Why I’m Closing AGX after a +166% Gain

I’m not timing the top. I’m rotating capital because upside shrank and better setups showed up.

I closed my AGX position after a +166% gain.

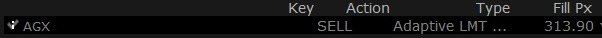

Trade alert:

Close AGX

AGX was my top pick for 2025 (read thesis here) and it is a company dear to me. So, I closed it not because the business broke nor because management lost the plot. I’m closing because I found a better use for my capital.

That sentence sounds colder than it feels. I like this company. I like how they run it. Read my investment thesis below.

Years ago I learned that the market does not pay me for loyalty. It pays me for risk adjusted returns.

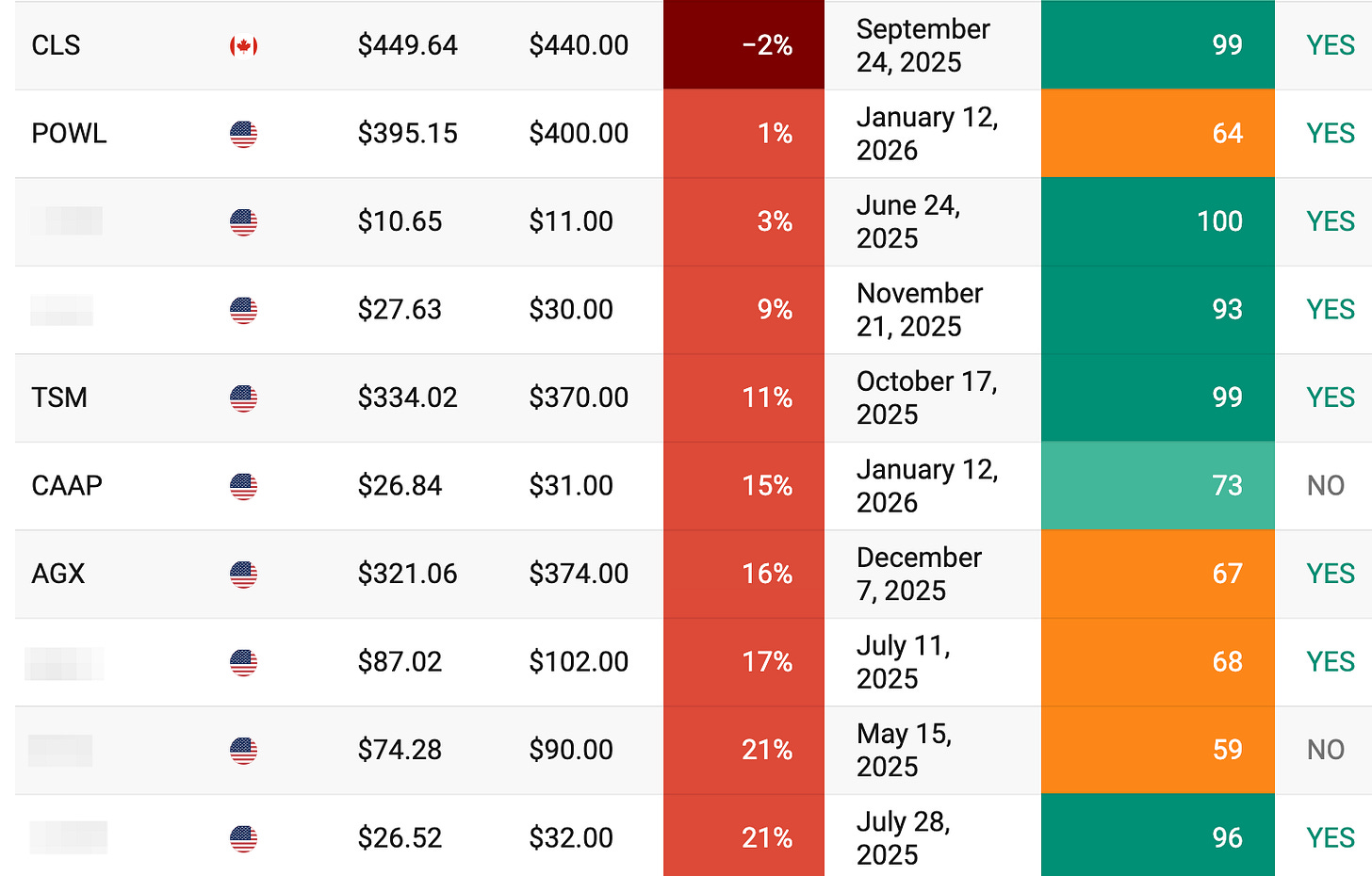

My AGX target price stays $374 and AGX trades around $314 as I write this.

That leaves me with a 19% upside. That is fine. It just isn’t the best bet on my board right now.

I’m closing because the risk reward shrank

I run a long only portfolio. So every dollar I keep in AGX is a dollar I cannot put into a name with larger upside. So the question is not “Do I like AGX?”

The question is “Does AGX rank high enough today to deserve its capital?”

With a $374 target and a $314 stock, I see limited upside. At the same time, AGX carries real risks. EPC work stays lumpy. Revenue can swing quarter to quarter based on project timing. Margins look great, but management does not promise they hold at today’s highs forever.

None of that breaks the thesis. It just compresses the return profile.

I would rather redeploy into something where the upside makes the bumps worth it.

I am not a great market timer

I want to say this clearly: I do not sell because I think I nailed the top.

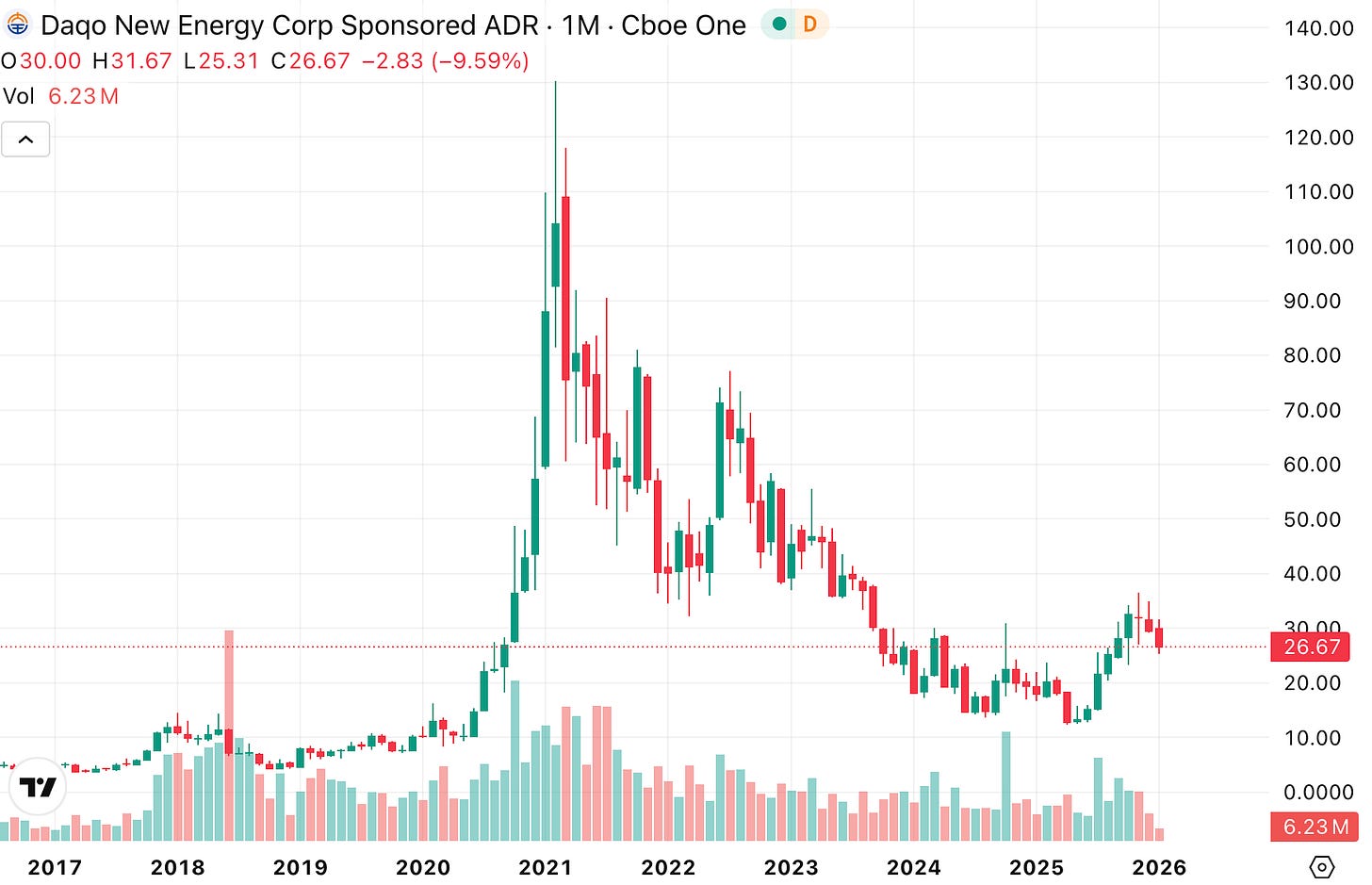

Remember that I sold DQ around $95. It ran to $130 before it collapsed. The run-up did not make my sell wrong. The later crash did not make it right. The only thing that matters is whether the risk reward made sense when I acted.

I closed URI around $725.

URI crossed the $1,000 mark before collapsing below $800 and now trades around $940. So was my $725-close right or wrong?

I closed TMUS around $240. Was it a right or wrong call?

It pushed to $260, then slid under $200.

So if AGX rips after I sell, that does not shock me. If it drops, that does not prove skill either.

I care about process and the risk:reward does not seem very attractive.

Here is a simple way to think about it.

Imagine someone offers you this bet:

If a coin lands heads, you win $50.

If it lands tails, you lose $100.

Now imagine the coin lands heads three times in a row. You just made $150.

You still took a bad bet.

The outcome does not change the expected value. The bet stays negative. Over time, it will eat you.

Investing works the same way. A stock can rise after I sell. That does not mean I made a mistake.

So when I sell AGX, I do not try to predict the next $20 move. I ask one question: does the payoff still justify the risk versus my alternatives?

Why I still hold names with “low” upside?

You might look at the watchlist and think: “Wait, why do you still own POWL if the upside shows less than 20%?”

Fair question.

My target prices do not update in real time. I do not tweak one assumption to force a higher target. Every time I update a target, I do a full refresh. I recheck the thesis. I run the model again. I read the latest filings and the new quarter. I do the channel checks… That takes time.

So there is often a gap between what the spreadsheet shows and what my current view is becoming as I work through new data. In that gap, I prefer to hold rather than sell just because the stock touched an old target. I learned that selling mid refresh creates more mistakes than it prevents. I would rather finish the work, then decide with a clear head.

Also, every stock that makes it into the portfolio starts as a great investment. These are not lottery tickets. These are solid businesses with real fundamentals. If you held a basket of the companies I cover for decades, I think you would do well. So these companies tend to apreciate (assymetric returns to the upside).

Rotation can still add juice. That is the whole point of what I do. I try to move capital toward the best risk reward available today. But when a company stays strong, I do not rush to the exit just because my target price update has not caught up yet.

That said, I hear you. One of the strongest pieces of feedback from the survey is that you want clearer guidance on the watchlist. Buy. Hold. Exit. I agree. I am going to add that soon. But as you know by now, I don’t like to rush things as I like to do them properly.

And if you have not filled the short survey yet, please do. It directly shapes what I build next, it helps me raise the value of this newsletter and you could win a 1-month access to paid.

What would make me buy AGX again

I would not blacklist AGX. I would revisit if one of these happens:

The stock drops enough to restore a fat margin of safety versus my $374 target.

The company wins more large projects, and my target moves up in a way that restores meaningful upside.

The market offers me a new setup where I get both earnings growth and a favorable re-rating again.

Until then, I tip my hat, take my gains, and move on.