Oil-Dri (ODC): Up 57% in 5 Months, Record Quarter & Why I Sold

Up 57% in 5 Months, Hitting My Target Price and Posting Record Quarterly Results. Why I’m Still Closing the Position.

Trade:

Closing ODC position

On April 8, I sent a trade alert adding Oil-Dri Corporation of America (ODC 0.00%↑) to the portfolio.

And on April 15, I published the deep dive explaining my rationale.

In that original thesis, I argued that this under-the-radar business was poised for a profitability inflection. Oil-Dri’s vertically integrated model (they own their clay mines and control production end-to-end) and its mix shift toward higher-margin products were key drivers.

In recent years, the company had been moving into premium niches like lightweight cat litter and renewable fuel filtration, which carry fatter margins and growth rates than the legacy clay products.

Earnings were already on the upswing, EPS had tripled from under $1 to over $3 in the span of a few years, and I believed the market was overlooking Oil-Dri’s transformation into a more profitable enterprise.

At the time, ODC stock was trading in the low-$40s. By my estimates, that was a steal. I pegged fair value around $64/share using a DCF model. The thesis was that as the company’s “dirt into dollars” strategy (turning sorbent clay into high-value products) played out, investors would catch on. Oil-Dri was a classic boring-but-beautiful compounder with secular tailwinds: pet ownership “humanization” driving steady litter demand, a renewable energy boom fueling its filtration clay sales, and even trends like reduced antibiotic use in livestock bolstering its animal health clay business.

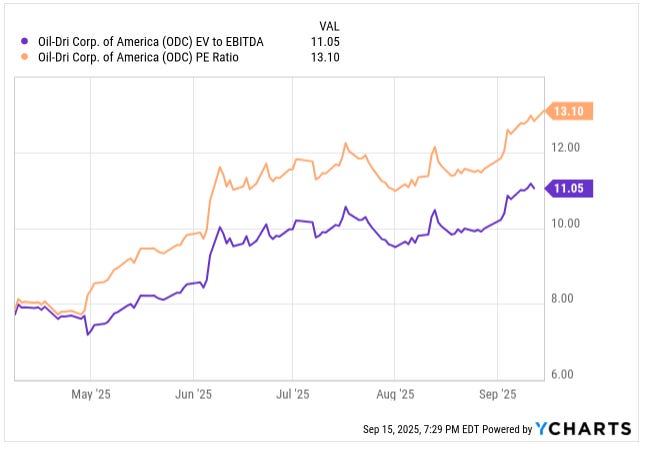

Yet despite these positives, the stock traded at single-digit earnings and EBITDA multiples, in part because it’s family-controlled and had been flying under Wall Street’s radar.

In short, my April call was bullish: ODC had (still has) a hidden moat (huge proprietary mineral reserves, decades of know-how) and improving fundamentals that warranted a re-rating. That thesis played out faster than I expected: in barely five months, ODC ran up to my target price.

In this article, I’ll walk through what went right, what went wrong, and why I’ve decided to close the position and take profits.

Table of Contents:

What I Got Right … And Wrong

Looking back, a lot of the original thesis has played out as expected and then some.

First, the core narrative was spot on: ODC’s pivot to higher-margin, value-added products has driven remarkable improvements in revenue and profitability. In fact, the latest results show accelerating sales growth and the 13th straight quarter of y/y gross profit improvement.

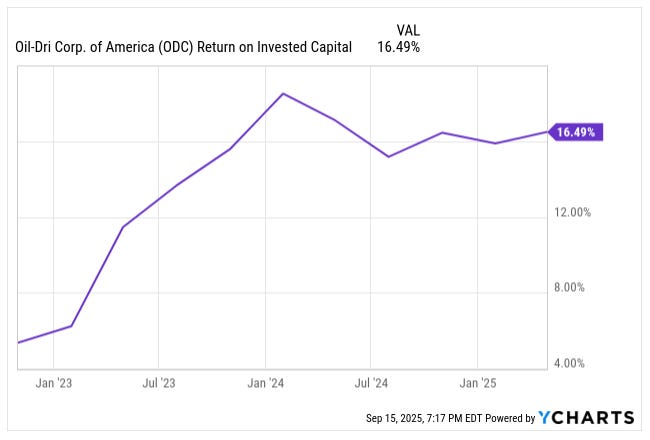

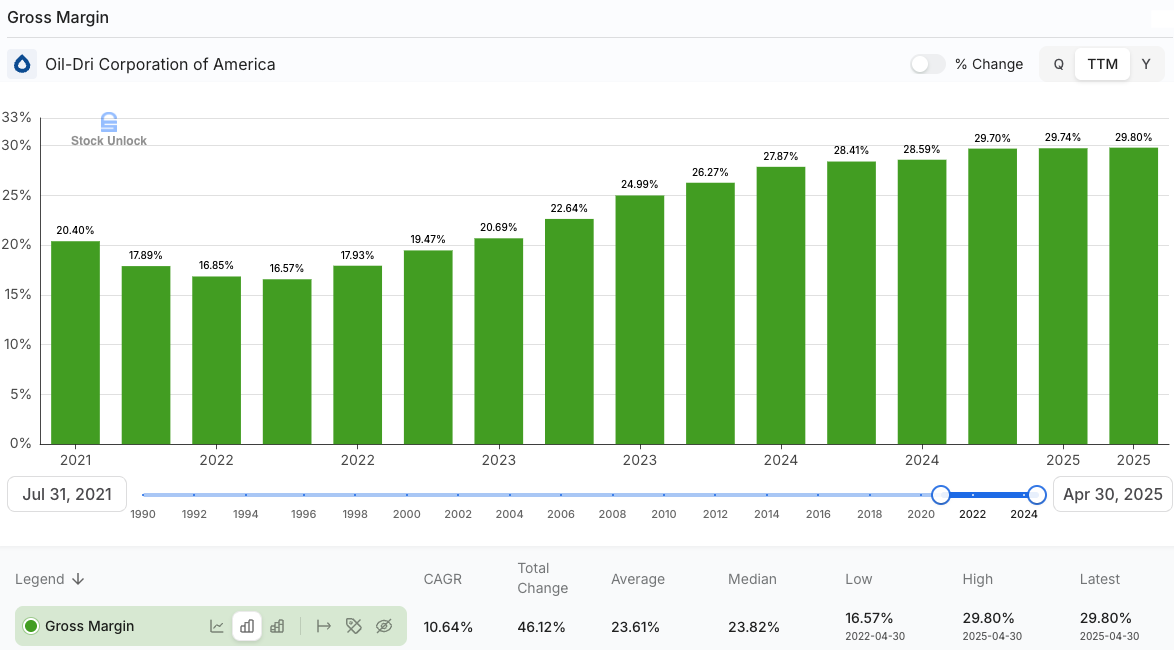

Gross margins continue to expand, confirming that the mix shift to premium products (like lightweight litter and renewable diesel filtration clay) is boosting profitability as predicted. The company’s free cash flow and return on capital have also strengthened alongside earnings, just as I anticipated.

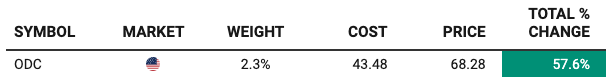

Crucially, the market has begun to recognize this progress. The stock price has surged, rising about 57% since mid-April (from the low-$40s then to around $68 now).

That re-rating has taken ODC from value territory toward a more reasonable valuation. In April, shares traded at less than 8x EV/EBITDA and under 8x earnings; today, those multiples are roughly 11x EV/EBITDA and 13x earnings, respectively, based on trailing figures.

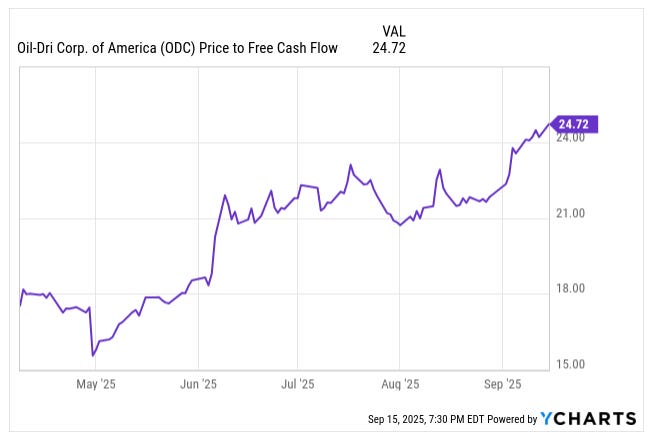

Price to free cash flow has climbed from around 18x to 25x.

In other words, the “steal” has been recognized, and ODC is no longer a dirt-cheap stock (pun intended). This validation of the thesis via both fundamentals and stock performance was a right call. I foresaw that ODC’s earnings trajectory and under-appreciated moat would force a rerating, and that’s exactly what happened.

That said, not every aspect of the call was perfect. One area I underestimated was the competitive intensity in the cat litter segment. While I noted Oil-Dri’s competitive advantages (vertical integration, patented tech, etc.), I expected its retail business to notch steady growth alongside the overall pet market.

Instead, the company hit a few speed bumps in its Retail segment. During the latest quarter, domestic clay-based litter sales actually fell about 6% organically, as a major private-label customer switched to a competitor and some smaller retail customers went bankrupt. Also, Smithland Pet & Garden Centers plans to close 13 stores in Connecticut and Massachusetts.

I didn’t foresee that kind of customer turnover in my original analysis. Competitors also ramped up promotional activity, forcing ODC to fight harder to maintain volumes.

In hindsight, I may have been a bit too optimistic on short-term Retail growth. The secular trend (pet owners spending more on litter) is intact, but the competitive jockeying caused a temporary setback in sales and margins for Oil-Dri’s clay litter line.

Another thing I was slightly off on was Ultra Pet’s near-term impact. Oil-Dri acquired Ultra Pet (a maker of silica gel crystal litter) in 2024 to expand into that premium niche. My thesis viewed this positively, and indeed, it has been a net positive. But the integration came with some hiccups.

The Ultra Pet business contributed ~$4.8 million in new sales in Q3, helping the Retail segment revenue grow modestly. However, the legacy Ultra Pet brands saw softer sales at some existing retailers post-acquisition, and Oil-Dri had to incur additional SG&A costs to fold in that business.

In other words, Ultra Pet is pulling its weight, but it didn’t provide an immediate growth explosion; it provided a more gradual benefit. I may have expected a bit more immediate boost. The good news is that management is actively leveraging Ultra Pet: they’ve added distribution for those crystal litter products and even launched a Cat’s Pride-branded crystal litter to broaden reach. So the strategic rationale is intact, even if the timeline to payoff is longer.

On the financial strategy side, one aspect of upside I mentioned was the potential for shareholder-friendly moves like buybacks or a bit of leverage (especially given the conservative balance sheet).

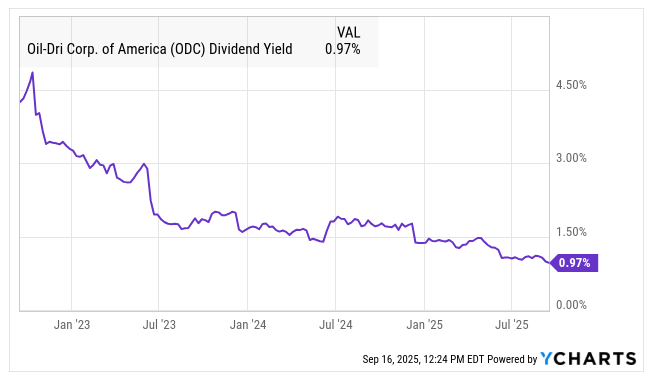

So far, Oil-Dri hasn’t done much on buybacks. Instead, they chose to reward shareholders through dividends. The Board approved a hefty 16% dividend increase this year, marking the 22nd consecutive annual raise.

This signals confidence (and it’s hard to complain about getting more cash back), but it also suggests the Jaffee family is sticking to their playbook of steady, long-term compounding rather than any aggressive financial engineering. In hindsight, expecting buybacks was probably wishful thinking; the family has always run the company conservatively, and they’re clearly prioritizing reinvestment and dividend growth over shrinking the float.

Lastly, I’ll admit I didn’t anticipate how quickly the stock would run to my fair value. Hitting ~$68 (my target price was $64) by late summer was faster than I expected, essentially compressing a year’s worth of upside into a few months. I’m certainly not complaining (57% gain in 5 months is ~195% annualized), but it’s a reminder that when a small-cap rerates, it can happen in big jumps. The speed of the move was surprising, though the direction was not.

Q3 FY2025: A Record-Breaking Quarter

Oil-Dri’s latest earnings (fiscal Q3 2025, for the quarter ended April 30, 2025) confirmed that the company’s momentum is real. It was the strongest third quarter in its 85-year history by several measures.

Net sales hit $115.5 million, up 8% y/y, and net income jumped 50% to $11.6 million. Diluted EPS for the quarter came in at $0.80, up 51% from a year ago. Both revenue and earnings were all-time highs for any Q3.

To put it in perspective, CEO Dan Jaffee noted on the call that the $11.6 million profit in Q3 alone exceeded the full-year earnings of all but 8 of the company’s past 84 fiscal years. And that year-to-date profits have already surpassed every prior full year on record. That’s a striking illustration of how far the business has come in this “inflection” phase.

By the numbers: Through the first nine months of FY2025, Oil-Dri generated $360.4 million in sales (+11% y/y) and $40.9 million in net income (+32% y/y). Operating income for the nine months was up 36%, and EBITDA was up 33%. Clearly, the company is firing on all cylinders.

Profitability is up even more than revenue, thanks to expanding margins. Gross profit rose 10% in Q3, nudging the gross margin to 28.6% (vs 28.2% a year ago). That may seem like a small uptick, but remember this is the 13th consecutive quarter of y/y gross margin expansion; a testament to pricing power and product mix improvements.

Meanwhile, SG&A expenses actually ticked down 3% in Q3 versus the prior year, partly because last year had some one-time acquisition costs. Lower overhead combined with higher gross profit led operating income to surge 33% in the quarter. In short, Q3 showed strong operating leverage: revenue up 8% translated to EBIT up one-third and EPS up 51%.

Drilling down, segment results were a tale of two divisions:

Business-to-Business (B2B) segment

The B2B Products Group was the star of Q3. Segment sales jumped 18% y/y to $42.7 million. Operating income in B2B climbed 26% to $13.4 million, implying an extremely robust operating margin of about 31%.

What drove this? Primarily agriculture and renewable energy. Agricultural product sales hit an all-time quarterly high of $11.6 million, up 43% from the prior year. This surge came as farm supply customers resumed ordering after working down excess inventories last year. Essentially, a rebound in demand once last year’s glut cleared.

On top of that, sales of fluid purification clay rose 13% y/y to $25.3 million. Renewable diesel is a key theme here: new biofuel plants have been coming online in the U.S., and Oil-Dri successfully secured business from these new facilities.

Even though U.S. renewable diesel production was down ~12% in early 2025, Oil-Dri’s sales to that sector were up, which means they captured market share and new customers. It’s a great example of ODC’s positioning; they are the go-to supplier of filtration clay, so when new refineries fire up, Oil-Dri is there to “soak up” that business.

The B2B segment also includes the Amlan animal health line, which was flat in Q3 (around $5.8 million in sales). Amlan hasn’t broken out yet, but management is tweaking its distribution strategy to spark growth. Overall, B2B’s performance was excellent, with broad-based strength across ag, renewable diesel, and even some pickup in traditional industrial absorbents. The segment’s success lifted the whole company’s results.

Retail & Wholesale (R&W) segment

The Retail side was more of a mixed bag. Segment revenue was $72.8 million, up a modest 3% y/y. However, that includes the contribution from the Ultra Pet acquisition (silica crystal litter). Excluding Ultra Pet, organic sales in Retail were actually down about 4%.

The major headwind was in traditional clay cat litter. Sales of ODC’s clay-based litter (excluding the coarse-grain litter it makes as a contract manufacturer) fell 6% from last year, due to the loss of a large private-label account and a few retailer bankruptcies. In plain English, one of Oil-Dri’s big retail customers for store-brand litter decided to switch suppliers, and some smaller chains that carried their products went under; a double whammy on volume.

Additionally, competitor promotions hurt; rivals were discounting heavily, which likely stole some shelf share and forced Oil-Dri to respond on pricing. The bright spot is the lightweight litter segment. ODC has been evangelizing lightweight cat litter (which it invented and patented years ago) as the future, and that sub-category is growing faster than the litter market as a whole.

In Q3, their lightweight products (including Cat’s Pride Fresh & Light and private-label lightweight litters) continued to gain adoption. Management noted on the call that even with the lost clay litter account, ODC still holds a commanding share in private-label lightweight litter and that more consumers are shifting to lightweight every month.

They’re targeting 4–5 major retailers who don’t yet carry ODC’s lightweight offerings, and active talks are underway with a couple of them. In other words, there’s still a growth runway as lightweight litter penetrates the market.

Meanwhile, the Ultra Pet crystal litter contributed ~$4.8M in Q3 sales, both in branded (Ultra, Cat’s Pride Fresh & Clear) and private-label crystal products. Crystal litter is a premium niche, and ODC’s entry via Ultra Pet is going well. In fact, they’ve increased the total number of retail “doors” carrying their branded crystal litter significantly versus a year ago. They’re now gearing up to pitch private-label crystal litter to retailers in the upcoming category review cycle.

So, despite a rough quarter for clay litter, the newer products (lightweight clay and crystals) are doing their job in keeping the retail segment moving forward.

In terms of Retail profitability, the Q3 segment operating income was $9.7 million, down 11% from $10.9M last year. Essentially, higher costs (including the added SG&A from Ultra Pet and some inflation) ate into profits despite slightly higher sales.

The segment margin was about 13% this quarter, compared to +15% a year ago, a dip, but not alarming. Management indicated that some cost pressures (like packaging) have eased, and they actually reduced advertising spend this year, which helps offset other expenses.

They expect total advertising costs in FY2025 to be lower than in 2024, which should cushion margins a bit. The lost volume from that one big customer also hurt fixed-cost absorption in the short run.

Going forward, if they win new accounts to replace it (which Dan Jaffee is confident about, as he believes the competitor’s product that replaced ODC will disappoint consumers), margins in Retail should recover.

In summary, Retail isn’t booming, but it’s holding up, and the strategic shift to new litter products is positioning it for future growth even in a competitive environment.

Outside of the segment breakdown, a few additional Q3 highlights worth noting:

Cash flow and balance sheet

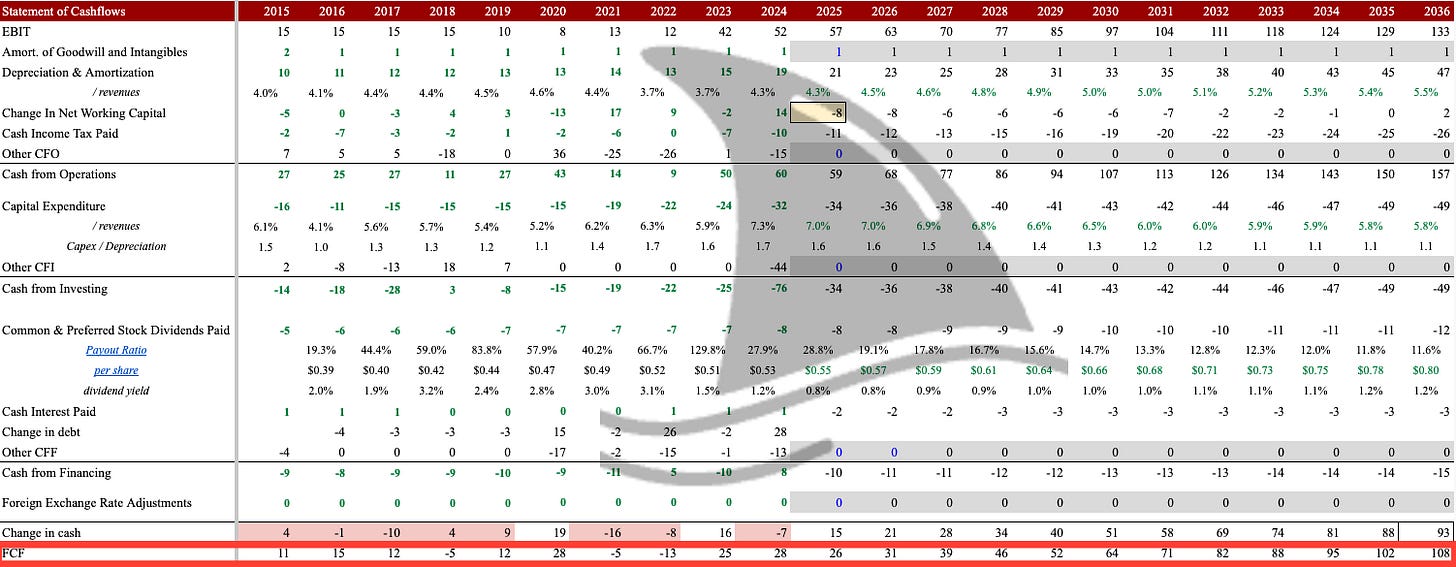

Oil-Dri’s cash on hand swelled to $36.5 million as of April 30, 2025 (up from $23.5M at the end of FY2024).

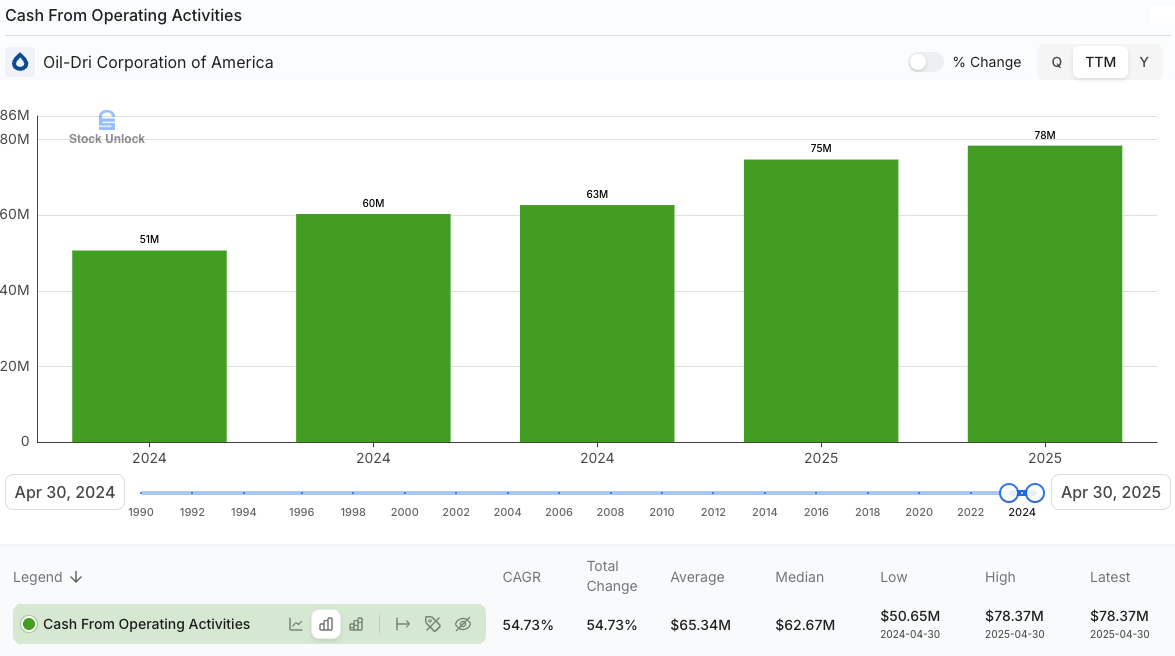

Operating cash flow was strong, aided by the higher profits.

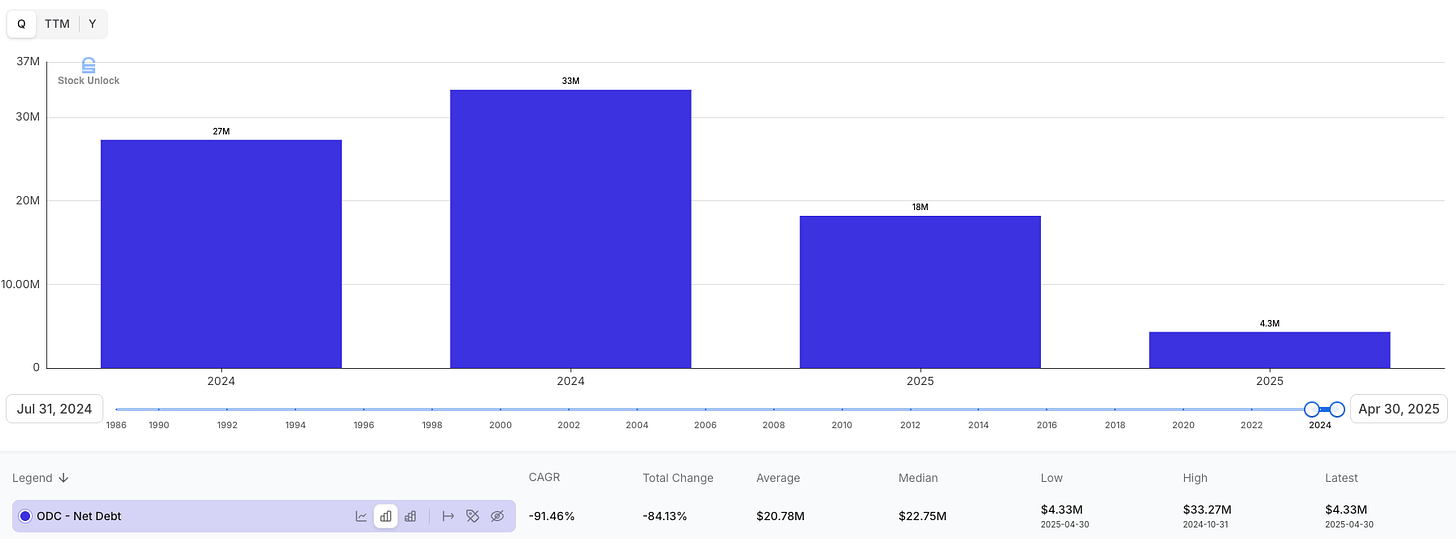

The company continues to carry minimal net debt (just about $4 million net debt, which is essentially zero leverage). They have maintained this conservative financial stance even while funding growth and a recent acquisition.

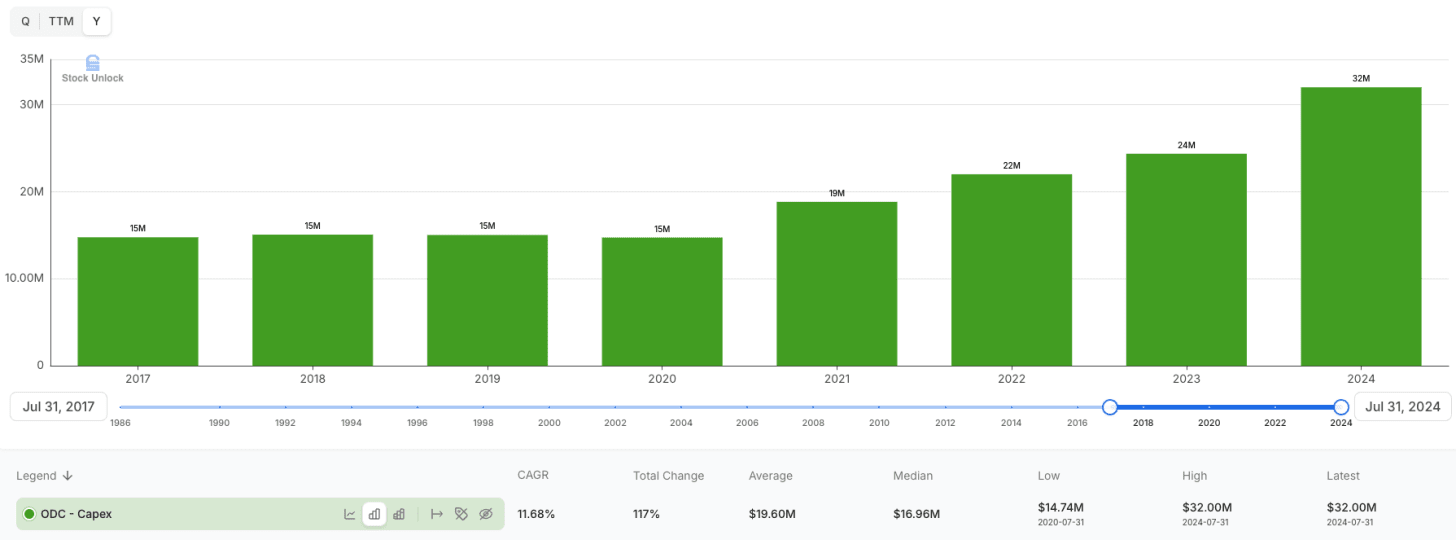

Capital investments

The company is in the midst of a major capex cycle. As discussed on the call, they expect to spend about $32 million in capex in FY2025 and a similar amount in FY2026. This is roughly double the annual capex pace of previous years.

Oil-Dri is plowing money into expanding and upgrading its production capacity (new equipment, plant improvements, etc.) after years of under-investment. Jaffee highlighted that this is part of a plan promised to customers: to ensure they have the capacity and modern infrastructure to meet growing demand. In essence, they’re reinvesting the current windfall back into the business, which should support long-term growth. It’s a bullish sign that they see opportunities to earn good returns on that investment.

Shareholder returns

As mentioned, the Board boosted the dividend by 16% in June. The quarterly payout is $0.18/share after the raise (for reference). The dividend yield isn’t high (~1.1% at the current stock price), but the willingness to make such a large increase suggests management’s optimism in the cash flow outlook.

They wouldn’t hike the dividend that much if they anticipated a downturn. This aligns with the confidence we’re seeing in their expansion plans.

Outlook and tone

On the Q3 conference call, management’s tone was upbeat yet measured. They expressed confidence for Q4 and beyond, especially as B2B tailwinds persist.

Bruce Patsey (VP of the fluids division) said they’re “looking forward to a good fourth quarter” in the filtration business.

In Retail, the team acknowledged the loss of one account but remained “very optimistic” about growing the lightweight litter segment and winning new private-label placements in the coming seasons.

Dan Jaffee doubled down on playing the “long game”. He likened Oil-Dri to the tortoise that wins the race by steadily plugging along without jeopardizing the future.

One illuminating question on the call was about where management sees ODC in 10 years. Jaffee’s response was essentially that the company will continue compounding methodically; they plan at least 40 years ahead in securing raw material reserves for each product line and won’t do anything rash for short-term gain.

It was a reminder that this family-led firm thinks in decades, not quarters.

In sum, Q3’s results and management commentary reinforce the core investment case. Oil-Dri is executing well: record sales and profits, smart reinvestment, and maintaining its competitive advantages even amid some industry turbulence. The outlook appears positive in both segments (with different drivers for each), and the company’s culture of long-term thinking remains intact.

Industry Trends and Developments (Since April 2025)

When I first wrote about Oil-Dri in April, I highlighted a few secular trends propelling its businesses. It’s worth updating where those stand:

Pet Care & Litter Market

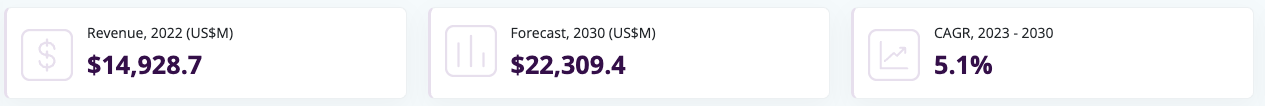

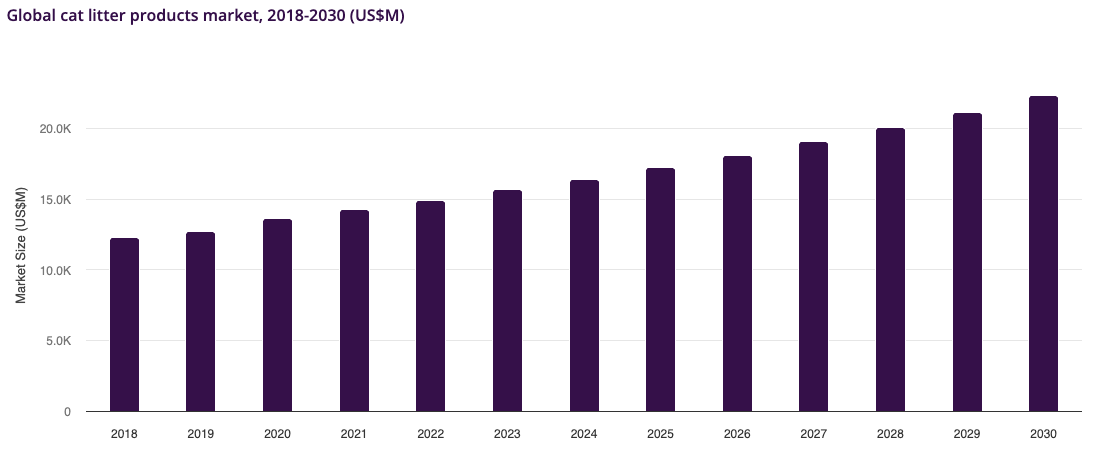

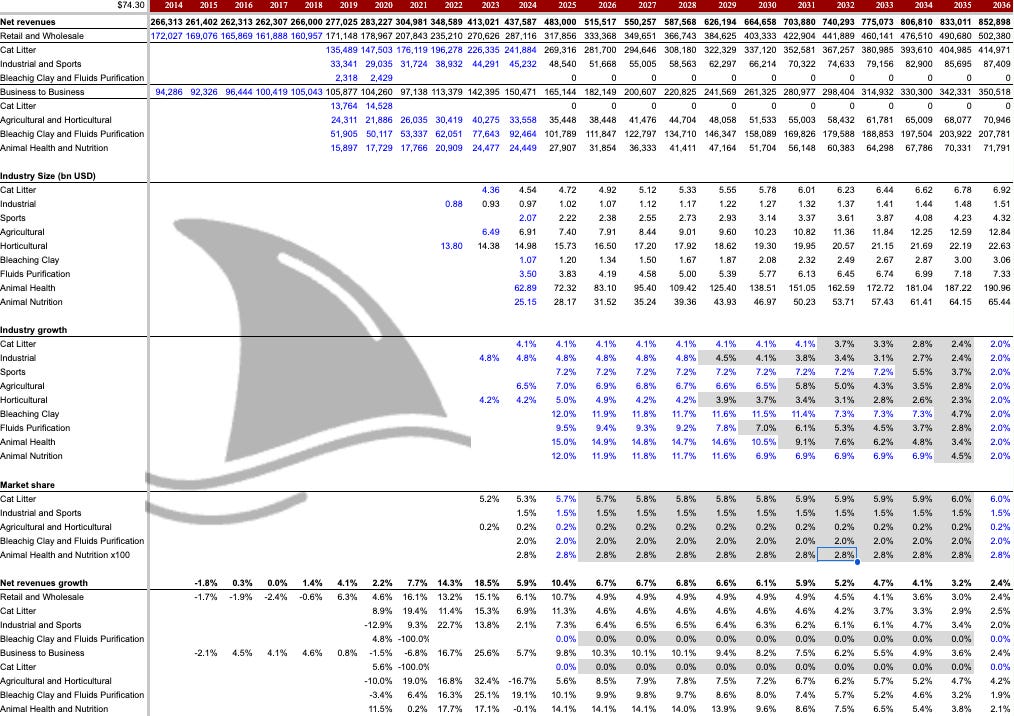

The “anthropomorphizing of cats” (essentially pet humanization) continues to underpin steady growth in the cat litter market. Industry sources still project ~5% annual growth in litter demand through 2030, fueled by rising pet ownership and people willing to spend more on pet products.

That hasn’t changed in a few months. However, since April, we’ve seen that growth within the category is uneven: traditional clay litter is fairly mature, while new subcategories like lightweight clumping litter and silica crystal litter are growing much faster.

Oil-Dri’s experience in Q3 bears this out. Lightweight litter sales grew strongly, outpacing the overall category, whereas conventional litter was flat-to-down.

An industry development worth noting is competitive dynamics in retail. Big consumer products players (Clorox’s Fresh Step brand, Church & Dwight’s Arm & Hammer brand, privately-held Mars with Tidy Cats, etc.) have been active with promotions this year, likely in response to consumers becoming more price-sensitive.

This promotional environment created a bit of a price war in certain retail channels, as ODC alluded to with competitors’ discounting. For Oil-Dri, which supplies both branded (Cat’s Pride) and private-label litter, these price wars can pinch volumes and margins temporarily.

On the plus side, Oil-Dri’s focus on private-label lightweight litter gives it a niche where it’s the category leader. Retailers are still adopting these products. ODC is in talks to get its lightweight litter into several large chains that don’t yet carry it. So, the trend of retailers shifting more shelf space to lightweight (and often store-brand) litter is ongoing, which benefits Oil-Dri as the main supplier.

Another recent wrinkle: the retail landscape itself has had some shake-ups (as seen with a couple of regional pet store chains filing bankruptcy). This has a short-term negative impact (lost distribution) but longer term, those volumes tend to shift to surviving outlets (e.g. if a Pet Valu closes, shoppers go to PetSmart or Chewy, who likely carry ODC products too).

Overall, the pet segment’s trend is still growing, but it’s a competitive fight for share.

Environmental & Renewable Energy

The original thesis talked about Oil-Dri’s role in environmental protection trends. Specifically, its clay products enable renewable fuel production. This trend is very much alive. The renewable diesel industry is expanding in the U.S., supported by clean energy mandates and favourable economics.

Since April, additional renewable diesel capacity has come online (for example, new units at refineries in the Gulf Coast and Midwest). ODC directly benefited by onboarding those new plants as customers.

Even though overall U.S. output of renewable diesel had a temporary dip early in 2025, the trajectory is upward as more facilities ramp up. Experts still forecast double-digit annual growth in renewable diesel usage for years to come, and ODC stands to gain because its Pure-Flo® and Perform® sorbent clays are a key consumable in that process.

Essentially, every gallon of renewable fuel needs filtration, and Oil-Dri provides the “dirt that makes clean fuel possible.” It’s a quietly growing profit engine for them, and one that wasn’t fully appreciated by the market until results like Q3 put a spotlight on it.

I’d also note that the push for sustainable products extends to other areas ODC serves, like edible oils (where consumers and regulators want high purity) and even industrial spill cleanup (environmental rules require cleanup kits, etc.). Oil-Dri’s product portfolio is tied to these macro trends of the cleaner industry and sustainability.

Agriculture and Animal Health

Another secular theme was the move away from antibiotics in livestock, creating demand for natural solutions like Oil-Dri’s clay-based feed additives (Amlan) that improve gut health.

This is a long game. In the EU, antibiotic growth promoters in feed are already banned, and other countries may follow. That tailwind is still in place, but we haven’t seen it manifest in a big revenue jump yet. Amlan’s sales were flat, suggesting the industry’s adoption of alternatives is slow.

However, ODC is continuing R&D and field trials for these products. I see this as an upside option in the long run: any breakthrough (regulatory or commercial) could scale Amlan higher.

On the crop/agricultural front, a notable trend since April has been the inventory correction cycle. Last year, some agricultural product customers of Oil-Dri (likely distributors of crop chemicals, carriers or soil amendment clays) had surplus inventory, which dampened orders. By mid-2025, that reversed as those customers worked through the excess and returned to more normal buying patterns. Thus, ODC’s ag revenue snapped back sharply (+43% in Q3).

The broader lesson: demand for Oil-Dri’s ag products (like carriers for pesticides, drying agents, etc.) is fundamentally growing with the global food production needs, but it can be lumpy depending on channel inventory. As we move forward, the agricultural market looks stable to positive; no new negative trend has emerged there, and commodity prices for crops are reasonably healthy, which supports farm input spending.

Cost & Supply Chain Factors

Since April, we’ve also seen some changes in cost inputs and logistics that affect the industry. Oil-Dri mentioned that domestic freight and material costs were up about 5% y/y in Q3, while packaging costs were down.

Fuel (diesel) and transportation had been a headache in 2022-2023; those have moderated a bit in 2025, but are still elevated. Natural gas, a major input for Oil-Dri’s kiln drying process, has been relatively low in price this year, though expectations are for gas prices to rise into 2026.

Oil-Dri hedges a portion of its gas needs to manage this risk. They also continuously explore alternatives (from fuel oil to experimental tech like microwave drying), but so far, natural gas remains the most efficient choice.

On the supply chain side, one trend is localization: ODC’s domestic U.S. production is a competitive advantage given global freight costs and tariffs. There was talk of potential new U.S. tariffs on certain imports (including pet products) as part of “Liberation Day” trade measures, something I noted could benefit ODC since it’s a U.S. producer.

As of now, I’m not aware of significant new tariffs implemented on litter imports since April, but it remains a possibility. Even without that, the fact that ODC mines and manufactures domestically gives it an edge on reliability and shipping time, especially as retailers have been cautious with inventories post-pandemic. This industry dynamic, favouring domestic, vertically-integrated suppliers, continues to play to Oil-Dri’s strengths.

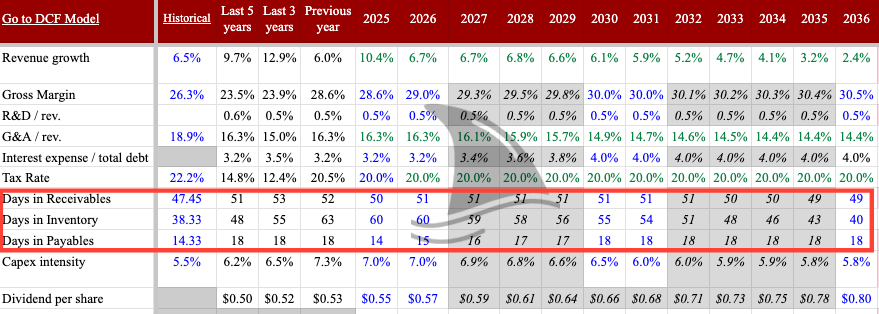

Valuation Update: Raising Target to $74

With the stock’s big move and all the new information from the past two quarters, it’s time to update the valuation. After incorporating the Q3 results and tweaking my forecast assumptions, I now arrive at a fair value of approximately $74 per share for ODC.

That represents some further upside from today’s ~$68 price, but notably less upside than before (when the stock was $43 and my target was $64).

Here’s how I’m thinking about the valuation drivers now:

Earnings and Margin Outlook

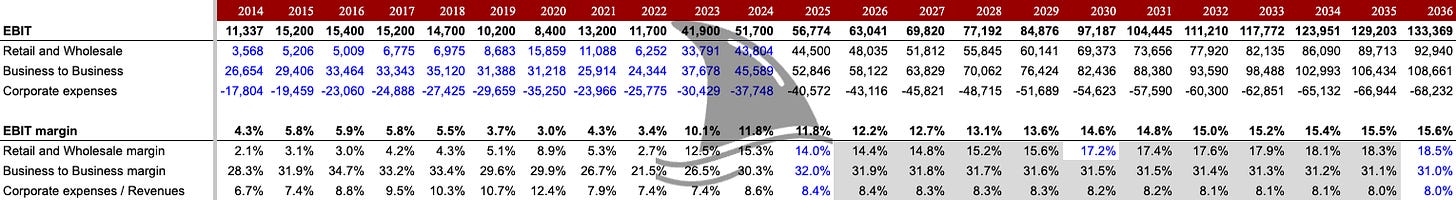

One reason the target has nudged up is that Oil-Dri’s operating margins, especially in B2B, have proven higher and more durable than I originally modelled.

The B2B segment delivered ~33% operating margin in the first nine months of FY2025. I’ve modelled B2B margins to remain around +30% going forward, whereas earlier I might have been a bit more conservative.

The Retail segment, conversely, has underperformed my initial margin expectations. I had hoped Retail’s profitability would steadily improve with volume growth and cost leverage, but the recent dip (13% margin this quarter, and roughly 15% YTD) shows retail margins are under pressure. Competition and integration costs are the culprits. So, I’ve trimmed my Retail margin assumptions slightly for the near term (mid-teens percentage instead of high-teens).

The net effect is that higher B2B profits compensate for softer Retail profits, resulting in a similar or slightly improved overall EBIT outlook in my model.

Essentially, ODC’s mix is shifting more toward B2B (which is now about 37% of sales and growing faster), and that mix shift supports a higher consolidated margin than the business had pre-inflection.

Growth and Revenue Forecasts

Fiscal 2025 is on track to be an excellent year, likely with around +15% EPS growth and double-digit revenue growth. For the next few years, I foresee moderate but positive growth. In my updated model, I project mid-single-digit annual revenue growth (around 5–6% CAGR) over the next 5 years.

While the topline growth is very close to my previous forecast, the mix is a bit different. Primarily because the Retail segment’s base has shrunk slightly (losing that one customer), and I expect the broader pet products market to grow a bit faster with ODC capturing a bit more via new lightweight accounts.

I expect B2B to grow faster than my previous forecast, driven by continued penetration of renewable diesel and steady ag demand. So overall, my revenue outlook is still healthy but slightly tempered on the retail side.

Beyond the explicit forecast period, I still assume ODC can grow at GDP-like rates as a mature company. The company’s own track record of 16 consecutive quarters of y/y sales increases through Q3 gives me comfort that a growth tilt is appropriate, not a no-growth value trap scenario.

Working Capital and Cash Flow:

One positive refinement in the valuation is better working capital efficiency. Oil-Dri has been managing its inventories and receivables well. Despite sales being up 11% year-to-date, accounts receivable only increased ~6% and inventories ~4% since the start of the fiscal year.

This indicates they are turning their working capital faster. In my original model, I had assumed higher working capital needs (perhaps too conservative). I’ve since adjusted those assumptions, projecting that ODC will not need to invest as much cash into receivables and inventory for each dollar of sales growth.

The result is improved free cash flow conversion. For example, as the company grows, a greater portion of EBIT should translate to free cash (rather than being tied up on the balance sheet). Combined with the slightly higher profit baseline, this boosts my DCF valuation.

In numbers, I’m now estimating Oil-Dri can generate around $30 million in annual free cash flow in the near term (vs. mid-$20s million previously). That underpins the higher fair value.

Valuation Multiples and Comparisons

Even after the run-up, ODC’s valuation is not crazy in context, but it’s no longer the bargain it was.

Back in April, the stock was under 8x earnings and EBITDA… extremely cheap. At $66/share, we’re looking at roughly 13x current-year earnings, 11x EBITDA, and about 25x free cash flow. For a business growing earnings ~15-20% this year and arguably high single-digits going forward, those multiples are reasonable, maybe slightly below the market average for similar small-cap industrial/consumer product hybrids.

Now, the margin of safety has shrunk. In raising my target to $74, I’m effectively valuing ODC at around 14–15x earnings and 12x EBITDA, which I believe is fair given its improved quality (higher margins, stronger competitive position). There aren’t many pure-play comps for Oil-Dri (it’s a unique mix), but consider that many small specialty chemical or niche consumer product firms trade in the mid-teens P/E. Given Oil-Dri’s clean balance sheet and consistent dividend, one could argue it deserves at least a market multiple. My $74 target implies about a 8% upside from current prices and would put the stock around that level.

Verdict: 8% Upside…Time to Take Profits

When I first pounded the table on Oil-Dri, it was a forgotten gem with a compelling story. Today, after a +57% rally and blowout earnings, ODC is no longer so forgotten. In fact, I’d say it’s fairly close to fully valued at around $68.

My updated target of $74 suggests roughly 8% further upside, which is decent but not enough to keep me in the trade given how far we’ve come. I am therefore closing out my position in ODC and locking in the gains.

This was a tough decision. I admire this business and management team, but discipline is important. One of the hardest things in investing is knowing when to sell a winner (if you need a refresher on when to sell, read this), especially a company you’ve grown fond of.

Oil-Dri has a lot of qualities I love: a shareholder-friendly, long-term oriented family at the helm, a niche domination with high barriers to entry, and the ability to keep compounding steadily. Dan Jaffee and his team have executed admirably, and I have no doubt they will continue to do so.

However, we must remain unemotional and focus on the numbers. At the current price, most of the good news is priced in. The stock’s valuation is no longer a glaring bargain as it’s more in line with the company’s growth prospects now.

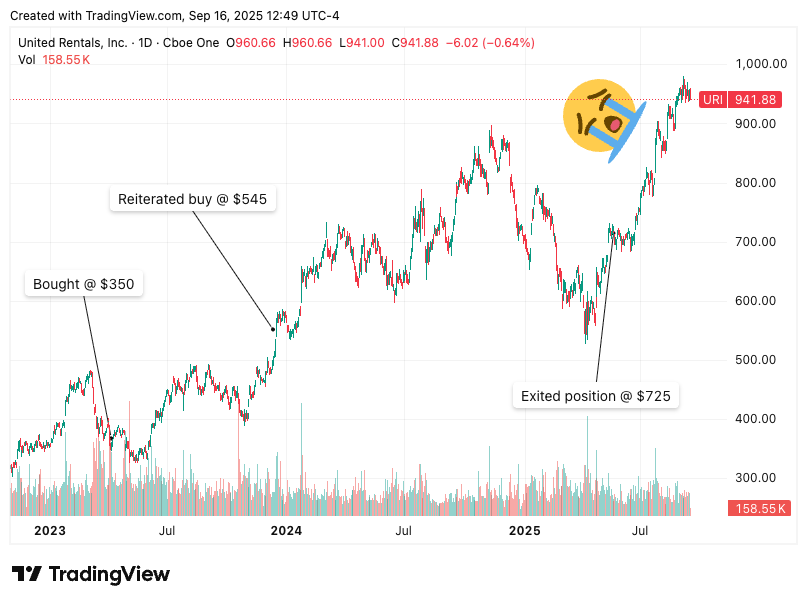

Could ODC overshoot my $74 fair value? Sure, stocks can and often do overshoot, especially if momentum continues. I have several examples where the stock kept going higher after I closed my position. Look at URI 0.00%↑, it is up 30% since I closed the position.

But when the risk/reward has normalized, I prefer to redeploy capital into the next underpriced opportunity with a better risk/reward profile.

Make no mistake: I’m not “breaking up” with Oil-Dri for good. It will firmly remain on my watchlist. If Mr. Market throws a tantrum and the stock pulls back to undervalued levels again, I’d be eager to revisit it.

To wrap up, I’ll echo a theme Dan Jaffee often stresses: investing (and running a business) is a long game. Oil-Dri’s journey from a sleepy clay miner to a high-margin specialty products company has been decades in the making, and it’s been rewarding for those who recognized the potential. After all, this tortoise still has many miles to go, and I’ll be ready if it falls behind the pack once more.

I’ll continue rooting for the company (even as a non-cat-person!).