JD.com Stock Deep Dive: Why a Cheap Valuation Wasn’t Enough

A post-mortem on my JD investment, the food delivery misstep, capital destruction, and why opportunity cost finally forced an exit

Selling a stock at a loss is never fun and it is hard as I explained before.

Trade alert:

Close JD

After much thought, I’ve decided to close my position in JD.com [JD 0.00%↑] at a 24% loss.

I’ll walk through why I’m making this tough call, reflecting on the original thesis, what panned out as expected, and what surprised me (not in a good way).

Original Thesis: High Hopes for a Retail Champion

JD.com is one of China’s e-commerce giants, known for its vast online retail platform and nationwide logistics network. When I first invested, my thesis was that JD had a strong moat and that it could ride China’s growing middle class consumption.

I expected JD to keep growing revenues solidly and, importantly, to expand its profit margins as it gained efficiency. The stock also looked reasonably priced at the time, trading at a low earnings multiple. In short, I bet that JD’s scale and operational strengths would lead to robust earnings growth and a stock price rebound.

Some key points from my original thinking:

Scale & Logistics Moat: JD built its own logistics arm (warehouses, delivery fleet) to ensure quality service. This required heavy investment, but I believed it would pay off by attracting more shoppers and merchants. JD’s direct first-party (1P) retail model (buying inventory and selling to consumers) contrasts with Alibaba’s purely marketplace model (third-party, or 3P). I thought JD’s model, though lower margin, would earn customer loyalty and volume growth.

Market Position: JD was (and is) China’s #2 e-commerce player after Alibaba. It was expanding into new categories (groceries, consumer electronics, etc.) and into smaller cities. Even as upstarts like Pinduoduo captured the ultra-budget shoppers, JD retained a strong base of consumers who trusted its quality. I assumed JD could co-exist with Pinduoduo by focusing on service and product quality, and perhaps even improve its margins via higher-margin services like advertising on its platform.

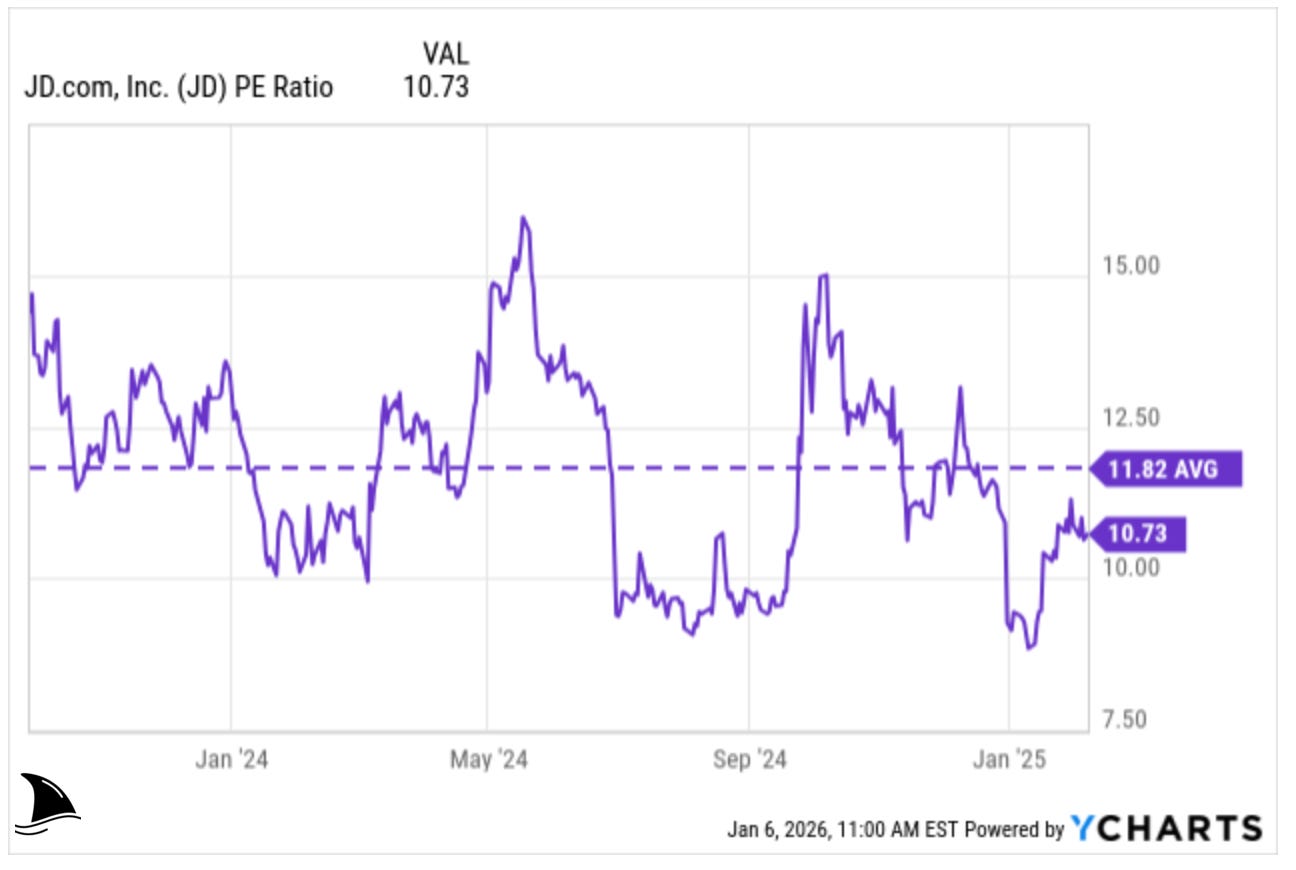

Undervalued Stock: When I entered the position, JD’s stock was already trading below its own historical average. The shares sat around 10–12x earnings, versus a long-term average closer to 12x. China tech fears and macro worries pushed the multiple down, even though the business was still generating profits and cash. I saw that gap as an opportunity, assuming sentiment would normalize and the valuation would drift back toward its historical range and earnings to continue expanding.

Catalysts I Imagined: I expected a few things might drive JD’s stock up: a post-pandemic consumer rebound in China, potential spinoffs of JD’s subsidiaries (like JD Logistics or JD Health) unlocking value, and the company’s own efforts to reward shareholders (share buybacks or dividends) as cash flows grew.

In essence, my thesis was optimistic: JD.com was a well-run retailer with huge scale that would grow steadily and become more profitable, and investors would eventually reward it with a higher stock price.

What Went Right

It’s important to note that not everything went wrong. Some aspects of the JD story played out as expected (or even better):

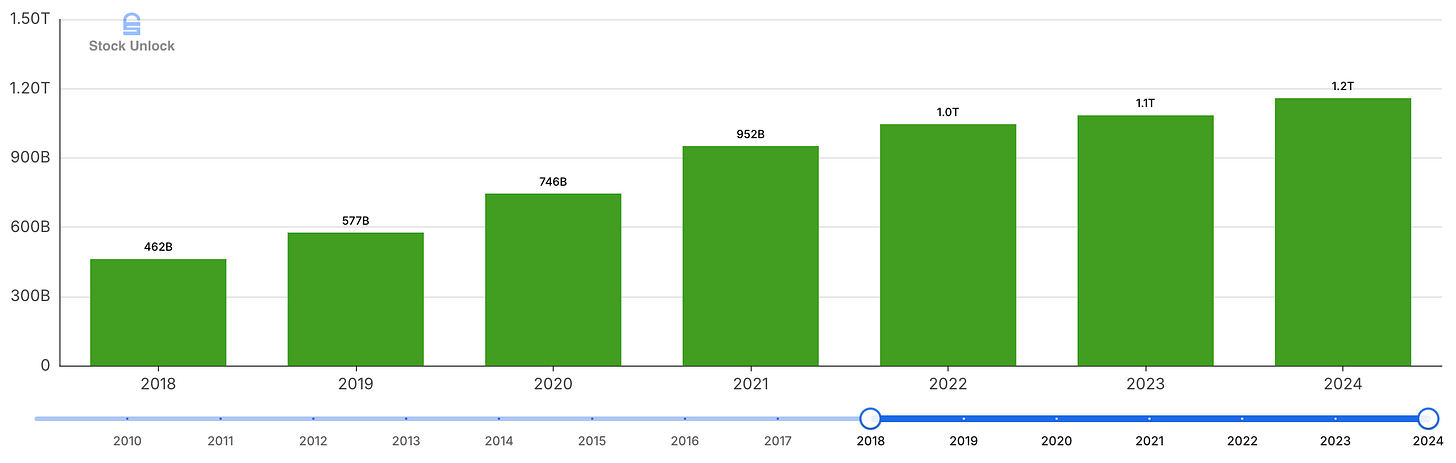

Continued Revenue Growth

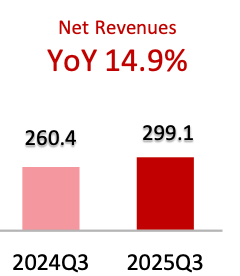

JD’s sales kept rising. Despite a sluggish economy, full-year 2024 revenue reached RMB 1.2 trillion (about $158.8 billion), up 6.8% from 2023.

In 2025, growth actually accelerated. By Q3 2025, quarterly revenue was up 14.9% y/y, marking a return to double-digit growth. This showed JD can still increase its top line even in a tough environment.

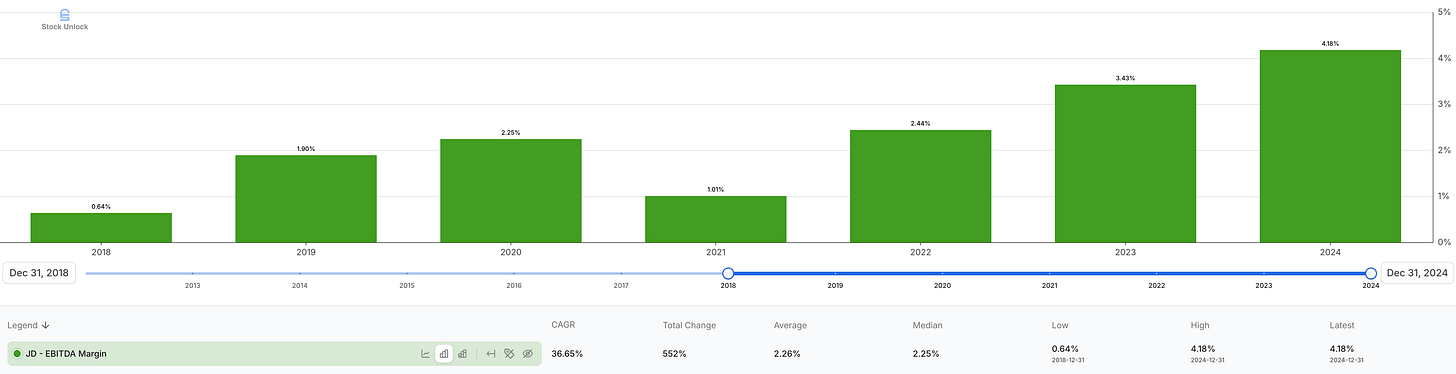

Improved Profitability (Until 2025)

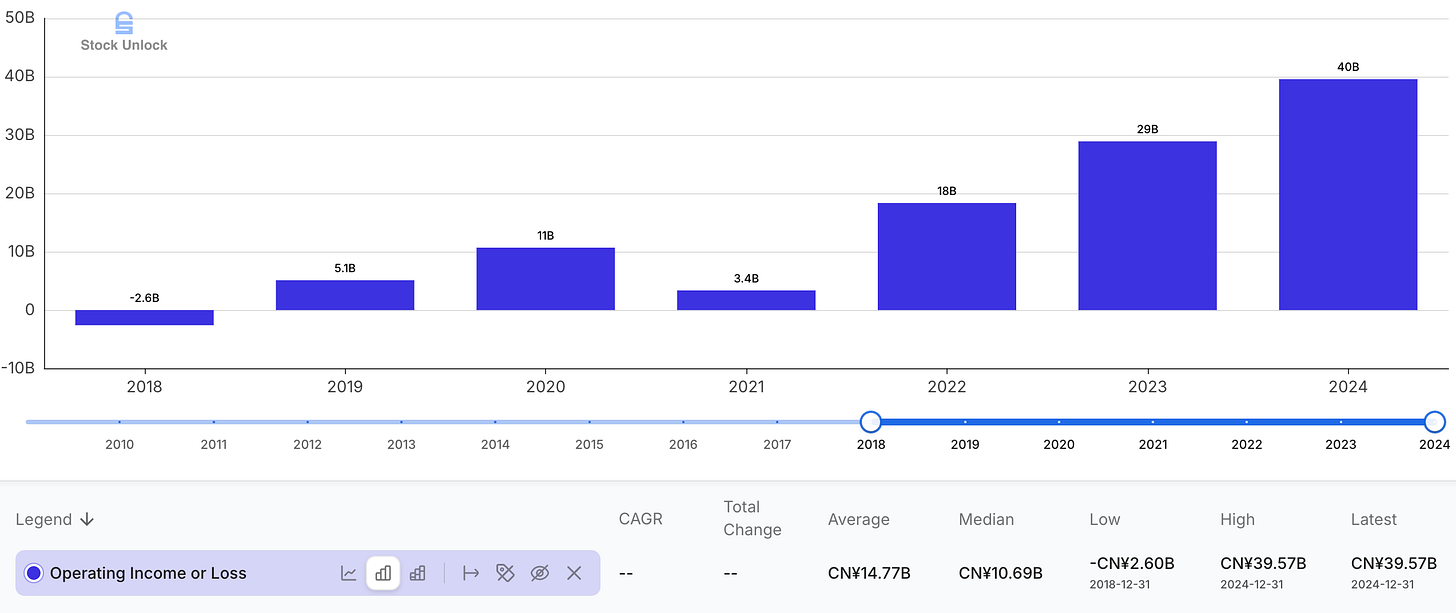

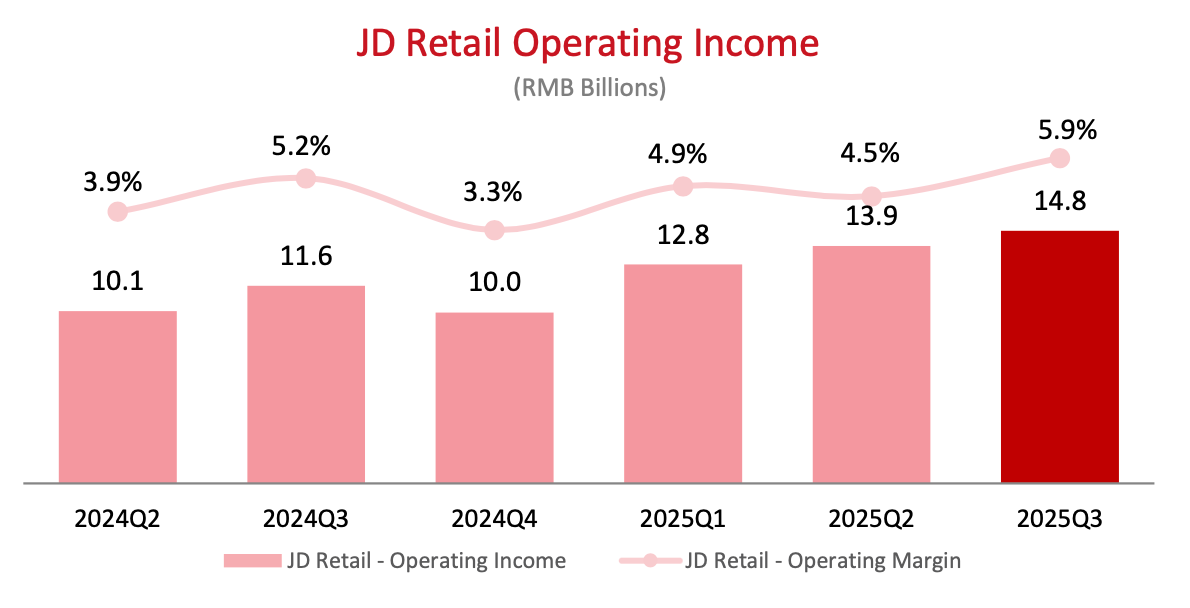

One of the big positives was JD’s margin improvement through 2024. The company had been optimizing costs and gaining efficiency in its retail operations. For the full year 2024, JD’s operating profit was RMB 39.6 billion, up 36.9% from 2023.

EBITDA margin climbed to 4.2%.

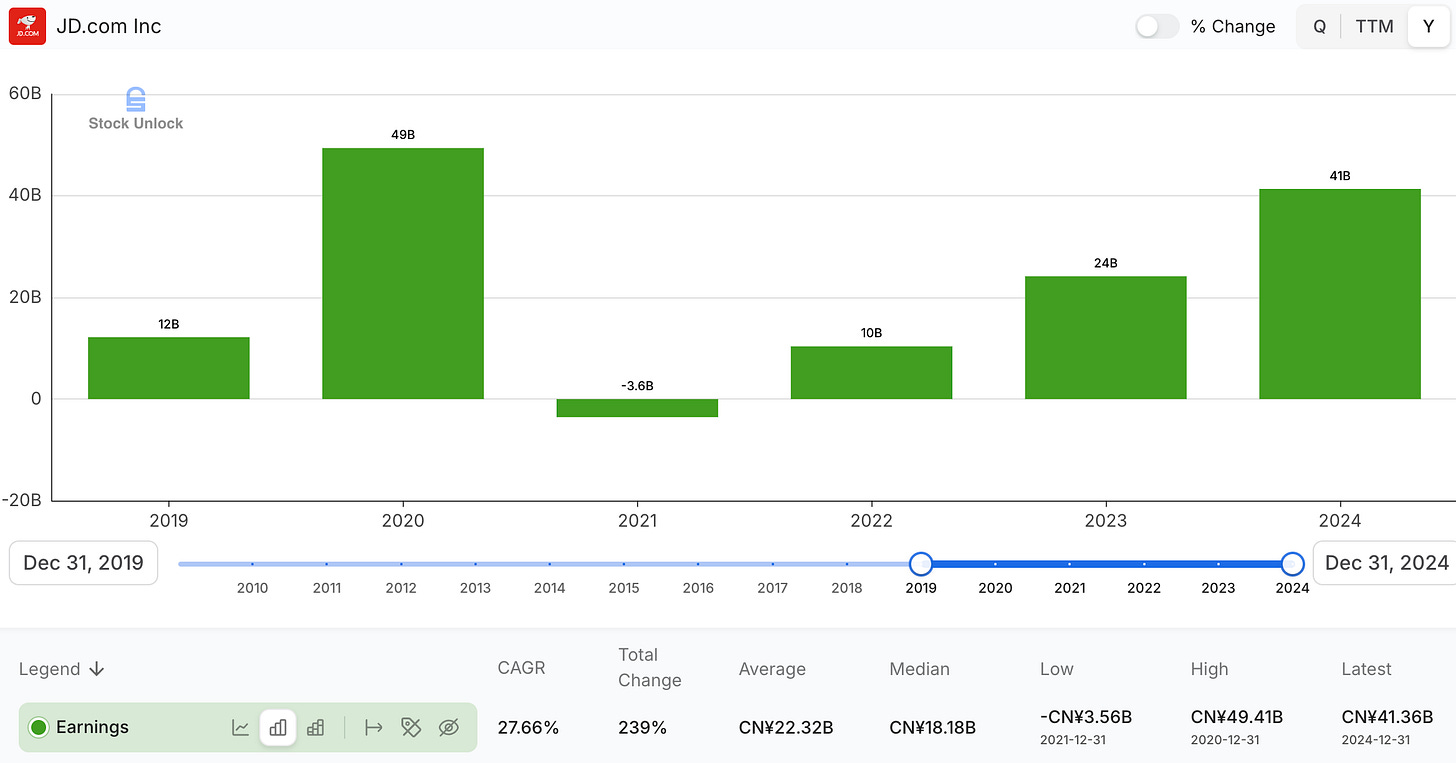

Net income to shareholders was RMB 41.4 billion in 2024, with a net profit margin of 3.6%, not high by global standards, but a notable improvement y/y.

In other words, through 2024 JD was getting more profitable on each yuan of sales. This was in line with my thesis that as JD matured, it could lift margins from the low single digits toward mid-single digits.

Cash Flow and Shareholder Returns

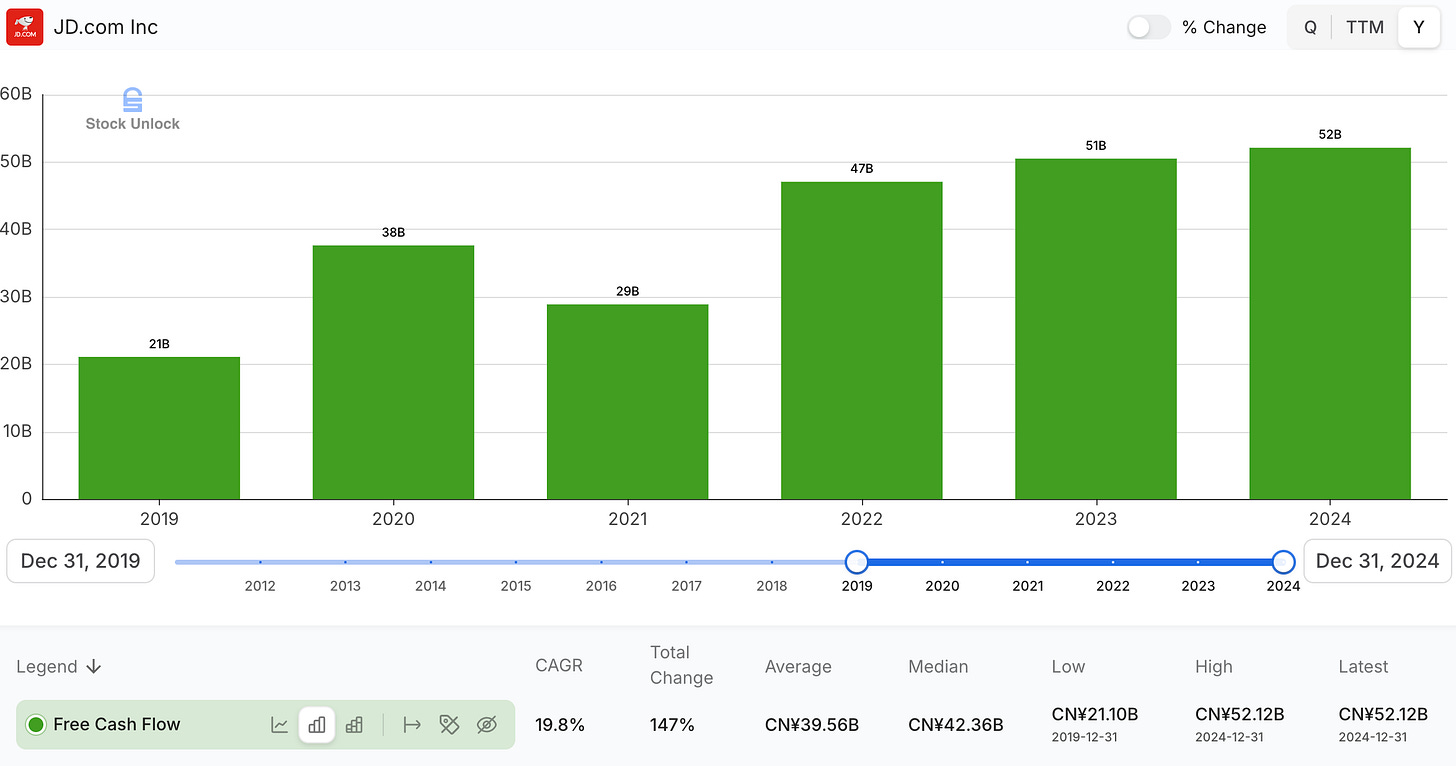

JD remained a solid cash generator. In 2024 it generated free cash flow of about RMB 52 billion, which even slightly exceeded the prior year’s free cash flow.

Competitive Strength in Core Retail

JD’s core JD Retail segment (online shopping platform) continued to perform well in its key categories. For Q3 2025, JD Retail segment revenues were RMB 250.6 billion, up 11.4% y/y, driven by solid demand for general merchandise and growth in advertising revenues.

JD has been able to leverage its huge customer base to grow higher-margin services like online marketing (advertising) on its platform. Those revenues helped boost profitability of the retail segment.

In fact, JD Retail’s operating margin reached 5.9% in Q3 2025 (before corporate overhead), reflecting efficient operations.

Even as Chinese consumers tightened spending, JD managed to increase its active customer accounts in 2024/25 and keep a high level of customer satisfaction with its delivery speed and service.

Long-Term Investments

JD’s investments in areas like logistics, AI, and overseas expansion (JD has ventures in Thailand, Indonesia, etc.) may not have paid off immediately, but they position the company for the future.

For instance, JD Logistics (now partly spun off but still majority-owned) grew its external client revenues by 10% in 2024, as more companies used JD’s delivery network. These moves build JD’s ecosystem beyond just selling products.

In summary, by early 2025, parts of my thesis were on track: JD was growing steadily, improving its margins, generating lots of cash, and even sharing some of that cash with shareholders. If we froze the picture at Q1 2025, JD looked like a potentially great story: in Q1 2025, net income jumped 52.7% y/y and net profit margin hit 3.6%.

Unfortunately, things did not stay that rosy…

What Went Wrong: Thesis vs. Reality

Despite the positive factors above, several developments undermined the original thesis. These were significant enough that, in my view, they materially changed JD’s risk/reward outlook. Here’s what went wrong (and why I’ve lost near-term confidence):

Chinese Consumer Slowdown

First, the macro environment in China turned out weaker than I hoped. Consumer spending recovery has been uneven and slower coming out of COVID lockdowns. Weak property prices and job market uncertainty have made shoppers cautious.

This meant less tailwind for all retail, including JD. JD’s revenue growth in 2022–2023 had decelerated to single digits, and even though it picked up in late 2024/2025, some of that was due to heavy promotions (not purely organic strength). The softer economy pressured JD’s core business and made it harder to grow sales without sacrifice (more on that next).

Intense Competition & Price War

This is the big one. Competition in China’s e-commerce and local services space went from strong to downright fierce in 2023–2025. Companies started a “price war” to win consumers, especially in the on-demand delivery arena.

What happened is a bit like a domino effect.

Domino #1. Meituan’s Encroachment

Meituan, the leader in food delivery, began selling a wider range of products on its app (like groceries, convenience items) edging into JD’s territory of general merchandise. Meituan was leveraging its huge user base who order meals to also deliver other retail goods quickly. This alarmed JD.com’s management, as JD saw a key rival moving in on retail.

Domino #2. JD’s Response: Entering Food Delivery

In response, JD made a strategic pivot in early 2025: it launched “JD Takeaway,” its own food delivery service, to challenge Meituan in that arena. The idea was to diversify revenue and not be a sitting duck while Meituan and Alibaba’s Ele.me grabbed the instant-delivery market.

JD poured billions of yuan into this new venture, offering subsidies and promotions to attract users. By mid-2025, JD Takeaway reportedly amassed 25 million daily orders across 350 cities (about half of Alibaba Ele.me’s volume). On paper, that’s impressive traction in a short time.

Domino #3. “Instant Retail” Subsidy Battle

However, breaking into food delivery has proven extremely costly for JD. Meituan and Alibaba are well-entrenched, and they fought back hard. All three players began pledging enormous subsidies (discounts & coupons) to win market share. Analysts estimate the industry-wide cash burn exceeded US$4 billion in Q2 2025 alone.

This is a huge cash drain. It’s like a high-stakes game of chicken, whoever blinks first loses, and whoever stays in loses a lot of money (at least in the short term).

Domino #4. Profit Squeeze

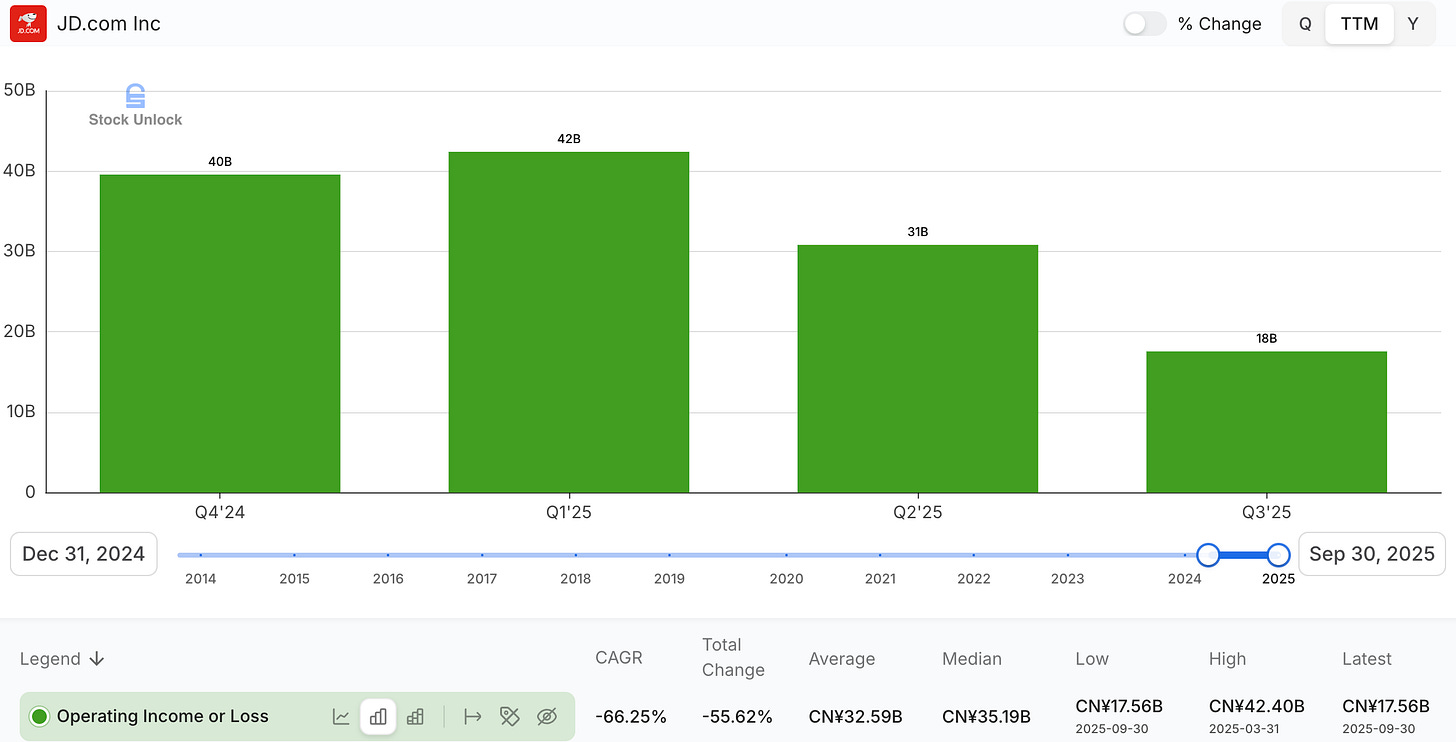

The effect on JD’s profitability was immediate and dramatic. By Q3 2025, JD’s trailing twelve months operating income shrunk from RMB 42B in Q1 2025 to RMB 18B in Q3 2025 and margin shrank 3.6% to 1.3% in that period.

The new food delivery investments nearly wiped out JD’s profit. Marketing expenses in particular soared (up 127% in the recent quarter) due to all those promotions and coupons.

Domino #5. Losing Focus?

The strategic gamble also means JD’s management is prioritizing long-term growth over short-term profit. This might be okay if you have patience, but it diverged from my original thesis which was expecting improving near-term margins.

Now, JD is willingly sacrificing earnings to build a presence in food delivery and local services. The big question: will this pay off eventually? Possibly, yes as these markets are huge (China’s food delivery market > $80B). But in the meantime it’s a drag on the business. And success is far from guaranteed, given formidable rivals.

Tough Rivals in New Areas

JD jumped into a fight where the incumbents have advantages. Meituan holds 70% of China’s food delivery market and is deeply experienced in local services. Alibaba, via Ele.me and its Taobao Deals, is also pushing into one-hour deliveries, reaching 80 million daily orders by mid-2025.

These companies have years of know-how in this segment. Meituan and Alibaba have years of experience running food delivery at scale. JD is still learning the ropes in this business. It will be very challenging.

Early data showed JD Takeaway’s user momentum actually fizzled by mid-2025 (daily active users peaked in June then fell 13% week-on-week by late July). That hints that sustaining growth will require even more subsidies or differentiation, which is costly.

JD is fighting an uphill battle outside its traditional wheelhouse.

Capital Destruction vs. Creation

My original hope was that JD would use its capital efficiently by expanding into profitable ventures or returning excess cash to investors. Instead, what I see now is capital destruction, at least in the near term. The company is spending huge sums on a price war that yields negative immediate returns (every subsidized order is essentially sold at a loss).

For example, JD could lose about RMB 10 billion in the food delivery segment in a single quarter. Meituan itself saw its profit plummet 89% in Q2 under competition pressure, so this war is hurting everyone’s economics.

It’s one thing to invest in R&D or new technology with an uncertain payoff. It’s another to burn cash on subsidies that train consumers to expect cheap deals. This kind of spending doesn’t build durable assets. It reminds me of meal delivery services like HelloFresh. I use the discount, cancel, and wait for the next coupon to show up.

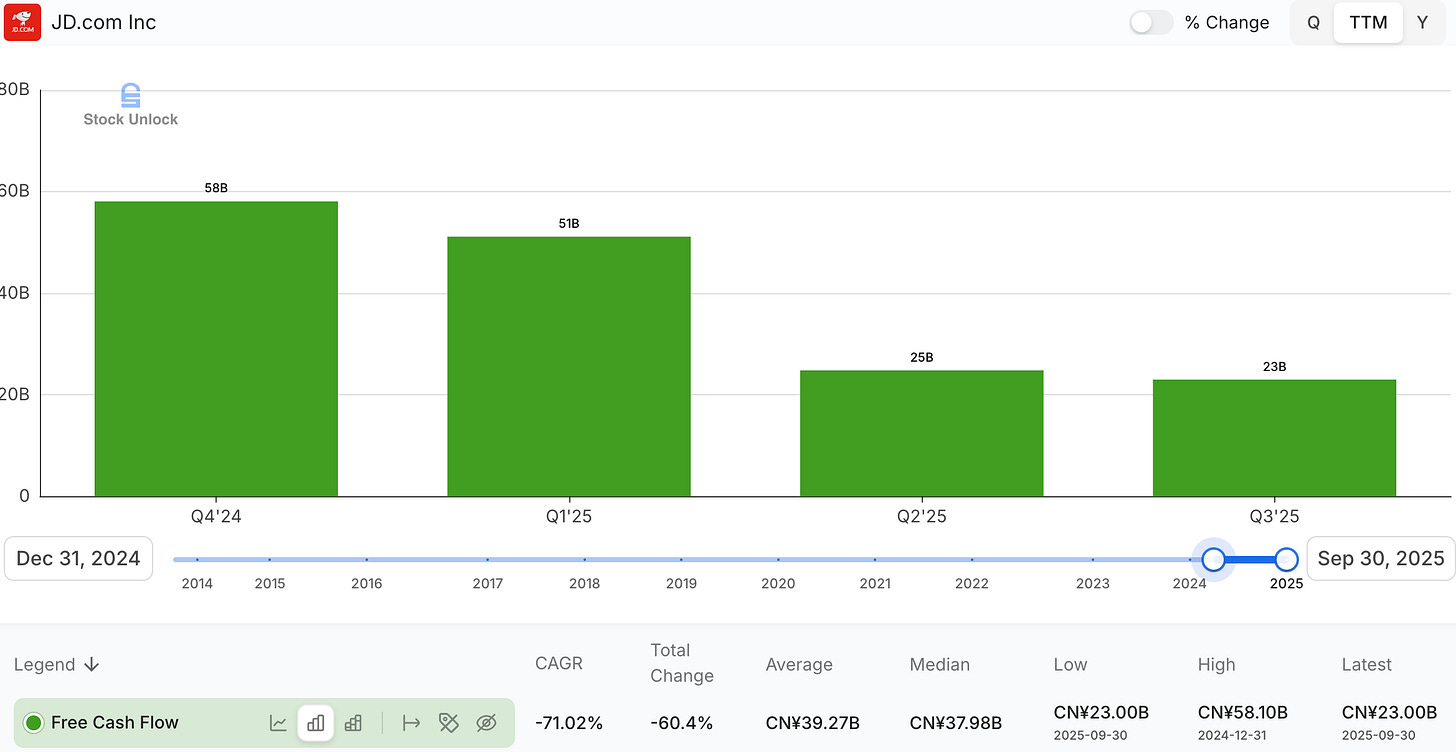

It’s disheartening to see earnings and cash that could have been mine as a shareholder instead being siphoned into a subsidy battle. JD’s free cash flow, while still positive, is being squeezed. On a trailing 12-month basis it was down from RMB 58B in Q4 2024 to RMB 23B in Q3 2025.

Strategic U-Turn

The pivot to aggressive expansion (what CEO Sandy Xu called “excessive competition”) marked a bit of a U-turn from JD’s prior strategy of margin improvement. It indicates management felt they had to defend JD’s turf and pursue growth at the expense of profits.

This introduces a strategic risk: if JD miscalculates, it could end up stuck with a money-losing side business. There’s also regulatory risk; authorities in China have warned against irrational price wars that lead to a “race to the bottom”.

The competitors have signaled they will eventually curb extreme subsidies, but it’s unclear when sanity will return. Until then, JD’s management seems willing to play the game and “dig in for a long-term battle”, which tempers the near-term investment case.

Opportunity Cost

The final nail for me is opportunity cost.

JD’s near-term profit outlook is weak and I don’t see a clear catalyst. The stock has gone nowhere. Meanwhile, other stocks and sectors offer clearer, nearer-term upside, especially with recent developments in Venezuela (read my quick thought on Venezuela here). Keeping capital tied up in JD risks turning it into dead money, or worse, watching it slide further if conditions deteriorate.

In summary, the original thesis didn’t account for JD diving into a costly war with Meituan and Alibaba. That move fundamentally changed JD’s earnings trajectory (from growing to shrinking) and delayed any thesis of margin expansion by at least a couple of years. While JD’s core business remains solid, the overall company’s profitability and focus have been derailed in the near term.

Valuation: cheap, but it needs a trigger

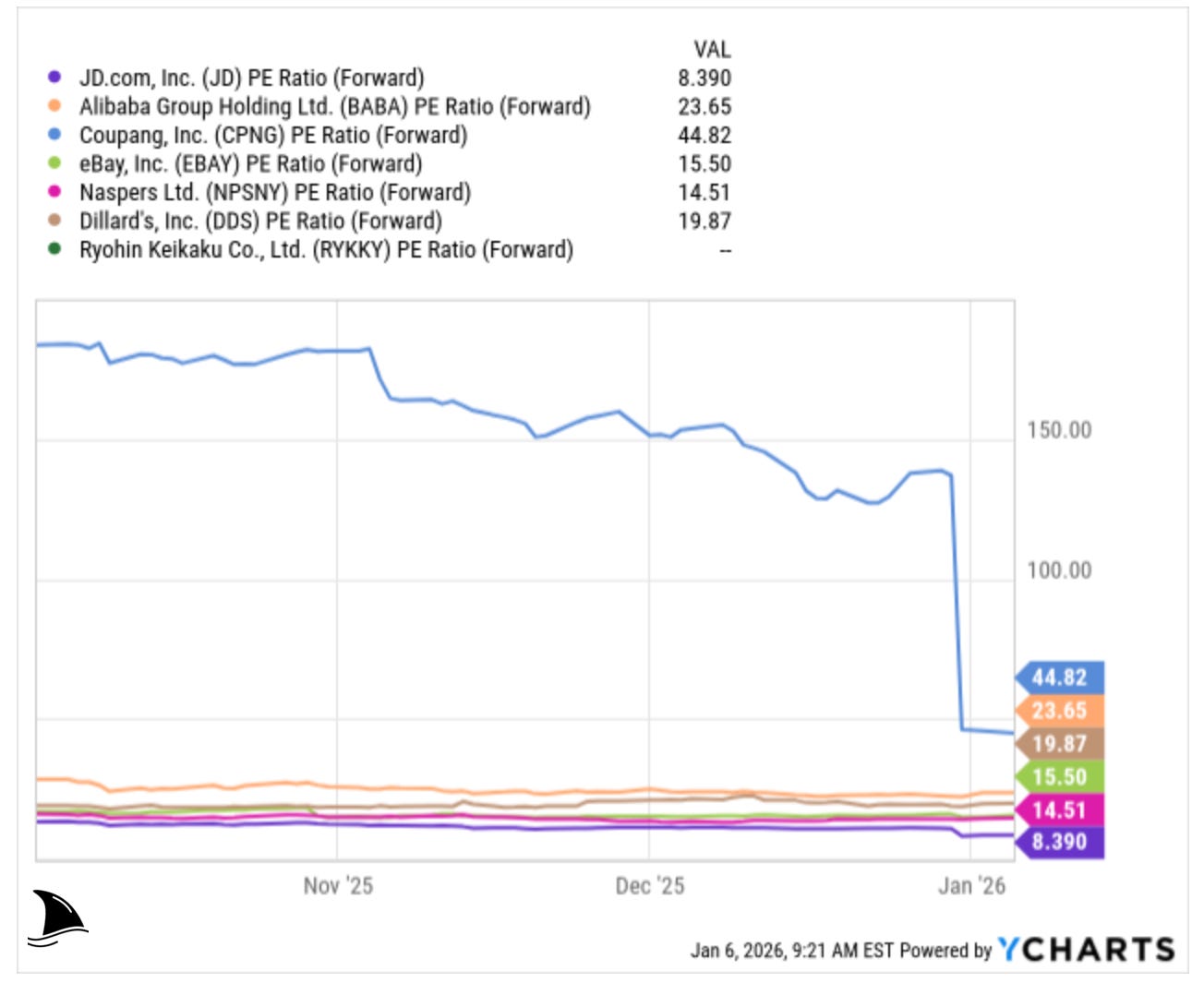

It’s obvious JD still trades at a discount to peers. I can see it in every basic multiple. JD trades at about 8.4x forward P/E. Alibaba sits closer to 23.7x. Coupang sits around 44.8x. Even eBay sits around 15.5x.

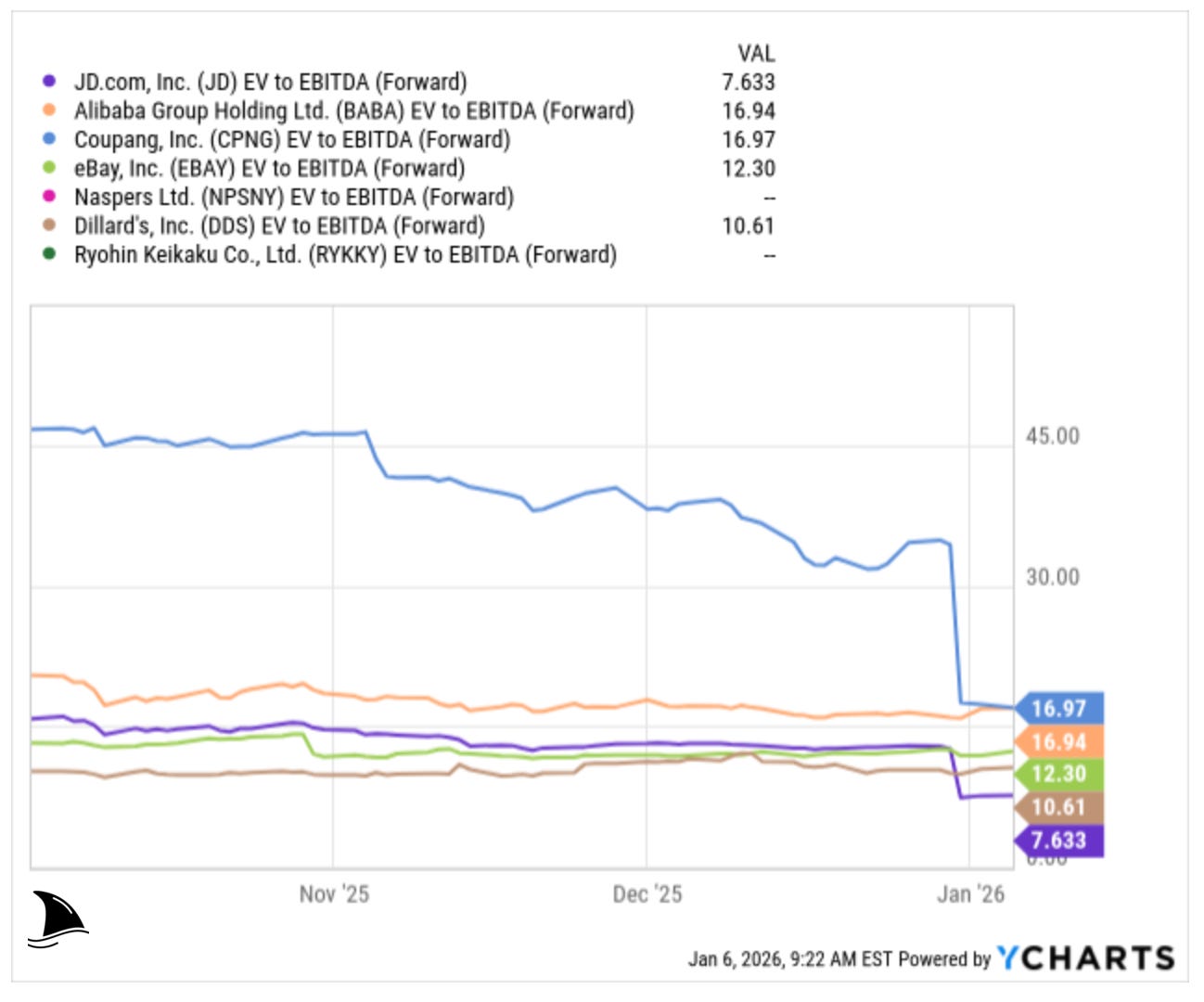

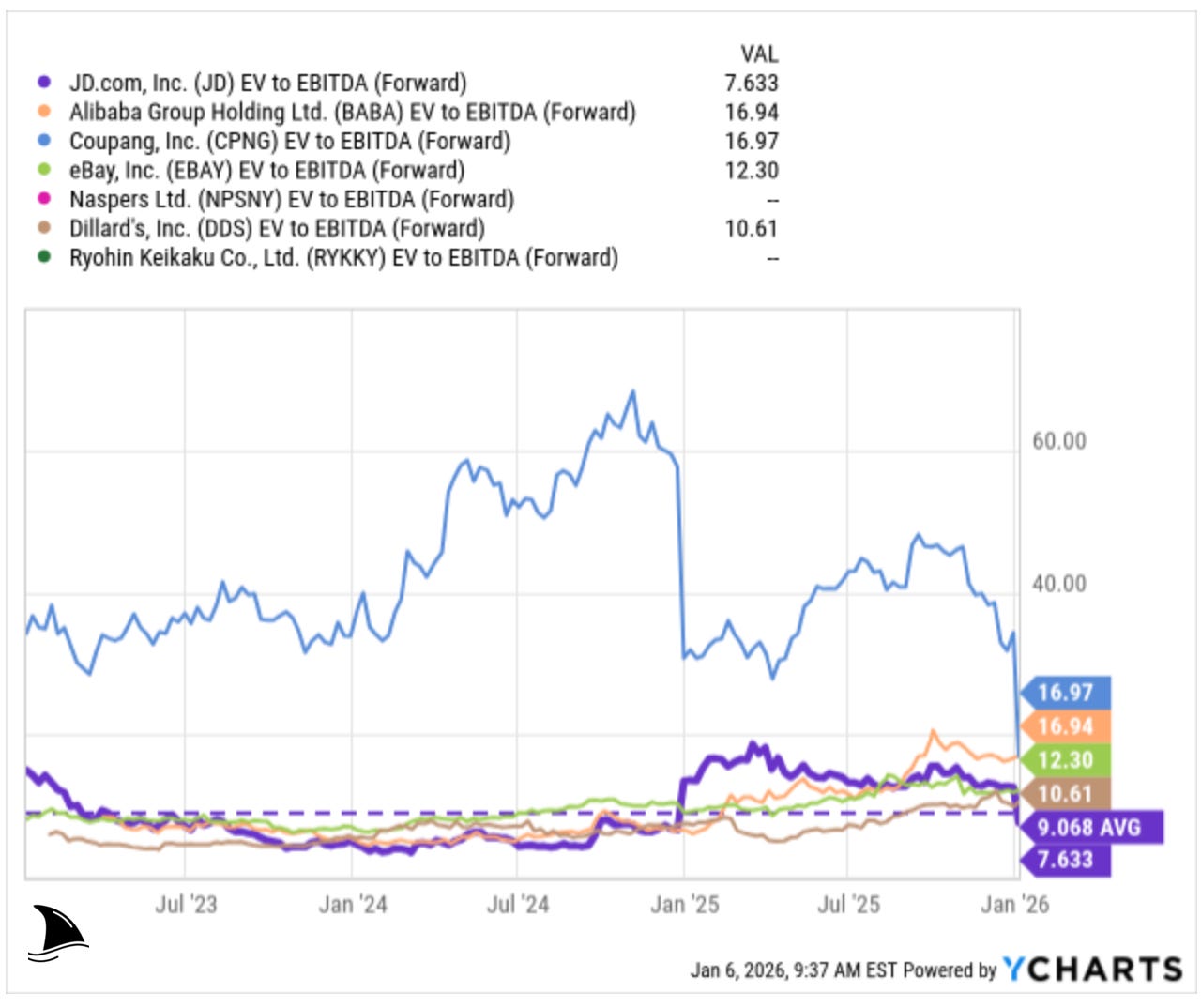

Same story on EV to EBITDA.

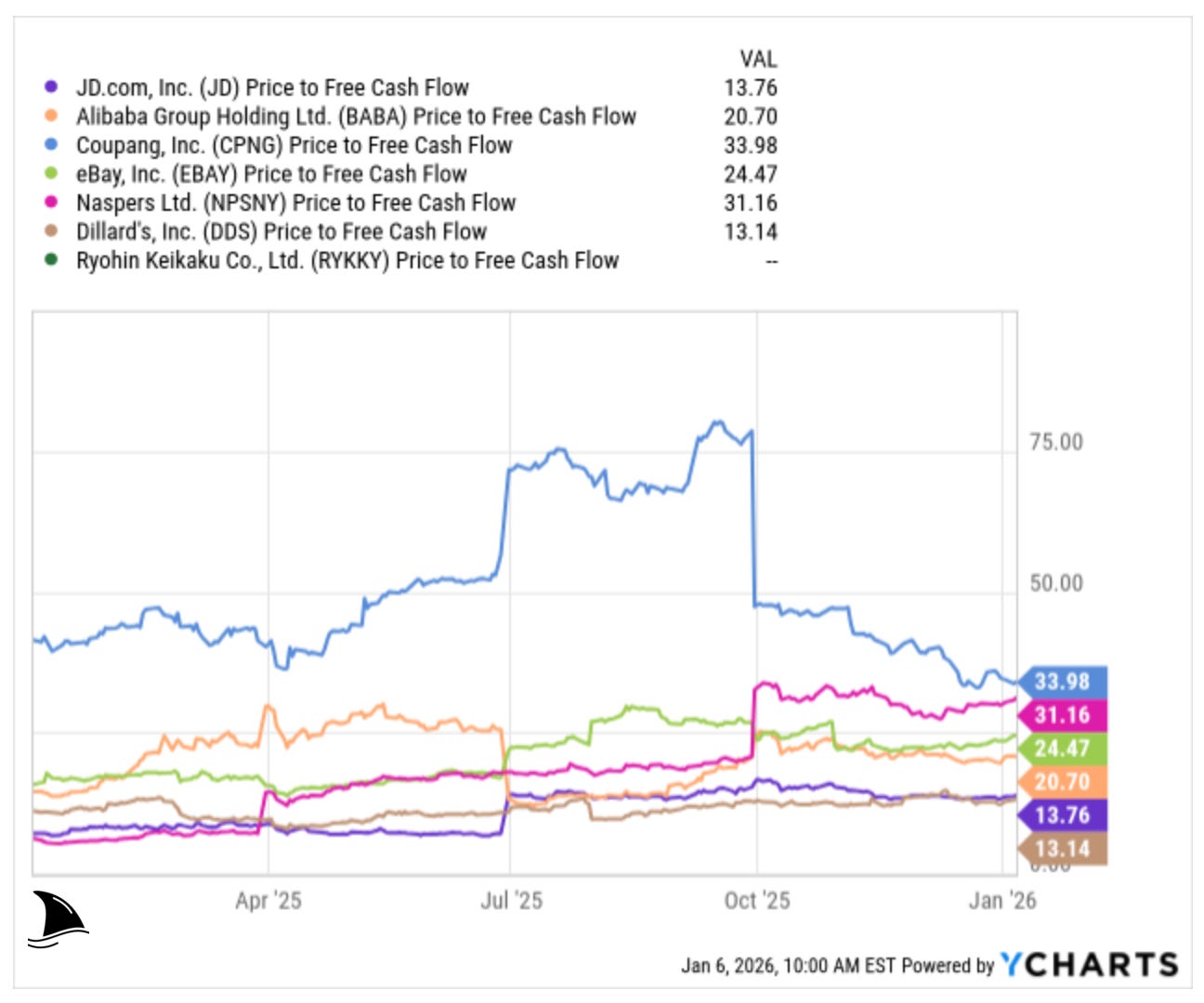

Free cash flow tells the same tale. JD trades around 13.8x price to free cash flow. Alibaba is around 20.6x. Coupang is around 34x.

So yes. JD looks cheap.

But cheap does not mean it has to go up next month. I still think the long-term value sits higher. I would not be surprised if the shares converge toward $46 over time.

At $46, JD would trade at about 13.5x forward EBITDA using today’s consensus. That sits above JD’s own history of 9x forward EBITDA. It is not insane when you compare it to peers, but it also is not a bargain multiple.

So the market will not give JD that valuation while JD keeps burning profit in a war where nobody makes good money.

Right now, the Street expects EBITDA to shrink by about 5.1%. That forecast reflects the same thing I see. JD keeps spending hard in areas with fierce competition and thin margins.

Food delivery is not a moat. It is a knife fight in a phone booth. Two players already own the game. The third player has to pay up just to stay in the room.

If JD wants a clean rerating, it needs to stop destroying value where it has no edge. Then it needs to reallocate that capital. I see two paths that make sense.

First, JD can send more cash back to shareholders. More buybacks. A stable dividend.

Second, JD can double down on the core business where it actually has a moat. Logistics and service quality. Higher-margin marketplace and advertising tools. If JD does that, I can see the stock trading above its historical average multiple.

Over the last few years, JD’s EV to EBITDA has hovered closer to 9x on average.

If the market regains confidence, I can see 10x to 12x being realistic. But the bigger lever is EBITDA itself.

Consensus expects EBITDA to fall. If JD pulls back on low-return spending, EBITDA does not need to shrink. It can grow. Even flat EBITDA would beat expectations.

So I still think JD has long-term upside. But I also think the stock gets there only if management shifts from fighting every battle to funding the ones that pay.

Conclusion: Long-Term Value + Short-Term Uncertainty = Time to Reallocate

After evaluating all of the above, I’ve concluded that closing my JD.com position is the prudent move for me. Yes, I’m crystallizing a 24% loss. But I have to compare JD’s future prospects from here against other opportunities, rather than against my past cost basis. And in that comparison, JD falls short on near-term outlook.

Do I think JD is going to zero or becoming irrelevant? No, not at all. In fact, I still admire a lot about JD as a company. It has a trusted brand, a massive active user base, and arguably one of the best logistics infrastructures in the world. Long-term, JD could very well emerge stronger and perhaps the food delivery venture will succeed and make JD an even more indispensable one-stop platform for consumers. Perhaps the Chinese economy will rebound, and JD’s core retail business will thrive again with higher margins, and all this will look like a savvy investment in hindsight.

However, I have to weigh the time and uncertainty involved. The reality is that JD currently lacks clear near-term catalysts to drive its stock higher. On the contrary, the next few quarters will likely show y/y profit declines, which usually isn’t a recipe for a rising stock price. The company is currently in a phase of capital destruction burning earnings to fund growth. Management is essentially asking shareholders to be patient and trust that this will pay off down the road. It might, but that road looks long and bumpy.

Meanwhile, there are other stocks, sectors and geographies that have more immediate positive catalysts or clearer earnings trajectories. By reallocating the funds from JD, I aim to capture nearer-term upside elsewhere, rather than have money sit in JD hoping for a turnaround that could take multiple years.

One could argue that because JD is so beaten down and unloved, it might be a contrarian buy now. It’s true the valuation is cheap and sentiment is poor and sometimes that’s the best time to buy a stock. But for me, the difference is the fundamental direction in the near term is also poor. I generally like contrarian plays where fundamentals are improving but the market hasn’t realized it. In JD’s case, fundamentals have deteriorated and everyone knows it; the question is when they’ll improve, and that’s uncertain.

I am adding. I love when short term uncertainty drives investors away. Looks like you manage do have good results by being catalyst oriented, fair play to you. Long term investors see moat building as an opportunity.