Weekly #31: 10 Timeless Investing Lessons from Warren Buffett That Still Beat the Market

The portfolio has delivered 9x the return of the S&P 500 — here’s what Warren Buffett’s wisdom teaches us about long-term investing, valuation discipline, and avoiding costly mistakes.

Hello fellow Sharks,

This week, the S&P 500 returned -2.64% and our portfolio -1.57%. Since launching this newsletter, the portfolio has returned +8.22% while the S&P 500 has returned just +0.90% in the same period. (If you want to skip straight to the portfolio update, click here.)

On March 30, I sent a survey in Weekly #23 to better understand what you value from this newsletter, what you would like to see more of and what could be reduced and eliminated. Some of the feedback such as moving the Portfolio Update to the bottom of the Weeklies I applied right away but there were some others that I held off as I didn’t want to integrate many changes during the volatile times of the tariff saga.

But now that that is mainly behind us (for now 🤔), I will be making the following change:

I will be closing Portfolio Canada

Moving three positions from Portfolio 🇨🇦 to Portfolio 🇺🇸: CLS 0.00%↑ , MFC 0.00%↑ and IAG 0.00%↑ (TSX: IMG)

Renaming Portfolio 🇺🇸 to Global Portfolio

Most subscribers found Portfolio Canada more distracting than value-added, so I’m streamlining the focus to the core portfolio. Since its inception, Portfolio 🇨🇦 returned 9.54% vs. 8.98% for the TSX. If you are curious about the latest portfolio, it is below.

This week’s Thought of the Week highlights 10 timeless investing lessons from Warren Buffett’s shareholder letters — insights that still shape smart investing today.

Happy reading and have a great Sunday.

~George

Table of Contents:

In Case You Missed It

This week, I sent a trade alert to close the URI position. Also, I followed up with a deep dive/post-mortem for URI 0.00%↑:

I closed the URI position at around $725 because, given the cyclical nature of the equipment rental market, it seemed like the perfect moment to lock in profits. Even though I continue to believe in URI’s strong fundamentals as a best-in-class operator in a growing industry, the recent run has priced in most of the upside already. Securing a 33% gain from when I added the position not only preserves our profits but also positions us for a potential re-entry later when the cycle creates a more attractive risk/reward setup. This approach is all about capitalizing on the current market exuberance while staying mindful that a pullback could offer an even better opportunity down the line.

10 Timeless Investing Lessons from Warren Buffett (That Still Work Today)

(Adapted from my LinkedIn newsletter, Weekly Investing Fundamentals)

I still remember it vividly: it was 2006, and I was browsing the Indigo bookstore at Bloor and Bay in search of an investment book. That’s when I stumbled upon The Intelligent Investor by Benjamin Graham. I was instantly hooked by the idea that stocks aren’t just ticker symbols — they’re ownership stakes in real businesses.

From there, it didn’t take long before I found Buffett’s letters. Page after page, his words reshaped how I thought about risk, value, temperament, and what actually matters in investing. Over the years, my style has evolved — a bit more active, a bit more opportunistic — but the foundation is still pure Buffett: think like an owner, focus on fundamentals, and stay within your circle of competence.

If you have been investing for a while, you know who Warren Buffett is. People claim that he holds the holy grail for investing; you find countless ‘investors’ claiming that they follow his investment approach. Berkshire Hathaway’s AGMs are like Woodstock for value investors—or maybe a pilgrimage to Mecca. Just like every Muslim is encouraged to go once in their lifetime, every value investor feels compelled to make that trip to Omaha.

At 94 years old, Warren Buffett is passing the CEO baton to Greg Abel, watch it below;

Now, as Buffett prepares to step down from his CEO role at Berkshire Hathaway after an epic 58-year run, I find myself reflecting on the wisdom he’s shared. His shareholder letters — not flashy or formulaic, just brutally clear and rational — are a masterclass in business and investing.

Buffett’s patient and disciplined approach has consistently created exceptional value. Berkshire Hathaway stock traded at $290 on May 18, 1985, and reached $809,350 as of May 2, 2025—an astonishing 19.3% annualized return over nearly 45 years. (The stock began trading in 1979, but I couldn’t locate reliable data going that far back.)

Adam Smith’s Wealth of Nations is a 530‑page tome that many quote but few have actually read. Buffett is often in the same boat: his quips are everywhere, yet most people haven’t read the primary sources — his annual letters. Pulling a line out of context can be dangerous.

Take the famous riff: “Our favorite holding period is forever” (Lesson 1 below). Too many interpret that as “buy and never sell.” Buffett never meant blind loyalty. He clarified that an investor should hold great businesses with the same tenacity an owner would exhibit if he owned all of that business. Tenacity, yes — but he’s also clear on risk‑reward: if the facts change or a clearly superior opportunity appears, reallocating is rational. Buffett demonstrated exactly that when he exited the airlines in 2020, saying "the world has changed" post‑COVID economics.

Reassessing risk and reward sometimes means holding Coca-Cola for 37 years—and other times, pulling the ripcord on airlines after just four. The principle is consistency of logic, not permanence of positions.

In this piece, I highlight 10 key lessons from Buffett that have truly stood the test of time. Each one is drawn directly from his annual letters (no second-hand summaries here!) and paired with real-world examples from recent years. Whether you’re just starting out or you’ve been doing this for decades, these Buffett-isms are worth engraving in your mind.

Let’s dive in.

1. Think Like an Owner, Not a Speculator

Buffett’s first lesson is simple but profound: treat stocks as pieces of real businesses. This means focusing on a company’s intrinsic value and performance, not the daily quote on your screen. Buffett emphasizes that what a stock does in any given quarter or year isn’t what matters; it’s the business results that count. “We do not measure the progress of our investments by what their market prices do during any given year”(2007), he wrote, explaining that he and Charlie Munger instead evaluate their performance by the two factors we control: the earnings the companies retain and invest for our benefit, and the market valuation of those retained earnings. In other words, ignore Mr. Market’s mood swings and keep your eyes on the enterprise itself.

This owner mindset guides Buffett’s famously long holding periods. “When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever” (1988). He’s not interested in flipping stocks for a quick profit. If a company is solid, Buffett is content to let years pass, allowing the business to compound value.

A great example is Apple. Berkshire started buying Apple in 2016; since then, Apple’s stock has had its volatile moments (a 30% drop in late 2018, for instance), but Buffett didn’t flinch (he sold minor stakes but kept his core position). He treated those shares like a long-term stake in Apple’s phenomenal ecosystem and cash machine. By 2023, Apple’s earnings and buybacks had significantly increased Berkshire’s ownership stake, and the stock price had more than doubled from its 2018 lows—a reward for thinking like an owner, not a jittery trader glued to the screen.

The takeaway: If you wouldn’t feel comfortable owning a company if the stock market closed for a few years, you might want to rethink owning it at all. Buffett’s approach reminds us that stocks aren’t just pixels on a chart — they represent real businesses with real profits, assets, and customers. Invest accordingly.

2. Stay Within Your Circle of Competence

Ever notice how Buffett famously avoided tech stocks for decades, saying he didn’t understand them? That wasn’t by accident. He was following another fundamental rule: stick to what you know. Buffett stresses that investors should define the boundaries of their “circle of competence” — the industries and businesses they can truly grasp — and not stray beyond them. “Charlie and I look for companies that have a) a business we understand; b) favorable long-term economics; c) able and trustworthy management; and d) a sensible price tag,” Buffett wrote in 2007. The very first item on that checklist is understanding the business. If it’s too hard to figure out how a company makes money or what its competitive advantage is, Buffett simply moves on.

In practice, this means passing on many investments, even trendy ones, if they’re outside your knowledge base. For example, during the cryptocurrency frenzy of 2017-2021, Buffett openly admitted he had no clue how to value Bitcoin (nor do I), so he stayed away (much to the chagrin of crypto evangelists). Similarly, Buffett avoided dot-com stocks in the late ’90s boom because they didn’t pass his understanding test. While he missed some huge short-term gains, he also avoided devastating losses when the bubble burst.

Contrast that with investors who piled into complex “hot” sectors they didn’t truly grasp — like biotech startups with no revenues or obscure SPACs — only to see their capital evaporate. A more recent case: many folks bought into flashy electric vehicle startups via SPAC mergers in 2020, not fully understanding the auto business; a lot of those stocks crashed 70-80% by 2022 when reality (production challenges, competition, etc.) set in. Buffett’s circle-of-competence rule serves as a compass: it’s better to play in your zone of expertise, even if that means saying “no” to most ideas.

Remember: You don’t have to swing at every pitch – just the ones right in your sweet spot.

I wrote about leveraging your competitive advantage in investing here.

3. Invest in Businesses with Durable “Moats”

Warren Buffett popularized the concept of an economic “moat” — a sustainable competitive advantage that protects a business from rivals. He loves companies that dominate their space and can fend off competition year after year, like a castle guarded by a moat. Buffett listed “widening the moats around our operating businesses”(2008) as a key goal.

What does a “moat” look like in practice? It could be a powerful brand, network effects, cost advantages, patented technology, or high switching costs — anything that keeps customers coming and competitors at bay. Buffett observed, for instance, that “well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits… Thus there is an element of compound interest operating in favor of a sound industrial investment”(2019), quoting economist John Maynard Keynes to illustrate how reinvesting earnings builds an advantage over time. That compounding edge is one form of moat.

For example, Taiwan Semiconductor Manufacturing Co. (TSMC) has a wide moat in semiconductor chip production. TSMC's moat lies in its near-monopoly on cutting-edge semiconductor manufacturing, enabled by unmatched scale, +$36 billion in annual capex and R&D, deep customer integration, and +90% market share in 3nm and 5nm chips—making it virtually irreplaceable in the global tech supply chain. You can read about TSMC’s moat in my deep dive here.

As Buffett wrote, “favorable long-term prospects”(1992) are a must. If a company has an enduring moat, over time the stock price tends to reflect that strength through steady earnings growth and resilience in tough times.

So when analyzing a stock, ask yourself: What is this company’s moat, and is it getting wider? Buffett would.

4. Bet on High-Integrity, Able Management

Even the best business can falter under poor leadership. Buffett has always placed huge weight on the character and talent of management. He famously said he looks for people who are “able and trustworthy”(2007) to run the companies Berkshire buys. One of Berkshire’s owner-related principles is that “They [managers] unfailingly think like owners”(1986) — Buffett selects CEOs who treat the business and shareholders’ money with the same care that he would. Integrity is paramount. “If you lose money for the firm I will be understanding. If you lose reputation for the firm, I will be ruthless,” he said when he testified about a securities scandal at Salomon Brothers.

Real-world case studies abound. Look at Wells Fargo: Buffett was a major shareholder and long admired Wells Fargo’s stable banking franchise. But when the bank’s fake-accounts scandal exploded in 2016-2017, it became clear that management’s actions (pressuring employees to meet unrealistic sales goals, then failing to promptly fix the fraud) severely damaged the bank’s reputation. Buffett publicly rebuked Wells Fargo’s management for their “big mistake” in ignoring the problem and eventually slashed Berkshire’s stake.

In contrast, consider Apple’s management under CEO Tim Cook. Buffett has heaped praise on Cook’s steady leadership, calling Apple’s handling of shareholder capital “brilliant” — largely because Cook uses Apple’s prodigious cash flow to buy back shares, increasing Berkshire’s ownership. Buffett noted approvingly that Apple’s buybacks “increased Berkshire’s ownership a bit without any cost to us… The math isn’t complicated: When the share count goes down, our ownership interest in our many investments goes up.”(2022). This shareholder-friendly move reflected savvy capital allocation by Apple’s management — something Buffett loves to see.

The lesson? Align yourself with managers who are competent, honest, and treat shareholders like partners. Buffett often says he wants to invest in businesses that an idiot could run because someday one will. But ideally, you’ll never have to find out – because you picked great people from the start.

5. Only Buy When the Price is Right (Margin of Safety)

Even a wonderful business can become a terrible investment if you overpay for it. Buffett learned from Benjamin Graham the crucial concept of margin of safety — essentially, don’t pay $1 for 50 cents of value. He reiterated this in the 2008 shareholder letter with a pithy quote: “Long ago, Ben Graham taught me that Price is what you pay; value is what you get. Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”. In plain English: don’t chase hype; insist on a bargain. Buffett’s strategy is to wait for opportunities when he can buy a great company at a price below its intrinsic value. That way, even if his analysis is a bit off, the built-in discount offers protection (the “safety” in margin of safety). Conversely, paying a sky-high price leaves zero room for error — you’re relying on rosy scenarios to come true.

We saw this play out in recent years with growth stocks. In late 2020 and early 2021, many high-flying tech companies traded at absurd valuations – prices implied perfection (and then some) in their future growth. Investors who bought Zoom Video Communications at 100+ times earnings, or electric truck maker Rivian at a $120 billion market cap pre-revenue, learned a painful lesson when reality set in. Zoom’s stock plunged over 80% from its peak once competition and post-COVID normalization hit.

And Rivian’s share price collapsed as production delays and rising costs became evident.

Why? Not because these companies disappeared, but because their lofty price far exceeded any reasonable value for an investor. As Buffett wrote in 2018, “Blindly buying an overpriced stock is value-destructive” — so always demand a sensible price. When quality merchandise goes on sale, that’s when you pounce. Buffett studiously avoided such scenarios. Instead, he looks for cases like Bank of America(BofA) in 2011, when he injected $5 billion into BofA at a distressed moment, negotiating preferred shares and warrants at a steep discount. That deal had a huge margin of safety, and indeed it netted Berkshire a multibillion-dollar profit a few years later.

The key learning: make sure there’s a cushion between what you pay and what you think a business is worth.

6. Harness the Power of Compounding and Retained Earnings

Perhaps Buffett’s greatest “secret” is really no secret at all: the magic of compound interest. He has repeatedly extolled the virtues of reinvesting earnings and letting time do the heavy lifting. In his 2019 letter, Buffett recounted a 1920s insight from economist Edgar Lawrence Smith, who discovered that "Well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits. In good years, if not in all years, they retain a part of their profits and put them back into the business. Thus there is an element of compound interest operating in favour of a sound industrial investment. Over a period of years, the real value of the property of a sound industrial is increasing at compound interest, quite apart from the dividends paid out to the shareholders.”

For investors, this means that companies which reinvest profits wisely can grow exponentially. It also means that if you, as an investor, continually reinvest your returns (instead of cashing out or spending them), your wealth can snowball impressively over the decades.

Buffett practices what he preaches. Berkshire Hathaway famously has never paid a dividend — Buffett prefers to retain all earnings and reinvest them, either in acquiring new businesses or buying stocks. Why? Because he can generally earn higher returns by redeploying that cash than shareholders could by getting a small check and reinvesting on their own. The results speak for themselves: Berkshire’s stock compounded at over 19% annually for decades, an almost superhuman feat attributable to internally compounding earnings.

In one illustration, Buffett calculated that if he had started with $1 and doubled it every year for 20 years (a 100% annual return — purely hypothetical), but paid taxes on each gain, he’d end up with about $25,252. But if instead the $1 were compounded internally for 20 years with taxes only at the end, the result would be around $692,000. “The sole reason for this staggering difference in results would be the timing of tax payments,”(1989) he explained. The deferral of taxes and continuous reinvestment turbocharge the compounding.

For a real-world example, look at Amazon. Amazon infamously reported little to no net profit for years, but it was plowing operating cash flow into expanding fulfillment centers, AWS data servers, and new products. Those retained earnings (plus some debt) fueled Amazon’s explosive growth. Investors who understood the power of compounding weren’t scared off by the lack of dividends — they realized Amazon’s reinvestment was increasing the company’s long-term value. Sure enough, from 2015 to 2024 Amazon’s revenue multiplied by six and its stock price multiplied by 11x, reflecting the payoff from years of reinvestment.

The lesson for us: seek businesses that wisely reinvest their profits, and consider reinvesting your own investment gains as well. Compounding really is the eighth wonder of the world, and time is the friend of the patient investor.

7. Be Patient and Don’t Feel Obligated to Act

In our hyperactive market culture, many investors think they always need to be doing something — buying, selling, rotating sectors, etc. Buffett takes the opposite approach: patience is a virtue. He once joked that the stock market is a no-called-strike game — you don’t get penalized for letting pitches go by, so you can wait indefinitely for the one that’s in your sweet spot. In his 1996 letter, he wrote, “Inactivity strikes us as intelligent behavior.” In other words, doing nothing is often the smart move.

Buffett and Munger will gladly sit on a growing pile of cash if they can’t find investments that meet their criteria. As of Q1 2025, Berkshire Hathaway is sitting on a record $347 billion in cash — a staggering war chest that reflects just how disciplined they are about only acting when the odds are overwhelmingly in their favor. This discipline prevents them from forcing bad bets out of impatience or boredom. As Buffett put it in 2008, “Indeed, we enjoy such price declines if we have funds available to increase our positions” — a reminder that he waits for the right opportunity (often when prices fall) to pounce, rather than always swinging.

A striking recent example was Berkshire’s cash position in the late 2010s. For several years, Buffett faced criticism for not making any big acquisitions and allowing Berkshire’s cash to swell over $138 billion as of 2020. But he wasn’t seeing businesses selling at sensible prices in that period — everything looked pricey. Rather than succumb to pressure, he was content to wait. This patience paid off in 2020: when the COVID-19 pandemic shook markets, Berkshire suddenly had options. (Buffett did deploy some cash, though interestingly, he also sold airline stocks — demonstrating he’s patient, but not inflexible when facts change.)

Individual investors can take a page from this. Think of the 2020 market crash: those who had cash or courage to hold steady reaped huge rewards when the S&P 500 recovered and hit new highs in 2021. Meanwhile, investors who panicked and sold at the bottom, or who churned their portfolios trying to time every zigzag, often ended up worse off. The U.S. stock market’s long-term upward drift has handsomely rewarded the patient: even including downturns, the S&P 500 returned roughly 12% annually since 2012. Trying to hop in and out to catch each squiggle would likely have hurt more than helped (not to mention incurred taxes and fees).

Buffett’s calm, inactive stance teaches us that you don’t get extra points for activity in investing — you get points for being right. So when nothing attractive is available, it’s perfectly okay to sit on your hands (or hold cash) and wait. As the saying goes, sometimes the hardest thing to do in investing is nothing, but often, it’s the right thing. Here, I go into details about this one skill.

8. Turn Volatility to Your Advantage (Be Fearful When Others Are Greedy)

If there’s one Buffett maxim every investor knows, it’s this: “Be fearful when others are greedy, and be greedy when others are fearful.”(2004)

This encapsulates Buffett’s contrarian approach to market sentiment. Instead of dreading market volatility, Buffett welcomes it, because wild swings often produce mispriced opportunities. In the exuberance of a bubble, he gets cautious (fearful) as others throw caution to the wind. In the depths of a crash, he gets excited (greedy) to deploy capital while everyone else is panicking. “When investing, pessimism is your friend, euphoria the enemy,”(2008) Buffett wrote during the 2008-09 market crisis.

In practical terms, this means don’t follow the herd. The best bargains tend to appear in times of maximum pessimism, when the news is grim and sellers abound. Conversely, the riskiest time to buy is when everyone else is bullishly piling in and valuations are frothy. This post discussed the benefits of not following the herd.

We saw this vividly in March 2020. As the COVID pandemic spread and markets plunged, many investors ran for the exits. But a Buffett-minded investor might have recognized that plenty of strong companies were temporarily on sale. Indeed, those who bought solid stocks in late March or April 2020 — say, Microsoft MSFT 0.00%↑, Apple AAPL 0.00%↑, Google GOOG 0.00%↑ or TSMC TSM 0.00%↑ — likely more than doubled their money over the next 18 months as the market rebounded at record speed.

Pessimism was their friend. On the flip side, consider the meme-stock mania of early 2021 (GameStop GME 0.00%↑, AMC AMC 0.00%↑, etc.) when euphoric greed took over. A prudent Buffett-style investor would have been extremely fearful seeing shaky companies soar to insane prices driven by social media frenzy. And rightly so — many who chased those stocks at their peaks have since lost shirts.

Buffett also loves using market dips to buy back Berkshire’s own stock or increase positions in his favorite holdings. For example, Berkshire added to its Apple stake during a Q1 2020 dip. He knows that volatility is inevitable, so you might as well profit from it. The key is having the emotional fortitude (and liquidity) to zig when the crowd zags.

As Buffett quipped after one market swoon, “You only find out who is swimming naked when the tide goes out”(2001). In other words, when times get tough, weak hands are exposed and assets often revert to their sensible owners. Strive to be the strong hand who can act when fear is high.

Buffett’s contrarian lesson boils down to this: make volatility work for you, not against you. It’s not easy — it requires a cool head — but as his track record shows, it’s immensely rewarding.

9. Never Risk What You Need for What You Don’t Need (Avoid Excessive Leverage)

Buffett is famously averse to excessive debt and leverage, both for companies and investors. He likes to sleep soundly at night, and leverage is a fast lane to sleepless nights (or worse).

In his 2018 letter, Buffett delivered a stern warning: “Rational people don’t risk what they have and need for what they don’t have and don’t need.”. This was in reference to companies that load up on debt to juice returns, but it applies just as well to individuals using margin loans or risky bets.

Why gamble your hard-earned capital (that you need) for some extra gains that you don’t necessarily need? Buffett compares heavy debt to a “Russian roulette equation” — nine times out of ten, you may be fine, but that tenth time can kill you. His advice: don’t play games that can ruin you, even if the odds look favourable.

Berkshire Hathaway itself carries minimal parent-level debt. Buffett runs a “Gibraltar-like” balance sheet with oceans of liquidity. This conservative approach meant Berkshire not only survived crashes like 2008 but was in a position to help others (and earn great returns doing so).

Consider the 2008 financial crisis: highly leveraged Wall Street firms like Lehman Brothers and Bear Stearns imploded virtually overnight, largely because their debt levels left no margin for error when asset prices fell. In contrast, Berkshire used its fortress balance sheet to inject capital into Goldman Sachs and General Electric on very favourable terms — deals that made Berkshire billions when the crisis abated.

More recently, in 2020, many healthy companies suddenly faced shutdowns. Those with too much debt, such as Hertz (the car rental company), couldn’t stay afloat when business dried up; Hertz HTZ 0.00%↑ filed for bankruptcy, wiping out shareholders. But stronger peers with less leverage, like Enterprise Holdings (privately held) or even Avis CAR 0.00%↑, managed to ride it out.

As an investor, using margin or leverage can similarly spell disaster in a downturn — margin calls don’t care how solid your stocks are; if you’re overextended, you may be forced to liquidate at the worst time. I discussed the dangers of using leverage in this post.

Buffett’s rule of thumb is to always plan for rainy days. He keeps a cash cushion at Berkshire for emergencies and refuses to jeopardize the company’s future for a bit more yield. “At rare and unpredictable intervals, credit vanishes and debt becomes financially fatal… But that strategy would be madness for Berkshire,”(2018) he wrote, after noting that debt-fueled strategies often “juice returns” until they blow up.

The bottom line: stay solvent. Don’t risk bankruptcy or permanent loss for a slim chance at slightly higher gains. In investing, as in life, survival is the first victory. You only have to get rich once — and you can’t do that if you’re wiped out along the way.

10. Keep the Faith: Never Bet Against Long-Term Prosperity

Buffett is an unyielding optimist about the long run. He has witnessed world wars, recessions, 15% inflation, market crashes — you name it — yet his conviction in the resilience of the economy (particularly the American economy) has never wavered.

In his 2020 letter, reflecting on America’s incredible progress since 1776, Buffett stated his “unwavering conclusion: Never bet against America.”. He wrote that despite “some severe interruptions” (think pandemics, depressions, etc.), our country’s economic growth has been “breathtaking”, and investing in the U.S. remains a sure bet on human ingenuity and productivity.

This sentiment echoes his long-held view that, given enough time, innovation, productivity, and the power of markets will create wealth, even if the path is volatile.

For investors, this is a reminder to focus on the long term and not get bogged down by doom and gloom. For example, every few years, the headlines scream some variant of “the world is ending” — be it the Eurozone crisis in 2011, the Brexit vote in 2016, the pandemic in 2020 or the current Trump tariffs drama. Each time, markets plunged and pessimism spiked. But those who heeded Buffett’s advice — betting on eventual recovery rather than permanent collapse — were rewarded. After the 2016 Brexit panic, UK and U.S. equities rebounded within weeks. Following the March 2020 COVID crash, the S&P 500 had one of its fastest turnarounds ever and hit new highs by year-end 2020.

Buffett often cites America’s track record: In the 20th century, we endured two world wars, a Great Depression, and numerous smaller crises, "and still, the Dow rose from 66 to 11,497.” His optimism isn’t blind; it’s informed by history. That doesn’t mean every stock will succeed or that you won’t have down years – Buffett is very clear that one should expect market declines and can’t predict short-term outcomes. But the trend over many decades has been up and up, reflecting the creation of real business value.

So Buffett’s final lesson is a heartening one: have faith in the future. For him, that specifically means faith in American businesses’ future, but it can also apply more broadly to human progress. Invest in quality companies (or index funds) with the expectation that years down the line, they’ll be earning more and worth more, even if intervening news is terrible. This positive outlook underpins Buffett’s willingness to put money to work in scary times. It’s not naive — it’s a bet on an engine that’s proven its mettle over centuries. In short, never bet against America (or innovation, or humanity). Stay long-term greedy.

Those are just 10 of the countless lessons I’ve picked up from Warren Buffett, but they cover the core of his investing philosophy: think like an owner, do your homework, wait for your pitch, keep emotions in check, and play the long game.

As Buffett steps back from the helm of Berkshire Hathaway, his wisdom is as relevant as ever for us investors. I know that personally, applying these principles has made me a more disciplined and successful investor. I hope you found a nugget or two in here to apply to your own investing journey.

If this Buffett-themed edition resonated with you, you’ll love what’s behind the paywall. For just $130/year, paid subscribers get full access to my real-time trade alerts, portfolio allocations, and in-depth deep dives on high-conviction stock ideas — all rooted in the same timeless investing pillars we covered here: business fundamentals, moats, capital allocation, risk-reward, and long-term thinking.

Portfolio Update

We are back to outperforming the S&P 500 and TSX 😉

Portfolio USA’s performance improved more than the S&P 500’s, widening the performance gap from 86 bps to 193 bps. Same story for Portfolio Canada. The portfolio outpaced the TSX, narrowing the performance gap from -84 bps to +126 bps YTD.

Since launching the newsletter a bit more than seven months ago, Portfolio USA has delivered 9x the return of the S&P 500.

All sectors in Portfolio USA were negative led by financials and industrials. The top performing sectors in Portfolio Canada was technology and gold.

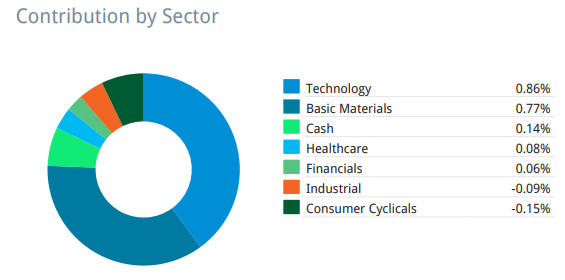

Contribution by Sector - Portfolio USA

Contribution by Sector - Portfolio Canada

You may have noticed that Nordstrom JWN 0.00%↑ has disappeared from your portfolio. That's because on May 20, 2025, Nordstrom announced that the Nordstrom family—Erik, Pete, Jamie, and other family members—together with Liverpool, completed an all-cash acquisition at $24.25 per share. Our cost basis was $24.66, this was an immaterial loss.

Some contributors to Portfolio 🇺🇸:

+30 bps AGX 0.00%↑

-3 bps KINS 0.00%↑

-7 bps TSM 0.00%↑

-12 bps POWL 0.00%↑

-14 bps DXPE 0.00%↑

Notable contributors to Portfolio 🇨🇦:

+91 bps CLS 0.00%↑

For the full breakdown, here’s the weekly stock performance for each portfolio: Weekly Stock Performance Tracker

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: