Weekly #50: Fashionably Late Investing. What Parties Taught Me About Catalyst Timing

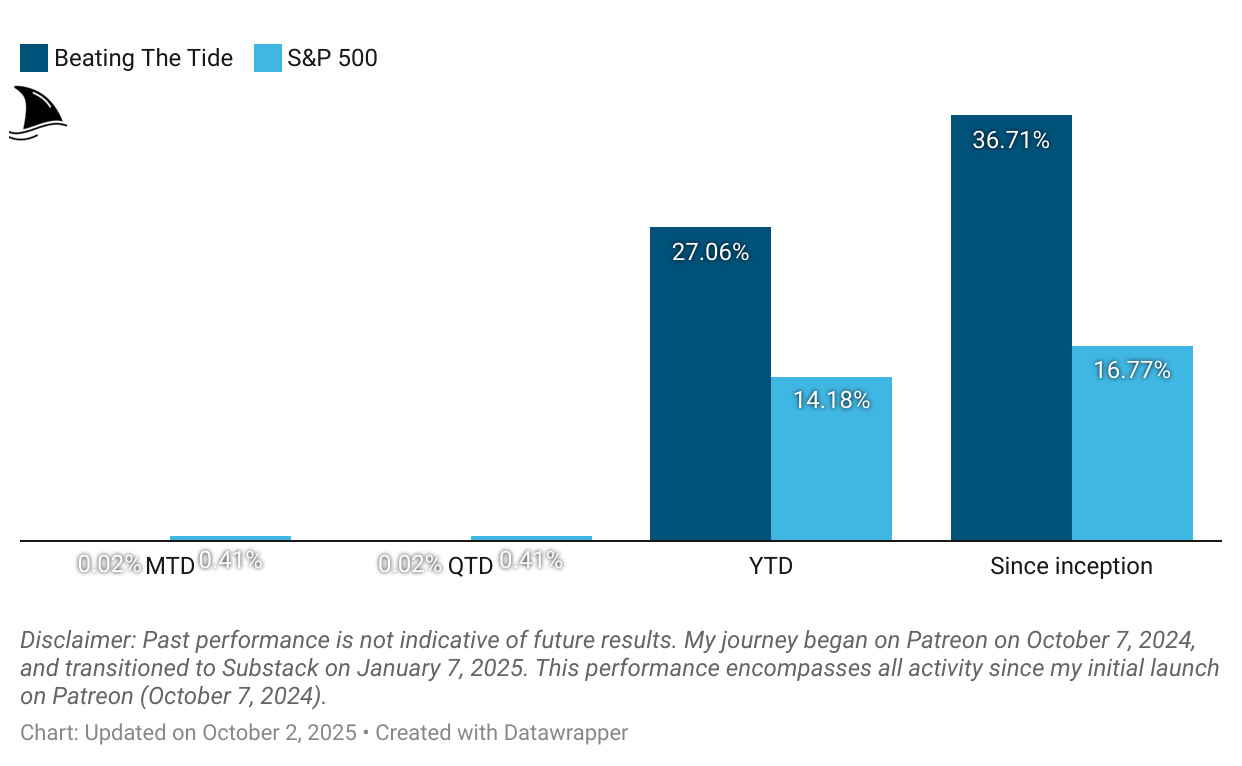

Portfolio +27.1% YTD, 2.2x the market.

Hello fellow Sharks,

This week, the portfolio kept climbing. YTD, we’re +27.1% and 2.2x the market since inception. If you want to skip straight to the numbers, jump to the Portfolio Update.

Also, this week, I share why I quit being painfully punctual at parties and how that shift improved my stock entry timing.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

If you read one fundamentals piece this week, make it my FCF Yield guide. I break down what free cash flow yield actually measures (cash the business can return divided by market cap), why it beats P/E in capital-intensive or cyclical names, and how to avoid traps like one-off working capital boosts or under-investment that flatter “free” cash. I also show how to compare FCF yield across sectors.

Thought Of The Week: Investment Punctuality and Catalysts

When I was younger, I was obsessed with punctuality. If a friend said a party started at 8 pm, I would plan my route on Google Maps so that I could knock on the door by 7:55 pm. This worked about as well as you’d expect in Chile: by 8 pm the hosts were still showering, by 8:45 the first guests might drift in, and by 9:30 the party was finally alive.

My time from 7:55 to 9:30 was dead time.

I could have been reading, exercising, or doing anything else instead of sitting on a couch making small talk with the host’s younger brother.

Eventually I adapted.

I still don’t show up at 9:30 like everyone else (old habits die hard), but I might show up at 8:55. On the flip side, walking into a party at 4 am is a mistake; most people are either drunk or already gone.

A few years ago, I saw the parallel between showing up early to a party and showing up early in the stock market. For many years, my instinct was to buy beaten‑down companies before they budged at all. If the stock moved up 5%–10%, I would often skip it, waiting for a pullback that rarely arrived.

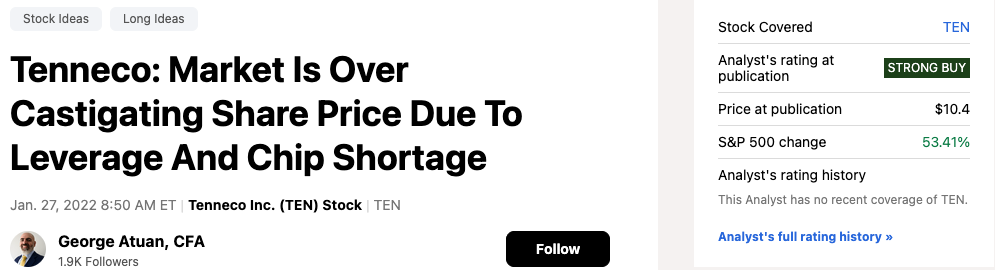

In my mind, getting in at the absolute bottom mattered more than anything. When the timing worked, it felt great: in 2022, I bought Tenneco for around $10 and wrote a strong buy thesis.

Less than a month later, Apollo bought it for $20. A double in 28 days is intoxicating.

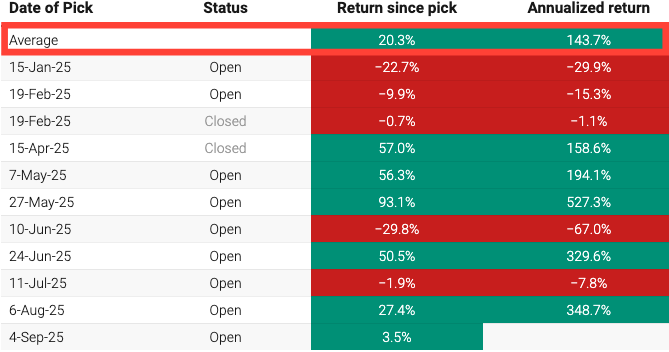

A more recent example: the May 27 stock pick for paid subscribers. It’s already up 93% from my entry or 527% annualized.

And I still think we’re early. The catalyst stack is just starting to play out, so my base case is a 4–9x path as execution compounds and the business gets re-rated.

But luck is not a strategy.

I’ve also had positions where nothing happened for years. In November 2016, I bought Tecnoglass (TGLS 0.00%↑).

My thesis was right: the business was cheap, the management team was competent, and the upside was huge. The problem? The stock stayed flat for six years and didn’t really take off until 2021.

For six years, my capital did nothing. That’s dead money, time I could have allocated elsewhere. So while my holding period return was 339%, the annualized return was 22.1%. If I had bought at $30 per share in the peak of 2022 and exited at the same price of $51, my holding period return would have been just 78% but my annualized return would have been 60%. So while my entry point would have been 2.6x my original entry point ($30 vs. $11.73), the annualized return would have been 2.7x the original (60% vs. 22%).

The Catalyst Primer explains why this matters: if catalysts have an undefined timing, you could be waiting indefinitely, and your capital is tied up with no movement.

Why Catalysts Matter

Seth Klarman wrote that after buying a stock at a big discount, shareholders benefit if “an event occurs that causes that value to be realized”. In other words, a catalyst lights the fuse. Without one, you are just hoping the market comes around.

Joel Greenblatt built a hedge fund on this idea and generated ~50% annual returns by focusing on special situations like spinoffs and mergers. Catalysts reduce the time you wait and thus reduce your risk. They also improve your IRR, which is the annualized return accounting for time.

On the other hand, Richard Pzena famously said, “Once you can see a catalyst, you are late”. If a catalyst is obvious to everyone, the market may have already priced it in. The trick is to find catalysts that are not obvious or to understand the event better than the crowd.

My compromise is to insist on a solid margin of safety in the valuation and then look for catalysts as the cherry on top. If the catalyst fizzles or takes longer, I still own a good business. But I no longer tie up capital for years with no clear trigger.

Adjusting My Process

After six years of watching TGLS do nothing, I changed my process. I still look for value, but I now emphasize identifiable catalysts. Sometimes this means I miss the first 30% of a run (or sometimes +100%).

That’s fine; my new and improved goal was not to buy at the absolute bottom but to achieve a better IRR. If you don’t care about IRR, investing would be easy as I explained in Weekly #23:

I have said this a couple of times before, but I want to repeat it: Investing is easy. It is people that make it complex:

Instead of betting on one variable (stock price going up or down), people prefer to guess 9 variables by using options, as I discuss in Weekly #21.

They speculate in risky stocks rather than invest in stable, reliable companies.

They look for short-term quick games instead of almost guaranteed returns in the long term.

You could buy any cheap stock and wait for the market to recognize its value. You might get a 10x multibagger, but if it takes 10 years, the annualized return is only ~27%. A 3x return in 3 years produces ~44% per year. IRR rewards speed as much as magnitude. I’d rather get two or three doubles in shorter cycles than hold a dormant ten‑bagger for a decade.

Catalysts come in many forms. They can be internal, like a new CEO who decides to sell a non‑core division, or external, like a lock‑up expiry or a regulatory ruling. What matters is that the event forces the market to revalue the company.

I use the STAR framework (which I first introduced in my book): Structural, Timing, Assurance, Relevance. Structural events (spin-offs, mergers, recapitalizations) tend to have a lasting effect. Timing asks whether the catalyst has a clear date or could drag on. Assurance measures the probability that the catalyst will happen. Relevance checks whether the event will move the needle. When I evaluate a new idea, I mentally score each of these.

Before we move on, it helps to see STAR in the wild. I’ll use KINS 0.00%↑ as an example. When the stock was ~$1.50, parts of the framework were missing. A few quarters later, around ~$10, the signals lined up. Same company, different STAR score.

KINS Through the STAR lens (Why I bought at $10, not $1.50)

At ~$1.50 (watchlist, not buy):

Structural. New CEO and a proposed reset, but the turnaround hasn’t been proven yet. The legacy book still dominated the story; dilution and past missteps hung over the name.

Timing. No clear clock. There were intentions: tighten underwriting, reprice, clean up reinsurance. But no firm milestones investors could underwrite. That’s dead-money risk.

Assurance. Low. Multi-year combined ratios north of 100%, dividend suspended, capital raised.

Relevance. Levers like pricing, mix, and expense cuts could change earnings power, but the impact wasn’t visible. The market still saw a broken insurer.

At ~$10 (I acted):

Structural. “Kingstone 3.0” was in place and working: tighter underwriting, Select product gaining share, focus back on core geography, reinsurance right-sized, and real cost discipline.

Timing. A calendar existed: rate actions flowing through, treaty changes live, and quarterly prints to validate progress over the next few quarters. You could model the path instead of guessing.

Assurance. Evidence showed up. Loss trends improved, expense run-rate fell, combined ratio trended toward profitable territory, and guidance held.

Relevance. These levers hit what matters: loss ratio, expense ratio, and reinsurance cost. That flows straight into earnings and multiple. The move from $10 to +$15 reflected that, with runway left as Select scales.

At $1.50, STAR was misaligned: unclear timeline, low assurance, and an unproven structural fix. At $10, all four clicked. I paid up for proof.

Books That Shaped My Thinking

Several books have helped me frame this approach. Seth Klarman’s Margin of Safety stresses that buying cheap is not enough; you need an event to unlock value.

Joel Greenblatt’s You Can Be a Stock Market Genius is a treasure trove of special situations. He shows how spin-offs, recapitalizations and other catalysts can create outsized returns. Read my piece on Spin-offs, Split-offs & Carve-outs: Where Structural Alpha Hides.

Benjamin Graham’s The Intelligent Investor reminds us to demand a margin of safety and to avoid overpaying.

Each of these authors warns against complacency. When you own a stock with no catalyst, you are exposed to dead money syndrome as your capital sits idle while opportunity costs mount.

The Party Analogy Revisited

Today, I approach parties and investing with a similar mindset. I no longer insist on being first through the door. Arriving at 7:55 gives you bragging rights but wastes time. Arriving at 8:55 means the hosts are ready, the early awkwardness has passed, and you still have a full evening ahead. Arriving at 4 am means you missed the main event.

In investing, trying to buy at the absolute bottom ties up capital in dead money. Waiting too long to “confirm” a story can mean you miss the conviction run. The sweet spot is somewhere in the middle: early enough to capture most of the upside, late enough that a catalyst is visible.

In practical terms, this means I’m willing to buy a stock that’s already up 30%-100% if my work suggests there’s a high‑probability catalyst ahead. I do not chase momentum; I require a margin of safety and a clear reason for the stock to keep moving. This approach has improved my IRR and my sanity. It acknowledges that time is money and that an 8 pm start time is often a fiction.

Portfolio Update

This week, the portfolio climbed a bit higher 🏔️.

Month-to-date: +0% vs. the S&P 500’s +0.4%.

Year-to-date: +27.1% vs. the S&P’s +14.2%, a gap of 1,288 basis points.

Since inception: +36.7% vs. the S&P 500’s +16.8%. That’s 2.2x the market.

Portfolio Return

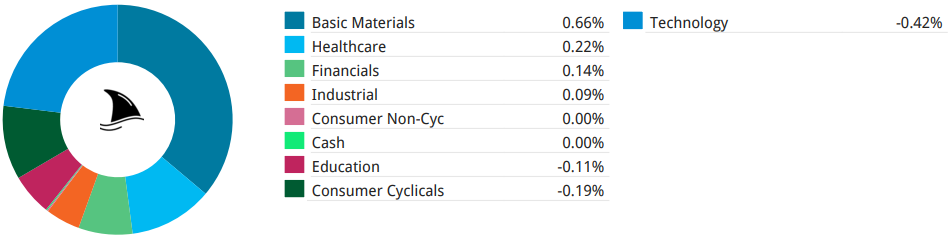

Contribution by Sector

Gold, healthcare and financials led the gains, partially offset by technology.

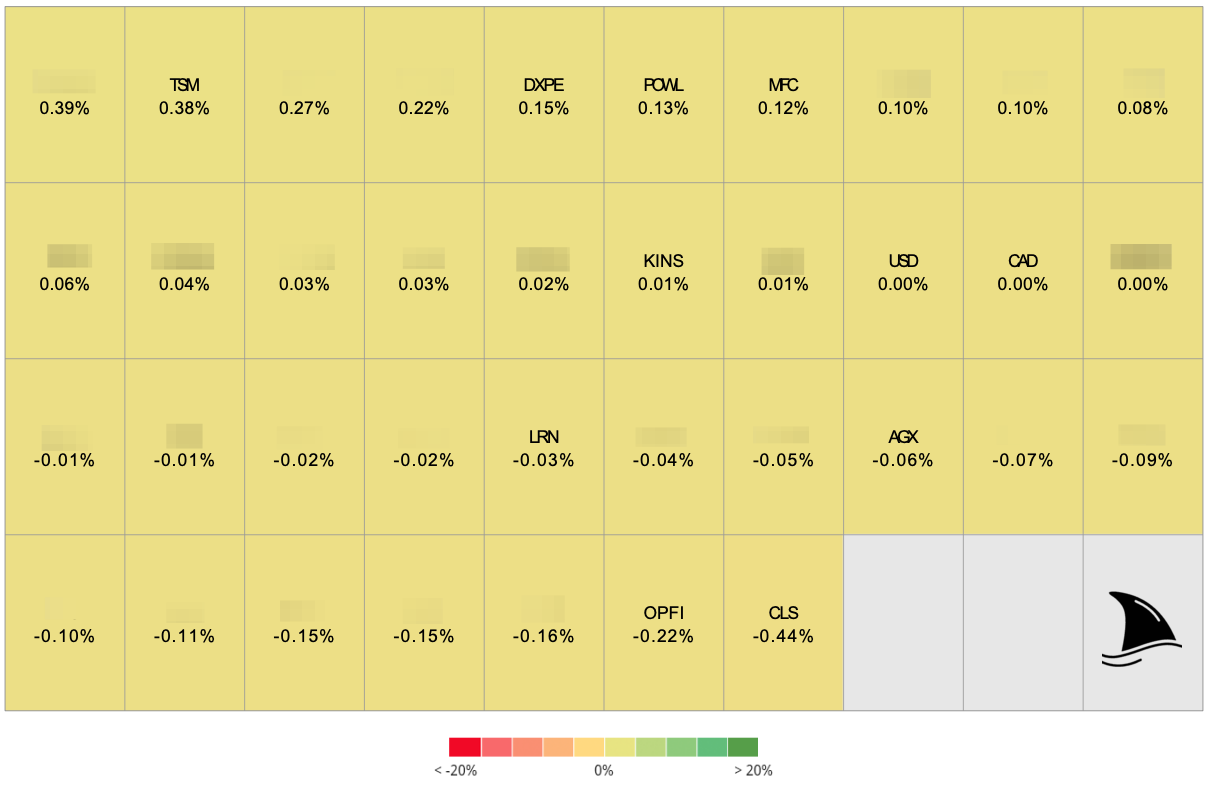

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+38 bps TSM 0.00%↑ (Thesis)

+15 bps DXPE 0.00%↑ (Thesis)

+13 bps POWL 0.00%↑ (Thesis)

+12 bps MFC 0.00%↑ (TSX: MFC)

+1 bps KINS 0.00%↑ (Thesis)

-3 bps LRN 0.00%↑ (Thesis)

-6 bps AGX 0.00%↑ (Thesis)

-22 bps OPFI 0.00%↑ (Thesis)

-44 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: