PRTH Deep Dive: This Under-the-Radar Fintech Could Deliver a 55%-80% Upside

A deep dive into a fast-growing payments and B2B fintech that’s transforming financial infrastructure.

Note: This analysis is no longer updated as the position was closed on June 20, 2025 (details here). You’re welcome to read it as a sample of the kind of deep dives I publish.

In mid-January, we added a payment company to the USA portfolio.

Today, we’re diving into another company in the industry—similar in some ways, but unique in others as it operates more behind the scenes in payments. This under-the-radar fintech offers a 55% to 80% upside.

Grab your goggles and let’s dive in 🏊♂️

I am talking about Priority Technology Holdings (PRTH)—they’re basically the financial backbone that keeps businesses running. They’re not the flashy, consumer-facing fintech like PayPal (PYPL), nor are they a giant like Global Payments (GPN). Instead, PRTH sits in the middle, providing embedded financial infrastructure for small-to-medium businesses (SMBs), B2B payments, and enterprise banking solutions.

Trade Alert: Buy PRTH for the USA portfolio.

Imagine you run a construction company. You just wrapped up a big project and are thrilled about the large paycheque—but then reality sets in. Your client is on a 30-day payment term, but you still need to pay subcontractors, cover payroll, and buy materials for the next project. This is where PRTH steps in. PRTH provides the tools to move money in your business, bridges cash flow gaps and automates transactions.

PRTH sits between consumer-focused payment providers like PayPal and enterprise giants like Global Payments. Think of it like this:

PayPal is the Apple Pay of fintech—slick, consumer-friendly, and everywhere.

Global Payments is the Visa of fintech—large, stable, and primarily serving big enterprises.

PRTH is the Stripe for B2B—providing businesses with the infrastructure they need to handle payments, banking, and cash flow automation under one roof.

Company Overview - Powering SMB, B2B, and Enterprise Payments with Scalable Fintech Solutions

PRTH plays in three big arenas:

SMB Payments

PRTH enables small businesses to accept payments by leveraging ISOs, ISVs, and VARs. Let me explain what each acronym stands for:

ISOs are Independent Sales Organizations. They are third-party resellers selling PRTH’s services to merchants. This allows PRTH to scale without directly managing every client.

ISVs are Independent Software Vendors. They integrate PRTH’s payment solutions into their software platforms. This allows seamless transactions for businesses using industry-specific tools.

VARs are Value-Added Resellers that bundle PRTH’s services with other services, like point-of-sale systems. This makes it easier for businesses to adopt a full-suite solution.

Together, these channels expand PRTH’s reach into the SMB market without the costly overhead of a direct sales force.

B2B Payments

The Plastiq acquisition was a huge boost in PRTH’s automation of accounts payable and supplier payments. Believe it or not, many businesses still rely on paper checks and manual processes to manage their accounts payable (AP) operations. I was shocked when one of my previous employers, a Fortune 500 company, was still using manual processes in Excel to manage their APs. I won’t mention the company but if you check my LinkedIn profile, you might figure it out. 😉

PRTH offers an advanced AP automation platform that allows businesses to pay their suppliers digitally, even if those suppliers don’t accept credit cards. The solution enables faster payments, improved cash flow management, and reduced processing costs.

PRTH’s B2B payments infrastructure supports multiple payment rails, including ACH, wire transfers, virtual cards, and credit cards, making it a versatile tool for supplier payments. The acquisition of Plastiq has expanded PRTH’s reach into an established client base that is already transitioning to digital B2B payments, accelerating adoption and revenue growth in this high-margin segment.

Enterprise Payments

TheBanking-as-a-Service (BaaS) division helps businesses move and manage money. The BaaS segment is growing rapidly.

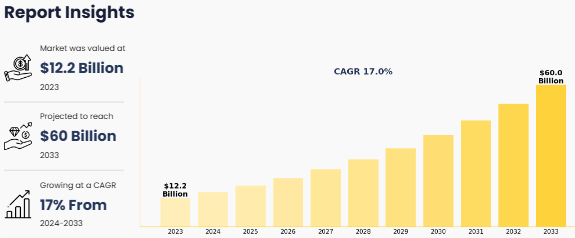

The global BaaS market was worth $12.2 billion in 2023 and is expected to grow to $60 billion by 2033, a 17% CAGR. Simply put, BaaS is changing the game, letting non-banks—think fintechs, retailers, and even SaaS platforms—offer financial products directly using APIs and embedded finance solutions. This growth is driven by rising digitalization, consumer demand for customized banking experiences, and partnerships between fintechs and traditional banks.

PRTH’s BaaS platform gives businesses everything they need to hold, transfer, and manage funds—without the headache of becoming a licensed financial institution. This is a game-changer for marketplaces, gig economy platforms and fintech startups that want to embed banking services. Whether it’s digital wallets, embedded payments, or automated reconciliation, PRTH provides the infrastructure.

During the last earning call, Tom Priore (Chairman and CEO) said:

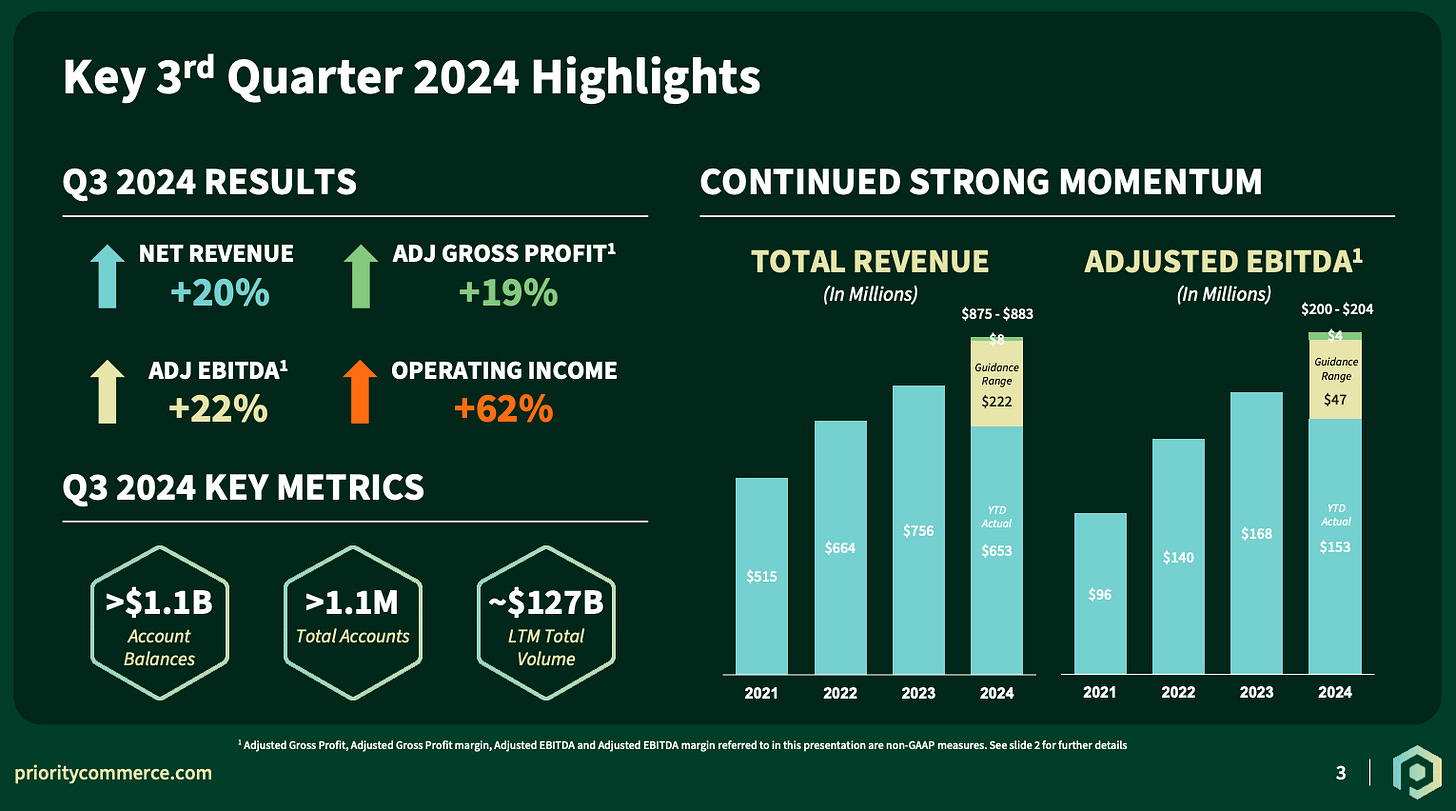

As of the end of Q3, total customer accounts operating on our commerce platform exceed $1.1 million as we process nearly $127 billion in annual transaction volume during the prior 12 months while administrating over $1.1 billion in average daily account balances during the quarter.

They’re moving $127 billion in annual transaction volume and hold $1.1 billion in average daily balances. Not bad for an “under-the-radar” stock.

Industry Trends & Market Outlook

The global mobile payments market is expected to grow at a click of 28% per year, reaching $27.81 trillion by 2032. This trend is driven by the increasing adoption of digital payment solutions across businesses of all sizes. PRTH’s strong presence in both SMB and B2B payments enables them to capitalize on this shift. Companies and consumers are moving away from traditional banking to more streamlined, integrated financial services.

Businesses are no longer satisfied with just processing transactions—they want to own and control the financial experience. PRTH’s BaaS platform enables companies to integrate custom financial solutions, including fund flows, lending, and payments, directly into their operations. This means that PRTH isn’t just a payments processor; it’s helping businesses become financial service providers in their own right, a major differentiator in the rapidly evolving fintech space.

PRTH has a significant structural advantage through its $1.1 billion in deposits, allowing it to capitalize on rising interest rates and generate higher interest income, boosting overall profitability. Unlike other fintech firms that struggle in high-rate environments, PRTH’s business model allows it to leverage rate hikes as a source of additional revenue, strengthening its margins without needing to increase transaction fees. This isn’t just a temporary boost—it’s a long-term advantage that enhances their profitability and cash flow stability.

Competitive Advantage & Positioning

PRTH has solidified its position as the 5th largest non-bank merchant acquirer in the US, a testament to its reach and influence in the payments industry. A contributor to this achievement is PRTH's network of over 1,200 reseller partnerships, which serve as a distribution moat. These partnerships with ISOs, ISVs and VARs, enable PRTH to efficiently scale its services without the overhead associated with a direct sales force. This strategy not only broadens PRTH's market penetration but also fosters strong relationships with a diverse clientele.

In contrast to industry giants like Fiserv (FISV), Global Payments (GPN), and Square (XYZ), which primarily focus on direct SMB acquisitions, PRTH adopts a distinctive approach. By leveraging its reseller network, PRTH effectively taps into the SMB market indirectly, ensuring a broader and more diversified customer base. This method allows PRTH to sidestep the intense competition for direct clients, positioning itself advantageously within the industry.

A cornerstone of PRTH's competitive advantage lies in its emphasis on B2B automation. The acquisition of Plastiq has significantly bolstered PRTH's capabilities in this domain. This strategic move has led to a remarkable 657% year-over-year increase in B2B segment revenue. By integrating Plastiq's advanced features, PRTH offers businesses streamlined payment processes, enhanced cash flow management, and access to working capital solutions. Not only does this focus on B2B automation address a critical market need, but also positions PRTH at the forefront of the fintech revolution.

Financial Performance & Momentum

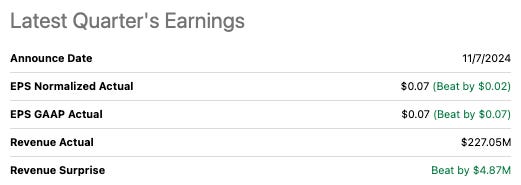

PRTH delivered Q3 2024 revenue of $227 million, reflecting a 20.1% year-over-year growth and an EPS of 7 cents, both metrics beat consensus estimates.

For the full-year 2024, revenue is expected to reach between $875 million and $883 million, a solid 16% YoY increase. The company's adjusted EBITDA for Q3 2024 came in at $54.6 million, marking a 22% YoY growth.

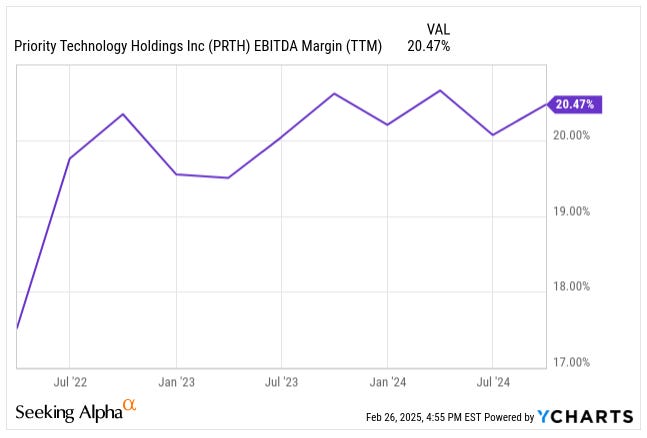

PRTH has set an EBITDA target for 2024 between $200 million and $204 million, representing an 18–21% YoY increase, driven by expanding margins and increased adoption of its B2B and embedded finance solutions.

PRTH also benefits from a strong, recurring revenue model. Approximately 60% of its gross profit is derived from monthly fees and non-transaction revenue, providing a steady and predictable income stream. This stability is further complemented by expanding margins, which have improved in the last three years, reflecting the company’s ability to scale efficiently while enhancing profitability.

PRTH is executing a disciplined debt reduction strategy, making the company financially stronger while increasing shareholder value. In May 2024, PRTH redeemed $170 million in preferred stock, significantly cutting future dividend obligations. This move directly benefits shareholders by reducing interest expenses and improving free cash flow, ensuring more capital is allocated toward growth initiatives rather than debt servicing.

Valuation & Upside Potential

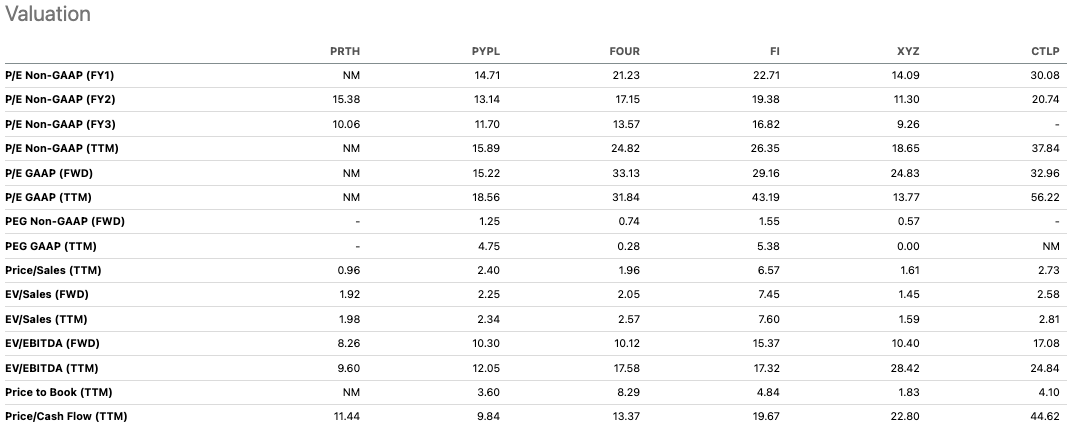

PRTH is currently trading at 8.6x forward EBITDA, compared to 10x+ multiples for its peers, indicating a potential valuation gap.

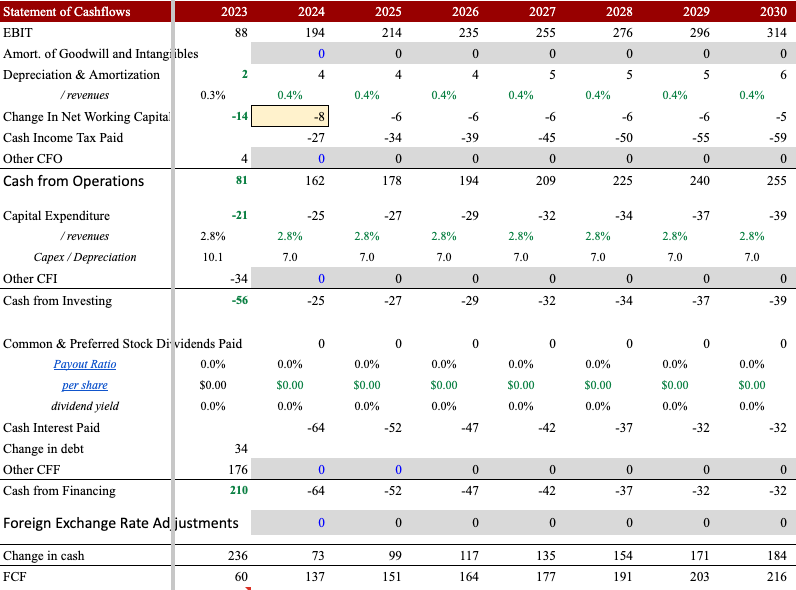

I estimate PRTH’s 2025 EBITDA at $218 million, a conservative projection given the likelihood of greater-than-expected margin expansion.

Based on PRTH’s strong cash flow generation, I anticipate it achieving a net cash position by 2029 (meaning cash exceeds debt), which should further accelerate interest expense reductions.

If the stock re-rates to 10x EBITDA, the lower end of its peers, based on $218 million EBITDA, the shares would be worth $17.

However, based on a DCF, the value of the shares is a bit higher at $20 per share. The DCF uses a 10.6% cost of capital based on a 0.8 unlevered beta for the industry and an optimal debt-to-capital ratio of 60%.

Risks & How PRTH Handles Them

Debt Load & Interest Expense

PRTH carries a long-term debt of $808 million, with interest expenses amounting to $23.2 million per quarter. While this level of debt may appear concerning, as mentioned earlier in the article, PRTH has implemented a disciplined debt reduction strategy to mitigate financial risk.

Competition & Regulatory Risks

The fintech space is highly competitive, with major players like Fiserv, Stripe, and Square actively seeking market share. Additionally, evolving regulatory frameworks can impact fintech operations, adding compliance costs and potential restrictions.

I would be very surprised if more regulation is implemented during the Trump administration as the winds are directing to less regulation, not more.

Economic Sensitivity

Economic downturns or recessions can lead to lower consumer spending and reduced transaction volumes, particularly in the SMB sector. However, PRTH is strategically diversified across SMB, B2B, and enterprise payments, with a strong recurring revenue component that provides stability in uncertain economic conditions.

While SMBs may see fluctuations in spending, PRTH’s B2B and Enterprise Payments divisions are more resilient, as businesses continue to require payment automation and embedded financial services regardless of the broader economy. This diversification insulates PRTH from cyclical downturns, making it more adaptable than competitors with singular revenue streams.

Final Thoughts: Why PRTH is a Buy

PRTH may not have the brand recognition of PayPal or the scale of Global Payments, but it plays a crucial role in powering the financial infrastructure behind SMBs, B2B payments, and embedded banking. With strong revenue growth, expanding margins, and a strategic focus on automation, PRTH is well-positioned to capitalize on the growing demand for digital payment solutions. Moreover, its aggressive debt reduction strategy enhances its long-term financial stability. Given its undervalued multiple relative to peers and strong earnings growth, PRTH represents a compelling investment opportunity with significant upside. If the company continues executing on its growth strategy, it wouldn’t be surprising to see its valuation re-rate higher in the coming years.

![[Trade Alert] This industry leader is a steal](https://substackcdn.com/image/fetch/$s_!bSVi!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa1191ab6-080e-49bb-8021-0a6174eb6d88_1024x1024.jpeg)