Weekly #57: The AI Boom Feels Familiar But This Cycle Isn’t Over

Portfolio +24.5% YTD, 2.3x the market since inception. Why today feels familiar, why it’s still early, and how to position your portfolio when the crowd gets nervous.

Hello fellow Sharks,

The market pulled back this week. The narrative changed again, and most of it comes down to two things: nobody’s sure what the Fed will do in December, and the “AI bubble” conversation is back in full force. Both weighed on sentiment, and you saw that show up in the portfolio and across the major indices.

If you want, to skip straight to the numbers, jump to the Portfolio Update.

So in this week’s Thought of the Week, I wanted to zoom out. I drew a line between where we are today in the AI cycle and where the world stood during the fiber-optic boom and bust of the late 1990s.

The parallels are real.

The differences matter even more.

And the goal is simple: understand what kind of environment we’re investing in and what to do with our portfolio even if we’re marching toward a bubble.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

On November 19 I broke down Global Ship Lease (GSL); a rare combo of excellent management in a very awkward part of the cycle. On the plus side, GSL runs a simple chartering model with long-term contracts, high utilization, a much cleaner balance sheet after the Covid boom, and a stock that screens optically cheap on earnings, book value, and dividend yield.

The problem is the backdrop: a record orderbook of new container ships, the eventual normalization of Red Sea/Suez detours, and the risk that re-charters in 2026–27 happen in a buyer’s market, pulling ROIC down toward or below the cost of capital. My Monte Carlo work showed most long-run scenarios landing below today’s price, so for now GSL sits on my watchlist as a great operator in an unattractive cycle, not a position in the portfolio.

Thought of the Week: The Fiber-Optic Gold Rush and the AI Boom: A Tale of Two Bubbles

I’ve been thinking about history lately… about how the late-1990s was a kind of gold rush for fiber-optic cables. In those days it felt like everyone was building internet highways at once. Telcos and startups borrowed piles of money to lay miles of fiber everywhere, convinced that demand for data would grow forever.

In fact, telecom firms invested well over $500 billion (mostly debt-financed) from 1996 to 2001 to build networks. They even joked about “dark fiber” cables sitting in the ground lit up only a bit, waiting for traffic. By 2000, after too many companies and too much competition, it all went wrong. Traffic didn’t double fast enough. Many companies such as WorldCom and Global Crossing folded under debt.

By 2002 the NASDAQ had lost $5 trillion in value, and half of all dot-coms went bankrupt.

But here’s the twist: all those fiber cables didn’t vanish after the crash. The once-wasted “dark fiber” became cheaper capacity for a new Internet era. The huge fiber infrastructure cut the cost of internet access dramatically and “paved the way for the digital economy,” from broadband to cloud services.

In other words, the telecom “bust” left behind a foundation that later fueled growth (think broadband video, streaming, smartphones). That story is a reminder: bubbles burst, but sometimes they leave something useful.

The New AI Gold Rush

Fast forward to 2025. We’re in the middle of a fresh AI investment boom. Tech giants and startups are pouring money into chips, data centers, tools and AI companies.

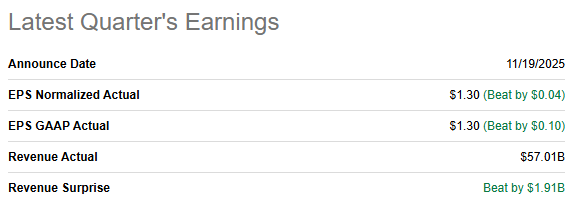

It feels a lot like the 1990s telecom era. For example, this week Nvidia stunned markets. After their Q3 earnings on Nov 19, 2025, Nvidia’s shares jumped about 5% in after-hours trading. That reflected their booming AI chip sales and a forecast of $65 billion revenue next quarter. But the very next day the stock fell sharply and ended down 3.2% despite earlier gains. (In short: AI is hot… and volatile.)

Is this just the beginning of a big wave, or are we in an AI bubble that’s about to pop?

It’s a fair question. AI valuations are soaring, and some big names (like Nvidia) are up more than a thousand percent in a few years.

Even Bill Gates has warned that we might be in the middle of a bubble. He said on CNBC that while AI will be “very valuable,” a frenzy has gripped markets. Some companies “will be glad they spent all this money,” others will find it too expensive and end up with white elephant data centers.

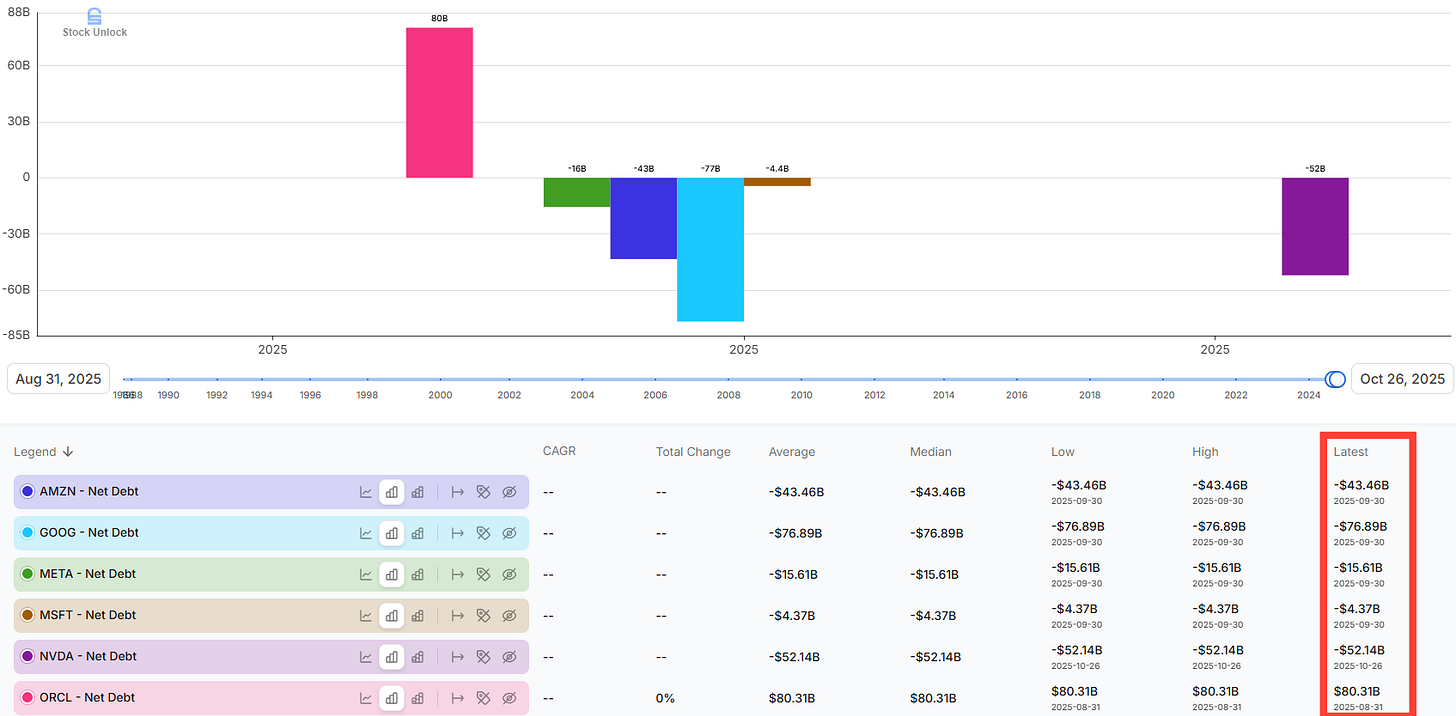

On the other hand, AI isn’t a dot-com website. It’s a platform technology that’s already in our phones and search engines. And unlike many dot-com startups back then, today’s tech giants generally have rock-solid finances.

If you look at the balance sheets of the main AI platforms, the picture is very different from 2000. Amazon, Alphabet, Meta, Microsoft and Nvidia all sit in net cash positions today, not net debt. Oracle, a newer entrant in the AI race, is the only one in this group with material net debt (maybe the first to bust? 🤔).

That cushion means the core AI players are not levered like the old telecoms were, which gives them far more room to absorb a shock if things turn.

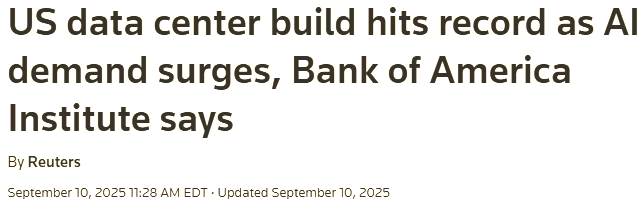

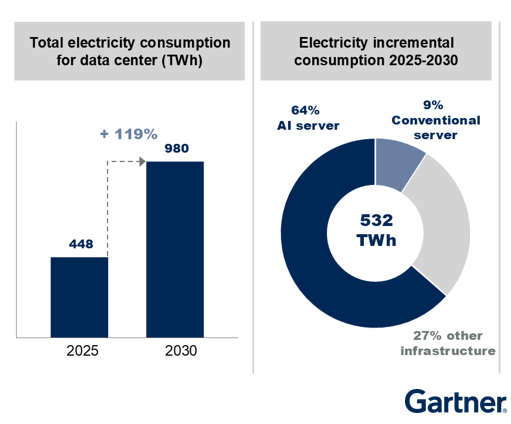

At the same time, AI infrastructure still feels under-built, not over-built. Datacenter construction is at record highs: U.S. data center spending hit $40 billion (annual rate) in mid-2025, a 30% jump.

Yet power use projections show data center electricity demand will double by 2030 as AI servers spread.

In the late 1990s, fiber capacity far outpaced actual internet traffic. Today, by contrast, tech companies are still racing to add capacity. The big cloud providers are scrambling to build more centers for AI, which boosts business for chip firms like Nvidia.

And think of what’s coming next: I’ve mainly talked about AI training in data centers, but the real story might be broader. The phases of an AI cycle include massive chip-powered training (which is happening now) followed by widespread inference (running AI in products), and then AI-driven robotics or automation.

We’re just at the early innings of all that.

For example, human-like robots, autonomous vehicles, industrial AI are applications that aren’t yet at scale. And while ChatGPT and similar tools grabbed headlines, the technology is still improving fast and finding new uses (education, science, energy, etc.) and getting smarter.

Are We in a Bubble?

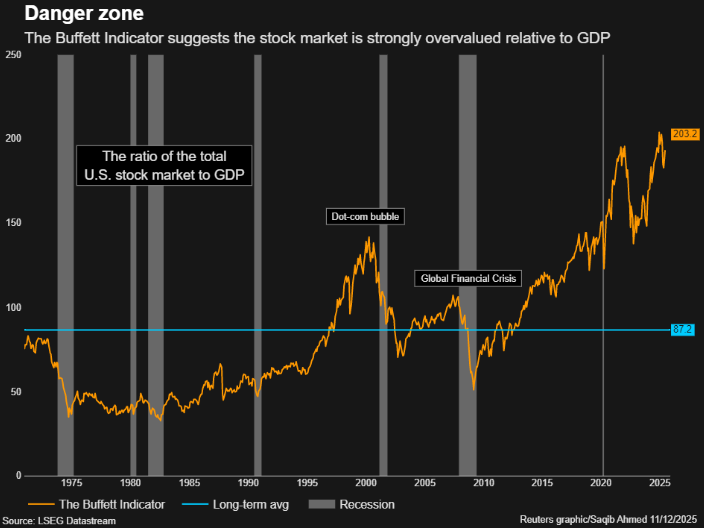

It’s healthy to ask if AI investing has gotten ahead of itself. Many charts and analysts point to similarities with past manias. For example, the Buffett Indicator (total stock market cap vs GDP) recently topped 200%, a level higher than at the dot-com peak.

Some AI-related stocks have plunged 10-20% from their highs. Media columns and reports have headlines warning of a possible AI bubble popping.

Optimists push back with data: They note big tech revenues are surging on real AI work. Nvidia just beat earnings and saw record sales, quadrupling y/y in data-center chips.

After those numbers, a wave of analysts said the AI boom is still accelerating. One wrote that “fears of an AI bubble are way overstated,” calling Nvidia’s results a “pop-the-champagne moment”. Another analyst said the world is only in the early innings of the AI revolution, with both demand and supply chain scaling still on the rise. Even Jensen Huang shrugged at bubble talk: “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different,” he told investors, pointing to huge cloud demand and $500 billion worth of future chip orders.

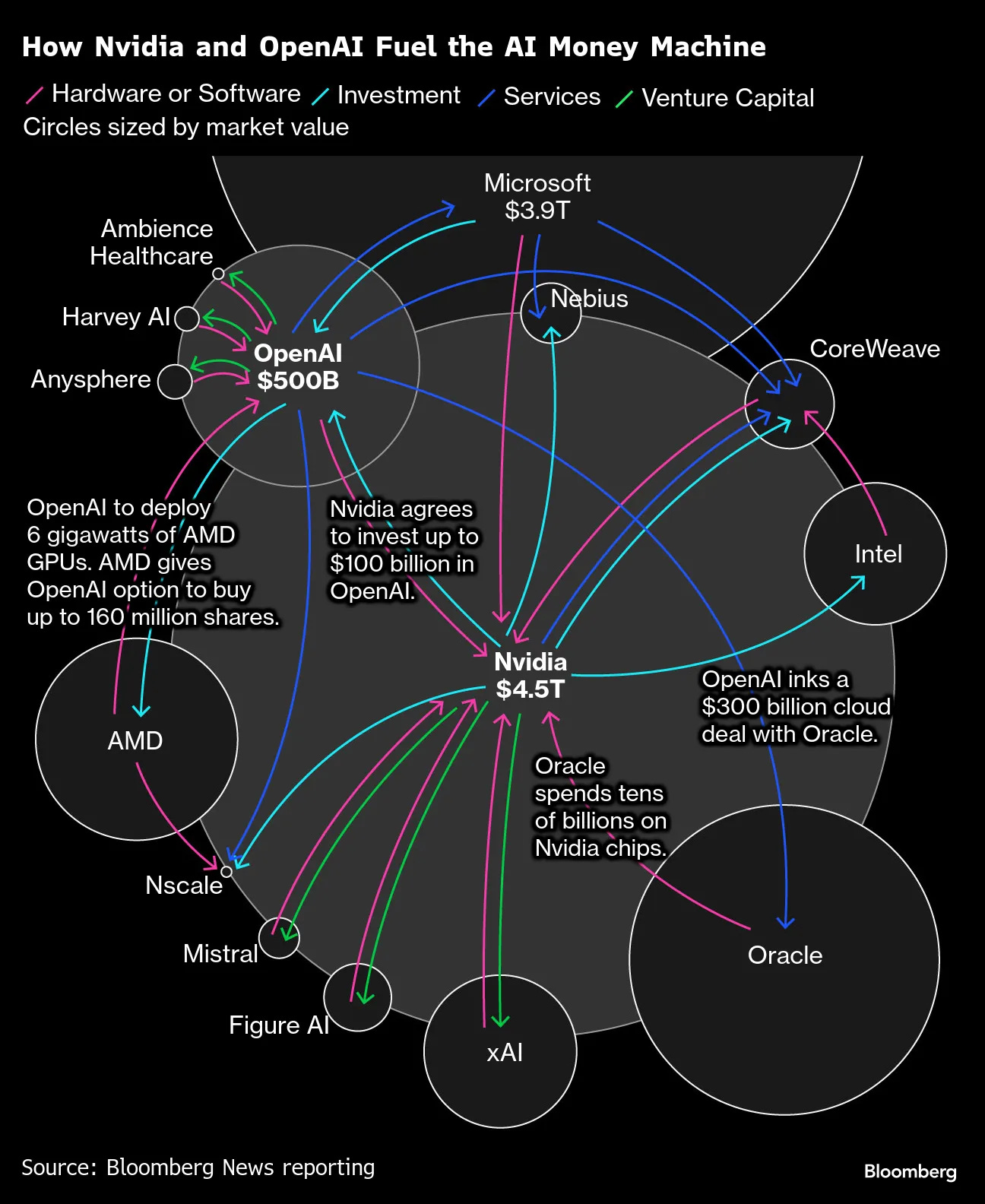

Others are more cautious. They note warning signs in the nuts and bolts: clouds and data centers are spending huge sums, sometimes leasing or re-leasing hardware to boost current earnings, which could inflate the numbers. Deal structures can be weird: major AI players are becoming customers and investors in each other, creating a “circular” money loop that resembles past excesses.

Energy and materials are constraints too. Power availability and chip supply might limit growth. Some worry whether there’s enough land, electricity and grid to actually use all this new GPU capacity.

In short: neither side has proved conclusively right yet. Some say AI is just like the dot-com bubble: a mania that will end badly. Others say it’s different because the fundamentals (sales, tech leadership, government backing) are strong. The truth may lie in the middle.

Why the AI Cycle Might Still Grow

I’m convinced there are reasons this wave could keep inflating, even if some froth comes out.

Reason #1. Strong balance sheets

Unlike the dot-com-era companies that burned cash and built debt, today’s AI leaders are profitable. Google, Microsoft, Amazon and Nvidia all earn huge profits and generate free cash flow. That means they can fund data centers and R&D without scrambling for debt.

A crash in prices wouldn’t instantly ruin a flush balance sheet. This contrasts sharply with 2000, when telecom firms owed trillions and went belly-up once the music stopped.

Reason #2. Infrastructure still being built

It turns out we’re still early on the digital highway. Data center construction is at an all-time high. Gartner predicts that by 2030 data centers globally will use nearly double the electricity they use today.

In practical terms, Big Tech and utilities are literally planning new power plants so AI servers have juice. In other words, we haven’t saturated capacity, we’re adding it. There’s “dark fiber” wisdom from 20 years ago: laying extra cable seemed wasteful then, but turned into a bargain later. A similar build-out for AI infrastructure (data halls, power, networks) could serve us for many years.

Reason #3. New stages ahead

So far the frenzy is on chip-based training and big models. But other stages of AI use aren’t mainstream yet. Inference (embedding AI in devices and apps) will scale only as devices get smarter and cheaper.

Robotics and autonomous vehicles, promised for a decade, are only now edging into reality. In energy, smart grids and industrial AI are just starting. If any of these “next innings” really take off, that could justify more spending.

For comparison, the late 1990s still hadn’t delivered on most promised web services; many real Internet applications came after the boom, when companies could build on cheap networks. It’s possible AI’s biggest impacts (and profits) are similarly a ways off.

Reason #4. Geopolitical and policy drivers

AI is not just another tech fad and it’s a national priority. The U.S. government is treating the AI race like a new space race. A 2025 White House AI plan declares: “Winning the AI race will usher in a new golden age of… economic competitiveness and national security” (interesting document, it is just 28 pages but a ‘must’ read if you are investing in AI).

Ministers and CEOs talk about AI dominance as the next Manhattan Project. That means policymakers are likely to keep easing regulations, funding R&D, and even permitting power plants and data centers fast. It’s hard to imagine Washington publicly rooting for U.S. AI leadership to fail, even if valuations seem high. This political imperative could sustain investment that pure profit-driven models might shy away from.

Reason #5. Emerging use cases

Finally, new AI applications keep appearing. Look at robotics in warehouses and factories: companies like Amazon and Tesla are integrating more AI-driven robots every year. In energy, AI labs are modeling grids and renewable power use. Sam Altman says its tools will bring in tens of billions in revenue soon.

Nvidia recently booked half a trillion dollars of future chip orders, firms ordering today for projects not even started yet. You have to figure some of that is aimed at ambitious “AGI” or advanced robotics projects. In short, people are finding so many ways to use AI that investment isn’t just a fad and it’s fueling startups and projects across industries.

Of course, being early has its risks too: some bets may flop, and supply bottlenecks (chips, talent, power) will strain the system. But these factors also argue that AI spending has room to run further before the cycle fully plays out. The field is simply much larger now than the 1990s telecom world was.

Investing in a Frenzy: Tips from History

What does this mean for us with money on the line? History tells us that when a true bubble pops, almost no stock or sector is safe. In the dot-com crash, even solid companies got caught up in the rout.

So, the safest approach is diversification and caution. Spread your bets. Avoid high leverage or margin in this environment. If it’s truly a bubble, nobody can time it perfectly, but being heavily short or invested with debt is risky.

At the same time, throwing out the whole trend could be a mistake. The 1990s telecom bust was painful, but investors who bought the underlying fiber and internet stocks after the crash did very well over the next decades. The internet kept growing. I see the same pattern here. Even if AI stocks stumble, the technology and the infrastructure will keep pushing forward.

A long-term view helps. I want to own companies with strong balance sheets, real cash generation, and exposure to AI without depending on sky-high valuations. And I don’t want to sit entirely in cash or jump entirely out of tech.

But I also want cash on hand. Not a huge pile, just enough to take advantage of forced selling if the bubble pops. Margin has no place here. It takes you out of the game at the worst moment.

And diversification still matters, even if a bubble burst hits everything. You can’t hide in Walmart or utilities if the market drops 40% in a panic, but spreading exposure across sectors gives you a smoother ride and keeps you from tying your entire future to one theme.

Crucially, remember that value often survives even when sentiment shifts. When dot-com mania faded, the fiber network and the early internet companies that had solid businesses eventually became the pillars of today’s economy.

In a calm future, AI chips, data centers, and software (the infrastructure being built now) will still exist. They’ll be just as much the backbone of the next 10–20 years as the 90s fiber lines were for the 2000s.

Conclusion

I’ll admit: it’s a weird feeling to compare chips to vacuum tubes. But both stories have the same pattern: wild optimism, massive investment, then a sobering pause. The big lesson is to keep perspective. Bubbles do bust. Yet often the underlying innovation does not go away.

Right now, signs of over-exuberance are popping up. But fundamentals are still growing. The government and big companies are treating AI like rocket science and they won’t let the American AI project fail lightly. So I lean toward thinking we still have more to see in this cycle, especially with so many use cases and strategic factors at play.

Ultimately, as I’ve seen before, bubbles burst, but underlying tech survives and thrives. The internet was born out of that fiber bubble. The next big wave may well ride on today’s AI boom. If we can weather the storm without panic, we’ll come out of it with a lot of powerful new tools, maybe even ones we haven’t dreamed of yet.

Portfolio Update

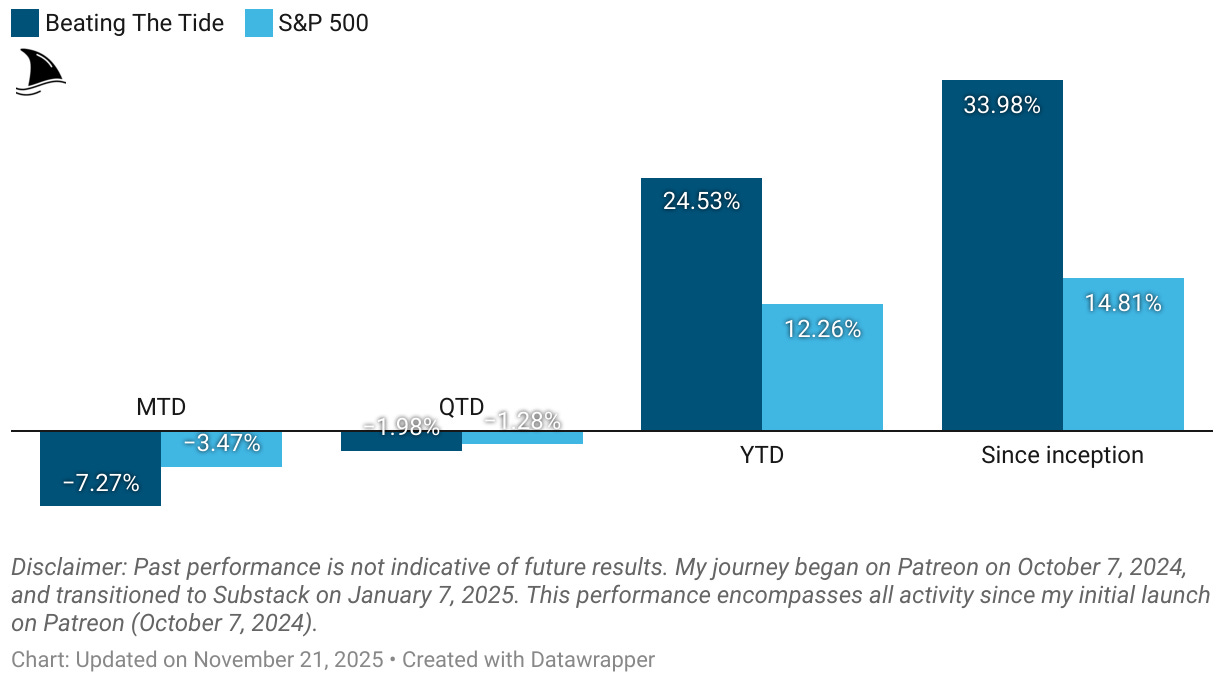

The portfolio was down last week along with the S&P 500.

Month-to-date: -7.3% vs. the S&P 500’s -3.5%.

Quarter-to-date: -2.0% vs. S&P 500’s -1.3%.

Year-to-date: +24.5% vs. the S&P’s +12.3%, a gap of 1,227 basis points.

Since inception: +34.0% vs. the S&P 500’s +14.8%. That’s 2.3x the market.

Portfolio Return

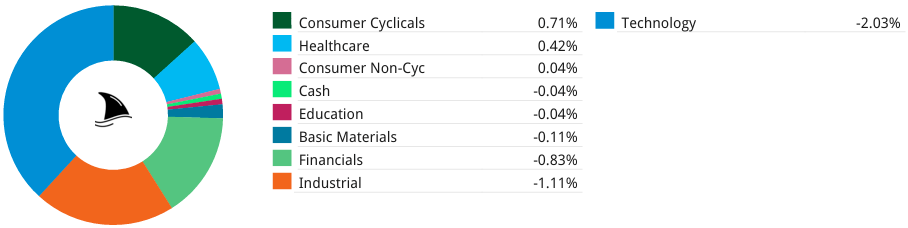

Contribution by Sector

The losses were driven by tech, industrials and financials partially offset by consumer cyclicals and healthcare.

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+2 bps KINS 0.00%↑ (Thesis)

+2 bps LRN 0.00%↑ (Thesis)

-5 bps DXPE 0.00%↑ (Thesis)

-10 bps OPFI 0.00%↑ (Thesis)

-20 bps TSM 0.00%↑ (Thesis)

-23 bps AGX 0.00%↑ (Thesis)

-49 bps POWL 0.00%↑ (Thesis)

-133 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: