Weekly #49: Billion-Dollar AI Love Triangle: How OpenAI, NVIDIA & Oracle Reset Data-Center Capex

Portfolio +26.6% YTD, 2.3x the market, plus OpenAI–NVIDIA–Oracle reset AI data-center demand.

Hello fellow Sharks,

This week, the portfolio retreated a bit, driven by the tech sector. YTD, we’re +26.6% and 2.3x the market since inception. If you want to skip straight to the numbers, jump to the Portfolio Update.

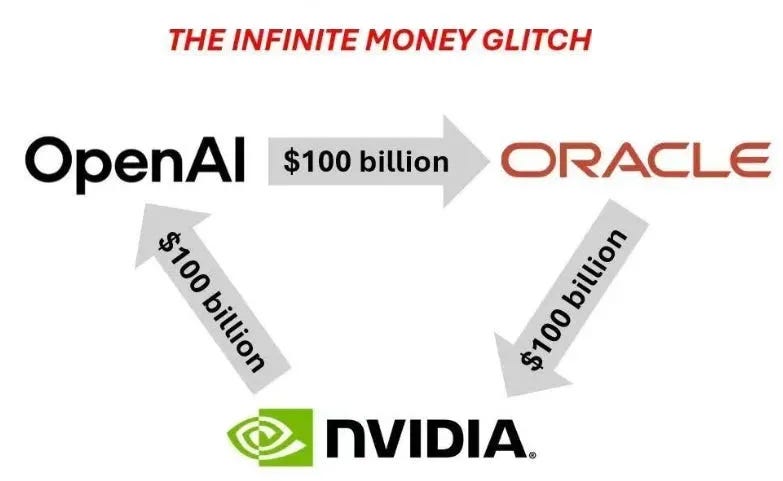

Last week, multi-billion-dollar deals were announced by OpenAI, Nvidia, and Oracle. They spawned countless memes. Some funny, some R-rated, and some that actually made you think (like this one).

In the Thought of the Week, I’ll double-click on these partnerships and what they mean. Two takeaways: #1 we need to keep a close eye on capex, revenue models, and the competitive landscape; and #2 these deals are tailwinds for several of our positions such as CLS (high-speed switches), TSM (leading-edge nodes), and POWL and AGX (power infrastructure).

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

I pushed an update on Celestica because the stock reached my $253 USD / $350 CAD target much faster than I expected. The core idea hasn’t changed. CLS sits in the slipstream of the shift from 400G to 800G, with 1.6T on deck next. CCS grew 28% y/y last quarter.

What’s new is the NVIDIA–OpenAI partnership to deploy at least 10GW of GPU data centers, with NVIDIA planning up to $100B invested as each gigawatt comes online starting in the back half of 2026; that lengthens the runway for the high-speed racks, optics, and switches Celestica builds (I double-click on the partnership in this week’s Thought of the Week). Since we added CLS, the position is up 353% and it’s my largest holding.

Thought Of The Week: Multi-Billion Dollar Bets: Oracle, OpenAI, and Nvidia’s AI Investment Circle

Nvidia’s $100B Hardware-for-Equity Pledge

Nvidia’s recent LOI to invest up to $100 billion in OpenAI is unprecedented. The structure is twofold: Nvidia (NVDA 0.00%↑) buys non-voting shares of OpenAI, and OpenAI uses that cash to purchase Nvidia’s cutting-edge chips.

This essentially pre-finances OpenAI’s GPU needs ensuring Nvidia remains its go-to supplier as the company deploys an eye-popping 10 gigawatts of AI compute (roughly the output of 8 million U.S. homes). It’s a symbiotic deal that raised eyebrows.

Oracle’s $300B Cloud Compute Commitment

Not to be outdone, Oracle stunned markets with a five-year, $300 billion cloud services agreement to power OpenAI’s future workloads. Starting in 2027, OpenAI would effectively owe Oracle $60 billion per year for hosting. An astronomical sum given OpenAI’s current revenue (reportedly ~$10 billion).

In return, Oracle (ORCL 0.00%↑) becomes a top-tier AI cloud provider overnight, having booked an additional half-trillion in OCI contract revenue. But fulfilling this “Stargate” deal means Oracle must massively expand its infrastructure adding 4.5 GW of new data center capacity and procuring perhaps hundreds of thousands of Nvidia GPUs to deliver the promised compute.

Oracle is, in effect, betting the house on Nvidia-powered AI; Moody’s analysts have already flagged the “counterparty risk” of relying so heavily on a small number of AI customers, and note that Oracle may see years of negative cash flow as it shoulders this build-out.

Circular Capital Flows and Capped-Profit Quirks

These giant deals also invite questions about financial circularity. In Nvidia’s case, some portion of its $100 billion investment could boomerang straight back as chip sales to OpenAI.

OpenAI’s unusual capped-profit structure (now transitioning toward a more traditional model) adds another wrinkle. With investors like Microsoft (MSFT 0.00%↑) and Nvidia injecting capital that’s immediately plowed into GPUs and cloud credits, the lines blur between equity funding, customer prepayments, and vendor financing.

It’s an AI ouroboros of money: Nvidia bankrolls OpenAI so OpenAI can buy Nvidia hardware; OpenAI pre-pays Oracle for future capacity that Oracle can only build using Nvidia chips. OpenAI does not have $300 billion to spend, so the figure presumes immense growth. Even Sam Altman himself has mused about froth in the AI market while in the same breath doubling down on spending illustrating the exuberant (if paradoxical) mindset driving these deals.

Supply Chain Ripple Effects: Celestica and the AI ‘Arms Dealer’ Economy

Behind every headline investment is a massive procurement spree for the AI supply chain. A single 1‑GW AI supercluster requires roughly $50 billion of hardware, including $35 billion worth of Nvidia components. Multiply that by OpenAI’s 10 GW ambition, and you get a bonanza for chipmakers and hardware integrators.

This is where “picks and shovels” players like Celestica (CLS 0.00%↑) come in. Celestica has quietly become a key enabler of hyperscale AI build-outs, making everything from high-speed 800G network switches to fully integrated GPU servers. The company boasts a top-four share in backend Ethernet switching (over 1.6 million 800 Gbps ports shipped in Q1 2025) and even embeds Microsoft’s open-source SONiC software into its hardware for cloud data centers.

In fact, Nvidia relies on partners like Celestica and Supermicro (SMCI 0.00%↑) to assemble and deliver its AI supercomputers at scale. Nvidia ships tens of thousands of GPUs in pre-built racks to Celestica, which then packages and deploys them for clients like Microsoft, Meta (META 0.00%↑), and Amazon (AMZN 0.00%↑).

If OpenAI and Oracle are spending hundreds of billions on AI hardware and facilities, companies like Celestica are likely busy on the factory floor, turning those dollars into the physical infrastructure that makes AI magic possible. It’s a virtuous (and lucrative) cycle for the supply chain: more AI hype drives more GPUs and servers, which drives more demand for Celestica’s gear: a feedback loop feeding the broader AI boom.

Can the Spending Cycle Sustain Itself?

Optimists argue that we are still in the second inning of a decades-long AI transformation, implying today’s extravagant outlays will be justified by world-changing innovations (and eventually, profits). They point to projections of nearly $3 trillion in AI-related infrastructure spend by 2028 as evidence that Oracle’s and Nvidia’s commitments are shrewd moves to secure future dominance.

Skeptics, however, warn of bubble-like dynamics. Moody’s has fretted that Oracle’s AI bet could stretch its balance sheet with extended negative cash flow. Others note that OpenAI might be overextending itself. The company is losing money and doesn’t expect to turn a profit until late this decade, yet it has committed to payments predicated on ChatGPT’s user base scaling to “billions of people… as well as major businesses and governments”.

In the end, this triad of OpenAI, Oracle, and Nvidia has essentially formed a high-stakes circular funding loop to build the next generation of AI supercomputers. The strategy could lock in a formidable lead in AI infrastructure for all three; or, if the boom cools, leave them with a multi-billion-dollar hangover.

Portfolio Update

This week, the portfolio retracted a bit, led by the sell-off in the tech sector.

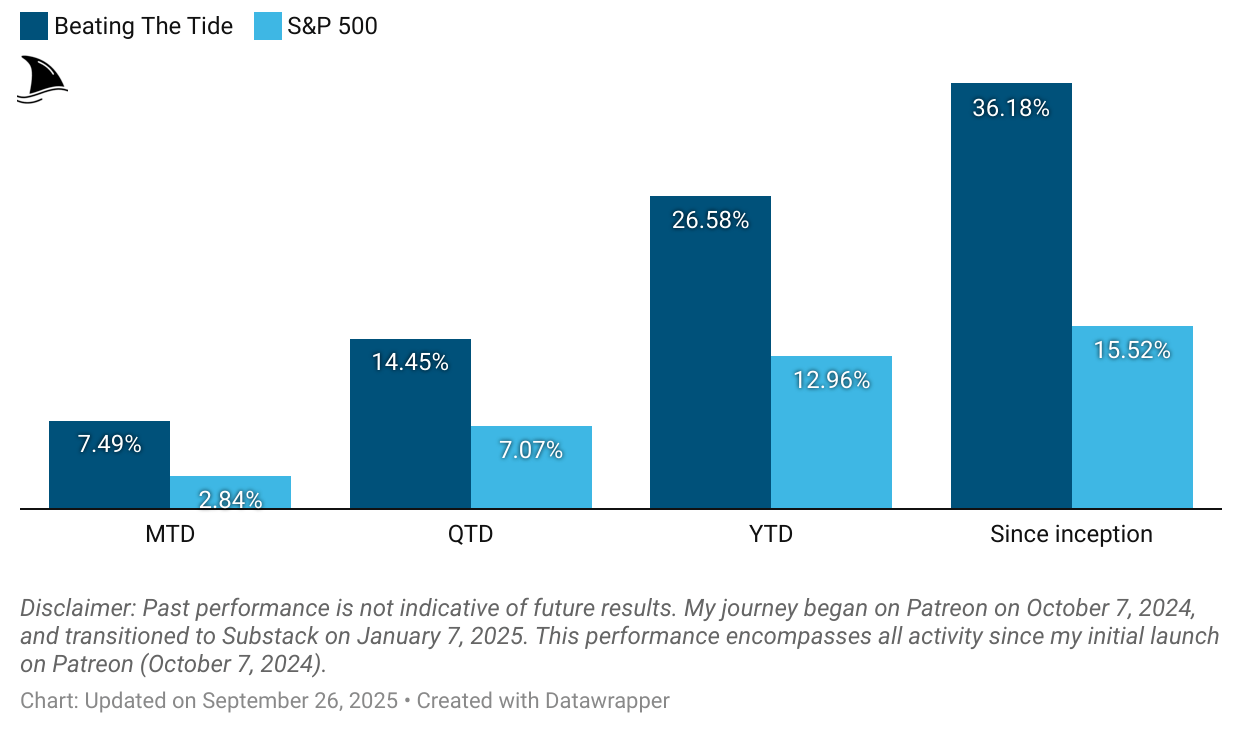

Month-to-date: +7.5% vs. the S&P 500’s +2.8%.

Quarter-to-date: +14.5% vs. the S&P 500’s +7.1%.

Year-to-date: +26.6% vs. the S&P’s +13.0%, a gap of 1,362 basis points.

Since inception: +36.2% vs. the S&P 500’s +15.5%. That’s 2.3x the market.

Portfolio Return

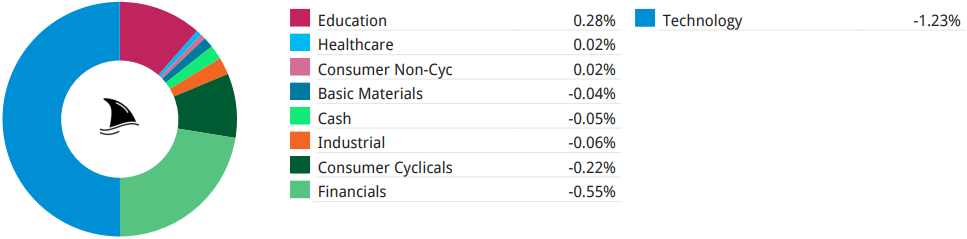

Contribution by Sector

The drag was led by tech, financials and consumer cyclicals, slightly offset by education.

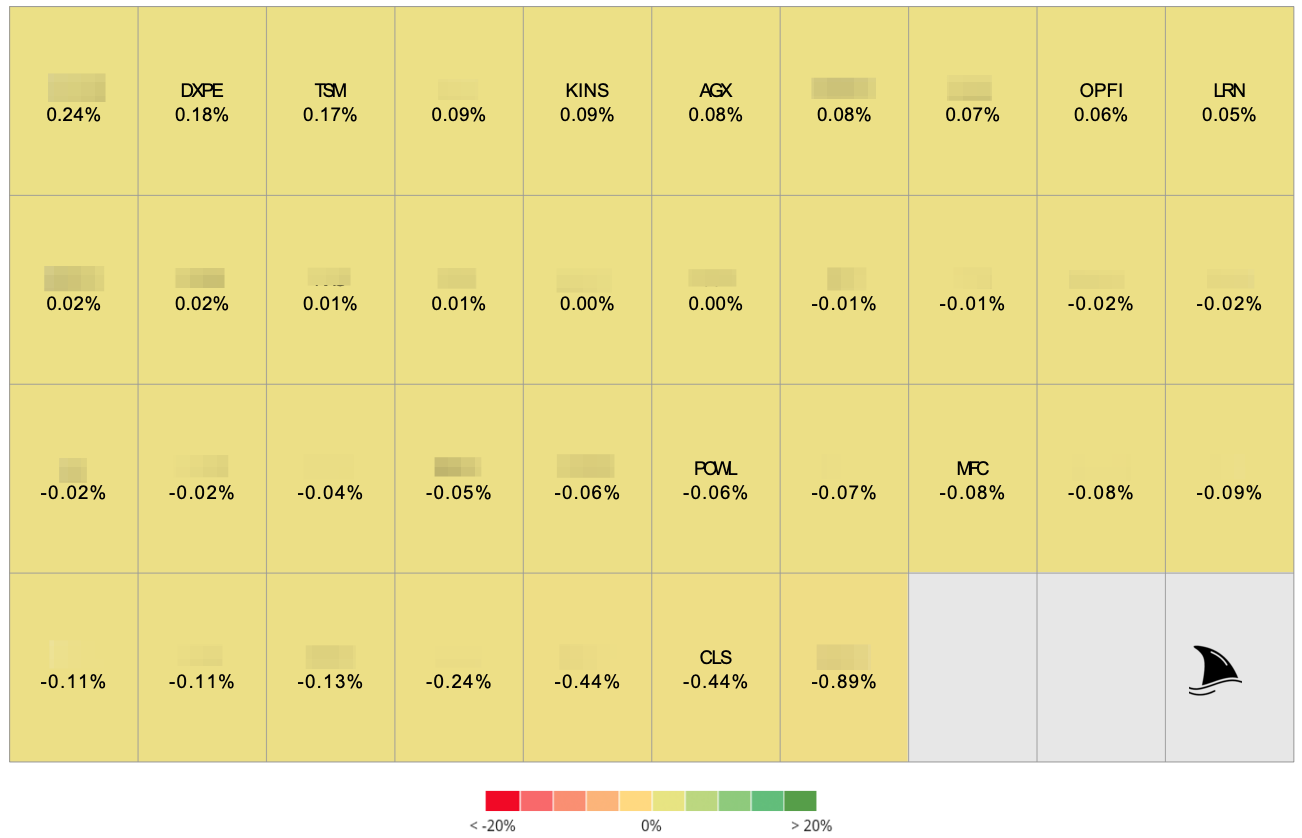

Contribution by Position

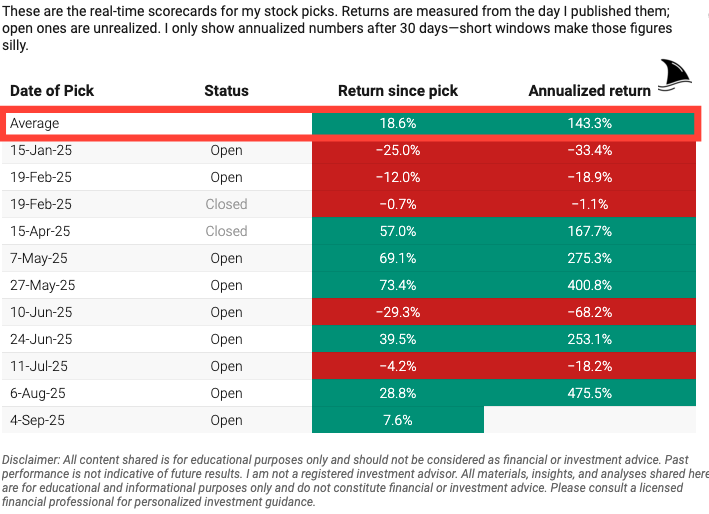

(For the full breakdown, see Weekly Stock Performance Tracker)

+18 bps DXPE 0.00%↑ (Thesis)

+17 bps TSM 0.00%↑ (Thesis)

+9 bps KINS 0.00%↑ (Thesis)

+8 bps AGX 0.00%↑ (Thesis)

+6 bps OPFI 0.00%↑ (Thesis)

+5 bps LRN 0.00%↑ (Thesis)

-6 bps POWL 0.00%↑ (Thesis)

-8 bps MFC 0.00%↑ (TSX: MFC)

-44 bps CLS 0.00%↑ (TSX: CLS) (Thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: