounded optimistic about the demand environment feeding this backlog growth. He highlighted an “urgent need for new power resources” as the grid faces the “electrification of everything” from EVs to AI-driven data centers plus a resurgence of domestic manufacturing.

In plainer terms, power infrastructure is in high demand. I explored this trend in detail in a recent deep dive on data center energy needs. With so many aging power plants retiring and energy use rising, AGX finds itself in the right place at the right time, building the next generation of power capacity.

Revenue Dip and Project Transitions

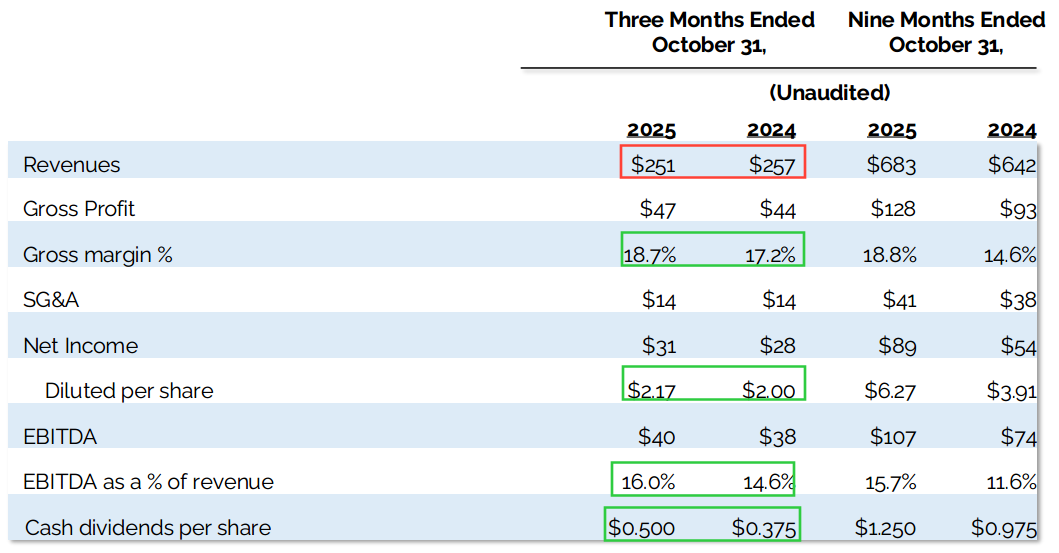

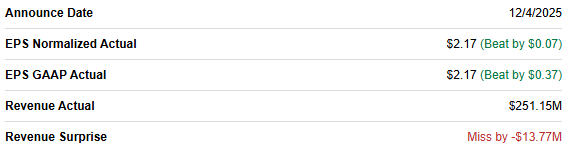

Despite the record backlog, revenues in Q3 came in at $251.2 million, which was down about 2.3% from the same quarter last year. That slight dip might seem puzzling given the company’s growth prospects, but it actually makes sense once you consider project timing.

Last year’s Q3 included peak construction activity on several large projects that were in full swing. This year, those big jobs are wrapping up, and the new mega-projects (like the Texas power plants) are only in early stages. As the company explained, the decrease in revenue was due to recently awarded contracts still ramping up in early construction phases, while a year ago AGX was finishing big jobs at full tilt.

In fact, two major projects reaching completion were the culprits: the Trumbull Energy Center in Ohio and a large LNG-related power project in Louisiana. The completion of those projects created a gap in revenue that hasn’t been fully backfilled yet by the new ones.

It’s almost like AGX is between waves. One wave of projects is ending, and the next wave is just starting to build momentum. Sequentially, revenue actually rose 6% from Q2 to Q3, indicating that activity is picking up as new projects start contributing. But compared to last year’s high-water mark, Q3 revenue was a bit lower. Importantly, this is a timing issue, not a loss of business. The $3B backlog gives confidence that revenue will inflect upward as those Texas projects and others hit their stride.

It’s worth noting it’s history too: the company’s project work can be lumpy quarter to quarter. Big EPC (engineering, procurement, construction) contracts recognize revenue based on progress, so timing differences (e.g. one project finishing before another ramps up) can cause short-term dips. That appears to be exactly what happened here.

Management’s commentary backs this up. They specifically cited the winding down of the Louisiana LNG power facility and Trumbull plant as key factors in the y/y revenue decline. Meanwhile, newly awarded projects are in early innings and haven’t hit peak revenue generation yet. Once they do, the top line should resume growing. So you see that the revenue pipeline is loaded, but you need to give it a little time to flow.

Expanding Margins Boost Earnings

While revenue took a modest hit, AGX’s profitability actually improved. The company earned a gross profit of $46.9 million for the quarter, which is a gross margin of 18.7%. That’s up from a 17.2% margin in the year-ago quarter. This improvement was driven by strong execution in the Power and Industrial segments. In complex construction projects, hitting efficiency targets and avoiding cost overruns can make a big difference to margins. It appears Argan did a great job controlling costs and delivering on its contracts this quarter, especially on the power plant builds.

As a result, net income rose to $30.7 million, up from $28.0 million in Q3 last year. EPS came in at $2.17, which is about an 8.5% increase. This bottom-line growth is pretty impressive considering revenue was slightly lower as it shows the power of those better margins. Another profitability metric, EBITDA, was $40.3 million for the quarter (a 16.0% EBITDA margin). That’s up from $37.5 million a year ago, reflecting higher core operating earnings as well.

It’s worth highlighting that the margins so far this year are running well above normal levels. YTD gross margin is about 18.8%, which even management admits is unusually high. They have been guiding to a “16-plus percent” gross margin as a long-term benchmark, and they’re already beating that by a wide margin in 2026. The CEO noted that they’re staying conservative on margin guidance going forward, since the mix of projects can change. Still, the execution so far in fiscal 2026 has been excellent on the profitability front.

Segment Breakdown: Power Shines, Industrial Rebounds, Telecom Lags

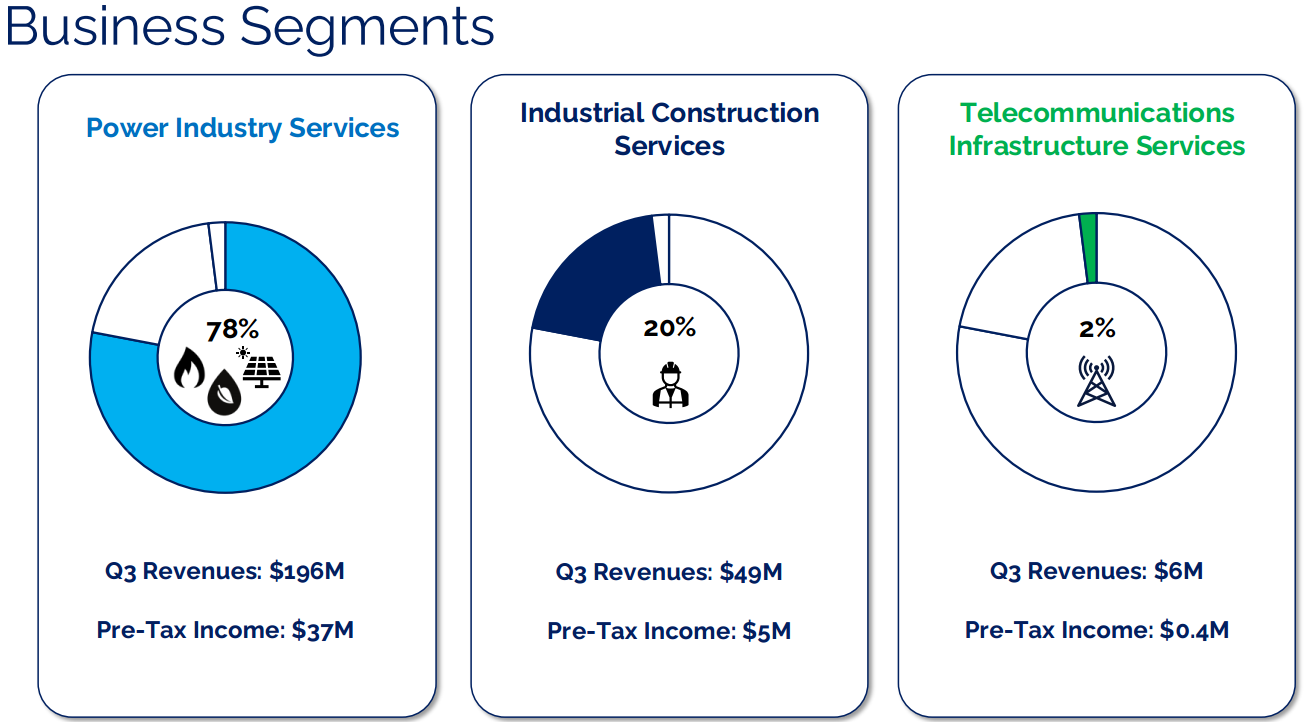

Digging a bit deeper, each segment tells s different story on margins. The Power Industry Services segment is performing exceptionally well. For the first nine months of fiscal 2026, the power segment’s gross profit was about 20.0% of its revenue, compared to just 14.8% a year earlier. That’s a huge jump in margin. It suggests the power projects are executing better (or priced better) than they were in 2025. Every quarter so far, Power has outpaced its prior-year margin. Given Power accounted for 78% of its Q3 revenues, this margin strength has a big impact on overall results.

The Industrial Construction Services segment had a slower start to the year, but showed improvement in Q3. In the first half of 2026, industrial project margins were a bit behind last year’s comps. However, in Q3 the industrial segment’s profitability surpassed the year-ago level, which helped bring its YTD margin slightly above last year’s. For the first nine months, industrial segment gross margin stands at 12.7%, just edging out the 12.5% margin in the same period of 2025. In short, industrial projects are now performing a tad better than last year after lagging in early 2026. Management had flagged some execution issues in industrial earlier, but Q3 showed a nice rebound.

Meanwhile, the Telecommunications Infrastructure Services segment continues to be a small contributor with relatively lower performance. Telecom made up only 2% of revenues, so it’s almost a rounding error. Its gross margin for the year to date is 21.4%, which is down from 26.8% in the prior year. That drop in telecom margin looks dramatic percentage-wise, but because telecom is such a tiny piece of the pie, it doesn’t weigh much on consolidated results. The telecom segment mostly does infrastructure installation, which can have chunky, project-specific margins.

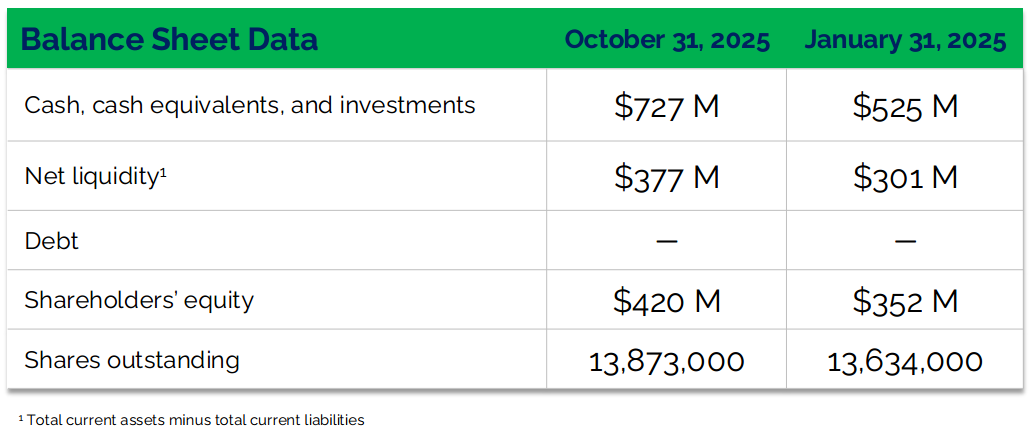

Cash-Rich Balance Sheet and a Bigger Dividend

One area where Argan shines unabashedly is its balance sheet. The company continues to have zero debt.

In an industry like construction where many peers carry leverage, AGX’s debt-free status is a notable strength. Even better, AGX has amassed a huge cash and investments pile of $726.8 million as of quarter-end. That’s three-quarters of a billion dollars in liquidity just sitting there. After accounting for current liabilities, net liquidity (working capital) is $377.3 million, which means it could pay all its short-term obligations and still have over $377M leftover in quick cash. This financial flexibility is an enormous strategic asset as it enables AGX to bond large projects, weather any downturns, and pursue opportunities without worrying about funding.

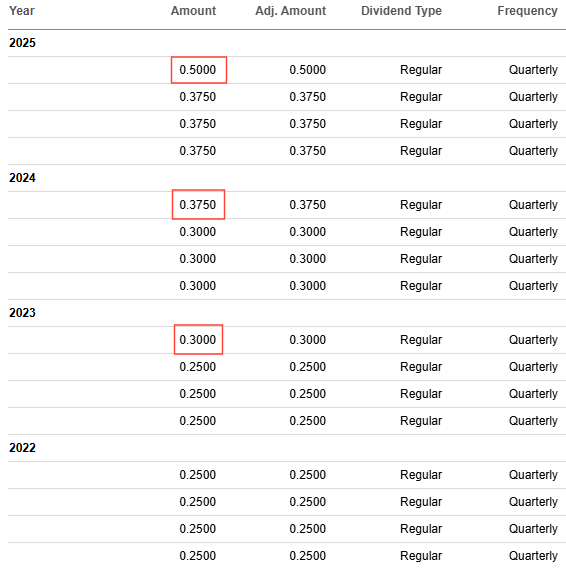

The company is actively returning some of that cash to shareholders as well. In Q3, Argan hiked its quarterly dividend by 33% to $0.50 per share, up from $0.375 previously. That marks the third annual increase in a row, and brings the annualized dividend to $2.00 per share.

A 33% raise in one go is nothing to sneeze at. It shows confidence from management in the company’s cash-generating ability. They’ve paid out about $17 million in dividends over the first nine months of the year, and also bought back roughly $7 million worth of stock in that period.

In fact, the board authorized a $150 million share repurchase program as well, giving the company the option to buy back a substantial chunk of stock. Between the buyback authorization and the richer dividend, Argan is basically saying: “We have more cash than we need to run the business, so we’re giving a lot back to shareholders.” That’s a good position to be in.

It’s refreshing to see a construction company with a fortress-like balance sheet and a generous capital return policy. There’s no risk of distress here. Instead, the discussion is about how best to deploy excess cash. AGX appears to be balancing growth needs (they’ll use plenty of cash as working capital to execute that $3B backlog) with shareholder rewards. For now, they have more than enough to do both.

Why the Stock Dropped Anyway

Given all the positives from record backlog, rising margins, no debt, higher EPS and higher dividend, why on earth did AGX’s stock tank after earnings?

It boils down to expectations and maybe a bit of caution about the road ahead. First, Argan’s revenue came in a few million below analysts’ estimates for the quarter.

The Street was expecting about $265 million in revenue; Argan delivered $251 million. That’s a 5% miss and in today’s market of all-or-nothing thinking (as I explained here) any top-line miss can trigger a sharp sell-off especially for a stock that had run up strongly earlier.

Second, the market may be concerned about the gap between backlog and current revenue. Yes, $3B in backlog is fantastic, but investors want to know when and how that turns into actual revenue and profit. The fact that revenue declined y/y, even modestly, might have raised fears that AGX could be entering a slow patch before the new projects ramp up.

Essentially, there might be a timing lag in revenue growth that isn’t fully clear yet. If the new Texas projects don’t contribute significantly until later in fiscal 2027 (for example), then the next couple of quarters could also show flat or modest revenue, something traders might be wary of.

Another factor is margin sustainability. The margins are awesome right now, but management themselves are guiding more conservatively. On the earnings call, Watson reminded everyone that while YTD gross margin is 18.8%, they only commit to a “+16%” margin outlook and are cautious about forecasting beyond that. He basically said it’s too early to tell if these high margins will carry into fiscal 2027, given changing project mix. That kind of prudent tone, while wise from a business standpoint, can dampen investor enthusiasm. Bulls might have hoped the company would say “our margins are structurally higher now.” Instead, management is hinting that margins could normalize down a bit. Investors hate uncertainty, and here’s some uncertainty on a key variable.

There are also execution risks to consider, which investors likely factored in after the call. The CEO mentioned that labor availability and specialized skills are an ongoing challenge in executing multiple big projects (which actually is one of the bottlenecks I identified for the entire supply chain as I explained here). If you’re building 6 GW of power plants at once, you need a lot of engineers, construction managers, and skilled trades and the labor market in this sector is tight. Any hiccups in staffing or supply chain could slow project timelines or hit margins. So far AGX has managed these risks well, but scaling up to 10–12 large projects (the company’s stated capacity target) is a test. The market may have sold off partly on “sell the news” and these forward-looking worries, despite the strong quarter on paper.

In short, the stock drop doesn’t mean the quarter was bad. It means investors were expecting even more, or are nervous about the near-term cadence of revenue and the ability to sustain current profitability. The good news is that the fundamentals remain very strong. Sometimes the market’s knee-jerk reaction creates an opportunity if you have a longer-term view.

Updated Valuation: Raising Target to $374

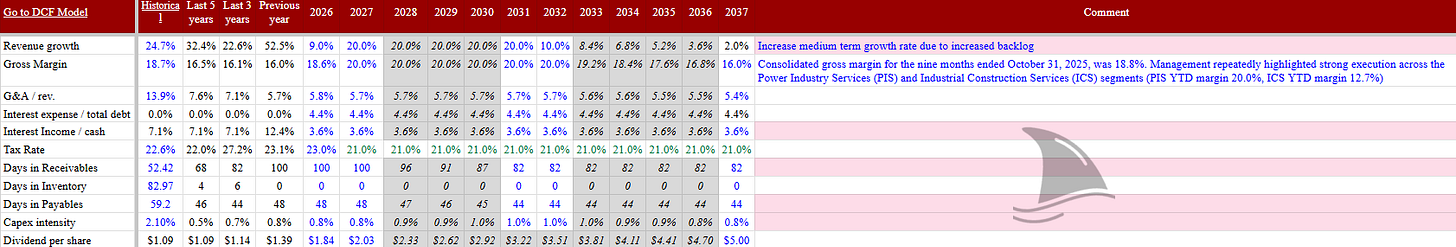

After digesting the Q3 results, I revisited my valuation model. The outcome: I’m increasing my fair value to $374 per share, up from my previous $274. That’s a sizable jump, reflecting several positive developments and assumptions:

Higher medium-term revenue growth: The huge backlog boost gives me confidence that revenue will accelerate over the next couple of years. I was previously modeling a more modest backlog and slower new order flow. With $3B in hand (and likely more to come), I now project a stronger revenue CAGR in the medium term. Put simply, the runway for growth is longer and higher than I thought, so future revenues get a bump in my model.

Improved 2026 margin outlook: Given the actual gross margin YTD is 18.8%, I have adjusted my assumptions for the full fiscal 2026. I now expect Argan to close out the year with a gross margin closer to 19% rather than the 9% I had assumed before. The company has demonstrated they can execute at higher margins through three quarters, so it’s prudent to bake that in. This lifts my forecasted earnings for 2026.

Long-term margin uptick: I also nudged up my longer-term steady-state margin assumption. Previously I was using 18% gross margin in future years, figuring competition and project mix would keep it around that level (which was management’s historical benchmark). However, with the backlog now 94% weighted to power projects (versus 90% before), I expect a slightly richer margin profile going forward. Power projects have generally yielded higher margins than, say, industrial jobs. So I’m now using a 20% medium-term gross margin in my model gradually converging to the 16%-level management suggested.

These adjustments collectively drive the valuation higher. The jump from $274 to $374 might seem large, but remember that the underlying performance has significantly outpaced expectations this year (especially on profitability), and the backlog increase is a game-changer in terms of visibility.

Of course, a valuation is only as good as the assumptions behind it. There are risks: if project execution falters or if the backlog growth stalls, those rosy projections could come down. But based on what I see now, AGX deserves a higher valuation than before, and the stock’s pullback makes it even more attractive in my eyes.

Conclusion

Q3 FY2026 was a mixed bag in the short term but very encouraging for the long term. Yes, revenue was a bit soft this quarter due to timing, and the stock got punished for it. But look beyond that, and you see a company that is firing on all cylinders operationally: building huge projects, expanding its margins, and amassing a record order book.

The demand for its services is clearly robust, fueled by trends like grid electrification, AI data center growth, and infrastructure investment. The company’s pristine balance sheet and shareholder-friendly moves only add to the appeal.

In my view, the market overreacted to the slight top-line miss. AGX is positioning itself to ride a powerful wave of energy infrastructure build-out in the coming years. I’d much rather see a temporary dip in revenue than see the company scramble with no work; the fact is, AGX has more work now than ever, and it’s high-value work to boot.

Portfolio Update

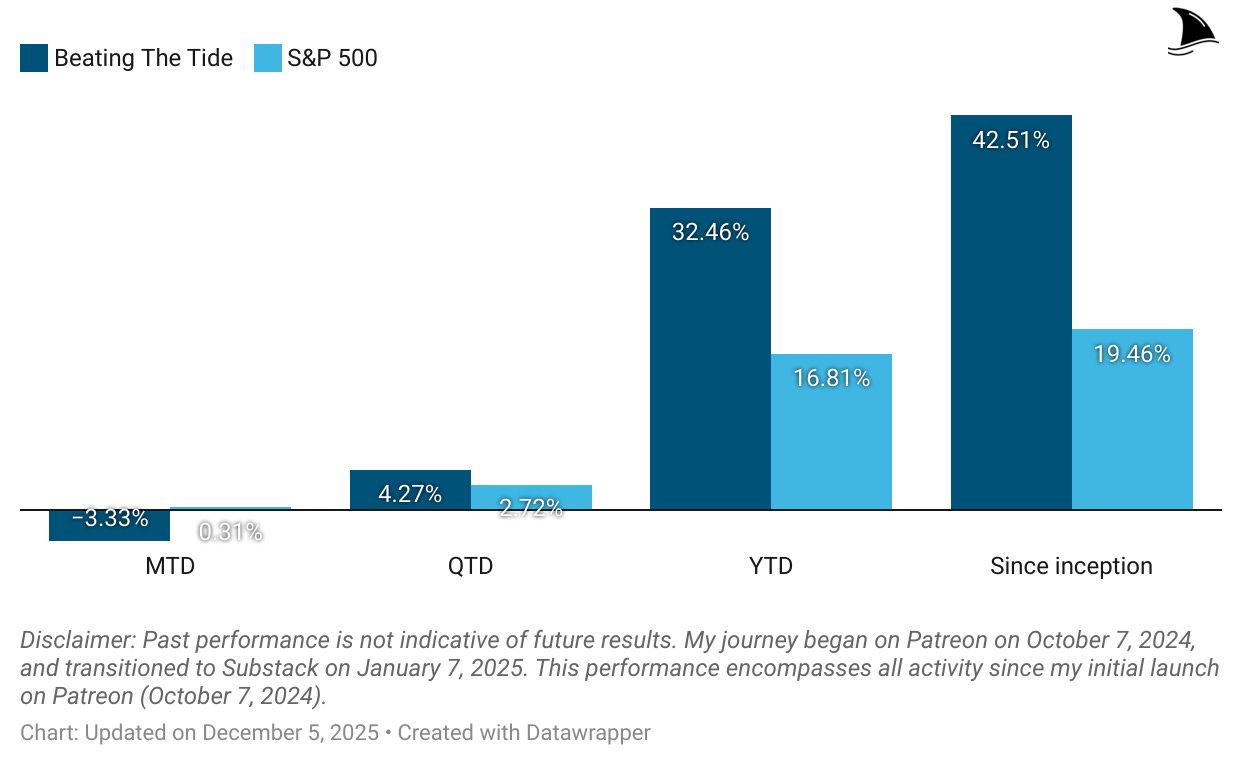

The portfolio retreated a bit the first week of December.

Month-to-date: -3.3% vs. the S&P 500’s +0.3%.

Quarter-to-date: +4.3% vs. S&P 500’s +2.7%.

Year-to-date: +32.5% vs. the S&P’s +16.8%, a gap of 1,565 basis points.

Since inception: +42.5% vs. the S&P 500’s +19.5%. That’s 2.2x the market.

Portfolio Return

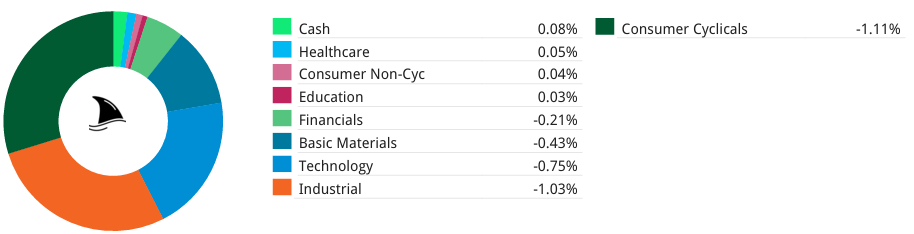

Contribution by Sector

Consumer cyclicals and industrials pulled most of the loses this week.

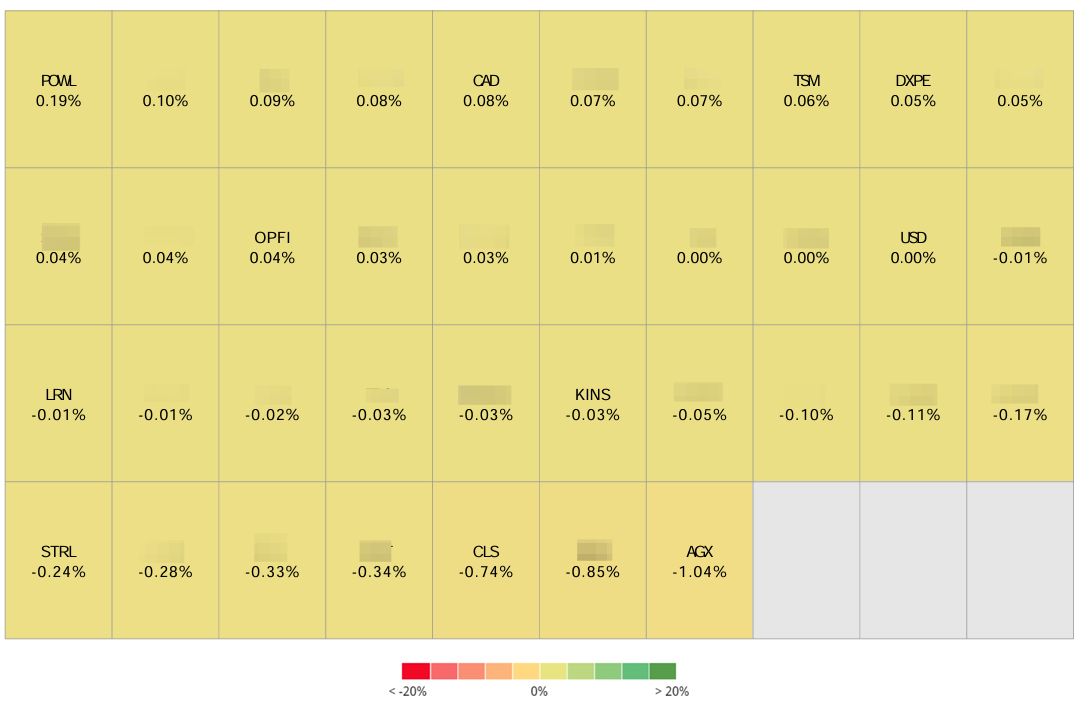

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+19 bps POWL 0.00%↑ (Thesis)

+6 bps TSM 0.00%↑ (Thesis)

+5 bps DXPE 0.00%↑ (Thesis)

+4 bps OPFI 0.00%↑ (Thesis)

-1 bps LRN 0.00%↑ (Thesis)

-3 bps KINS 0.00%↑ (Thesis)

-24 bps STRL 0.00%↑ (Thesis)

-74 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

-104 bps AGX 0.00%↑ (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

George

Great update on AGX. Going through their 10Qs, it looks like they have about $20/share in FCF over the trailing 12 months. A good chunk of this is prepayment for work contracted but not started and will be recognized as revenue going forward. Makes current valuation look very reasonable.

Mike Hostetler(will be subscribing soon)