Weekly #45: Opportunity Cost — Always Compare With Your Best Alternative

Portfolio is up +17.8% YTD. A personal tale of riot-driven change, a new watchlist of high R:R stock picks, and a Thought of the Week on why every decision comes down to opportunity cost.

Hello fellow Sharks,

We keep grinding higher. The portfolio is now +17.8% YTD, and since inception, we’ve compounded at 2.2x the market. If you want to skip straight to the numbers, jump to the Portfolio Update.

In this week’s note, I want to talk about how every choice has an opportunity cost. From deciding which stocks make it into your portfolio to choosing the gym over the muffin (or not), the idea is the same: every “yes” comes with a “no.” And learning to weigh those trade-offs well is one of the most important skills in both investing and life.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

This week I rolled out two new pieces of content you may want to check out:

New Watchlist: Why Risk/Reward Beats Raw Upside

I added a living watchlist so you can track target prices and risk/reward scores for each stock I’m following. It’s a simple way to see which opportunities look most attractive right now, and I’ll keep refreshing it as new data comes in.

Mueller Industries: Why 28% Margins Won’t Last Forever

I didn’t add MLI to the portfolio, but it was a fascinating case study in how a century-old manufacturer can compound value. Margins may not be sustainable, but the capital discipline here makes it worth studying.

Thought of the Week: All Choices Have an Opportunity Cost

In 2019, Chile’s public transit fares rose by a mere 30 pesos (about 3 cents). That tiny hike sparked something enormous: riots erupted all over the country. It was the last straw for a population fed up with inequality and high living costs.

And it turned out to be the last straw for me personally.

For two years prior, I’d been torn between staying in Chile or returning to Canada. I even kept a running pro/con list. On the Chile side, I had my close circle of friends, my business, and perfect year-round riding weather for my Harley.

On the Canadian side, I listed better professional opportunities, better future education for my (eventual) kids, and being closer to my brother.

For a long time, that list was deadlocked. After all, I had no kids yet, and my brother visited Chile often. But when those riots broke out, two of my big Chile “pros” vanished overnight: my business prospects dimmed amid the chaos, and riding my motorcycle freely was off the table.

Suddenly, the balance tipped decisively to Canada. The opportunity on that side now far outweighed what I’d be giving up by leaving Chile. I bought a plane ticket within the week and was back in Toronto six weeks later. In that moment, the cost of staying (in terms of what I’d miss out on elsewhere) became too high to ignore.

I’m not sure if this mindset came from my family or if I picked it up along the way, but I tend to be very calculative in my decisions. For better or worse, I naturally assess the cost of everything and what I could get instead. My brain is constantly running these little what-if analyses, asking questions like:

Should I work out for an hour, or should I give in to that chocolate chip muffin calling my name? What do I gain from the gym vs. the sweet satisfaction of the muffin?

Should I send that report off to the CEO now, or use the time to get the sales numbers to the CFO? What happens if I delay the CEO’s request?

Should I watch another episode on Netflix tonight, or get an extra hour of sleep and feel fresher in the morning?

Do I splurge on a vacation with my bonus, or invest that money and let it compound for future me?

This is how my mind works: I weigh what I’d gain from one choice against what I’d lose by not doing the other. It’s the lens through which I view almost every decision. I admit, sometimes I try to dial it back and just go with my gut or enjoy the moment without calculating everything. Acting on feeling can be liberating.

But it’s hard for me to escape this habit because it’s part of my nature. (I’m an INTJ-A personality type, the “Architect”. Basically, a strategic thinker with a plan for everything. In a previous Thought of the Week, I wrote about designing your life around your nature, and this trait is definitely a core part of mine.) Given that bent, it’s no surprise that opportunity cost is the concept I live and breathe.

One of my favourite quotes comes from Charlie Munger (R.I.P.), who captures this mindset perfectly:

All intelligent people should think primarily in terms of opportunity cost. When deciding whether to do something, compare it with the best opportunity you have.

In other words, every time you say yes to something, you’re automatically saying no to something else. So it’s wise to ask: Is this the best use of my time, money, or energy right now? Could I be doing something better? This might sound like a heavy way to go through life, but it’s a simple habit with powerful effects. It helps me prioritize what actually matters by constantly reminding me of the trade-offs. Big or small, everything in life is a choice, and each choice has a hidden price tag, the value of the best alternative you’re not choosing. Keeping that in mind leads to better decisions in the long run.

The CEO as Chief Capital Allocator

This opportunity cost lens isn’t just for personal decisions; it’s at the heart of good business strategy too. Companies, like people, have limited resources. A CEO’s real job (arguably their most important job) is capital allocation, deciding where to deploy the company’s limited dollars for the highest return. Should they invest in a new project, acquire another company, pay down debt, buy back their own shares, pay out dividends, or just hold cash?

A wise leader will compare all these options and choose the one with the best payoff relative to the others. If an initiative doesn’t promise a return above the company’s cost of capital, it’s essentially a destroyer of value and should be scrapped in favour of something better. As an old rule of thumb: invest in projects that earn more than a dollar for each dollar spent (after accounting for risk); otherwise, give that dollar back to shareholders or save it for a future opportunity.

In capital budgeting meetings, you see this principle in action. Say a company has $100 million to allocate this year. Project A might offer a 20% expected return, Project B 10%, and Project C 5%. A rational management team will rank these and fund as much of Project A as they can, maybe fund some of B if the budget allows and it clears the hurdle rate, and completely skip C if its return is too low.

Why? Because every dollar put into Project C (5% return) is a dollar not put into Project A (20% return). The opportunity cost of doing C is high, which means sacrificing the higher returns of A. This is why the best CEOs act like investors: they continually compare each use of capital against the next-best alternative.

Take Henry Singleton of Teledyne as a real-world example. He’s often cited as one of the greatest capital allocators ever. In the 1960s and ’70s, Singleton mastered the art of comparative decision-making. When Teledyne’s stock was wildly overvalued, he used that expensive stock as currency to buy other companies.

Later, when Teledyne’s stock price fell and became cheap, he switched tactics and aggressively bought back his own shares on the open market. By issuing stock when it was dear and repurchasing it when it was cheap, Singleton essentially traded up for value at every step.

The results were phenomenal: under his leadership, Teledyne delivered roughly 20% annual stock returns, nearly double the S&P 500’s performance over the same period. That kind of track record is no accident; it’s the product of relentlessly comparing options and choosing the best use of capital available.

Warren Buffett is another classic example. He likes to say that he’s not just in the business of picking stocks; he’s in the business of allocating capital to its best use. If he doesn’t see attractive opportunities, he’s perfectly content to let cash accumulate rather than force an investment for the sake of doing something.

Buffett often emphasizes opportunity cost implicitly: he’ll pass on deals that “might” be okay, because investing in those would mean he can’t deploy that money into a great deal when it comes along. The best CEOs have this discipline. They don’t build empires for ego’s sake; they build value by constantly asking, “Is this the best thing we can do with our resources, or is there a better alternative?”

Buffett has sat on an enormous cash pile because nothing on the market offered a compelling alternative with a better opportunity cost.

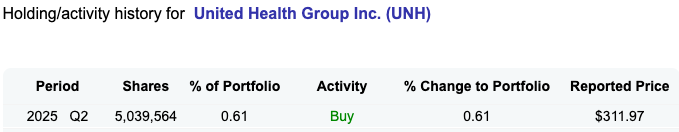

Then, when UnitedHealth Group (UNH 0.00%↑) shares dropped roughly 49% this year, Berkshire acquired about 5 million shares (worth ~$1.6 billion), capitalizing on a rare opening where the opportunity cost finally tilted significantly in favour of action.

When you see a company making a big acquisition, starting a new division, or even choosing to buy back a ton of stock, it’s useful to realize that decision only makes sense if it’s expected to beat any other use of that money. Opportunity cost is why focused companies win as they double down on their highest-return bets and skip the distractions that would only earn mediocre results.

Be the CEO of Your Own Portfolio

The opportunity cost mindset is just as crucial when managing your investments. I often remind myself that my portfolio is like a mini-company, and I’m the CEO allocating its capital. My resources (capital) are finite, so every dollar I invest in Stock X is a dollar I’m not investing in Stock Y. Every position I hold has an implicit cost: it ties up capital that could potentially earn more elsewhere.

You have to constantly weigh, “Is this position still the best place for my money, relative to everything else I could be in?” If not, it might be time to make a switch.

In practice, this means I limit my portfolio to what I believe are the best risk-adjusted opportunities among the stocks I follow. I’m not aiming to hold every stock that might go up. I want to hold the ones where I feel the upside is highest relative to the downside risk. If something better comes along, I’m not afraid to rotate capital.

Just recently, for example, I decided to close a position in one stock after it had a decent run-up, because I saw a higher-conviction idea on my watchlist with a more attractive reward-to-risk profile. I sold General Motors (GM 0.00%↑) earlier this month after it gained about 19% for us, largely because new risks had emerged and the upside looked capped.

I then funnelled that capital into a different pick that I believed had better prospects. Within days, that new position jumped about 25%. While the timing may have been luck, it was a conscious decision to reallocate money to where I saw a better opportunity.

It’s the same principle as the CEO examples above, just applied to a personal portfolio. I often think of it this way: I’m not managing a static list of stocks, I’m managing a list of opportunities. My job is to keep my money in the best opportunities I can find, and to let go of the ones that no longer shine as bright.

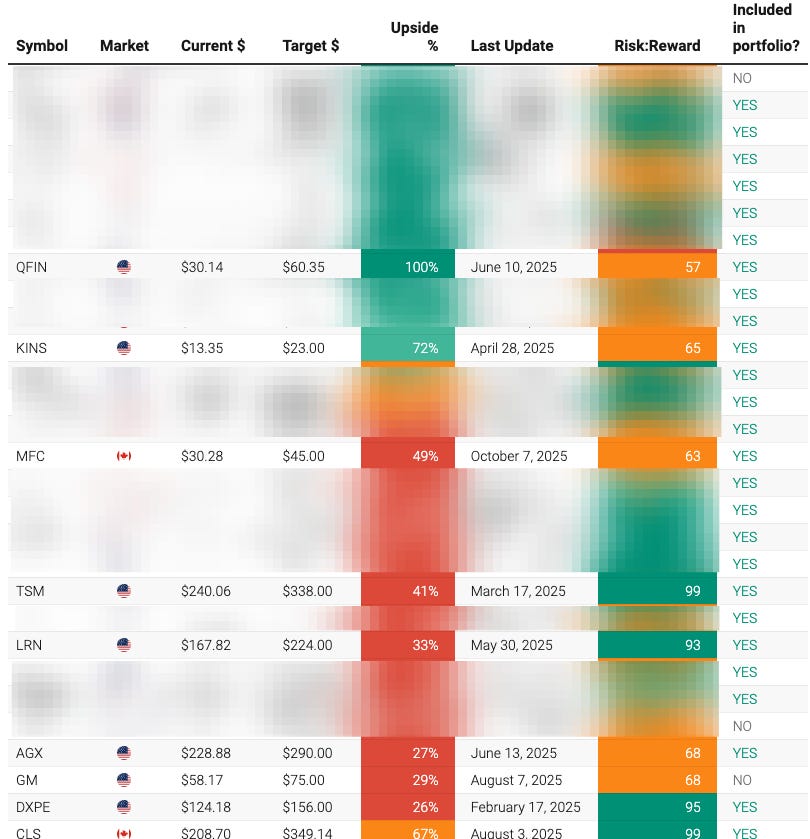

To help with this process, I’ve developed tools to score and compare investment ideas. In fact, this week I released a Stock Watchlist built around risk/reward rather than just raw upside.

It includes a target price for every stock I follow closely. For each stock, I estimate a reasonable upside (bull case), a downside (bear case), and the likelihood of each scenario. From that, I derive an expected value and a risk/reward score.

Without getting too technical, it’s basically a way to quantify the quality of each opportunity; higher scores mean a better payoff relative to risk. The watchlist currently features the stocks in the portfolio, plus names that were in the portfolio recently or companies I’ve researched but haven’t bought (yet).

I’ll be adding more names over time as I update their target prices and estimates. The goal is to have a living dashboard of all the potential investments on my radar, ranked by their risk/reward appeal at the moment.

This makes it much easier for me (and for you, if you’re a member) to act like a portfolio CEO: you can clearly see what your top five or ten opportunities are, rather than just chasing whatever’s popular or comfortable.

If you’re curious about the specifics, the watchlist shows each stock’s R:R score, the latest target prices, and even tracks when I last updated each one. I built it so that peer valuations update daily, and I refresh my scenario assumptions whenever new information comes out, ensuring the scores stay up-to-date.

The key idea is that I don’t want to hold a stock just because I happened to buy it in the past; I want to hold it because right now it’s still one of the best opportunities available. And if it’s not, I want to know that and have the courage to make a change.

This approach does come with a caveat: I’m not advocating for constant churn or knee-jerk reactions. Opportunity cost thinking doesn’t mean frantically switching lanes at every yellow light. Often, the best opportunity is to stick with a great business you already own.

In fact, I don’t exit positions just because their risk/reward score drops a bit; I use it as a flag to review the thesis, and only rotate out if I’m convinced something else is truly better. It’s a balance between staying disciplined and staying patient. But the underlying mindset never changes: always be aware of what you’re giving up when you make a choice.

Bringing It All Together (Plus, That Muffin…)

The happiest and most successful people I know aren’t necessarily the ones who have the most, but the ones who consistently choose well. They allocate their time and resources to what matters most and brings the highest return (whether financial, personal, or emotional).

Thinking in terms of opportunity cost forces you to prioritize. It cuts through the noise and asks the simple question: Is this worth it, given what I could do otherwise? When the answer is yes, you can proceed with confidence. When the answer is no, you gain the clarity to change course.

Most days, the gym wins. I’ll take the long-term payoff of health and energy over a sugar rush. But I’m human, sometimes the muffin wins, and I don’t regret it. The key is making a conscious trade-off. Opportunity cost isn’t about being a cold calculator; it’s about choosing what matters most. Usually that’s the gym… but every now and then, sanity tastes like a chocolate chip muffin.

When it’s your turn, do you pick the gym or the muffin?

Portfolio Update

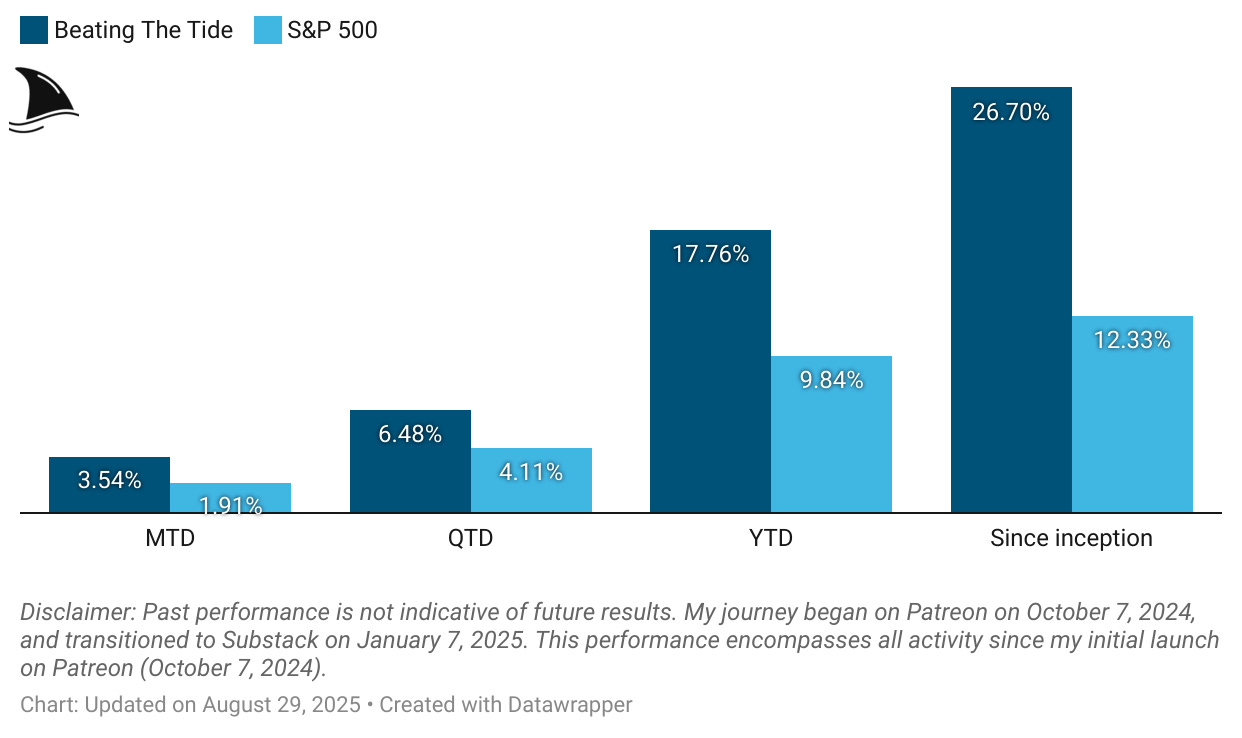

While the S&P 500 pulled back compared to last week, the portfolio’s return advanced, widening the performance gap.

Month-to-date: +3.5% vs. the S&P 500’s +1.9%.

Quarter-to-date: +6.5% vs. the S&P 500’s +4.1%.

Year-to-date: +17.8% vs. the S&P’s +9.8%, a gap of 792 basis points.

Since inception: +26.7% vs. the S&P 500’s +12.3%. That’s 2.2x the market.

Portfolio Return

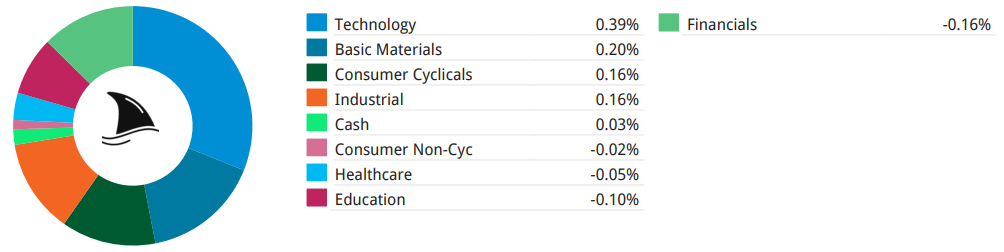

Contribution by Sector

Tech, gold, industrials and consumer cyclicals led the gains, partially offset by education and financials.

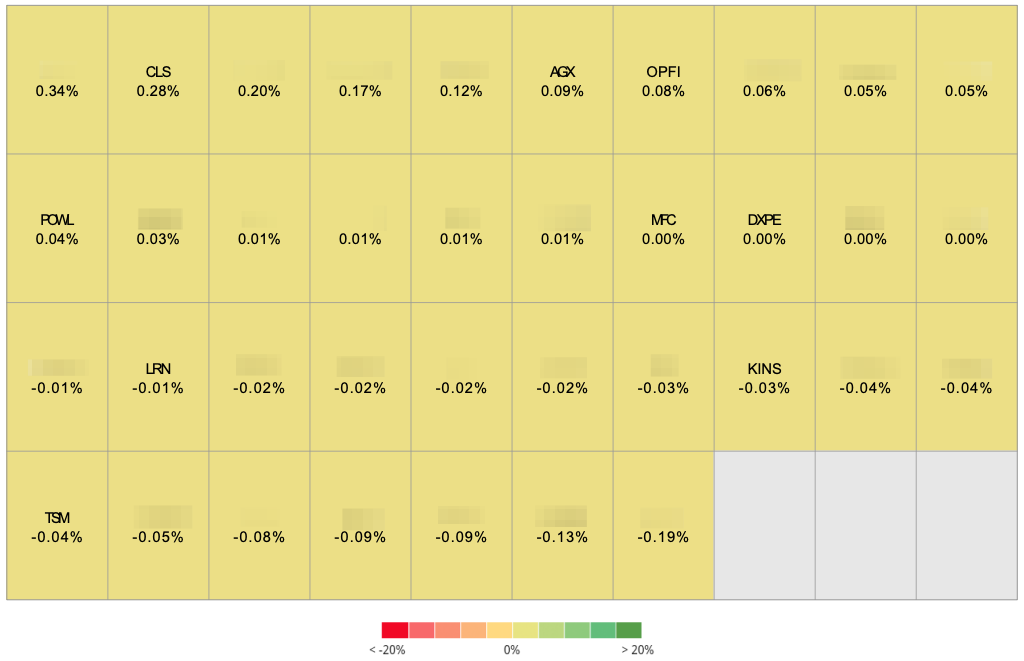

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+28 bps CLS 0.00%↑ (TSX: CLS)

+9 bps AGX 0.00%↑

+8 bps OPFI 0.00%↑

+4 bps POWL 0.00%↑

-1 bps LRN 0.00%↑

-3 bps KINS 0.00%↑

-4 bps TSM 0.00%↑

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: