Weekly #47: The Hidden Power of Playing Defense in Investing

Portfolio +25.6% YTD, 2.4x the market, plus why the “avoid losing” mindset drives compounding.

Hello fellow Sharks,

This was another strong week for the portfolio: YTD, we’re up +25.6% and sitting at 2.4x the market since launching the newsletter. If you want to skip straight to the numbers, jump to the Portfolio Update.

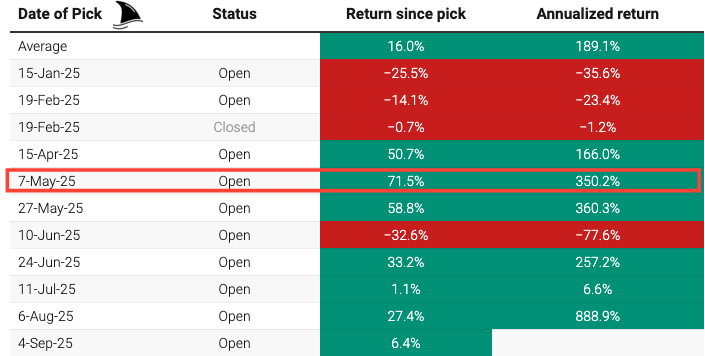

I’ve added a section on the May 7, 2025 pick, which is now up about 72% since I first wrote about it. I summarize its latest earnings results. While that pick has rallied 72%, the original upside case was 160%, so we’re almost halfway there.

On Wednesday, I’ll be uncovering the name of the April 15, 2025, stock pick. That pick has reached about 50% gains and already hit the target price I set at the time. In the deep dive, you’ll find why I bought it, what went right, what didn’t, and how I’m thinking about it now.

And as always, I’ve included a Thought of the Week. This one digs into a simple but powerful idea: while the rest of the world is chasing victory, the best avoid losing first. I walk through why that mindset drives compounding and how it’s played out in my own process.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

This week, I dropped my monthly pick for paid subscribers. I believe it has ~50% upside from current levels. It’s not flashy, but it’s the kind of company you walk past every day without noticing.

A Hidden Infrastructure Winner With +50% Upside

The company has turned a corner after several rough years, with profits back, cash generation solid, and a balance sheet moving toward net cash or at least low debt risk. Backlog and project ramps are accelerating again, with newer contracts carrying better margins as older, less profitable work winds down, making margin expansion realistic.

Despite that, the stock still trades at a discount to peers on cash flow and forward earnings multiples. I think the discount overstates the risk given the execution so far. If delivery, contract margins, and cost control hold up, I expect earnings to be meaningfully higher next year, which gives the thesis both upside and some built-in protection.

Execution slipups, delays, or cost overruns could compress margins, but I view those risks as manageable relative to the opportunity, and I’ve laid out the numbers, risks, and catalysts in the paid deep dive.

Update on the May 7, 2025, Pick

The stock pick I shared on May 7, 2025, is now up about 72% since I wrote about it.

Last week, it reported results that were its strongest in nearly three years, capping off a record fiscal 2025. Revenue jumped more than 18% y/y, adjusted EPS rose roughly 50%, and free cash flow hit new highs.

Management also guided to another year of double-digit revenue and EBITDA growth in fiscal 2026, with a clear plan to keep scaling its customer experience deployments and expanding its digital services footprint.

What stands out is how closely the company’s execution matches the thesis I laid out back in May. I argued then that its shift to nearshore/offshore delivery would expand margins and allow it to take share from slower incumbents. That’s exactly what happened. Offshore revenue climbed at a double-digit clip and now makes up nearly half of the business, supporting gross margins over 30%.

I also highlighted its technology edge as a differentiator. Management said those tools moved from pilot mode to full-scale production with clients, positioning the company for durable growth.

There are still a couple of areas I’m watching. In my thesis, I expected margin expansion to continue steadily; adjusted EBITDA did grow, but the margin dipped slightly as the company invested in new markets and absorbed higher payroll and FX costs.

That trade-off makes sense if the growth proves sustainable, but I’ll be tracking whether profitability stabilizes as those investments scale. Overall, though, the big picture has played out: a once-overlooked, “boring” outsourcer is turning into a tech-enabled compounder with a much stronger competitive moat than the market gives it credit for.

Check out the original thesis,

Thought of the Week: While the Rest Chase Victory, the Best Avoid Losing

Two days ago, I had a conversation that stuck with me. A friend kept insisting that my returns were “too good” to come from fundamental research alone. He was convinced I had a secret, some hidden algorithm, some trading signal, some whisper network of insiders.

I told him the truth.

There’s no trick. I’m old-school. I read filings. I build models. I call people. I make judgment calls one company at a time.

He didn’t believe me. Even when I mentioned that Warren Buffett and other well-known investors use the same approach, he shook his head. That disbelief nagged at me.

Why is the idea of plain work so unbelievable?

I’ve come to one conclusion.

People think a system has to be complex to be good. If it’s simple, it must be obvious, and if it’s obvious, it must be worthless. But nobody bothers to do the simple work of reading 10-Ks, understanding the business, calling customers, suppliers, and competitors.

That’s my moat. I do the work most people aren’t willing to do.

And that’s fine. It’s why I offer a paid subscription. Not everyone wants to read filings for hours or sit through two-hour earnings calls.

But the conversation also reminded me of a bigger shift I see everywhere. This tug-of-war between instant gratification and deferred payoff.

Scroll TikTok or Instagram and you’ll see it: videos promising a quick buck, schemes for making money with no effort while sipping a margarita in the Caribbean.

Get rich today, retire tomorrow.

It’s the adult version of that famous marshmallow experiment. You can have one donut now or two donuts later. The kids who waited for the second donut did better on SATs and life outcomes. Today, our culture swipes the donut before the scientist finishes explaining the rules.

This shift toward instant everything isn’t just about money. Same-day delivery, breaking news alerts, viral trends. Our patience muscle is atrophying. Reflection feels like an antique.

In investing, that reactive posture is poison. Staring at the screen and reacting to what’s flashing now is almost always the wrong move. I won’t rehash why, as I’ve covered it at length in previous Weeklies.

But there’s also a hidden advantage. In a world hooked on instant gratification, the ability to wait … reflect … and plan becomes a superpower.

Most people won’t do it.

If you can, you win by default.

And once you’ve built that patience muscle, the next step is obvious: you stop thinking about quick wins and start thinking about the long-term. You begin every decision by asking what could go wrong, not how flashy the upside looks.

That’s where the idea of “avoiding loss before chasing victory” comes in. The best in the world aren’t obsessed with winning at all costs. They’re obsessed with not losing stupidly.

In chess, grandmasters don’t go for dazzling sacrifices on move 15. They control the center. They develop their pieces. They avoid weaknesses.

In judo, the first thing you learn is how not to get thrown.

In investing, the best spend more time thinking about risk, liquidity, balance sheets, and incentives than about upside headlines.

I’ve built my process the same way. Before I even think about potential returns, I ask what can go wrong. How does the company make money? How durable is that engine? Where can it break? Who benefits if it fails? What’s the balance sheet look like in a stress scenario? Only after I’m satisfied with the downside do I even model the upside.

Most investors, especially in a bull market, invert the order. They start with the dream scenario. They imagine the total addressable market, slap a growth multiple on it, and ignore the potholes. They’re chasing victory. They’re reaching for the flashy tactic. That works until the first real punch. Then they’re out of the game.

The pattern repeats across fields. Great military leaders don’t rush to win. They shore up supply lines. They avoid overstretch. They train logistics first, tactics second. Elite athletes don’t just train to win. They train to not get injured. A marathon runner’s career isn’t built on one peak race; it’s built on thousands of boring, low-intensity runs that prevent breakdown. The common thread is simple: longevity beats brilliance when brilliance can’t last.

I keep thinking about the race to the South Pole between Roald Amundsen and Robert Falcon Scott in 1911. Amundsen’s team stuck to a disciplined pace of about 15–20 miles a day, no matter how brutal or fair the weather. Scott’s team pushed hard on good days, collapsed on bad ones, and paid the price. Amundsen’s crew reached the Pole first and made it back alive; Scott’s party arrived weeks later and perished on the return.

There’s a book about this I’ve been meaning to read. Roland Huntford’s The Last Place on Earth, but I first heard the story on a couple of podcasts. It’s the best illustration I know of how steady, boring consistency outlasts spurts of brilliance.

In my own track record, the compounding came not from moonshots but from discipline and consistency. Thirty percent a year for more than a decade turns into 3,700%.

That doesn’t happen because I guessed right on some obscure option strategy. It happens because I avoided catastrophic losses, kept my capital intact, and let time do the heavy lifting.

This mindset also changes how you handle temptation. When you’re offered an “easy” 200% return from some hot tip, you automatically ask: What can I lose? If the answer is “a lot” or “I don’t know,” you pass (read my piece on Opportunity Cost). That single habit will save you more money than any newsletter.

There’s a quiet freedom in this approach. You stop needing to be the hero. You stop chasing every shiny object. You build a portfolio the way an engineer builds a bridge: over-engineer for stress, then let cars drive over it for decades.

And here’s the twist. By focusing first on not losing, you actually create more room to win. Because you’re still in the game when others are forced out. You still have cash when prices drop. You still have patience when panic sets in. Compounding only works if you’re alive to compound.

I think about this when I’m scrolling those “quick money” videos. Most of those schemes are built on leverage and hype. They’re designed to make you feel late. But investing isn’t a race to the first finish line. It’s a test of staying power. When you build your process around survival, you give yourself a shot at the smart win.

This is the essence of delayed gratification at an adult level. You trade the dopamine hit of feeling clever today for the quiet satisfaction of actual wealth later. You give up the fantasy of instant mastery for the reality of slow, compounding skill.

It’s not glamorous, but it works. And the longer you do it, the more obvious the edge becomes. In a culture hooked on immediacy,

…patience is mispriced

…discipline is mispriced

…boring is mispriced.

It is no coincidence that I named my book The Most BORING Stock Investment Book You’ll Ever Read.

If you can be patient, disciplined, and boring in a world that’s frantic, distracted, and thrill-seeking, you’ll look like a genius without ever doing anything genius-like.

So that’s my “secret.” I’m not chasing victory. I’m avoiding loss. I’m doing the work others skip. And in the long run, that’s what tilts the odds.

Portfolio Update

This week, we continued climbing higher into the stratosphere 😊

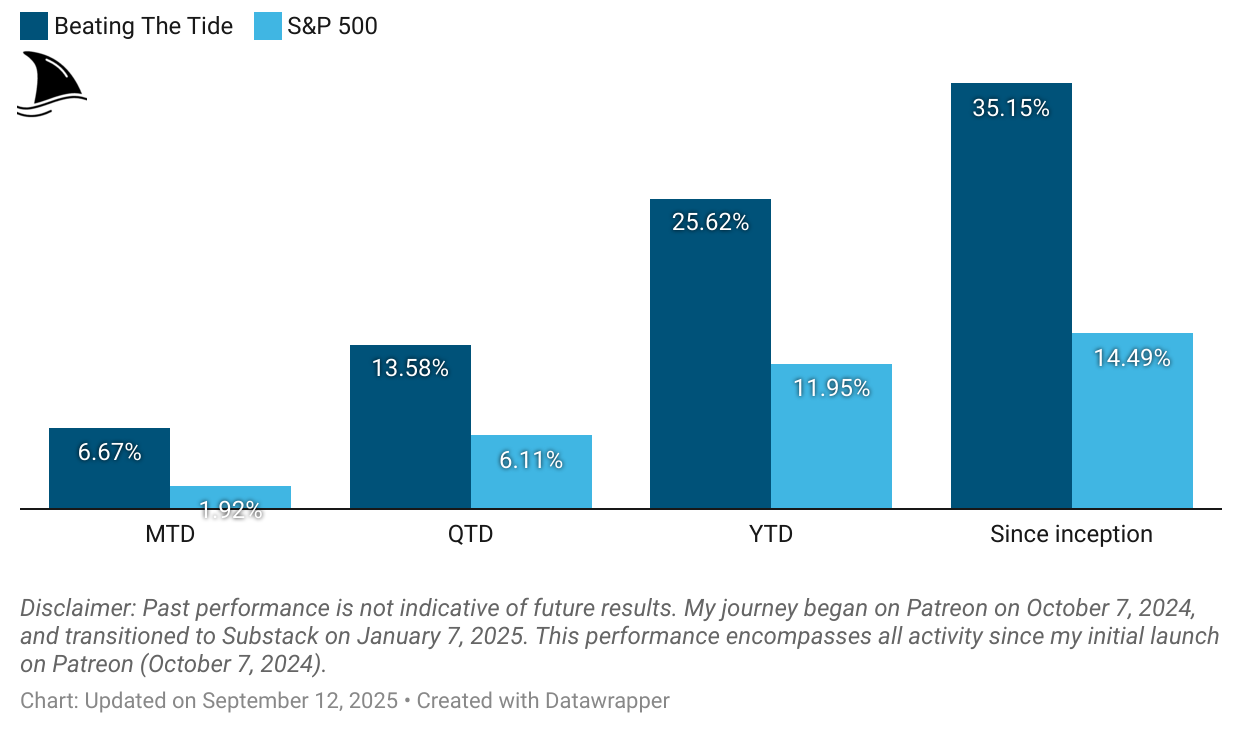

Month-to-date: +6.7% vs. the S&P 500’s +1.9%.

Quarter-to-date: +13.6% vs. the S&P 500’s +6.1%.

Year-to-date: +25.6% vs. the S&P’s +12.0%, a gap of 1,367 basis points.

Since inception: +35.2% vs. the S&P 500’s +14.5%. That’s 2.4x the market.

Portfolio Return

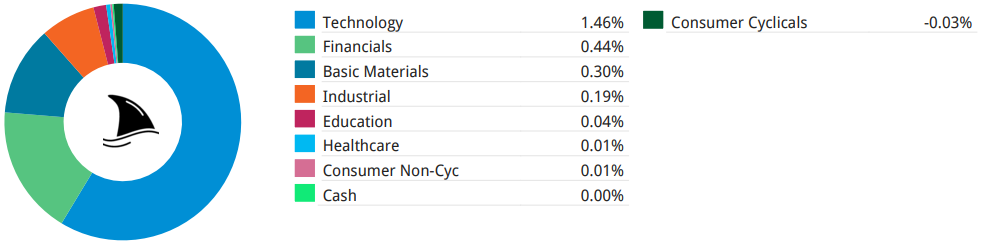

Contribution by Sector

Tech, financials and gold led the charge this week.

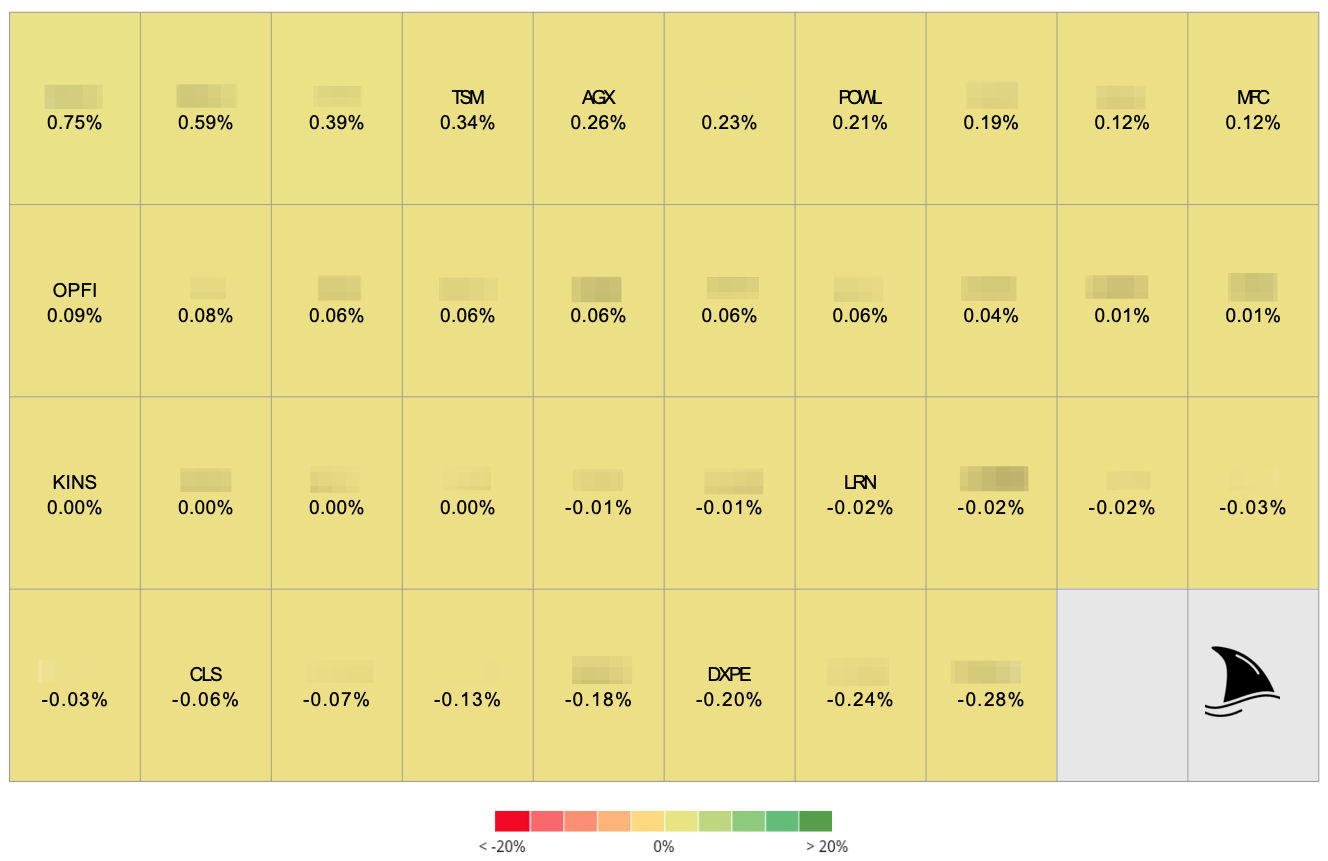

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+34 bps TSM 0.00%↑ (thesis)

+26 bps AGX 0.00%↑ (thesis)

+21 bps POWL 0.00%↑ (thesis)

+12 bps MFC 0.00%↑ (TSX: MFC)

+9 bps OPFI 0.00%↑ (thesis)

-2 bps LRN 0.00%↑ (thesis)

-6 bps CLS 0.00%↑ (TSX: CLS) (thesis)

-20 bps DXPE 0.00%↑ (thesis)

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: