Two Hidden Gems Poised for Explosive Growth and Market Dominance

These Under-the-Radar Stocks Offer High Margins, Strong Cash Flow, and a Massive Upside—Here’s Why They Belong in Your Portfolio.

As discussed in detail in Weekly #17, while I don’t believe that any significant tariffs will be implemented or remain in place for long, we should begin positioning the portfolio to safeguard against geopolitical risks.

That is why I have chosen two companies that, although listed in the US, generate their revenues and operations outside the country.

Let’s dive into the details and see why these two companies are strong additions to the portfolio.

Trade Alert: Buy JD and ITRN in the SVIF USA portfolio.

JD.com: Undervalued, High-Growth, and Margin Expansion Potential

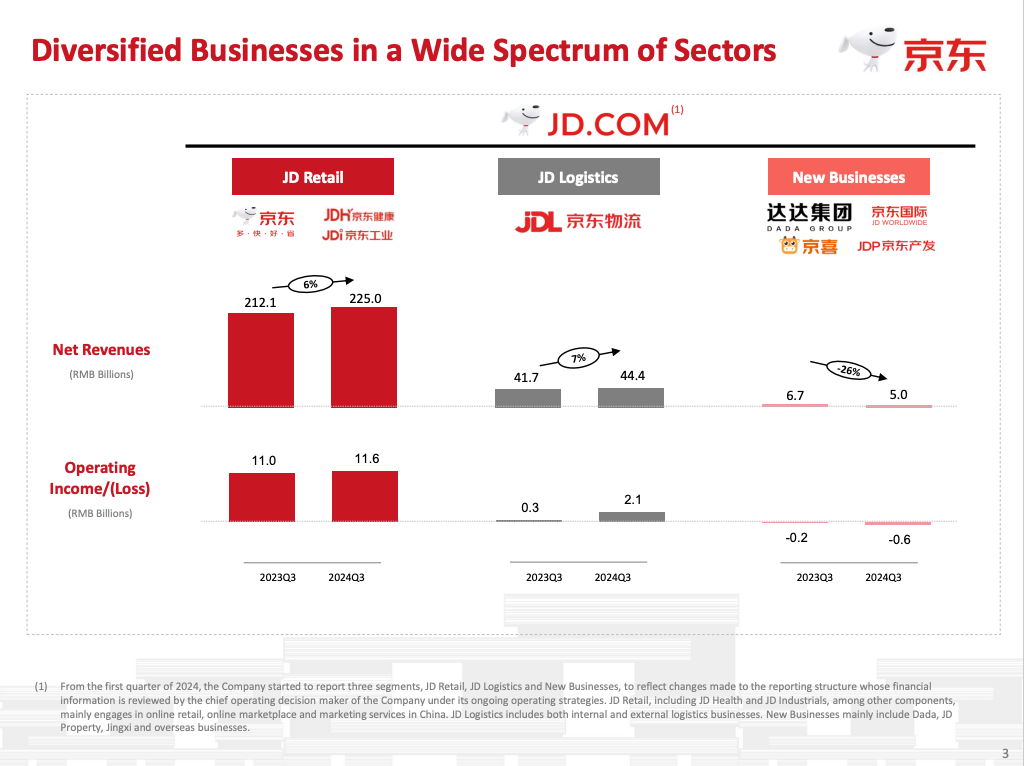

JD.com dominates China’s e-commerce space with its strong logistics network and trusted brand reputation. While it has historically focused on a first-party (1P) model, JD is rapidly expanding its third-party (3P) marketplace, leveraging its logistics infrastructure to attract more merchants and increase platform efficiency.

By balancing both models, JD benefits from the quality control and reliability of 1P while also scaling profitability through the asset-light, high-margin 3P business. This hybrid approach enhances customer trust, increases seller engagement, and drives long-term margin expansion—setting JD apart in China’s competitive e-commerce landscape.

What’s the difference between 1P and 3P models?

1P Model (JD): JD purchases inventory directly from suppliers and manufacturers, stores products in its warehouses, and fulfills customer orders through its proprietary logistics network. This ensures high product authenticity, quality control, and faster deliveries.

3P Marketplace Model (Alibaba, Pinduoduo): Competitors like Alibaba’s Taobao/Tmall and Pinduoduo function as intermediaries, connecting third-party merchants to consumers without managing inventory directly. While this lowers capital investment for the platform, it also introduces greater variability in product quality, fulfillment times, and customer service experience.

Click the ❤️ button on this post so that more people can discover it on Substack.

JD.com’s wide economic moat

Proprietary logistics infrastructure: Over 1,600 self-operated warehouses and 2,000 cloud warehouses give JD an edge in last-mile delivery, leading to a superior customer experience.

Direct supplier relationships: Unlike purely marketplace-driven competitors, JD negotiates directly with manufacturers, enabling competitive pricing and product authenticity.

Brand trust and reliability: JD has built a reputation for authentic goods in a market where counterfeits remain a concern.

Margin Expansion and Strategic Cost Optimization

JD.com is undergoing a significant transition toward a higher-margin business model, shifting more focus to its third-party (3P) marketplace and logistics services. This move enhances overall profitability by reducing the need for heavy inventory investments while increasing take rates from merchants.

Key margin drivers include:

Higher-margin third-party marketplace growth: JD is aggressively onboarding new merchants, leveraging the strength of its logistics to attract sellers seeking reliable fulfillment.

Logistics efficiency: JD Logistics (JDL) has shifted from a cost center to a profit driver, cutting costs while expanding third-party deliveries.

Exit from low-margin businesses: JD has divested from non-core ventures, including community group purchasing and unprofitable international expansions, to improve overall profitability.

JD.com has significantly scaled back its community group-buying operations, particularly through its platform Jingxi Pinpin. In 2022, the company ceased operations of Jingxi Pinpin in provinces like Hubei and Shandong, marking the second contraction of this business line within the year. This decision was driven by intense competition and the realization that the group-buying customer base was significantly different from JD.com's existing clientele. An executive from JD.com noted that the community group-buying business incurred heavy losses and faced challenges with customer loyalty.

JD.com has also streamlined its international operations by withdrawing from certain markets. In early 2023, the company announced the closure of its e-commerce platforms in Indonesia and Thailand. These ventures faced challenges in achieving sustainable growth and profitability amidst stiff competition from local and regional players. This strategic retreat allows JD.com to reallocate resources and focus more intently on its core domestic market and other areas with higher growth potential.

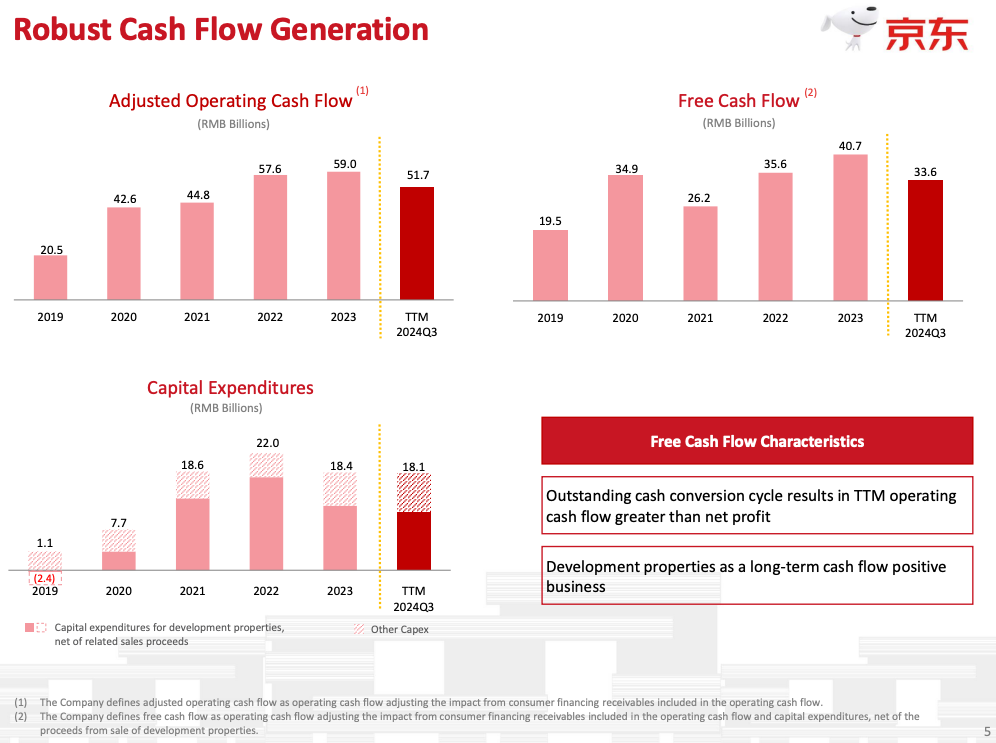

With these factors, JD’s operating margins are set to expand, reinforcing its ability to generate strong free cash flow and return capital to shareholders.

Capital Return Strategy Enhancing Shareholder Value

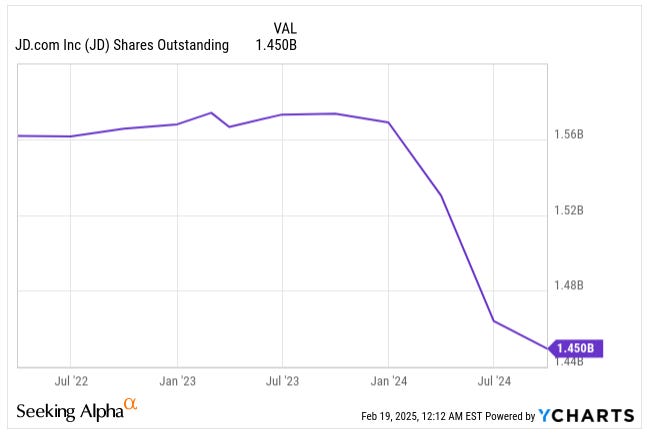

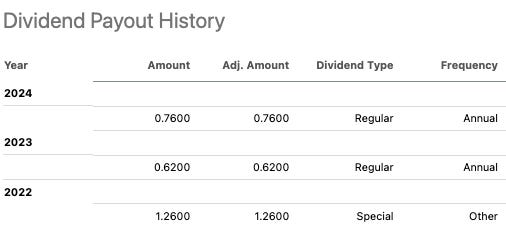

JD is making smart moves to reward investors—recent buybacks have cut outstanding shares, and dividends now align it with global tech giants prioritizing shareholder returns.

Additionally, JD has initiated dividend payments, aligning itself with global tech giants that emphasize shareholder returns.

The company’s strong cash flow generation allows it to continue these capital return programs without jeopardizing growth investments.

Expansion into High-Growth Segments

JD is actively diversifying beyond traditional e-commerce, expanding into adjacent markets with high growth potential:

On-demand services & food delivery: JD’s Dada Nexus acquisition speeds up its push into grocery and food delivery.

AI-driven retail enhancements: JD is integrating generative AI to improve search, recommendation engines, and customer engagement, enhancing conversion rates and user retention.

Omnichannel retail & enterprise services: JD is extending its reach into offline retail partnerships, offering supply chain solutions to businesses and leveraging its logistics dominance.

Undervalued Stock with Strong Upside Potential

JD is currently undervalued relative to both its peers and its intrinsic value. On a relative basis, it is trading at a significant discount to its peers.

Also, based on a discount cash flow model, the fair value of the shares is $60, offering a 54% upside and a downside of 23% to $30 per share, an attractive risk-reward profile.

Share the Love! Invite friends to join our community and earn rewards!

Ituran (ITRN): Strong Fundamentals, Growth Momentum, and Undervaluation

Leading Position in the Telematics Industry

Ituran Location and Control Ltd. (ITRN) is a dominant player in the global telematics and vehicle tracking industry, offering stolen vehicle recovery (SVR), fleet management, and connected car solutions. The company has established itself as the largest OEM telematics provider in Latin America, with a growing subscriber base of over 2.3 million users.

As connected vehicle technology adoption increases globally, ITRN is well-positioned to benefit from the expanding automotive telematics market. The global automotive telematics market is experiencing significant growth, driven by the increasing adoption of connected vehicle technology. In 2023, the market was valued at approximately $129 billion and is projected to reach about $441 billion by 2028, reflecting a CAGR of 27.6%.

This expansion is attributed to factors such as rising demand for electric vehicles, favorable government mandates, and heightened concerns about vehicle safety.

Consistent Revenue Growth with Expanding Margins

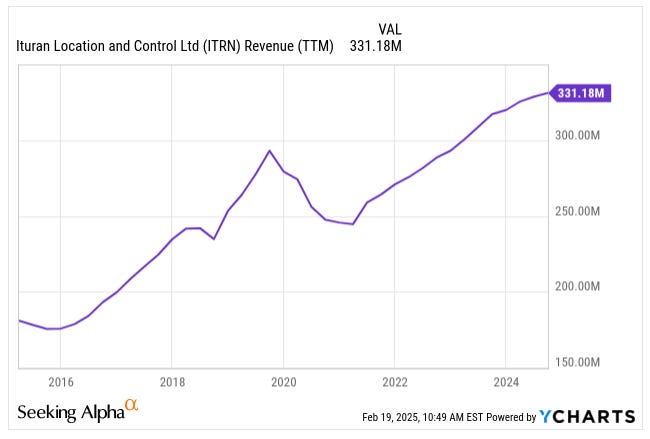

ITRN has maintained steady revenue growth, with a 9-10% CAGR over the past five years and Q2 2024 revenues of $84.9 million (+4% YoY)

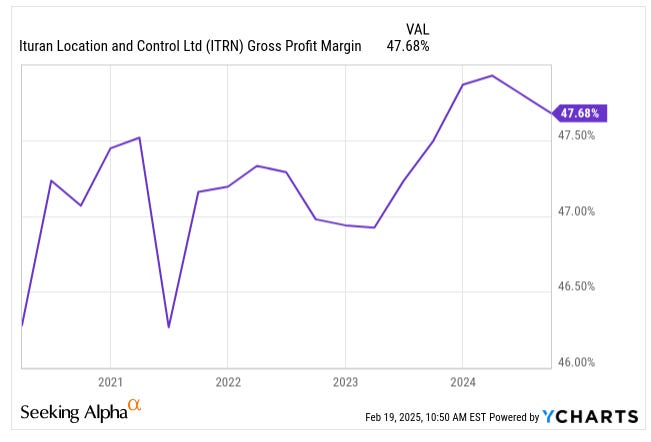

Gross profit margins have remained high, with the subscription-based segment (72% of revenue) achieving 47.7% margins.

Operating expenses have remained stable, supporting higher EBITDA margins (27.2% in Q2 2024, up from 26.7% in Q2 2023).

Expansion in High-Growth Markets

ITRN is focusing on car financing companies in Brazil and Mexico to capitalize on the used car markets and the rising demand for vehicle tracking services. In June 2023, Ituran Brazil partnered with Santander to facilitate vehicle financing by offering benefits like lower interest rates and telematic services to customers who opt for vehicle trackers.

The used car market in Brazil is substantial, with an estimated size of $152 billion in 2024, projected to reach $198 billion by 2029, growing at a CAGR of over 4%.

Additionally, Ituran's October 2024 investor presentation highlights its strategy of targeting car financing companies and leasing fleets in both Brazil and Mexico, aiming to expand its subscriber base by tapping into the steady demand for used cars in these regions.

ITRN has positioned itself to capitalize on India's expanding automotive market through its joint venture with Lumax Auto Technologies. Established in 2017, the 50-50 partnership formed Lumax Ituran Telematics Pvt Ltd., aiming to introduce advanced telematics solutions to the Indian automotive industry.

In December 2024, this joint venture achieved a significant milestone by successfully validating its connected telematic devices with Daimler India Commercial Vehicles. This validation involved over 15,000 vehicles operating in India, with expectations to supply tens of thousands of devices to DICV annually. These devices are essential for advanced telematics solutions, paving the way for future expansion into connected vehicle services.

The urgency for such solutions is underscored by a notable surge in vehicle thefts across India. Reports indicate that vehicle thefts increased by 2.5 times in 2023 compared to the previous year, with New Delhi accounting for a significant portion of these incidents.

Strong Financial Health with Shareholder Returns

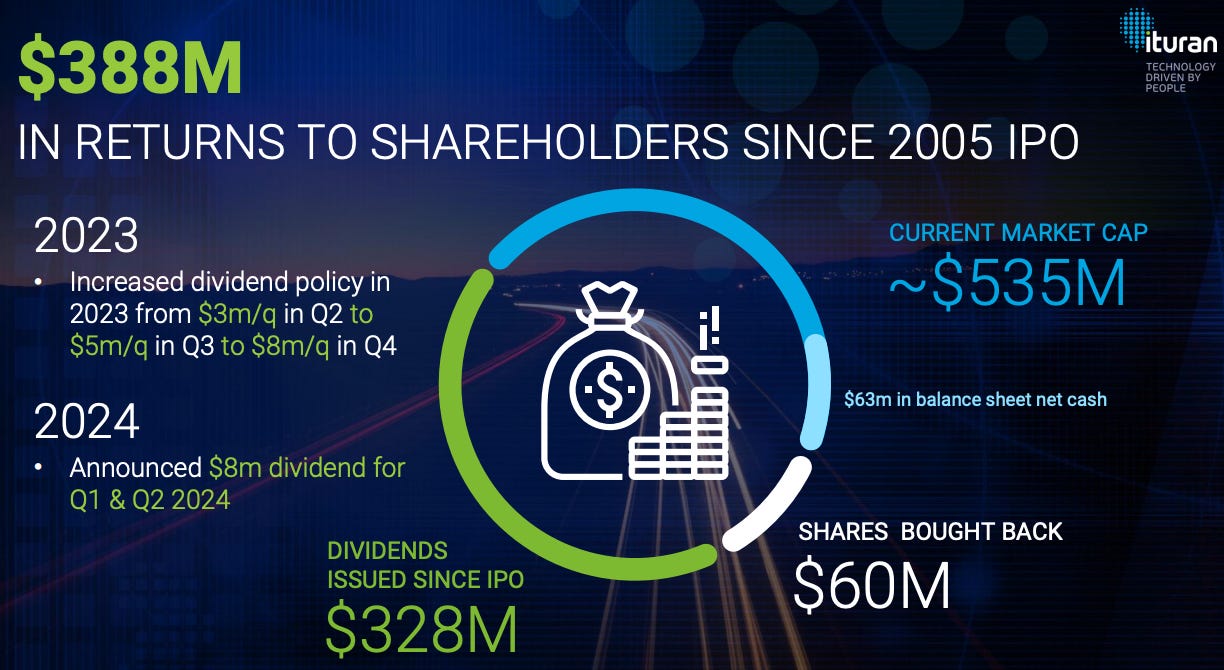

ITRN maintains a strong financial position, with virtually no debt and a solid cash reserve of approximately $63 million as of Q2 2024, providing it with significant financial flexibility. This stability enables the company to consistently return value to shareholders. It currently offers a dividend yield of around 6%, with its quarterly dividend payout increasing to $8 million, a 60% year-over-year rise. Additionally, ITRN continues to execute share repurchase programs, effectively reducing its diluted share count and further enhancing shareholder value.

Undervalued Stock with Strong Upside Potential

ITRN is trading below its intrinsic value. Based on a DCF, the fair value of the shares is $85 while the downside valuation is $25, offering a risk:reward profile of 1:2.7.

Risks Are Manageable

Although 51% of its revenue comes from Israel, the company reports that the ongoing conflict has had minimal impact on its operations.

While Argentina’s peso devaluation weighed on revenue, strong local currency growth offsets the impact.