Weekly #42: Stop Fighting Your Nature & Embrace It to Outperform the Market.

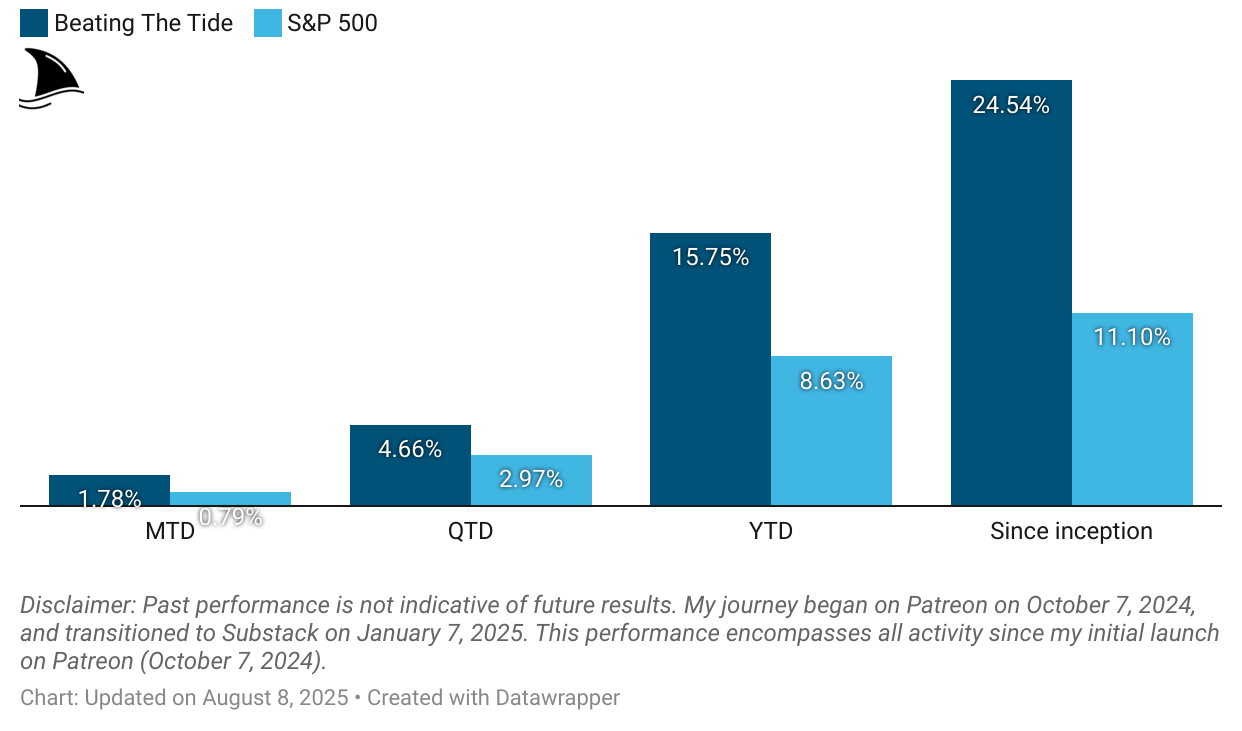

MTD +1.8%, YTD +15.8%, 2.2x the market since inception. Inside: earnings roundup: POWL, OPFI, DXPE, MFC, LRN. Thought of the Week on using your nature as an edge.

Hello fellow Sharks,

This week, the portfolio bounced. We’re +1.8% so far in August and +15.8% YTD. If you want to skip straight to the numbers, jump to the Portfolio Update.

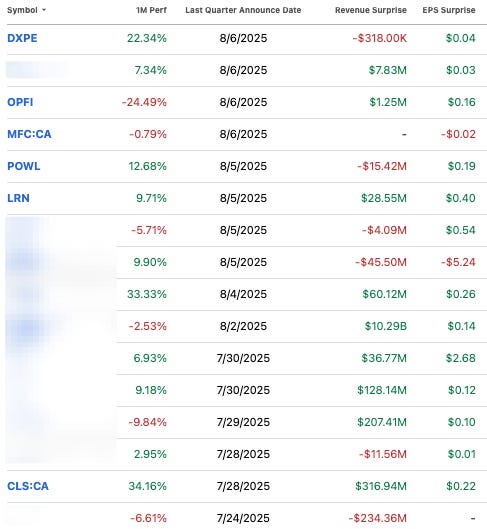

The new paid stock pick has already paid for the annual subscription in just three days. On earnings, since the last update, 15 companies reported: 13 beat or met EPS, 2 missed. So far in this earnings season, of the 36-stock portfolio, 30 beat or met, 4 missed, and 2 report next week.

This week’s Thought of the Week is personal: matching your work to your nature is how I’ve built a more fulfilling life, and it will sharpen your investment process too.

Enjoy the read!

~George

Table of Contents:

In Case You Missed It

On August 6, I published a new deep dive and trade alert for paid subscribers. It’s a small-cap financial with insider buying, a clean balance sheet, and a much tighter operation than a year ago. Pricing is firmer, book value is compounding, and the business is printing strong ROEs. The market still prices it below peers on earnings. So if +25% ROE holds, I see more room for a rerate plus earnings growth.

On execution: I released the trade alert at the same time that the company was releasing Q2 earnings. The results were very strong but not what the market expected. So Mr. Market decided to punish the stock. My order filled on the way down at $19.28. By the time the alert hit inboxes, shares traded around $17.30 as the selloff accelerated. The rebound was swift. The stock climbed back above $21 in the following sessions. At today’s price (~$21.4 when I pulled this), the portfolio position sits at ~11%. Several paid members who bought near the intraday lows are +25% already.

If you acted on the alert, this one trade likely covered the annual subscription and then some while adding a quality, improving company to the portfolio.

Earnings Roundup: CLS, POWL, OPFI, LRN, DXPE, MFC

Since my last update on earnings, 15 more companies have reported, two missed EPS and five missed revenues.

Celestica Inc. (CLS): +280.7%

I wrote a detailed earnings analysis last week and provided a revised target. The shares are up 280.7% and it is the largest position of the portfolio.

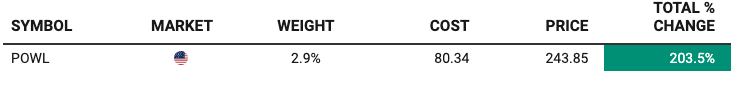

Powell Industries (POWL): +203.5%

Powell delivered another strong print and, more importantly, reinforced visibility. Revenue was essentially flat at $286.3 million, but gross margin climbed to 30.7%, book-to-bill was 1.3x, and backlog rose 7% sequentially to $1.4 billion. New orders landed at $362 million. Cash and short-term investments ended the quarter at $433 million, and the company remains debt-free. Management also announced a bolt-on: the acquisition of Remsdaq, a SCADA/automation asset that extends Powell’s utility offering.

On the call, the CFO gave rare specificity on revenue timing: ~65% of the backlog is slated to convert over the next 12 months. Management also pointed to continued strength in electric utility, improving data center demand, and healthy international activity (notably Canada, the Middle East, and Africa).

Backlog quality matters more than quarterly revenue noise for a project business. Here, the mix is improving. The quarter included the largest utility order in company history ($60M) and two sizable oil & gas module awards ($80M total), plus a $30M U.S. traction power order. Those wins reflect stronger positioning in utility and transportation.

Two watch items: First, management acknowledged some benefit from project closeouts and unusual items in the YTD margin (roughly 115–120 bps), so don’t straight-line +30% forever. Second, pricing on large projects is stable but not improving, so execution will do the heavy lifting. Even so, the message was consistent: demand is broad, visibility is high, and the new automation piece (Remsdaq) should let Powell sell a more complete “all-Powell” solution into utilities.

If you need a refresher, I wrote about Powell in January. The stock has done a lot of work since, but the operating story keeps improving with each quarter. The shares are +203.5% from our cost basis.

OppFi (OPFI): +38.3%

OppFi posted record quarterly revenue and record adjusted net income, raised full-year guidance on both, and kept credit trends moving the right way. Q2 revenue was $142.4M (+13% y/y) with adjusted net income of $39.4M (+59% y/y). Adjusted EPS printed $0.45 (+55% y/y). The net charge-off rate improved to 31.9% of revenue (-60 bps y/y). On the back of this, management increased 2025 revenue guidance to $578–$605M and adjusted net income to $125–$130M.

The call added context. Model 6 is driving origination growth while holding risk, and LOLA, the in-house AI-powered LOS, is pushing auto-approval rates higher without loosening standards. The CFO highlighted operating leverage: total expenses before interest fell to 39% of revenue (from 45% a year ago), and receivables grew 13% to $438M. Guidance moved up across revenue, adjusted net income, and adjusted EPS, reflecting confidence into 2H25.

A reminder if you’re newer here: I published a deep dive on July 23. The thesis was simple: credit normalization, tech-driven underwriting, and operating leverage could move earnings faster than the market implied. Q2 was a clean step in that direction. Near-term watch items: funding cost, charge-off cadence, and any regulatory noise. But the combination of better unit economics and higher guidance is exactly what you want to see.

The shares are up 38.3% from our cost basis.

Stride Inc. (LRN): +26.2%

LRN closed FY25 with another record year: revenue $2.41B (+18%), adjusted operating income $466.2M (+59%), adjusted EBITDA $571.0M (+46%), and adjusted EPS $8.10 (+48%). Q4 revenue grew 22% to $653.6M, with Q4 adjusted EPS at $2.29. The quarter also included a $59.5M non-cash impairment tied to Galvanize, excluded from adjusted results.

Enrollment and mix continue to do the work. FY25 average enrollments rose 20.4% to 234K, with Career Learning up 32.5% and General Education up 13.2%. Career Learning middle/high school revenue climbed 35%; General Education rose 12%. Management guided to 10–15% y/y enrollment growth for Q1 FY26.

From the call: leadership expects a flat to slightly up revenue-per-enrollment backdrop for FY26, modest SG&A leverage, and CapEx steady as a percent of revenue. They flagged a favorable funding environment (some states flat, others up), and called out continued investments in core learning products—like dedicated tutoring for 2nd–3rd graders—and responsible use of AI to improve efficiency. They also addressed New Mexico contract turnover and noted families have migrated to new partner programs. Gross margin expansion should continue but slow as they invest.

If you want a refresher, read the deep dive I published on June 6. The core thesis: Stride is a two-engine platform: General Education provides stable, contracted, recurring revenue with 5–7 year school partnerships and ~90% retention, while Career Learning is the growth engine (career-oriented K-12 programs plus adult upskilling). Scale, sticky contracts, and first-mover advantages create high switching costs; secular demand for flexible K-12 options and job-focused training extends the runway.

The position is +26.2% from the cost basis.

DXP Enterprises (DXPE): +17.6%

DXPE turned in a steady quarter with broad-based growth and healthy margins. Sales were $498.7M (+11.9% y/y; +4.6% q/q), EPS was $1.43 (beat by $0.04), and Adjusted EBITDA was $57.3M (~11.5% margin). Management closed two acquisitions during Q2 and another after quarter-end, and flagged an active pipeline for the second half.

By segment: Service Centers revenue hit $339.7M (14.8% operating margin), IPS reached $93.5M (19.9% margin), and Supply Chain Services posted $65.4M (8.0% margin). Cash from ops rose 26.5% to $18.6M; free cash flow improved to $8.3M. Leverage ended Q2 at 2.4x on covenant EBITDA.

On the call, management emphasized momentum and mix: IPS led growth (+27.5% y/y), energy within IPS was +37.3% y/y, and the water platform posted its 11th straight quarter of sequential growth. They reiterated a goal of maintaining 11%+ adjusted EBITDA margins and nudging that higher over time, supported by tuck-ins and service-heavy solutions.

I wrote the original piece in February and a refresher on August 6 on Seeking Alpha. The through-cycle logic still applies: a more diversified DXPE, with higher-value services and steady tuck-ins, should throw off durable mid-teens returns on capital. Keep an eye on the integration pace and price-cost in MRO; otherwise, the trend looks constructive.

Note that I sent a trade alert to paid subscribers on June 20 picking up DXPE shares at $79.42, bringing down our cost basis.

Our DXPE position is up +17.6%.

Manulife (MFC): +1.8%

Manulife’s quarter showed resilient fundamentals with a few headwinds. Core EPS was $0.95, up 2% y/y, while EPS was $0.98, up 88%. Core ROE landed at 15.0% and the LICAT ratio at 136%. Management continued buybacks and noted $1.1B repurchased year-to-date. Pressure came from U.S. mortality and a stronger ECL provision, which the CFO called out explicitly.

The growth engine is where you want it: Asia kept compounding with strong APE and NBV, while Global WAM produced $0.9B of net inflows and continued margin expansion. All three insurance segments posted +30% growth in new business CSM year over year, which is the best forward indicator of earnings power in this model.

Strategically, Manulife moved to buy 75% of Comvest Credit Partners, adding US$14.7B of AUM in private credit to the Global WAM platform. Management framed it as immediately accretive to core EPS, core ROE and core EBITDA margin, with minimal impact on capital ratios. This continues the push toward fee-based businesses where Manulife has edge and scale.

My read: the top line is doing its job. APE, NBV, and WAM flows set up future earnings, while the P&L absorbed a few transient hits (U.S. mortality, ECL). Balance sheet strength and buybacks give you cover. Near-term, watch U.S. mortality normalization and integration on Comvest. The setup is intact.

The shares are +1.8% from our cost basis.

Thought of the Week: Design Your Life Around Your Nature

Back in 2019, someone recommended me to read Principles by Ray Dalio. I read a review, watched the video he put out, and passed.

It felt like a legacy project more than a book with fresh insight. To be fair, I had just finished The Art of Being Unreasonable by Eli Broad and hated it. I even wrote a short Goodreads review.

So my filter was harsh.

Fast forward to 2025. Maybe it was seeing Dalio in a few interviews during the tariff drama. Maybe it was the mood of the market. I gave Principles a second shot. I’m glad I did. Yes, he wants to pass down his “wisdom” and shape how people see him. But the book has real ideas, and he came across as clear, transparent and vulnerable.

One line stopped me:

What I have seen is that the happiest people discover their own nature and match their life to it.

That line is true. Many of us chase a blanket formula for happiness. Get a “good” job. Make a lot of money. Buy the toys. Check the boxes. It’s a neat script and works for a few people. It did not work for me. It was someone else’s definition of a good life.

With time, I learned what does work. Feeding my curiosity. Reading. Writing. Time with the people I love. Control over how I spend my hours. Those things matter to me. Things don’t. A big title does not. A “perfect” corporate job does not. When that clicked, I started to steer toward it.

It did not happen in a day. I did not make one dramatic move and burn the ships. It was a slow pivot. I took short breaks (check the gaps in my work experience and you’ll get an idea). I tried new projects. I took time to write my first book. I took a less demanding role. I tested life outside the big-company lane. Then I left corporate. It was a multi-year project, not a cold-turkey leap. Think of it like rebalancing a portfolio over several quarters instead of selling everything in one trade. Less drama. Fewer mistakes. More staying power.

Why am I talking about happiness in an investing newsletter?

Because discovering your nature does more than make you happy. It makes you better at what you do. Alignment compounds. When you match your work to your wiring, you suffer less friction and more flow. You build endurance. You make clearer decisions because you are not fighting yourself.

When I started investing in 2006–2007, I sampled styles. I admired Buffett and value investing, but I still wanted to test other lanes. I tried day trading. I dabbled in futures and currencies. The promise: tight feedback loops and fast gains if you keep discipline. The reality for me: screens all day, constant noise, twitchy decisions. That did not fit my nature. I like quiet reading. I like slow digging. I like building a case and living with it. I like the game of patience. Deep fundamental research was my first love and the right one. So I committed to her.

Once I did, everything got simpler. My process stopped fighting me. I cut tools that did not suit my temperament. I added routines that did. I wrote more. I built checklists and post-mortems. I set rules that fit my pace. My returns improved, but more importantly, my head was calm. The result was not only better performance. It was a better life.

I see the same pattern in other fields. The best operators know their nature and shape their system around it. Some people draw energy from speed and conflict. They thrive in live negotiations and chaotic turnarounds. Others bloom in quiet. They make better calls after long walks and long reads. They need time. Different natures. Different playbooks. Both can win. Copying the wrong playbook is a slow form of self-harm.

Don’t Know Your Nature? Start Here

If you don’t know your nature, take the 16Personalities test. It’s free and it gives useful hints. Treat the result as a map, not a label and pair it with a few simple prompts:

Energy Audit. For two weeks, write down what gives you energy and what drains it. No judgment. Patterns show up fast.

Calendar Truth. Look at last month’s calendar. If a stranger saw only those blocks, what would they say your priorities are? If that story does not match your nature, change the next month now.

Envy Map. Who do you envy in a clean way? Not the car. The day-to-day life. What about their routine hits you? Use that as a clue.

Subtraction Test. If you could remove one type of task from your week and never do it again, what would it be? Your answer tells you what you are not.

Flow Log. When did time vanish last week? What were you doing? Build your work around more of that.

Friction Marker. Where do small decisions turn into battles? Friction points often mean “not your lane.”

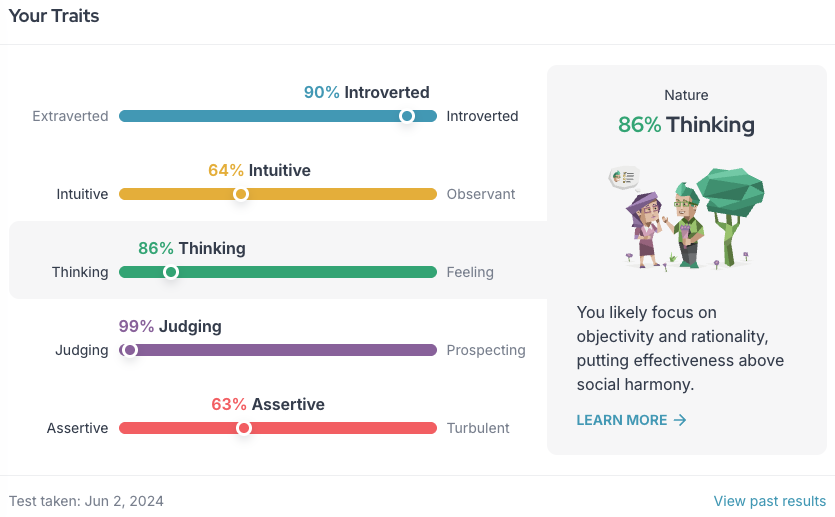

My personality result: Architect (INTJ-A).

The description fits. Architects like to build systems, not scenes. We think in frameworks, plan for contingencies, and prefer clear logic over social smoothing. We enjoy time alone, long problems, and finished work that holds up under scrutiny.

That bent explains why research feels like play to me and why I lose track of time when I’m knee-deep in filings or earnings calls.

The site also assigns a “role.” Mine is Analyst.

No surprise, I love researching, investing, and writing about it. Analysts lean on first-principles thinking. We want to understand cause and effect, not just outcomes. That bias shapes my process: I read, I model, I write deep dives, and I let the numbers and the narrative meet in the middle.

My “strategy” result, Confident Individualism, also rings true.

I like doing things on my own terms and judging my work by internal standards, not by applause. I’m happy to collaborate, but I don’t chase consensus. I’d rather be correct than popular. That stance keeps my circle small and my focus sharp.

Seeing these results helped me make a choice: instead of “fixing” my weaknesses (shouldn’t we all be a bit more extroverted?), I doubled down on my strengths and architected my life around them.

Here’s what that looks like in practice:

I protect two deep-work blocks for reading and writing. Phone off. Browser closed.

I run a memo-first research flow. If I can’t explain a thesis in plain English, I don’t buy.

I keep meetings short and scarce. I use email and docs when possible.

I design checklists and exit rules in advance. Structure frees me to think.

I pick investments that reward patience, not constant action.

You can do the same with your result. If you get Defender or Mediator or Commander. Use it as a hypothesis. Ask, “What schedule would make this type thrive?” Then test it for a month. Keep what works. Drop what doesn’t. The point isn’t to lock yourself in a box. The point is to stop fighting yourself.

Two cautions. First, these tests are blunt tools. They highlight tendencies, not fate. Your behaviour lives on a spectrum and moves with context. Second, leaning into strengths doesn’t mean ignoring gaps. It means covering gaps with design. I pair my independence with feedback loops: a red-team friend who punches holes in my ideas, a written error log, and preset kill rules. That way, I stay in my lane without getting tunnel vision.

If you take the test, here’s how to make it useful:

Underline one sentence from your type that feels most true. Build a daily habit that amplifies it.

Underline one sentence that feels risky. Build a guardrail against it.

Plan one experiment that shifts your calendar toward fit: more deep work, fewer status meetings; more reading, fewer alerts; more making, less talking about making.

Mismatch Is a Risk, In Markets and Life

Your nature shapes how you handle drawdowns, uncertainty, and boredom. If you enjoy speed and derive energy from action, a slow compounder strategy may wear you down. You may over-trade because you crave stimulation. If you like slow thinking, a scalping strategy will grind you down in a different way. You will hate your days and then hate your results. Risk is not only volatility or leverage. Risk is also the mismatch between you and your method. Mismatch breaks more portfolios than bear markets do.

You can apply the same idea beyond investing. If your nature draws you to teach and build community, lean into that. Start a small group. Share your work. Mentor someone. If you need long solo stretches, honour that. Do not chase roles that trap you in meetings and politics. Pay attention to how you feel at 10 a.m. on a Tuesday. If you dread the day, change the design of the day.

Another point from Dalio’s line: matching life to your nature is not a selfish move. It is a service move. When you live in your right lane, you produce better work, and you are easier to live with. You bring more patience and more care. You model a path for others. We all want to be around people who like the work they do.

A few additional notes on the process:

It will cost you something. You may give up status or easy praise. You may take a pay cut for a while. I did. It was worth it.

It is never done. Your nature stays stable, but the shape of your work will keep changing. Keep tuning.

If you are early in your career, this is the best time to explore. Try many styles. You do not marry the first person who smiles at you. I tried day trading, futures, and currencies. I learned fast that they were wrong for me. That data was gold. If you are later in your career, you can still change lanes. Do it with small steps. Keep your runway long. Run tests. Stack the right habits. It is never too late to make your days feel like your days.

In the end, this is about agency. I do not believe in a grand secret. There is no one formula. There is your nature, and there are the choices that match it. You can design a life that fits like a well-worn shirt. It takes time and a few honest questions. It takes saying no to paths that look good on LinkedIn but feel wrong at 10 a.m. on Tuesday.

Portfolio Update

After a choppy start to August, the portfolio moved higher this week. The gap keeps widening because stock selection is pulling its weight.

Month-to-date: +1.8% vs. the S&P 500’s +0.8%.

Quarter-to-date: +4.7% vs. the S&P 500’s +3.0%.

Year-to-date: +15.8% vs. the S&P’s +8.6%, a gap of 712 basis points.

Since inception: +24.5% vs. the S&P 500’s +11.1%. That’s 2.2x the market.

Portfolio Return

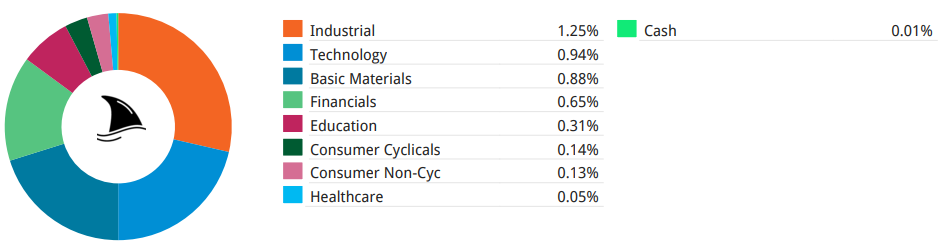

Contribution by Sector

All sectors contributed to the gains this week, led by industrials, tech and gold.

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+63 bps CLS 2.17%↑ (TSX: CLS)

+21 bps AGX 0.00%↑

+18 bps POWL 0.00%↑

+15 bps LRN 0.00%↑

+15 bps TSM 0.00%↑

+7 bps OPFI 0.00%↑

-3 bps KINS 0.00%↑

-4 bps MFC 0.00%↑ (TSX: MFC)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: