Why Beating the Tide Is One of the Best Stock Investing Newsletters in 2025

Discover why Beating the Tide is the best stock newsletter of 2025: Join hundreds of investors who rely on Beating the Tide for deep dives, actionable ideas, and market skepticism that pays.

Why Beating The Tide is the Best Stock Newsletter

Looking to stay ahead of market trends and uncover high-conviction stock ideas?

Beating the Tide has outperformed the S&P 500 by over 3,700% since 2011. Trusted by +1,000 of investors, the newsletter delivers deep-dive analyses, real-time trade alerts, and data-driven insights straight to your inbox.

Past Stock Picks

Click on the trade for more details on each (if links don’t work, they can be found at the bottom of this page).

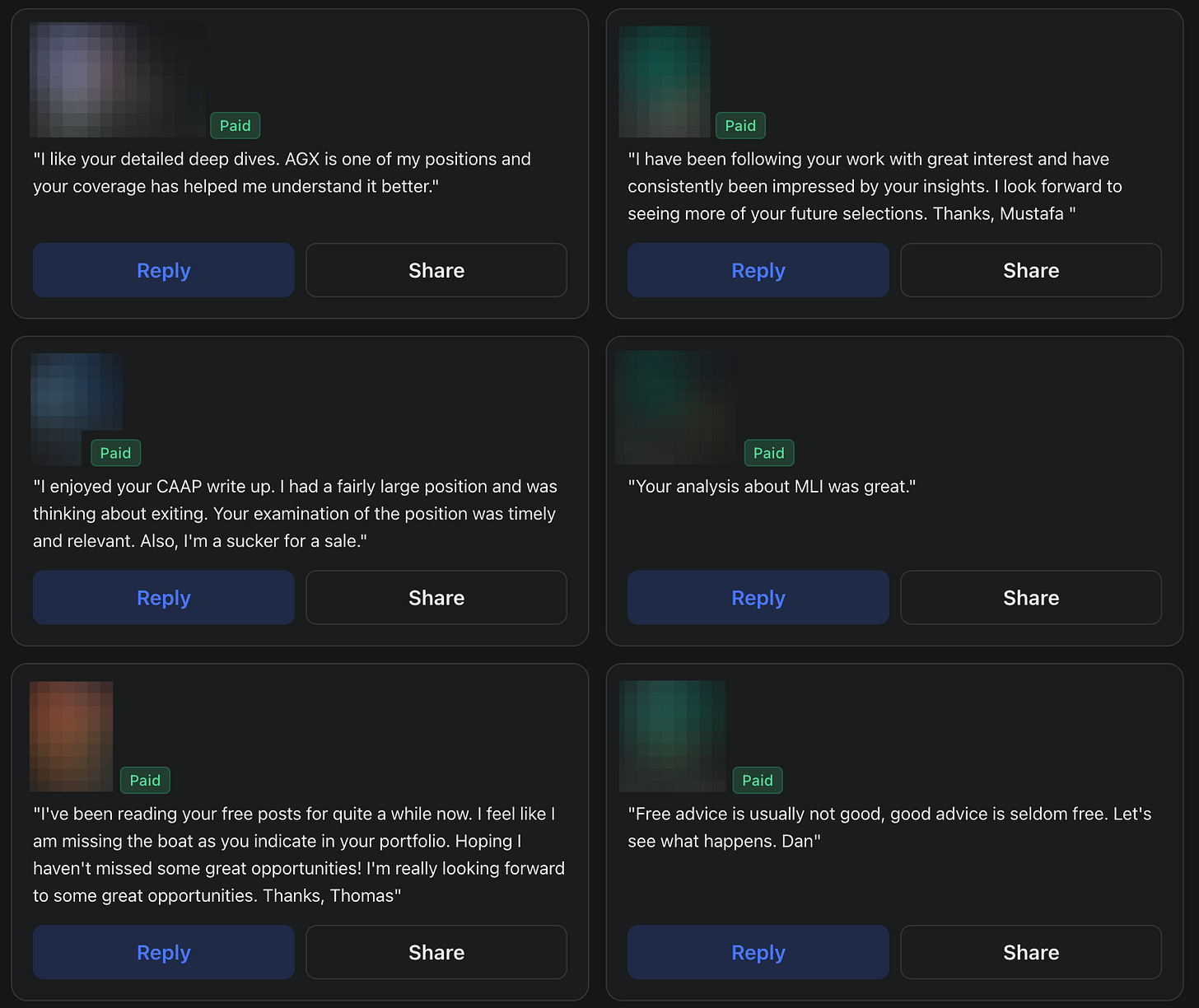

Testimonials

What You’ll Receive as a Free Subscriber

Here’s a breakdown of what you’ll receive in your inbox:

1. The Weekly newsletter

This is sent on Sundays. The Weekly includes the portfolio's performance and my thoughts for the week. The thought can be a stock idea, an opinion on the market, an investment philosophy, personal finance, or anything I believe would be of value to you. Everything is free except for the performance of each stock, which is under a paywall at the bottom of the Weekly.

You can find previous Weeklies here.

Here is a sample Weekly,

2. Occasional stock idea

A piece that would detail why I like or dislike a certain company, including a dissection of their strategy, stock valuation and risks.

You can find previous stock ideas here.

Here is a sample of a stock idea,

Unlock Premium Alerts & Portfolio Performance

As a Paid Subscriber, you receive everything Free Subscribers get, plus

1. Weekly stock performance

In Sunday Weeklies, I will include the performance of each stock in the portfolio. This will be at the bottom of the Weekly, behind a paywall.

2. Real-time buy/sell alerts in my portfolio

Whenever a position is added or sold in the portfolio, I will post the trade. I tend to send those notes between 10 am and 2 pm. The note will have a rationale behind the thesis. Those positions tend to stay in the portfolio for 6 months to 1.5 years, but I have had some that closed in 2 months and some that have been in my portfolio for 7 years (and are still open).

You can find my historical trade alerts here.

Here is a sample trade alert,

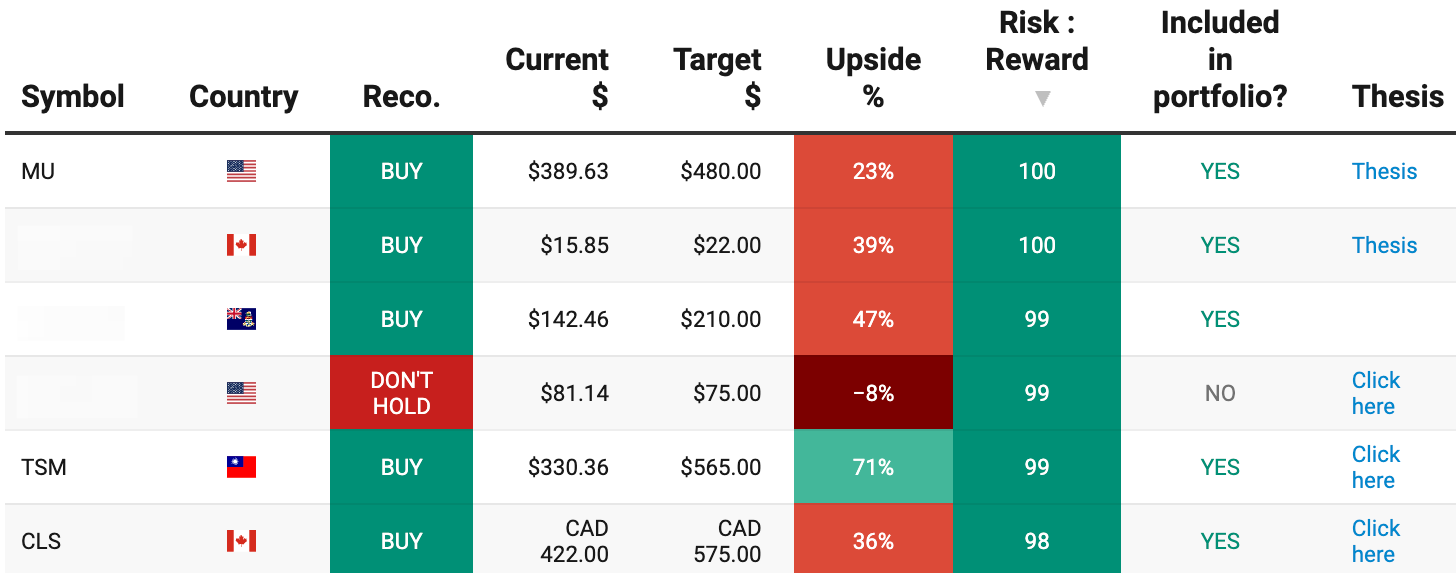

3. Access to my portfolios

On the top navigation bar on Home page, you can find the portfolio.

Below is a sample portfolio,

4. Access to my watchlist

5. One in-depth stock idea per month

Once a month, I will send a detailed investment analysis for a company I am adding to the portfolio.

Here is a sample deep dive that I did for TSMC [TSM 0.00%↑],

Below is the performance of the stock picks since launching this newsletter.

I look forward to sharing my insights with you. You can email me anytime at george@beatingthetide.com. I read all the emails and aim to reply within 24 hours.

~ George

Disclaimer

Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. I am not a licensed securities dealer, broker, US/Canadian investment adviser or investment bank. I am not licensed or certified by any institute or regulatory body.

Details on past stock picks

Trade details and sources are detailed in the caption of each chart.

Bought ⬆️ DQ: +1,721%

Bought ⬆️ LMB: +968%

Bought ⬆️ TGLS: +340%

Bought ⬆️ CPS: +273%

Bought ⬆️ BXC: +220%

Bought ⬆️ AGX: +166%

AGX 0.00%↑, Read the deep dive.

Bought ⬆️ GLGI: +164%

Bought ⬆️ AVGO: +154%

Bought ⬆️ NGL: +132%

Bought ⬆️ UBER: +121%

Bought ⬆️ NXXYF: +115%

Trade alert at $0.86 and was acquired within 2 months for $1.85.

Bought ⬆️ URI: +107%

Bought ⬆️ TEN: +99%

Sent a buy trade alert in January 2022 at $10.40 and was acquired in 31 days by Apollo for $20.

Short ⬇️ BYND: +97%

Bought ⬆️ RCL: +91%