Weekly #35: How I Get Paid $3,000–$7,000 a Month Waiting to Buy Stocks at My Desired Price

This Options Strategy Earned Me Thousands Just for Waiting. Plus, My Portfolio Is Up 4.3% YTD vs 1.5% for the S&P 500.

Hello fellow Sharks,

This week, we expanded our outperformance vs the S&P 500 (YTD: 4.3% vs 1.5%). (If you want to skip ahead to the Portfolio Update, click here.)

Also, a quick personal win: my book was just picked as one of the best new investment strategy books by BookAuthority.

As you probably know, I’m giving it away for free to all subscribers (free and paid). Check your welcome email for the download link.

If you want to learn more about the book, click here for details.

If you get a chance to read it, I’d really appreciate an Amazon review so more people can discover it. And here’s a little thank-you: if you leave a review, just email me a screenshot and I’ll add a 30-day paid membership to your subscription. Simple as that.

This week, I want to tackle a strategy that can help you generate income on your portfolio while you wait for stocks to drop to your desired purchase price. Before you follow my strategy, ensure you read and understand the risk section for this strategy (very important).

If you’ve ever felt stuck watching a quality company stay just out of reach… this one’s for you.

Let’s dive in.

Table of Contents:

In Case You Missed It

On Friday, I rebalanced the portfolio to increase our allocation to the highest risk-reward opportunities.

3 positions were fully exited, where I saw better long-term upside elsewhere.

4 positions were trimmed, locking in gains and improving risk/reward balance.

That capital was redeployed into 9 existing positions that I believe offer stronger upside from here.

By the way, tomorrow I will be releasing my deep dive on AGX and explaining why I decided to trim a bit of the position after the 87% rally.

Thought of the Week: How I earn $3,000-$7,000 a Month While Waiting to Buy Great Stocks Cheaper

Would you believe you can get paid just for waiting to buy a stock you already want?

It sounds almost too good to be true, but that’s essentially what I do by selling cash-secured put options on high-quality companies. Instead of twiddling my thumbs, hoping a great stock’s price finally dips, I earn steady premium income up front for agreeing to buy shares at my desired price down the line. Depending on the market, I make $3,000 to $7,000 a month just selling puts without stressing my portfolio.

If the stock never drops to my price, I simply keep the cash I earned. If it does drop, I buy the shares at the discount I wanted, with the premium effectively sweetening the deal. It’s a win-win scenario, as long as I stick to businesses I truly wouldn’t mind owning for the long term.

Let me walk you through how this works (no options jargon required!). I’ll explain what a cash-secured put is, why this strategy works so well, and of course, the risks and caveats to watch out for. By the end, you’ll see how selling puts can generate income while enforcing the discipline to only buy great stocks at your price.

But before we start, a quick reminder: I’m not someone who’s blindly pro-options or margin. Back in Weekly #21, I wrote about why using them the wrong way can wreck your portfolio. This is different; this is a strategy that fits my risk profile and has a logical role in my portfolio.

What Is a Cash-Secured Put?

A cash-secured put is an options contract that I sell to someone else, giving them the right to sell me a stock at a fixed price (the strike price) by a certain date. In exchange for taking on this obligation, I collect an upfront premium: cold, hard cash in my account. Crucially, I set aside enough cash to buy the stock if needed (hence “cash-secured”). I’m basically saying: “If Stock XYZ falls to $Y by this date, I’ll buy 100 shares from you at $Y. Pay me $Z today for that promise.”

Here’s the outcome of that deal:

If the stock stays above my strike price, the buyer won’t exercise the option. In that case, the option expires worthless. I keep the entire premium as profit, and I’m free to repeat the strategy with no further obligation.

If the stock falls below my price, the buyer will likely exercise the put, which means I’m assigned the stock; I’ll purchase those 100 shares at the strike price. Importantly, I still keep the premium I was paid upfront, so it effectively reduces my cost. For example, if my strike was $50 and I got $2 per share in premium, my net cost is $48 per share (not counting minor fees). I end up owning a stock I wanted, at a bargain price relative to when I started. This was my goal all along!

In other words, selling a cash-secured put is a way to potentially buy stocks at a lower price than they trade for today, and get paid for waiting for that dip. It’s essentially a stock acquisition strategy for patient investors: you’re agreeing to buy only if your price is reached, and you get income (premium) whether or not that happens.

Even Warren Buffett uses this approach. In 1993, Buffett wanted more Coca-Cola stock but felt it was a bit pricey at around $40, so he sold put options with a $35 strike, effectively saying he’d buy Coke at $35. For making that commitment, he collected about $7.5 million in premiums. If Coke had dropped below $35, he’d have happily bought at that price; since it didn’t, all that premium was pure income for Berkshire Hathaway. Not a bad way to earn income while waiting!

Important: I only sell puts on companies I truly want to own and believe in. Buffett follows this rule too: he only writes puts on businesses he understands and wouldn’t mind owning at the right price. If you wouldn’t gladly buy 100 shares of a stock at your strike price (or aren’t able to), then you have no business selling a put on it. The “cash-secured” part also cannot be overstated: this strategy is not about using margin or hoping for the best. I always have the cash ready to buy the shares if assigned, so I never risk a margin call or getting caught without funds. It’s a conservative, bullish strategy at heart to accumulate a stock on your terms.

Why This Strategy Works (Getting Paid to Wait)

Selling cash-secured puts has a few key advantages that make it so attractive, especially for quality stocks that look overpriced right now:

Immediate Income, Win or Lose: The premium you collect is yours to keep, no matter what. Whether the stock soars, crashes, or goes sideways, you pocket this consistent income up front for taking on the obligation.

Buy at Your Price (or Lower): If you do end up assigned, it means the stock hit your target price. You’ll buy it at that strike price, which is lower than where it was when you sold the put. And thanks to the premium, your effective cost basis is even a bit below the strike. This discipline helps you avoid chasing stocks at highs. You only get in if the valuation becomes attractive to you. Think of it as pre-committing to a buy-low philosophy.

Patience Is Rewarded: This strategy forces a patient, long-term mindset. You’re not day-trading; you’re waiting for a good company to go “on sale.” If the sale never comes, you still made money via the premiums (which can be seen as consolation prizes or even yield enhancement on your cash). If the sale does come, you buy the stock with a built-in discount (premium received). Either outcome is fine, whether or not the put is assigned, all outcomes are acceptable.

Enhances Your Return on Cash: Instead of leaving cash idle while you wait for a pullback, selling puts puts that money to work. For example, if you repeatedly sell puts and they expire unassigned, you’ve generated a series of premiums that can significantly boost your overall returns. I use this as a steady income strategy, almost like earning interest on cash I set aside for investing.

The Psychological Benefit of No FOMO: One underrated benefit: it cures “Fear of Missing Out.” When you sell a put, you’ve got a plan either way. You’re either getting the stock at your price or getting paid. This makes it easier to stick to your target entry price. You won’t feel the itch to chase a stock higher, because if it keeps running, at least you made some money from the premium. And if it falls, you’ll be ready to pounce with cash (which you already reserved). It’s a very disciplined approach to investing.

Validated by Experts: This isn’t some gimmick; it’s a well-known strategy among pros. The classic book Options as a Strategic Investment notes that writing cash-secured puts is fundamentally a stock acquisition tactic for price-sensitive investors. You’re essentially setting a desired purchase price (strike minus premium) and getting compensated for it. And as mentioned, even Warren Buffett has used it to buy stocks he loves at a discount. If the greatest value investor of all time is cool with selling puts for income, that says something!

Now, to be clear, selling puts works best on stable, high-quality stocks, think blue-chip companies or strong mid-caps that you believe have solid long-term prospects. Often, I use it when a stock I like has run up too far, too fast. By selling a put, I get paid to wait for a potential pullback.

For example, back in early March, I sold a secured put on CLS with a $105 strike. I got $144 in premium for doing… well, nothing except waiting. Then came the tariff drama, and CLS dropped like a rock to $67. I got assigned, meaning I had to buy the shares at $105. Most people would panic at that point, but because I wanted to own CLS long term, I just held on. You can read my deep dive on CLS to understand why I am so bullish on the company.

Fast forward to today: CLS is back around $135, so I’m sitting on about $3,000 in unrealized gains plus the $144 premium. Not bad for a trade that started by just being patient.

Only commit to what your wallet (and nerves) can handle. Don’t oversize your positions (I have a large portfolio and still only sold one put contract on CLS).

If you can afford to buy at most 100 shares of a stock, don’t sell more than one contract on it.

If you have $10k total, maybe don’t lock all of it into one single put position, leave some cash for flexibility or other opportunities.

Personally, I treat the cash reserved for puts as already invested; I consider it “spent” the moment I sell the put, because in the worst case, I will spend it to buy shares. This mindset helps me not to over-commit or view that cash as available for something else. It’s all about managing exposure and staying within your limits.

Risks and Things to Consider

Like any strategy, cash-secured puts aren’t magical free money. There are real risks and nuances to understand:

Risk #1. You could buy at a higher-than-market price

This is the big one. If the stock plummets below your strike, you’ll still be required to buy at the strike price, even though the market price is lower.

In volatile or crashing markets, you might feel regret as you watch the stock trading lower than what you paid. This risk is the flip side of getting a stock at a discount; your “discount” can vanish if the stock keeps falling past your strike minus premium (your breakeven point).

That’s why it bears repeating: only do this for stocks you truly believe in long-term. You must be comfortable holding the bag at your strike price, even if the market goes temporarily much lower (In the previous example, I was assigned CLS at $105 while the market price was $67).

If a stock’s drop would give you serious heartburn or threaten your finances, don’t sell a put on it.

Risk #2. The stock may never drop (opportunity cost)

On the other hand, you risk missing out if the stock never hits your strike. This happens with great companies as sometimes they just keep climbing. In that case, your puts expire and you’ve only made the premium, but you didn’t get to buy the stock. The cash you set aside might underperform the market if the stock rockets upward beyond the premium yield you earned.

This is the trade-off: the put strategy sacrifices some upside in exchange for downside protection (premium buffer) and income. One way I address this is by sometimes inching my strike prices up over time if I really don’t want to miss the boat, or I might split my order: buy some shares now and sell puts for additional shares later. In any case, be aware that you might not get your “dream stock” if it stays strong; you’ll just get your premium, which is a limited reward.

Risk #3. Cash is locked up (opportunity cost)

When you sell a cash-secured put, you need to keep the cash available to fulfill the contract. That means you can’t use that cash for other investments or expenses in the meantime. There’s an opportunity cost to consider if another fantastic investment comes along, your money might be tied up securing a put.

To manage risk, I typically sell puts with 1-month durations (sometimes up to 2 months), so I’m not tying up cash for too long. However, be careful not to sell too many puts at once so that all your cash isn’t tied up.

I generally sell puts on 10 to 20 companies, but that’s because I have a large portfolio with a comfortable cash cushion. If your portfolio is smaller (around $10k to $20k in cash), start by selling a put on just one company. As your portfolio grows, you can gradually increase the number of puts you sell, while still adhering to this risk management approach.

Risk #4. Dividend and upside foregone (opportunity cost)

Related to the above, note that while you wait with a put, you do not earn any dividends the stock pays (since you don’t own it yet), nor do you participate in any upside move above your strike. The premium is your only income.

This is usually fine for short periods, but it’s something to remember: if you’re selling a long-dated put, you might miss a year of dividends or upside.

Risk #5. Assignment timing and early exercise

Most of the time, if your put is going to be assigned, it happens at expiration. But technically, the buyer of the put could exercise early (especially if a big dividend is coming or the option is deep in-the-money).

Early exercise is uncommon, but it can happen, so be prepared that you could end up buying the stock before the expiration date. This isn’t usually a big problem if you want the stock anyway. But be aware of it, especially around ex-dividend dates.

Risk #6. Margin calls (if you’re not fully cash-secured)

I strongly advocate doing this strategy in a cash account or with a fully covered position. If you try to do it on margin (i.e. a “naked” put with only a fraction of the cash set aside), you expose yourself to nasty risks.

If the stock drops hard, your broker will demand more capital (a margin call) to cover the potential assignment. Many traders have gotten burned this way by being forced to liquidate positions or coming up with cash in a hurry because the short put position moved against them.

For example, during market crashes, a lot of naked put sellers get wiped out or panic-close at huge losses. Don’t be that person. Always ensure you have the full buy amount in cash or equivalents.

As Buffett himself emphasizes, part of why he can sell puts so safely is that he has the cash to back them up; he notes that traders without ample cash could face margin calls in a crash.

So, rule of thumb: treat a cash-secured put like a contingent stock purchase. Keep it cash-secured 100%. If you use margin at all, use it sparingly and know the worst-case exposure.

Risk #7. You own the stock if assigned

This sounds obvious, but it’s worth stating: if your put is assigned, you will end up owning 100 shares per contract. That means your portfolio’s makeup will change as you’ll have a big chunk of money converted into shares of that company.

You need to be comfortable with that concentration. If owning those shares will over-weight your portfolio in one stock, have a plan for it (maybe you’ll sell some shares gradually, or you simply have high conviction).

So don’t sell puts on a speculative stock that could suddenly become 20% of your holdings on assignment. Keep your overall portfolio balance in mind when choosing how many puts (and on what stocks) to sell.

Risk #8. Stock Fundamentals Can Change

What if the company’s situation changes dramatically for the worse after you sell the put?

You intended to buy it, but maybe new information or events make you no longer want it. Unfortunately, the option doesn’t care: if the price drops, you’ll still be on the hook unless you exit the position. You can buy back the put to close it if you’ve lost confidence in the stock, but by then, the put will be expensive (since the stock likely tanked).

You’d be taking a loss to avoid a bigger loss, essentially. This is why I try to only use this strategy on companies that I believe have very resilient fundamentals and a margin of safety. If something truly unforeseen happens (e.g. accounting scandal, sudden CEO departure, etc.), it might be better to cut and move on (close the put or, if already assigned, possibly sell the stock if the thesis is busted).

When closing a put, use the same philosophy as if you owned the stock. I talked about that in Weekly #34; the art of knowing when to sell applies just as much here.

Now, I don’t want the risks to scare you off entirely. When managed prudently, selling cash-secured puts is considered a moderately conservative strategy. You have a built-in buffer (the premium), and you’re transacting at a price you chose. The key is managing it well: use it on quality stocks, don’t overextend, keep it cash-covered, and be disciplined about what price you’re willing to pay. If you do that, the risks become acceptable and the strategy can be very rewarding.

Conclusion: Patience Pays (Literally)

Selling secured puts is my favourite way to get paid for my patience. It aligns perfectly with a long-term, value-oriented mindset: only buy great companies at a fair or bargain price, and get compensated if you have to wait. Instead of feeling frustrated that a stock I love is out of reach, I’m proactively profiting from the situation. It turns market volatility and timing uncertainty to my advantage.

This strategy isn’t about get-rich-quick schemes or wild speculation; it’s about slowly and steadily building wealth, one premium at a time, and entering stock positions on your terms. I’ve found that it not only boosts my returns, but it also makes me more disciplined. In a way, I’ve internalized a bit of Buffett’s philosophy here: “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.” And selling puts is how I consistently get a “markdown” or a paycheck in the stock market.

Of course, as we discussed, there are risks to respect. You have to be willing to own the stocks, and you need to manage your capital so that no single position can knock you out. It’s not a strategy for someone who isn’t prepared to follow through on the purchase. But if you use it wisely, it can be a fantastic income strategy that complements a long-term investment plan.

It feels like I’m running an insurance business, collecting small premiums in exchange for providing a safety net (the safety net being my willingness to buy shares from someone if things go south).

I’d love to hear your thoughts! Do you prefer a different approach to generate income or enter positions? Let me know in the comments, I’m curious about your experiences and strategies. Let’s discuss!

Portfolio Update

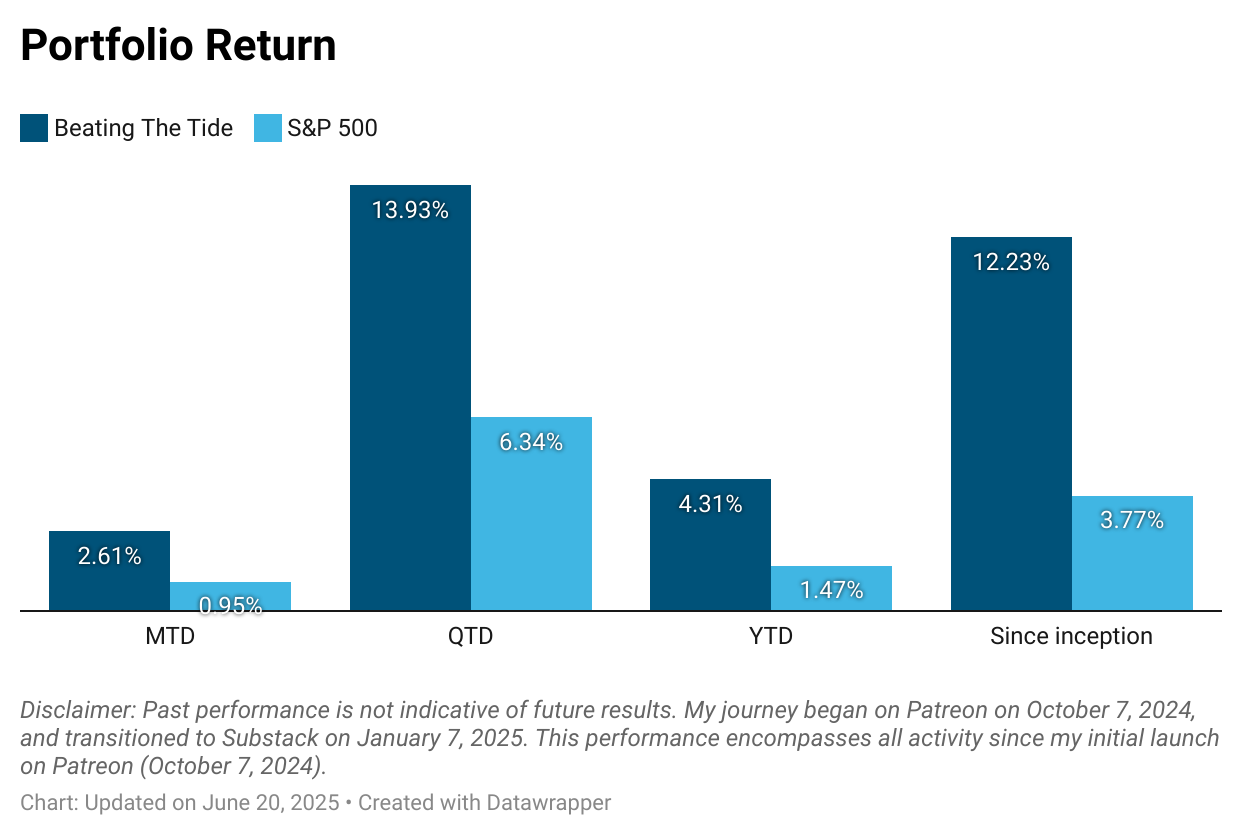

In just one week, the portfolio made a nice move. Here’s how Beating the Tide now stacks up:

Month-to-date: We rose to +2.6%, up from +1.3% last week, nearly doubling the gain in just six days. The S&P inched up, too, but only to +0.9%, trailing us by 166 bps.

Quarter-to-Date: We’re now sitting at +13.9%, more than double the S&P 500.

Year-to-Date: The portfolio advanced to +4.3%, up from +2.9% last week. Meanwhile, the S&P dropped from +1.6% to +1.5%.

Since Inception: Our lead continues to widen, now at +12.2% vs the S&P’s +3.8%, that’s 3.2x the S&P 500.

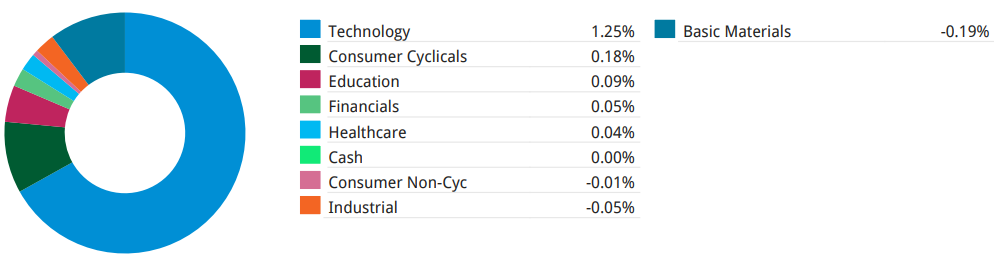

Contribution by Sector

Tech remains the dominant growth engine, standing out again as the largest contributor. You’ll recall that through mid-June, tech stocks topped the S&P 500, largely led by semis and hardware names benefiting from renewed AI demand. Our exposure to chip and software names paid off, riding that same tailwind into this week’s gains.

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+67 bps CLS 0.00%↑ (TSX: CLS)

+15 bps DXPE 0.00%↑

+1 bps KINS 0.00%↑

+1 bps LRN 0.00%↑

-4 bps TSM 0.00%↑

-6 bps MFC 0.00%↑ (TSX: MFC)

-15 bps POWL 0.00%↑

-19 bps IAG 0.00%↑ (TSX: IMG)

-24 bps AGX 0.00%↑

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process: