Weekly #69: Why I Respect Cemex More Than Ever and Still Won’t Buy It Here

Portfolio +11.3% YTD, 3.0x the market since inception. Plus why I am not buying Cemex stock right now.

Hello fellow Sharks,

The S&P 500 and the portfolio both retracted this week. But the portfolio retracted less than the S&P 500. So while the S&P 500 is flattish YTD (-0.1%), the portfolio is up +11.3%. If you want to skip straight to the numbers, jump to the Portfolio Update.

This week I have been working from the clinic on my laptop, so I haven’t been able to get much done (don’t worry, nothing serious; my mother had a scheduled procedure, she is fine).

As I mentioned in the past, I have been reviewing non-US companies to add to the portfolio. Last week I reviewed Cemex. It is a company that I have covered for more than a decade. I think the company has made some great changes. The macro is supporting the stock (everyone loves Mexico), but as I will explain below, we are too late to the party and should wait for a better entry point.

Enjoy the read, and have a great Sunday.

~George

Table of Contents:

Thought Of The Week: Why Cemex Rewards Timing

I have covered Cemex for more than a decade. I recently found an old presentation I prepared in 2014 while working at Moneda.

Download the 2014 presentation

The industry was different then. Cemex struggled with debt. I saw a company that could not generate returns above its cost of capital. Back then, the stock traded at $12. I issued a short recommendation with a target value of $9.80. I argued that the market was too optimistic about plant use in Mexico and the United States. I worried about currency risks in emerging markets. My target was roughly 20% below the market price. The actual outcome was much more dramatic. The stock did not just drop to $9.80. It crashed all the way to $4.

I underplayed the impact of the cyclicality. I learned a valuable lesson that year. Heavy construction materials are the ultimate cycle. When the tide goes out, it goes out much further than you expect.

Today, Cemex trades at $12.90. The fundamentals of the business still look like my 2014 slides. The business moats are real. This is true in Mexico. But I think the stock is almost fully priced now. My fair value estimate is $15.20. That is only a 17% upside.

From my experience, this ticker is a great swing trade. You buy it at $5 and you sell it at $12. It might go up a bit more before it turns.

The good news from Latin America is driving the current momentum. The Mexican stock market is way up since Jan 2025.

I think we should wait for the cycle to turn again. I will wait to buy it at $5. The fundamentals remain valid. The business has undergone a profound transformation.

A history of growth and the Rinker nightmare

Cemex began in 1906 in northern Mexico. It spent its first 70 years consolidating Mexican plants. It was listed on the Mexican stock exchange in 1976. The company began its international journey in the 1990s. It expanded into Spain and then South America. In 1999, it listed its shares on the New York Stock Exchange. Each share you buy on the NYSE is an American Depositary Share. One ADS represents ten certificates listed in Mexico. Those certificates represent thirty common shares.

The company grew through huge acquisitions. It bought Southdown in 2000 for $2.9 billion. It bought RMC Group in 2005 for $5.8 billion. The biggest mistake happened in 2007. Cemex bought Rinker in Australia for $14.2 billion. This happened just before the global financial crisis. The housing market collapsed. Cemex was stuck with billions in debt and no customers. I watched the company fight for its life for the next decade. It sold assets and refinanced debt. It stopped paying dividends. It focused on survival.

The transformation reached a milestone in 2024. Cemex regained its investment-grade rating. This was a decade in the making. Management reduced the leverage ratio to 1.81x EBITDA by late 2024. They sold non-core assets in the Philippines and Guatemala. They even sold their operations in the Dominican Republic.

The company I see today is lean. It focuses on the United States, Mexico, and Europe. These three regions now provide 90% of the operating flow. It is no longer a sprawling, indebted giant. It is a focused player in the world’s best construction markets.

How Cemex turns rocks into cash

The business of cement is simple. You dig rocks out of the ground. You heat them until they change. You grind them into a powder. Then you sell that powder to people building things. Cemex makes money through four main lines. These are cement, ready-mix concrete, aggregates, and urbanization solutions.

Cement is the most important part. It is the glue of construction. Cemex makes it by mining limestone and clay. These materials go into giant kilns. The kilns reach temperatures of 1,450 degrees Celsius. This creates clinker. Cemex then grinds the clinker with gypsum to make the final powder. This process is very energy-heavy. Fuel and power make up about 35% to 60% of the cost.

The second line is ready-mix concrete. This is a service business. Cemex mixes cement with water and aggregates. They deliver it in those trucks with rotating drums. You have to use concrete within 90 minutes of mixing. This means you can only sell to customers close to your plant. It is a local business.

The third line is aggregates. These are rocks, sand, and gravel. Aggregates have the best margins. You just pull them out of the ground and wash them. They are very heavy. They are even harder to move than cement. This creates a natural moat. If you own the quarry near a big city, you win.

The fourth line is Urbanization Solutions. This is the new part of Cemex. It focuses on green building and recycling. It provides 3D printing for houses. It recycles construction waste. This segment grew its EBITDA contribution to 8% of the total in 2025. It is a high-growth area with higher margins than the traditional cement business.

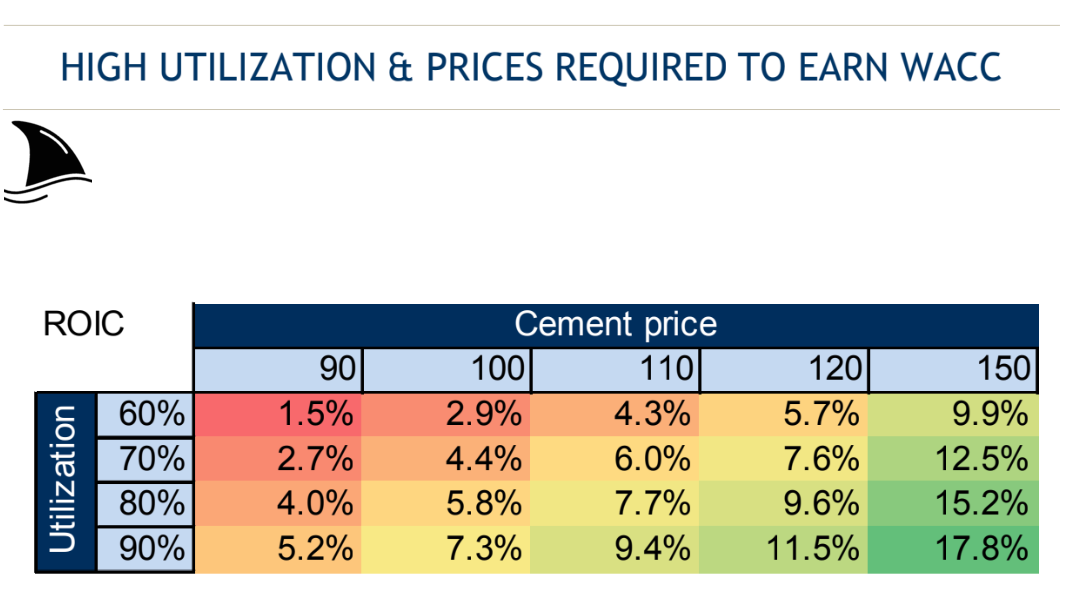

The unit economics of a plant

I still like to explain cement with one simple plant math model. I built it in 2014. The exact dollars changed since then. The shape of the business did not.

In that 2014 deck, I used a clean example:

I also baked in the annoying truth that hauling this stuff costs real money, so distance caps your market. Cement stays local because trucks and fuel force you into it.

Fast forward to 2026, and I would not reuse those exact inputs. I still reuse the logic.

Capex moved. Industry groups in Europe still call cement one of the most capital-intensive industries, and they put the investment cost of a new cement plant above €150M to €200M per 1 million tonnes of annual capacity. And if you want to bolt on serious decarbonization, the same sources talk about €200M to €500M for a capture plant.

Prices moved, too. The latest USGS Mineral Commodity Summaries show an average U.S. mill unit value around $160 per metric ton in 2024 and 2025. That does not mean every market clears at $160. Cement never does one global price. It does your local price plus freight.

So the story stays the same:

Utilization runs the whole show.

When a cement plant runs pretty full, the fixed cost gets spread across a lot of tons, and margins look magical. When the plant runs “kind of empty,” fixed cost turns into a brick on your ankle. ROIC falls fast. You still pay the same people, you still run the kiln, you still maintain the plant, and you still carry the depreciation. You just sell fewer tons to cover it.

That is why the sector feels bipolar. A small volume drop does not just trim profit. It can erase it. A small volume lift does not just help. It can make you look like a genius. The cycle does not need a hurricane to hurt you. It just needs demand to go from “good” to “fine.”

One more point that matters in 2026: distance still sets the boundaries.

The old rule of thumb that people used to say cement could not be hauled economically beyond 200 to 300 km. Cement Europe makes the same point in a softer way by describing shorter transport distances in Europe and how land transportation costs matter.

So yes, my 2014 unit economics table looks dated on the numbers. It looks current on the physics.

That is the message I want you to keep: cement plants do not print money because cement feels “in demand.” They print money when local demand stays high enough to keep the plant full enough, long enough, to beat the cost of capital.

The current landscape and growth levers

The construction industry is healthy right now. Three big trends are helping Cemex. These are nearshoring in Mexico, infrastructure spending in the US, and the Mexican social housing push.

The nearshoring wave in Mexico

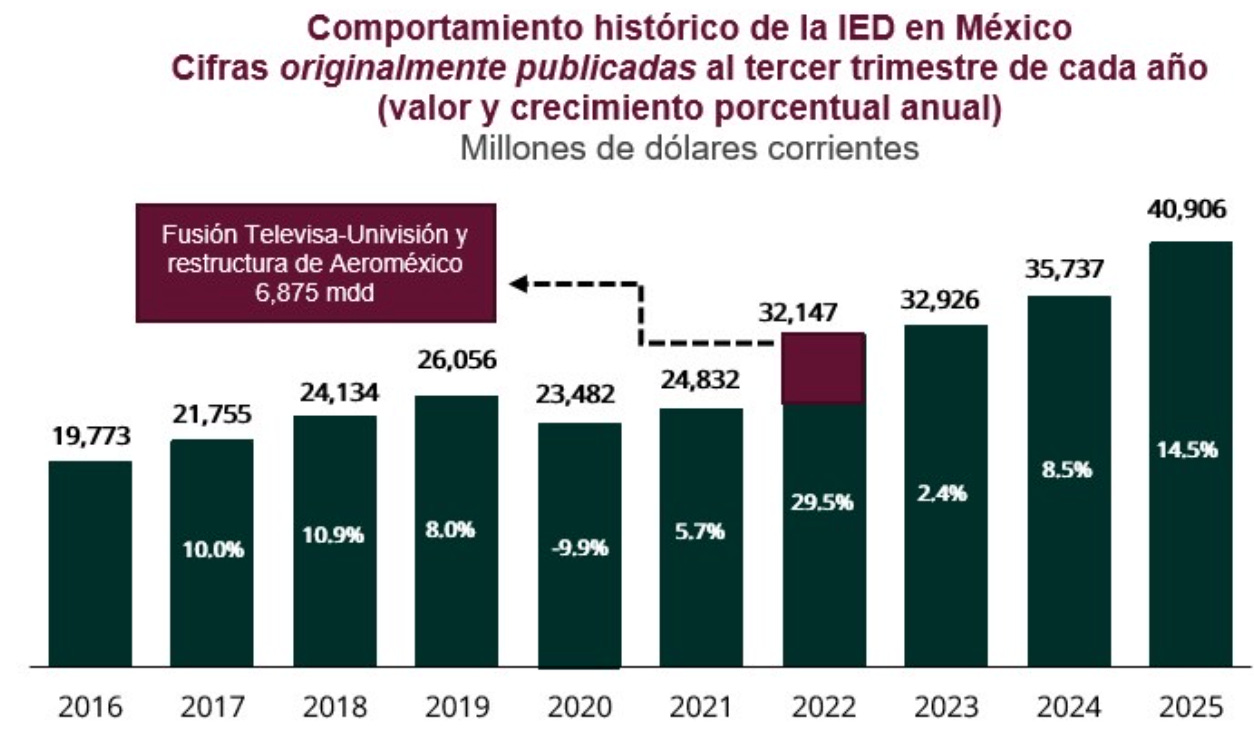

Companies want to build factories in Mexico instead of China. This is nearshoring. Mexico reached a record of $41 billion in foreign direct investment in 2025.

Manufacturing makes up 37% of that money.

These factories need massive amounts of concrete and cement. Cemex owns the best locations in northern Mexico. In Nuevo Leon, the economy grew by 3.8% in 2025. That is double the national average. This industrial build-out is a long term win for Cemex. They do not just sell cement for the factories. They sell urbanization solutions for the roads and housing around them.

US Infrastructure and peak spending

The US government passed the Infrastructure Investment and Jobs Act. This bill provides $1.2 trillion for roads and bridges. Only half of that money has been alloctaed and 1/5 spent. The peak spending year is 2026.

Cemex is a leader in the US Sun Belt. They operate 8 cement plants and nearly 50 aggregate quarries in the US. The US business is becoming the engine of the company. US EBITDA grew from 19% of the total in 2015 to 31% in 2024. Management wants it to reach 40% soon.

Mexican housing goals

The new Mexican government wants to build 1.8 million social homes by 2030. They plan to build 400,000 homes in 2026 alone. This is a massive project. It will drive huge demand for bagged cement.

In Mexico, many people build their own homes one bag at a time. This is a very profitable market for Cemex. The government is also investing in rail lines and airports. One project is the AIFA Airport to Pachuca rail line. These projects provide a steady stream of work for years.

Competitors and the Cemex edge

Cemex is not alone. It fights with giants like Holcim and Heidelberg Materials. In the US, it competes with Vulcan Materials and Martin Marietta. I believe Cemex has a structural edge in its core markets.

Vertical integration

Cemex owns the entire chain. They own the rocks. They own the kilns. They own the trucks. This is vertical integration. It lets them control the quality and the timing. If you are a big builder, you want one partner. Cemex provides that.

Project Cutting Edge

Management is focused on costs. They launched Project Cutting Edge in 2024. The goal is $400 million in recurring savings by 2027. They use AI to run their plants. AI models adjust the kiln settings thousands of times a day to save fuel. This helped lower energy costs per ton by 12% in 2025.

They also reduced their corporate headcount. Half of the savings come from overhead. The other half comes from plant efficiency.

The green pivot

Cemex is building a global low-carbon platform. Their Vertua line of products is the leader in this space. Vertua cement sales reached 63% of the total in 2024. These products have a lower CO2 footprint.

In Europe, the rules are getting very strict. The government is removing free carbon allowances. This makes it expensive for dirty producers to operate. Cemex is already five years ahead of its 2030 targets in Europe. They are turning a regulatory risk into a competitive moat.

Management and capital allocation

Jaime Muguiro became the new CEO in April 2025. He has been with Cemex for 30 years. He previously ran the US operations. He seems to be a results-focused leader. I like that the new boss comes from the fastest-growing part of the business. He understands the US market. He is focused on operational excellence and shareholder returns.

The capital allocation strategy has completely changed. For years, every dollar went to debt, which was a great strategy, more than halving net debt over a decade.

Now, the company is returning cash to investors. They proposed an annual cash dividend of $180 million for 2026. That is a 40% increase.

They also started a $500 million share buyback program. They repurchased 8 million certificates in early February 2026. Management is also doing bolt-on acquisitions. They bought Couch Aggregates to expand in the US mid-south. This is a smart use of cash. Aggregates have higher margins and lower maintenance costs than cement plants.

The valuation math for CX

My DCF result is $15.20 per ADS. The stock currently trades at $12.90. This leaves a 17% upside. I used a WACC of 9%. This is based on an unlevered beta of 1.02 for construction supplies. This beta is corrected for cash.

Below are the main assumptions in the model.

I expect revenue to grow by 7% in 2026. This is driven by high prices and low-single-digit volume growth. Long term, I assume 3% growth. This is in line with global GDP. I forecast a gross margin of 33.5% for 2026. This includes the savings from Project Cutting Edge. Over the long term, I use a margin of 32.5%. This is the 5-year average plus structural savings.

I expect SG&A to be 21%of revenue in 2026. This will fall to 20.5% long term. The company is cutting IT spend by $61 million in 2026. Capex intensity will be 6.5% of sales. This reflects management’s plan to constrain spending. The tax rate should stay around 23%.

I keep working capital efficiency stable. I assume days in receivables, inventory, and payables stay roughly flat over time. This matters because Cemex has run working capital well, including negative working capital days in 2025.

That helps cash flow. But I don’t assume it improves every year. In fact, management’s own guidance framework implies that working capital can be a use of cash when activity increases.

Why am I cautious?

The fair value of $15.20 assumes everything goes right. It assumes the US infrastructure peak happens as planned. It assumes a stable Mexican peso. It assumes energy costs only rise by a mid-single-digit rate.

The biggest risk is the cyclicality I learned about in 2014. If volumes drop more than expected, margins will collapse. Fixed costs are high. In late 2024 and early 2025, we saw this happen. Heavy rain and high rates hit the US and Mexico. Sales volumes fell. EBITDA fell 11% in some segments.

Cemex saved the day with price hikes. But you can only raise prices so much before customers stop buying. If the US enters a recession in 2026, the peak spending from the infrastructure bill might not be enough.

The verdict: Wait for the tide to turn

Cemex is a much better company today than it was 11 years ago. It has solved its debt problem. It has regained its investment-grade status. It is a leader in green building. Management is finally returning cash to shareholders. These are all great things. If you bought the shares at $5, you should be very happy.

But I am not a buyer at $12.90. The upside to my fair value is too small. The margin of safety is thin. Historical trends show that CX is a cycle stock. It goes from $5 to $12 and back again. Right now, the momentum of good news from Latin America is keeping the price high. Everyone is talking about nearshoring. Everyone is excited about the 1.8 million homes.

This is usually when the top of the cycle happens.

Portfolio Update

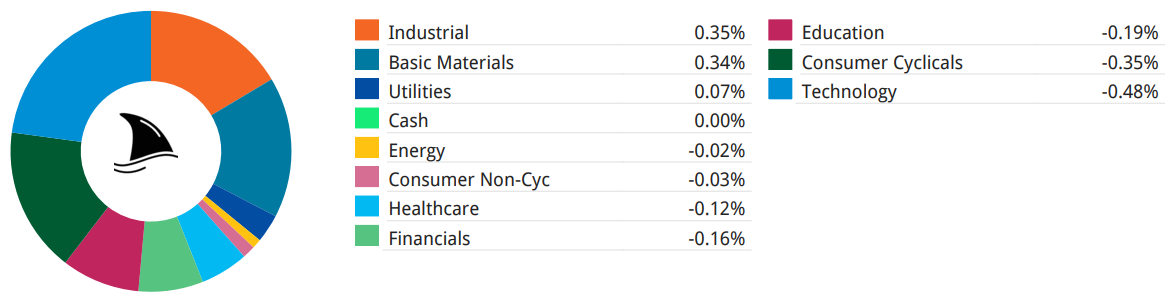

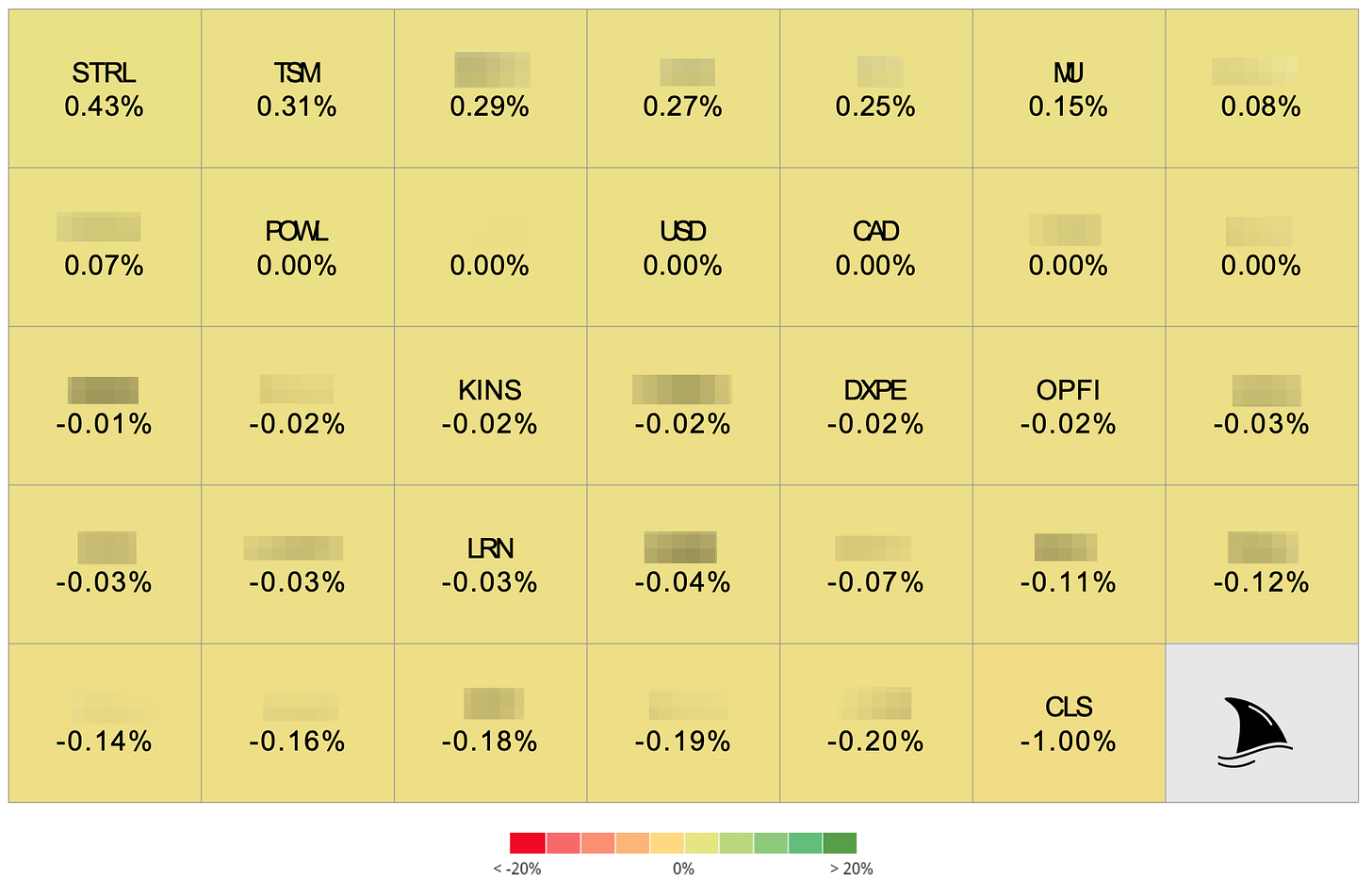

While the portfolio ended in the red this week, it outperformed the S&P 500.

Portfolio Return

Month-to-date: +5.4% vs. the S&P 500’s -1.5%.

Year-to-date: +11.3% vs. the S&P 500’s -0.1%. That is a gap of 1,146 points.

Since inception: +57.1% vs. the S&P 500’s +18.9%. That’s 3.0x the market.

Contribution by Sector

Industrials and gold led the gains this week, partially offset by tech.

Contribution by Position

(For the full breakdown plus commentary on earnings results and the big movers, see Weekly Stock Performance Tracker)

+43 bps STRL 0.00%↑ (Thesis)

+31 bps TSM 0.00%↑ (Thesis)

flat POWL 0.00%↑ (Thesis)

-2 bps KINS 0.00%↑ (Thesis)

-2 bps DXPE 0.00%↑ (Thesis)

-2 bps OPFI 0.00%↑ (Thesis)

-3 bps LRN 0.00%↑ (Thesis)

-100 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: