Weekly #41: Tariffs 2: Why This Sequel Might Flop

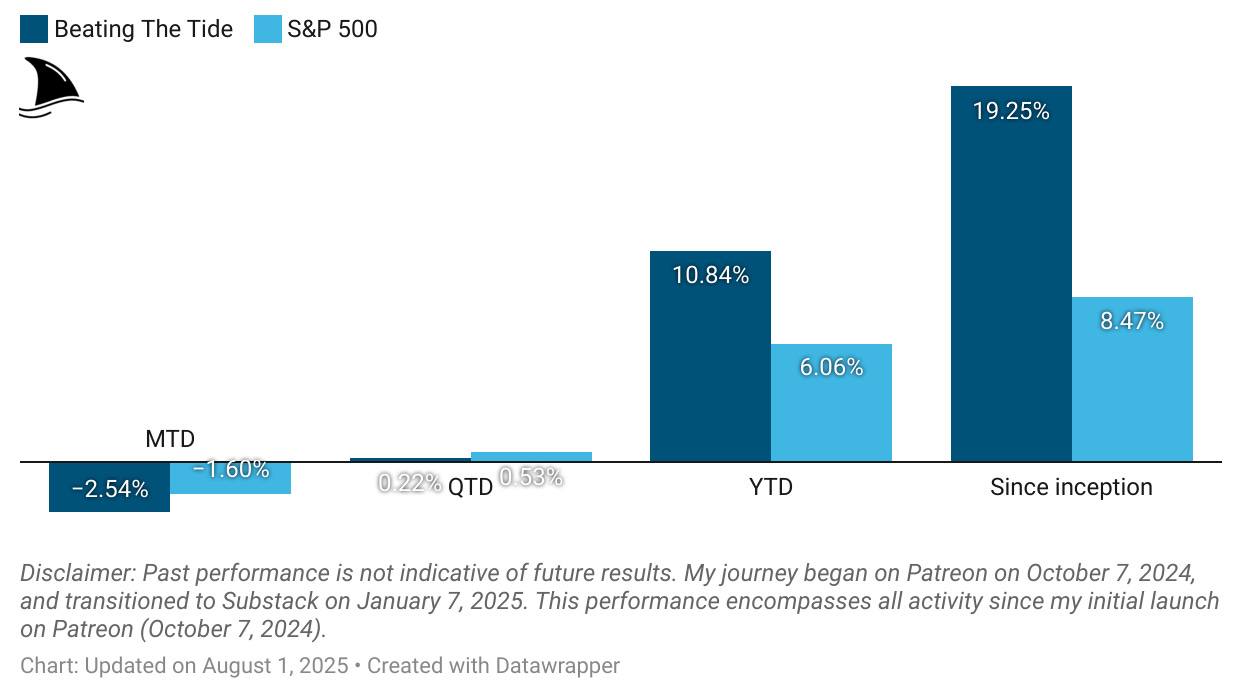

We’re down 2.5% for August, still up 10.8% YTD. Celestica pops after Q2 earnings beat. Renewed tariff and recession fears drag markets.

Hello fellow Sharks,

Our portfolio was green until Thursday… and then Friday came. We are down -2.5% for the month, but still +10.8% YTD and sitting at 2.3x the market return since inception. (If you want to skip ahead to the Portfolio Update, click here.)

🚨Be aware of scammers

Last week, I noticed two accounts were impersonating me. I reported both to Substack. One account is still up, and one account removed my picture and name. The differences are subtle; there was a minor change in the handle.

My handle is @beatingthetide, not @beatingtihetide nor @beatinggthetide.

Funny thing, one of the accounts was trying to sell my ‘trading decisions’ based on ‘technical analysis’ prepared by ‘my team’… I know most of you wouldn’t fall for that, as I invest (don’t trade), do not use technical analysis and do not have a team of experts (this is a one-man show!).

If they try to add you or contact you, please report them or email me, and I will take care of it.

So with that out of the way, let’s start!

In this Weekly, I go over what happened on Friday and go over CLS earnings results, our top performing position for the week.

Also, a heads-up:

This Wednesday, I’ll be releasing the next deep dive and trade alert to paid subscribers. It’s on a company that already doubled in the past year, and I still see meaningful upside from here.

If you’re on the free list and don’t want to miss it, now’s the time to upgrade. It’s $130/year; one trade alert can easily pay for that (and then some).

Enjoy the read!

~ George

Table of Contents:

CLS Q2 Earnings Result & Revised Target Price

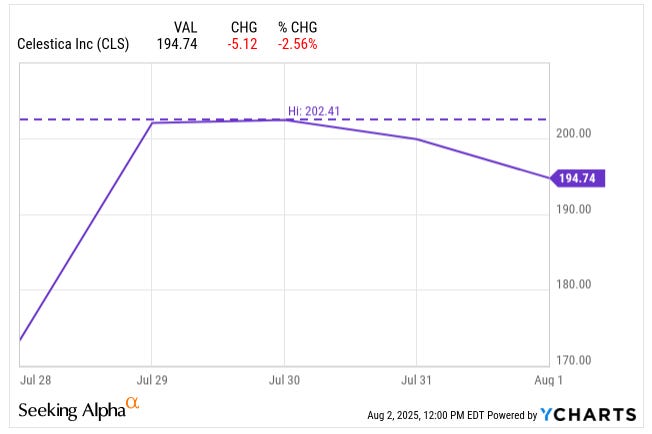

Last week, CLS released Q2 earnings, and they were excellent. So good, in fact, that the stock popped 17% after the release to $202/share, but by Friday it settled around $195/share.

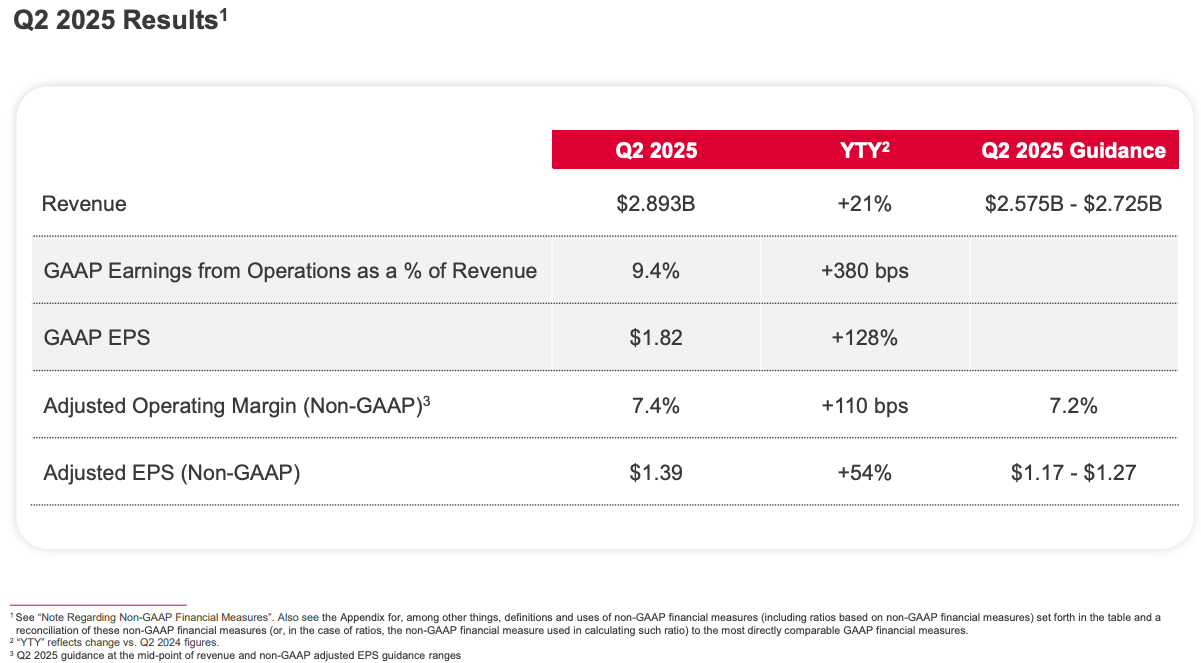

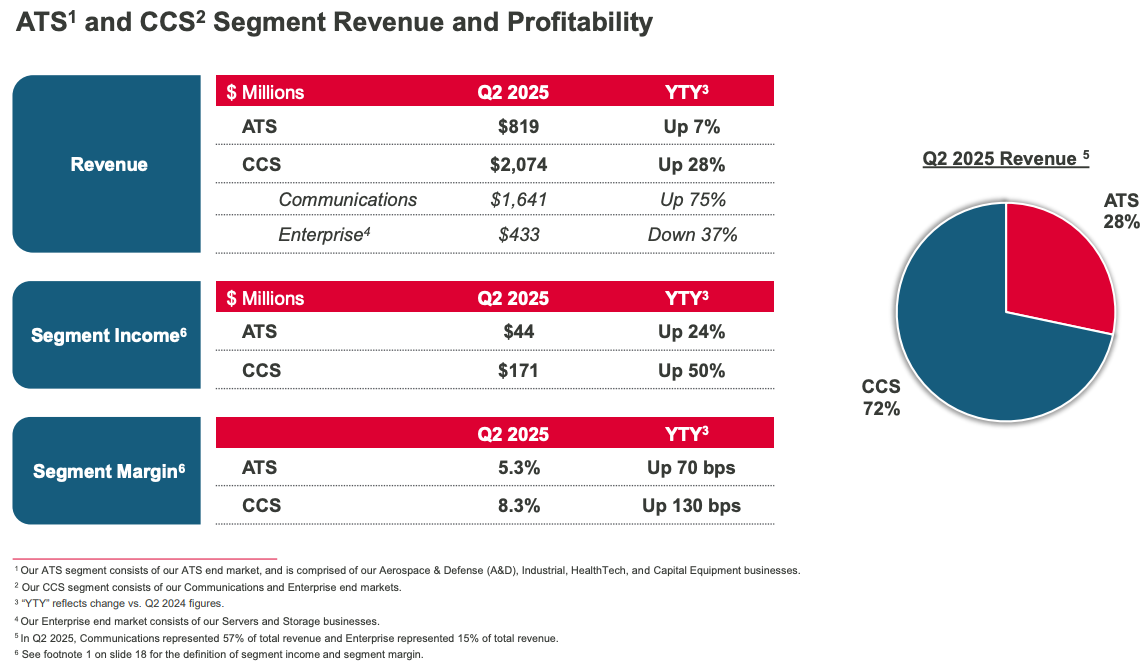

Celestica reported revenue of $2.89 billion, crushing their own guidance range and up a solid 21% y/y. Adjusted EPS landed at $1.39, way above expectations and a robust 54% increase compared to last year. What I think was impressive was the jump in adjusted operating margins to 7.4%, another record high for CLS.

Digging deeper into the segments, CCS was the star performer, growing revenue 28% y/y, driven by explosive 82% growth in HPS, now making up 43% of total revenue.

On the flip side, the Enterprise sub-segment within CCS declined 37%, but even this beat guidance expectations.

Meanwhile, the ATS segment grew at a healthy 7%, thanks to robust demand in capital equipment and industrial businesses. Margins improved nicely to 5.3%, primarily from gains in the Aerospace & Defense division.

During the earnings call, analysts zeroed in on the sustainability of this growth. Citigroup’s analyst asked about the long-term visibility of the booming hyperscaler demand for networking products. The CEO noted that the strong demand, particularly for 800G and 400G networking switches, is driven by hyperscalers ramping up data center infrastructure for AI applications, and he sees this continuing well into 2026. UBS’s analyst questioned whether the impressive margin expansion is sustainable, to which the CFO pointed out that continued mix improvement towards higher-margin HPS products and operational efficiencies support further margin upside.

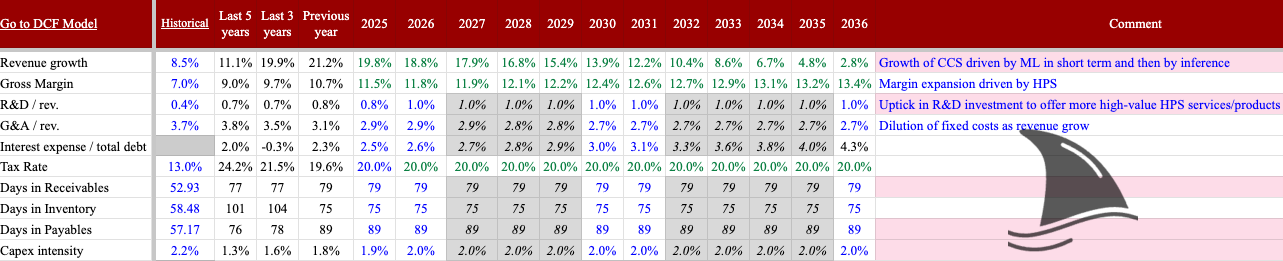

When I initially recommended Celestica, my target price was $153 USD (you can refer to the valuation here). But given the robust results in the last couple of quarters and my more bullish outlook for both sales growth and margin improvement, I refreshed my valuation assumptions.

Incorporating the latest sales trajectory, segment outlooks, and margin trends, the updated fair value now sits comfortably at $253 USD.

Bottom line: CLS continues to deliver, and the momentum seems far from slowing.

Thought of the Week: Sequels Tend to Suck

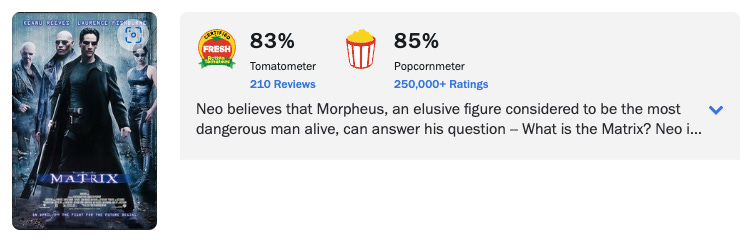

I’m a big sci-fi guy. One of the best stories in a sci-fi movie, in my opinion, was The Matrix. The first time I watched it, I was hooked: the slow-motion bullet dodging, the red pill vs. blue pill, the whole “what if we’re in a simulation?” premise. It was original, edgy, and mind-bending in all the right ways. The movie resonated with many viewers as it was reflected in the great reviews.

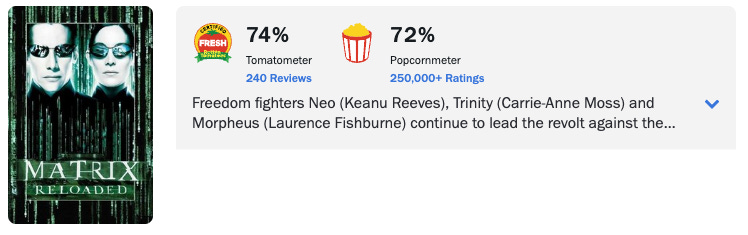

Then The Matrix Reloaded came out. And yeah, it had some cool scenes but it was more of the same, just louder and messier. The market agreed with me as reflected in the reviews.

The third movie, Revolutions, tried to wrap it all up and just left us confused and unsatisfied.

And don’t even get me started on the fourth one (Resurrections). I’m still not sure if it was a parody or a serious attempt.

Sequels tend to disappoint because they lack the shock factor and originality of the first. They rely on recycled tricks and tired plotlines.

Why am I talking about sequels and The Matrix franchise in an investing newsletter?

Because on Friday, the market reacted to Trump Tariffs: Reloaded. We’ve seen this movie before. Back in April, the mere whispers of tariffs sparked panic and led to a sharp pullback. This time, the actual rollout caused a 2–3% dip across major indexes. But while investors may be bracing for a repeat of the original, I’m not convinced this sequel will pack the same punch.

Here’s why.

We’ve seen this script before. Companies have had time to prep. Many already stockpiled inventory ahead of the deadline or adjusted supply chains. The knee-jerk uncertainty from Round 1 isn’t as acute this time. The Yale Budget Lab estimates average U.S. tariff rates have risen from ~2% to ~18%, the highest since the 1930s, but unlike April, many firms anticipated this move.

Some deals were struck. The EU, Japan, and South Korea all reached partial or full agreements. That leaves tensions mainly with China, Mexico, Canada, India, and Brazil. It’s not nothing, but it’s not a total trade war redux either.

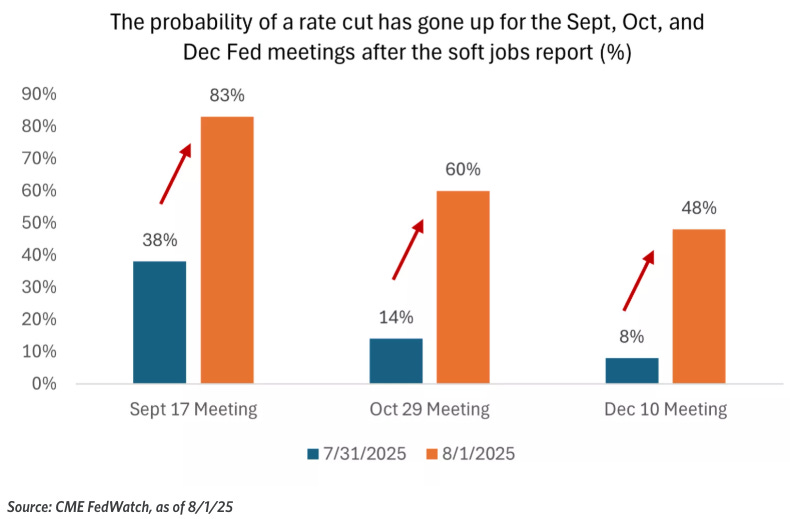

The Fed is now more flexible. After Friday’s weak jobs report (only 73,000 new jobs in July) and significant downward revisions to past months, the market is pricing in an 83% chance of a September rate cut.

That wasn’t on the table last time around. So unlike in the original tariff scare, the Fed might act as a buffer instead of standing on the sidelines.

So yeah, the market dropped on Friday. But let’s not overstate the sequel’s power. It’s loud. It’s messy. But it’s also more predictable.

That said, I won’t pretend everything’s rosy.

This week delivered a flood of economic data that raised eyebrows. Q2 GDP came in strong at +3.0%, helped by resilient consumer spending, but the worry isn’t growth; it’s PCE inflation. June’s PCE inflation came in hotter than expected: +2.6% y/y, up from 2.4% in May.

And while prices are heating, the labour market is cooling.

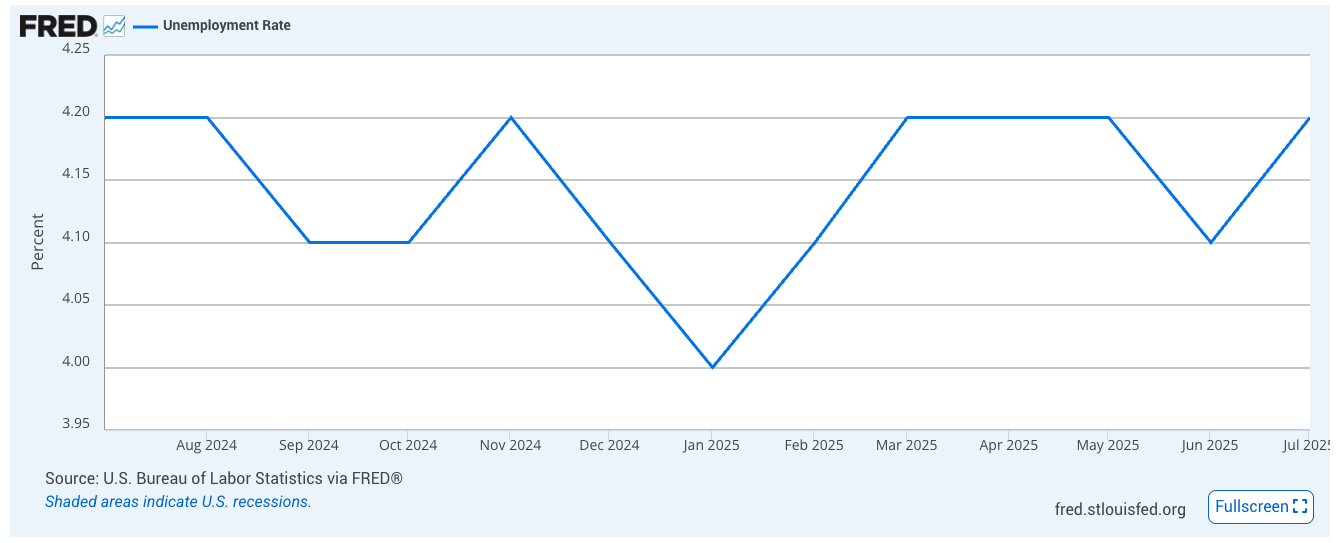

JOLTs job openings fell from 7.7 million to 7.4 million. The unemployment rate ticked up to 4.2%.

Not terrible in isolation, but add that to stickier inflation, and we get whispers of a stagflation-lite scenario. That’s why recession chatter picked up again, not because growth is falling off a cliff, but because inflation isn’t backing off and the labour market is losing some steam.

So yeah, the selloff might continue next week. Maybe we retest April’s dip. Or maybe markets take a breath and stabilize.

The reality is that I don’t know what will happen next week.

What we do know is that these moments can be prime opportunities.

Remember the April drop? Remember how we capitalized on TSM during previous volatility.

We bounced back stronger.

Stay prepared, avoid using margin, and focus only on quality companies.

Stick to our strategy, and market noise can become your ally.

This is the way.

Portfolio Update

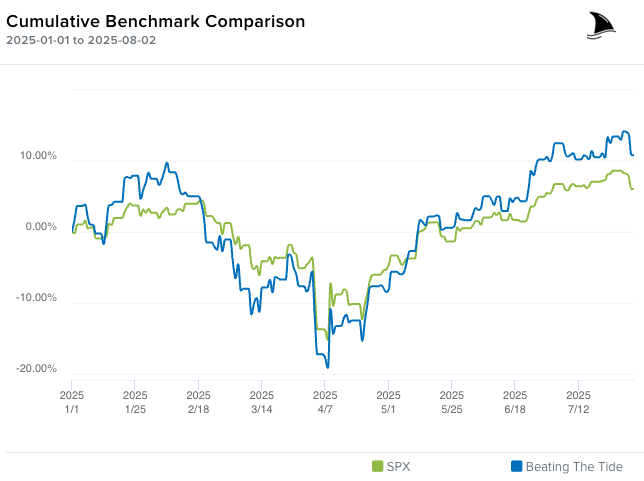

This week, we were up until Thursday, but gave it all back on Friday and some more.

Month-to-date: -2.5% vs. the S&P 500’s -1.6%.

Quarter-to-date: +0.2% vs. the S&P 500’s +0.6%.

Year-to-date: +10.8% vs. the S&P’s +6.1%, a gap of 478 basis points.

Since inception: +19.3% vs. the S&P 500’s +8.5%. That’s 2.3x the market.

Portfolio Return

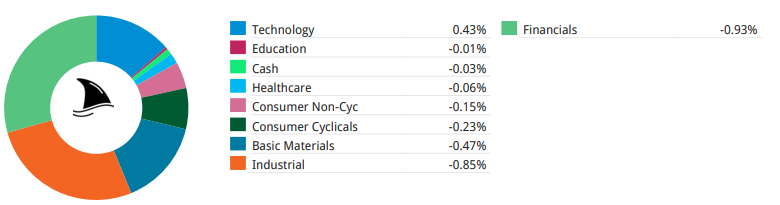

Contribution by Sector

Tech was the only sector to finish the week in the green, thanks largely to CLS’s strong performance. Every other sector ended in the red, weighed down by Friday’s flood of negative news.

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+123 bps CLS 2.17%↑ (TSX: CLS)

+6 bps DXPE 0.00%↑

-1 bps LRN 0.00%↑

-3 bps KINS 0.00%↑

-9 bps MFC 0.00%↑ (TSX: MFC)

-16 bps AGX 0.00%↑

-17 bps OPFI 0.00%↑

-24 bps POWL 0.00%↑

-24 bps TSM 0.00%↑

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

Thanks for the clear-eyed update. Market selloffs tied to tariff drama often spark panic, but like you said, sequels rarely deliver the shock of the original. The fact CLS crushed earnings and the portfolio is still well ahead of the market shows disciplined investing pays.

Volatility is a given, especially with inflation stickiness and the Fed’s moves in play. Staying focused on quality names and avoiding margin is exactly the right call now.

Your performance numbers speak volumes — 2.3x market since inception is impressive, and that kind of track record beats chasing headlines every day.

Keep navigating the noise with patience and strategy. This is the way.