GM +18.7%: Why I Took Profits and the One Risk I Couldn’t Ignore

A full breakdown on what I got right, what changed, and why I’ve redeployed

I closed my General Motors (GM 0.00%↑) position on August 6, locking in an +18.7% gain.

This post-mortem will walk you through why I was bullish in the first place, what went according to plan, what surprised me, and ultimately why I decided to exit. Paid subscribers to best stock pick newsletter in the world (😉) already saw the new trade idea where I redeployed this capital.

Recap: Why I Was Bullish on GM

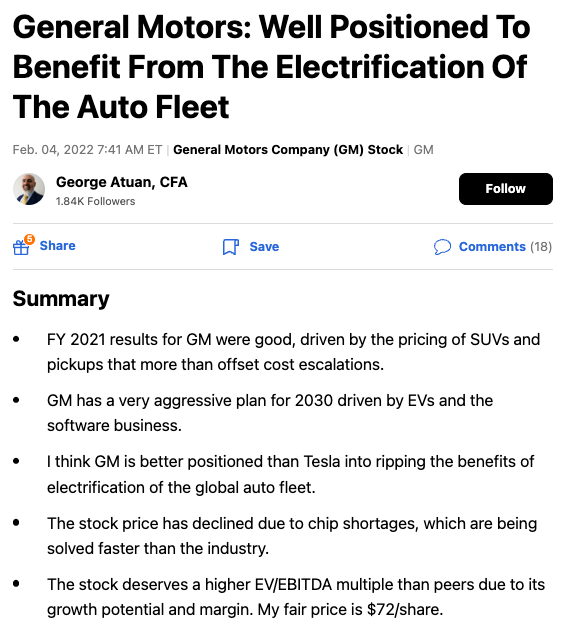

I have been bullish on GM since 2022 as I detailed in my initial thesis on Seeking Alpha with a BUY rating.

In September 2024, I wrote again on Seeking Alpha that GM was a “strong buy” – I even slapped an $89 price target on it.

My bullish thesis centred on a few big points:

Point #1. EV Expansion

GM was charging ahead into EVs. Management had committed to 30 new EV models by 2025 and aimed to double revenue by 2030 with the help of electric sales.

In 2023, GM had already built momentum, delivering new electric models and planning to retool factories (like converting the Fairfax plant from making Malibus to Bolts and Cadillacs) to focus on EV production.

The company’s vision was that EVs, along with high-margin software/services (OnStar, Super Cruise, etc.), would drive growth. I was impressed by how GM was continuing the EV momentum trying to take Tesla (TSLA 0.00%↑) head-on with Chevrolet and Cadillac electrics.

Point #2. Cost Leadership and Lower Breakeven Production

GM had undergone a serious fitness regimen on costs. The company was forging strategic partnerships (for example, with chip and battery suppliers) to stabilize supply and cut input costs. They revamped operations and processes to boost efficiency. GM was trimming the fat so it could make money even if car volumes slipped. This cost-leadership strategy meant GM’s breakeven point got lower so GM could stay profitable at lower sales volumes.

In Q2 2024, GM’s net profit was $3.5 billion, well above expectations, largely because of these cost controls and efficiency gains. I noted things like reduced logistics costs, better supplier visibility using analytics, and a general focus on productivity. All of that suggested GM could weather storms (like recessions or price wars) better than before.

Point #3. Dominant North American Market Position

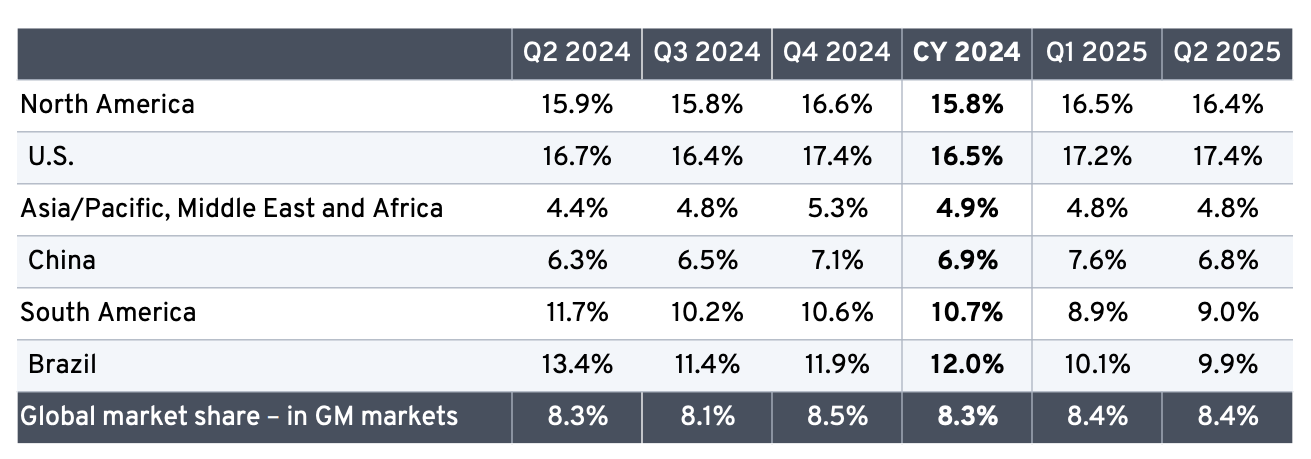

GM was (and still is) the heavyweight champ in U.S. auto sales. In 2023, they held 16.3% U.S. market share, up a bit from the prior year, thanks to strong sales of trucks, SUVs, and fleet vehicles. Crucially, GM was keeping prices high and incentives low, choosing profit per vehicle over raw volume. I believed this strategy of selling fewer vehicles at higher prices would sustain margins. I expected GM’s market share to at least hold steady, because even if unit sales didn’t skyrocket, they were commanding a premium price per vehicle. Their full-size pickups and SUVs were outselling rivals, and GM was on track to lead those segments for the 6th and 51st consecutive years, respectively. This NA strength was the cash cow to fund the EV future. GM itself said it was #1 in total U.S. auto sales and #1 in retail sales in Q2 2025, underscoring how central the home market was.

In short, my original bull case was:

EV growth engine + cost discipline + U.S. market dominance = continued outperformance.

I even predicted that interest rate cuts (back then, the Fed had just trimmed rates a bit) would boost car demand and give GM an extra tailwind. Everything was lined up for GM to beat expectations and for a while, it did and the share price reached $60 within a couple of months, a 33% gain.

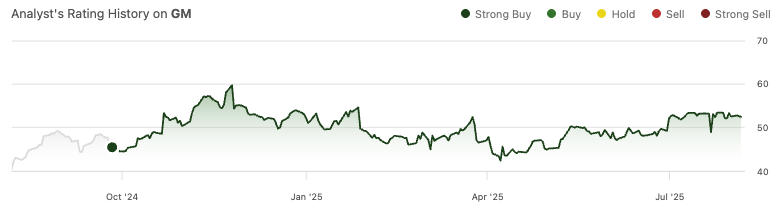

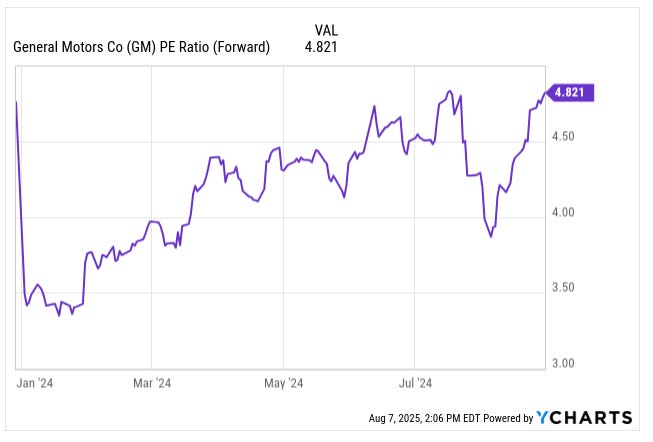

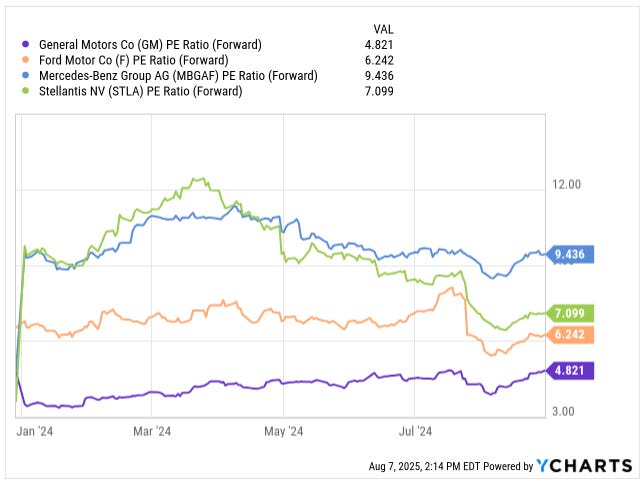

Before we move on, let’s also note valuation: GM stock looked downright cheap in 2024. At the time of my write-up, it was trading around 4-5 times forward earnings, which is an earnings yield of 20-25%.

That’s extremely low for a profitable, established automaker. In fact, GM’s earnings yield was roughly 24%, making it the cheapest large-cap auto stock.

So GM was priced as if the sky was falling, even though business was strong. I argued for a re-rating to at least 6–7x P/E, which would put the stock in the $60–70 range if things went right. (Spoiler: GM never quite got that re-rating, largely due to the risks we’ll discuss soon.)

GM vs. Ford Valuation: The chart above illustrates the valuation gap. GM was trading at a ~25% discount to Ford (F 0.00%↑) based on the forward P/E ratio. This suggested the market was very pessimistic on GM relative to its Detroit peer.

In summary, I was bullish on GM because it was a value stock with a growth story. The company was aggressively expanding in EVs, fiercely cutting costs (making each car more profitable), and milking its leading position in trucks/SUVs in the profitable U.S. market. And the stock was priced for disaster, which I thought was too pessimistic.

What I Got Right

Several parts of the thesis played out well over the past year:

#1 EV Sales Surged

GM’s EV sales have been on a tear. I anticipated strong EV momentum, and GM delivered triple-digit growth. In Q2 2025, GM sold 46,280 EVs in the U.S., a 111% y/y increase. To put that in perspective, they sold roughly 22k EVs in Q2 2024, so it more than doubled.

For the first half of 2025, GM moved about 78,000 EVs in the U.S., which is already close to their 2024 full-year total of ~114,000. This means GM now holds about 16% of the U.S. EV market, up from roughly 9% a year ago. Chevrolet has become the #2 EV brand in America (only behind Tesla), and Cadillac now ranks #1 in luxury EVs. The Equinox EV in particular has been a star with over 27,000 units sold in H1 2025, it actually surpassed Ford’s Mustang Mach-E to become the best-selling non-Tesla EV in the U.S.

This surge validated my view that GM’s EV lineup (Lyriq, Hummer EV, Equinox/Blazer EV, etc.) would gain traction. GM’s EV portfolio is outpacing the industry’s EV growth, which is a big positive. Simply put, GM proved it can sell EVs beyond the Chevy Bolt; it’s building a real presence in the electric market.

#2 Margin Strength (Excluding One-Off Hits)

Despite new headwinds (more on those later), GM’s core operations remained quite profitable. In North America, GM kept operating margins healthy through strong pricing and cost controls. For Q2 2025, GM North America’s EBIT-adjusted margin was 6.1% after absorbing a big tariff cost. Without the tariff hit, the margin would have been around 9% right in line with historical norms.

In fact, management has an 8–10% margin target and said they’re still on track when you exclude tariffs. This tells me the underlying business (trucks, SUVs, EVs) is still carrying decent margins, and GM didn’t have to resort to heavy discounting to sell cars. They actually maintained stable pricing in retail channels; GM’s pricing power held up, with only some softness in fleet sales pricing.

Also, GM has been cutting fixed costs (they mention $0.8B of fixed cost savings in Q2), which helped offset some headwinds.

#3 U.S. Market Share Gains

GM continued to flex its muscles in the U.S. market, which I had expected. They’ve grown their share recently. In Q2 2025, GM’s U.S. market share hit 17.4%, up from 16.3% in 2023.

They were the #1 seller of vehicles in the country in the first half, with 1.4 million deliveries. This happened even as the overall market grew, GM outpaced the industry. The Chevy Silverado and GMC Sierra trucks are still dominating, and GM remains #1 in full-size pickups and SUVs (decades running, literally).

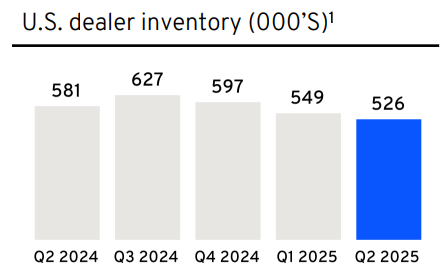

On the EV side, as mentioned, GM is now #2 in U.S. EV sales. This strong performance stateside was exactly what I was counting on to underpin earnings. GM has also managed its inventories well to avoid oversupply: U.S. dealer inventory came down ~10% y/y to ~526,000 units, meaning GM isn’t stuffing dealers with unwanted cars.

That’s a sign of discipline. All in all, GM’s home court advantage remains in full force. They’re winning in the USA, which buoys the investment case.

So, in terms of the original thesis:

EV expansion ✅

Cost discipline ✅

U.S. strength ✅

GM executed well on those fronts. The +18.7% gain on the position reflects these positive developments (and some multiple expansion from the ultra-low P/E, though the stock never reached my full target).

However, investing is about what happens next, not just patting ourselves on the back. And as I’ll outline, some new negatives emerged, and some of my assumptions didn’t pan out as I hoped.

What I Got Wrong (or What Changed)

No investment is ever perfect. Here are the key things that didn’t go as expected or that changed my mind about holding GM for longer:

Factor #1. Underestimating Chinese EV Competition

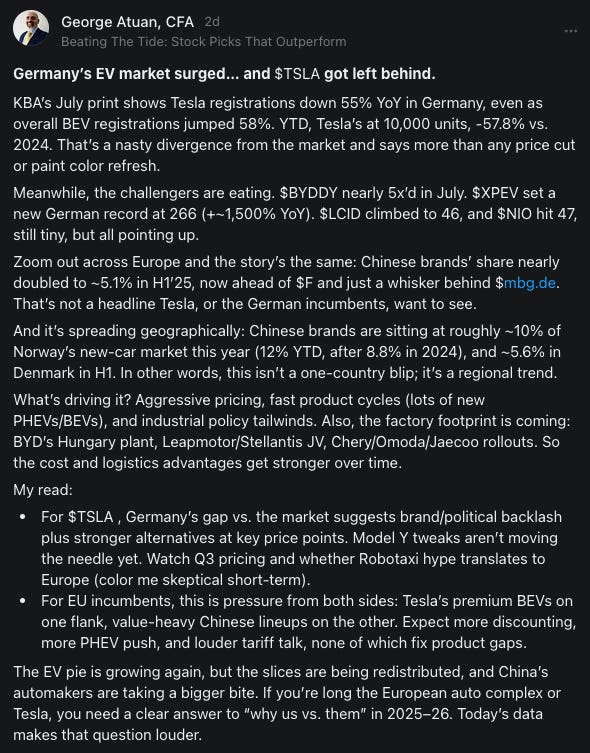

I didn’t fully appreciate how fierce the competition from Chinese automakers would become not just in China, but even in Europe (with implications for the global industry).

In China, GM has been struggling; local brands and Tesla have eroded its once-formidable position. But the bigger surprise has been how Chinese EV makers are expanding internationally. In my August 5 post, I noted that Tesla’s sales in Europe have been slumping while brands like BYD, XPeng (XPEV 0.00%↑), and NIO (NIO 0.00%↑) are surging.

For example, Tesla’s car sales in Germany fell over 50% in July, while BYD’s sales in Germany jumped almost fivefold. Across 28 European countries, Chinese brands went from about 2.5% to 5.1% of new vehicle registrations in the first half of 2025, essentially doubling their share in one year.

BYD is now a top-10 auto brand in Europe by sales, and Chinese EVs collectively grabbed 10.6% of Europe’s EV market in June despite EU tariffs meant to slow them down.

Why am I talking about Europe?

Because it’s a canary in the coal mine. It shows that Chinese automakers (with their affordable yet increasingly high-quality EVs) can rapidly penetrate Western markets. If they can crack Europe, they could move on to North America once today’s tariff wall and planned security rules ease, or if they sidestep them by building cars locally.

The U.S. car market gets tighter every year as Chinese manufacturers and up-and-coming EV brands move in and gradually nibble away at GM’s slice of the pie. This intensifying competition threatens GM’s growth and pricing power in EVs long term.

Even in China right now, GM has lost ground because domestic brands (like BYD) offer very competitive electric models. I remain pessimistic about GM’s China prospects due to significant Chinese automaker competition. In hindsight, I underplayed this risk. The global auto game is getting tougher, and GM will be challenged to defend its turf against this new wave of rivals who are often willing to sacrifice margins to gain share. That realization made me more cautious on GM’s future earnings potential from EVs, which was a pillar of the bull thesis.

Factor #2. Slower-Than-Expected Free Cash Flow Growth

While GM remained profitable, its FCF hasn’t ramped up as I’d hoped. Part of the original appeal was that GM’s robust earnings would translate into gushing free cash, potentially enabling more buybacks or dividends.

But in 2024–2025, FCF has been under pressure. For instance, GM’s automotive free cash flow in Q2 2025 was $2.8 billion, down $2.5 billion y/y. Working capital swings (like building inventory in anticipation of demand) and the cash cost of tariffs hurt their cash generation. The company had to reduce its full-year FCF guidance for 2025 when tariffs hit: they now expect $7.5–10.0B, which is roughly a 25–30% cut from the prior outlook.

I see that in the mid-year results: through the first half of 2025, GM’s net automotive operating cash flow was $7.1B, down from $11.3B in the first half of 2024. In other words, cash flow is moving in the wrong direction. Even if some of that is timing, it’s disappointing. It also ties in with higher costs (tariffs and other expenses), eating into what’s left over for shareholders. My initial thesis assumed FCF would grow as margins held and EV sales rose, but instead, FCF has been sluggish.

This matters because stock valuations ultimately follow cash generation. If GM isn’t converting its EV sales and accounting profits into significantly higher free cash, the ultra-low valuation may persist. Slower FCF also limits the pace of buybacks (though GM did restart them in a limited way). So, this was a miss on my part; I expected a bit too much too soon on the cash front.

Factor #3. Rising Warranty and Recall Costs

One negative surprise has been higher warranty and quality expenses. Car manufacturing is complex, and GM has had some bumps with new technologies and models, leading to costly recalls or repairs.

In the first half of 2025, GM’s warranty and recall costs jumped noticeably. The company reported about $3.3 billion in warranty expenses (net of supplier recoveries) in H1 2025, up from $2.7 billion in H1 2024. In Q2 alone, warranty-related costs were up $300 million y/y . This kind of increase acts like a stealth tax on profits as it’s money going out the door to fix or buy back defective vehicles.

Some of this may be related to EVs (new tech teething issues or recalls) and some to internal combustion vehicles (every automaker has recall cycles).

During the Q2 call, the CFO acknowledged that warranty expenses have been obscuring underlying performance, noting an increase of about $300M in the quarter. Essentially, GM’s earnings could have been higher if not for these quality-related costs. I didn’t factor this into my thesis before. My bad, I perhaps took for granted that GM’s product launch execution would be smooth.

While these costs aren’t catastrophic, they do nibble away at margins and cash flow. They also raise the question: are GM’s aggressive cost cuts or rapid EV rollouts causing any quality control slip-ups?

Over the long run, persistent warranty issues can hurt brand reputation (and result in more “goodwill” repairs). So this is something that changed my outlook, it adds another headwind to sustaining margins.

Factor #4. Tariff Mitigation Efforts

A newer development (that I hadn’t anticipated initially) was the U.S. government’s auto tariffs in 2025. These tariffs have been painful (costing GM billions as I explained above), but I want to highlight that GM responded proactively, which is a positive.

Management didn’t just sit and take the hit; they’re reconfiguring production to dodge as much tariff as possible going forward. GM announced a $4 billion investment in U.S. assembly plants to add capacity for high-demand vehicles and reduce tariff exposure.

By localizing more production in the U.S. (including shifting some truck and crossover manufacturing from Mexico/Canada to Michigan, Kansas, Tennessee, etc.), GM can avoid import taxes. The CEO said this will “greatly reduce our tariff exposure” and satisfy unmet demand for certain models.

In the interim, the company is also pushing other mitigation strategies for example, negotiating cost offsets with suppliers and carefully managing pricing. They expect to offset about 30% of the tariff impact through these actions. By late 2025 and beyond, these moves should start bearing fruit. I consider this a partial “right” because GM showed it can adapt strategically to policy changes. They even felt confident enough in visibility to resume share buybacks in July, after pausing, which signals management believes they have the tariff problem handled to a degree.

In summary, the landscape in 2025 turned out tougher than I foresaw. The biggest shift is the competitive environment which casts a shadow on GM’s growth story. Additionally, the macro/trade curveball of tariffs (an external shock) and higher internal costs (warranty) mean GM’s earnings quality is a bit worse than I hoped. These factors made me question how much upside is left in the stock versus the risks.

Q2 2025: By the Numbers

To really understand why I closed the position, let’s dig into GM’s latest financials and what they signal. GM reported its Q2 2025 earnings on July 22, and the results were a mixed bag of strong core operations and significant one-time drags.

A few highlights from the Q2 2025 numbers:

Flat Revenues, Lower Profits

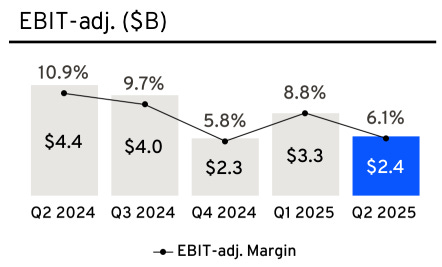

GM’s Q2 revenue was $47.1B, basically flat (down 1.8% y/y). Unit sales were up, but price/mix was slightly weaker (more on that below). Adjusted EBIT was $3.0B, down from $4.4B in Q2 2024, that’s a 32% drop in operating profit.

For the first half of 2025, EBIT is down about 22% y/y. So earnings did decline despite higher EV sales and steady revenue. The main culprits: tariffs, inventory write-downs, and costs like warranty. Without the tariff hit, Q2 EBIT would have been closer to $4.1B (essentially flat y/y) which shows how big a swing factor these new costs are.

Adjusted EPS for Q2 was $2.53, which beat analyst expectations and was only slightly below the ~$2.70 in Q2 last year. So GM managed the quarter well given the circumstances, but profits are definitely off their peak.

Margins Squeezed by Tariffs & Write-Downs

As mentioned, GM’s North America margin was 6.1% in Q2, down from around 9-10% historically. The company quantified the drags: a $1.1B tariff impact and a $0.6B EV inventory adjustment (write-down) in the quarter. Those two alone reduced profit by ~$1.7B. The EV inventory write-down is essentially GM saying some EVs in stock weren’t worth as much as they thought (either due to having to discount them or lower demand expectations). They wrote down $600M to realign inventory values. It’s a one-time hit, but it does indicate maybe GM overbuilt certain EV models relative to immediate demand.

The CFO expects this to improve as they right-size production and incentives. Tariffs, on the other hand, are an ongoing issue, Q3’s tariff bill will be higher than Q2’s, though GM still thinks the full-year hit will be $4–5B as guided.

Crucially, if you exclude these unusual costs, GM’s underlying margin was roughly on plan. They said the NA margin would have been ~9% absent tariffs, and globally the company would still target ~8-10% margins pre-tariff. This gives some comfort that the business isn’t structurally deteriorating. It’s external stuff and short-term inventory corrections. But still, we can’t ignore that those costs are real and they hurt 2025’s results.

Cash Flow and Capital

As noted, free cash flow took a hit from these issues. GM generated $4.7B automotive operating cash in H1 2025, down from $7.1B last year. After capex, the free cash flow is even slimmer (H1 capex was $3.9B). Tariff payments directly reduce cash (they’re basically a tax), and GM also built some inventory earlier in the year, which used cash.

The company is still on track to produce around $7.5-10B in automotive FCF for full-year 2025, but that’s down from original expectations. On the positive side, GM’s balance sheet is solid: they have about $12.5B in automotive cash on hand and plenty of liquidity. They even paid a $350M dividend up to the parent from GM Financial in Q2, which helps. GM also restarted share buybacks in July, with $4.3B authorization left. However, I suspect the buyback pace will be measured given the uncertainties.

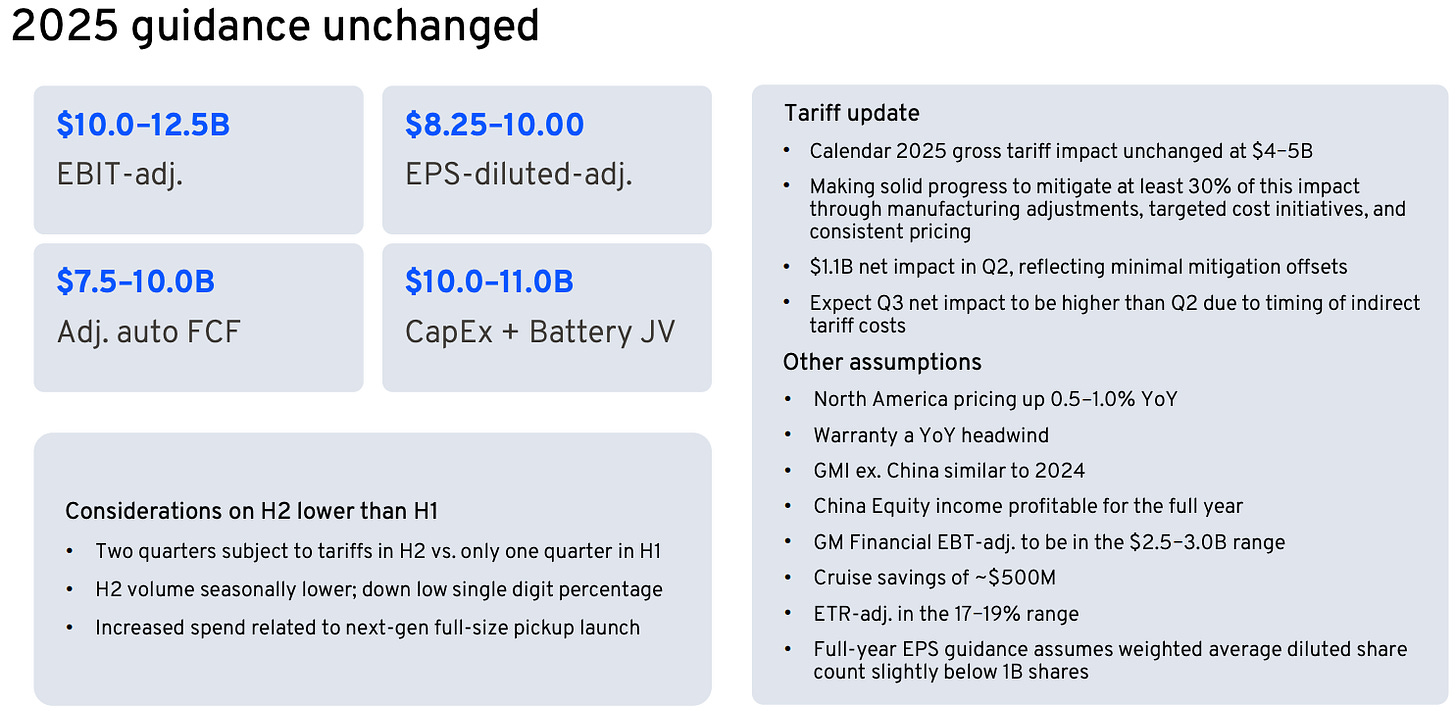

Updated Guidance Affirmed

GM chose to reaffirm its full-year 2025 guidance despite the Q2 profit drop. They still see $10.0–12.5B EBIT-adjusted for the year, $8.25–10.00 adjusted EPS, and $7.5–10.0B adjusted automotive FCF.

Essentially ,they are absorbing the tariff hit and not lowering the range (though they’d likely land toward the lower half of it). One reason is that GM had a strong first half (EBIT $6.5B) and they knew the second half would be lighter. They explicitly warned that H2 EBIT will be ~$1.75B lower than H1 due to an extra quarter of tariffs (Q3 and Q4 will have them), seasonally lower volumes, and launch costs for new trucks.

So don’t be shocked when Q3 EBIT is down again y/y, that’s baked in.

The good news is that beyond 2025, if tariffs get mitigated and new EVs ramp up, GM could have a nice rebound. They mentioned some tailwinds: improved mix (selling more high-end trucks/SUVs) gave a $500M boost in Q2, and they expect pricing to be slightly up for the full year by ~0.5-1%. They’re also saving ~$500M from winding down Cruise robotaxi efforts. But the big question is 2026 and beyond, can GM hit its 2030 targets (12-14% EBIT margins, >$250B revenue)?

That assumed no crippling tariffs and successful EV adoption. Right now, the 2030 vision is still alive but looking harder to achieve.

All these numbers and trends fed into my decision. The thesis was right that GM would outperform for a while (and it did), but now the easy money has been made. The risk/reward shifted as margins got pinched and future competition looms large.

The China EV Storm and Why GM’s Outlook Changed

Perhaps the single biggest factor in my decision to sell is the changing competitive dynamics, epitomized by what’s happening with China’s EV makers. I touched on it above as something I underestimated.

Let’s dig deeper because it’s crucial for GM’s future.

As I explained earlier, Tesla’s grip on Europe is slipping fast. July sales: -55 % in Germany, -60 % in the U.K. BYD, now the top global EV maker, jumped 5x in Germany. Chinese brands doubled their EU share in a year by undercutting rivals +20% on models like the BYD Atto 3 and MG4. Result: they took 5% of all EU car sales (10 % of EV sales) in H1 2025 despite rumblings of tariffs.

Now, how does this relate to GM?

GM actually isn’t a major player in Europe these days (they pulled out of selling cars in Europe aside from niche Corvette/Cadillac imports). But GM is a major player in China, and it plans to be a major player in EVs globally (including presumably defending its home U.S. market).

The trend I see is that Chinese EV makers have scale, cost advantages, and increasingly strong products. They are likely to challenge incumbents outside China, not just Tesla but all legacy automakers. Mary Barra has a strategy for EVs in China, but GM’s China sales have been declining, and it’s been punished like VW and Tesla in China. GM’s market share in China fell into the single digits as Chinese brands dominated the EV segments where GM was late or lacking.

Now GM is trying to catch up in China with new EVs (the Buick Electra, Cadillac EVs, etc.), and they did see NEV sales in China up 50% in Q2, which is a glimmer of hope. But I remain skeptical that GM can regain its former glory in China, given the local competition and the Chinese government’s support of domestic OEMs.

Looking to the U.S., it’s true that no Chinese brand sells passenger cars here yet (aside from limited numbers of Polestar, which is a Sweden/China hybrid). But I think it’s only a matter of time. Chinese automakers may soon build factories in the U.S. or Mexico to sell vehicles in GM’s home market. Imagine a company like BYD, which makes millions of EVs at low cost, deciding to enter the U.S. with a mass-market $25,000 electric crossover. It would put huge pressure on GM (and Ford and others) to either cut prices or lose sales. We already saw how Ford had to slash prices on its F-150 Lightning EV this summer, likely due to softer demand and competition (Tesla’s Cybertruck, Chevy’s Silverado EV on the way, plus eventual newcomers).

If a price war erupts in EVs, GM’s nice margins could evaporate. Tesla has been cutting prices all year; that hasn’t directly hurt GM’s Hummer or Cadillac Lyriq yet (since those are supply-constrained and target different buyers), but a broad EV price erosion is something to watch.

The point is: the auto industry is entering a more competitive era. GM in 2024-25 benefited from being early with some EV models in the U.S. (like the Bolt, Hummer, Lyriq) and from legacy competitors having missteps (e.g., Ford’s EV sales dropping 31% in Q2 due to Mach-E recall issues). But the window where GM had a relatively open field is closing. New EV startups, plus Tesla’s push, plus the looming China incursion, all make me concerned that GM’s future market share and pricing power will be under attack.

That means GM might have to fight harder and spend more (on marketing, on incentives) to sell its vehicles, which could hurt profitability. It also could mean slower EV sales growth than the bullish scenarios, if GM cedes some portion of the pie to others. In essence, the risk-adjusted upside for GM stock is lower now that this competitive storm is on the horizon.

When I first bought GM, the narrative was “legacy titan transforms into EV leader, crushes it, stock rerates higher.” Now the narrative might become “legacy titan battles in a crowded arena with razor-thin margins.” That’s not an attractive picture for a stock, even a “cheap” one. Cheap stocks can always get cheaper if the market thinks their future is dim.

Why I Closed the Position and Redeployed

With all the above context, the decision to close my GM position came down to a simple question: Would I buy GM fresh today?

By August 6, my answer was no.

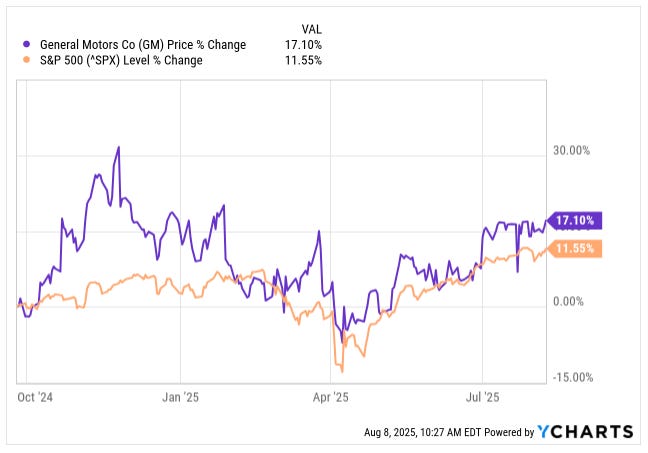

The stock had risen nicely (beating the S&P in the period I held it), but the future looked murkier than when I started the position. So I chose to cash out and rotate into a new idea with, in my view, better upside.

To summarize my rationale:

Thesis Fulfilled (and Priced In): Much of what I hoped for from GM happened and the stock went up and then down. GM also restarted dividends and buybacks in the past year (after suspending them in 2020), which likely helped the stock sentiment. The stock’s valuation, while still low, is now less of a secret. It trades around $50–$55, up from mid-$40s when I was pounding the table. It’s still only <6x earnings, but given the risks, I don’t expect a big rerating upwards anymore.

New Headwinds = Capped Upside: The macro environment flipped with the tariff issue. GM is essentially paying a new tax that didn’t exist before (up to $5B this year). That alone reduced the expected 2025 EBIT by ~24% from prior guidance. Even if GM mitigates some of it, it’s a permanent drag unless trade policies change. Additionally, the UAW labour contract is set to expire in late 2025; a strike or increased labour costs could pose another challenge (not covered above, but worth mentioning). When I look at 2024-2025 earnings, they are lower than I thought a year ago because of these costs. So the stock’s cheap multiple is somewhat justified as there’s more uncertainty in the “E” of P/E now. GM’s margin of safety has shrunk.

Competitive Uncertainty: The discussion on Chinese EVs and market crowding is a medium-term concern that made me less comfortable projecting GM’s growth 2-3 years out. Could GM still thrive? Sure: it has great engineers, good brands, and dealers, and it’s not going to roll over easily. But I foresee more price competition and maybe some market share losses in EVs as the wave of new models hits the market. If GM has to, say, price the Equinox EV lower to fend off a future BYD Atto or a Tesla Model 2, that squeezes profits. GM is also investing heavily in software, autonomous (Cruise unit), etc., which may pay off later, but in the meantime, it burns cash. All this makes the risk profile higher now than when I first invested. Back then, the main risk was a macro recession (which didn’t really happen yet). Now we have geopolitics, trade tariffs, and a full-on EV arms race as risks.

Opportunity Cost (Better Trades Elsewhere): Finally, and importantly, I found a new trade idea that I have higher conviction in (I alerted it on Aug 6, the same day I sold GM). It’s a company that I believe has more near-term upside catalysts and fewer of the above concerns. In fact, it has already returned +25% to paid subscribers that bought it when I sent the trade alert, 25% in 3 days is already better than the 18.7% GM returned over several months. Part of portfolio management is choosing your battles. I could keep sparring in the auto arena with GM, or move to what I see as a more favourable matchup. I chose the latter.

One thing I want to emphasize: this isn’t me saying GM is doomed or that the stock will tank. GM is still reasonably valued. The dividend is modest at about 1%, and if cash flow stabilizes, management could increase shareholder returns. I can see a path to $70ish per share, but it would take time, and it is uncertain. I also see a credible downside near $30. At about $55 today, that means risking around $25 on a higher-probability outcome to make about $15 on a lower-probability one. That is not an attractive risk-reward.

So yes, GM could muddle through and reward patient holders. Given everything we’ve covered, though, the risk now outweighs the reward for me.