Weekly #46: Why 20% of Stocks Create 80% of Your Returns

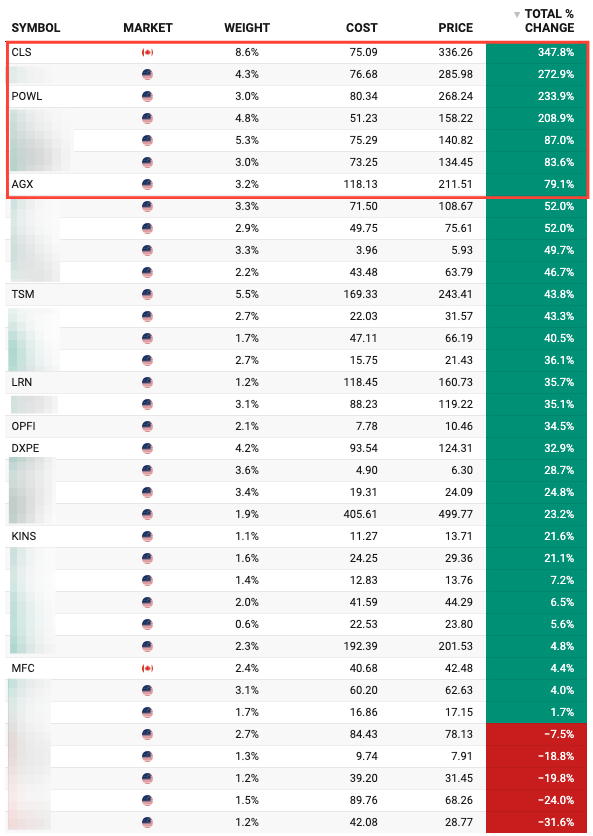

Portfolio is up +22.6% YTD. This week one stock (CLS) delivered over half the gains in a 36-position portfolio. Here’s how the Pareto principle shapes returns, risk, and portfolio strategy.

Hello fellow Sharks,

This week was strong for the portfolio: YTD, we’re up +22.6% and sitting at 2.5x the market since launching the newsletter. If you want to skip straight to the numbers, jump to the Portfolio Update.

What stood out most was the concentration of the gains. Out of 36 holdings, one stock, Celestica (CLS), drove more than half of this week’s +4.13% performance. That dynamic set the stage for my Thought of the Week, where I dig into the 80/20 rule and how it shapes investing outcomes.

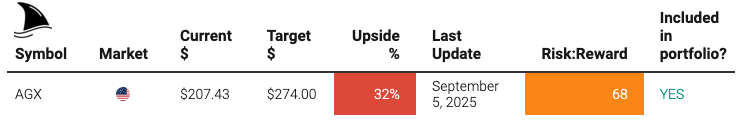

I also break down Argan’s (AGX) latest earnings, what the numbers really mean, and how they change my outlook on the position.

Enjoy the read, and have a great Sunday!

~George

Table of Contents:

In Case You Missed It

This week I rolled out two new pieces of content you may want to check out:

1. A new portfolio position

I added a fresh name to the portfolio. Quiet operator, unglamorous industry, but the turnaround is hard to ignore. After years of red ink, it’s back to profitability, with record operating cash flow and more cash than debt for the first time in a decade. The full deep dive on the company drops next Wednesday.

2. ROIC explained

ROIC is one of the most powerful metrics I use. In deep dives, I usually zoom out to industry and company background. This time, I pulled back the curtain to show the “behind the scenes” of how I actually use ROIC in my process. I’ll be doing more of this going forward (starting with the deep dive dropping next Wednesday) as it’s useful to see the mechanics, not just the conclusions.

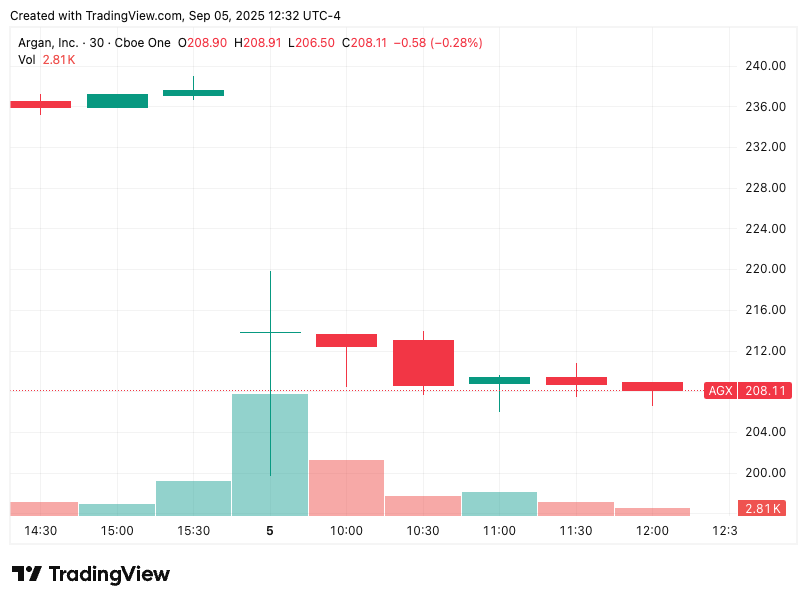

AGX Q2 2026: Strong Execution, Slower Growth, Balanced Risk/Reward

Argan (AGX 0.00%↑) just posted another record-breaking quarter.

But the stock responded with a shrug, dropping from $236 to $2013 and $208 as of Friday.

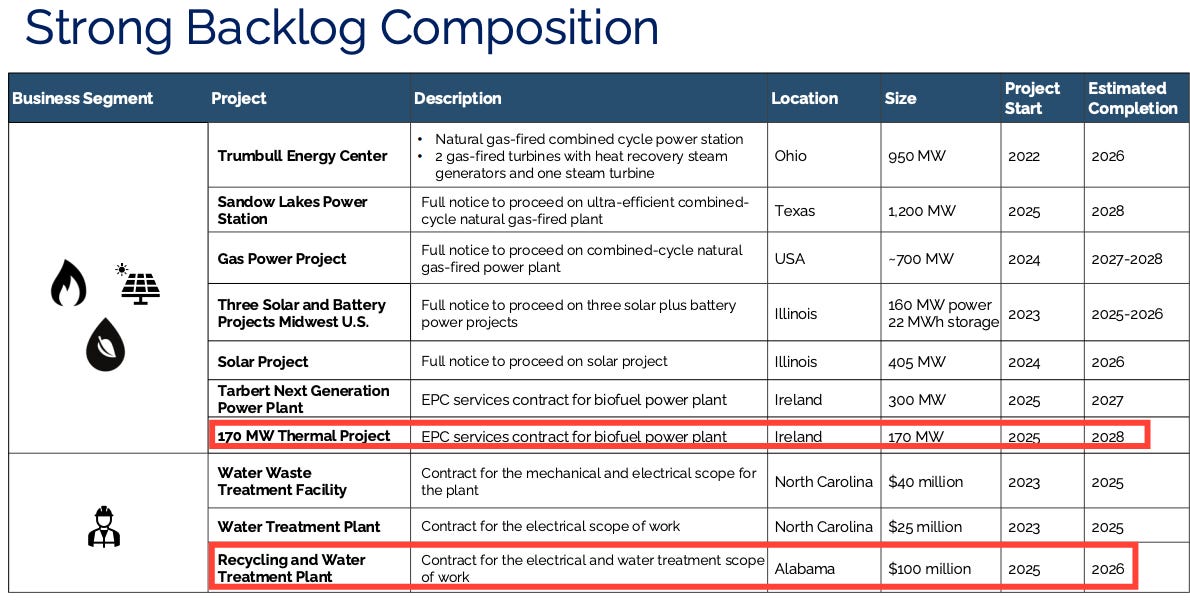

Revenue climbed 5% y/y to $238M, and gross margin jumped to 18.6%. EPS came in at $2.50, a record high and a full $0.90 above last year’s number. Backlog hit a new record: $2 billion, driven by new awards like the 170MW project in Ireland and a $100M industrial job in Alabama.

The balance sheet remains a fortress: $572M in cash, no debt, and net liquidity of $344M. They also returned more capital: $0.375 dividend and some modest buybacks.

On the call, management sounded confident. Less worried about inflation than in previous quarters, a bit more watchful of tariffs. All in all, steady hands.

But here’s the nuance.

Growth is slowing a bit. Revenue was up just 5% y/y. Management still expects to add projects, but the cadence feels more measured than the last two years. It’s not a red flag, but it’s enough for me to revisit the risk/reward.

Updated Valuation

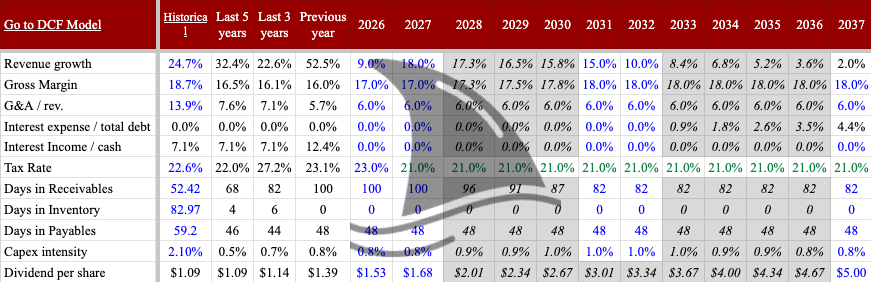

After adjusting my model, I’ve lowered my DCF target from $290 to $274.

Revenue: I now expect slower growth. Instead of low-20s, I’m assuming high-teens y/y growth as a base case. That still implies a solid pipeline, but not quite the breakneck pace from 2023–2025.

Margins: Q2 gross margin was 18.6%, but I’m not baking in that level across the year. I’ve modelled 17% for FY2026 to stay conservative until we get more data points.

Even with a slightly lower fair value, the math still works. My revised R:R score is 68, which makes it one of the more balanced names on the tracker.

Portfolio Action

For now, I’m holding, but I’ve flagged AGX as a trim candidate when capital is needed. That’s not a knock on the business. It’s just me practicing what I preach on portfolio hygiene and rebalancing around evolving upside.

If you missed my full deep dive on AGX, you can find it here.

Thought of the Week: The 80/20 Rule in Investing

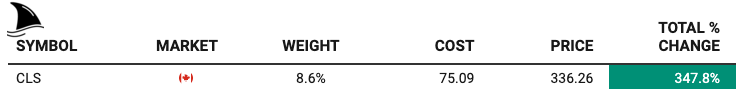

This week, the portfolio gained +4.13%, and more than half of that came from a single name: Celestica (CLS). One stock out of 36, just 2.8% of the portfolio by count, drove 55.7% of the week’s return. Even by weight, CLS is only an 8% position, yet it contributed 55.7% of the performance. That’s the 80/20 rule playing out in real time.

I forgot in what class in engineering it was when I first heard about the Pareto 80/20 rule. The rule says that 80% of outcomes come from 20% of causes. At first, I didn’t give it much weight, but later I realized it was everywhere. At my last corporate job, 80% of the revenues came from 20% of the clients. When I came back to Canada in 2020 and was interviewing for jobs, I noticed that 80% of the achievements I highlighted in interviews were things I had dedicated maybe 20% of my time to. I could go on and on, but you get the point.

Now let’s turn to how this rule shows up in investing.

Portfolio Results Are Never Even

If you look at my own portfolio, 80% of the returns come from 20% of the names, or about seven companies out of the 36 I currently hold.

Some of them are names we’ve talked about before, such as:

Celestica (CLS), up +348%

Powell Industries (POWL), up +234%

Argan (AGX), up +79%.

These winners don’t just contribute. Without them, the portfolio would look very different.

That’s the first lesson: diversification doesn’t mean equal contribution.

The reality is that only a handful of companies will truly move the needle. Most stocks in a portfolio will lag, grind, or even lose money. In our case, only 5 out of the 36 positions are losing money. A few will become the heavy lifters.

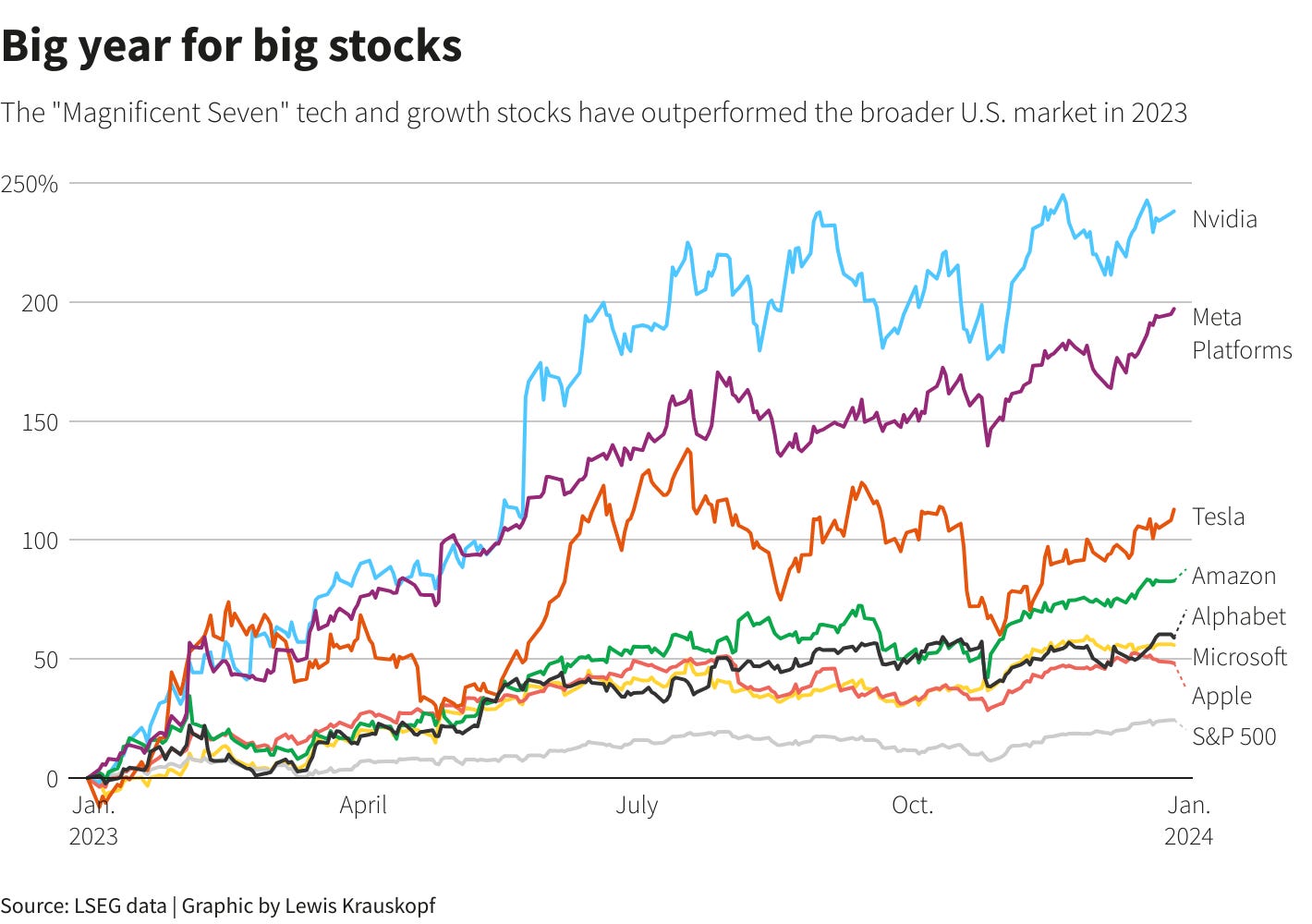

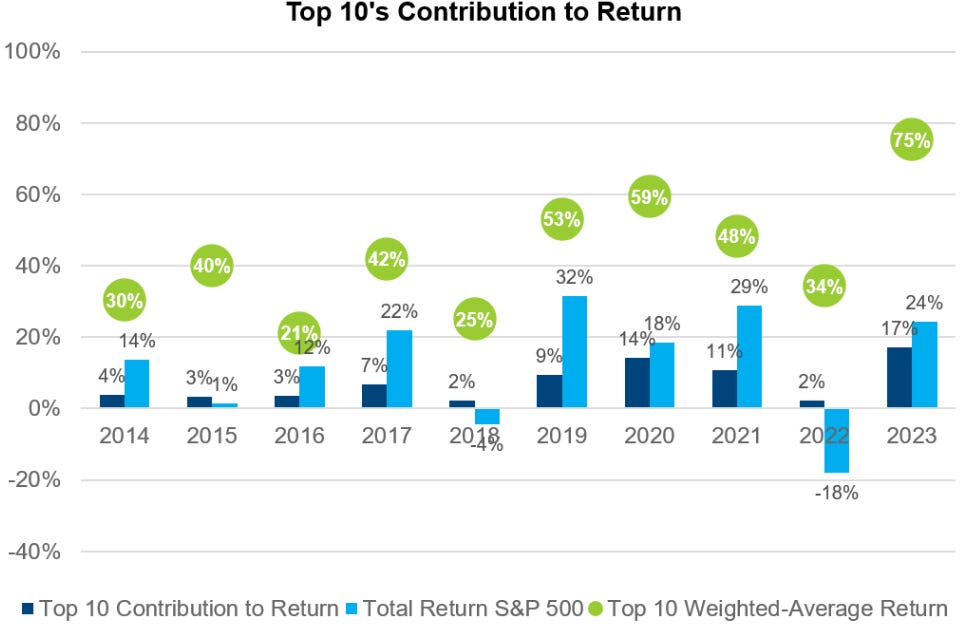

Take the S&P 500. In 2023, the “Magnificent Seven” accounted for ~63% of the index’s ~24% gain (about 15 percentage points).

If you take the 80/20 idea literally, the ‘next 93’ would only need to add ~4 percentage points for the top 100 names (20% of the index by count) to sum to ~80% of the year’s total return. I don’t have an official top-100 breakout, but FactSet shows the top 10 alone contributed ~75% of the return in 2023, which makes the inference reasonable.

The Power Law of Stock Returns

This isn’t just anecdotal. Market-wide studies confirm it. Hendrik Bessembinder, a finance professor at Arizona State, published research showing that from 1926 to 2016, just 4% of listed U.S. stocks created all of the net wealth in the stock market. Out of more than 25,000 stocks studied, most underperformed Treasury bills. A tiny sliver, companies like Exxon (XOM 0.00%↑), Apple (AAPL 0.00%↑), and Microsoft (MSFT 0.00%↑), were responsible for trillions in wealth creation.

That’s not just 80/20. It’s closer to 99/1.

It means missing the big winners has a far greater cost than holding onto a few losers. A loser can only go to zero, but a winner can multiply 10x, 20x, 50x. Amazon (AMZN 0.00%↑) went public in 1997 at $18 a share. Adjusted for splits, it was 9 cents!

Even after the dot-com crash, an investor who held on is up thousands of percent.

The asymmetry is staggering.

Why This Rule Matters for Stock Pickers

For a fundamentals-driven investor, this creates a challenge. I spend hours combing through filings, listening to earnings calls, and modelling cash flows. Yet deep down, I know that most of that work will only produce modest results. The outsized returns will come from a select few cases.

That doesn’t mean the work is wasted. The process increases the odds of finding the rare businesses where everything lines up: industry tailwinds, strong management, disciplined capital allocation, and an undervalued entry point. Those are the names that turn into the 20% of holdings driving 80% of results.

Look at Buffett. Berkshire Hathaway owns dozens of companies, but a small handful drive the bulk of its value. Apple alone accounts for about 22% of Berkshire’s equity portfolio. Add in Coca-Cola, American Express, and a couple of others, and you cover most of the value creation.

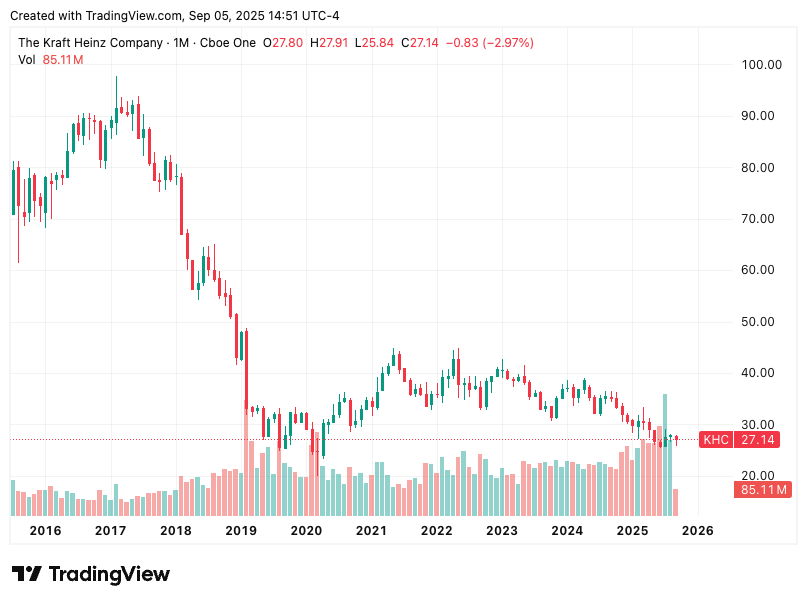

Buffett knows the 80/20 rule intimately. He doesn’t try to make every pick a home run (remember he owns KHC 0.00%↑).

Here is my 2 cents on the Kraft Heinz split.

Position Sizing: Riding the Winners

The Pareto principle has clear implications for position sizing. If a few names will determine your fate, then the ability to let winners run becomes essential.

Too often, investors trim their best performers simply because the gains “look too big” on paper. I’ve made that mistake before selling down a winner too early only to watch it double or triple again. The 80/20 rule reminds me that the math of compounding lives in the tails.

Celestica is a case in point for me. It started as a small position in the portfolio, but as the thesis played out, it grew into one of the largest drivers of returns. If I had capped it early, the portfolio would be weaker today.

This doesn’t mean ignoring risk management. It’s reckless to put half your portfolio into one stock. But it does mean resisting the urge to clip the wings of the very businesses that are proving themselves in real time.

The Other 80%: What to Do With Mediocrity

The flip side of the 80/20 rule is that most of your portfolio won’t be in the top 20%. Some holdings will tread water. Others will go down. The trick is deciding which ones to cut and which ones to tolerate.

For me, the key question is whether the thesis is broken or just delayed. If a business still has a solid balance sheet, aligned management, and industry tailwinds, I’ll give it time even if the stock hasn’t moved much. Sometimes the market is simply slow to recognize value.

Take Stride (LRN 0.00%↑). For years, online education stocks were ignored. Then the pandemic hit, enrollment surged, and suddenly the thesis was validated. Investors who gave up early missed the run.

Here is my LRN deep dive if you missed it.

On the other hand, I’ve cut names where management proved undisciplined, or where competitive dynamics shifted. That’s the discipline part. The 80/20 rule isn’t an excuse to let dead money sit forever. It’s a reminder that attention and capital should go to where the odds are best.

Idea Generation: Focus Where It Counts

The 80/20 principle also applies to where I spend my research time. Not every idea deserves the same attention.

There are thousands of publicly traded companies. If I tried to give each one equal time, I’d drown. Instead, I triage quickly. If a company fails the basic filters, poor balance sheet, no clear moat, weak management, I move on.

This allows me to concentrate my deep research hours on the few companies that could actually change the portfolio. It’s why I spent weeks digging into Argan’s backlog or Celestica’s supply chain positioning. These are businesses with leverage to big trends and management teams that know how to allocate capital.

That’s the 80/20 of research: most of the edge comes from going deep on a few, not skimming the surface of many.

The 80/20 Rule of Time Allocation

The rule doesn’t just govern stocks, it governs my time as well. Eighty percent of my insights often come from 20% of the reading I do. One great shareholder letter, one transcript with a revealing comment, or one overlooked footnote in a filing can matter more than hundreds of pages of boilerplate.

Buffett has said he spends 80% of his day reading, but he’s not reading everything equally. He’s scanning, skipping, and then diving deep when something sparks interest. That’s the practice of applying 80/20 to time.

In my own process, I’ve noticed that one or two filings a month often generate the best ideas. I’ll read dozens, but the breakthroughs come from a small handful. That’s why I value curation as much as volume.

Conviction vs. Overconfidence

The 80/20 rule can encourage conviction, but it can also breed overconfidence. Knowing that winners matter more, it’s tempting to convince yourself that your current favourite must be in the top 20%.

That’s dangerous.

Conviction is earned through process: deep research, cross-checking assumptions, and stress-testing the thesis. Overconfidence is assuming you’ve already found the golden goose without doing the work.

The line between the two is thin.

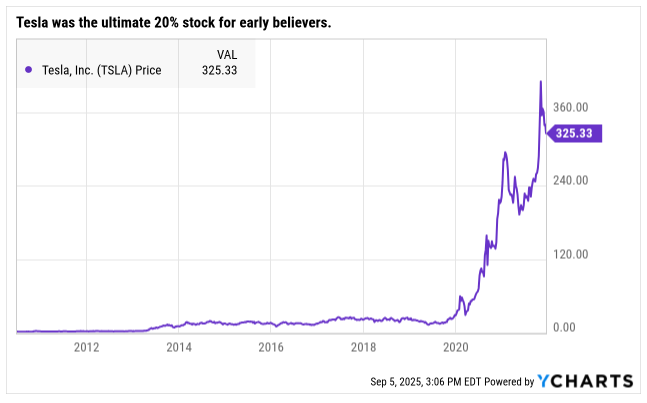

Tesla (TSLA 0.00%↑) is a great case study. For some, it became the ultimate 20% stock, generating enormous returns.

For others, it became a trap, an excuse to dismiss risks and double down on a narrative.

The lesson isn’t whether Tesla is good or bad. The lesson is how the 80/20 principle can distort thinking if you let conviction slide into certainty.

The Psychological Trap of the 80/20 Rule

The Pareto principle sounds rational, but it plays havoc with psychology. Watching one or two positions dominate a portfolio can make you nervous. You worry they’ll collapse. You feel tempted to “spread things out” by selling.

But diversification doesn’t protect you from opportunity cost. Selling your best ideas too early often does more harm than letting them grow. That’s the emotional discipline the 80/20 rule forces on you.

Think about Apple. Many investors sold after a double or triple, congratulating themselves, only to watch it become the most valuable company in the world. The winners always feel too big until you realize they’re still growing.

It’s uncomfortable to have a portfolio where a few names carry the weight. Yet that’s reality.

Accepting it is part of the game.

Beyond the Portfolio: The 80/20 Rule in Life

One final note. The 80/20 principle doesn’t stop at investing. It shows up in health, relationships, and careers.

A small number of habits drive most outcomes.

A small number of relationships bring most of the joy.

A small number of decisions define a career.

For me, writing is a good example. Twenty percent of the essays I’ve written have generated 80% of the reader response. Certain ideas resonate far beyond others. Recognizing that helps me focus on the types of topics that create the most value for readers.

In life, as in investing, the edge comes from knowing which 20% matters most and having the discipline to prioritize it.

What’s the 20% in your own life that’s delivered 80% of the results?

Portfolio Update

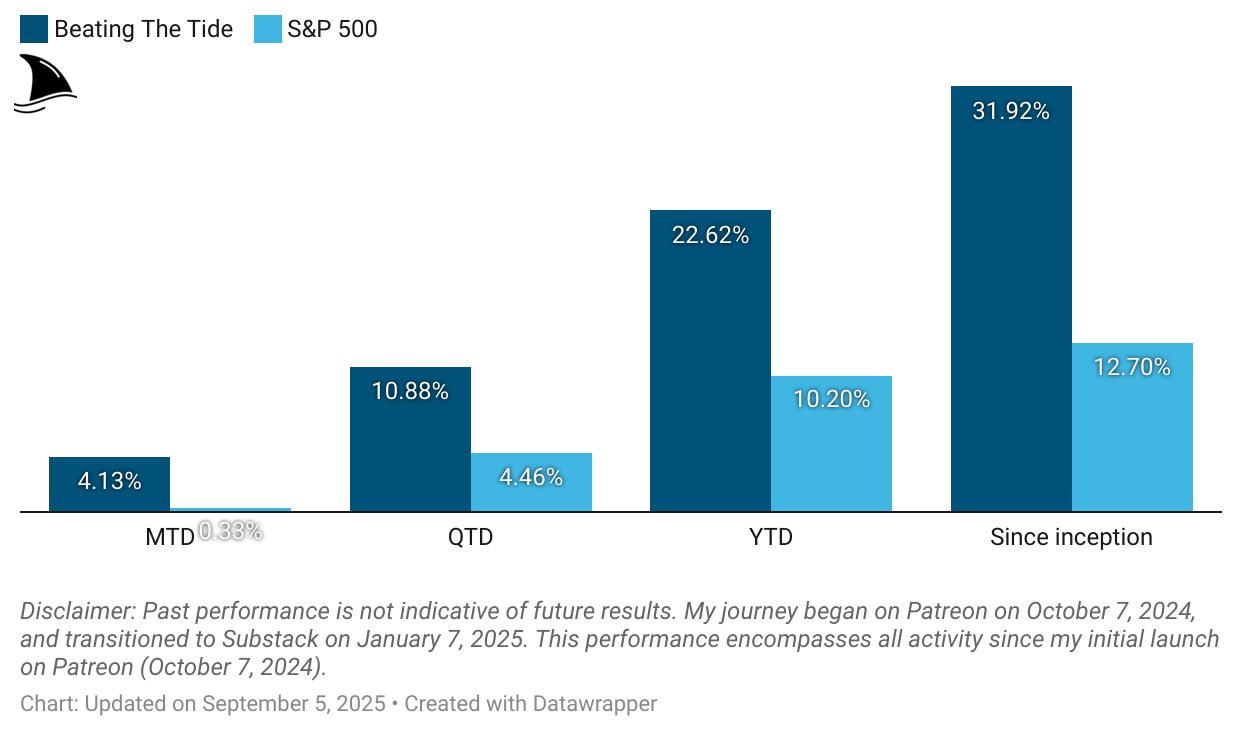

This week, we almost doubled the YTD performance gap to the S&P 500, with a bit more than half of that outperformance driven by CLS.

Month-to-date: +4.1% vs. the S&P 500’s +0.3%.

Quarter-to-date: +10.9% vs. the S&P 500’s +4.5%.

Year-to-date: +22.6% vs. the S&P’s +10.2%, a gap of 1,242 basis points.

Since inception: +31.9% vs. the S&P 500’s +12.7%. That’s 2.5x the market.

Portfolio Return

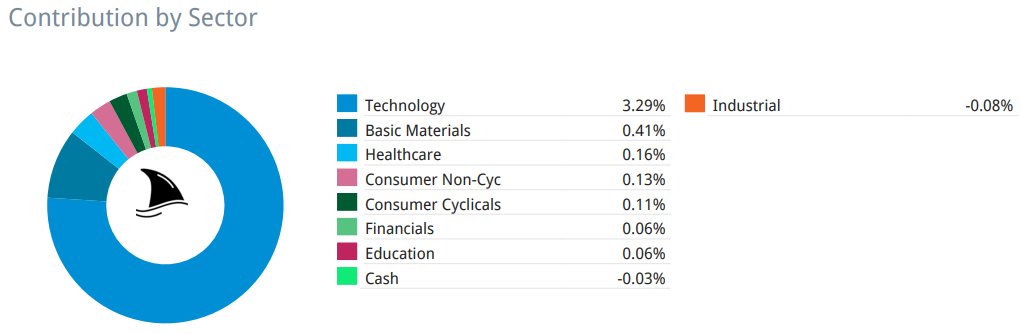

Contribution by Sector

Tech led the charge this week, with CLS driving most of the gains, while industrials (mainly AGX) were a modest drag.

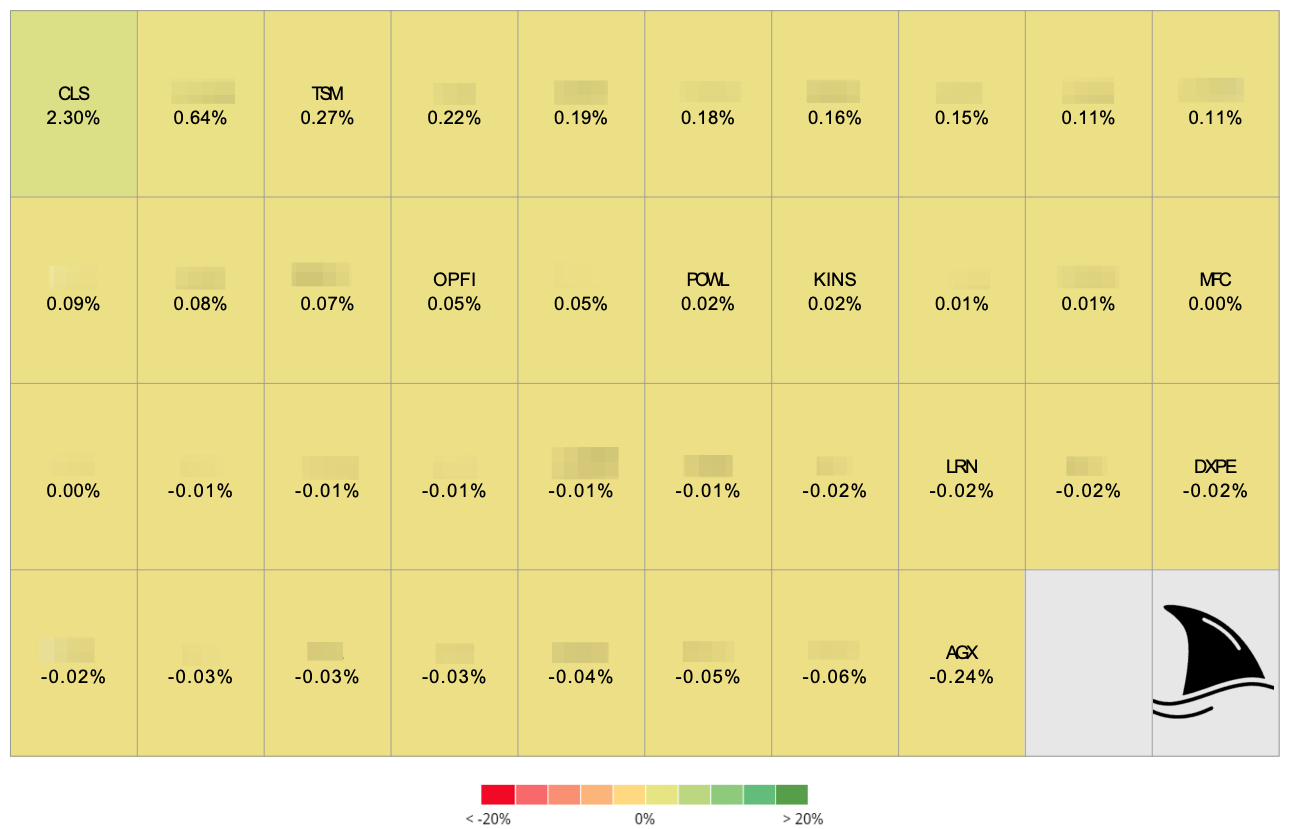

Contribution by Position

(For the full breakdown, see Weekly Stock Performance Tracker)

+230 bps CLS 0.00%↑ (TSX: CLS)

+27 bps TSM 0.00%↑

+5 bps OPFI 0.00%↑

+2 bps POWL 0.00%↑

+2 bps KINS 0.00%↑

-2 bps LRN 0.00%↑

-2 bps DXPE 0.00%↑

-24 bps AGX 0.00%↑

That’s it for this week.

Stay calm. Stay focused. And remember to stay sharp, fellow Sharks!

Further Sunday reading to help your investment process:

20% of people have 80% of the impact on the world

By the way I love your picks! I sell puts on Your picks and it has been amazing.

Keep it up