Celestica (CLS) Q4 2025 Earnings: Double Beat, $1B Capex Plan, and Why the 15% Drop Looks Wrong

CLS posts record margins and ROIC, raises 2026 outlook, confirms Google TPU partnership, and signals AI infrastructure demand strength

I know CLS 0.00%↑ has been front and center in my recent discussions. In fact, I’m putting out this update now so I can keep this Sunday’s Weekly piece free for another topic (I’ll be covering LRN then).

Let’s talk about Celestica’s Q4 2025 results and the market’s reaction.

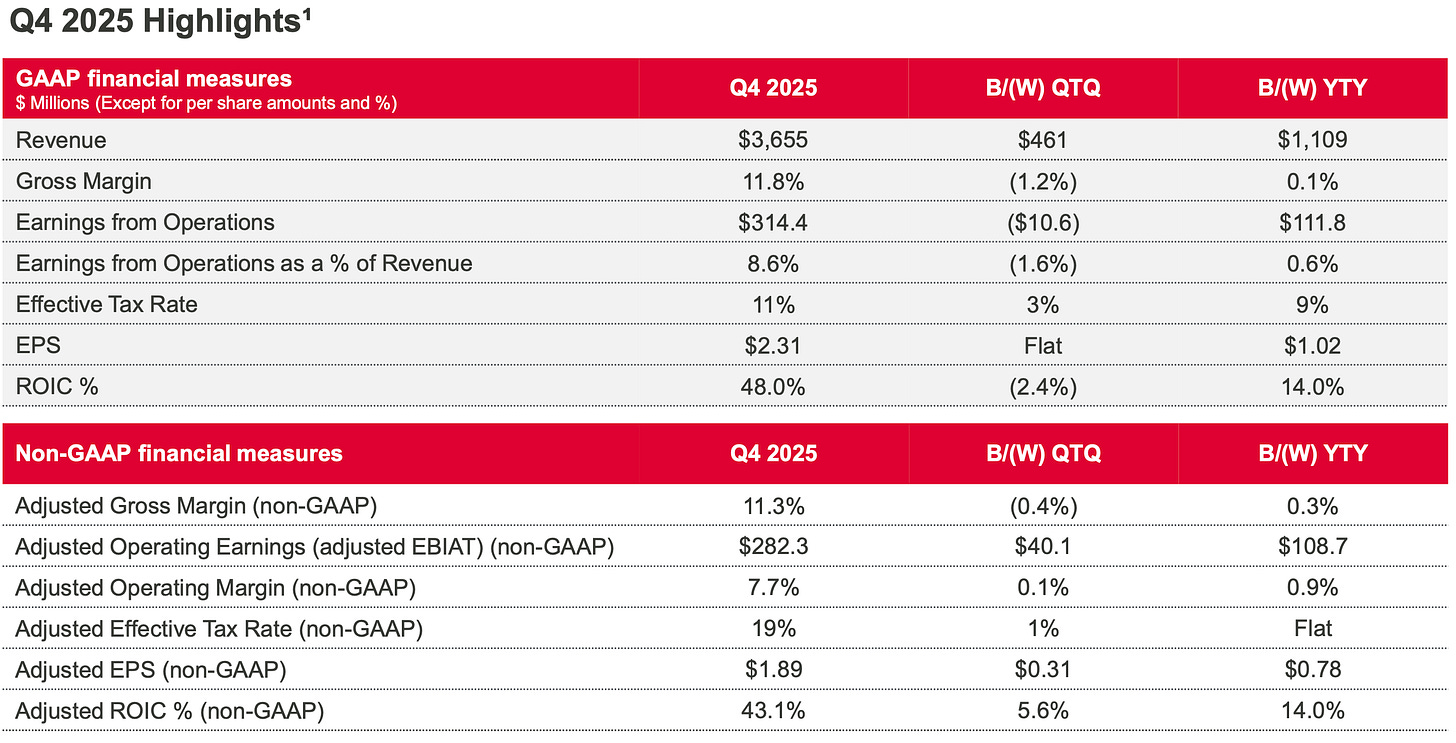

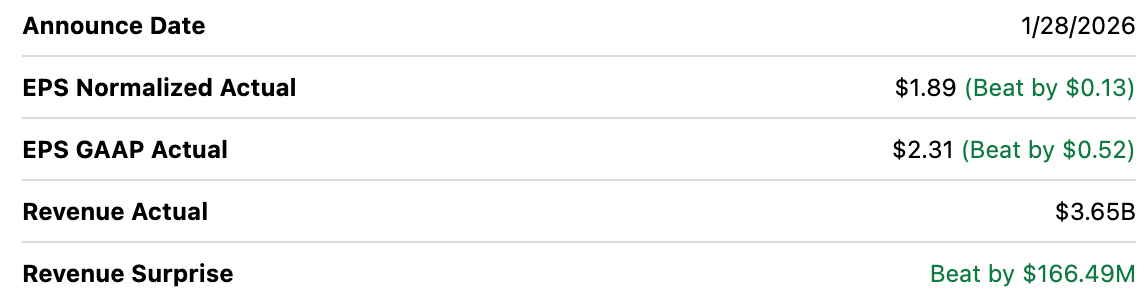

CLS put up a monster quarter. Revenue hit $3.6B, up 44% y/y. Adjusted EPS came in at $1.89, up 70%. Adjusted operating margin printed 7.7%, which matches the best level in company history. Adjusted ROIC landed at 43.1%.

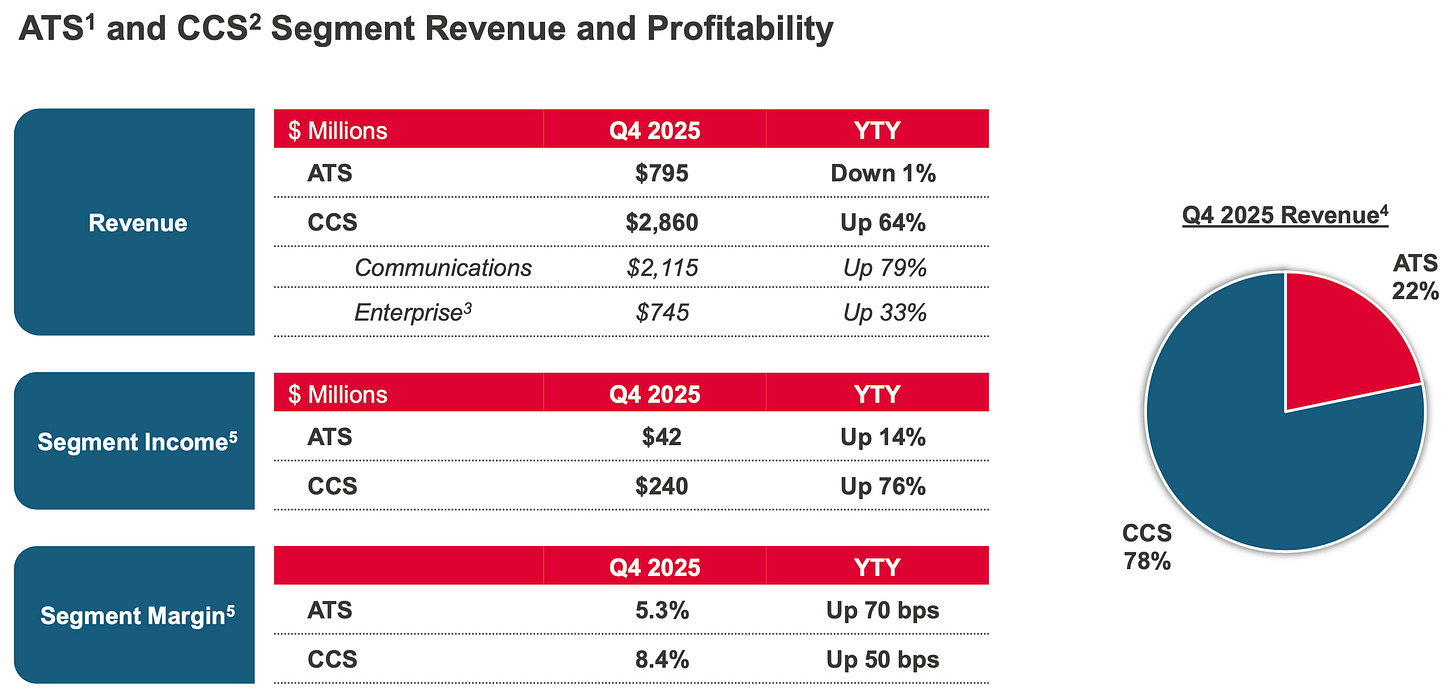

The engine stayed the same. CCS drove the bus. CCS revenue reached $2.86B, up 64%, and it made up 78% of total revenue. Communications grew 79% on 800G switch ramps. Enterprise grew 33% thanks to an accelerating next-gen AI/ML compute program with a large hyperscaler. HPS alone did $1.4B in Q4 revenue, up 72%, or 38% of the whole company. CCS segment margin rose to 8.4%. ATS margin improved too, up to 5.3%.

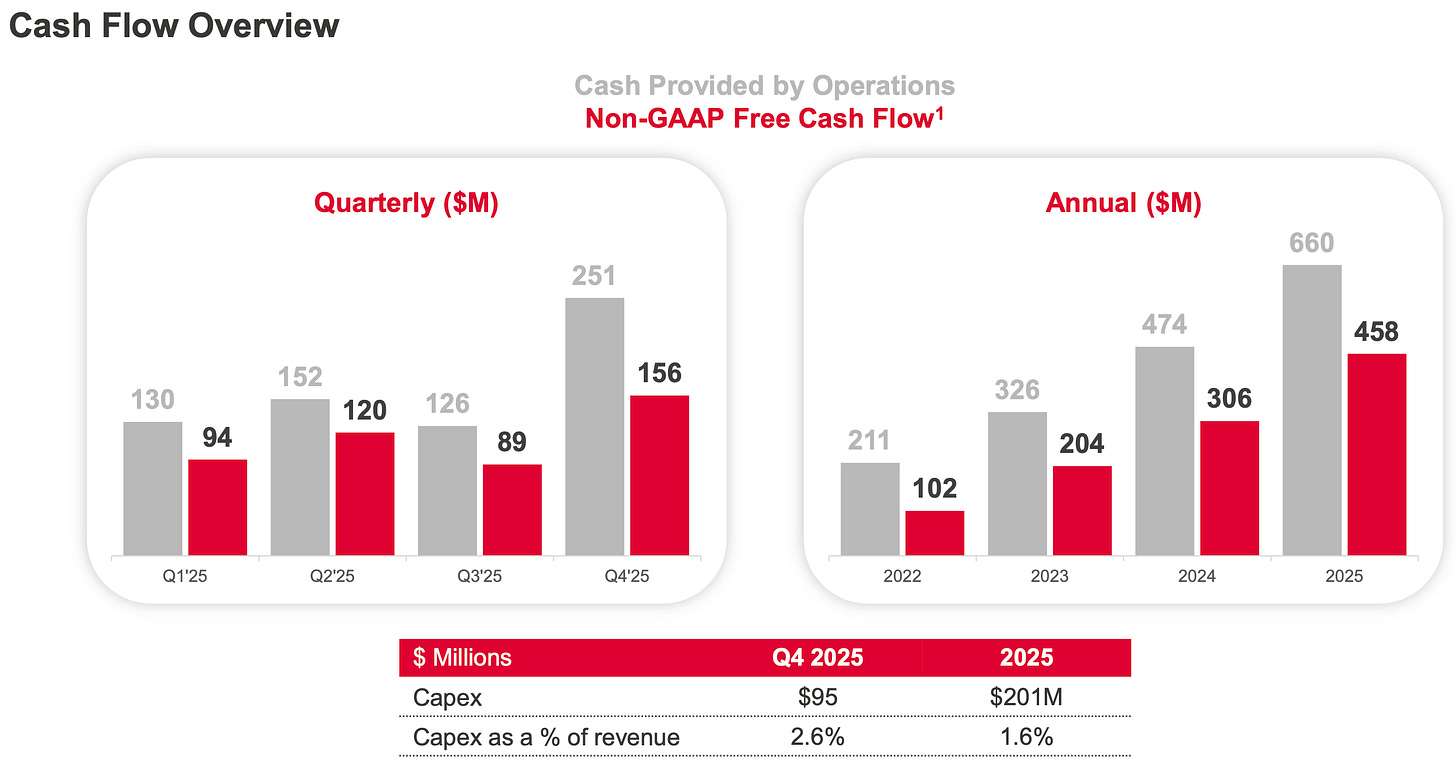

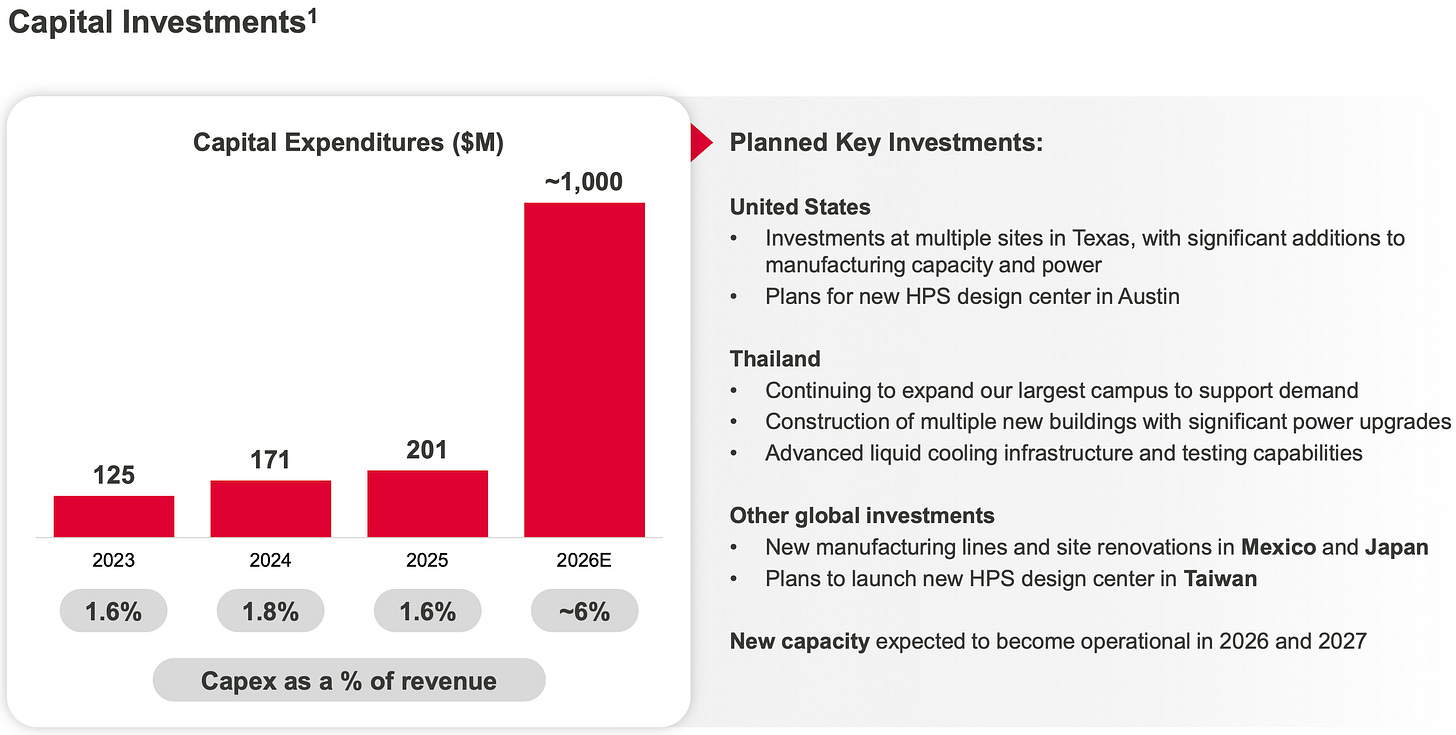

CLS generated $156M of free cash flow in Q4 and $458M for the full year. It spent $95M of capex in Q4 and $201M in 2025.

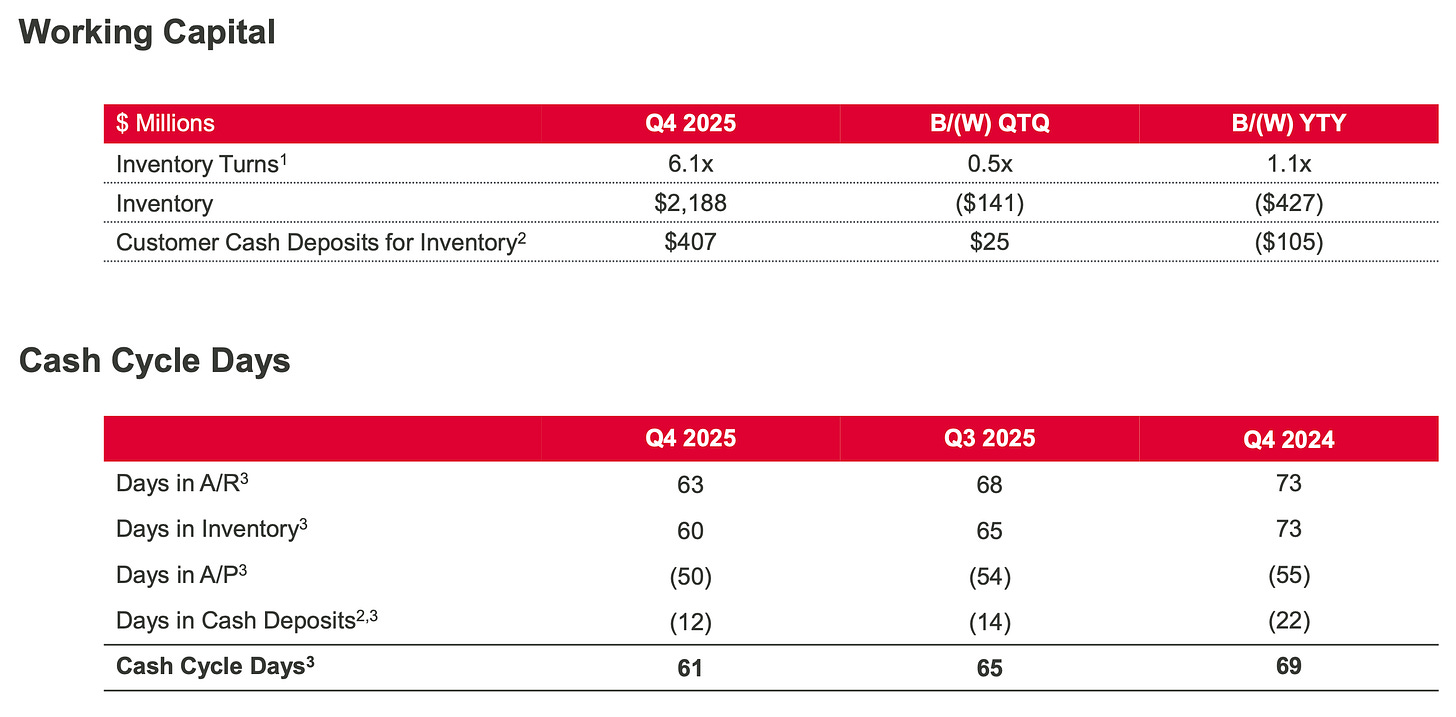

Cash cycle days improved to 61. Inventory ended at about $2.19B, which makes sense with this kind of CCS ramp.

Also, I’m happy to report that management directly addressed the Google TPU rumour mill and the recent DigiTimes noise. They confirmed the Google partnership is solid. CLS is still Google’s preferred manufacturing partner for its TPU systems and broader data center hardware.

Then they backed that statement with actions. The press release spells out US capacity expansion designed to support Google TPU systems, with completion targeted for 2027. On the call, management tied long-term capacity investments to Google’s multiyear roadmap and to scaling current and future TPU generations.

To me, that frames the “Google shifting orders” scare in a different light. It smells less like Google walking away and more like demand running into physical limits. Capacity bottlenecks create weird headlines. Google needs more servers than CLS alone could build, so it added a secondary supplier to help fill the gap.

This is exactly what I preached last week:

Celestica’s response? A massive expansion plan. Management is boosting 2026 capex by 5x to expand production, ensuring they can meet that surging demand. This fivefold capex increase is a direct reaction to hitting those capacity limits with key customers like Google.

Why the Stock Dropped 15%: Four Fears vs. My Take

Last week, I said:

I expect the earnings call next week to clear the air. Management will likely confirm that utilization remains at peak levels. I anticipate they will raise guidance for 2026.

Well, Celestica delivered a double beat.

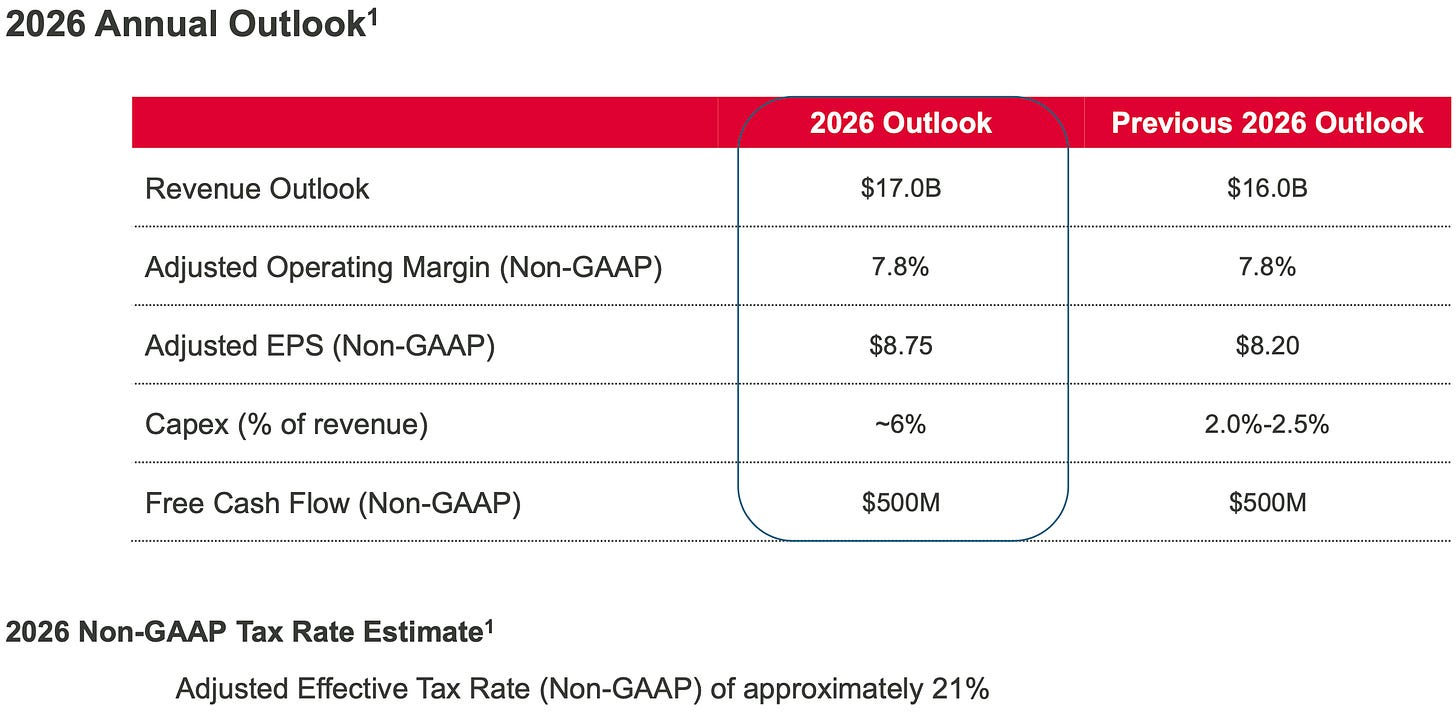

They even raised their 2026 outlook for revenues, margins and EPS.

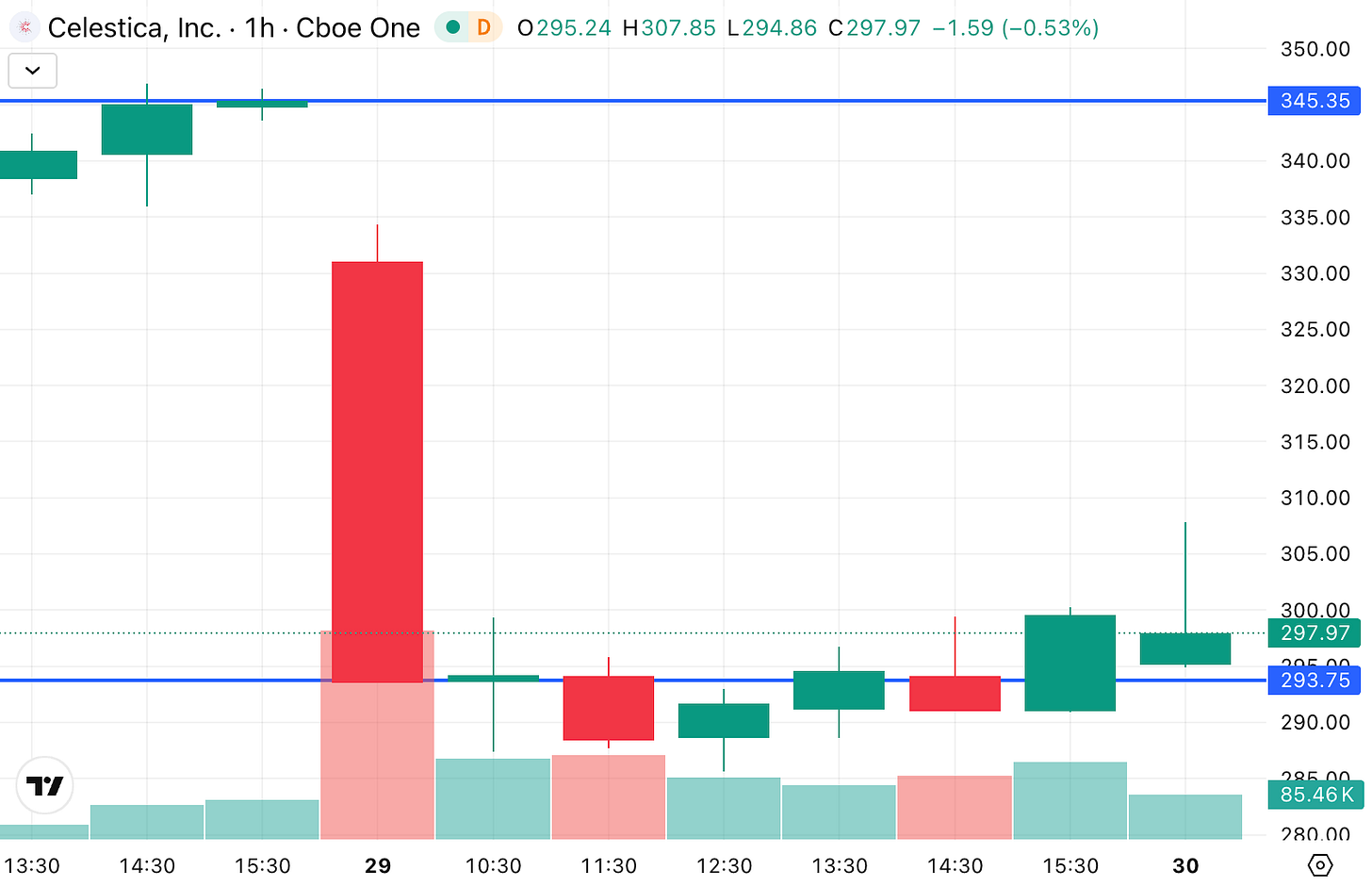

You’d think the stock would celebrate, but instead it fell about 15% after earnings.

Why?

Here are the four main worries I’ve heard, and why I believe the market overreacted:

Reason #1. “One billion capex?! Are they overspending?”

People got spooked by the plan to spend $1 billion on capital projects in 2026, up from about $200 million last year.

The fear is that such a big spend could hurt returns or signal a peak.

I disagree.

Management has been clear that this expansion is driven by customer demand visibility, not hubris. They’ve collaborated closely with key customers on multi-year capacity planning, which gives them confidence to invest. The new $1 B capex will add factories and upgrades in Texas, Thailand, Mexico, Japan and elsewhere to support anticipated growth in AI hardware orders.

Crucially, Celestica expects to fund this build-out entirely with operating cash flow, so it’s not taking on risky debt. With an adjusted ROIC of around 43% last quarter, the company has earned the right to reinvest aggressively. In short, a big capex bump doesn’t worry me when it’s backed by real demand and strong execution… it tells me Celestica sees a golden opportunity.

Reason #2. “Growth will slow in the second half of 2026.”

Another concern is that Celestica’s explosive growth might fizzle out next year. Management’s $17B revenue outlook implies a moderation in the growth rate by late 2026 (after an extremely strong first half).

Here’s my take:

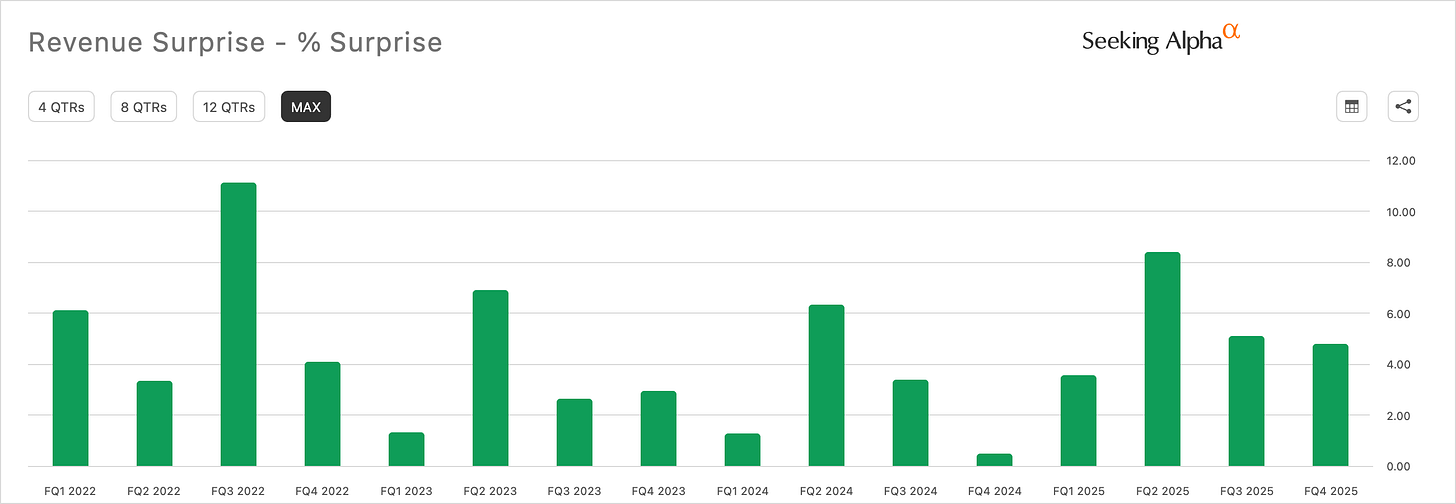

The company is known for guiding conservatively and then exceeding those targets. In this case, management admitted they’re taking a “pragmatic” view beyond the next couple of quarters.

In fact, their key customers are forecasting even higher demand than what CLS baked into the $17B outlook. The only reason they didn’t guide above $17B is to account for potential supply-chain constraints and general macro uncertainty in late 2026.

In other words, slower second-half growth is more about cautious forecasting than a drop in orders. Given CLS’s track record, I wouldn’t be surprised if they end up beating the guidance as they have up to now.

The growth story still looks intact and management actually said 2026 growth should accelerate versus 2025, which hardly sounds bearish to me.

Reason #3. “AI capex fatigue is setting in.”

There’s chatter that the big cloud players might be getting cold feet on huge AI infrastructure spending after a year of frenzy. Some fear a broader slowdown in AI-related capex that could hit CLS.

I’m not seeing that.

This isn’t a short-term hype cycle; it’s shaping up to be an AI infrastructure supercycle. Consider that Nvidia [NVDA 0.00%↑] and OpenAI recently announced plans to deploy an enormous 10 GW of AI computing capacity over the next few years. An investment so large implies AI data center spending will stay in high gear for years. All that hardware has to be built and integrated by someone, and Celestica is a prime beneficiary of this trend.

On Celestica’s Q2 call, management noted they had visibility well into 2026 with “no slowdown” in sight from their hyperscaler customers. In Q4, they added new program wins (like a third hyperscaler for 1.6 T switches) that will ramp in 2027, extending the growth runway. So far, every data point suggests the AI build-out is still gaining steam, not petering out. “AI capex fatigue” might eventually become a thing, but right now it looks premature. Companies like Microsoft [MSFT 0.00%↑] , Google, Amazon [AMZN 0.00%↑], etc. are increasing their budgets to stay ahead in the AI race, not pulling back.

Reason #4. “What if Google bails on Celestica?”

This was the big one a few weeks ago, after that DigiTimes rumour. The fear was that Google might shift its AI server manufacturing away from Celestica to other suppliers (e.g. Inventec), which would be a major blow since Google is a top customer. (Read my full take here)

That fear has been alleviated.

Management stated unequivocally that CLS remains Google’s “preferred” partner for these TPU systems. Google isn’t dropping Celestica at all. The reality is Google’s AI hardware needs are so massive that it makes sense to dual-source at a certain point for risk management. Celestica simply couldn’t single-handedly produce the 3.3 million TPU units Google plans to deploy in 2026 without additional capacity. So Google is adding a second manufacturer to boost output, not because of any dissatisfaction with Celestica.

In fact, CLS is expanding its US footprint specifically to support Google’s next-gen data center builds going forward. Far from losing Google, Celestica is deepening the partnership and they’re investing to make sure they never have to say “no” to a Google order again. Given this context, the “Google might leave” narrative was overblown, and the market is starting to realize that.

Capex: From $200M to $1B Is A Bold but Smart Expansion

Let’s dive a bit deeper into that capex increase. Last year, capex was $201 million. This year, they plan to spend about $1 billion, a quintupling of investment. On the surface, that kind of jump can look shocking but it’s important to understand why they’re doing it.

The short answer: they have the orders to justify it.

The CEO said 2025 was a record year for bookings, and the company is “building out to support those bookings” in 2026. In other words, this isn’t a “build it and hope they come” scenario; the demand is essentially already in hand. These new factories and capacity additions are being done in close coordination with customers’ multi-year roadmaps. Management has historically been pretty cautious about expansion. For much of 2023 and 2024, they only added capacity incrementally. Now, with customers asking for dramatically more hardware (AI servers, high-speed networking gear, etc.), CLS is finally stepping on the gas to scale up.

I actually view this $1B capex plan as a positive sign of confidence. It shows it has visibility into sustained growth. The scale is big for Celestica, but still reasonable in context: $1B is 6% of the expected 2026 revenue. For comparison, the giants of the industry are spending far more in absolute terms. Memory-maker Micron, for instance, is reportedly ramping its FY2026 capex into the double-digit billions (up from an already hefty plan) to ride the AI memory boom. The entire tech sector is pouring money into capacity to keep up with AI demand.

Here is my Micron [MU 0.00%↑].

That billion-dollar plan is aggressive by its own historical standards, but it’s the kind of move you make when you’re in the early innings of a secular growth cycle. And let’s not forget, Celestica has been delivering excellent returns on its investments: its adjusted ROIC was over 43% in the latest quarter. Few companies in this industry generate that kind of return on capital. That tells me Celestica knows how to invest efficiently and get a payoff from new projects.

Management also emphasized that they plan to fund this expansion through internal cash generation. In fact, even after spending the $1B, they’re still targeting about $500M of free cash flow in 2026. This speaks to the robust cash engine underlying the business now. So, while a 5x capex jump is eye-popping, I see it as a calculated bet backed by strong fundamentals.

Raising My Target Share Price to $575 (from $416)

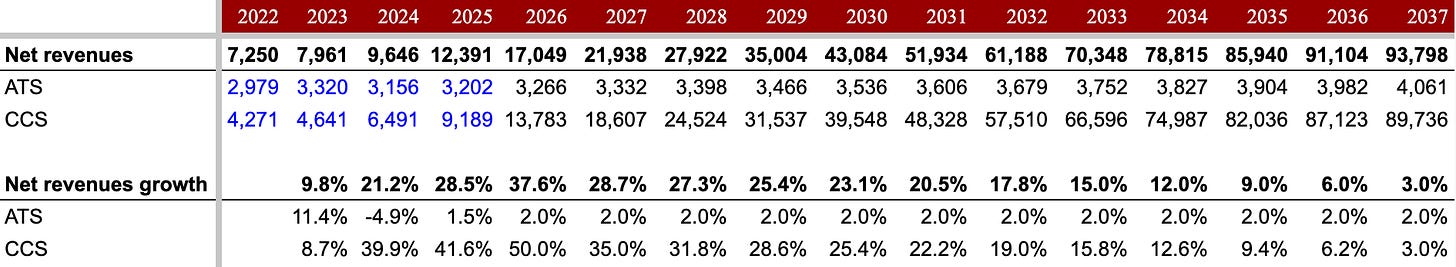

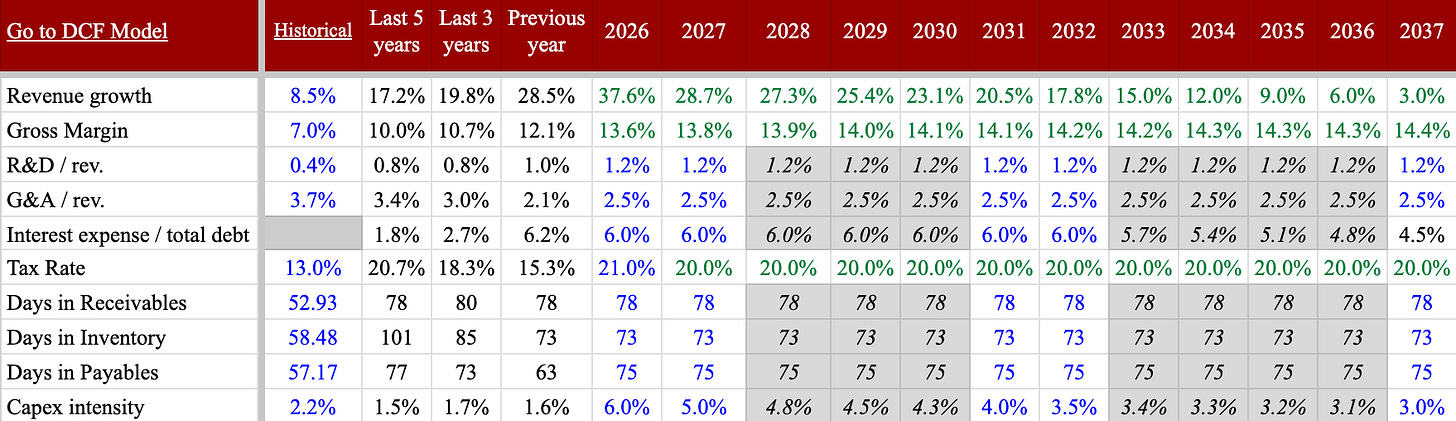

With Q4’s results and all these updates, I went back to my valuation model. I’m raising my price target to $575 per share, up about 38% from my previous $416 target. Let me walk you through the logic and assumptions behind that jump.

Key model assumptions for 2026: I’m now using the company’s updated outlook of $17 billion in revenue for 2026. By segment, that assumes Celestica’s ATS segment (which includes aerospace, defense, health tech, etc.) grows only around 2% (basically flat), while the much larger CCS segment (cloud and connectivity hardware) grows on the order of 50%.

That may sound high, but remember CCS just grew 44% y/y in Q4 and the pipeline of AI-related programs keeps growing. A 50% jump in CCS for 2026 is ambitious, but not outlandish, given continued hyperscaler ramp-ups and new wins. Combined, these segment assumptions get me to the 37% total revenue growth that management guided.

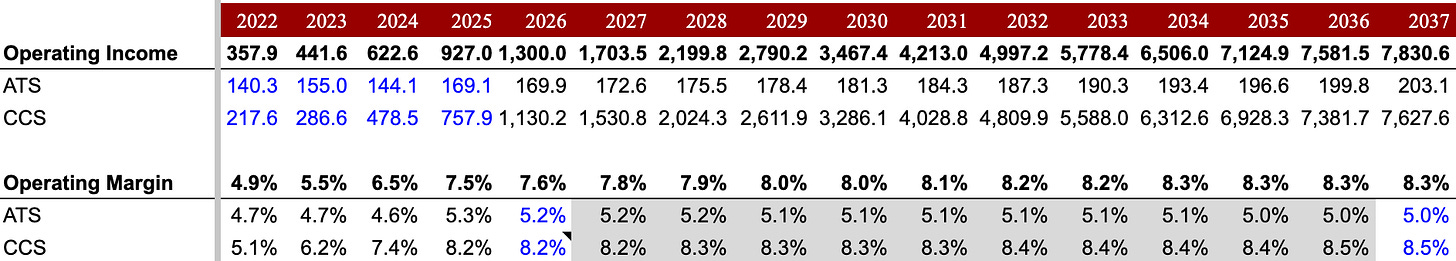

On margins, I’m holding the line at roughly 7.8% adjusted operating margin, which is about what CLS achieved in Q4 and what they are guiding for 2026. They’ve expanded margins nicely two years in a row (2025 came in around 7.5%, up 100 bps from 2024). For 2026, it’s reasonable to expect margins to be flat to slightly up, since efficiency gains and mix shift to high-margin products could be offset by the costs of such rapid expansion.

So, 7.8% is a fair, steady assumption. That yields an adjusted EPS around $8.75 (in line with guidance) and about $300M-$500M in free cash flow for 2026, which again matches what management projected.

Below are the rest of the assumptions used in my DCF.

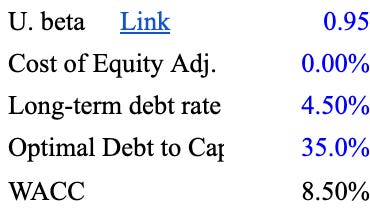

Based on a cost of capital of 8.5%…

…the fair value is $575/share for CLS. Now, a DCF is only as good as its inputs, and of course, reality will be messier. But it gives a sense of the magnitude of undervaluation I still see here, even after the stock’s big run in 2025.

It’s worth highlighting how my valuation evolved over time as Celestica executed. When I first wrote about the stock, my initial target was about $153 per share. As the story progressed, I raised that to $253, then to $320, and most recently to $416. Each time, incorporating new data and more confidence in the trajectory.

CLS kept outperforming, so my fair value estimates kept climbing accordingly. The current jump to $575 is another step in that journey. Why such a large increase this time? Mainly because the Q4 results and outlook gave me comfort to project higher growth for longer, and to assume Celestica can maintain its margin gains even as it scales.

Margin Pressures Ahead? (Keeping an Eye on Customer Pushback)

I want to briefly touch on one potential headwind: margin pressure from big customers in the future. We’re in a period where Celestica’s margins have been expanding nicely, partly due to operating leverage and partly due to selling more high-value, high-margin products.

Customers push back when their total system costs rise. The pressure does not hit every supplier the same way. The strongest vendors keep pricing power. The rest absorb the squeeze.

In semiconductors, companies like TSMC [TSM 0.00%↑] and Micron Technology [MU 0.00%↑] sit at the top of the value chain. When they raise prices, customers usually accept it because there are few ( or no substitutes in the case of TSMC) real substitutes. Advanced nodes and leading-edge memory have tight supply and high switching costs. That limits customer leverage.

The savings hunt then moves downstream.

When chip and memory bills go up, hyperscalers look for offsets in parts of the stack where suppliers have less pricing power. That often includes integrators and manufacturing partners. Celestica has some negotiation power because of its design capability, program complexity, and execution record. But its leverage is still weaker than that of a leading foundry or memory producer.

So the risk is that their increased force will cause customers to look elsewhere for savings. If suppliers with low leverage cannot meet those targets, customers may turn to vendors like CLS and push for better terms. That is the more realistic margin pressure path.

That said, I’m not overly worried about CLS’ margin sustainability in the near term. There are a few reasons. First, Celestica’s business model is largely based on collaboration and cost transparency with its customers. They’re not simply jacking up prices; much of the pricing is tied to component costs and value-add, with mechanisms in place to pass through cost changes. This makes a sudden margin squeeze less likely, because if input costs drop, savings are often passed along (and if costs rise, customers share the pain).

Second, the kind of programs CLS is involved in now is highly complex and strategic. They’re co-developing cutting-edge infrastructure. Those customers value reliability and innovation support, not just the lowest bid. CLS has aligned itself as a partner, not a commodity supplier, which gives it more leeway to maintain fair margins.

Third, Celestica’s recent margin expansion wasn’t due to gouging or one-off pricing power; it came from portfolio mix and efficiencies. They exited lower-margin businesses and ramped higher-margin ones (for example, their HPS products carry better margins).

As long as they keep executing on that strategy, they can defend their profitability even if some clients push for cost savings. Of course, we should watch this risk. If, say, hyperscaler spending cools in 2027, there could be more pressure on contract manufacturers to cut costs. But in my view, Celestica is far better positioned than most to weather that, due to its close customer relationships and prudent contracts. It’s something to monitor, not a reason to bail out.

Conclusion

In summary, Celestica’s Q4 was excellent, the long-term thesis remains very much intact, and the stock’s pullback looks like an emotional overreaction to me. The company is executing well in the midst of an AI infrastructure boom that’s still unfolding. I’ve substantially increased my valuation estimate as Celestica continues to prove itself quarter after quarter.